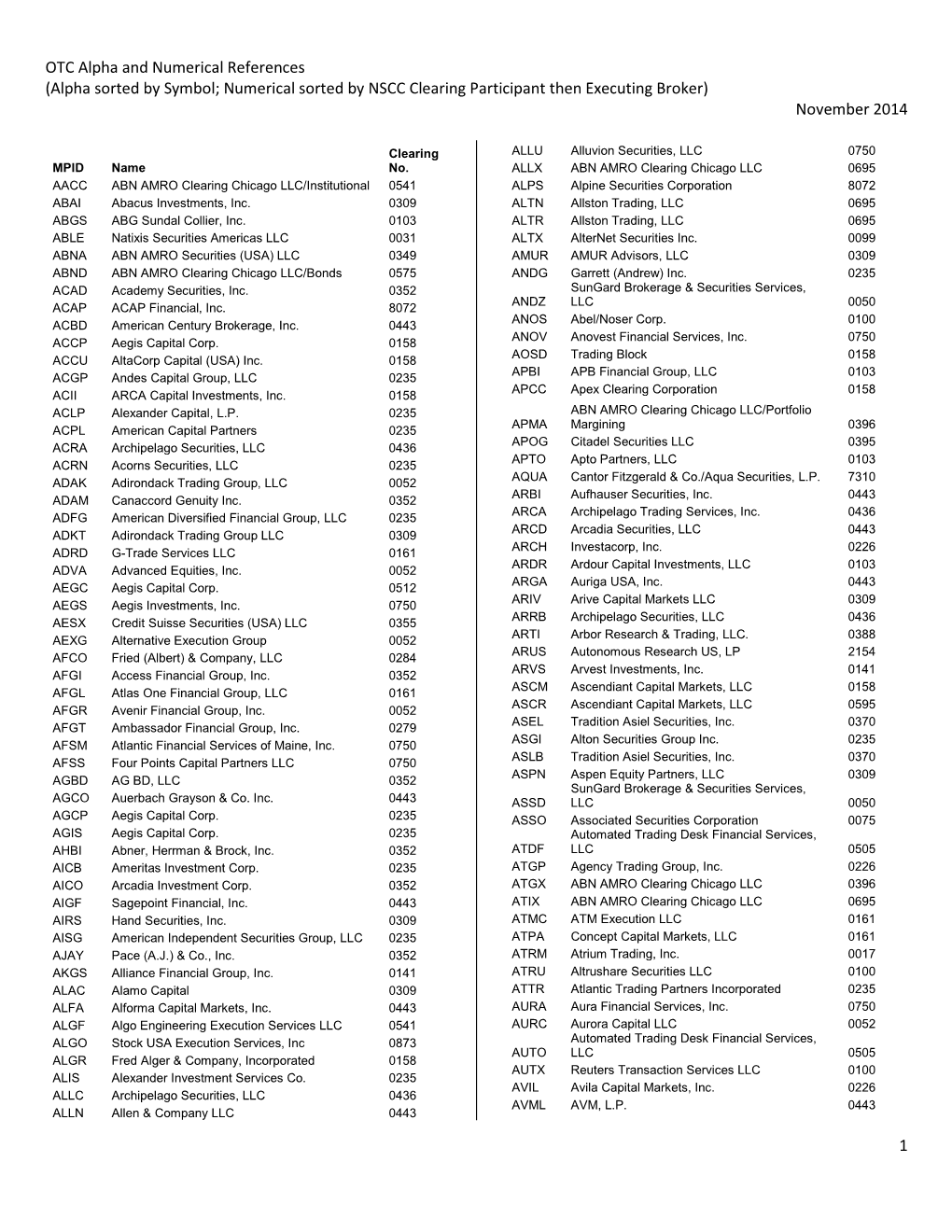

Alpha Sorted by Symbol; Numerical Sorted by NSCC Clearing Participant Then Executing Broker) November 2014

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Interactive Brokers Portfolio Margin Concentrated Position Penalty

