Market Review March 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

16 Annual Report

47th Annual Report and Financial Statements 30 SEPTEMBER 2016 2 - 47th annual report & financial statement AUDITORS AND REGISTERED OFFICE Auditors KPMG (ICAG/F/2014/038) Chartered Accountants 13 Yiyiwa Drive, Abelenkpe Post Office Box 242 Accra. Registered Office Cocoa House 41 Kwame Nkrumah Avenue Post Office Box GP 933 Accra Tel. 233 -302 – 661752/678972/661782/683300 Fax: 233 -302- 667104/665076 E-mail: [email protected] Website: www.cocobod.gh 2 - 47th annual report & financial statement I - 47th annual report & financial statement TABLE OF CONTENTS Auditors i Registered Office i Table of Contents ii Highlights iii Board of Directors 2015/16 iv Heads of Subsidiaries and Divisions 2015/16 iv Chairman’s Statement v Review of Business Operations 1 1. Producer Price 1 2. Cocoa Purchases Performance and Licensed Buying Companies 1 3. Coffee and Sheanut Purchases/Exports 2 4. Performance of Divisions and Subsidiaries 4 A. Quality Control Company 4 a. Selective Grading of cocoa 4 b. Grading and Sealing 5 i. Cocoa 5 ii. Composition of Bean-size Categories 5 iii. Other Produce Inspected 5 c. Check Sampling 5 d. Disinfestation Activities 5 1. Insect Control Operations 5 2. Shipment Inspection and Treatment 5 B. Cocoa Marketing Company (Gh.) Ltd. 6 a. Shipments and Processing 6 i. Cocoa Beans 6 ii. Cocoa Products 6 C. Seed Production Division 6 a. Hybrid Seed Pods 7 b. Cocoa Seedlings 7 47th annual report & financial statement - II Table of contents cont. D. Cocoa Health & Extension Division 7 a. Field Operations 7 b. CODAPEC & Hi-Tech 8 E Cocoa Research Institute of Ghana 9 TABLE OF a. -

Has Gse Played Its Role in the Economic Development of Ghana?

CAPITAL MARKET 23 YEARS AND COUNTING: HAS GSE PLAYED ITS ROLE IN THE ECONOMIC DEVELOPMENT OF GHANA? 1st CAPITAL MARKET CONFERENCE BY EKOW AFEDZIE, DEPUTY MANAGING DIRECTOR MAY 10, 2013 INTRODUCTION Ghana Stock Exchange (GSE) was established with a Vision: -To be a relevant, significant, effective and efficient instrument in mobilizing and allocating long-term capital for Ghana’s economic development and growth. INTRODUCTION OBJECTIVES - To facilitate the Mobilization of long term capital by Corporate Bodies/Business and Government through the issuance of securities (shares, bonds, etc). - To provide a Platform for the trading of issued securities. MEMBERSHIP OF GHANA STOCK EXCHANGE GSE as a public company limited by Guarantee has No OWNERS OR SHAREHOLDERS. GSE has Members who are either corporate or individuals. There are two categories of members:- - Licensed Dealing Members - 20 - Associate Members - 34 HISTORICAL BACKGROUND 1968 - Pearl report by Commonwealth Development Finance Co. Ltd. recommended the establishment of a Stock Exchange in Ghana within two years and suggested ways of achieving it. 1970 – 1989 - Various committees established by different governments to explore ways of bringing into being a Stock Exchange in the country. HISTORICAL BACKGROUND 1971 - The Stock Exchange Act was enacted. - The Accra Stock Exchange Company incorporated but never operated. Feb, 1989 - PNDC government set up a 10-member National Committee on the establishment of Stock Exchange under the chairmanship of Dr. G.K. Agama, the then Governor of the Bank of Ghana. HISTORICAL BACKGROUND July, 1989 - Ghana Stock Exchange was incorporated as a private company limited by guarantee under the Companies Code, 1963. HISTORICAL BACKGROUND Nov. -

