CARICOM Business, 10 August, 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Caricom Business

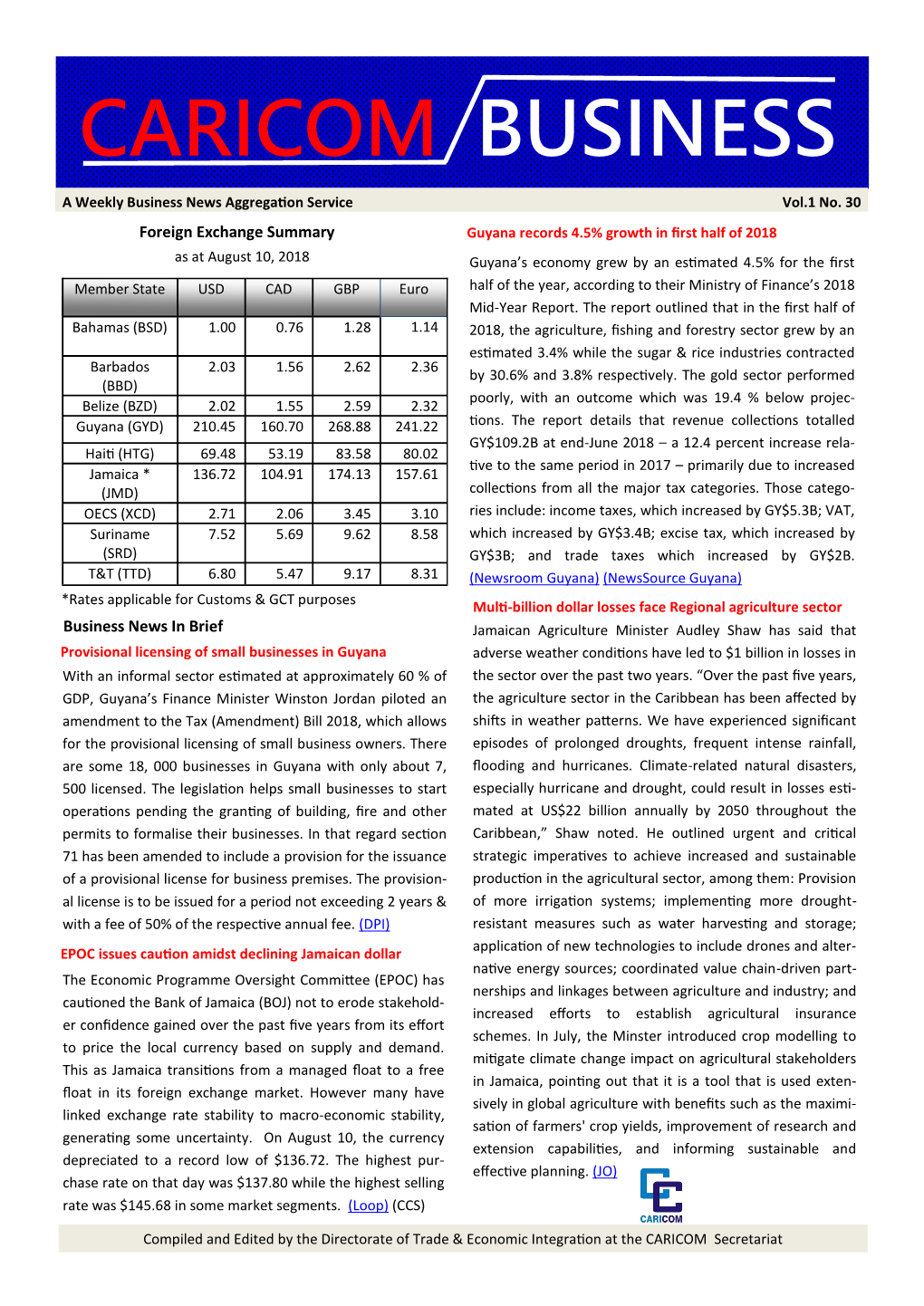

CARICOM BUSINESS A Weekly Business News Aggregation Service Vol. 2 No. 30 Foreign Exchange Summary St Lucia’s loss is Antigua’s gain in Virgin Airlines pullout as at July 26, 2019 Virgin Atlantic says after June 8, 2020 it will stop its opera- Member State USD CAD GBP Euro tions between St Lucia and London’s Gatwick Airport, for the “foreseeable future”. This after the airline asked for USD$7.5 Bahamas (BSD) 1.00 0.76 1.24 1.11 million over 3 years to maintain its current flight schedule. In a statement, According to Tourism Minister Dominic Fedee " Barbados 2.03 1.54 2.54 2.28 agreeing to Virgin Atlantic’s demands for a multi-million- (BBD) Belize (BZD) 2.02 1.54 2.52 2.26 dollar subsidy would have opened the door for other airlines Guyana (GYD) 210.45 159.58 261.66 234.43 to also ask for subsidy. In fact, upon hearing the news that Virgin Atlantic has requested subsidies from 4 Caribbean Haiti (HTG) 93.89 71.38 116.85 104.74 Jamaica * 137.47 105.06 170.04 153.01 governments, namely Grenada, Trinidad & Tobago, Antigua (JMD) and St. Lucia, other airlines have been in talks with OECS (XCD) 2.71 2.05 3.36 3.01 respective governments.” However according to Virgin Suriname 7.52 5.65 9.36 8.39 Atlantic “the proposed changes mean we will increase flights (SRD) from London Gatwick to Antigua, boosting services from 3 T&T (TTD) 6.80 5.44 8.94 7.95 per week to 4 per week, from 8 June 2020.” (LOOP) *Rates applicable for Customs & GCT purposes Cayman tightens financial services legislation Business News In Brief A raft of financial services legislation went before the Gov't securities to trade on local stock exchange Legislative Assembly this week. -

