1111Wrilid R Fr

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Download (Pdf)

X-6737 TUB DISCOUNT RATE CONTROVERSY BETWEEN THE FEDERAL RESERVE BOARD and THE FEDERAL RESERVE BANK OF NEW YORK -1- November [1st approx., 1930. The Federal Reserve Bank of New York, in its Annual Report for the year 1929, stated: "For a number of weeks from February to May, 1929, the Directors of the Federal Reserve Bank of New York voted an increase in the discount rate from 5% to 6%. This increase was not approved by the Board." Annual Report, Page 6. ~2~ The above statement makes clear the error of the prevailing view that the discount rate controversy lasted from February 14, 1929, - the date of the first application for increase in discount rates, - to August 9, 1929, the date of the Board's approval of the increase from 5% to 6%. The controversy began on February 14, 1929, but practically ended on May 31, 1929. On May 22, 1929, Governor Harrison and Chairman McGarrah told the Board that while they still desired an increase to 6%, they found that the member banks, under direct pressure, feared to increase their borrowings, and that they wanted to encourage them to borrow to meet the growing demand for commercial loans. 16 Diary 76 (69). Furthermore, on May 31, 1929, Chairman McGarrah wrote to the Federal Reserve Board that the control of credit without increasing discount rates Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis X-6737 - 2 - (direct pressure) had created uncertainty; that agreement upon a program to remove uncertainty was far more important than the discount rate; that in view of recent changes in the business and credit situation., his directors believed that a rate change now without a mutually satis- factory program, might only aggravate existing tendencies; that it may soon be necessary to establish a less restricted discount policy in order that the member banks may more freely borrow for the proper conduct of their business:; that the Federal reserve bank should be prepared to increase its portfolio if and when any real need of doing so becomes apparent. -

Records of the Immigration and Naturalization Service, 1891-1957, Record Group 85 New Orleans, Louisiana Crew Lists of Vessels Arriving at New Orleans, LA, 1910-1945

Records of the Immigration and Naturalization Service, 1891-1957, Record Group 85 New Orleans, Louisiana Crew Lists of Vessels Arriving at New Orleans, LA, 1910-1945. T939. 311 rolls. (~A complete list of rolls has been added.) Roll Volumes Dates 1 1-3 January-June, 1910 2 4-5 July-October, 1910 3 6-7 November, 1910-February, 1911 4 8-9 March-June, 1911 5 10-11 July-October, 1911 6 12-13 November, 1911-February, 1912 7 14-15 March-June, 1912 8 16-17 July-October, 1912 9 18-19 November, 1912-February, 1913 10 20-21 March-June, 1913 11 22-23 July-October, 1913 12 24-25 November, 1913-February, 1914 13 26 March-April, 1914 14 27 May-June, 1914 15 28-29 July-October, 1914 16 30-31 November, 1914-February, 1915 17 32 March-April, 1915 18 33 May-June, 1915 19 34-35 July-October, 1915 20 36-37 November, 1915-February, 1916 21 38-39 March-June, 1916 22 40-41 July-October, 1916 23 42-43 November, 1916-February, 1917 24 44 March-April, 1917 25 45 May-June, 1917 26 46 July-August, 1917 27 47 September-October, 1917 28 48 November-December, 1917 29 49-50 Jan. 1-Mar. 15, 1918 30 51-53 Mar. 16-Apr. 30, 1918 31 56-59 June 1-Aug. 15, 1918 32 60-64 Aug. 16-0ct. 31, 1918 33 65-69 Nov. 1', 1918-Jan. 15, 1919 34 70-73 Jan. 16-Mar. 31, 1919 35 74-77 April-May, 1919 36 78-79 June-July, 1919 37 80-81 August-September, 1919 38 82-83 October-November, 1919 39 84-85 December, 1919-January, 1920 40 86-87 February-March, 1920 41 88-89 April-May, 1920 42 90 June, 1920 43 91 July, 1920 44 92 August, 1920 45 93 September, 1920 46 94 October, 1920 47 95-96 November, 1920 48 97-98 December, 1920 49 99-100 Jan. -

