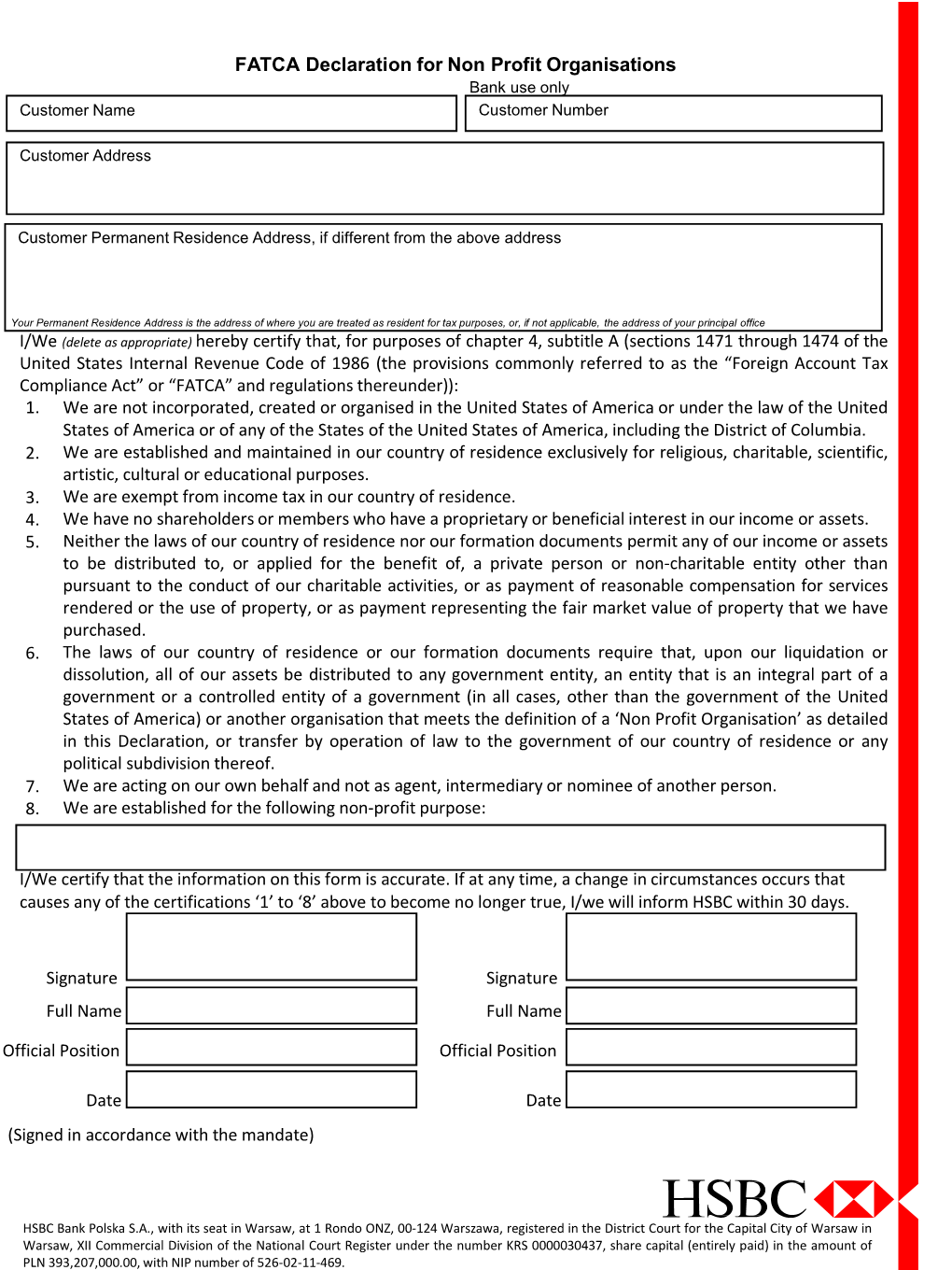

FATCA Declaration for Non Profit Organisations Bank Use Only Customer Name Customer Number