2012-Edition-GC100-Directory.Pdf

2012 2012 DIRECTORY DIRECTORY NAME OF COMPANY BUSINESS CATEGORY LOCATION ADDRESS TELEPHONE FAX/E-MAIL/WEBSITE CONTACT PERSON TITLE 7 Dr. Amilcar Cabral Road, Accra (233-302) 770189/90/91 “(233-302) 770187 1 Abosso GoldFields Limited Mining Institution Airport Residential Area P. O. Box KA 30742 www.goldfields.co.za” Alfred Baku Managing Director Accra Banking Services [email protected] Head, Corporate 2 Acces Bank (Ghana) (Commercial & Merchant) “Starlets ‘91 Road “P. O. Box GP 353 Osu- Accra” (233-302) 684860 / 742699 www.accessbankplc.com/gh Matilda Asante-Aseidu Communications (233-302) 2688960 3 Accra Brewery Manufacturing - Beverages Opp. Ohene Djan Staduim” P. O. Box GP351 (233-302) 688851-6 [email protected] Gregory Metcalf Managing Director www.sabmiller.com (233-302) 685176 4 Activa International Insurance Company Non-Banking-Insurance Graphic Road, Adabraka PMB KA 85 (233-32) 686352 / 672145 [email protected] Limited www.group-activa.com “P. O. Box 35 Banking Service-Rural & 3rd Floor Heritage Tower, 6th Ave. West (233-322) 420926 / 90099 Lucy Opoku-Arthur Ag General Manager 5 Adansi Rural Bank Limited Community Banking Ridge, Accra Fomena-Adansi” Banking Services-Rural & 6 Adonten Community Bank Limited Community Banking Head Office: Fomena - Adansi P.O.Box 140 3420-24109/027-895636/027-7609343 3420-26780 [email protected] Mr.Francis Mensah Senior Manager Banking Services-Rural & 7 Ahantaman Rural Bank Limited Community Banking New Tafo, Akyem, Eastern Region P. O. Box 41, Ahanta (233-312) 23431 / 21016 (233-312)29116 David Bampoe General Manager Banking Services-Rural & 8 Amanano Rural Bank Limited Community Banking Agona Ahanta,Western Region P. -

Produce Buying Company Limited

PRODUCE BUYING COMPANY LIMITED FINANCIAL STATEMENTS 30 SEPTEMBER 2010 PRODUCE BUYING COMPANY LIMITED FINANCIAL STATEMENTS CONTENTS PAGE COMPANY INFORMATION 1 CHAIRMAN'S STATEMENT 2-4 MANAGING DIRECTOR'S REVIEW 5-8 REPORT OF THE DIRECTOR'S 9-11 REPORT OF THE AUDITOR'S 12-13 STATEMENT OF COMPREHENSIVE INCOME 14 STATEMENT OF FINANCIAL POSITION 15 STATEMENT OF CHANGES IN EQUITY 16 STATEMENT OF CASH FLOW 17 NOTES TO THE FINANCIAL STATEMENTS 18-47 SCHEDULE TO THE STATEMENT OF COMPREHENSIVE INCOME 48-50 PRODUCE BUYING COMPANY LIMITED CORPORATE INFORMATION FOR THE YEAR ENDED 30 SEPTEMBER 2010 BOARD OF DIRECTORS Dr. John Frank Abu - Chairman Kojo Atta-Krah - Managing Director Hon. Ernest Kofi Yakah (MP) - Director Mabel Oseiwa Quakyi (Mrs.) - Director Ebenezer Tei Quartey - Director James M. K. Ampiaw - Director Kofi Graham - Director Cecilia Nyann (Mrs.) - Director Nana Kwame Nkrumah I - Director Alhaji Yakubu Ziblim - Director Yaw Sarpong - Director SECRETARY Godfrey Osei Aggrey TOP MANAGEMENT Kojo Atta-Krah - Managing Director George Kwadwo Boateng - DMD-Operations Joseph Osei Manu - DMD-Finance and Administration AUDITORS Pannell Kerr Forster Chartered Accountants Farrar Avenue P. O. Box 1219 Accra SOLICITOR Godfrey Osei Aggrey Olusegun Obasanjo Road Dzorwulu Junction Accra REGISTERED OFFICE Olusegun Obasanjo Road Dzorwulu Junction Accra BANKERS Barclays Bank of Ghana Limited Ecobank Ghana Limited Ghana Commercial Bank Limited SG-SSB Bank Limited Standard Chartered Bank Ghana Limited Merchant Bank 1 CHAIRMAN’S STATEMENT Distinguished Shareholders, I am very pleased to welcome you once again to the 10th Annual General Meeting of the Produce Buying Company Limited and have the pleasure to present to you the Annual Report and Statement of Accounts of your company for the Financial Year ended September 30, 2010. -

