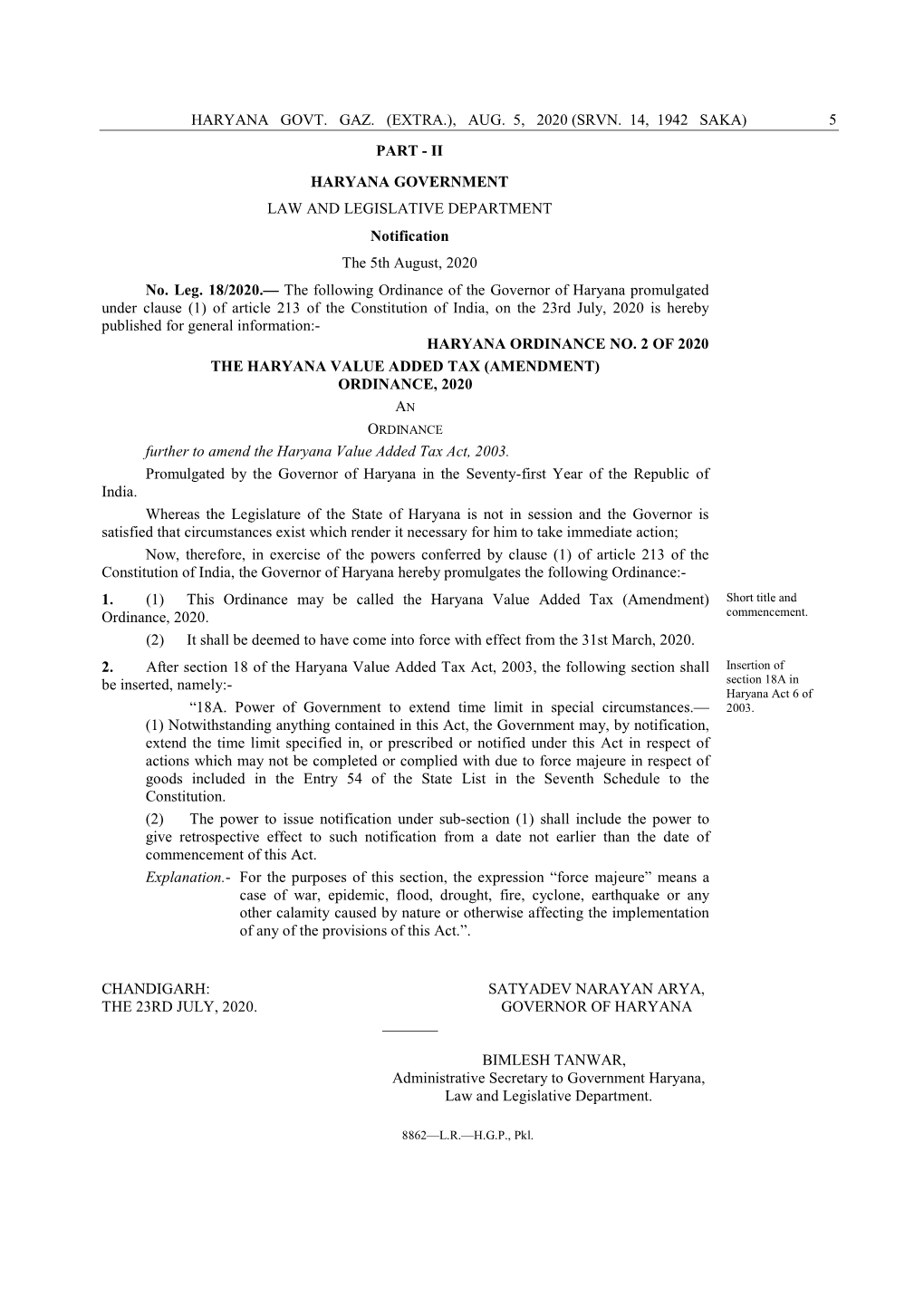

(AMENDMENT) ORDINANCE, 2020 an ORDINANCE Further to Amend the Haryana Value Added Tax Act, 2003