Caricom Business August 21 2020-Vol 3 No-34

CARICOM BUSINESS A Weekly Business News Aggregation Service Vol. 3 No. 34 Foreign Exchange Summary Guyana waives all banking charges for the rest of 2020 as at August 21, 2020 The Government of Guyana has announced measures geared Member State USD CAD GBP Euro towards easing the financial burden on citizens in the wake of the COVID-19 pandemic. According to newly appointed Bahamas (BSD) 1.00 0.76 1.31 1.18 President, Dr Irfaan Ali an agreement has been reached with the local banking sector to extend the moratorium on loan Barbados 2.03 1.54 2.70 2.42 payments until the end of the year and to cut interest rates. (BBD) Belize (BZD) 2.02 1.53 2.66 2.39 “Commercial banks agreed to offer general concessional re- Guyana (GYD) 218.00 159.23 276.33 248.02 ductions of interest rates of 1% and up to 2% on customer loans below GUY$10 million until December 30, 2020. The Haiti (HTG) 120.53 92.19 146.79 144.23 existing lending rate ranges between 6.5% and 16%. Some Jamaica * 151.33 114.94 198.76 180.16 (JMD) commercial banks have agreed to apply special treatment to OECS (XCD) 2.71 2.05 3.56 3.19 the interest accrued during the moratorium period,” he said. Suriname 7.52 5.66 9.89 8.92 “Commercial banks have agreed to waive all bank charges, (SRD) including ATM and merchant bank charges to encourage T&T (TTD) 6.80 5.51 9.53 8.60 more out-of-bank transactions, as well as charges for trans- *Rates applicable for Customs & GCT purposes actions by senior citizens.” The President added that these Business News In Brief measures will not impact the soundness of the banking sec- No tax increase for the Bahamas tor. -

