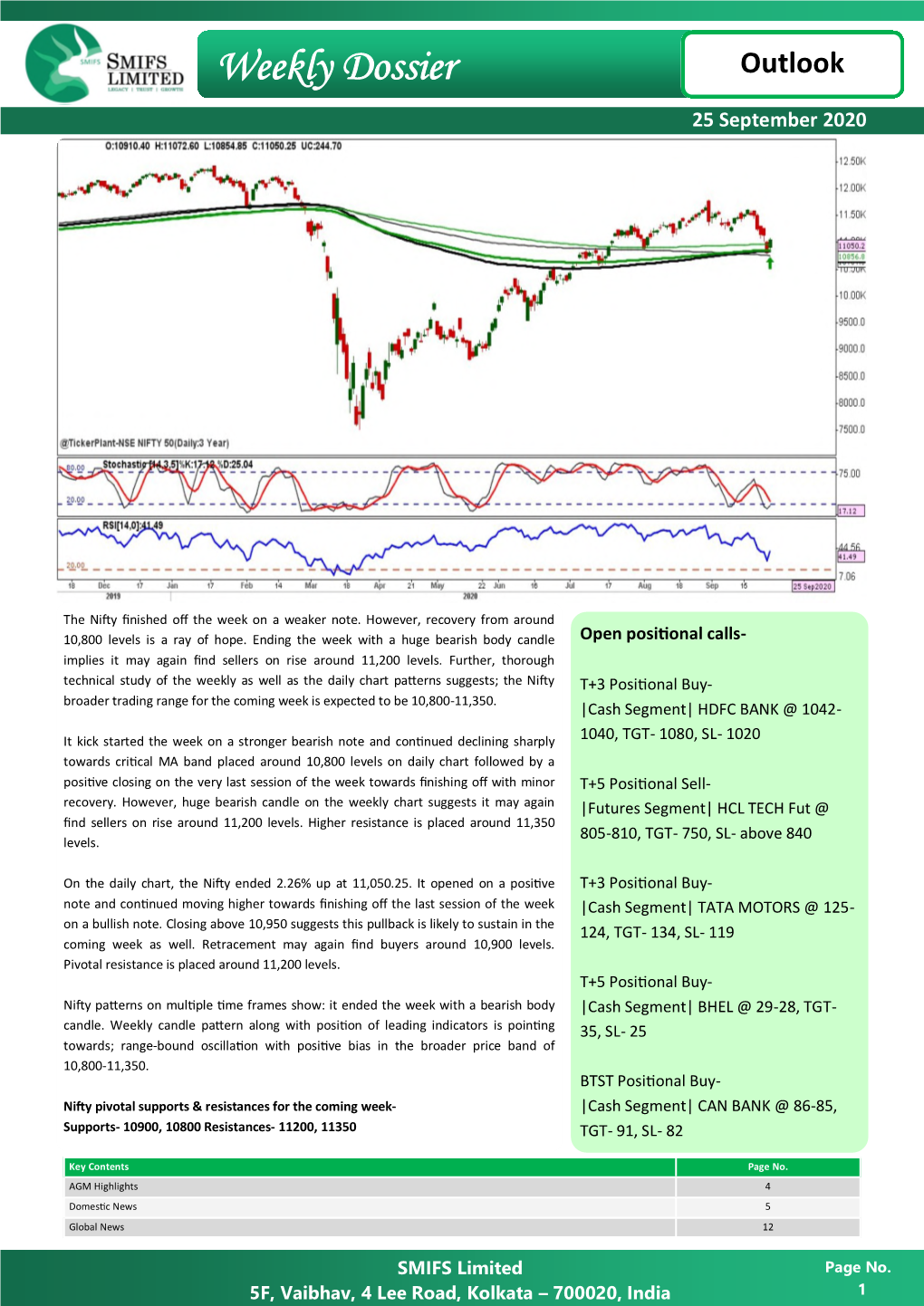

Weekly Dossier 25-09-2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

December 2011

Europe India Chamber of Commerce Issue: 46 Volume: 4 December 2011 Flanders in action with Global India Business on agenda The Global India Business Meeting (GIBM) to be held in Antwerp on 24-25 June 2012 received a wide coverage in the press and media in India and in Europe when the Minister-President of the Flemish government Mr. Kris Peeters, during his visit to India last fortnight, declared that the GIBM 2012 will be the most important business conclave for European and Indian business of the year 2012. The Flemish government which will host the Horasis business event, often described as the regional version of the World Economic Forum, is collaborating with EICC and other stakeholders in the preparation of the meeting. More than 300 business leaders and industrialists from India and Europe will participate. The Indian Commerce and Industry Minister Mr. Anand Sharma whom Mr. Peeters met in New Delhi will be the chief guest and address the meeting. The trade and economic relations between India and Belgium has been going from strength to strength with India being an important investor in the Flanders with investment of about 1.2 billion Euros. Over 50 Indian companies in the field of ICT, Pharma, Transport and Machinery equipment have established their presence. Top CEOs and selected business executives will discuss issues like trade and investment, finance, green tech, etc. The GIBM will be held in a very unsettled and fluid global business environment and the Eurozone economic crisis will offer the participant opportunities to debate on the global economy and what solution they think both India and Europe can help tide over the crisis. -

JRD Denims Limited 07 Nov 2018 Brickwork Ratings Assigns BWR

Rating Rationale JRD Denims Limited 07 Nov 2018 Brickwork Ratings assigns BWR BBB-/A3 for the Bank Loan Facilities of Rs. 112.00 Crores of JRD Denims Limited (‘JRDDL’ or ‘the Company’) Particulars Facility* Amount (Rs. Crs) Tenure Rating1 Fund based Cash Credit 20.00 BWR BBB- Long Term (Pronounced as BWR Triple B Minus) Term Loans 85.00^ (Outlook: Stable) Non Fund Based Bank Guarantee BWR A3 7.00 Short Term (Pronounced as BWR A Three) Total 112.00 (Rupees One Hundred Twelve Crores Only) 1 For definitions of the rating symbol please visit our website www.brickworkratings.com *Annexure I show details of bank loan facilities;^ includes undisbursed portion of Rs. 25.00 crs Rationale/Description of Key Rating Drivers/Rating sensitivities: Brickwork Ratings (BWR) has essentially relied upon the audited financial results of the Company upto FY18, provisional financials of H1FY19, projected financials, publicly available information and information/clarifications