A Behavioral Economics Approach to Regulating Initial Coin Offerings

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CRYPTONAIRE WEEKLY CRYPTO Investment Journal

CRYPTONAIRE WEEKLY CRYPTO investment journal CONTENTS WEEKLY CRYPTOCURRENCY MARKET ANALYSIS...............................................................................................................5 TOP 10 COINS ........................................................................................................................................................................................6 Top 10 Coins by Total Market Capitalisation ...................................................................................................................6 Top 10 Coins by Percentage Gain (Past 7 Days)...........................................................................................................6 Top 10 Coins added to Exchanges with the Highest Market Capitalisation (Past 30 Days) ..........................7 CRYPTO TRADE OPPORTUNITIES ...............................................................................................................................................9 PRESS RELEASE..................................................................................................................................................................................14 ZUMO BRINGS ITS CRYPTOCURRENCY WALLET TO THE PLATINUM CRYPTO ACADEMY..........................14 INTRODUCTION TO TICAN – MULTI-GATEWAY PAYMENT SYSTEM ......................................................................17 ADVERTISE WITH US........................................................................................................................................................................19 -

Cryptocurrencies and Blockchain Technology

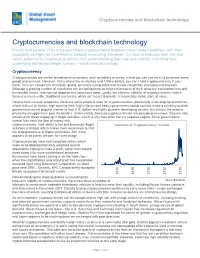

Cryptocurrencies and blockchain technology Cryptocurrencies and blockchain technology Bitcoin and several of its more prominent cryptocurrency brethren have made headlines, with their popularity as high-risk investments steadily increasing. However, it’s hard to evaluate their risk and return potential as investments without first understanding their use and viability, including their underlying distributed ledger system – blockchain technology. Cryptocurrency Cryptocurrencies are similar to traditional currencies, such as dollars or euros, in that you can use them to purchase some goods and services. However, that’s where the similarities end. Unlike dollars, you can’t hold cryptocurrencies in your hand. They are completely electronic, global, generally unregulated and almost completely anonymous to transact. Although a growing number of merchants are accepting them as payment because of their attractive transaction fees and irrevocable nature, widespread adoption is a long ways away. Lastly, the extreme volatility of cryptocurrencies makes them very much unlike traditional currencies, which are meant to provide a reasonably stable store of value. Despite their unusual properties, there are some practical uses for cryptocurrencies, particularly in developing economies where distrust for banks, high banking fees, high inflation and heavy government capital controls make a currency outside government control popular (similar to how U.S. dollars are highly prized in developing nations, but without the need to physically smuggle them past the border). Unfortunately, because cryptocurrencies are pseudo-anonymous, they are also attractive for those engaging in illegal activities, which is why they often carry a negative stigma. Since governments cannot fully track the flow of money with cryptocurrencies, their ability to tax and prosecute illegal Instances of "Cryptocurrency" Articles activities is limited, which makes them more likely to limit the widespread use of digital currencies. -

A Survey on Volatility Fluctuations in the Decentralized Cryptocurrency Financial Assets

Journal of Risk and Financial Management Review A Survey on Volatility Fluctuations in the Decentralized Cryptocurrency Financial Assets Nikolaos A. Kyriazis Department of Economics, University of Thessaly, 38333 Volos, Greece; [email protected] Abstract: This study is an integrated survey of GARCH methodologies applications on 67 empirical papers that focus on cryptocurrencies. More sophisticated GARCH models are found to better explain the fluctuations in the volatility of cryptocurrencies. The main characteristics and the optimal approaches for modeling returns and volatility of cryptocurrencies are under scrutiny. Moreover, emphasis is placed on interconnectedness and hedging and/or diversifying abilities, measurement of profit-making and risk, efficiency and herding behavior. This leads to fruitful results and sheds light on a broad spectrum of aspects. In-depth analysis is provided of the speculative character of digital currencies and the possibility of improvement of the risk–return trade-off in investors’ portfolios. Overall, it is found that the inclusion of Bitcoin in portfolios with conventional assets could significantly improve the risk–return trade-off of investors’ decisions. Results on whether Bitcoin resembles gold are split. The same is true about whether Bitcoins volatility presents larger reactions to positive or negative shocks. Cryptocurrency markets are found not to be efficient. This study provides a roadmap for researchers and investors as well as authorities. Keywords: decentralized cryptocurrency; Bitcoin; survey; volatility modelling Citation: Kyriazis, Nikolaos A. 2021. A Survey on Volatility Fluctuations in the Decentralized Cryptocurrency Financial Assets. Journal of Risk and 1. Introduction Financial Management 14: 293. The continuing evolution of cryptocurrency markets and exchanges during the last few https://doi.org/10.3390/jrfm years has aroused sparkling interest amid academic researchers, monetary policymakers, 14070293 regulators, investors and the financial press. -