Dietz, Cyrus E 1928-1929

Cyrus E. Dietz 1928-1929 © Illinois Supreme Court Historic Preservation Commission Image courtesy of the Illinois Supreme Court Cyrus Edgar Dietz was born on a farm near Onarga, Illinois, a town on the Illinois Central Railroad in Iroquois County on March 17, 1875. At the peak of a highly successful career as a prominent attorney, he won a seat on the Supreme Court only to die of injuries sustained in an equestrian accident barely nine months after his swearing-in, making his tenure one of the shortest in the Court’s history. His parents were Charles Christian Dietz and Elizabeth Orth Dietz. He was the youngest of eight children. His father was born in Philadelphia of Alsatian background. His mother came from a Moravian family that settled in Pennsylvania in the early eighteenth century. Elizabeth Orth Dietz’s uncle was Godlove Orth, a friend of Abraham Lincoln’s during the Civil War, a prominent lawyer in Indiana, serving in the state legislature, in the United States House of Representatives, and as minister to the court of Vienna.1 His education began at the Grand Prairie Seminary at Onarga. From there he went to Northwestern University and majored in speech and law, obtaining his Bachelor of Law degree in 1902. His brother Godlove Orth Dietz graduated with him.2 While pursuing his double-major at Northwestern, he also played fullback for the university football team, an effort that earned him All-American status in 1901.3 2 After graduation he stayed near Northwestern to practice law in the Chicago office of William Dever, who would later become mayor of Chicago in the 1920s. -

Strafford, Missouri Bank Books (C0056A)

Strafford, Missouri Bank Books (C0056A) Collection Number: C0056A Collection Title: Strafford, Missouri Bank Books Dates: 1910-1938 Creator: Strafford, Missouri Bank Abstract: Records of the bank include balance books, collection register, daily statement registers, day books, deposit certificate register, discount registers, distribution of expense accounts register, draft registers, inventory book, ledgers, notes due books, record book containing minutes of the stockholders meetings, statement books, and stock certificate register. Collection Size: 26 rolls of microfilm (114 volumes only on microfilm) Language: Collection materials are in English. Repository: The State Historical Society of Missouri Restrictions on Access: Collection is open for research. This collection is available at The State Historical Society of Missouri Research Center-Columbia. you would like more information, please contact us at [email protected]. Collections may be viewed at any research center. Restrictions on Use: The donor has given and assigned to the University all rights of copyright, which the donor has in the Materials and in such of the Donor’s works as may be found among any collections of Materials received by the University from others. Preferred Citation: [Specific item; box number; folder number] Strafford, Missouri Bank Books (C0056A); The State Historical Society of Missouri Research Center-Columbia [after first mention may be abbreviated to SHSMO-Columbia]. Donor Information: The records were donated to the University of Missouri by Charles E. Ginn in May 1944 (Accession No. CA0129). Processed by: Processed by The State Historical Society of Missouri-Columbia staff, date unknown. Finding aid revised by John C. Konzal, April 22, 2020. (C0056A) Strafford, Missouri Bank Books Page 2 Historical Note: The southern Missouri bank was established in 1910 and closed in 1938. -

Lovestone Becomes a Lovestoneite, 1928–9

chapter 13 Lovestone Becomes a Lovestoneite, 1928–9 Late 1928 to early 1929 was Lovestone’s apex. The anti-Trotsky campaign was integral to his tenure as party leader. Many of the leaders of the campaign would soon be purged themselves. By supporting Bukharin at the same time as Stalin was preparing an attack on the head of the Comintern, Lovestone sowed the seeds of his own downfall. Lovestone had genuine affinities to Bukharin, but he also miscalculated in his attempt to position himself with the Comintern leadership. Lovestone had attacked Lozovsky, Stalin’s ally, for ‘making a muddle of nearly everything he has touched’, and at the last meet- ing of the Senioren Convent (comprising high-ranking Comintern leaders), Lovestone attacked the ‘corridor congress’ against Bukharin, compelling Stalin to deny any breach between the two Russian leaders. Meanwhile the campaign against the ‘right danger’ in the Comintern increased; Lovestone’s fixation with Cannon—and his attacks on Foster and Bittelman—left him open to criticism as a ‘rightist’.1 Engdahl, in a cable from Moscow, indicated ‘general approval here [about] Cannon expulsion’, but stressed that the ‘party must emphasize more how- ever [the] struggle against right danger while fighting Trotzkyism’. Some in the Comintern attacked the Daily Worker’s coverage of the expulsions as ‘mostly selfpraise and going [to] ridiculous extremes’. Couching himself in Comintern rhetoric, Lovestone argued that fighting Cannon and Trotskyism was part of the fight against the ‘right danger’. According to a motion by the leadership of the Young Workers’ (Communist) League: ‘In the American Party at the present time, the Right danger is represented sharply by the Trotskyists’. -