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Directory of Officers Office of Director of Income Tax (Inv.) Chandigarh Sr

Directory of Officers Office of Director of Income Tax (Inv.) Chandigarh Sr. No. Name of the Officer Designation Office Address Contact Details (Sh./Smt./Ms/) 1 P.S. Puniha DIT (Inv.) Room No. - 201, 0172-2582408, Mob - 9463999320 Chandigarh Aayakar Bhawan, Fax-0172-2587535 Sector-2, Panchkula e-mail - [email protected] 2 Adarsh Kumar ADIT (Inv.) (HQ) Room No. - 208, 0172-2560168, Mob - 9530765400 Chandigarh Aayakar Bhawan, Fax-0172-2582226 Sector-2, Panchkula 3 C. Chandrakanta Addl. DIT (Inv.) Room No. - 203, 0172-2582301, Mob. - 9530704451 Chandigarh Aayakar Bhawan, Fax-0172-2357536 Sector-2, Panchkula e-mail - [email protected] 4 Sunil Kumar Yadav DDIT (Inv.)-II Room No. - 207, 0172-2583434, Mob - 9530706786 Chandigarh Aayakar Bhawan, Fax-0172-2583434 Sector-2, Panchkula e-mail - [email protected] 5 SurendraMeena DDIT (Inv.)-I Room No. 209, 0172-2582855, Mob - 9530703198 Chandigarh Aayakar Bhawan, Fax-0172-2582855 Sector-2, Panchkula e-mail - [email protected] 6 Manveet Singh ADIT (Inv.)-III Room No. - 211, 0172-2585432 Sehgal Chandigarh Aayakar Bhawan, Fax-0172-2585432 Sector-2, Panchkula 7 Sunil Kumar Yadav DDIT (Inv.) Shimla Block No. 22, SDA 0177-2621567, Mob - 9530706786 Complex, Kusumpti, Fax-0177-2621567 Shimla-9 (H.P.) e-mail - [email protected] 8 Padi Tatung DDIT (Inv.) Ambala Aayakar Bhawan, 0171-2632839 AmbalaCantt Fax-0171-2632839 9 K.K. Mittal Addl. DIT (Inv.) New CGO Complex, B- 0129-24715981, Mob - 9818654402 Faridabad Block, NH-IV, NIT, 0129-2422252 Faridabad e-mail - [email protected] 10 Himanshu Roy ADIT (Inv.)-II New CGO Complex, B- 0129-2410530, Mob - 9468400458 Faridabad Block, NH-IV, NIT, Fax-0129-2422252 Faridabad e-mail - [email protected] 11 Dr.Vinod Sharma DDIT (Inv.)-I New CGO Complex, B- 0129-2413675, Mob - 9468300345 Faridabad Block, NH-IV, NIT, Faridabad e-mail - [email protected] 12 ShashiKajle DDIT (Inv.) Panipat SCO-44, Near Angel 0180-2631333, Mob - 9468300153 Mall, Sector-11, Fax-0180-2631333 Panipat e-mail - [email protected] 13 ShashiKajle (Addl. -

Download Download

PLATINUM The Journal of Threatened Taxa (JoTT) is dedicated to building evidence for conservaton globally by publishing peer-reviewed artcles OPEN ACCESS online every month at a reasonably rapid rate at www.threatenedtaxa.org. All artcles published in JoTT are registered under Creatve Commons Atributon 4.0 Internatonal License unless otherwise mentoned. JoTT allows unrestricted use, reproducton, and distributon of artcles in any medium by providing adequate credit to the author(s) and the source of publicaton. Journal of Threatened Taxa Building evidence for conservaton globally www.threatenedtaxa.org ISSN 0974-7907 (Online) | ISSN 0974-7893 (Print) Note Actinor radians (Moore, 1878) (Hesperiidae: Hesperiinae: Aeromachini): addition to the butterfly fauna of Haryana, India Bitupan Boruah, Rajesh Chahal & Abhijit Das 26 March 2021 | Vol. 13 | No. 3 | Pages: 18039–18041 DOI: 10.11609/jot.5938.13.3.18039-18041 For Focus, Scope, Aims, Policies, and Guidelines visit htps://threatenedtaxa.org/index.php/JoTT/about/editorialPolicies#custom-0 For Artcle Submission Guidelines, visit htps://threatenedtaxa.org/index.php/JoTT/about/submissions#onlineSubmissions For Policies against Scientfc Misconduct, visit htps://threatenedtaxa.org/index.php/JoTT/about/editorialPolicies#custom-2 For reprints, contact <[email protected]> The opinions expressed by the authors do not refect the views of the Journal of Threatened Taxa, Wildlife Informaton Liaison Development Society, Zoo Outreach Organizaton, or any of the partners. The journal, the publisher, -