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

HSBC Global Investment Funds

HSBC Global Investment Funds Unaudited Semi-Annual Report for the period from 1 April 2009 to 30 September 2009 Unaudited semi-annual report for the period from 1 April 2009 to 30 September 2009 Société d’Investissement à Capital Variable (SICAV), Luxembourg 1 Information concerning the distribution of shares of HSBC Global Investment Funds in Switzerland or from Switzerland. HSBC Private Bank (Suisse) SA, Quai du Général Guisan 2, case postale 3580 CH-1211 Geneva 3, is the legal representative of the Company in Switzerland and the Company’s paying agent. The prospectus, simplified prospectuses, articles and annual and semi-annual reports of the Company may be obtained free of charge upon request from the HSBC Private Bank (Suisse) S.A. A breakdown of all the transactions carried out on behalf of each sub-fund of HSBC Global Investment Funds in the period under review can be obtained, free of charge, from the Company’s representative in Switzerland. Information concerning the distribution of shares of HSBC Global Investment Funds in Germany or from Germany. HSBC Trinkaus & Burkhardt AG, 21-23 Königsallee, D-40212 Düsseldorf, is the legal representative of the Company in Germany and the Company’s paying agent. The prospectus, simplified prospectuses, articles and annual and semi-annual reports of the Company may be obtained free of charge upon request from the HSBC Trinkaus & Burkhardt AG. A breakdown of all the transactions carried out on behalf of each sub-fund of HSBC Global Investment Funds in the period under review can be obtained, free of charge, from the Company’s representative in Germany. -

For Legal Reasons, Private Bankers Domiciled in Switzerland Were Not Included in This List

Bank for International Settlements March 2010 Monetary and Economic Department RESTRICTED Triennial Central Bank Survey of Foreign Exchange and Derivatives Market Activity Turnover in April 2010 FINAL list of reporting dealers by country, name and SWIFT code SWIFT ID Country Name (N: Not available) Note: For legal reasons, private bankers domiciled in Switzerland were not included in this list. 1 AR ABN AMRO BANK N V ABNAARBA 2ARAMERICAN EXPRESS BANK LTD SA AEIBARB1 3ARBANCO BI CREDITANSTALT SA BIINARBA 4ARBANCO BRADESCO ARGENTINA SA BBDEARBA 5ARBANCO CETELEM ARGENTINA SA N 6ARBANCO CMF SA CMFBARBA 7ARBANCO COLUMBIA SA N 8ARBANCO COMAFI SA QUILARBA 9ARBANCO CREDICOOP COOPERATIVO LIMITADO BCOOARBA 10 AR BANCO DE CORRIENTES SA N 11 AR BANCO DE FORMOSA SA BFSAARBF 12 AR BANCO DE GALICIA Y BUENOS AIRES SA GABAARBA 13 AR BANCO DE INVERSION Y COMERCIO EXTERIOR SA BICXARBA 14 AR BANCO DE LA CIUDAD DE BUENOS AIRES BACIARBA 15 AR BANCO DE LA NACION ARGENTINA NACNARBA 16 AR BANCO DE LA PAMPA PAMPARBA 17 AR BANCO DE LA PROVINCIA DE BUENOS AIRES PRBAARBADIV 18 AR BANCO DE LA PROVINCIA DE CORDOBA CORDARBA 19 AR BANCO DE LA PROVINCIA DEL NEUQUEN BPNEARBA 20 AR BANCO DE LA REPUBLICA ORIENTAL DEL URUGUAY BROUARBA 21 AR BANCO DE SAN JUAN SA N 22 AR BANCO DE SANTA CRUZ SA BPSCARB1 23 AR BANCO DE SANTIAGO DEL ESTERO SA N 24 AR BANCO DE SERVICIOS Y TRANSACCIONES SA N 25 AR BANCO DE VALORES SA BAVAARBA 26 AR BANCO DEL CHUBUT SA BPCHARBA 27 AR BANCO DEL SOL SA N 28 AR BANCO DEL TUCUMAN SA BDTUARBM 29 AR BANCO DO BRASIL SA BRASARBA 30 AR BANCO FINANSUR SA BFSUARBA -