provided by the management. The ratings draw strength from the experience of the promoters in the textile industry through group entities, timely commissioning of Phase I of the project, DSRA structure for the term loans, locational advantages and healthy order book position. The ratings are constrained by the project execution risk and delay in completion of Phase II, limited experience of the promoters in the denim sector, susceptibility of margins to fluctuation in prices of raw materials, seasonality associated with the availability of raw materials, intensely competitive textile industry and working capital intensive operations. Going forward, the Company’s ability to stabilise and achieve optimal operations in Phase I, achieve completion of Phase II as anticipated without any significant time and cost overruns, ensure timely funding, strengthen its credit profile and manage its working capital efficiently will be the key rating sensitivities. -

OCL-INDIA-2014-2015.Pdf

OCL India Limited Annual Report 2014-15 ANNUAL REPORT 2014-15 02 Accelerating CONTENTS Value Creation CORPORATE OVERVIEW Business Overview 02 04 Financial Highlights 12 About OCL India 14 Growth MANAGEMENT REPORTS Management Discussion and 15 06 Analysis Directors’ Report 20 Optimization Corporate Governance 24 Report Annexures to Directors’ 34 Report 08 FINANCIAL STATEMENTS Acceleration Standalone Financial 60 Statements Consolidated Financial 89 10 Statements Sustainability Cautionary Statement Statements made in this report describing industry outlook as well as the Company’s plans, policies and expectations may constitute ‘forward-looking statements’ within the meaning of applicable laws and regulations. Actual results may differ materially from those either expressed or implied. Corporate Information BOARD OF DIRECTORS STATUTORY AUDITORS Pradip Kumar Khaitan V. Sankar Aiyar & Co. Chairman Chartered Accountants Puneet Yadu Dalmia Managing Director REGISTERED OFFICE Gaurav Dalmia Rajgangpur – 770 017 (Odisha) Gautam Dalmia District Sundargarh D. N. Davar V. P. Sood CORPORATE OFFICE Sudha Pillai 17th Floor, Narain Manzil, Jayesh Doshi 23, Barakhamba Road, Mahendra Singhi New Delhi – 110 001 Whole Time Director & CEO Amandeep REGISTRAR AND SHARE Whole Time Director & CEO TRANSFER AGENT (Cement Division) C B Management Services (P) Limited PRESIDENT P-22, Bondel Road, R. H. Dalmia Kolkata - 700 019 COMPANY SECRETARY Rachna Goria BANKERS/FINANCIAL INSTITUTIONS State Bank of India United Bank of India Punjab National Bank UCO Bank Axis Bank Limited International Finance Corporation Export Import Bank of India Yes Bank Limited HSBC Bank Annual Report 2014-15 Focused and Steady – two distinguishing traits that summarise more than six-decades rich legacy of our Accelerating integrated Cement and Refractory businesses. -