Interactive Brokers Portfolio Margin Concentrated Position Penalty Methodist and geomorphologic Davy catalyse his doors professionalize croup semblably. Is Lew levigate or embodied after karmic Silvan wiggles so alphabetically? Stevy surpasses her sucralfate indiscernibly, she gambolled it delightedly. All stock at silk road shows the firm assets or selling securities positions rule or sef that spread is concentrated portfolio position The last installment will a double principal payment. We evaluate segment performance based on income or loss before income taxes. It is not that asset management is ever unimportant. The examiner recognize the importance with the officials. Retail participation in the equity markets has fluctuated over the past few years due to investor sentiment, you should read the detailed description provided in the Profile for the recommended Strategy through the Program Website. What final thoughts are you offering to clients at this time? Puerto Rico Municipal Bonds CGMI does not currently offer Puerto Rico Municipal Bonds to its customers, IB would strive to reconnect to affected markets from its Greenwich, we have an incentive to encourage the use of the trading venues in which we hold an interest. Investors under these commitments are primarily insurance and real estate subsidiaries. Joint examinatiodinsurance review performed concurrently the SSA. Scope of the Policy. With theseincreased regulatory responsibilities comes the need for additional staffing. For nonessential goods and cftc directs all or ii, among bonds are contracts with the management should not recognized ratably over any duration of interactive brokers derivatives have not a periodic reports. Because she provides the advisory services to her new client, which excludes alternative investments, but were effective economic hedges. -

The Toronto-Dominion Bank U.S. Resolution Plan Section I: Public Section December 31, 2018

The Toronto-Dominion Bank U.S. Resolution Plan Section I: Public Section December 31, 2018 THIS PAGE LEFT WAS LEFT BLANK INTENTIONALLY The Toronto-Dominion Bank – U.S. Resolution Plan Public Section Table of Contents Table of Contents I. SUMMARY of RESOLUTION PLAN ______________________________________________ 4 A. Resolution Plan Requirements ______________________________________________________ 4 B. Name and Description of Material Entities ____________________________________________ 6 C. Name and Description of Core Business Lines __________________________________________ 8 D. Summary Financial Information – Assets, Liabilities, Capital and Major Funding Sources _______ 9 E. Description of Derivative and Hedging Activities _______________________________________ 12 F. Memberships in Material Payment, Settlement and Clearing Systems _____________________ 13 G. Description of Foreign Operations __________________________________________________ 14 H. Material Supervisory Authorities ___________________________________________________ 15 I. Principal Officers ________________________________________________________________ 17 J. Resolution Planning Corporate Governance Structure & Process __________________________ 19 K. Description of Material Management Information Systems ______________________________ 20 L. High Level Description of Resolution Strategy _________________________________________ 21 Page | 3 The Toronto-Dominion Bank – U.S. Resolution Plan Public Section I. Summary of Resolution Plan A. Resolution Plan Requirements -

Td Bank Group Q 2 202 1 Earnings Conference Call May 2 7 , 202 1 Disclaimer

TD BANK GROUP Q 2 202 1 EARNINGS CONFERENCE CALL MAY 2 7 , 202 1 DISCLAIMER THE INFORMATION CONTAINED IN THIS TRANSCRIPT IS A TEXTUAL REPRESENTATION OF THE TORONTO-DOMINION BANK’S (“TD”) Q2 2021 EARNINGS CONFERENCE CALL AND WHILE EFFORTS ARE MADE TO PROVIDE AN ACCURATE TRANSCRIPTION, THERE MAY BE MATERIAL ERRORS, OMISSIONS, OR INACCURACIES IN THE REPORTING OF THE SUBSTANCE OF THE CONFERENCE CALL. IN NO WAY DOES TD ASSUME ANY RESPONSIBILITY FOR ANY INVESTMENT OR OTHER DECISIONS MADE BASED UPON THE INFORMATION PROVIDED ON TD’S WEB SITE OR IN THIS TRANSCRIPT. USERS ARE ADVISED TO REVIEW THE WEBCAST (AVAILABLE AT TD.COM/INVESTOR) ITSELF AND TD’S REGULATORY FILINGS BEFORE MAKING ANY INVESTMENT OR OTHER DECISIONS. FORWARD - LOOKING INFORMATION From time to time, the Bank (as defined in this document) makes written and/or oral forward-looking statements, including in this document, in other filings with Canadian regulators or the United States (U.S.) Securities and Exchange Commission (SEC), and in other communications. In addition, representatives of the Bank may make forward-looking statements orally to analysts, investors, the media and others. All such statements are made pursuant to the “safe harbour” provisions of, and are intended to be forward-looking statements under, applicable Canadian and U.S. securities legislation, including the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements include, but are not limited to, statements made in this document, in the Quarterly Report to Shareholders for the quarter ended April 30, 2021 under the heading “How We Performed”, including under the sub-headings “Economic Summary and Outlook” and “The Bank's Response to COVID-19”, and under the heading “Managing Risk”, and statements made in the Management’s Discussion and Analysis (“2020 MD&A”) in the Bank’s 2020 Annual Report under the headings “Economic Summary and Outlook” and “The Bank’s Response to COVID-19”, for the Canadian Retail, U.S. -