Return Variability in CARICOM Equity Markets

Return Variability in CARICOM Equity Markets 1 Patrick Kent Watson Sir Arthur Lewis Institute of Social & Economic Studies, University of the West Indies, St. Augustine, Trinidad & Tobago Abstract This paper examines the validity of the Sharpe-Linter-Black Capital Asset Pricing Model (CAPM) to stocks traded on the Barbados, Jamaica and Trinidad & Tobago Stock Exchanges. Tests of the CAPM are based on portfolio Betas made up of stocks emanating from all exchanges, and tests are also made on alternative multifactor specification proposed by Fama and French, extended to include the possible pricing of idiosyncratic volatility. The CAPM tests are also carried out to account explicitly for negative excess market returns. The results support the contention that betas alone are not sufficient to account for the variation in equity returns in the CARICOM markets. JEL CLASSIFICATION NUMBERS: G110, G120, G150 KEYWORDS: CAPM, 3-factor model, CARICOM Equity markets. 1 The author gratefully acknowledges the invaluable research assistance provided by Shakti Babooram. 1 1. Introduction The Capital Asset-Pricing Model (CAPM) of Sharpe (1964), Linter (1965) and Black (1972) is one of the most influential contributions to modern financial theory and practice. Its fundamental prediction is that the market portfolio is mean-variance efficient and that the expected return of any security is a linear function of the market β. It received initial endorsement from papers like Fama and MacBeth (1973) but soon met with some stern resistance. In particular, in their seminal paper, Fama and French (1992) argue for a 3-factor model in which the excess return on a portfolio is explained by its sensitivity to three factors (i) the expected return on a broad market portfolio (ii) the difference between portfolios of small and large stocks (SMB) and (iii) the difference between returns on portfolios of the high and low book-to-market values (HML). -

Green State Development Strategy: Vision 2040

Diversified, Resilient, Low-carbon, People-centred VOLUME I POLICY RECOMMENDATIONS, FINANCIAL MECHANISM & IMPLEMENTATION An inclusive and prosperous Guyana that provides a good quality of life for all its citizens “ based on sound education and social protection, low-carbon resilient development, new economic opportunities, justice, and political empowerment. ” Executive Summary Background The Green State Development Strategy: Vision 2040 is Guyana’s twenty-year, national development policy that reflects the guiding vision and principles of the ‘green agenda’: “An inclusive and prosperous Guyana that provides a good quality of life for all its citizens based on sound education and social protection, low-carbon and resilient development, providing new economic opportunities, justice and political empowerment.” The central objective is development that provides a better quality of life for all Guyanese derived from the country’s natural wealth – its diversity of people and abundant natural resources (land, water, forests, mineral and aggregates, biodiversity). The vision of the ‘green agenda’ is centred on principles of a green economy defined by sustainable, low-carbon and resilient development that uses its resources efficiently, and sustained over generations. The development philosophy emphasises the importance of a more cohesive society based on principles of equity and tolerance between ethnic groups – recognising that diversity of culture and heritage is the underlying strength of the country’s human capital. Development objectives therefore seek to improve the health, education and overall well-being of Guyanese citizens, to lift people out of poverty through an economy that generates decent jobs and that provides opportunities for sustaining livelihoods over the long term. For decades, geopolitical events, natural disasters and global commodity price swings have weighed upon Guyana’s development. -

Doing Data Differently

General Company Overview Doing data differently V.14.9. Company Overview Helping the global financial community make informed decisions through the provision of fast, accurate, timely and affordable reference data services With more than 20 years of experience, we offer comprehensive and complete securities reference and pricing data for equities, fixed income and derivative instruments around the globe. Our customers can rely on our successful track record to efficiently deliver high quality data sets including: § Worldwide Corporate Actions § Worldwide Fixed Income § Security Reference File § Worldwide End-of-Day Prices Exchange Data International has recently expanded its data coverage to include economic data. Currently it has three products: § African Economic Data www.africadata.com § Economic Indicator Service (EIS) § Global Economic Data Our professional sales, support and data/research teams deliver the lowest cost of ownership whilst at the same time being the most responsive to client requests. As a result of our on-going commitment to providing cost effective and innovative data solutions, whilst at the same time ensuring the highest standards, we have been awarded the internationally recognized symbol of quality ISO 9001. Headquartered in United Kingdom, we have staff in Canada, India, Morocco, South Africa and United States. www.exchange-data.com 2 Company Overview Contents Reference Data ............................................................................................................................................ -