EBRD Trade Facilitation Programme Confirming Banks

EBRD Trade Facilitation Programme Confirming Banks Table of Contents (Click on a country heading to go to that section) Algeria ...................................................................................................................................................... 4 Angola...................................................................................................................................................... 4 Argentina ................................................................................................................................................. 4 Armenia ................................................................................................................................................... 4 Australia ................................................................................................................................................... 4 Austria ...................................................................................................................................................... 5 Azerbaijan ................................................................................................................................................ 6 Bahrain .................................................................................................................................................... 6 Bangladesh .............................................................................................................................................. 6 Belarus.................................................................................................................................................... -

Doing Business in Poland 2016

Doing business in Poland 2016 In association with: 1 Contents Introduction ................................................................................................................................................................................ 3 – Country Profile ................................................................................................................................................................... 4 Legal overview ........................................................................................................................................................................... 5 Conducting business in Poland .................................................................................................................................................. 9 Tax system ................................................................................................................................................................................11 Labour ...................................................................................................................................................................................... 18 Audit ......................................................................................................................................................................................... 24 Trade ........................................................................................................................................................................................ -

Universal Registration Document and Annual Financial Report 2019

HSBC France Universal registration document and Annual Financial Report 2019 Contents Page Highlights 3 Presentation of activity and strategy 4 HSBC France group‘s Consolidated Results 12 Other information on HSBC France 20 Corporate governance report 21 Statutory Auditors‘ report on regulated agreements 50 Sustainability 53 Risks 78 Capital 151 Consolidated financial statements 155 Parent company financial statements 226 HSBC France’s principal subsidiaries and investment policy 259 Proposed resolutions to the Combined General Meeting to be held on 13 March 2020 263 Information on HSBC France and its share capital 265 Persons responsible of the Registration Document and for auditing the financial statements 268 Cross-reference table 270 Network of offices 272 Universal registration document and Annual Financial Report 2019 1 Highlights Presentation of information Cautionary statement regarding forward- looking statements This universal registration document was filed on 19 February 2020 with the Autorité des Marchés Financiers (‘AMF’), as the This Universal Registration Document 2019 contains certain competent authority under Regulation (EU) n°2017/1129, without forward-looking statements with respect to the financial condition, prior approval in accordance with Article 9 of that Regulation. results of operations and business of the group. Statements that The universal registration document may be used for the purposes are not historical facts, including statements about the group’s of an offer to the public of securities or the admission of securities beliefs and expectations, are forward-looking statements. Words to trading on a regulated market if supplemented by a securities such as ‘expects’, ‘anticipates’, ‘intends’, ‘plans’, ‘believes’, note and if necessary, a summary and any amendments to the ‘seeks’, ‘estimates’, ‘potential’ and ‘reasonably possible’, universal registration document. -

Amcham Quarterly

AmCham.Pl QUARTERLY The o!cial magazine of the American Chamber of Commerce in Poland SUMMER!2018 VOL!I, No. 1 COVER!STORIES AMCHAM!SEEKS!ANSWERS!TO!QUESTIONS!ON!HOW!TO!MAKE!POLAND’S! ECONOMIC BOOM!SUSTAINABLE, p. 12 DESPITE!POLITICAL!CONTROVERSIES!POLAND!CONTINUES!TO!BE!A!GOOD!COUNTRY TO!INVEST!IN, p. 16 MONTHLY!MEETINGS AMBASSADOR PAUL W. JONES ON US"POLAND BILATERAL RELATIONS, p. 22 FOREIGN MINISTER JACEK CZAPUTOWICZ ON POLAND’S ROLE IN THE EU AND THE CEE REGION, p. 24 COMPANY!PROFILES EXPERTS PwC on the Employee Capital Plans; Avis Polska Squire Patton Boggs on the split payment; Wardy#ski & Partners on the legal aspects of arti$icial Dow Poland intelligence; KPMG on the threat of cyber attacks; Forever Living Products DLA Piper on concluding internal investigations; Pegasystems Wierzbowski Eversheds Sutherland on how EU laws are implemented in Poland; JF Legal on new changes to the regulation on statutory preemption rights; %aszczuk and Partners on new regulations p. 26 supporting small business; Deloitte on the circular economy p. 34 PLUS!OVER!100 PICTURES!FROM!AMCHAM!EVENTS, p. 45 AMCHAM.PL QUARTERLY Vol. I, No. 1, Q3 2018 It’s your AmCham... p. 26 p. 39 p.37 p. 50 p. 48 p. 49 p. 15 p. 17 p. 19 p. 20 p. 51 It’s your debate... We do worry about the deteriorating relationship The 2008 crisis was 10 years ago, and today the between the US and the EU because, as a part of world is a different place and this is why, in the the EU, we have been always supporting long!term the Polish economy will be much safer transatlantic relations. -

