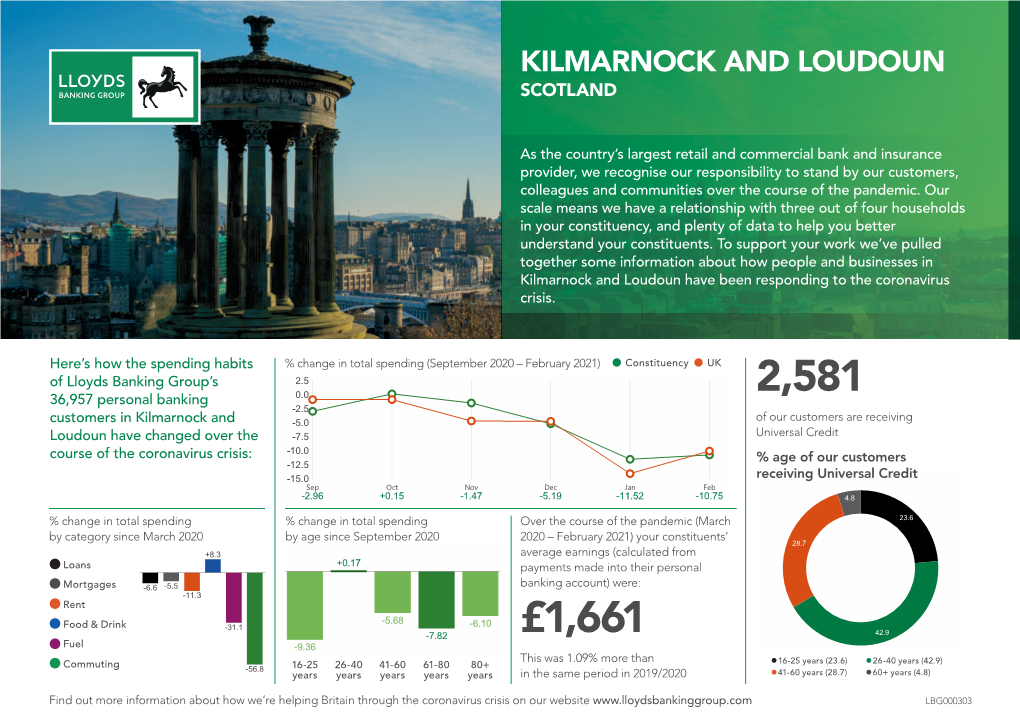

£1,661 2,581

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1 Bus Time Schedule & Line Route

1 bus time schedule & line map 1 Priestland - Kilmarnock View In Website Mode The 1 bus line (Priestland - Kilmarnock) has 2 routes. For regular weekdays, their operation hours are: (1) Kilmarnock: 5:23 AM - 10:30 PM (2) Priestland: 4:51 AM - 10:00 PM Use the Moovit App to ƒnd the closest 1 bus station near you and ƒnd out when is the next 1 bus arriving. Direction: Kilmarnock 1 bus Time Schedule 29 stops Kilmarnock Route Timetable: VIEW LINE SCHEDULE Sunday Not Operational Monday 5:23 AM - 10:30 PM Loudon Avenue, Priestland Loudoun Avenue, Scotland Tuesday 5:23 AM - 10:30 PM John Morton Crescent, Darvel Wednesday 5:23 AM - 10:30 PM McIlroy Court, Scotland Thursday 5:23 AM - 10:30 PM Murdoch Road, Darvel Friday 5:23 AM - 10:30 PM Murdoch Road, Darvel Saturday 5:23 AM - 10:30 PM Green Street, Darvel Temple Street, Darvel Hastings Square, Darvel 1 bus Info Fleming Street, Darvel Direction: Kilmarnock Stops: 29 Fleming Street , Darvel Trip Duration: 33 min Line Summary: Loudon Avenue, Priestland, John Dublin Road, Darvel Morton Crescent, Darvel, Murdoch Road, Darvel, Dublin Road, Scotland Green Street, Darvel, Temple Street, Darvel, Fleming Street, Darvel, Fleming Street , Darvel, Dublin Road, Alstonpapple Road, Newmilns Darvel, Alstonpapple Road, Newmilns, Union Street, Newmilns, East Strand, Newmilns, Castle Street, Union Street, Newmilns Newmilns, Baldies Brae, Newmilns, Queens Crescent, Isles Street, Scotland Greenholm, Mure Place, Greenholm, Gilfoot, Greenholm, Barrmill Road, Galston, Church Lane, East Strand, Newmilns Galston, Boyd -

