Brunei Darussalam

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Brunei Darussalam

Human Capital Project - October 2020 Brunei Darussalam Human Capital Index 2020 This brief provides an update to the Human Capital Index (HCI). First launched in 2018, the HCI measures the amount of human capital that a child born today can expect to attain by age 18. It conveys the productivity of the next generation of workers compared to a benchmark of complete education and full health. Worldwide a child born in 2020 can expect, on average, to be 56 percent as productive as she could be when she grows up. All data represent the status of countries pre-COVID-19. THE HUMAN CAPITAL INDEX Human Capital Index. A child born in Brunei Darussalam today will be 63 percent as productive when she grows up as she could be if she enjoyed complete education and full health. This is higher than the average for East Asia & Pacific region but lower than the average for High income countries. • Probability of Survival to Age 5. 99 out of 100 children born in Brunei Darussalam survive to age 5. Figure 1. HCI and Components • Expected Years of School. In Brunei Darussalam, a child who starts school at age 4 can expect to complete 13.2 years of school by her 18th Human Capital Index birthday. • Harmonized Test Scores. Students in Brunei Darussalam score 438 on .2 .4 .6 .8 1 a scale where 625 represents advanced attainment and 300 represents minimum attainment. Probability of Survival to Age 5 • Learning-adjusted Years of School. Factoring in what children actually learn, expected years of school is only 9.2 years. -

Logistics Sector in Brunei Darussalam

FOSTERING COMPETITION IN ASEAN OECD Competition Assessment Reviews BRUNEI DARUSSALAM LOGISTICS SECTOR OECD Competition Assessment Reviews: Logistics Sector in Brunei Darussalam PUBE Please cite this publication as: OECD (2021), OECD Competition Assessment Reviews: Logistics Sector in Brunei Darussalam oe.cd/comp-asean This work is published under the responsibility of the Secretary-General of the OECD. The opinions expressed and arguments employed herein do not necessarily reflect the official views of the OECD or of the governments of its member countries or those of the European Union. This document and any map included herein are without prejudice to the status or sovereignty over any territory, to the delimitation of international frontiers and boundaries and to the name of any territory, city, or area. The OECD has two official languages: English and French. The English version of this report is the only official one. © OECD 2021 OECD COMPETITION ASSESSMENT REVIEWS: LOGISTICS SECTOR IN BRUNEI DARUSSALAM © OECD 2021 3 Foreword Southeast Asia, one of the fastest growing regions in the world, has benefited from a broad embrace of economic growth models based on international trade, foreign investment and integration into regional and global value chains. Maintaining this momentum, however, will require certain reforms to strengthen the region’s economic and social sustainability. This will include reducing regulatory barriers to competition and market entry to help foster innovation, efficiency and productivity. The logistics sector plays a significant role in fostering economic development. Apart from its contribution to a country’s GDP, a well-developed logistics network has an impact on most economic activities. -