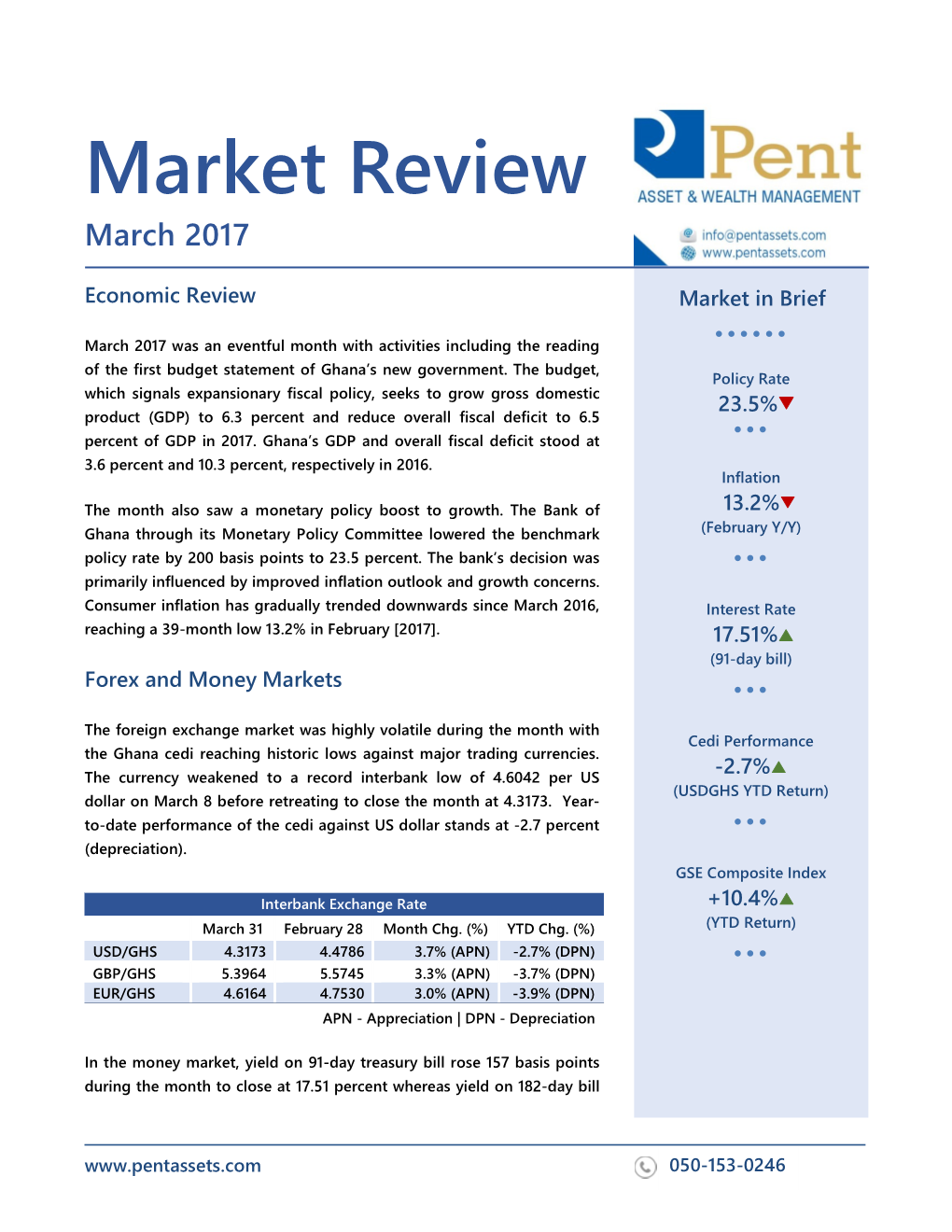

Market Review

Market Review February 2017 The month of February was dominated by a highly volatile foreign Market in Brief exchange market resulting from news of a worse-than-expected • • • • • • 2016 budget deficit. The deficit stood at 10.3 per cent of gross domestic product against a target of 5.3 per cent. Policy Rate 25.5% Forex and Money Markets • • • The Ghana cedi recorded a month-on-month depreciation of 4.6 Inflation per cent against the US dollar in the Interbank market, having 13.3% opened the month at 4.2711 per US dollar and closed at 4.4786, (January Y/Y) extending the year’s depreciation to 6.2 per cent. In the money • • • market, yield on 91-day bill remained at 15.94 per cent at close of the month whereas yield on 182-day bill rose marginally to 17.10 Interest Rate per cent from 16.99 per cent in January. 16.3827% (91-day bill) Interbank Exchange Rate (February 2017) • • • Current Previous Change (%) USD/GHS 4.4786 4.2711 -4.60% GBP/GHS 5.5745 5.3488 -4.00% Cedi Performance EUR/GHS 4.7530 4.6073 -3.10% -6.2% Ghana Government Treasury Securities (YTD Return) Current Previous Change (bps) 91-Day T-Bill 15.9438% 15.9376% +1bps GSE Composite Index 182-Day T-Bill 16.9927% 17.0978% -11bps +9.8% (YTD Return) Equities • • • The stock market remained optimistic in February. The benchmark GSE Composite Index gained 78.13 points (representing 4.4 per cent) month-on-month to close February at 1,854.53 points, www.pentassets.com 050-153-0246 extending year-to-date return to 9.8 per cent. -