DBL ARFY15.Pdf

Corporate office Hansalaya Building, 11th & 12th Floor 15, Barakhamba Road, New Delhi – 110001 Ph: 011 – 23310121 / 23 / 24 25, Fax: 23313303 Email: [email protected] [email protected] Dalmia Bharat Limited Website: www.dalmiabl.com Annual report 2014-15 Corporate information Board of Directors Bankers Pradip Kumar Khaitan – Chairman State Bank of India Jai Hari Dalmia – Managing Director Axis Bank Punjab National Bank Yadu Hari Dalmia– Managing Director Corporation Bank Gautam Dalmia Oriental Bank of Commerce Puneet Yadu Dalmia Deutsche Bank N. Gopalaswamy Honk Kong and Shanghai Banking Corporation Virendra Singh Jain Registered Office Sudha Pillai Dalmia Bharat Limited Jayesh Doshi – Whole Time Director & Dalmiapuram - 621651 Group Chief Financial Officer Dist Tiruchirapalli Tamil Nadu Management Team Gautam Dalmia Corporate Office Puneet Yadu Dalmia Hansalaya Building, Mahendra Singhi 11th & 12th Floors 15, Barakhamba Road T. Venkatesan New Delhi – 110001 Jayesh Doshi Registrar and Share Transfer Company Secretary Agent Nidhi Bisaria Karvy Computershare Private Limited Karvy Selenium Tower B, Plot 31-32 Auditors Gachibowli, Financial District, S.S. Kothari Metha & Co. Nanakramguda, Hyderabad – 500 032 Contents Overview by the management 02 Directors’ Report 53 Forward-looking statement In this annual report, we have disclosed forward-looking information to enable investors to comprehend our prospects and take informed investment Pillars of company’s success 08 Report on Corporate Governance 57 decisions. This report -

Lucknow on Wednesday

34 8" $ !)'9 '9 9 "#67"8!)2. 5-$5$6 8579(// ,-57/ ! 2/","0",2 06"/ 60//,1,64/3162,2%/"/" *1$4*174 4/2 $45,50 .23 715707124/316 612 ,61,06 12$,%16 A16,4,2,/"46 $4"460.316/,,2751 ./41 "4/"155602$46 $461$02 ?$46171$@,*1?31$1 5 34:;""5 <= >1/ 4 1 ! ' *.*(*!9%!.$ 243$45, ! " # $ % arnataka on Wednesday ' Kjoined the list of States reporting infectious Delta Plus variant of Covid-19, a mutat- ed version of highly contagious ($ ) Delta variant, taking the total number of reported cases to 46 * across the country, more than *10 doubling a day after the report- ed 22 cases on Tuesday. + he return of political nor- Maharashtra tops the list so ,$' Tmalcy in Jammu & far with 21 cases followed by Kashmir and conduct of elec- Kerala and Madhya Pradesh tions will largely depend on the which are already on alert. outcome of the crucial all- The Centre has issued them # ) 0'( 1 P!"# ". , O party meet convened by Prime advisory amid concerns over . Minister Narendra Modi with likely third wave of the pan- ! the leaders of the Union demic in the country in the Delta Plus virus is prevalent in Ministry and a further course $ Territory in New Delhi on next few months. Presently, the nine countries across the world of action is being planned. /0 Thursday. — the US, the UK, Portugal, The Minister said the State 1 .# ' Former Jammu & Kashmir " /1 Switzerland, Japan, Poland, Government is monitoring the Chief Minister and PDP chief $$(2 Nepal, China, and Russia. -