Export and Import License Issued to Halliburton Energy Services

IMPORT AND EXPORT: LICENSE NRC FORM 250P.(12/05) NRC LICENSE NO.: CBP8b-3 UnTifri *tafies of Anwdria Nuclear Regulatory Commission LICENSE EXPIRES: October 31, 2009 0 Washington, D.C. 20555 * -0 Page 1 of 3 Pursuant to the Atomic Energy Act of 1954, as amended, and the regulations issued by the Nuclear Regulatory Commission (NRC) pursuant thereto, and in reliance on statements and representations heretofore made by the applicant/licensee, this license is hereby issued authorizing the licensee to import and/or export the byproduct materials listed below, subject to the terms and conditions herein. This license is only valid if the licensee maintains the requisite NRC or Agreement State domestic licenses. LICENSEE ULTIMATE FOREIGN CONSIGNEE(S) Halliburton Energy Services ATTN: Cindy Dorris Listed on Page 3. 2101 City West Blvd., Bldg. 2 Houston, Texas 77042 APPLICANT'S REFERENCE: HES4031 INTERMEDIATE CONSIGNEE(S) IN FOREIGN OTHER PARTY(IES) TO IMPORTIEXPORT COUNTRY(IES) AND/OR IN THE U.S. NONE NONE COUNTRY(IES) OF ULTIMATE DESTINATION: Brunei, Equatorial Guinea, Malaysia, Papua New Guinea, and United States. CONDITIONS, NOTES, AND DESCRIPTIONS OF 10 CFR PART 110, APPENDIX P, BYPRODUCT MATERIALS TO BE IMPORTED ANDIOR EXPORTED (NOTE: SEE PAGE 2 FOR DEFINITIONS OF CATEGORY 1 AND CATEGORY 2) Import and export, from and to Ultimate Foreign Consignees in Brunei, Equatorial Guinea, Malaysia, and .Papua New Guinea, Category 2 quantities of Americium-241 and Americium-241/Beryllium, contained in sealed sources for use in oil and gas well logging operations. Sealed sources will remain in the custody of either Halliburton Energy Services or its subsidiaries onshore and/or -offshore in Brunei, Equatorial Guinea, Malaysia, and Papua New Guinea. -

Side Agreement Among HKSAR, Brunei, Malaysia and Singapore (Rev)

[Date] In connection with the Agreement on Investment among the Governments of the Hong Kong Special Administrative Region of the People’s Republic of China and the Member States of the Association of Southeast Asian Nations (“the Investment Agreement”) signed on this day, we hereby confirm the following agreement reached by the Governments of the Hong Kong Special Administrative Region of the People’s Republic of China (“the HKSAR”), Brunei Darussalam, Malaysia and the Republic of Singapore (“Singapore”). Notwithstanding the definition of “natural person of a Party” under Article 1(i) (Definitions) of the Investment Agreement read with Article 22 (Work Programme) (including any amendments to such definition), for the application of the Investment Agreement among the HKSAR, Brunei Darussalam, Malaysia and Singapore, the term “natural person of a Party” shall mean: (a) in respect of the HKSAR, a permanent resident under its law; and (b) in respect of each of Brunei Darussalam, Malaysia and Singapore, a national or citizen or a permanent resident under their respective laws. The above shall constitute an integral part of the Investment Agreement as among the parties to this Side Agreement, and shall enter into force between any two of the parties to this Side Agreement on the date on which the Investment Agreement enters into force between such parties. For the Government of For the Government of the Brunei Darussalam Hong Kong Special Administrative Region of the People’s Republic of China PEHIN DATO LIM JOCK SENG Minister at the Prime Minister's Office and Second Minister of EDWARD YAU TANG-WAH Foreign Affairs and Trade Secretary for Commerce and Economic Development For the Government of Malaysia DATO’ SRI MUSTAPA MOHAMED Minister of International Trade and Industry For the Government of the Republic of Singapore LIM HNG KIANG Minister for Trade and Industry (Trade) . -

Don't Make Us Choose: Southeast Asia in the Throes of US-China Rivalry

THE NEW GEOPOLITICS OCTOBER 2019 ASIA DON’T MAKE US CHOOSE Southeast Asia in the throes of US-China rivalry JONATHAN STROMSETH DON’T MAKE US CHOOSE Southeast Asia in the throes of US-China rivalry JONATHAN STROMSETH EXECUTIVE SUMMARY U.S.-China rivalry has intensified significantly in Southeast Asia over the past year. This report chronicles the unfolding drama as it stretched across the major Asian summits in late 2018, the Second Belt and Road Forum in April 2019, the Shangri-La Dialogue in May-June, and the 34th summit of the Association of Southeast Asian Nations (ASEAN) in August. Focusing especially on geoeconomic aspects of U.S.-China competition, the report investigates the contending strategic visions of Washington and Beijing and closely examines the region’s response. In particular, it examines regional reactions to the Trump administration’s Free and Open Indo-Pacific (FOIP) strategy. FOIP singles out China for pursuing regional hegemony, says Beijing is leveraging “predatory economics” to coerce other nations, and poses a clear choice between “free” and “repressive” visions of world order in the Indo-Pacific region. China also presents a binary choice to Southeast Asia and almost certainly aims to create a sphere of influence through economic statecraft and military modernization. Many Southeast Asians are deeply worried about this possibility. Yet, what they are currently talking about isn’t China’s rising influence in the region, which they see as an inexorable trend that needs to be managed carefully, but the hard-edged rhetoric of the Trump administration that is casting the perception of a choice, even if that may not be the intent. -