Turks and Caicos Islands Companies Regulations 2018

TURKS AND CAICOS ISLANDS COMPANIES REGULATIONS 2018 (Legal Notice /1 of2018) ARRANGEMENT OF REGULATIONS REGULATION Preliminary I. Citation and commencement 2. Interpretation 3. Terms defined or specified for purposes of Ordinance Company names 4. Permitted characters 5. Requirements for a company name 6. Company name in a foreign language or containing words in a foreign language 7. Additional company endings Re-use ofcompany names 8. Interpretation for regulations 9 to 12 9. Re-use of name changed under Ordinance or former Ordinance 10. Re-use of name of a struck-off or dissolved company 11. Re-use of name of discontinued company 12. Restrictions Registers and records 13. Register of members 14. Register of directors 15. Period for which documents shall be kept 16. Circumstances in which director interested in a transaction Voluntary liquidation 17. Individuals eligible to be appointed as or to act as voluntary liquidator 18. Circumstances in which voluntary liquidator shall be licensed insolvency practitioner 19. Advertisement of voluntary liquidator's appointment Miscellaneous 20. Additional matters to be included in articles of incorporation 21. Service of documents on company 22. Certificates oftranslation 23. Information to be contained in Register of Registered Charges 24. Certificate of good standing 25. Notices, returns and documents to be filed by companies and foreign companies 26. Documents and particulars prescribed for the purposes of sections 268 and 270 of the Ordinance 27. Documents excluded from section 293 of the Ordinance 28. Publication of approved forms 29. Registrar not responsible for verifying documents filed Fees and penalties 30. Fees and late payment penalties 31. -

Caricom Business Caricom Business

CARICOM BUSINESS A Weekly Business News Aggregation Service Vol. 4 No. 3 Foreign Exchange Summary Jamaica’s securities market grows by 100% as at January 15, 2021 Finance Minister Dr Nigel Clarke, says Jamaica’s private Member State USD CAD GBP Euro securities market grew by approximately 100% between 2017 and 2020, with the value of bond issuance transactions Bahamas (BSD) 1.00 0.79 1.36 1.21 doubling from some $200 million to $400 million. This metric was noted within the context that the banking sector Barbados 2.03 1.61 2.79 2.48 (BBD) recorded loan growth ranging between 16 and 35% over the Belize (BZD) 2.02 1.60 2.77 2.46 period. He was speaking during the digital launch of the Guyana (GYD) 218.00 165.45 287.17 255.26 Jamaica Stock Exchange private market. The private market Haiti (HTG) 74.90 57.76 100.58 89.16 will facilitate the listing of private bonds and equities Jamaica * 144.97 118.45 198.34 179.32 securities on the NASDAQ Platform. “It will build secondary (JMD) market participation and offer opportunities for investors and OECS (XCD) 2.71 2.12 3.69 3.29 corporates alike [by providing a] transparent mechanism for Suriname 14.29 11.12 19.47 17.33 the pricing and trading of private market securities,” Dr (SRD) Clarke said. The private listing and trading of securities on the T&T (TTD) 6.78 5.67 9.75 8.64 new platform will be in accordance with the FSC’s guidelines *Rates applicable for Customs & GCT purposes for exempt distributions which allows companies to issue Business News In Brief securities to raise money without filing a prospectus. -