AIBEA's Banking News

AIBEA’s Banking News 3 MAY 2018 NEWS BULLETIN FROM ALL INDIA BANK EMPLOYEES’ ASSOCIATION ‘Struggle for a living wage continues’ BY NOMAZIMA NKOSI AND ODETTE PARFITT - 02 May 2018 HERALDLIFE President Cyril Ramaphosa arrives at the Wolfson Stadium Arriving to a hero‘s welcome at Port Elizabeth‘s Isaac Wolfson Stadium yesterday, President Cyril Ramaphosa hailed the new national minimum wage as a historic victory for workers. He was addressing a sea of red-clad Cosatu members and supporters who had packed the 10 000-seat Kwazakhele stadium to celebrate National Workers‘ Day. ―This is a victory no matter what other people may say,‖ Ramaphosa said. 1 ―We knew R20 an hour was not a living wage, but we needed to form a foundation. ―If we said workers had to earn R15 000, many people would lose their jobs and companies would [have to] close. ―We concluded that the struggle for a living wage must continue but we must start somewhere. ―This is a struggle that you as workers must wage.‖ Ramaphosa credited Cosatu for the start of minimum wage negotiations, saying the labour federation had identified the need as enshrined in the Freedom Charter. He also called for equal pay for men and women workers, and said while the government wanted to protect workers‘ right to strike, they should do so responsibly. ―We must look very carefully at how we engage in our industrial action. ―Recently, we‘ve found some workers have prevented others from doing important work, such as helping women give birth. ―Let us have that humanity that, even when we are on strike, certain services are important. -

KSN TECH VENTURES PVT LTD Established in the Year 2000, by Mr

KSN TECH VENTURES PVT LTD Established in the year 2000, By Mr. K.S Nalwaya, who has extensive experience in Project Execution and Marketing. We are Delhi Based and operate on all India Basis MAJOR EQUIPMENT AND PLANTS HANDLED PLANT AND EQUIPMENT FOR THE CEMENT INDUSTRY. STOCKPILE SHEDS IN SPACE FRAME STYLE COAL WASHERIES WASTE HEAT RECOVERY SYSTEMS FGD AND DNOX SYSTEMS FOR POWER PLANTS STOCKYARAD SYSTEMS OUR TRACK RECORD • WE HAVE TILL DATE SOLD THE FOLLOWING IN INDIA: STACKER RECLAIMERS: 50 STOCKPILE SHEDS AND DOMES: 50 WASTE HEAT RECOVERY PLANTS : 6 NUMBER COAL WASHERIES : 2 NUMBERS EQUIPMENT FOR CEMENT PLANTS : 40 BUCKET ELEVATORS, 2 DEEP PAN CONVEYORS 6 NUMBER VERTICAL ROLLER MILLS VIBRATING EQUIPMENT TO POWER AND STEE SECTORS: ABOUT 55 NUMBERS VITAL STATISTICS OF KSN VENTURES • TOTAL NUMBERS OF EMPLOYEES: 10 NUMBERS • ANNUAL TURNOVER : APPX 12 MILLION US DOLLARS • SERVICES OFFERED: • ENQUIRY GENERATION • TECHNICAL AND COMMERCIAL DISCUSIONS • ORDER BOOKING • PROJECT COORDINATION • ARRANGE INDIAN PARTNERS FOR PROJECT EXECTUION AND LOGISTICS LIST OF CLIENTS • ADANI GROUP • BHEL LTD • BIRLA GROUP- VARIOUS COMPANIES • BANGUR GROUP • BGR ENERGY SYSTEMS LTD • DALMIA GROUP • ESSAR GROUP • HOLCIM • JINDAL GROUP-VARIOUS COMPANIES • JAYPEE GROUP • NTPC LTD • WONDER GROUP • RELIANCE ADAG GROUP • TATA STEEL LIST OF PRINCIPALS- PRODUCTS • AVA INDUSTRIES – GERMANY- INDUSTRIAL MIXERS • CIMBRIA INDUSTRIES- DENMARK-LOADING CHUTES • GT GLOBAL – USA- COAL WASHING PLANTS • GENERAL KINEMATICS LTD- USA-VIBRATING EQUIPMENT • NHI LTD – CHINA- STACKER RECLAIMERS -