OFFICIAL LIST 4024 Trading Session Friday, June 28, 2013 GSE STOCK INDICES

OFFICIAL LIST 4024 Trading Session Friday, June 28, 2013 GSE STOCK INDICES GSE Composite GSE Financial Stocks Index (GSE-CI) Index (GSE-FSI) PREVIOUS 27/06/2013) = 1,877.65 1,585.72 CURRENT 28/06/2013) = 1,880.26 1,591.18 2.61 points 5.46 points CHANGE-YEAR TO DATE (Jan 01, 2013- June 28, 2013) 56.72% 53.02% This Week in Focus Shares Bonds GSE Value of Composite Government Index Market Capitalization Bonds Traded Date Volume Value GH¢ (GSE-CI) GH¢ million GH¢ million Monday 24-Jun-13 493,511 1,581,041.68 1,900.10 56,154.80 0.000 Tuesday 25-Jun-13 426,550 1,196,438.69 1,891.94 56,110.32 1.240 Wednesday 26-Jun-13 880,088 966,256.30 1,874.67 55,894.32 15.743 Thursday 27-Jun-13 1,553,869 2,844,118.70 1,877.65 55,910.61 4.295 Friday 28-Jun-13 251,546 482,820.80 1,880.26 55,924.82 0.000 Notes/Announcements 1. The following announcements have been made on final dividends and annual general meetings: Dividend per Company Share ¢ Qualifying Date Ex-Div Date Payment Date AGM Date Venue for AGM CAL 0.006 26/06/2013 24/06/2013 30/08/2013 AYRTN 0.0013 25/06/2013 21/06/2013 8/8/2013 27/06/2013 OEPCH TOTAL 0.6900 18/07/2013 16/07/2013 26/07/2013 GCPS:GhanaAICC: Accra International College of Physicians Conference and Centre Surgeons OEPCH:Osu Ebenezer Presbyterian Church HalL Enquiries to: General Manager Ghana Stock Exchange 5th & 6th Floors Cedi House, Liberia Road, Accra Tel: 021 669908, 669914, 669935 Fax: 021 669913 e-mail: [email protected] OFFICIAL LIST 4024 Trading Session ODD LOT Friday, June 28, 2013 ISIN Share Code Total Shares No. -