Malaysia and Brunei: an Analysis of Their Claims in the South China Sea J

A CNA Occasional Paper Malaysia and Brunei: An Analysis of their Claims in the South China Sea J. Ashley Roach With a Foreword by CNA Senior Fellow Michael McDevitt August 2014 Unlimited distribution Cleared for public release This document contains the best opinion of the authors at the time of issue. It does not necessarily represent the opinion of the sponsor. Cover Photo: South China Sea Claims and Agreements. Source: U.S. Department of Defense’s Annual Report on China to Congress, 2012. Distribution Distribution unlimited. Specific authority contracting number: E13PC00009. Copyright © 2014 CNA This work was created in the performance of Contract Number 2013-9114. Any copyright in this work is subject to the Government's Unlimited Rights license as defined in FAR 52-227.14. The reproduction of this work for commercial purposes is strictly prohibited. Nongovernmental users may copy and distribute this document in any medium, either commercially or noncommercially, provided that this copyright notice is reproduced in all copies. Nongovernmental users may not use technical measures to obstruct or control the reading or further copying of the copies they make or distribute. Nongovernmental users may not accept compensation of any manner in exchange for copies. All other rights reserved. This project was made possible by a generous grant from the Smith Richardson Foundation Approved by: August 2014 Ken E. Gause, Director International Affairs Group Center for Strategic Studies Copyright © 2014 CNA Foreword This is the second of three legal analyses commissioned as part of a project entitled, “U.S. Policy Options in the South China Sea.” The objective in asking experienced U.S international lawyers, such as Captain J. -

Background Note for the South East Asia Justice Network (The Seajust)

Background note for the South East Asia Justice Network (The SEAJust) ⚫ The United Nations Office on Drugs and Crime (UNODC), Organized Crime Branch (OCB), Global Programme to Support the Capacity of member States to Prevent and Combat Serious and (transnational) Organized Crime (GP-TOC), facilitates international cooperation in criminal matters by supporting the development and implementation of regional judicial cooperation networks. The GP-TOC has supported the establishment of four judicial cooperation networks. These include the Judicial Cooperation Network of Central Asia and Southern Caucasus (CASC), the West African Network of Central Authorities and Prosecutors (WACAP), the Great Lakes Judicial Cooperation Network (GLJC) and most recently, the South East Asia Justice (SEAJust) Network. These networks are based upon the model and working methods of the European Judicial Network (EJN). ⚫ The networks provide a framework to promote expeditious execution of mutual legal assistance (MLA) requests for all forms of serious and organized crime. The networks work through formally appointed contact points who serve as “active intermediaries” to facilitate judicial cooperation in criminal matters with competent authorities of other networks or countries, if requested. In addition to the case work performed by the network contact points, the networks may convene or establish working groups on specific thematic issues on a temporary or a permanent basis. The networks may also facilitate training and the development or dissemination of practical tools and guides on international cooperation in criminal matters through the networks’ regional meetings and capacity building activities. ⚫ In 2019, with funding from the Government of Japan, the GP-TOC together with the UNODC Regional Office for Southeast Asia and the Pacific (ROSEAP) undertook an initiative to support the establishment of a judicial cooperation network in Southeast Asia. -

