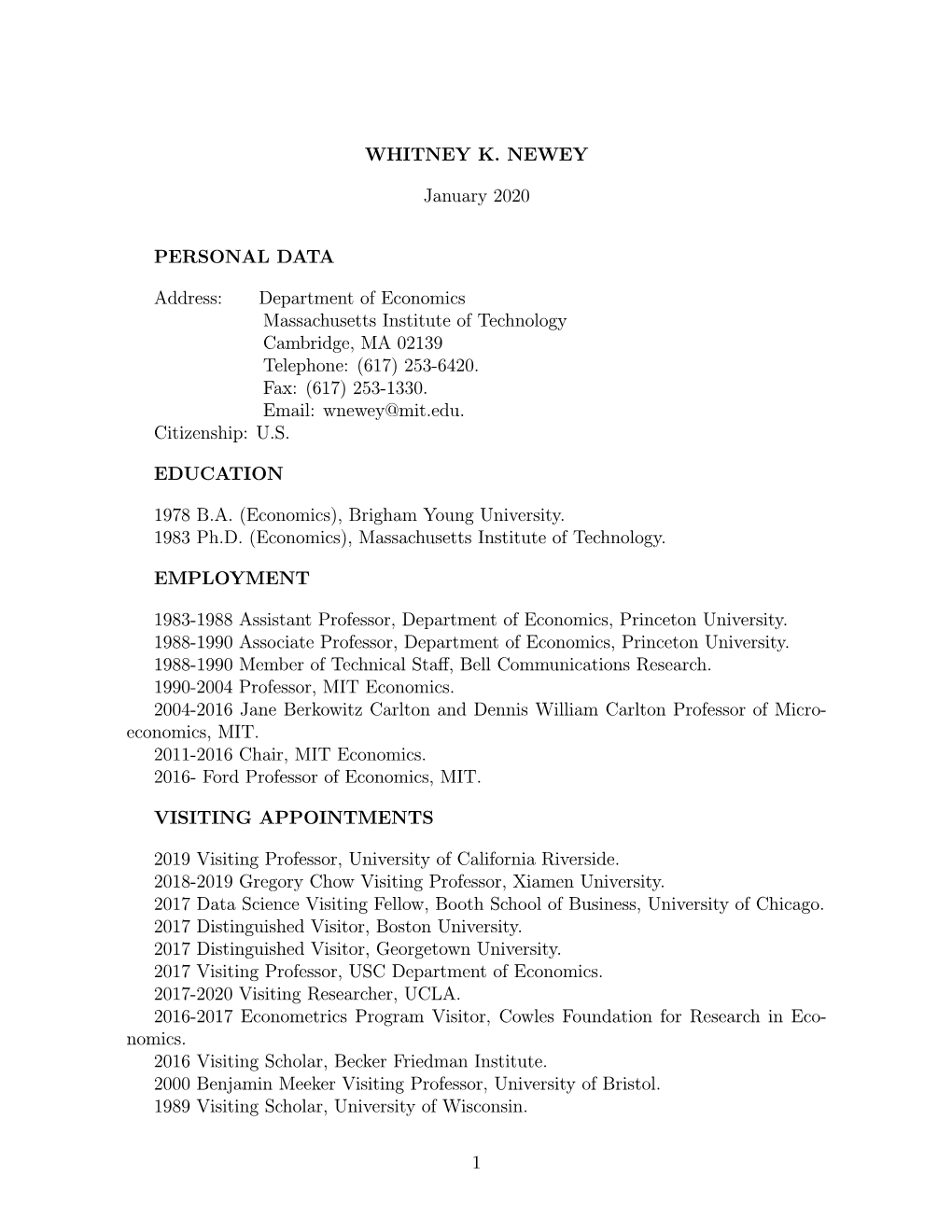

WHITNEY K. NEWEY January 2020 PERSONAL DATA Address

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Publishing and Promotion in Economics: the Curse of the Top Five