Prelims Practice Questions 12-02-2018 Basai Wetland Is In

Prelims Practice Questions 12-02-2018 01. Consider the following pairs. Wetland - State 1. Najafgarh jheel - Haryana 2. Sukhna lake - Chandigarh 3. Basai wetland - Rajasthan Which of the above pairs is/are correct? a. 1 and 2 only b. 2 and 3 only c. 1 and 3 only d. 1, 2, 3 Answer : a Basai wetland is in Haryana. 02. Consider the following statements. 1. Asian Waterbird Census surveys sites across Asia and Australasia. 2. The census usually takes place in January month every year. 3. This event is coordinated by Wetlands International and forms part of global waterbird monitoring programme called the International Waterbird Census. Which of the above statements is/are correct? a. 1 and 2 only b. 2 and 3 only c. 1 and 3 only d. 1, 2, 3 Answer : d Asian Waterbird Census is an annual event in which thousands of volunteers across Asia and Australasia count waterbirds in the wetlands of their country. Its main focus is to monitor the status of waterbirds and the wetlands. AWC also aims to create public awareness on various issues concerning wetlands and waterbird conservation. Each year the census is carried out as a voluntary activity. 03. Consider the following statements. 1. The National Wetland Atlas was prepared by ISRO. 2. As per the Wetland (Conservation and Management) Rules 2017, manmade waterbodies and salt pans are considered as Wetlands. Which of the above statements is/are correct? a. 1 only b. 2 only c. Both 1 and 2 d. Neither 1 nor 2 Answer : a As per the Wetland (Conservation and Management) Rules 2017, manmade waterbodies and salt pans are not considered as Wetlands. -

City of Chandigarh the City Beautiful ABOUT CHANDIGARH

City of Chandigarh The city beautiful ABOUT CHANDIGARH AREA: 114 sq. km POPULATION 1.05mn YEAR OF DEVELOPMENT : 1952 REASON FOR SELECTION OF SITE: The present site was selected in 1948 taking into account 1.its Central location in the state, 2.proximity to the national capital 3.availability of sufficient water supply, 4.fertile soil, 5.gradient of land for natural drainage, 6.beautiful site with the panorama of blue hills as backdrop 7.moderate climate. LE CORBUSIER TEAM OF ARCHITECTS: Le Corbusier and his team which consisted of 1.Maxwell Fry 2.Jane B Drew(wife of Maxwell Fry) 3.Pierre Jeanneret (cousin of Le Corbusier) These senior architects were supported by Indian architects and planners consisting of: 1.M.N. Sharma, 2.A. R. Prabhawalkar, 3.U.E. Chowdhary, 4.J.S. Dethe, 5.B.P. Mathur, 6.Aditya Prakash, and others DIVISION OF WORK: Le Corbusier : Master plan of the city The Capital Complex Established the architectural control & design of the main buildings of the city. Senior architects: Housing for Govt. employees, schools, shopping centers, hospitals LE CORBUSIER’S MASTER PLAN: The master plan of the city has a rectangular shape with a grid iron pattern for the fast traffic roads. Vertical and high rise buildings were ruled out, keeping in view the socio economic-conditions and living habits of the people. The master plan was to be realized in two phases, catering to a total population of half a million. Phase-I 30 low density sector s area of 9000 acres (Sector 1 to 30) 1,50,000 population Phase-II 17 considerably high density Sectors ( Sectors 31 to 47) area of 6000 acres 3,50,000 population. -