Final List of Reporting Dealiers by Country, Name and SWIFT Code

Bank for International Settlements March 2007 Monetary and Economic Department RESTRICTED Triennial Central Bank Survey of Foreign Exchange and Derivatives Market Activity Turnover in April 2007 Final list of reporting dealers by country, name and SWIFT code ID Country Name SWIFT 1 AR ABN AMRO BANK N. V. ABNAARBA 2 AR BANCO B.I. CREDITANSTALT S.A. BIINARBA 3 AR BANCO BRADESCO ARGENTINA S.A. BBDEARBA 4 AR BANCO CMF S.A. CMFBARBA 5 AR BANCO COMAFI S.A. QUILARBA 6 AR BANCO CREDICOOP COOPERATIVO LIMITADO BCOOARBA 7 AR BANCO DE FORMOSA S.A. BFSAARBF 8 AR BANCO DE GALICIA Y BUENOS AIRES S.A. GABAARBA 9 AR BANCO DE INVERSION Y COMERCIO EXTERIOR S.A. BICXARBA 10 AR BANCO DE LA CIUDAD DE BUENOS AIRES BACIARBA 11 AR BANCO DE LA NACION ARGENTINA NACNARBA 12 AR BANCO DE LA PAMPA PAMPARBA 13 AR BANCO DE LA PROVINCIA DE BUENOS AIRES PRBAARBA 14 AR BANCO DE LA PROVINCIA DE CORDOBA CORDARBA 15 AR BANCO DE LA PROVINCIA DEL NEUQUEN BPNEARBA 16 AR BANCO DE LA REPUBLICA ORIENTAL DEL URUGUAY BROUARBA 17 AR BANCO DE VALORES S.A. BAVAARBA 18 AR BANCO DEL CHUBUT S.A. BPCHARBA 19 AR BANCO DO BRASIL S.A. BRASARBA 20 AR BANCO FINANSUR S.A. BFSUARBA 21 AR BANCO HIPOTECARIO S.A. BHIPARBA 22 AR BANCO ITAU BUEN AYRE S.A. ITAUARBA 23 AR BANCO MACRO S.A. BOSUARBA 24 AR BANCO MARIVA S.A. MARIARBA 25 AR BANCO MERIDIAN S.A. BMRDARBA 26 AR BANCO MUNICIPAL DE ROSARIO MUNRARBR 27 AR BANCO PATAGONIA S.A. -

Information on Notice of BGŻ BNP Paribas SA and HSBC Bank Polska SA Concerning Occurrence of Breaching the Agreements and Its Results

(Translation from the Polish language) FINANCIAL SUPERVISORY COMMISSION Current report No 15/2016 P Date: 1 March 2016 Issuer’s shortened name: KOPEX SA Subject: Information on notice of BGŻ BNP Paribas SA and HSBC Bank Polska SA concerning occurrence of breaching the agreements and its results. Legal basis: Law on Offer, Art. 56, Par.1 Item 1 – confidential information Contents of the report: The Management Board of KOPEX SA with its registered seat in Katowice (the Issuer) informs that: 1) today has been aware of receiving on 29.02.2016, in the evening, an e-mail correspondence from BGŻ BNP Paribas SA, announcing the occurrence of breaching the agreements, involving: - failure to maintain financial indicator Net Financial Debt / EBITDA according to the state announced by the Issuer on 31 December 2015 in relation to the level required by the agreements, - other event, which in the reasonable opinion of the Bank may have a material adverse effect on the financial or legal standing of the Issuer, which adversely affects the ability to perform the obligations under any agreement concluded with the Bank, i.e. recognition of events of breaching and suspension further use of the limits provided under the argeements with Powszechna Kasa Oszczędności Bank Polski SA and ING Bank Śląski SA, as well as the result of these events, ie. reduction with immediate effect, the amount of available credit limits to the amount of resources already used on 29.02.2016 and refusal of granting new guarantees or issuing new letters of credit on behalf of the Issuer. The Bank declared its willingness to clarify the situation of the Issuer and the agreements during the direct meeting. -