Publishing and Promotion in Economics: The Curse of the Top Five James J. Heckman 2017 AEA Annual Meeting Chicago, IL January 7th, 2017 Heckman Curse of the Top Five Top 5 Influential, But Far From Sole Source of Influence or Outlet for Creativity Heckman Curse of the Top Five Table 1: Ranking of 2, 5 and 10 Year Impact Factors as of 2015 Rank 2 Years 5 Years 10 Years 1. JEL JEL JEL 2. QJE QJE QJE 3. JOF JOF JOF 4. JEP JEP JPE 5. ReStud JPE JEP 6. ECMA AEJae ECMA 7. AEJae ECMA AER 8. AER AER ReStud 9. JPE ReStud JOLE 10. JOLE AEJma EJ 11. AEJep AEJep JHR 12. AEJma EJ JOE 13. JME JOLE JME 14. EJ JHR HE 15. HE JME RED 16. JHR HE EER 17. JOE JOE - 18. AEJmi AEJmi - 19. RED RED - 20. EER EER - Note: Definition of abbreviated names: JEL - Journal of Economic Literature, JOF - Journal of Finance, JEP - Journal of Economic Perspectives, AEJae-American Economic Journal Applied Economics, AER - American Economic Review, JOLE-Journal of Labor Economics, AEJep-American Economic Journal Economic Policy, AEJma-American Economic Journal Macroeconomics, JME-Journal of Monetary Economics, EJ-Economic Journal, HE-Health Economics, JHR-Journal of Human Resources, JOE-Journal of Econometrics, AEJmi-American Economic Journal Microeconomics, RED-Review of Economic Dynamics, EER-European Economic Review; Source: Journal Citation Reports (Thomson Reuters, 2016). Heckman Curse of the Top Five Figure 1: Articles Published in Last 10 years by RePEc's T10 Authors (Last 10 Years Ranking) (a) T10 Authors (Unadjusted) (b) T10 Authors (Adjusted) Prop. -

Brendan K. Beare

Brendan K. Beare Department of Economics University of California – San Diego 9500 Gilman Drive #0508 La Jolla, California 92093, U.S.A. Email: [email protected] : http://econweb.ucsd.edu/ bbeare/ ∼ Born: January 23, 1980 Citizenship: Australia & United States Current position 2015– Associate Professor, University of California – San Diego Prior appointments held 2008–2015 Assistant Professor, University of California – San Diego 2007–2008 Research Fellow, Nuffield College and University of Oxford Education 2007 PD in Economics, Yale University 2006 MA in Statistics, Yale University 2005 MP in Economics, Yale University 2004 MA in Economics, Yale University 2002 BE(H) in Econometrics, University of New South Wales Honors & awards 2011–2016 Sir Clive W. J. Granger Chair, University of California – San Diego 2008 George Trimis Prize for Distinguished Dissertation in Economics, Yale University 2007 MA by Resolution, University of Oxford 2007 Dissertation Fellowship, Yale University 2006 Carl Arvid Anderson Prize, Cowles Foundation for Research in Economics 2006 Cowles Summer Prize, Cowles Foundation for Research in Economics 2002–2006 Cowles Prize, Cowles Foundation for Research in Economics 2002–2006 University Fellowship, Yale University 2002 Economic Society of Australia Honours Prize 1 Publications 2019 Beare, Brendan K. and Shi, Xiaoxia. An improved bootstrap test of density ratio ordering. Econometrics and Statistics, 10: 9-26. 2019 Seo, Won-Ki and Beare, Brendan K. Cointegrated linear processes in Bayes Hilbert space. Statistics and Probability Letters, 147: 90-95. 2018 Beare, Brendan K. Unit root testing with unstable volatility. Journal of Time Series Analysis, 39(6): 816-835. 2018 Beare, Brendan K. and Dossani, Asad. Option augmented density forecasts of market returns with monotone pricing kernel. -