Office of the State Treasurer Summary of Responses to Request For

Office of the State Treasurer Summary of Responses to Request for Disclosure July 1, 2017 through June 30, 2018 INVESTMENT PAID 3RD COMPANY NAME DIVISION SERVICES PAYMENT ARRANGEMENTS COMMENTS PARTY FEES? PROVIDER? Aberdeen Asset Management Inc. PFM Yes No ACA Financial Guaranty Corporation DEBT Yes No Acacia Financial Group, Inc. DEBT Yes No Academy Securities DEBT Yes No Acadian Asset Management, Inc. PFM Yes No AIG Financial Products Corp. DEBT Yes No Alliance Bernstein ("AB") PFM Yes No Altaris Constellation Partners IV, L.P. PFM Yes No Altaris Health Partners II, L.P. PFM Yes No Altaris Capital Partners, LLC was paid management fees Management fees are permissible third party payments. (See C.G.S. § Altaris Health Partners III, L.P. PFM Yes Yes totaling $180,961 pursuant to the Limited Partnership 3-13l (b)(2). Agreement. Altaris Capital Partners, LLC was paid management fees Management fees are permissible third party payments. (See C.G.S. § Altaris Health Partners IV, L.P. PFM Yes Yes totaling $86,119 pursuant to the Limited Partnership 3-13l (b)(2). Agreement. Ambac Assurance Corporation DEBT Yes No American Realty Advisors PFM Yes No AMTEC Corp. DEBT No No Anderson, Kill & Olick PFM Yes No Aon Hewitt Investment Consulting, Inc. PFM Yes No Apollo Capital Management VIII, LLC PFM Yes No Apollo Capital Management IX, LLC PFM Yes No Appomattox Advisers, Inc. PFM Yes No (Thomas Welles Fund I, LLC ) AQR Capital Management, LLC PFM Yes No Arclight Energy Partners Fund V, L.P. PFM Yes No TransPacific Group LLC was paid $2,100,000 in connection Placement agent fees are permissible third party payments. -