Distribution and Abundance of Indian Peafowl and Their Nesting Preferences Within Chandigarh City and Its Adjoining Areas

European Journal of Molecular & Clinical Medicine ISSN 2515-8260 Volume 7, Issue 8, 2020 DISTRIBUTION AND ABUNDANCE OF INDIAN PEAFOWL AND THEIR NESTING PREFERENCES WITHIN CHANDIGARH CITY AND ITS ADJOINING AREAS Sandaldeep Kaur1 and Tejdeep Kaur Kler2 1Assistant Professor, Department of Zoology, PG Govt. College for Girls, Chandigarh 2Principal Ornithologist, Department of Zoology, Punjab Agricultural University, Ludhiana Abstract - Indian Peafowl (Pavo cristatus) is widely distributed bird but its status is unknown in urban landscape. The aim of the study was to estimate the distribution and abundance and nesting preferences of Indian Peafowl in Chandigarh and adjoining areas from January 2017 to December 2017. Two locations in the city viz: Peacock Garden, Sector- 39 (location I), near bus stand Sector- 43 (location II) two locations from adjoining areas i.e. village Palsora (location III) and village Maloya (location IV) were selected. Point transect method was used during study. The total inhabitants of Indian Peafowl was recorded to be 30-35 at location I, 15-20 at location II, 10-15 at location III and IV with flock size ranged between 7-10 individuals. The sex ratio was highly skewed towards females at all selected locations. The thick, thorny and scrub vegetation cover was found to be the most preferred habitat. Indian Peafowl devoted maximum time in feeding and standing followed by roosting, calling and display. Roosting was observed on Azadiracta indica (Neem), Ficus religiosa (Peepal), Acacia nilotica (Kikar), Melia azedarach (Dhek). Breeding activities of Indian Peafowl was commenced in the month of April till first week of October. At location I, II, III and IV nests observed were 7, 5, 3, and 2 respectively. -

Addresses of NIC State Units

Addresses of NIC State Units NIC, Andaman Nicobar UT Unit NIC, Andhra Pradesh State Unit NIC, Arunachal Pradesh State Unit Old Room No.11 A-Block, Block-23 Old Pradesh Council, Govt. Offices Complex Secretariat Building Secretariat Tank Bund Road Itanagar – 791111 Complex Portblair – 744101 Hyderabad – 500063 NIC, Assam State Unit NIC, Bihar State Unit NIC, Chandigarh UT Unit Block-F, Secretariat Complex 3rd Floor, Technology Bhavan, Room No.222, IInd Floor Dispur, Guwahati - 781006 Bailey Road, Patna - 800015 UT Secretariat, Sector-9 Chandigarh – 160017 NIC, Chattisgarh State Unit NIC Dadra & Nagar UT Unit NIC Daman & Diu UT Unit Room No.238, 1st Floor 3rd floor, Secretariat, 66 KV road, First Floor Secretariat Fort Area Moti Mantraylaya, Raipur - 492001 AMLI SILVASSA-396230 Daman PIN 396 220 NIC, Delhi UT Unit NIC, Goa State Unit NIC, Gujarat State Unit B-301, Delhi Secretariat H-Block, Paraiso De Goa BLock-13, IInd Floor I. P. Estate, New Delhi Porvorim Goa New Sachivalaya Goa – 403521 Gandhinagar - 382010 NIC, Haryana State Unit NIC, Himachal Pradesh State Unit NIC, Jammu & Kashmir State Unit G-03, Haryana New Secretariat 6th Floor, Armsdale 1. Room No. NB-12, Building, Sector-17,(Opp. Main Building, Chotta Shimla, Mini Secretariat Bus Stand) Shimla – 171002 JAMMU - 180001 Chandighar – 160017 2. Room No.1/48, Gr. Floor, Civil Secretariat, Srinagar-190001 NIC, Jharkhand State Unit NIC, Karnataka State Unit NIC, Kerala State Unit Room No.104/3, Nepal House, 6 & 7th Floor, Mini Tower, ER & DC Building, Keltron House, Doranda, Ranchi, 834004 Dr. Ambedkar Road, Vellayambalam, Bangalore – 560001 Triruvananthapuram – 695033 NIC, Lakshadweep UT Unit NIC, Madhya Pradesh State Unit NIC, Maharashtra State Unit Indira Gandhi Road Computer Center 'C' Wing Basement New Administrative Building Willington Island Vidhyanchal Bhavan, Opp. -