Alberto Abadie

ALBERTO ABADIE Office Address Massachusetts Institute of Technology Department of Economics 50 Memorial Drive Building E52, Room 546 Cambridge, MA 02142 E-mail: [email protected] Academic Positions Massachusetts Institute of Technology Cambridge, MA Professor of Economics, 2016-present IDSS Associate Director, 2016-present Harvard University Cambridge, MA Professor of Public Policy, 2005-2016 Visiting Professor of Economics, 2013-2014 Associate Professor of Public Policy, 2004-2005 Assistant Professor of Public Policy, 1999-2004 University of Chicago Chicago, IL Visiting Assistant Professor of Economics, 2002-2003 National Bureau of Economic Research (NBER) Cambridge, MA Research Associate (Labor Studies), 2009-present Faculty Research Fellow (Labor Studies), 2002-2009 Non-Academic Positions Amazon.com, Inc. Seattle, WA Academic Research Consultant, 2020-present Education Massachusetts Institute of Technology Cambridge, MA Ph.D. in Economics, 1995-1999 Thesis title: \Semiparametric Instrumental Variable Methods for Causal Response Mod- els." Centro de Estudios Monetarios y Financieros (CEMFI) Madrid, Spain M.A. in Economics, 1993-1995 Masters Thesis title: \Changes in Spanish Labor Income Structure during the 1980's: A Quantile Regression Approach." 1 Universidad del Pa´ıs Vasco Bilbao, Spain B.A. in Economics, 1987-1992 Specialization Areas: Mathematical Economics and Econometrics. Honors and Awards Elected Fellow of the Econometric Society, 2016. NSF grant SES-1756692, \A General Synthetic Control Framework of Estimation and Inference," 2018-2021. NSF grant SES-0961707, \A General Theory of Matching Estimation," with G. Imbens, 2010-2012. NSF grant SES-0617810, \The Economic Impact of Terrorism: Lessons from the Real Estate Office Markets of New York and Chicago," with S. Dermisi, 2006-2008. -

Econometric Theory

Econometric Theory John Stachurski January 10, 2014 Contents Preface v I Background Material1 1 Probability2 1.1 Probability Models.............................2 1.2 Distributions................................. 16 1.3 Dependence................................. 25 1.4 Asymptotics................................. 30 1.5 Exercises................................... 39 2 Linear Algebra 49 2.1 Vectors and Matrices............................ 49 2.2 Span, Dimension and Independence................... 59 2.3 Matrices and Equations........................... 66 2.4 Random Vectors and Matrices....................... 71 2.5 Convergence of Random Matrices.................... 74 2.6 Exercises................................... 79 i CONTENTS ii 3 Projections 84 3.1 Orthogonality and Projection....................... 84 3.2 Overdetermined Systems of Equations.................. 90 3.3 Conditioning................................. 93 3.4 Exercises................................... 103 II Foundations of Statistics 107 4 Statistical Learning 108 4.1 Inductive Learning............................. 108 4.2 Statistics................................... 112 4.3 Maximum Likelihood............................ 120 4.4 Parametric vs Nonparametric Estimation................ 125 4.5 Empirical Distributions........................... 134 4.6 Empirical Risk Minimization....................... 137 4.7 Exercises................................... 149 5 Methods of Inference 153 5.1 Making Inference about Theory...................... 153 5.2 Confidence Sets.............................. -

Rankings of Economics Journals and Departments in India

WP-2010-021 Rankings of Economics Journals and Departments in India Tilak Mukhopadhyay and Subrata Sarkar Indira Gandhi Institute of Development Research, Mumbai October 2010 http://www.igidr.ac.in/pdf/publication/WP-2010-021.pdf Rankings of Economics Journals and Departments in India Tilak Mukhopadhyay and Subrata Sarkar Indira Gandhi Institute of Development Research (IGIDR) General Arun Kumar Vaidya Marg Goregaon (E), Mumbai- 400065, INDIA Email (corresponding author): [email protected] Abstract This paper is the first attempt to rank economics departments of Indian Institutions based on their research output. Two rankings, one based on publications in international journals, and the other based on publications in domestic journals are derived. The rankings based on publications in international journals are obtained using the impact values of 159 journals found in Kalaitzidakis et al. (2003). Rankings based on publications in domestic journals are based on impact values of 20 journals. Since there are no published studies on ranking of domestic journals, we derived the rankings of domestic journals by using the iterative method suggested in Kalaitzidakis et al. (2003). The department rankings are constructed using two approaches namely, the ‘flow approach’ and the ‘stock approach’. Under the ‘flow approach’ the rankings are based on the total output produced by a particular department over a period of time while under the ‘stock approach’ the rankings are based on the publication history of existing faculty members in an institution. From these rankings the trend of research work and the growth of the department of a university are studied. Keywords: Departments,Economics, Journals, Rankings JEL Code: A10, A14 Acknowledgements: The auhtors would like to thank the seminar participants at Indira Gandhi Institute of Development Research. -