PBC As the Most Attractive Dealer in Cocoa, Sheanut and Any Other Cash Crop in the West African Sub-Region

2011 FINANCIAL STATEMENTS CONTENTS PAGE CORPORATE VISION NOTICE OF ANNUAL GENERAL MEETING CURRENT COMPANY REGULATIONS OF P.B.C. CORPORATE INFORMATION CHAIRMAN’S STATEMENT REPORT OF DIRECTORS CORPORATE GOVERNANCE DIRECTORS’ PROFILE STATEMENT OF DIRECTORS AUDITOR’S REPORT STATEMENT OF COMPREHENSIVE INCOME BALANCE SHEET CHANGES IN EQUITY STATEMENT OF CASH FLOW NOTES TO THE FINANCIAL STATEMENTS ii 2011 FINANCIAL STATEMENTS PRODUCE BUYING COMPANY LIMITED CORPORATE VISION FOR THE YEAR ENDED 30TH SEPTEMBER 2011 Develop and maintain PBC as the most attractive dealer in cocoa, sheanut and any other cash crop in the West African sub-region MISSION Purchase high quality produce, store and deliver same to designated Take Over Centres internally and the export market in the most efficient and profitable manner. COMMITMENT Produce Buying Company’s traditional commitment to its stakeholders remains the same, that is to ensure: Farmer satisfaction Good return on shareholders’ investment Recruitment and retainment of a well-motivated workforce Support of projects and activities to benefit farming communities. CORE VALUES Integrity Reliability Confidentiality Discipline Team work Customer Satisfaction 1 2011 FINANCIAL STATEMENTS NOTICE OF ANNUAL GENERAL MEETING NOTICE IS HEREBY GIVEN THAT the 11th Annual General Meeting of Produce Buying Company Limited will be held at the OSU EBENEZER PRESBYTERIAN CHURCH HALL, OSU, ACCRA on WEDNESDAY, 28TH MARCH, 2012 at 10:00 a.m. to transact the following business:- AGENDA 1. To receive and adopt the Report of the Directors, Auditors and the Financial Statements for the year ended 30th September, 2011 2. To declare Dividends for the year ended 30th September, 2011 3. To approve changes in Directorship · Mr. -

Weekly Market Watch Sic-Fsl Investment+ Research| Market Reviews|Ghana

WEEKLY MARKET WATCH SIC-FSL INVESTMENT+ RESEARCH| MARKET REVIEWS|GHANA 10th March, 2016 FINANCIAL STOCKS DRAG PERFORMANCE STOCK MARKET FURTHER DOWN INDICATORS WEEK OPEN WEEK END CHANGE The Ghana Stock Exchange (GSE) declined for the fourth consecutive time last week, following increased uncertainty in Market Capitalization market dealings. Losses in the shares of Ecobank Ghana Limited (GH¢'million) 56,312.92 56,078.75 -0.42% (EBG), Trust Bank (Gambia) Limited (TBL), Ecobank Transnational Market Capitalization (US$'million) 14,559.04 14,562.88 0.03% Incorporated (ETI) and SIC Insurance Company Limited (SIC) dragged the broader market further down by 0.31%. Volume traded (shares) 1,561,353.00 309,918.00 -80.15% In the end, key benchmark indices like the GSE Composite Index Value Traded (GH¢) 1,836,433.71 441,146.43 -75.98% (GSE-CI), the GSE Financial Stocks Index (GSE-FSI) and the SIC- Value Traded (US$) 474,788.31 114,559.68 -75.87% FSL Top 15 Liquid Index (SIC-FSL T-15) closed the week at Table 1: Market Summary annual losses of 1.56%, 1.71% and 6.24% respectively, from a year-to-date losses of 1.25%, 1.23% and 4.75% accordingly. INDEX ANALYSIS The value of listed companies dropped to GH¢56.08 billion INDICATORS Closing Week YTD Level Change CHANGE from GH¢56.31 billion last Thursday. However, an equivalent dollar value remained fairly stable at USD 14.56 billion. GSE Composite Index 1,963.72 -0.31% -1.56% SIC-FSL Top 15 Index 3,478.70 -1.57% -6.24% GSE Financial Stocks Index 1,897.09 -0.48% -1.71% Table 2: Key Stock Market Indices LIQUIDITY Aggregate volume and value of traded shares dropped last week, following the exchange of 309,918 shares which was valued at GH¢441,146.43. -