The Laws of Jamaica, 1928

Florida International University College of Law eCollections Jamaica Caribbean Law and Jurisprudence 1929 The Laws of Jamaica, 1928 Jamaica Follow this and additional works at: https://ecollections.law.fiu.edu/jamaica Part of the Comparative and Foreign Law Commons, and the Legislation Commons Repository Citation Jamaica, "The Laws of Jamaica, 1928" (1929). Jamaica. 85. https://ecollections.law.fiu.edu/jamaica/85 This Book is brought to you for free and open access by the Caribbean Law and Jurisprudence at eCollections. It has been accepted for inclusion in Jamaica by an authorized administrator of eCollections. For more information, please contact [email protected]. r — Laws of Jamaica PASSED IN THE YEAR 1928. THE LAWS OF JAMAICA PASSED IN THE YEAR, 1928. PUBLISHED BY AUTHORITY 6Z6I 96Z6I - N(1P JAMAICA GOVERNMENT PRINTING OFFICE, KINGSTON. 1929. c/.-C TABLE OF LAWS, [Assented to 6th March,: 1928.] 1. A Law to continue a certain Expiring Law. [.Assented to 6th March, 1928.] 2. The Public Utilities Protection Law, 1928. [Assented to 6th March, 1928.] 3. A Law to continue and amend the Jamaica Hotels Law, 1904 (Law 15 of 1904). [Assented to 6th March, 1928.] 4. A Law to validate the coming into operation of certain Laws enacted since the coming into operation of the Interpretation Law, 1926, and to validate all proceedings taken and Acts done and Rules or Orders made or issued under all' or any of such Laws and particularly to validate certain proceedings taken and acts done under the Spirit License Law, 1928. [Assented to 7th March, 1928.]. 5. The Jamaica Co-operative Marketing Association Protection Law, 1928. -

United States Department of Agriculture SERVICE and REGULATORY ANNOUNCEMENTS

S. R. A.-B. A. I. 260 Issued January, 1929 United States Department of Agriculture SERVICE AND REGULATORY ANNOUNCEMENTS BUREAU OF ANIMAL INDUSTRY DECEMBER, 1928 [This publication is issued monthly for the dissemination of information, instructions, rulings, etc, concerning the work of the Bureau of Animal Industry. Free distribution service of the bureau, is limited to persons in the establishments at which the Federal meat inspection is conducted, public officers whose duties make it desirable for them to have such information, and journals desiring copies especially concerned. Others may obtain them from the Superintendent of Documents, Government Printing Office, Washington, D. C., at 5 cents each, or 25 cents a year. A supply will a station or branch be sent to each official in charge of of the bureau service, who should promptly distribute copies to members of his A file should be kept at each station for references.] force. CONTENTS rag# Changes in directory----------------------------------------------------------------------- 105 Notices regarding meat inspection_ -. _-------------------------- ------------ --------------------- 106 Animal casings for Canada -------------------------------------------------------- 106 Certificate for animal casings destined to Australia ------------------------------------- 106 Mineral oil used as a denaturant ---------------------------------------------------- 106 Animals slaughtered under Federal meat inspection----------------------------------------------- 107 Extent of tuberculosis in animals -