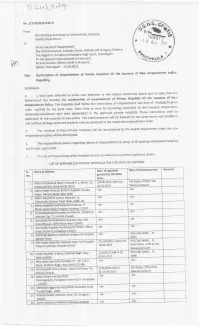

List of Empanelled Hospitals

a "[^: a , f \^ ' C- ft]^Y' t",l] Na. 21 27 6 | 2012-l H B-lll From Government, Haryana' /ff"u The Principal Secretary to Health DePartment. To t.,oW All the Heads of Departments \ Hissar, Rohtak and Gurgaon Division' R The Commissioners, Ambala, \^ The Registrar, Punjab and Haryana High Court' Chandigarh' \rl(qrr,xu All the Deputy Commissioners in Haryana ,r-y All Sub-Division Officer (Civil) in Haryana Dated Chandigarh 13'08.2015 the issuance of llew Empanelment policy- Sub:- Continuation of Empanelment of Private Hospitals till Regarding. Sir/Madam mentioned above and to state that the 2. l, have been directed to invite your attention to the subject Private Hospitalsi till the issuance of New Governmerlt has decided the continuation of ernpanelment of empanelment and that of Package/lmplant Ernpanelment Policy. The hospitals shall follow the instructions of treatment to the Haryana Government rates notified by the state Govt. from time to time for providing private hospitals' 'fhese instructions shall be employees/pensioners and their dependents in the approved be allowed on the same terms and conditions applicable till the issuance of new policy. The reimbursement will empanelment order' and notified package rates and implants rates as explained in the respective the Health Departrnent when the new 3. The renewal of these private Hospitals will be reconsidered by empanelment policy will be introduced' (2 years) of all existing empanelled hospitals 4. The empanelment orders regarding period of empanelment are hereby suPerseded. to continue is given as under:- 5. The list of Private Empanelled Hospitals which are aliowed L|sToFEMPANELLEDPR|VATEHOSP|TALSFoRTHESTATEoFHARYANA Remarks Date of aPProval Rate of reimbursement Sr. -

Punjab, Haryana, Chandigarh and Himachal Pradesh, India

Punjab, Haryana, Chandigarh and Himachal Pradesh, India Market summary Golden Temple, Amritsar – The holiest shrine of the sikh religion Introduction Gurgaon - One of India’s largest Industrial/IT The region of Punjab, Haryana, and Himachal hubs. Its proximity to New Delhi means that it has Pradesh forms the heartland of Northern India and evolved as a major corporate hub with half of has amongst the highest per capita income in India. Fortune 500 companies having a base here The state of Punjab is the food basket and the Faridabad - Faridabad is an industrial hub of granary of India contributing to over 20 per cent of Haryana, for manufacturing tractors, motorcycles, India’s food production. Punjab is also the textile and and tyres manufacturing hub of Northern India. The state of Haryana has strong agricultural, food processing and education sectors. Together the states of Punjab & Punjab, Haryana, Chandigarh & Haryana have one of the largest dairy sectors. The state of Himachal Pradesh is renowned for Himachal – Key industry facts horticulture and tourism. Punjab Punjab produces around 10% of India's cotton, Quick facts 20% of India's wheat, and 11% of India's rice Punjab's dairy farming has 9% share in country's Area: 150349 sq. kms milk output with less than 2% livestock Population: 60.97 million Regional GDP: US$164 billion Haryana Haryana is 2nd largest contributor of wheat and Major cities 3rd largest contributor of rice to the national pool Haryana's dairy farming has 6% share in Chandigarh – Shared capital of the states of country's milk output Punjab and Haryana. -