Loudoun Castle Theme Park Have Had on the Character of the Historic Designed Landscape at Loudoun

EAST AYRSHIRE COUNCIL DEVELOPMENT SERVICES COMMITTEE: 18 DECEMBER 2001 99/0723/FL: CHANGE OF USE FROM VARIOUS USES TO AMUSEMENT PARK, INCLUDING ERECTION OF PLAY FORT AT LOUDOUN CASTLE PARK, GALSTON BY LOUDOUN CASTLE (THEME PARK) LTD 99/0708/FL: ERECTION OF DROP TOWER AT LOUDOUN CASTLE PARK, GALSTON BY LOUDOUN CASTLE (THEME PARK) LTD EXECUTIVE SUMMARY SHEET 1. DEVELOPMENT DESCRIPTION 1.1 There is a full application for the change of use of various existing uses to an amusement park including the erection of a play fort. Such a designation would, if unrestricted, permit the applicant to erect unlimited numbers of rides within the site up to a maximum of 25 metres in height utilising the permitted development rights that would be conferred through any consent for an amusement park. The proposed play fort is located immediately north of the east-west internal road within the Garden Plantation. The fort measures 15.2 m x 15.2 m and is to be constructed from logs taking account of the location of existing trees. An Environmental Impact Assessment (EIA), including a Transport Impact Assessment (TIA) and an Ecology Assessment have been submitted in respect of this application. The EIA is required under the Environmental Impact Assessment (Scotland) Regulations 1999 as the application is for a theme park, the area of which exceeds 0.5 ha. The application for the erection of a theme park ride, the Drop Tower, comprises a 30m lattice tower construction on a base measuring 13m x 15.5m approximately. Three sets of seats are located on the 4 sides of the tower which are raised to the top of the tower and then dropped downwards. -

Kilmarnock Living

@^abVgcdX`A^k^c\ 6 H E : 8 > 6 A E A 6 8 : I D A > K : ! L D G @ ! A : 6 G C 6 C 9 : C ? D N ilZcineaVXZhndj]VkZid`cdlVWdji ^c@^abVgcdX`VcY:Vhi6ngh]^gZ The Dean Castle and Country Park, Kilmarnock River Ayr Way, from Glenbuck A phenomenal medieval experience. The Dean Castle is a A unique opportunity for walkers to experience the most glorious wonderfully well-preserved keep and surrounding buildings set in Ayrshire countryside on Scotland’s first source to sea walk. Starting beautifully manicured gardens and Country Park extending to more at Glenbuck, the birthplace of legendary football manager Bill than 480 acres. Shankley, the path travels 44 miles to the sea at Ayr. The Historic Old Town, Kilmarnock Burns House Museum, Mauchline Narrow lanes and unique little boutique shops. There are plenty of Situated in the heart of picturesque Mauchline, the museum was supermarkets and big stores elsewhere in Kilmarnock, but check the first marital home of Robert Burns and Jean Armour. As well as out Bank Street for something really different. being devoted to the life of Scotland’s national poet, the museum The Palace Theatre and Grand Hall, Kilmarnock has exhibits on the village’s other claims to fame – curling stones The creative hub of East Ayrshire. This is where everything from and Mauchline Box Ware. opera companies to pantomimes come to perform. And the hall is a great venue for private events. Kay Park, Kilmarnock Soon to be home to the Burns Monument Centre, this is one of Rugby Park, Kilmarnock the best of Kilmarnock’s public parks. -