Weekly Market Watch Sic-Fsl Investment+ Research| Market Reviews|Ghana

WEEKLY MARKET WATCH SIC-FSL INVESTMENT+ RESEARCH| MARKET REVIEWS|GHANA 15th January, 2015 STOCK MARKET PROFIT-TAKING SLOWS DOWN MARKET PERFORMANCE INDICATORS WEEK OPEN WEEK END CHANGE Despite, the excitement that characterized market activities last week, performance of the bourse dipped on the back of Market Capitalization profit-taking by shareholders. Shares of Ecobank (GH¢'million) 64,229.12 63,654.84 -0.89% Market Capitalization Transnational Incorporated (ETI), Cocoa Processing Company (US$'million) 20,014.06 19,779.64 -1.17% (CPC), UT Bank (UTB), GCB Bank (GCB), Ecobank Ghana Limited (EBG) and SIC Insurance Company Limited (SIC) were Volume traded (shares) 573,274.00 4,233,537.00 638.48% responsible for last week’s sluggish performance. Value Traded (GH¢) 2,482,296.35 2,251,183.89 -9.31% In effect, benchmark indices turned southward, as the yield on Value Traded (US$) 773,493.81 699,516.47 -9.56% the GSE-Composite Index dipped by 1.02% to settle at an Table 1: Market Summary annual drop of 1.44%. Similarly, the GSE Financial Stock INDEX ANALYSIS Index (GSE-FSI) which tracks the performance of financial stocks fell by 0.99% to close at a drop of 1.66% from INDICATORS Closing Week YTD beginning of year to-date. Level Change CHANGE The value of all listed companies (market capitalization) also GSE Composite Index 2,228.48 -1.85% 0.42% went down by 0.89% to settle at GH¢63.65 billion from the GSE Financial Stocks Index 2,206.33 -2.32% 0.67% previous GH¢64.23 billion, which is is attributable to the Table 2: Key Stock Market Indices marginal depreciations of the local currency during the period under review. -

GNAM Investment Competition UNIVERSITY of GHANA

GNAM Investment Competition UNIVERSITY OF GHANA BUSINESS SCHOOL FAN MILK GHANA LTD 31ST October, 2015 MEMBERS Abdulai M. Sadat Getrude A Dzansi Bismark Amewu Enoch Dadzie Paula Araba Bentil Gyamfi K. Arthur INTRODUCTION The Ghana stock Exchange has provided the platform for both the Government and the private businesses to enable them raise capital. Investors also play a key role in the Ghana stock Exchange market because they are the provider of capital. As much investor wish to earn huge returns they are also mindful of risk. Diversification of investment is essential to ensure: Liquidity of investment Good returns Capital safety Stock performance evaluation is therefore very crucial to investment decision 2 The Ghana stock exchange(GSE) 36 Companies r listed of the GSE. The manufacturing and brewing sectors currently dominate the exchange. A distant third is the banking sector while other listed companies fall into the insurance, mining and petroleum sectors In 1994 it was the best index performing stock market among all emerging markets, gaining 124.3% in its index level. From January to July 2013, the GSE Composite Index stands at 61.39% as against 6.06 per cent for the whole of 2012. At the close of business on July 31, In terms of value, total trade stands at GH¢230.51 million, as against GH¢102.2 million for the whole of last year. 3 METHODOLOGY OVERVIEW It considers the formula adopted for the research, the investment tools, the sources of data and the methods used in analyzing the data The study is purely archival research using data from the firms listed of the GSE Data sample description; which talks about the sources of data Performance measure; methods used in analyzing the data This measure is to evaluate the performance of the listed companies in Ghana 4 DATA AND SAMPLE DESCRIPTION The analysis was based on past data of the firms listed on GSE over a period of five years spanning from 2010 to 2014. -