Negara Brunei Darussalam

Grids & Datums NEGARA BRU N EI DARUSSALAM by Clifford J. Mugnier, C.P., C.M.S. East Borneo has been settled from circa 1st century B.C. by Hindu geodetic reference system known as Borneo Triangulation 1948 and Pallavas from southeast India. Chinese and Arabic records indicate was established with the origin at Bukit Timbalai, Labuan Island where: that this ancient trading kingdom existed at the mouth of the Brunei Φo = 05° 17' 03.55" North, Λo = 115° 10' 56.41" East of Greenwich. River as early as the seventh or eighth century A.D. This early kingdom The reference ellipsoid used for the BT 1948 is the Modified Everest 1 was apparently conquered by the Sumatran Hindu Empire of Srivijaya where a = 6,377,298.556 m and /f = 300.8017. The BT68 results in the early ninth century, which later controlled northern Borneo and from the readjustment of the primary control of East Malaysia (Sabah, the Philippines. It was subjugated briefly by the Java-based Majapahit Sarawak plus Brunei) made by DOS, and the old Borneo West Coast Empire but soon regained its independence and once again rose to Triangulation of Brunei and Sabah (1930-1942), the Borneo East Coast prominence. In the early 15th century, with the decline of the Majapa- Triangulation of Sarawak and extension of the West Coast Triangula- hit kingdom and widespread conversion to Islam, Brunei became an tion in Sabah (1955-1960), and some new points surveyed between independent sultanate. It was a powerful state from the 16th to the 1961 and 1968. -

Asean Economic Prospects Amid Emerging Turbulence: Development Challenges and Implications for Reform Khuong Vu

ASEAN ECONOMIC PROSPECTS AMID EMERGING TURBULENCE: DEVELOPMENT CHALLENGES AND IMPLICATIONS FOR REFORM KHUONG VU JULY 2020 EXECUTIVE SUMMARY This paper reviews the performance of ASEAN countries over the two decades since the Asian financial crisis in the late 1990s, as well as the countries’ vulnerabilities to the U.S.-China trade war and the COVID-19 pandemic. It argues that these turbulences indicate that the world has reached an inflection point, requiring fundamental change in development thinking and approaches. This message is particularly relevant for Association of Southeast Asian Nations (ASEAN) countries, which made impressive economic achievements before the COVID-19 outbreak. As all ASEAN countries have established aspirational goals for their development journeys over the next two to three decades, it is imperative that each country undertake decisive fundamental reforms and strategic shifts in order to be highly prepared, competitive, and resilient in the future development landscape. Furthermore, ASEAN will be much stronger if it can position itself as an integrated market and a well-coordinated community, in which each country endeavors to enhance not only its own fitness, but also the fitness of the region in the post-COVID-19 global economic evolution. INTRODUCTION To better project the future prospects of ASEAN countries, it is important to comprehend the The Association of Southeast Asian Nations (ASEAN) three prevailing distinctive features of the region: comprises 10 countries: Brunei, Cambodia, Indonesia, harmonious diversity, development aspirations, Laos, Malaysia, Myanmar, the Philippines, Singapore, and an embrace of global integration. In terms of Thailand, and Vietnam (Table 1). Situated between harmonious diversity, the 10 countries have different two rising economic powers, China and India, ASEAN religions, population sizes, political systems, and countries are facing enormous direct opportunities levels of economic development. -

Economic Impact 2015 Antigua and Barbuda for More Information, Please Contact: Rochelle Turner Head of Research [email protected]

The Authority on World Travel & Tourism Travel & Tourism ECONOMIC IMPACT 2015 ANTIGUA AND BARBUDA For more information, please contact: Rochelle Turner Head of Research [email protected] ©2015 World Travel & Tourism Council Foreword The World Travel & Tourism Council (WTTC) is the global authority on the economic and social contribution of Travel & Tourism. WTTC promotes sustainable growth for the sector, working with governments and international institutions to create jobs, to drive exports and to generate prosperity. Travel & Tourism’s impact on the economic and social development of a country can be enormous; opening it up for business, trade and capital investment, creating jobs and entrepreneurialism for the workforce and protecting heritage and cultural values. To fully understand its impact, however, governments, policy makers and businesses around the world require accurate and reliable data on the impact of the sector. Data is needed to help assess policies that govern future industry development and to provide knowledge to help guide successful and sustainable Travel & Tourism investment decisions. For 25 years, WTTC has been quantifying the economic impact of Travel & Tourism. This year, the 2015 Annual Economic Reports cover 184 countries and 25 regions of the world, including, for the first time, the Pacific Alliance. Travel & Tourism generated US$7.6 trillion (10% of global GDP) and 277 million jobs (1 in 11 jobs) for the global economy in 2014. Recent years have seen Travel & Tourism growing at a faster rate than both the wider economy and other significant sectors such as automotive, financial services and health care. Last year was no exception. -