Kilmarnock & Loudoun

Citizens Advice service in Scotland Kilmarnock & Loudoun Westminster Constituency Statistics 2019-20 Westminster Constituency Kilmarnock & Loudoun contains the following member bureau(x) East Ayrshire CAB *stats are for the whole service provided by the bureau(x); constituency residents may also be served by other bureaux outwith the constituency … dealt with in 2019-20 clients 3,787 helping clients gain £6.2 million Areas of advice for Citizens Advice Bureau(x) within constituency Benefits 8,578 Housing 415 Consumer 175 Immigration, Asylum and Nationality 81 Debt 2,134 Legal Proceedings 579 Discrimination 4 NHS Concern or Complaint 579 Education 27 Relationship 161 Employment 405 Tax 455 Finance and Charitable Support 313 Travel, Transport and Holidays 176 Health and Community Care 112 Utilities and Communications 303 In total the bureau gave advice 14,497 times Scottish Index of Multiple Deprivation - bureaux clients and population residing in constituency 50% 31% 25% 21% 19% 17% 11% 13% 8% 6% Quintile 1 Quintile 2 Quintile 3 Quintile 4 Quintile 5 Most Deprived Least Deprived Clients served by bureau(x) Kilmarnock & Loudoun % of clients seen residing in each quintile % of datazones in constituency that are in each Scottish quintile Citizens Advice service in Scotland Kilmarnock & Loudoun National Statistics 2019-20 Profile of clients served by Citizens Advice Bureau within constituency *based on a sample from November 2019 Gender Ethnicity BAME Male 3% 52% Female 48% White 97% Disability Age 18 - 24 3% No to having a 25 - 34 14% disability 33% 35 - 44 14% 45 - 59 36% Yes to having a 60 - 64 14% disability 67% 65+ 19% Employment Housing Status Owner Occupier 29% Employed 24% Private landlord 15% Unemployed 13% Council Rented 37% Unable to work due to ill health /… 38% Other Social rented 6% Retired 17% Staying with friends / relatives 10% Other 9% Homeless / temporary housing 2% Other 2% Citizens Advice service in Scotland includes…. -

Ayrshire, Its History and Historic Families

suss ^1 HhIh Swam HSmoMBmhR Ksaessaa BMH HUB National Library of Scotland mini "B000052234* AYRSHIRE BY THE SAME AUTHOR The Kings of Carrick. A Historical Romance of the Kennedys of Ayrshire - - - - - - 5/- Historical Tales and Legends of Ayrshire - - 5/- The Lords of Cunningham. A Historical Romance of the Blood Feud of Eglinton and Glencairn - - 5/- Auld Ayr. A Study in Disappearing Men and Manners -------- Net 3/6 The Dule Tree of Cassillis - Net 3/6 Historic Ayrshire. A Collection of Historical Works treating of the County of Ayr. Two Volumes - Net 20/- Old Ayrshire Days - - - - - - Net 4/6 X AYRSHIRE Its History and Historic Families BY WILLIAM ROBERTSON VOLUME I Kilmarnock Dunlop & Drennan, "Standard" Office Ayr Stephen & Pollock 1908 CONTENTS OF VOLUME I PAGE Introduction - - i I. Early Ayrshire 3 II. In the Days of the Monasteries - 29 III. The Norse Vikings and the Battle of Largs - 45 IV. Sir William Wallace - - -57 V. Robert the Bruce ... 78 VI. Centuries on the Anvil - - - 109 VII. The Ayrshire Vendetta - - - 131 VIII. The Ayrshire Vendetta - 159 IX. The First Reformation - - - 196 X. From First Reformation to Restor- ation 218 XI. From Restoration to Highland Host 256 XII. From Highland Host to Revolution 274 XIII. Social March of the Shire—Three Hundred Years Ago - - - 300 XIV. Social March of the Shire—A Century Back 311 XV. Social March of the Shire—The Coming of the Locomotive Engine 352 XVI. The Secession in the County - - 371 Digitized by the Internet Archive in 2012 with funding from National Library of Scotland http://www.archive.org/details/ayrshireitshisv11908robe INTRODUCTION A work that purports to be historical may well be left to speak for itself. -