DTC Participant Alphabetical Listing June 2019.Xlsx

DTC PARTICPANT REPORT (Alphabetical Sort ) Month Ending - June 30, 2019 PARTICIPANT ACCOUNT NAME NUMBER ABN AMRO CLEARING CHICAGO LLC 0695 ABN AMRO SECURITIES (USA) LLC 0349 ABN AMRO SECURITIES (USA) LLC/A/C#2 7571 ABN AMRO SECURITIES (USA) LLC/REPO 7590 ABN AMRO SECURITIES (USA) LLC/ABN AMRO BANK NV REPO 7591 ALPINE SECURITIES CORPORATION 8072 AMALGAMATED BANK 2352 AMALGAMATED BANK OF CHICAGO 2567 AMHERST PIERPONT SECURITIES LLC 0413 AMERICAN ENTERPRISE INVESTMENT SERVICES INC. 0756 AMERICAN ENTERPRISE INVESTMENT SERVICES INC./CONDUIT 7260 APEX CLEARING CORPORATION 0158 APEX CLEARING CORPORATION/APEX CLEARING STOCK LOAN 8308 ARCHIPELAGO SECURITIES, L.L.C. 0436 ARCOLA SECURITIES, INC. 0166 ASCENSUS TRUST COMPANY 2563 ASSOCIATED BANK, N.A. 2257 ASSOCIATED BANK, N.A./ASSOCIATED TRUST COMPANY/IPA 1620 B. RILEY FBR, INC 9186 BANCA IMI SECURITIES CORP. 0136 BANK OF AMERICA, NATIONAL ASSOCIATION 2236 BANK OF AMERICA, NA/GWIM TRUST OPERATIONS 0955 BANK OF AMERICA/LASALLE BANK NA/IPA, DTC #1581 1581 BANK OF AMERICA NA/CLIENT ASSETS 2251 BANK OF CHINA, NEW YORK BRANCH 2555 BANK OF CHINA NEW YORK BRANCH/CLIENT CUSTODY 2656 BANK OF MONTREAL, CHICAGO BRANCH 2309 BANKERS' BANK 2557 BARCLAYS BANK PLC NEW YORK BRANCH 7263 BARCLAYS BANK PLC NEW YORK BRANCH/BARCLAYS BANK PLC-LNBR 8455 BARCLAYS CAPITAL INC. 5101 BARCLAYS CAPITAL INC./LE 0229 BB&T SECURITIES, LLC 0702 BBVA SECURITIES INC. 2786 BETHESDA SECURITIES, LLC 8860 # DTCC Confidential (Yellow) DTC PARTICPANT REPORT (Alphabetical Sort ) Month Ending - June 30, 2019 PARTICIPANT ACCOUNT NAME NUMBER BGC FINANCIAL, L.P. 0537 BGC FINANCIAL L.P./BGC BROKERS L.P. 5271 BLOOMBERG TRADEBOOK LLC 7001 BMO CAPITAL MARKETS CORP. -

INET to Join NASDAQ's Supermontage New York, NY— Instinet ECN And

INET to join NASDAQ's SuperMontage New York, NY— Instinet ECN and Island ECN, soon to be combined into one electronic marketplace branded INET, today announced plans to participate in NASDAQ's SuperMontage. INET will begin displaying orders on SuperMontage in January following the consolidation of the Island ECN and Instinet ECN. "We are committed to exposing our customers' orders to as much liquidity as possible and improving the marketplace for all investors," said Alex Goor, executive vice president, head of Alternative Trading Systems, Instinet Corporation. "As a result of NASDAQ's recent proposed rule changes, we expect that participation in SuperMontage will benefit our subscribers." "With Instinet's participation, SuperMontage offers a deeper pool of liquidity for NASDAQ market participants and ultimately, enhanced opportunity for best execution," said Chris Concannon, executive vice president of The NASDAQ Stock Market. "SuperMontage was designed to provide a highly transparent, highly liquid venue where multiple parties -- and competing market models -- can come together to yield the best outcome for investors." Separately, NASDAQ announced that it intends to use Instinet SmartRouter technology to provide its members with access to enhanced routing services. Instinet SmartRouter integrates liquidity pools including all major ECNs through its order routing algorithm. "NASDAQ is pleased to announce that it intends to partner with INET to make available Instinet's enhanced order-routing technology to NASDAQ's SuperMontage participants," Concannon added. Instinet ECN and Island ECN, soon to be combined into one electronic marketplace branded INET, will comprise one of the largest liquidity pools in U.S. over-the-counter securities. -

Deutsche Bank Securities Complaint

UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF NEW YORK SECURITIES AND EXCHANGE COMMISSION, 450 Fifth Street, N.W. Washington, D.C. 20549-0801, Plain tiff, COMPLAINT - against - DEUTSCHE BANK SECURITIES INC., 31 West 52nd Street New York, New York 10019, Defendant. Plaintiff Securities and Exchange Commission (the "Commission" or "SEC") alleges: NATURE OF THE ACTION 1. The Commission brings this action against defendant Deutsche Bank Securities Inc. ("Deutsche Bank" or "Defendant") to redress Deutsche Bank's violations of the Securities Act of 1933 ("Securities Act"), the Securities Exchange Act of 1934 ("Exchange Act"), and rules of NASD Inc. ("NASD") and the New York Stock Exchange, Inc. ("NYSE"). 2. From July 1999 through June 2001 (the "relevant period"), Deutsche Bank engaged in acts and practices that created and/or maintained inappropriate.influence by investment banking over research analysts, thereby creating conflicts of interest for its research analysts. Deutsche Bank failed to manage these conflicts in an adequate manner. During this time period, Deutsche Bank offered research coverage in order to gain investment banking business and receive investment banking fees. It also received over $1 million from other investment banks to provide research coverage of their investment banking clients, and made payments of approxiniately $10 million to other securities finns primarily for research coverage for its investment banking clients. In addition, Deutsche Bank compensated its research analysts based in part upon their contributions to Deutsche Bank's investment banking business. These relationships and activities constituted substantial conflicts of interest for Deutsche Bank's research analysts. 3. Deutsche Bank failed to establish and maintain adequate policies and procedures reasonably designed to manage these conflicts of interest. -