Static GK Digest

www.gradeup.co 1 www.gradeup.co Static GK Digest Dear Readers, This Static GK Digest is a complete docket of important information of Static topics. The Static GK Digest is important and relevant for all competitive exams like Banking, Insurance, SSC and Govt. Exams. LIST OF NATIONAL PARK AND WILDLIFE SANCTUARIES States National park Remarks Andhra Pradesh Papikonda National Park - Sri Venkateswara National Park - Coringa Wildlife Sanctuary Krishna Wildlife Sanctuary Arunachal Pradesh Mouling National Park - Namdapha National Park - Kamlang Wildlife Sanctuary Assam Kaziranga National Park One-Horned Rhinoceros, UNESCO World Heritage Site Dibru-Saikhowa National Park Feral horse, Golden Langur Golden Langur, Red Panda, UNESCO World Heritage Manas National Park Site Nameri National Park - Orang National Park - Bihar Valmiki National Park - Kaimur Wildlife Sanctuary Chhattisgarh Indravati National Park - Kanger Valley National Park - Guru Ghasi Das (Sanjay) National Park - Achanakmar Wildlife Sanctuary Goa Mollem National Park - Salim Ali Bird Sanctuary Gujarat Gir Forest National Park Asiatic lion Blackbuck National Park Black Buck Marine National Park, Gulf of Kutch - Vansda National Park - Indian Wild Ass Sanctuary 2 www.gradeup.co Haryana Kalesar National Park - Sultanpur National Park - Himachal Pradesh Pin Valley National Park - Great Himalayan National Park UNESCO World Heritage Site Inderkilla National Park - Khirganga National Park - Simbalbara National Park - Jammu & Kashmir Dachigam National Park Kashmir stag Hemis National Park -

Stadiums of the States List of Stadiums of the States State City

Stadiums Of The States List Of Stadiums Of The States State City Name of the stadium Purpose of Stadium Andhra Pradesh Visakhapatnam Dr. Y.S. Rajasekhara Reddy ACA- Cricket VDCA Cricket Stadium Kadapa YS Raja Reddy Stadium Cricket Assam Guwahati Dr. Bhupen Hazarika Cricket Cricket Stadium Guwahati Indira Gandhi Athletic Stadium Football,Athletics Silchar Satindra Mohan Dev Stadium Footbal Guwahati Jawaharlal Nehru Stadium Sports and games Bihar Patna Moin-ul-Haq Stadium Cricket Patna Patliputra Sports Complex Footbal Siwan Rajendra Stadium Football Chandigarh Chandigarh Sector 42 Stadium Hockey Chhattisgarh Raipur Shaheed Veer Narayan Singh Cricket International Cricket Stadium Rajnandgaon International Hockey Stadium Hockey Page 1 Stadiums Of The States Delhi NCR Delhi Jawaharlal Nehru Stadium Footbal Delhi Feroz Shah Kotla Cricket Delhi Dhyan Chand National Stadium Hockey Delhi Ambedkar Stadium Footbal Delhi Chhatrasal Stadium Sports and games Goa Margao Fatorda Stadium Footbal Vasco da Gama Tilak Maidan Stadium Footbal Mapusa Duler Stadium Footbal Taleigao Dr Shyama Prasad Mukherjee Sports and games Indoor Stadium Gujarat Ahmedabad Sardar Vallabhbhai Patel Stadium Cricket Surat CB Patel International Cricket Cricket Stadium Rajkot Saurashtra Cricket Association Cricket Stadium Ahmedabad The Arena Footbal Baroda Moti Bagh Stadium Cricket Baroda IPCL Sports Complex Ground Cricket Rajkot Madhavrao Scindia Cricket Ground Cricket Haryana Hisar Mahabir Stadium Sports and games Page 2 Stadiums Of The States Gurgaon Tau Devi Lal Stadium Cricket, -