Summary Market Share Non- All Big 3 Polish Polish Public Private 1.PKO BP 12.9 12.9 12.9 12.9 2.Bank Pekao 12.7 12.7 12.7 12.7 3

Thirty Polish Banks – 2020 Program December 2105 Summary Market share non- all big 3 polish polish public private 1.PKO BP 12.9 12.9 12.9 12.9 2.Bank Pekao 12.7 12.7 12.7 12.7 3. BRE bank 7.9 7.9 7.9 7.9 4. ING BSK 6.7 6.7 6.7 5. BZ WBK 5.6 5.6 5.6 6. Bank Millenium 4.5 4.5 4.5 7. Citibank 4.1 4.1 4.1 8. Kredyt Bank 3.7 3.7 3.7 9. BGK 3.3 3.3 3.3 10. Raiffeisen Bank 2.8 2.8 2.8 64.2 33.5 19.9 44.3 16.2 48 Other factors 1. PKO Bank Polski (OTC: PSZKY) 12.9% market share/$32 billion State-owned 2. Bank Pekao 12.7% market share/$32 billion Part of UniCredit of Italy 3. BRE bank (OTC:BREJY) 7.9% market share/$20 bilion Investor – Commerzbank of Germany (OTC: CRZBY) 4. ING BSK 6.7% market share/$17 billion Investor – ING Group (ING) 5. BZ WBK 5.6% market share/$14 billion Investor – Allied Irish Bank (AIB) 6. Bank Millenium 4.5% market share/$11.5 billion Banco Comercial Portugues 7. Citibank 4.1% market share/$10 billion Citigroup 8. Kredyt Bank 3.7% market share/$9 billion KBC Group 9. BGK 3.3% market share/$8 billion State-owned 10. Raiffeisen Bank 2.8% market share/$7 billion Part of the Raiffeisen Group of Austria. 1 Thirty Polish Banks – 2020 Program December 2105 Details Alphabetical Index Bank DnB NORD Polska S.A..................................................................................................................25 Bank Gospodarki Zywnosciowej SA.......................................................................................................23 Bank Gospodarstwa Krajowego.................................................................................................................7 -

Annual Report and Accounts 2017

HSBC Bank plc Annual Report and Accounts 2017 Contents Presentation of Information Page This document comprises the Annual Report and Accounts 2017 Strategic Report for HSBC Bank plc (‘the bank’) and its subsidiaries (together ‘the Highlights 2 group’). ’We’, ‘us’ and ‘our’ refer to HSBC Bank plc together with Purpose and strategy 3 its subsidiaries. It contains the Strategic Report, the Report of the Directors, the Statement of Directors’ Responsibilities and Products and services 4 Financial Statements, together with the Independent Auditors’ How we do business 5 Report, as required by the UK Companies Act 2006. References to Key performance indicators 7 ‘HSBC’ or ‘the Group’ within this document mean HSBC Holdings Economic background and outlook 8 plc together with its subsidiaries. Financial summary 9 Risk overview 19 HSBC Bank plc is exempt from publishing information required by Report of the Directors The Capital Requirements Country-by-Country Reporting Risk 20 Regulations 2013, as this information is published by its parent, – Our conservative risk appetite 20 HSBC Holdings plc. This information will be available in June 2018 – Top and emerging risks 20 on HSBC’s website: www.hsbc.com. – Areas of special interest 23 Pillar 3 disclosures for the group are also available on – Risk management 23 www.hsbc.com, under Investor Relations. – Other material risks 35 All narrative disclosures, tables and graphs within the Strategic – Key developments and risk profile 36 Report and Report of the Directors are unaudited unless otherwise Capital 56 stated. – Capital management 56 Our reporting currency is £ sterling. – Capital overview 56 Corporate Governance Report 59 Unless otherwise specified, all $ symbols represent US dollars. -