Caricom Business

CARICOM BUSINESS A Weekly Business News Aggregation Service Vol. 2 No. 10 Foreign Exchange Summary Jamaicans get a $14 Billion stimulus package as at March 8, 2019 Jamaicans will be paying J$14.032 billion (US$110.3 million) Member State USD CAD GBP Euro less in taxes as the government reduces the tax burden as part of measures to stimulate greater business and econom- Bahamas (BSD) 1.00 0.75 1.30 1.12 ic activity and boost growth. Finance Minister Dr Nigel Clarke made the announcement on Thursday, fresh on the heels of Barbados 2.03 1.51 2.67 2.29 a reduction of the primary surplus target to 6.5% from 7.0% (BBD) under the IMF programme. The measures, which take effect Belize (BZD) 2.02 1.51 2.65 2.28 on April 1st, include abolishing the Minimum Business Tax, Guyana (GYD) 210.45 156.39 275.44 236.21 and increasing the General Consumption Tax (GCT) threshold Haiti (HTG) 84.16 62.53 108.47 94.18 to J$10 million (US$78,603), up from the current J$3 million Jamaica * 126.68 94.28 166.21 143.17 (JMD) (US$23,581). The Minister also tabled a proposal to supplant OECS (XCD) 2.71 2.00 3.53 3.03 all Ad Valorem Stamp Duty rates payable on any instrument Suriname 7.52 5.58 9.83 8.40 pursuant to the Stamp Duty Act, including the granting of (SRD) security as collateral for loans, with a specific (flat rate) T&T (TTD) 6.80 5.34 9.41 8.07 stamp duty of J$5,000 (US$39.30) per document. -

Stock Markets in the Caribbean: from 1969 and Beyond

The Evolution of Stock Markets in the Caribbean: From 1969 and Beyond Advisory Committee Members: Dr. P. K. Watson Dr. C. Bhatnagar Mr. A. Birchwood Submitted in Partial Fulfillment of the Requirements for the Degree of Master of Philosophy in Economic Development Policy and Management of The University of the West Indies John G. Cozier February 2010 TABLE OF CONTENTS 1. Abstract…………………………………………………………………4 2. Introduction….........................................................................................5 3. Literature Review………………………………………………………6 3.1 Stock Market Development and Economic Growth………7 3.2 The History of Stock Exchanges in the Caribbean………..8 3.2.1 Jamaica…………………………………………………9 3.2.2 Trinidad and Tobago………………………………….13 3.2.3 Barbados…….………………………………………...15 4. Data and Methodology…………………………………………………16 5. Empirical Analysis……………………………………………………...20 5.1 Market Size…………………………………………………21 5.2 Market Depth and Liquidity………………………………33 5.3 Market Risk and Return…………………………………..39 6. Limitations and Scope of Study………………………………………..49 7. Conclusions...............................................................................................51 References………………………………………………………………….53 Appendix of Statistical Tables…………………………………………….61 2 Appendix of Statistical Tables Table 1: Number of listed companies (1969 – 2009)………………………………………61 Table 2: Comparison of Numbers of listed companies for JSE, TTSE, BSE with selected benchmark stock exchanges………………………………………………………………...63 Table 3: Estimate of Fees for Issuance of $500 Million Common Equity -

The Evolution of Stock Markets in the Caribbean: from 1969 and Beyond

The Evolution of Stock Markets in the Caribbean: From 1969 and Beyond Advisory Committee Members: Dr. P. K. Watson Dr. C. Bhatnagar Mr. A. Birchwood Submitted in Partial Fulfillment of the Requirements for the Degree of Master of Philosophy in Economic Development Policy and Management of The University of the West Indies John G. Cozier February 2010 TABLE OF CONTENTS 1. Abstract…………………………………………………………………4 2. Introduction….........................................................................................5 3. Literature Review………………………………………………………6 3.1 Stock Market Development and Economic Growth………7 3.2 The History of Stock Exchanges in the Caribbean………..8 3.2.1 Jamaica…………………………………………………9 3.2.2 Trinidad and Tobago………………………………….13 3.2.3 Barbados…….………………………………………...15 4. Data and Methodology…………………………………………………16 5. Empirical Analysis……………………………………………………...20 5.1 Market Size…………………………………………………21 5.2 Market Depth and Liquidity………………………………33 5.3 Market Risk and Return………………………………….. 39 6. Limitations and Scope of Study………………………………………..49 7. Conclusions...............................................................................................51 References………………………………………………………………….53 Appendix of Statistical Tables…………………………………………….61 2 Appendix of Statistical Tables Table 1: Number of listed companies (1969 – 2009)………………………………………61 Table 2: Comparison of Numbers of listed companies for JSE, TTSE, BSE with selected benchmark stock exchanges………………………………………………………………... 63 Table 3: Estimate of Fees for Issuance of $500 Million Common Equity IPO……………64 Table 4: Average Annual Trading Volumes for the JSE, TTSE and the BSE…………….. 64 Table 5: Comparison of values of share trading for JSE, TTSE, BSE with selected benchmark stock exchanges (in billions of U.S. dollars)……………………………………………….. 65 Table 6: Volume and Value of Shares Traded (1969 – 2009)……………………………... 66 Table 7: Year-end Market Capitalization (in Millions of country’s local currency) (1969 – 2009)………………………………………………………………………………. -