Luciana De Paula Soares.Pdf

UNIVERSIDADE NOVE DE JULHO FACULDADE DE DIREITO MESTRADO EM DIREITO LUCIANA DE PAULA SOARES CRIPTOMOEDA E BLOCKCHAIN: O RIGOR DAS REGRAS BRASILEIRAS FRENTE AO MERCADO TRADICIONAL São Paulo 2021 LUCIANA DE PAULA SOARES CRIPTOMOEDA E BLOCKCHAIN: O RIGOR DAS REGRAS BRASILEIRAS FRENTE AO MERCADO TRADICIONAL Dissertação de mestrado apresentada ao Programa de Pós-graduação em Direito da Universidade Nove de Julho - UNINOVE, como requisito parcial para obtenção do grau de Mestre em Direito. Orientador: Prof. Dr. Dr. h.c. João Maurício Adeodato São Paulo 2021 Soares, Luciana de Paula. Criptomoeda e Blockchain: o rigor das regras brasileiras frente ao mercado tradicional / Luciana de Paula Soares. 2021. 119 f. Dissertação (Mestrado) - Universidade Nove de Julho - UNINOVE, São Paulo, 2021. Orientador (a): Prof. Dr. João Maurício Adeodato. 1. Criptomoeda. 2. Blockchain. 3. Regulamentação. 4. Receita Federal do Brasil. 5. Banco Central do Brasil. I. Adeodato, João Maurício. II. Titulo. CDU 34 Luciana de Paula Soares CRIPTOMOEDA E BLOCKCHAIN: O RIGOR DAS Dissertação apresentada ao REGRAS BRASILEIRAS FRENTE AO MERCADO TRADICIONAL Programa Pós-Graduação Stricto Sensu Em Direito da Universidade Nove de Julho como parte das exigências para a obtenção do título de Mestre em Direito São Paulo, 04 de março de 2021. BANCA EXAMINADORA __________________________________ Prof. Dr. João Mauricio Leitão Adeodato Orientador UNINOVE ________________________________________ Prof. Dr. José Renato Nalini Examinador Interno UNINOVE ________________________________________ Profa. Dra. Alexandre Freire Pimentel Examinador Externo UNICAP AGRADECIMENTOS Agradeço primeiramente à minha família que sempre me apoiou nessa estrada sem fim e de inestimável valor, o estudo. Agradeço, ainda, a paciência dos meus filhos, ainda pequenos, em disponibilizar sua mãe para os livros em plena pandemia da Covid-19. -