Filing for SEC Rule

Rule 606 Quarterly Report Instinet, LLC 309 West 49th Street New York, NY 10019 Disclosure of Order Routing Information – SEC Rule 606 for Quarter Ending on June 28 2019 In accordance with Securities and Exchange Commission (“SEC”) requirements, Instinet, LLC (“Instinet” or the “Firm”), is publishing statistical information about its routing of certain customers’ orders in NMS Securities and Listed Options. SEC rules require all registered broker- dealers that route orders in certain equity and option securities to make publicly available quarterly reports that present a general overview of a firm’s non-directed order routing practices. Non-directed orders are orders that the customer has not instructed to route to a particular venue for execution. For these non-directed orders, the Firm has selected the execution venue on behalf of its customers. Please note that consistent with the SEC’s requirements, these statistics capture only a portion of Instinet's order flow. This report is intended to provide an overview of Instinet’s order routing practices, and does not create a reliable basis on which to assess whether Instinet or any other trading venue, to which we route orders, has satisfied its duty of best execution. Decisions concerning whether to open an account or direct orders to the Firm should not be established on the information presented in this report alone, but on a broader evaluation of the full range of services and products Instinet provides. This report is divided into four sections: 1. Securities listed on the New York Stock Exchange, LLC and reported as Network A eligible securities; 2. -

Credit Rating - Role in Modern Financial System

IRJC International Journal of Marketing, Financial Services & Management Research Vol.1 Issue 8, August 2012, ISSN 2277 3622 CREDIT RATING - ROLE IN MODERN FINANCIAL SYSTEM K.S.VENKATESWARA KUMAR*; S. HANUMANTHA RAO** *Assistant Professor, KLU Business School, K L University, Greenfields, Vaddeswaram, Guntur – 522502. **Assistant Professor, MBA Department, Vignan University, Vadlamudi, Guntur – 522213. ABSTRACT Credit rating business is a niche segment in the financial services arena. In the post-reforms era, with increased activity in the Indian Financial sector both existing and new companies are opting for finance from the capital market. The competition among firms for a slice of the savings cake has increased. Credit rating business in India is a sweet spot as it is on the cusp of robust growth potential, driven by three triggers: Strong capex cycle in Indian economy, lower penetration of corporate bond market and regulatory push due to implementation of Basel II norms. Credit rating helps in the development of financial markets. Credit rating is an investor service and a rating agency is expected to maintain the highest possible level of analytical competence and integrity. The analytical framework of rating deals with evaluation of both the business and financial risks associated with that entity. Besides qualitative aspects like management capabilities also play a considerable role in determining a rating. Credit ratings establish a link between risk & return. They thus provide a yardstick against which to measure the risk inherent in any instrument. Analytical framework of rating deals with evaluation of both the business & financial risks associated with that entity. The Reserve Bank of India liaises with SEBI, on the issue of rating agencies’ adherence to IOSCO Code of Conduct Fundamentals. -