Stock Market Indices in the CARICOM Sub-Region Construction and Use

Stock Market Indices in the CARICOM sub-region Construction and Use Cécile Pemberton Sir Arthur Lewis Institute of Social & Econom ic Studies Victor Vaugirard Departm ent of Managem ent Studies Patrick Kent Watson Sir Arthur Lewis Institute of Social & Econom ic Studies University of the West Indies St. Augustine Trinidad & Tobago Tel: (868) 662-2002, ext. 2037 Fax: (868) 645-6329 E-m ail: [email protected] The authors of this paper gratefully acknowledge the generous financial and other material assistance given to them by the Caribbean Money Market Brokers (CMMB) of Trinidad & Tobago. They also acknowledge the invaluable research assistance provided by Kevin Deopersad. The usual caveat about responsibility for errors applies. April 2004 ABSTRACT Stock Market Indices in the CARICOM sub-region: construction and use Cecile Pemberton, Victor Vaugirard and Patrick Watson If the embryonic financial markets of CARICOM are destined to play a major role in the development of the individual economies as well as the region as a whole within the framework of the CSME, then a minimum informational requirement is the existence of appropriate CARICOM wide and, by implication, national stock market indices. The main purpose of this paper is the construction of CARICOM-wide stock market indices, including indices for important sub sectors, based on stock market activity data obtained from the Stock Exchanges of Barbados, Jamaica and Trinidad & Tobago, as well as the construction of the individual country indices. These various indices are used to evaluate and compare rates of return and risk on the various portfolios implied by the indices as well as to make a preliminary analysis of the efficiency of the markets. -

Caricom Business

CARICOM BUSINESS A Weekly Business News Aggregation Service Vol. 2 No. 50 Foreign Exchange Summary Moody’s upgrades Jamaica’s rating as at December 13, 2019 Moody's Investors Service has upgraded the Government of Member State USD CAD GBP Euro Jamaica's long-term issuer and senior unsecured ratings to B2 from B3, and senior unsecured shelf rating to (P)B2 from Bahamas (BSD) 1.00 0.76 1.33 1.11 (P)B3. Moody's has also raised Jamaica's long-term local-currency bond and deposit ceilings to Ba1 from Ba2, as Barbados 2.03 1.54 2.67 2.27 well as the long-term foreign-currency deposit ceiling to B3 (BBD) from Caa1. The long-term foreign-currency bond ceiling re- Belize (BZD) 2.02 1.54 2.71 2.27 mains at Ba3. The outlook has been changed to stable from Guyana (GYD) 218.00 159.84 281.88 235.37 positive. Moody's cited Jamaica's vigorous commitment to Haiti (HTG) 93.27 70.07 128.22 102.72 “fiscal consolidation and structural reforms” as well as the Jamaica * 134.91 103.03 180.00 150.58 (JMD) improvement of “debt structure limits risks associated with OECS (XCD) 2.71 2.05 3.57 3.01 a high level of government debt” as the key factors pushing Suriname 7.52 5.66 10.07 8.41 the upgrade. The stable outlook reflects the structural credit (SRD) constraints due to the country's small size, sizeable T&T (TTD) 6.75 5.39 9.39 7.98 economic concentration in the tourism industry, low eco- *Rates applicable for Customs & GCT purposes nomic growth and vulnerability to external shock.