Fraud & White Collar Crime 2019

FRAUD & WHITE COLLAR CRIME 2019 EXPERT GUIDE www.corporatelivewire.com 33 CHANCERY LANE Expert Guide | Fraud & White Collar Crime 2019 Alma Angotti United Kingdom | United States [email protected] UK: +44 (0) 20 7550 4604 | US: +1 202 481 8398 www.navigant.com The ability to trace transactions on the blockchain allows for the identification of the originating cryptocurrency wallet address and the beneficiary cryptocurrency wallet address. Elizabeth Sisul Bitcoin is said to offer “pseudo-anonymity” because it United States [email protected] is often difficult to connect the cryptocurrency wallet +1 646 227 4725 www.navigant.com addresses with real-world individuals and entities. Brandy Schindler United States 1. Money Laundering Risks ability to move private keys across borders with a piece of paper [email protected] in his or her pocket, or by handing off that piece of paper to a co- +1 646 227 4881 I. Pseudo-anonymity/Anonymity conspirator crossing a border. www.navigant.com Many erroneously believe that the most popular cryptocurren- The ability to easily move money across borders facilitates the cies, including bitcoin, offer complete anonymity to its users. In layering3 stage of money laundering. Bad actors may leverage reality, bitcoin transactions can be traced on the bitcoin block- the ability to conduct cross-border transactions in order to direct chain. The ability to trace transactions on the blockchain allows complex transactions through multiple countries and/or through Key Considerations and Risk Management Practices in Building for the identification of the originating cryptocurrency wallet countries with weak regulatory frameworks. In addition, the in- address and the beneficiary cryptocurrency wallet address. -

Is It Better to Invest in Bitcoin Or Ethereum

1 Is It Better to Invest in Bitcoin or Ethereum Update [06-07-2021] The Ethereum Virtual Machine is the global virtual computer whose state every participant on the Ethereum network stores and agrees on. A blockchain is best described as a public database that is updated and shared across many computers in a network. This causes a state change in the EVM, which is committed and propagated throughout the entire network. Execution of any code causes a state change in the EVM; upon commitment, this state change is broadcast to all nodes in the network. Etc rally strength only exceeded by the rally into the end of may 2017. Cryptocurrency buy entries june 2021. Etc and eth technologies such as;. Bitcoin, ethereum, and dogecoin are plunging. Meanwhile, KODAKCoin will help photographers get paid when their content is used. 7 billion to 20. Ethereum has been a go-to alternative to Bitcoin because it typically offers shorter transaction wait times and lower transaction fees. Launched in August, Bitcoin Cash is hard fork of Bitcoin. The Ethereum Virtual Machine is the global virtual computer whose state every participant on the Ethereum network stores and agrees on. A blockchain is best described as a public database that is updated and shared across many computers in a network. This causes a state change in the EVM, which is committed and propagated throughout the entire network. Execution of any code causes a state change in the EVM; upon commitment, this state change is broadcast to all nodes in the network. Etc rally strength only exceeded by the rally into the end of may 2017. -

The Revolution a TECHNOLOGY DESTINED to CHANGE OUR LIVES

the revolution A TECHNOLOGY DESTINED TO CHANGE OUR LIVES WHAT IS A BLOCKCHAIN The impact on the financial system The Blockchain is a register. Each unit in the register is a “block”, and the blocks Although there are already those who speculate that the cryptocurrencies in are linked each other following the sequence of their creation. Blockchains are the future may replace cash, now – however - the real revolution is repre- useful for two things: recording events and making sure the recording will ne- sented in the Blockchain, destined to have on the financial system (and not ver be deleted. It is so difficult to change blocks because a Blockchain works only) an impact comparable to that of social network on interpersonal rela- through a diffused computer network, which have to approve all the changes tionships. The bank of Italy, which has been following the phenomenon for that take place. at least a couple of years with a dedicated program, explains that «the set of Since there is no a central server to tamper with or attack, hackers can’t simply informatic rules (protocol) generates the mutual trust of the partecipants in take control of a single computer and make changes. As a result, participants the stored data and is potentially able to replace the trust ensured by ‘public can trust the data contained in a blockchain without having to know or to trust registers’ managed in a centralized way by an authority recognized by the each other and without having to rely on a central authority. regulatory framework». Apllications to our daily life A simplification applicable to health The technological innovation based on Blockchain will have enormous posi- In the health sector, the Blockchain could be very useful in the management tive repercussions on the mostvaried aspects of our daily life: thanks to use and storage of the various medical documents. -