List of Cold Storages in the State: HARYANA Sr

Annexure-I List of Cold Storages in the State: HARYANA Sr. No District Name of Cold Owners of the cold Capacity Year of Type of Whether cold store Remarks Storage store with complete of the establishment produce under NHM scheme address and contact cold store or NHB scheme or number store self-constructed (in MTs) 1. Ambala 1. Ambala S.R. Cold Store Sanjeev Kumar, 4500 1998 & 2001 Potato Banana NHM Extension of Shishpal, Shiyaram, existing Manish Kumar Vill.- Cold Store Sirashgarh (Ambala) 2. Ambala Shri Shivam Cold S SushilaKumari, Vill.- 1500 1997 Potato Self-constructed Store, Mullana, 9896374128 3. Ambala Markanda Cold Lekhraj 3550 1995 & 2001 -Do- NHM Extension of Store & ICE Heralal, VPO- Saha existing Factory 9991587882 Cold Store 4. Ambala Kamdhanu Cold ParsotumDass, 2250 1998 -Do- Self-constructed Store Vill.- Tepla, Saha, 9416026199 5. Ambala S.P Cold Store & Harish Kumar 2000 1991 -Do- Self-constructed ICE factory Rakesh Mohan HarminderGoel, Vill.- Rukree (Dosarka), Ambala, 9416375948, 6. Ambala Milap Cold Store Anil Ahuja, VPO- 2000 1984 & 1984 -Do- Self-constructed Shehzadpur 9355211994 7. Ambala Janta Cold Store Mohan Lal, VPO- 2500 1979 & 1979 -DO- Self-constructed Naraingarh 1734284072, 9729541488 8. Ambala Shivalik Cold Ajit Dang, VPO- 2500 1975 & 1976 Potato & Self-constructed Store Naraingarh Onion 1 01734284101 9. Ambala Shivalik Cold Village Raipur, Viran, 2912 2015-16 NHM incomplete Storage Tehsil, Naraingarh 10. Ambala Shree Ganesh Gulshan Dang, VPO- 2200 1995 & 1996 Potato Self-constructed Cold Store Naraingarh 01734263362, 9466409017 11. Ambala HarMilap Cold Vijay Dang, VPO- 2300 2000 & 2001 Potato Self-constructed Store Naraingarh 01734263151, 9416009419 12. -

PROSPECTUS for Admission to M.Phil/Ph.D

PROSPECTUS For Admission to M.Phil/Ph.D. Programme and Award of University Research Scholarship (URS) For the session 2018-19 MAHARSHI DAYANAND UNIVERSITY ROHTAK (A State University established under Haryana Act No. 25 of 1975) (NAAC Accredited ‘A’ Grade) 1 विश्वविद्यालय कु लगीत भभू ुवभ ः स्वः । तत्सववतवभ ुरेण्यं भर्गो दवे स्य धीमवि । वधयो यो नः प्रचोदयात ् ।। अनसभ ꅍधान से ववज्ञान से िम ज्ञान को अवजुत करᴂ, वनःस्वार्ु िो श्रम भाव को िम राष्ट्र को अवपुत करᴂ। ऋविकभ ल का स륍मान िी िम सब का स्वावभमान िो, जब कोई 핍यवधान िो, अनष्ठभ ान िो 핍या奍यान िो । संर्गम ि ै कला संस्कृ वतयों का संर्गम ि ै कला संस्कृ वतयों का संचय उत्तम मनोववृ तयों का ज्ञान का र्गूँजू े तराना ि ै वेदों कोजर्ग ने माना िै ववकृ वतयों का दमन करᴂ ऋविकभ ल तमभ को नमन करᴂ राष्ट्र का नव वनमाुण िो ऋविकभ ल तमभ को प्रणाम िो ऋविकभ ल तमभ को प्रणाम िो ऋविकभ ल तमभ को प्रणाम िो ऋविकभ ल तमभ को प्रणाम िो ओम ् भभू ुवभ ः स्वः । 2 CONTENTS Sr. No. Particulars Page 1. Vice-Chancellor’s Message 2. Officers of the University 5-6 3. The University 7-12 4. Chapter-I Eligibility and Procedure for Admission to M.Phil. 13-14 5. Chapter-II Eligibility and Procedure for Admission to Ph.D. and Award of University Research Scholarship (URS) 15-17 6. Chapter-III Number of Seats 18-20 7.