Maine Alumnus, Volume 10, Number 2, November 1928

The University of Maine DigitalCommons@UMaine University of Maine Alumni Magazines University of Maine Publications 11-1928 Maine Alumnus, Volume 10, Number 2, November 1928 General Alumni Association, University of Maine Follow this and additional works at: https://digitalcommons.library.umaine.edu/alumni_magazines Recommended Citation General Alumni Association, University of Maine, "Maine Alumnus, Volume 10, Number 2, November 1928" (1928). University of Maine Alumni Magazines. 82. https://digitalcommons.library.umaine.edu/alumni_magazines/82 This publication is brought to you for free and open access by DigitalCommons@UMaine. It has been accepted for inclusion in University of Maine Alumni Magazines by an authorized administrator of DigitalCommons@UMaine. For more information, please contact [email protected]. MR. EDW. H. KELLEY PURCHASING AGENT UN I V. OF ME . % MS Crowell and Lancaster, Architects Rogers Hall, the New Dairy Manufactures Building Rogers Hall Dr. Lore A. Rogers Student Memorial Drive About Maine Athletics Volume 10 November, 1928 Number 2 THE MAINE ALUMNUS November, 1928 The college of Agriculture offers four year curricula in Agricultural Education, Agronomy, Animal Husbandry, Botany, Dairy Husbandry, Entomology, Forestry, Home Economics, Home Economics Education, Horticulture, and Poultry Husbandry, and a two year curriculum in Agriculture. Training is also given on subjects of agricultural chemistry, agri cultural economics, bacteriology, farm engineering, farm management and veterinary science. E x t e n s i o n W o r k —L e c t u r e a n d C orrespondence S e r v ic e . S p e c ia l C o u r s e s The alumni of the University will be interested to know that more than three fourths of the agricultural graduates are farmers, farm man agers, teachers of agriculture, research or extension agents or are manu facturers or salesmen of farm products, supplies or equipment. -

The Frisco Employes' Magazine, November 1928

HAMILTON RAILROAD MODEL No. 5 ERE is ti watch for the Railrond man who lcants accuracy. This purticular case is designed by Hamilton to [~roperlyprotect the ftzmoun 992 tnoxetnent. It is sturdily constructed und has s/>ecial clust-proof features. It is uxailnhle in either IOK filled yellow or 14K filled grcen or tullitc gold- with choice of four differ. YOU LIVE WITH TIME ~.;iilro;ttl n~;tn bows to his timepiece. You mcn livc with time. It is timc you feed into the EVnERY;trning f~~rnace. It is timc that flickers in the speeding \vheels of your train. Accur:tcy is ;I prt of your job. You need a watch thxt will insure your gettillg thcrc on time- ;tl\v;l\-:;-and the Hamilton is just the very watch to do that job. That is one of the reasons why it is the fi~vorirew;~tch of most railroad men. That is also why the Hamilton is known everywhcrc :ls "The Railroad Tinekeeper of America." Soon, perhaps, you will be considering a new timepiece for your own usc. When you do, ask your jcwcler to sholv you the Hamilton railroad models-watches that havc bceil helping to make r,lil~-oadhis- tory since 1892. Show your old timer to your jcwcler. Hc m:ly have a trade-in proposition that will appd to you-wherehv you can own :L Hamilton, the latest word in r:~ilro;~dtimekeeping. There is a copy of the Hamilton Time Book waiting for you-as well as orhcr intercstir~gfolders de- scribing Halnilton Rai1ro:td models. -

December 1928

MONTHLY REVIEW OF AGRICULTURAL AND BUSINESS CONDITIONS IN THE NINTH FEDERAL RESERVE DISTRICT R. Afmcilm.r.., Chairman of the Board CURTIS L. MOSHER F. M. BAILEY OLIVER S. POWELL and Federal Reserve Agent Assistant Federal Reserve Agents Statistician Vol. IV Gt.%) Minneapolis, Minnesota December 28, 1928 Number DISTRICT SUMMARY OF BUSINESS go The volume of business in the Ninth Federal Re- BUSINESS FAILURES serve District in November and the first half of December exceeded the volume in the same period 150 last year. In the larger cities, debits to individual ac- counts in November increased 2 per cent over No- vember last year. In the rural portion of the district, III the country check clearings index increased 11 per 100 OvirgL I •A I, , ii IP 1, A cent. Rural Minnesota, and the portions of Wiscon- i i a 1■ sin and Michigan lying within this district, experi- enced greater increases in check clearings than were . 411111111111 = shown in the western states of the district. Increases in November, as compared with the same month last 4 year, were shown by carloadings of grains and grain products, coke, forest products, ore and miscellane- . ,37111110.1 =rm.,. 1 IMT Fi. IIIIM 1-I. ous commodities, building permits and contracts, ill Business Failures in the Ninth Federal Reserve District, country lumber sales, linseed product shipments and as reported by R. G. Dun and Company. The heavy curve postal receipts. Decreases occurred in carloadings of is the twelve-month moving average of the monthly data. livestock and coal, department store sales, whole- sale trade and flour shipments. -