Intra-Industry Trade and North-North Migration: How TTIP Would Change the Patterns

Model Data Results References Intra-Industry Trade and North-North Migration: How TTIP Would Change the Patterns Mario Larch1 Steffen Sirries1 1University of Bayreuth ETSG 2014 1 / 38 Model Data Results References Funding and Notes on the Project This project is funded by DFG within the Project \Gravity with Unemployment" part of a bigger research agenda: Heid and Larch (2012) for unemployment, Heid (2014) for informality up to now without labor market imperfections work in progress ! input is very welcome! 2 / 38 Model Data Results References Why trade and migration? I Traditional view: H-O-type trade models with migration: Trade substitutes for migration (Mundell (1957)). Signing free trade agreements lowers the pressure of migration. Expected (bilateral) correlation between trade and migration ! negative! Gaston and Nelson (2013) BUT... 3 / 38 Model Data Results References Why trade and migration? II 15 10 5 0 TRADEFLOWS in logs (normalized) −5 −5 0 5 10 15 20 MIGRATION STOCKS in logs (normalized) 4 / 38 Model Data Results References Why trade and migration? III 2 0 −2 Residuals of trade gravity −4 −5 0 5 Residuals of migration gravity corr(^etrade ; e^migr ) = 0:2304 5 / 38 Model Data Results References Why trade and migration? IV There might be more than just a spurious correlation between trade and migration. New trade models with intra-industry trade and north-north migration ! complementarity of trade and migration (e.g OECD). This is not new (Head and Ries (1998)): Migrants also bring along preferential access to the markets of the country of origin. We think simpler: Migrants are not just a factor but consumers and though they bring their demand! Migrants have idiosyncratic shocks which drive the migration decision! 6 / 38 Model Data Results References Why \A Quantitative Framework"?I One of the core issues in empirical international trade is the quantification of the welfare gains from trade liberalization. -

What Is in a Word Or Two?

What Is in a Word or Two? Dale J. Poirier Department of Economics University of California, Irvine April 15, 2004 Abstract To measure the impact of Bayesian reasoning, this paper investigates the occurrence of two words, “Bayes” and “Bayesian,” over 1970-2003 in journal articles in a variety of disciplines, with a focus on economics and statistics. The growth in statistics is documented, but the growth in economics is largely confined to economic theory/mathematical economics rather than econometrics. Poirier (1989, 1992) described the penetration of Bayesian articles in econometrics and statistics journals. Data were collected by examination of individual articles and classifying each as “Bayesian” or “non-Bayesian.” Here the time period is expanded to 1970-2003 (when possible), and the number of journals is expanded to include journals in JSTOR (see Appendix) plus some from Elsevier [Journal of Econometrics (JE) and Economics Letters (EL)], the American Statistical Association [Journal of Business & Economic Statistics (JBES)], and Cambridge University Press [Econometric Theory (ET)]. Attention focuses (but not exclusively) on economics and statistics. The data collection exercise is “objectified” by using search engines to compute the annual proportion of journal “articles” containing in their text either the words “Bayes” or “Bayesian.” While not all such articles are “Bayesian,” their numbers provide an upper bound on the number of Bayesian articles, and they capture the impact of Bayesian thinking on authors. Two qualifiers should be kept in mind. First, what constitutes an “article” differs across journals. Some journals [e.g., Journal of the American Statistical Association (JASA)] count comments and replies separately, whereas other journals [e.g., Journal of the Royal Statistical Society, Series B (JRSSB)] count them as part of the original text. -