Annual Report : 2019

The Hongkong and Shanghai Banking Corporation Limited – India Branches (Incorporated in Hong Kong SAR with limited liability) INDEPENDENT AUDITORS’ REPORT To The Chief Executive Officer The Hongkong and Shanghai Banking Corporation Limited – India Branches Report on the Audit of the Standalone Financial Statements Opinion We have audited the standalone financial statements of The Hongkong and Shanghai Banking Corporation Limited – India Branches (the “Bank”), which comprise the Balance Sheet as at March 31, 2019, the Profit and Loss Account, the Cash Flows Statement for the year then ended, and notes to the standalone financial statements, including a summary of significant accounting policies and other explanatory information. In our opinion and to the best of our information and according to the explanations given to us, the aforesaid standalone financial statements give the information required by the Companies Act, 2013 (“the Act”) as well as provisions of section 29 of the Banking Regulation Act, 1949 and circulars and guidelines issued by the Reserve Bank of India (the “RBI”), in the manner so required for banking companies and give a true and fair view in conformity with the accounting principles generally accepted in India, of the state of affairs of the Bank as at March 31, 2019, its profit and its cash flows for the year ended on that date. Basis for Opinion We conducted our audit in accordance with the Standards on Auditing (SAs) specified under section 143(10) of the Act. Our responsibilities under those Standards are further described in the Auditors’ Responsibilities for the Audit of the Standalone Financial Statements section of our report. -

Euroclear Bank Participants List

Euroclear Bank Participants List Participant Name BIC Code Participant Code AARGAUISCHE KANTONALBANK KBAGCH22XXX 92304 AB SVENSK EXPORTKREDIT SEKXSESSXXX 97147 ABAXBANK SPA ICBBITMMXXX 27431 ABBEY NATIONAL TREASURY SERVICES PL ANTSGB2LXXX 21391 ABBEY NATIONAL TREASURY SERVICES PL ANTSGB2LXXX 24587 ABBEY NATIONAL TREASURY SERVICES PL ANTSGB2LXXX 90281 ABLV BANK AS AIZKLV22XXX 18576 ABN AMRO BANK (SWITZERLAND) AG UBPGCHZ8XXX 12180 ABN AMRO BANK N.V. (FORMERLY FBN) FTSBNL2RXXX 12826 ABN AMRO BANK N.V. (FORMERLY FBN) FTSBNL2RXXX 12827 ABN AMRO BANK NV ABNAJESHXXX 13030 ABN AMRO BANK NV ABNANL2AXXX 90105 ABN AMRO BANK NV, RODERVELTLAAN ABNABE2AIPCXXX 93170 ABN AMRO GLOBAL CUSTODY NV n.a. 21900 ABN AMRO GLOBAL CUSTODY NV n.a. 24936 ABN AMRO GLOBAL CUSTODY SERVICES N. FTSBNL2RXXX 10937 ABN AMRO GLOBAL CUSTODY SERVICES N. FTSBNL2RXXX 11963 ABN AMRO GLOBAL CUSTODY SERVICES N. FTSBNL2RXXX 14447 ABN AMRO GLOBAL CUSTODY SERVICES N. FTSBNL2RXXX 14448 ABN AMRO GLOBAL CUSTODY SERVICES N. FTSBNL2RXXX 94763 ABN AMRO GLOBAL CUSTODY SERVICES N. FTSBNL2RXXX 97465 ABSA BANK LTD ABSAZAJJXXX 18440 ABU DHABI COMMERCIAL BANK PJSC ADCBAEAATRYXXX 15438 ABU DHABI INVESTMENT COMPANY ADICAEAAXXX 93301 ADAM & COMPANY PLC ADAGGB2SXXX 13446 ADAM & COMPANY PLC ADAGGB2SXXX 13458 ADAM & COMPANY PLC ADAGGB2SXXX 13460 1 ADAM & COMPANY PLC ADAGGB2SXXX 13504 ADAM & COMPANY PLC ADAGGB2SXXX 13576 ADAM & COMPANY PLC ADAGGB2SXXX 13638 ADAM & COMPANY PLC ADAGGB2SXXX 13641 ADAM & COMPANY PLC ADAGGB2SXXX 13646 ADM INVESTOR SERVICES INTERNATIONAL n.a. 10123 AFRICAN DEVELOPMENT BANK