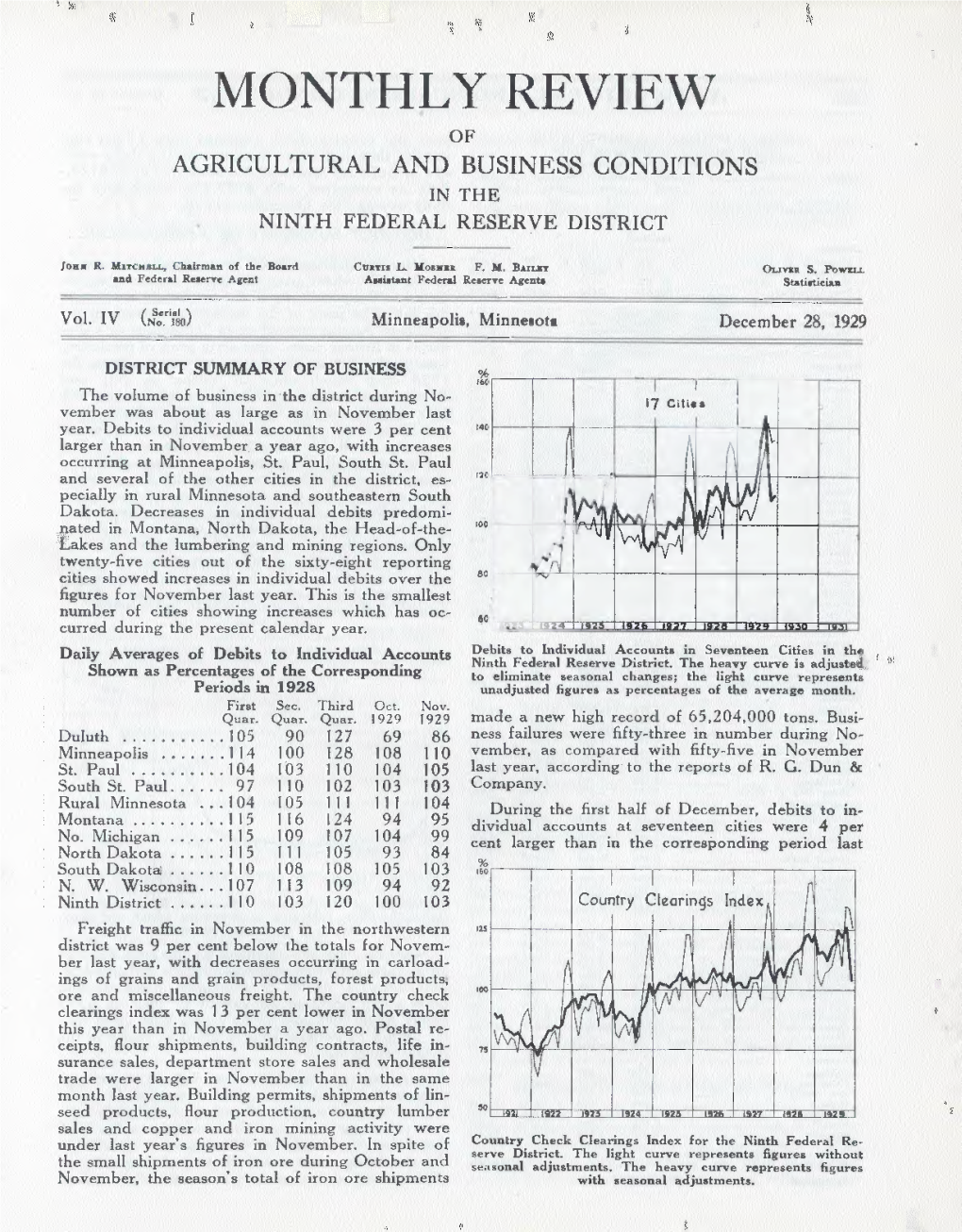

November 1929

iii .(1 MONTHLY REVIEW OF AGRICULTURAL AND BUSINESS CONDITIONS IN THE NINTH FEDERAL RESERVE DISTRICT Currier L. Ifosnaa F. M. BAILIOY OLIVRR S. Powers. Jon a R. Afircava.i., Chairman of the Board and Federal Reserve Agent Assistant Federal Reserve Agents Statistician Vol. IV (4:19) Minneapolis, Minnesota November 29, 1929 DISTRICT SUMMARY OF BUSINESS October were chiefly those cities in the mixed farm- ing sections of this district. Due to the early marketing of wheat supplies in the Northwest this fall, October business records Daily Averages of Debits to Individual Accounts did not contain the usual share of the autumn grain Shown as Percentages of the Corresponding business. The early marketing movement is best Periods in 1928 illustrated by a comparative statement of wheat First Sec. Third Sept. Oct. receipts at Minneapolis and Duluth-Superior from Quar. Quer. Quer, 929 1929 the Northwest during the past four months. These Duluth 05 90 27 90 69 figures are given in the table below, and exclude Minneapolis 14 00 28 22 108 southwestern wheat. It will be noted that in July St. Paul 04 03 10 06 104 and August receipts were much heavier during the South St. Paul .. 97 10 02 94 103 current year than a year ago, but that in September Rural Minnesota 04 05 11 14 1 i 1 ,and October wheat receipts have been running far Montana . 15 16 24 13 94 behind last years volume. No. Michigan 15 09 07 06 104 North Dakota 15 11 05 06 93 Net Wheat Receipts at Minneapolis and Duluth-Superior South Dakota 10 08 08 01 105 July-October, 1928 and 1929 N. -

Federal Reserve Bulletin November 1928