In Collaboration with CONTENTS

QUARTERLY REPORT Q3 2018 in collaboration with CONTENTS FOREWORDS BITCOIN’S VALUE PROPOSITIONS TO INVESTORS CRYPTOASSET MCAPS OUTLOOK INDUSTRY EXCHANGES PEER-TO-PEER EXCHANGES DECENTRALIZED EXCHANGES ESCALATING TECH ADOPTION STABLECOINS TOKEN MARKET SUMMARY ASSET RISK-ADJUSTED RETURNS CORRELATIONS INDEXES NETWORK HEALTH LAYER 2 SOLUTIONS LIGHTNING NETWORK LINDY EFFECT REFERENCES FOREWORDS Bitcoin, the digital asset that just celebrated its 10 year anniversary, has been attracting investor attention by offering potentially high returns with relatively low correlation to other traditional asset classes. Bitcoin’s nature as digital payment method and its scarcity in terms of limited supply has also driven many investors to call bitcoin as “digital gold”. Bitcoin was founded shortly after the noto- rious 2008 subprime crisis and following reces- sion, by mysterious person or group called Satoshi Nakamoto. The following text included in bitcoin genesis block: “The Times 03/Jan/2009 Chancel- lor on brink of second bailout for banks”, can be interpreted as a statement questioning fractional- reserve banking system [1]. In summary, Satoshi’s core objective was to create “peer-to-peer elec- tronic cash system”. That objective was fulfilled completely and rest of the bitcoin’s developing story will be among significant financial innovations of our time. In the Q3 report we’ll dive deep into bitcoin & cryp- toassets, including topics within: Cryptocurrency market caps, exchanges, decentralized exchanges, and tech adoption. With Asset Summary, we’ll explore asset correlations, indices, network health, layer 2 solutions, and bitcoin fundamentals. The report aims to provide value for investors, clients, and individuals, by delivering a complete quarterly overview of the industry. -

Initial Coin Offerings the Frontier of Financing

Initial Coin Offerings The Frontier of Financing February 2018 Initial coin offerings (ICOs) are a new fundraising model whereby a venture issues a new cryptocurrency to raise capital. ICOs offer both benefits and risks. This paper provides general background information on initial coin offerings, while our forthcoming companion report, ICOs: Defining Characteristics and Taxonomy of Crypto Coins and Tokens, delves into the technical elements and characteristics of initial coin offerings. What is an ICO? An ICO is a means of crowdfunding startups, whereby the venture issues a new crypto token1, specific to its own protocol or network, to investors in exchange for capital—typically an established cryptocurrency like ether or bitcoin. Startups use the raised capital for future expenses associated with developing their business. A typical ICO works as follows: a white paper outlining the project’s objectives and purpose is released to the public and a new crypto token is created on a platform such as Ethereum. Network participants settle on the tokens value through different auction models which play out during the fundraising process. Most ICOs function by having investors transfer funds (typically ether or bitcoin) to a smart contract that safeguards the capital and automatically redistributes an equivalent value in the new crypto asset in the future based upon pre-determined conditions. Some firms using ICOs have raised millions of dollars seconds after opening bidding, illustrating both the frenzied market and the reach of the technology. ICOs leverage crypto and smart contract technologies to replace venture capital (VC) and other funding models with more direct, automated, and decentralized solutions for participants to fund and then benefit from the development of a crypto network. -