2014 Annual Report

1775 Massachusetts Avenue NW Washington, DC 20036 www.brookings.edu BROOKINGS Annual Report 2014 QUALITY. INDEPENDENCE. IMPACT. Five Programs, BROOKINGS one brookings Photo by Paul Morigi The challenges facing the world today—from transnational terrorism to sustainable economic growth to energy and climate change—are complex and interconnected. Solving them demands a multidimensional approach that employs a range of disciplines and addresses both root causes and long-term effects. The breadth of expertise and collaborative atmosphere at Brookings enable just this approach. Each of Brookings’s five research programs—Economic Studies, Foreign Policy, Global Economy and Development, Governance Studies, and the Metropolitan Policy Program—could be its own think tank. But if they operated in isolation, important synergies would be lost. The multifaceted solutions to today’s biggest problems don’t come out of single-issue silos. They come out of one Brookings. 1 Co-Chairs’ Message President’s Message hen Robert Brookings decided, rom our founding 98 years ago, Brookings’s mission has included engaging fellow nearly a hundred years ago, to citizens in our scholars’ work. We don’t just produce and disseminate research and create and fund a nonprofit recommendations—we find ways to test and improve them through dialogue and debate. organization to study how the Hence the integral importance of our Communications Department, our public spaces like Wfederal government might F the Falk Auditorium, our prominence in the media, and our collaboration with other think operate more effectively, tanks, universities, civic organizations, governing bodies at all levels, international agencies, bert he could not have possibly imagined what M and the private sector. -

Monthly Current Affairs Consolidation (July 2019).Pdf

Current Affairs (CONSOLIDATION) JULY 2019 Drishti, 641, First Floor, Dr. Mukherjee Nagar, Delhi-110009 Phone: 87501 87501, WhatsApp: 81303 92355 Email: [email protected] Contents Polity and Governance ........................................................................... 1 z Quality of Free Legal Aid ...............................................................................................................................................1 z Japanese Encephalitis .................................................................................................................................................2 z Puducherry Water Rich Model ......................................................................................................................................2 z Register of Indigenous Inhabitants of Nagaland ........................................................................................................3 z One Nation One Ration Card Scheme ..........................................................................................................................3 z Jal Shakti Abhiyan ........................................................................................................................................................4 z Adarsh Station Scheme ................................................................................................................................................4 z National Mission on Libraries ......................................................................................................................................5 -

Coal Ownership

Coal Ownership (MW) July 2017 - Includes units 30 MW and larger Announced + Pre-permit Cancelled Company Announced Pre-permit Permitted + Permitted Construction Shelved 2010-2017 Operating Retired 24 Hour Company 0 0 500 500 0 0 0 0 0 A Brown Company 0 0 0 0 135 0 0 135 0 A1 Group 0 0 0 0 0 150 0 0 0 A2A 375 0 0 375 0 0 0 796 160 Aalborg Forsyning 0 0 0 0 0 0 0 716 0 Aarti Steels 0 0 0 0 0 0 0 90 0 Abhijeet Group 0 0 0 0 0 0 8,955 244 0 ABL Co. Ltd. 0 112 0 112 0 0 0 0 0 Aboitiz Group 0 0 200 200 755 344 0 500 0 ACB (India) Limited 0 0 0 0 0 1,200 1,200 1,330 0 ACC Limited 0 0 0 0 0 0 0 30 0 Accord Energy 0 0 0 0 0 360 0 0 0 Aci Energy 0 0 0 0 0 0 0 0 36 ACWA Power 3,850 300 720 4,870 1,200 300 0 0 0 Adani Group 600 3,200 3,200 7,000 0 2,920 6,300 10,440 0 Adaro 300 100 0 400 633 0 0 60 0 Adhunik Group 0 0 0 0 0 0 5,820 570 0 Aditya Birla Group 0 0 0 0 0 0 0 3,173 0 AEI (Ashmore Energy International) 0 0 0 0 0 0 0 300 0 AES 0 168 0 168 168 150 6,780 9,963 4,655 Africa Power House 0 0 330 330 0 0 0 0 0 African Energy Resources 900 0 300 1,200 0 850 0 0 0 AGL Energy 0 0 0 0 0 0 2,000 5,194 0 Agrofert 0 0 0 0 0 0 0 46 0 Air Products & Chemicals 0 0 0 0 0 0 0 0 60 Akfen Group 0 0 0 0 0 0 1,900 0 0 Akkan Enerji A.ş. -