FEDERAL RESERVE BULLETIN NOVEMBER, W28 ISSUED BY THE FEDERAL RESERVE BOARD AT WASHINGTON Money Rates and Bank Credit District Data on Currency Demand State Laws Relating to Bank Reserves UNITED STATES GOVERNMENT PRINTING OFFICE WASHINGTON 1928 Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis FEDERAL RESERVE BOARD Ex officio members: ROY A. YOUNG, Governor, EDMUND PLATT, Vice Governor. A. W. MELLON, Secretary of the Treasury, Chairman. ADOLPH C. MILLER. CHARLES S. HAMLIN. J. W. MCINTOSH, GEORGE R. JAMES. Comptroller of the Currency. EDWARD H. CUNNINGHAM. WALTER L. EDDY, Secretary. WALTER WYATT, General Counsel. J. C. NOELL, Assistant Secretary. E. A. GOLDENWEISER, Director, Division of Research E. M. MCCLELLAND, Assistant Secretary. and Statistics. W. M. IMLAY, Fiscal Agent. J. F. HERSON, CARL E. PARRY, Assistant Director^ Division of Re- Chief\ Division of Examination, and Chief Federal search and Statistics. Reserve Examiner. E. L. SMEAD, Chief, Division of Bank Operations. FEDERAL ADVISORY COUNCIL District No. 1 (BOSTON) ARTHUR M. HEARD. District No. 2 (NEW YORK) JAMES S. ALEXANDER. District No. 3 (PHILADELPHIA) L. L. RUE. District No. 4 (CLEVELAND) HARRIS CREECH. District No. 5 (RICHMOND) JOHN F. BRUTON, Vice Presidents District No. 6 (ATLANTA) . P. D. HOUSTON. District No. 7 (CHICAGO) FRANK O. WETMORE, President. District No. 8 (ST. LOUIS) .__„___ W. W. SMITH. District No. 9 (MINNEAPOLIS) THEODORE WOLD. District No. 10 (KANSAS CITY) P. W. GOEBEL. District No. 11 (DALLAS) B. A. MCKINNEY. District No. 12 (SAN FRANCISCO) F. L. LIPMAN. Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis OFFICERS OF FEDERAL RESERVE BANKS Federal Reserve Bank of- C hair man Governor Deputy governor Cashier W.