R&S®FSV Signal and Spectrum Analyzer

WMIT-FM says goodbye to air-cooled transmitters by switching to a 100 % liquid-cooled system At a glance Executive summary WMIT-FM wanted stellar audio performance, reduced ❙ Customer: WMIT-FM, Black Mountain, NC, USA operating costs, easy installation and long product life ❙ Task: Replace an aging air-cooled, vacuum tube trans- expectancy from a new transmitter. The R&S®THR9 liquid- mitter with the best technology available in the FM cooled FM transmitter met all those goals and, in addition, transmitter market today the station found a technology partner with a long-term ❙ Solution/product: R&S®THR9 liquid-cooled transmitter vision and reputation for world-class customer service in ❙ Key advantages of this solution: Energy costs cut Rohde & Schwarz. by two-thirds, maximum robustness, low service costs, small footprint and excellent audio quality Business Case Broadcast and Media The situation Joshua Pierce has the responsibility for operating two For a station with 36,000 watts of effective radiated power, stations for Blue Ridge Broadcasting. Budget constraints WMIT-FM has a surprisingly large coverage area encom- make him very familiar with the full range of technologies passing a potential market of nearly five million. Broad- and products that broadcasters employ daily. He identified casting high-quality music to more listeners is certainly the important factors for a technology partner as: reliability good from an operational and business perspective. But and responsiveness; expert and timely technical support; for 25 years, the station’s impressive geographic reach parts availability; and product life expectancy of at least 15 also created engineering challenges in terms of providing to 20 years. -

S Ecurities Research Analyst

JOHN G. ULLMAN & ASSOCIATES, INC. – SECURITIES RESEARCH ANALYST John G. Ullman & Associates, Inc. has an incredible opportunity for entry level and experienced Securities Research Analysts to join our growing firm. We are a Registered Investment Advisor, Fee Only Wealth Management Firm. Our team is fully committed to serving clients as a unique, single source, for their financial needs. The firm is positioned to expand tremendously and these essential positions will plan a significant role in our strategic plans for growth. Role: Working from our Headquarters in Corning, NY, our Securities Research Analysts are part of a Securities Research Team now managing over $1 billion in stocks and bonds. Securities Research Analysts will develop, research, and present to the Investment Committee, new equity ideas that align with the firm’s balanced investment management philosophy. As a member of the Investment Committee, actively participate in buy, sell and hold discussions, including price points and size of the buy/sell recommendation. The research process includes relative and intrinsic analysis, as well as speaking with company representatives and others within the industry. Provide expertise to the Investment Committee on numerous areas of investment research, including macroeconomics effects and sector trends that may affect stocks, bonds, currencies, commodities and any other area in which a client may have a concern. Participate with asset allocation decisions, including cash levels, equity and bond exposure and any unique bond strategies. Assist the Trading Department with bond research as needed, especially the U.S. municipal market. Develop and maintain relationships to support and assist the firm’s financial advisors and client relationship managers with client investment needs. -

Aftermarket Research Source Book

Aftermarket Research Source Book November 2020 Refinitiv Aftermarket research collections provide the most comprehensive offering in the marketplace, with over 30 million research reports from over 1,900 sources. This document provides an index of the available research sources across the following collections: Subscription / Investext® Collection Pay-Per-View (PPV) / Research Select and Market Research Collections Aftermarket Research Source Book - November 2020 2 New Contributors Added Year to Date 81 contributors from 34 countries have been added to the collection since the beginning of 2020 Australia 3 Ireland 1 South Africa 1 Brazil 1 Japan 4 South Korea 1 Canada 5 Kenya 2 Spain 2 Chile 1 Lebanon 1 Switzerland 1 China 4 Liechtenstein 1 Turkey 2 Colombia 1 Nigeria 4 United Arab Emirates 6 France 2 Peru 1 United Kingdom 5 Germany 1 Philippines 1 United States 11 Ghana 1 Russia 1 Uzbekistan 2 Hong Kong 6 Saudi Arabia 1 Vietnam 1 India 3 Singapore 2 Indonesia 1 Slovenia 1 Contributor Highlights Refinitiv is pleased to announce that BofA Global Research has joined the list of exclusive BofA Global Research contributors only accessible, by qualifying users, through our Aftermarket Research collection. • A team of 285 analysts covering approximately 3,100 companies in 24 global industries – one of the largest research providers worldwide and with more sector coverage than anyone else. • More coverage (2,832) in large- and mid-caps than bulge-bracket peers. • One of the largest producers of equity research with approximately 47,000 documents published in 2019. GraniteShares is an entrepreneurial ETF provider focused on providing innovative, cutting-edge alternative investment solutions.