2011-12 Annual Report

PBC LIMITED FINANCIAL STATEMENTS 30 SEPTEMBER 2012 PBC LIMITED FINANCIAL STATEMENTS CONTENTS PAGE CORPORATE INFORMATION 1 CHAIRMAN'S STATEMENT 2 - 4 REPORT OF THE DIRECTORS 9 - 11 REPORT OF THE AUDITORS 12 - 13 STATEMENT OF COMPREHENSIVE INCOME 14 STATEMENT OF FINANCIAL POSITION 15 STATEMENT OF CHANGES IN EQUITY 16 STATEMENT OF CASH FLOW 17 NOTES TO THE FINANCIAL STATEMENTS 18 - 47 PBC LIMITED CORPORATE VISION Develop and maintain PBC as the most attractive dealer in cocoa, sheanut and any other cash crop in the West African sub-region MISSION Purchase high quality produce, store and deliver same to designated Take Over Centres internally and the export market in the most efficient and profitable manner. COMMITMENT PBC Limited’s traditional commitment to its stakeholders remains the same, that is to ensure: Farmer satisfaction Good return on shareholders’ investment Recruitment and retainment of well-motivated workforce Support of projects and activities to benefit farming communities. CORE VALUES Integrity Reliability Confidentiality Discipline Team Work Customer Satisfaction NOTICE OF ANNUAL GENERAL MEETING NOTICE IS HEREBY GIVEN THAT the 12th Annual General Meeting of PBC LIMITED will be held at the OSU EBENEZER PRESBYTERIAN CHURCH HALL, OSU, ACCRA on FRIDAY, 22ND MARCH, 2013 at 10:00 a.m. to transact the following business:- AGENDA Ordinary Resolutions 1. To receive and adopt the Report of the Directors, Auditors and the Financial Statements for the year ending 30th September, 2012 2. To declare Dividends for the year ending 30th September, 2012 3. To approve changes in Directorship Dr. John Frank Abu – Retiring by rotation Mrs. Mabel Oseiwaa Quakyi – Retiring by rotation Mr. -

Cocoa in West Africa Report

the Cocoa Industry in West Africa A history of exploitation Anti-Slavery International 2004 Anti-Slavery International The Cocoa Industry in West Africa: A history of exploitation The Cocoa Industry in West Africa: A history of exploitation Introduction When extensive child and slave labour was found on the cocoa farms of Côte d’Ivoire in late 2000, many British consumers were shocked. Chocolate companies, cocoa suppliers, and retailers searched for a way to address this serious problem. The way forward was unclear. The immediate reaction of some consumers was a decision to stop eating chocolate altogether or to call for a boycott of exports from Côte d’Ivoire. Yet it quickly became clear that a boycott might have disastrous results for both cocoa workers and Côte d’Ivoire as a whole. What was needed was more in-depth information of the conditions and extent of enslaved labour, of how cocoa from West Africa reaches the consumer, of what would be appropriate and reasoned responses to the problem. In answer to this need and to provide information on the industry reaction and actions since, Anti-Slavery International has prepared this document – an in-depth analysis of how cocoa is produced and how child and slave labour enter its chain of production. It relates the history of cocoa and explores how this commodity fits within a global market. It also explains the events following the ‘discovery’ of slavery in cocoa farming, what actions have been and are being taken to remove slavery from the chocolate we eat. Drawing on a wide range of sources, it concludes with recommendations for consumers, the chocolate industry and governments on actions needed to address this serious problem.