Newmilns & Greenholm Community Action Plan 2021-2026 Profile

Newmilns & Greenholm Community Action Plan 2021-2026 Profile 1. Brief Description and History 1.1 Early History Evidence of early habitation can be found across The Valley, with the earliest sites dating from around 2000 BC. To the east of Loudoun Gowf Course, evidence has been found of the existence of a Neolithic stone circle and a Neolithic burial mound lies underneath the approach to the seventh green. A site in Henryton uncovered a Neolith barrow containing stone axes (c. 1500 BC) and a Bronze Age cairn dating from about 1000 BC (the cairn itself contains cists which are thought to have been made by bronze weapons or tools). Following this early period, from around AD 200 evidence exists of not only a Roman camp at Loudoun Hill, but also a Roman road running through The Valley to the coast at Ayr. The camp was uncovered through quarry work taking place south of Loudoun Hill but tragically much of this evidence has been lost. According to local workmen, many of the uncovered remains & artefacts were taken with the rest of the quarried materials to be used in road construction projects. Typically, little is known of The Valley's history during the Dark Ages, but it seems likely that an important battle was fought around AD 575 at the Glen Water. In addition, given the strong strategic importance of Newmilns' position as a suitable fording place and a bottleneck on one of Scotland's main east-west trade routes, it is not unlikely that other battles and skirmishes occurred during this period. -

Case Study Loudoun Academy Parents in Partnership

EAST AYRSHIRE COUNCIL DATA HOME LINK TEAM 11 Parents attended every session Demonstrates 11 Pupils attended final session with CASE STUDY - Parents in Partnership Collaborative parents Working In partnership with Family Learning Co-ordinator we established a Pip Evaluation Parental Parents in Partnership Programme running over 6 weeks for parents of 6 identified new S1 pupils for 2018. We gained the views of parents 6 6 Engagement 5 5 5 5 5 prior to the programme starting through planning and delivery 5 5 sessions and built a timetable based around the feedback from 4 4 4 4 4 parents. A member of staff from each department delivered a class 4 Venue 3 lesson in their subject. Contacted colleagues within Essentials Skills, 3 Active Schools, Youth Mentoring, and Police Scotland & Social Work to 2 Loudoun Academy 2 deliver sessions on their services alongside sessions on managing teenage behaviour, family learning, and community activities. Welcomed parents for 1 morning 10.30am-1.15pm each week for 5 HOW MUCH DO HOW MUCH DO HOW MUCH DO HOW WELL DO HOW WELL DO HOW HOW OFTEN DO HOW OFTEN DO HOW OFTEN DO HOW CONFIDENT YOU KNOW ABOUTYOU KNOW ABOUTYOU KNOW ABOUT YOU KNOW THE YOU KNOW THE COMFORTABLE YOU ASK YOUR YOU ASK YOUR YOU OFFER TO ARE YOU HELPING THE SCHOOL THE CURRICULUM THE SCHOOL DAY BUILDING STAFF ARE YOU CHILD ABOUT CHILD ABOUT HELP WITH WITH HOMEWORK weeks and, on their request, invited their children to join in on week 6. APPROACHING SCHOOL HOMEWORK HOMEWORK THE SCHOOL Average Pre-Programme Average Post-Programme BEST BIT: Top Tips The parents fully participating in every class/session offered and their Build Positive relationships with enthusiasm each week as they returned parents Listen to the views of the parents BIGGEST ACHIEVEMENTS Gain support from all school staff Positive Feedback Fantastic, Fun and Informative to engage in Programme One parent agreed to speak at the Festival of Learning to promote the Link in with partner agencies to programme to all parents of P7 pupils transitioning into S1 this year. -