Econometrics Conference May 21 and 22, 2015 Laudation By

Grant H. Hillier – Econometrics Conference May 21 and 22, 2015 Laudation by Kees Jan van Garderen ©GHHillier University of Amsterdam Welcome to this conference in honour of Grant Highmore Hillier. It is great to see you all here and it is great that we can jointly celebrate Grant’s continuing contributions to Econometrics and his non-retirement. A few years ago, before Grant was going to turn 65 and retire, there was some talk about having a conference like the one we are having now. He didn’t retire, however, and nothing eventuated. This year I had time and money, with the University of Southampton also contributing, to organize a “party” and allows me to settle part of my debt. I am deeply indebted, as many of you are also. Many of you are indebted to his teaching, research training and academic approach, insight, solving ability, and friendship. Of course this differs per person but we are all indebted to him for his contributions to science. The scientific community owes him. Grant contributed significantly to exact small sample distribution theory. In particular multivariate structural models, Hypothesis testing , likelihood and regression techniques. No integral over a manifold was avoided, whether it was the Stiefel manifold or very general, as in his Econometrica 1996 paper. The formula used there is one of his favourites and he put this to canvas. This is the painting which is on the Book of Abstracts of this conference in his honour. No zonal- or other polynomials he avoided. No shortcuts to find out the deep meaning of the structure of the problem. -

Journal of Econometrics, 133, 97-126 (With R. Paap). • Testing, 2005, Forthcoming in the New Palgrave Dictionary of Economics

Curriculum Vitae Personal data: Name Frank Roland Kleibergen Professional Experience: • September 2003-present: professor of Economics, Brown University • January 2002-December 2007: associate professor University of Amsterdam sponsored by a NWO Vernieuwingsimpuls research grant • April 99-December 2001: Postdoc in Econometrics at the University of Amsterdam • April 96-April 99: NWO-PPS Postdoc Erasmus University Rotterdam • August 95-April 96: Assistant professor, Econometrics Department, Tilburg University • September 94-August 95: Assistant professor, Finance Department, Erasmus University Rotterdam Grants and Prizes: • Fellow of the Journal of Econometrics, 2007 • 2003 Joint winner of the Tinbergen Prize for the most scientifically successful alumnus of the Tinbergen Institute • Acquired a DFL 1.5 million (680670 € = 680000 USD) NWO (Dutch NSF) Vernieuwingsimpuls research grant entitled “Empirical Comparison of Economic models” for the period 2002-2007 • Acquired a DFL 200.000 (90.756 € = 80000 USD) NWO PPS subsidy for 1995-1997 Editorships: Associate editor of Economics Letters Referee of the journals/conferences: Journal of Econometrics, Journal of Applied Econometrics, Journal of Empirical Finance, Econometric Theory, Econometrica, Journal of the American Statistical Association, International Journal of Forecasting, Journal of Business and Economic Statistics, Review of Economics and Statistics, Econometrics Journal, Economics Letters, Program committee member ESEM 2002 and Econometric Society World Meeting 2005. Scientific publications: • Weak Instrument Robust Tests in GMM and the New Keynesian Phillips Curve, 2009, Journal of Business and Economic Statistics, (Invited Paper), 27, 293-311 (with S. Mavroeidis). • Rejoinder, 2009, Journal of Business and Economic Statistics, 27, 331-339. (with S. Mavroedis) • Tests of Risk Premia in Linear Factor Models , 2009, Journal of Econometrics, 149, 149- 173. -

Fractional Cointegration and Aggregate Money Demand Functions

CORE Metadata, citation and similar papers at core.ac.uk Provided by Brunel University Research Archive FRACTIONAL COINTEGRATION AND AGGREGATE MONEY DEMAND FUNCTIONS Guglielmo Maria Caporale Brunel University, London Luis A. Gil-Alana University of Navarre Abstract This paper examines aggregate money demand relationships in five industrial countries by employing a two-step strategy for testing the null hypothesis of no cointegration against alternatives which are fractionally cointegrated. Fractional cointegration would imply that, although there exists a long-run relationship, the equilibrium errors exhibit slow reversion to zero, i.e. that the error correction term possesses long memory, and hence deviations from equilibrium are highly persistent. It is found that the null hypothesis of no cointegration cannot be rejected for Japan. By contrast, there is some evidence of fractional cointegration for the remaining countries, i.e., Germany, Canada, the US, and the UK (where, however, the negative income elasticity which is found is not theory-consistent). Consequently, it appears that money targeting might be the appropriate policy framework for monetary authorities in the first three countries, but not in Japan or in the UK. Keywords: Money Demand, Velocity, Fractional Integration, Fractional Cointegration JEL Classification: C32, C22, E41 We are grateful to an anonymous referee for useful comments, and to Mario Cerrato for research assistance. The second named author also gratefully acknowledges financial support from the Gobierno de Navarra, (“Ayudas de Formación y Desarrollo”), Spain. Corresponding author: Professor Guglielmo Maria Caporale, Brunel Business School, Brunel University, Uxbridge, Middlesex UB8 3PH, UK. Tel. +44 (0)1895 203 327. Fax: +44 (0)1895 269 770. -