Brunei Darussalam

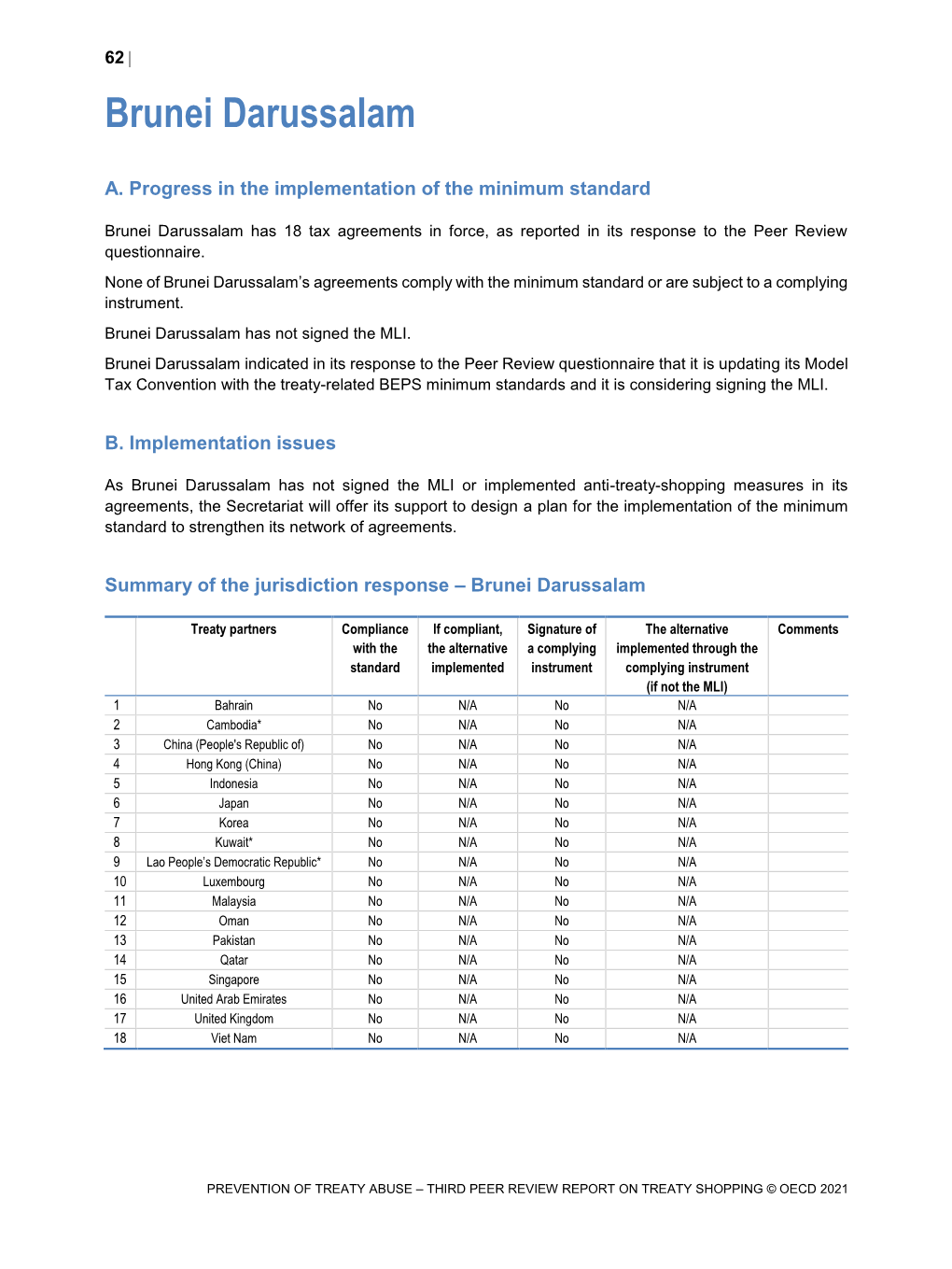

52 Brunei Darussalam A. Progress in the implementation of the minimum standard Brunei Darussalam has 18 tax agreements in force, as reported in its response to the Peer Review questionnaire. None of Brunei Darussalam’s agreements comply with the minimum standard or are subject to a complying instrument. Brunei Darussalam indicated in its response to the Peer Review questionnaire that it is updating its Model Tax Convention with the treaty-related BEPS minimum standards and it considers signing the MLI. B. Implementation issues No jurisdiction has raised any concerns about their agreements with Brunei Darussalam. Brunei Darussalam is encouraged to implement the minimum standard in its agreements. Summary of the jurisdiction response – Brunei Darussalam Treaty partners Compliance with If compliant, the Signature of a The alternative Comments the standard alternative complying implemented implemented instrument through the complying instrument (if not the MLI) 1 Bahrain No N/A No N/A 2 Cambodia* No N/A No N/A 3 China (People's No N/A No N/A Republic of) 4 Hong Kong (China) No N/A No N/A 5 Indonesia No N/A No N/A 6 Japan No N/A No N/A 7 Korea No N/A No N/A 8 Kuwait* No N/A No N/A 9 Lao People’s No N/A No N/A Democratic Republic* 10 Luxembourg No N/A No N/A 11 Malaysia No N/A No N/A 12 Oman No N/A No N/A 13 Pakistan No N/A No N/A 14 Qatar No N/A No N/A 15 Singapore No N/A No N/A 16 United Arab No N/A No N/A Emirates 17 United Kingdom No N/A No N/A 18 Viet Nam No N/A No N/A PREVENTION OF TREATY ABUSE – SECOND PEER REVIEW REPORT ON TREATY SHOPPING © OECD 2021 From: Prevention of Treaty Abuse – Second Peer Review Report on Treaty Shopping Inclusive Framework on BEPS: Action 6 Access the complete publication at: https://doi.org/10.1787/d656738d-en Please cite this chapter as: OECD (2020), “Brunei Darussalam”, in Prevention of Treaty Abuse – Second Peer Review Report on Treaty Shopping: Inclusive Framework on BEPS: Action 6, OECD Publishing, Paris. -

Brunei Darussalam

Integrated Country Strategy Brunei Darussalam FOR PUBLIC RELEASE Table of Contents 1. Chief of Mission Priorities .................................................................................................................. 2 2. Mission Strategic Framework ............................................................................................................ 2 3. Mission Goals and Objectives ............................................................................................................ 4 4. Management Objectives .................................................................................................................... 6 FOR PUBLIC RELEASE Originally Approved: Aug 3, 2018 Reviewed and Updated: Feb 11, 2021 1 1. Chief of Mission Priorities The U.S. relationship with Brunei dates back to April 6, 1845 when the USS Constitution, or “Old Ironsides,” arrived in Brunei Bay to start more than 170 years of friendly relations. Five years later, we concluded the Treaty of Peace, Friendship, Commerce and Navigation, which is still in effect today. The Mission will focus on further strengthening our security ties, particularly those related to military-to-military cooperation and countering the threats of terrorism and transnational crimes, including assuring Brunei continues to meet the requirements of remaining in the Visa Waiver Program. Brunei’s economy is projected to grow by 8 percent in 2019, reversing several years of decline due to low hydrocarbon prices. This economic rebound should offer new opportunities