Deputy Head Greenkeeper

Deputy Head Greenkeeper Loudoun Gowf Club - Galston - East Ayrshire Loudoun Gowf Club is a member’s golf club which was founded in 1909 and is situated on the outskirts of Galston, East Ayrshire. Set over a parkland setting the club continues to invest in improving and renovating various areas on the course. The position of Deputy Head Greenkeeper has become available and we are looking for a highly motivated and enthusiastic person to join our hard working and committed team of greens staff. The successful applicant will report to the Head Greenkeeper and will assist with the day to day maintenance of the course and have the ability to manage the team and the course in the absence of the Head Greenkeeper. Main duties and responsibilities: • Promote, monitor and maintain health and safety of self, team and others. • Prepare the course for play in accordance with the rules of golf. • Communicate information to staff, management and golfers. • Assist in training staff. • Prepare machinery for daily use. • Ensure the correct procedures are followed for the safe use of all machinery, fertilisers and pesticides. • Supervise staff to ensure the desired work is carried out safely and to an excellent standard with a disciplined approach to meet targets whilst adhering to Health and Safety legislation. • Self motivated with a flexible approach to working hours. Qualifications and experience: • Minimum 5 years experience. • NVQ level 3 or equivalent is essential. • PA1, PA2, and PA6A spraying certificates. • Knowledge of irrigation maintenance and repair would be advantageous. • Mechanical knowledge for basic maintenance of machinery. • Chainsaw licence would be advantageous. -

Galston Conservation Area Appraisal

East Ayrshire Council East Ayrshire Local Development Plan Non-statutory Planning Guidance Galston Conservation Area Appraisal 2014 Contents 1 Introduction 6 Negative Factors • Context and Purpose of the Appraisal • What does Conservation Area Status mean? 7 Assessment of Significance • What does a Conservation Area Appraisal do? 8 Opportunities for Action and 2 Statutory Designations Enhancement • Conservation Area • Listed Buildings 9 Conservation Strategy • Other Statutory Designations APPENDICES 3 Location and Setting Appendix 1 Schedule of Listed Buildings in Galston Appendix 2 East Ayrshire Local Plan extracts 4 History and Development Appendix 3 Permitted Development Rights • Early Development Appendix 4 Buildings at Risk Register • 18th Century Development for Scotland extracts • 19th Century Development NB. Post Card illustrations by kind permission of Mr Richard Stenlake. 5 Conservation Area Appraisal • Character and Land Use • Topography • Street Pattern and Access Routes • Townscape • Public and private open space • Street surfaces • Archaeological Assessment • Building scale and form • Architectural styles • Building types and materials • Roofing and high level features • Windows and doors • Key buildings appraisal 2 1 Introduction Context and Purpose of the Appraisal 1.1 Scottish Planning Policy includes the policy ‘Valuing the Historic Environment’ which refers to the contribution cultural heritage makes to economy, identity and quality of life. It highlights the importance of planning in maintaining and enhancing irreplaceable -

East Ayrshire Council’S Programme for 2016/17 Was Approved by Cabinet on 10 February 2016