Putting Behavioral Economics to Work: Testing for Gift Exchange in Labor Markets Using Field Experiments

Econometrica, Vol. 74, No. 5 (September, 2006), 1365–1384 PUTTING BEHAVIORAL ECONOMICS TO WORK: TESTING FOR GIFT EXCHANGE IN LABOR MARKETS USING FIELD EXPERIMENTS BY URI GNEEZY AND JOHN A. LIST1 Recent discoveries in behavioral economics have led scholars to question the under- pinnings of neoclassical economics. We use insights gained from one of the most influ- ential lines of behavioral research—gift exchange—in an attempt to maximize worker effort in two quite distinct tasks: data entry for a university library and door-to-door fundraising for a research center. In support of the received literature, our field evi- dence suggests that worker effort in the first few hours on the job is considerably higher in the “gift” treatment than in the “nongift” treatment. After the initial few hours, however, no difference in outcomes is observed, and overall the gift treatment yielded inferior aggregate outcomes for the employer: with the same budget we would have logged more data for our library and raised more money for our research center by using the market-clearing wage rather than by trying to induce greater effort with a gift of higher wages. KEYWORDS: Gift exchange, field experiment. 1. INTRODUCTION NEOCLASSICAL ECONOMICS treats labor as a hired input in much the same manner as capital. Accordingly, in equilibrium, the firm pays market-clearing wages and workers provide minimum effort. The validity of this assumption is not always supported by real-life observations: some employers pay more than the market-clearing wage and workers seemingly invest more effort than nec- essary (Akerlof (1982)). The “fair wage–effort” hypothesis of Akerlof (1982) and Akerlof and Yellen (1988, 1990) extends the neoclassical model to explain higher than market-clearing wages by using a gift exchange model, where “On the worker’s side, the ‘gift’ given is work in excess of the minimum work stan- dard; and on the firm’s side the ‘gift’ given is wages in excess of what these women could receive if they left their current jobs” (Akerlof (1982, p. -

G023) 1 Autumn Term 2007/2008: Weeks 2 - 8 J´Erˆomeadda

M.Sc. in Economics Department of Economics, University College London Econometric Theory and Methods (G023) 1 Autumn term 2007/2008: weeks 2 - 8 J¶er^omeAdda for an appointment, e-mail [email protected] Introduction This course provides students with a foundation in econometric theory and methods. Courses in Microeconometrics and Time Series Econometrics in the Spring Term provide further instruction on speci¯c econometric topics. Many of the other M.Sc. course in economics provide material essential in developing econometric models and a strong motivation for the use of econometric methods. Some of these courses will make frequent reference to the results of econo- metric analysis. Econometric methods are used by academic researchers to develop and test models of economic behaviour and interaction, by govern- ment in the design and evaluation of economic and social policy and by commercial users to understand aspects of the markets in which they oper- ate. Most practicing professional economists, and many academic economists, have to conduct, evaluate, or use the results of econometric analysis on a day to day basis. There has been recent rapid growth in the availability of information on economic phenomena, in the computing power necessary to access and analyse this information, and in the scope and power of econo- metric techniques. As a result there is rapidly increasing demand for people with good econometric skills. 1I am grateful to Andrew Chesher, the previous lecturer of this course to make the teaching material available. 1 Econometrics Econometrics is the collection of tools and methods used to understand and predict economic phenomena.