Highly Secure Cryptocurrency Hardware Wallet

© 2021 JETIR May 2021, Volume 8, Issue 5 www.jetir.org (ISSN-2349-5162) Highly Secure Cryptocurrency Hardware Wallet Srinivas Vedula, Abdul Sameer, Vaishali K, Varun VP, Radha Prajapath, Ms. Shaleen Bhatnagar Student, Student, Student, Student, Student, Professor, Department of Computer Science and Engineering, School of Engineering, Presidency University, Bengaluru, India. Abstract: With the increasing popularity of Bitcoin, decentralized digital currency, and payment systems, the number of malicious third parties trying to steal Bitcoin has greatly increased. An attacker can steal bitcoins worth millions of dollars from victims by using simple malware code to gain access to the system that contains the information about the user’s private key, these systems can be a computer or smartphone. To prevent the attackers from stealing the user's Bitcoin private key, We propose the use of a hardware wallet for the authentication of every payment, this will provide security from the hackers because the private key would be on an offline device built using raspberry pi zero. This allows the users private key to be separately stored in a hardware device that is not vulnerable to online malware attacks, hence providing security and ensuring a reliable transaction. IndexTerms - Blockchain, Cryptocurrency, Raspberry Pi, Trezor, SHA-256, PBKDF-2. I. INTRODUCTION Internet is all over the world and has reached a level where it merges with one's life, data security holds a lot of importance and it is a concern for everyone connected to the web. The era of information and communication has given many excellent opportunities in several areas. One such field that is benefitted is the financial and business sector, many transactions are activated virtually thus creating a new business phenomenon of trading and new transactions and currencies have been arising. -

The Latest Frenzy: Rise of the Token by Evan Jaysane-Darr, Jessica Mulvihill and Mariam Waheed

The latest frenzy: rise of the token By Evan Jaysane-Darr, Jessica Mulvihill and Mariam Waheed In brief In this article, we discuss various aspects of Bitcoin and other cryptocurrencies, as well as the underlying blockchain technology. We offer a detailed description of the technical aspects of blockchain, its applications in the world of finance, fundraising mechanisms for new crypto projects, cryptocurrencies as an asset class, risks, regulatory aspects and the future potential of the new technology. We end on an optimistic note, arguing that the advent of blockchain has the potential to be the beginning of a new technological revolution. The latest frenzy: rise of the token 1 Bitcoin and other cryptotokens (hereafter used During the installation period, investment ramps up interchangeably with cryptoassets) have as speculators are drawn to the new opportunity captivated a large segment of the retail and promise of outsized returns. This speculative investment world in ways not seen since the behavior peaks with in the frenzy phase, deemed dotcom bubble of 1998-2000. Despite a recent “irrational exuberance” in 1996 by Alan Greenspan. correction Bitcoin has appreciated ~23x since Some contend this is where we sit today within the the start of 2016. Other cryptoassets have crypto space. followed similar trajectories. In spite of (or perhaps because of) the volatility present in these assets, speculators of all stripes have been attracted to the emerging asset class by the echo of ever increasing prices. It is undoubtedly If we are nearing the end of a speculative bubble. Yet most speculative the current IT paradigm then bubbles have something real and potentially transformative underpinning them, and crypto it begs the question of what is no exception. -

Cryptic Currencies: Bitcoin at Its Peak

Jurnal Jurnal Metris 19 (2018) 1–6 Metris journal homepage: http://ojs.atmajaya.ac.id/index.php/metris ISSN: 1411 - 3287 Cryptic Currencies: Bitcoin at its Peak Cheng-Wen Lee, Esentur Ivagov* Department of International Trade, College of Business, Chung Yuan Christian University 200 Chung Pei Road, Chung Li District, Taoyuan City, 32023, Taiwan, ROC Article Info Abstract Article history: The cryptocurrencies are digital currencies that were initially designated to replace the old ones. However, they act as investment assets and many treat them Received like stocks. The market for cryptocurrencies counts more than 1600 types and 14 June 2018 the Bitcoin is the first and foremost of all of them. In one year the price of Bitcoin grew staggering 2000 percent. Other currencies have not seen this type of rising. Accepted 17 July 2018 This study investigates the period of over 4 years of data for 5 cryptocurrencies, the three years before and the last year of hyper-growth of the Bitcoin. We used GARCH model to see if two periods of data may offer some incites for patterns. Keywords: Bitcoin The findings of this paper show that the Bitcoin in the period of high volatility cryptocurrency is more diverged from its counterparts. According to results in the period of high GARCH model volatility, the factors that influence the price formation of cryptocurrencies may spillover effect not be the same for all of them. Using the price of the Bitcoin of one day earlier and the price of altcoins today we find spillover effect. Spillover effect is less prominent in the second period of high volatility.