AGENDA ITEM NO. 11 THE AYRSHIRE SHARED SERVICE JOINT COMMITTEE 17 JUNE 2016 AYRSHIRE ROADS ALLIANCE ROADWORKS PROGRAMME 2016/17 Report by the Head of Roads - Ayrshire Roads Alliance PURPOSE OF REPORT 1. The purpose of this report is to advise the Joint Committee of the progress made with the road improvement programmes within the geographical boundaries of East Ayrshire and South Ayrshire for financial year 2016-2017. DETAIL 2. Prior to 1 April 2014, the Roads Maintenance Units within both authorities had the role of implementing and managing the road works programmes within the geographical areas of both authorities. 3. East Ayrshire Council’s programme for 2016/17 was approved by Cabinet on 10 February 2016. The available budgets for 2016/17 from East Ayrshire Council are £3.305m carriageways; street lighting £250k; traffic & road safety £200k; bridges £1.59m; New Cumnock Flood Work £600k; A71 Moorfield £600k; A70 Glenbuck £1.4m; and A71 Gowanbank £400k. 4. South Ayrshire Council’s programme for 2016/17 was approved by Leadership Panel on 26 April 2016. The available budgets for 2016/17 from South Ayrshire Council are £710k carriageways; street lighting £1.050m; and bridges £325k. 5. The Ayrshire Roads Alliance formally commenced on Tuesday 1 April 2014 and will deliver the programmes across the geographical areas served by East Ayrshire and South Ayrshire Councils through its combined operations unit. 6. Updated progress of programmes 2016-2017 are contained within Appendices One and Two. FINANCIAL IMPLICATIONS 7. The Ayrshire Roads Alliance will deliver the strategic and local services as stated in the Service Plan associated with Roads Operations. -

Galston Heritage Trail History of Galston

Galston Heritage Trail History of Galston Complimentary copy Location 1: Parish Church Leave the side gate of the church in Brewland Street and walk to the corner past the cafe and turn left. Continue past the front gate of the church to Location 2: The Cross Cross over the pedestrian crossing outside the butcher’s shop and enter 5 Location 3: Church Lane Continue along Church Lane and at the end, where it meets Polwarth Street turn left to the front of 4 Location 4: Brown’s Institute 3 Continue to the left and reach, at the top of the rise, 2 Location 5: The Muckle Bridge Retrace your steps and continue along Polwarth Street towards 1 the Four Corners, cross to the left at the Pedestrian Crossing to Henrietta Street and then right to the crossing for Wallace Street. Walk along Wallace Street past the chemist and the Wee Train Public House and bear left into Station Road. At the 13 first corner, turn left into Bentinck Street and walk along to Location 6: St Sophia’s Church Retrace your route to Station Road and at the corner turn left, walk on uphill to the corner with Duke Street and in front is Location 7: The War Memorial From the War Memorial turn right along Duke Street to the corner with Belvedere View. This brings you to Location 8: Once the site of the Railway Station 6 Turn around and go back to the War Memorial. Cross the street, look both ways carefully, and go down the lane at the side of the vacant plot of land. -

Loudoun Hall and Its Owners. Porterfield, and on the Death of the Latter Was Appointed the ' Town's Minister in 1604

i. 54 ^1 55 his ministty. On the petition of the Assembly of the Church, however,^ he was allowed to resume his labours. In 1600 Welch came to Ayr as assistant or colleague to the then minister of the town, Mr. John Loudoun Hall and its Owners. Porterfield, and on the death of the latter was appointed the ' town's minister in 1604. By James Fergtisson. John Welch married Elizabeth, the youngest daughter of John Loudoun Hall is the oldest house in Ayr, one of the very few Knox, Scotland's great Reformer. Her heroism, like that of her examples surviving in Scotland to-day of domestic burgh architecture illustrious husband, has made her one of the outstanding characters dating from the period of Flodden. It was built very early in the in Scottish history. She did not long survive her husband: she sixteenth century, if not in the late fifteenth. This is certain from died at Ayr on the 8th January, 1625, and was buried in the grave- some details of its architecture, and especially from the very fine yard beside her husband's Kirk, the Church of St. John the Baptist. large fireplace with moulded jambs that survives in the main hall To this day the old tower of the Church keeps silent watch over on the first floor of the building. The first owner of the house, her unmarked grave. and presumably its builder, was one James Tait, a merchant and burgess of Ayr. Judging by the size and style of his dwelling, he must have been a man of considerable substance.