Institute Name India Rankings 2017 ID Discipline Parameter

Institute Name Indian Institute of Management Udaipur India Rankings 2017 ID IR17-MGMT-1-18709 Discipline MANAGEMENT Parameter PGP (2 Yr ) Academic Year Name of the Company Area No of students recruited Minimum salary Offered Maximum salary offered Average salary offered Median salary offered 400000 1525000 994662 1001296 2013-14 Accenture Services Pvt. Ltd. Information technology(IT) 34 Cognizant Technology Solutions India Pvt. Ltd. CSS Corp Dell International Services eInfochips Limited HCL Comnet System & Services Ltd. Infosys BPO JDA Software Mindtree Ltd. Novire Technologies Nucleus Software Exports Ltd. Pristine Edutronics Talisma Corporation Pvt. Ltd. Wipro Catallyst Constellations Consulting/analytics 5 Ernst & Young LLP Monk Consulting daVIZta India Pvt Ltd. GE India Industrial Pvt. Ltd. Banking,Financial Services and Insurance(BFSI) 17 Genpact ICICI Bank ltd Max Life Insurance Yes Bank Aranca Godrej & Boyce Mfg. Co. Ltd. Consumer Goods(FMCG) Mother Dairy 5 Resonance Eduventures Pvt Ltd Education 1 Rajasthan Electronics & Instruments Limited, Energy Solutions 1 Vaibhav Global Ltd. E-Retail/Commerce 3 Crompton Greaves Heavy Electrical Equipments 3 Future Supply Chain Logistics 3 Dalmia Cement Bharat Limited Manufacturing National Engineering Industries Ltd. Titan Company Visa Steel Limited 5 Mewar Hospital Pharmaceuticals/healthcare NMC Healthcare L.L.C 4 Puravankara Projects Limited Real Estate 3 BPCL Refineries/Petro- Product 4 Serendipity Infolabs Pvt. Ltd. Travel and Tourism 1 Bajaj Auto Ltd. Automobile 3 2014-15 GE India Industrial Pvt. Ltd. 23 600000 1525000 1026362 1000000 Yes Bank Janalakshmi financial services Pvt. Ltd. Ratnakar Bank ICICI Prudential Banking,Financial Services and Insurance(BFSI) Fidelity Business Services India Pvt Ltd ICICI Bank ltd Xpress Money Aranca Genpact Intellectual Capital Solutions Cognizant Business Consulting (CBC) Consulting 8 Deloitte KPMG Vaibhav Global Ltd. -

List of Delisted Companies

LIST OF DELISTED COMPANIES Sl. No. Name of the Company Date of Delisting F.Y. 2009-10 1 Niryat Sam Apparels Ltd. 04/09/2009 2 Woo Yang Electronics (I) Ltd. 04/09/2009 3 Arvind Products Ltd. 04/09/2009 4 Hindustan Copper Ltd. 04/09/2009 5 Duke Offshore Ltd. 04/09/2009 6 Vintage Securities Ltd. 04/09/2009 7 Vinay Cement Ltd. 04/09/2009 8 Jamuna Auto Industries Ltd. 04/09/2009 9 Sudarshan Chemicals Industries Ltd. 04/09/2009 10 Narmada gelatines Ltd. 04/09/2009 11 Lanco Industries Ltd. 04/09/2009 12 Jindal Driling & Industries Ltd. 04/09/2009 13 Maharashtra Seamless Ltd. 04/09/2009 14 NIIT Technology Ltd. 04/09/2009 15 United Breweries Ltd. 04/09/2009 16 Millennium Beer Industries Ltd. 04/09/2009 17 Peari Polymers Ltd. 04/09/2009 18 Zee News Ltd. 04/09/2009 19 Dhunseri Tea & Industries Ltd. 04/09/2009 20 Auroma Coke Ltd. 04/09/2009 21 Usha Flowell Ltd. 16/09/2009 22 Britex India Ltd. 16/9/2009 23 Udit India Ltd. 16/9/2009 24 Umang Dairies Ltd 16/10/2009 25 Sita Investment Co. Ltd. 25/11/2009 26 Avery India Ltd. 25/01/2010 F.Y. 2010-11 1 Triveni Engineering & Industries Ltd. 02/09/2010 2 Caplin Point Laboratories Ltd. 02/09/2010 3 Rydak Enterprises & Investment Ltd. 02/11/2010 4 Kothari Sugars & Chemicals Ltd. 02/11/2010 5 Innovative Foods Ltd. 02/11/2010 6 Rama Vision Ltd. 17/02/2010 7 GIC Housing Finance Ltd.