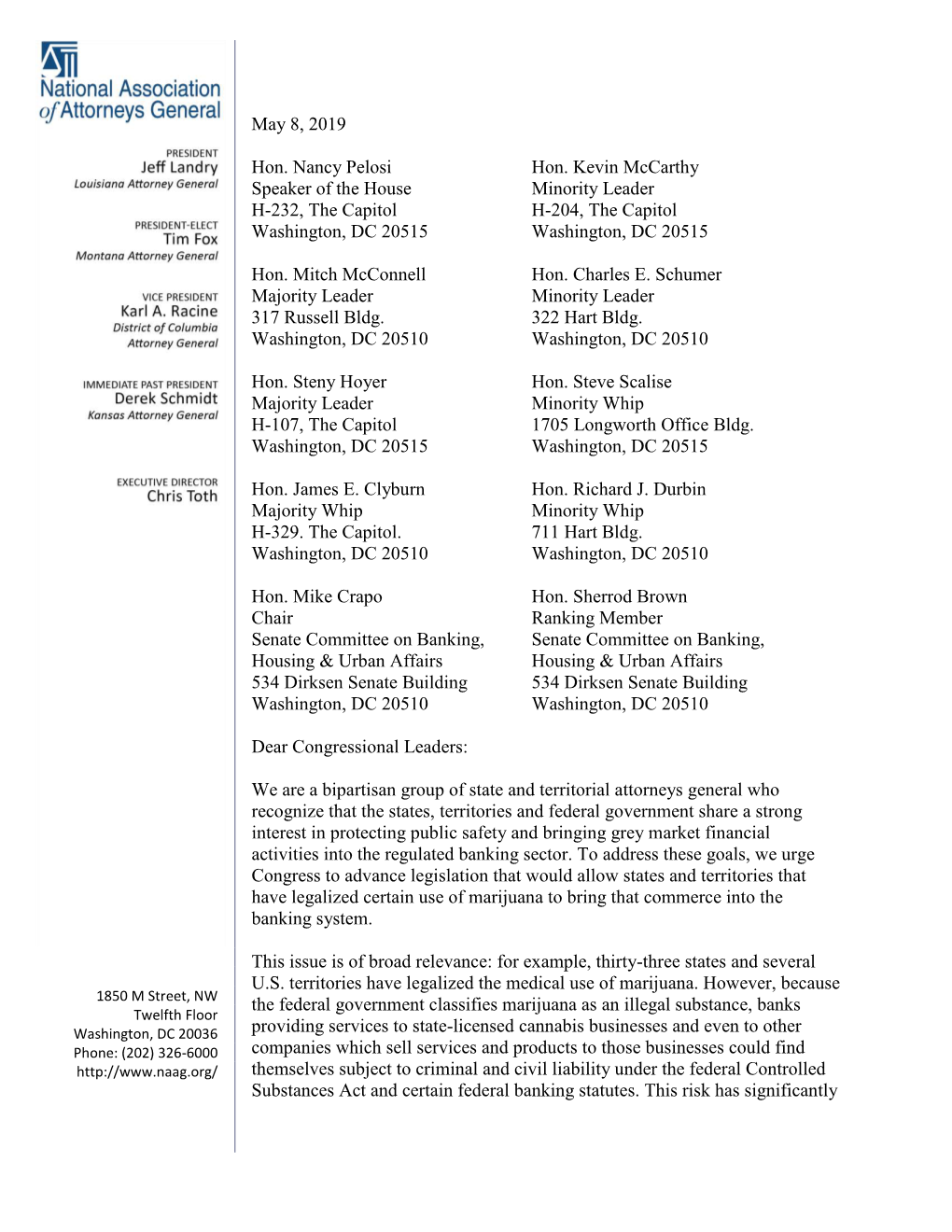

NAAG Letter Safe Banking Act 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

March 24, 2021 Via First Class and Electronic Mail Jack Dorsey Chief

OFFICE OF THE ATTORNEY GENERAL CONNECTICUT william tong attorney general March 24, 2021 Via First Class and Electronic Mail Jack Dorsey Chief Executive Officer Twitter, Inc. 1355 Market St. San Francisco, CA 94103 Mark Zuckerberg Chairman & Chief Executive Officer Facebook, Inc. 1 Hacker Way Menlo Park, CA 94025 Re: Vaccine Disinformation Dear Messrs. Dorsey and Zuckerberg: As Attorneys General committed to protecting the safety and well-being of the residents of our states, we write to express our concern about the use of your platforms to spread fraudulent information about coronavirus vaccines and to seek your cooperation in curtailing the dissemination of such information. The people and groups spreading falsehoods and misleading Americans about the safety of coronavirus vaccines are threatening the health of our communities, slowing progress in getting our residents protected from the virus, and undermining economic recovery in our states. As safe and effective vaccines become available, the end of this pandemic is in sight. This end, however, depends on the widespread acceptance of these vaccines as safe and effective. Unfortunately, misinformation disseminated via your platforms has increased vaccine hesitancy, which will slow economic recovery and, more importantly, ultimately cause even more unnecessary deaths. A small group of individuals use your platforms to downplay the dangers of COVID-19 and spread misinformation about the safety of vaccines. These individuals lack medical expertise and are often motivated by financial interests. According to a recent report by the Center for Countering Digital Hate1, so-called “anti-vaxxer” accounts on Facebook, YouTube, Instagram, and Twitter reach more than 59 million followers. -

Post-Election Attorneys General November 7, 2018 TBD** 2020

November 7, 2018 State Attorneys General Post-Election Report 2018 The Top Line Results New Attorneys General 18 new attorneys general will take office in January as a result of this election cycle, including • 10 Democrats elected (Colorado, Connecticut, Delaware, Illinois, Michigan, Minnesota, Nevada, New York, Rhode Island, and Wisconsin) • 3 Republicans elected (Florida, Ohio, and South Dakota) • 4 attorneys general yet to be appointed (Wyoming, Alaska, Hawaii, Maine) • 1 attorney general to be appointed to fill a vacancy (Missouri) Turnovers There were four states that turned over party control. All turnovers were Republican to Democrat: Colorado, Wisconsin, Michigan, and Nevada. In all of these races, the governorship went to the Democratic candidate as well. Partisan Split Party control among attorneys general is expected to be split among 27 Democratic and 24 Republican attorneys general, assuming that the three governor-appointed attorneys general will follow the governor’s party (Alaska, Wyoming, and Hawaii) and that Maine will be Democratic based on the composition of the state legislature. Before the election, the partisan split was 28 Republicans, 22 Democrats, and one Independent. Incumbency All incumbents seeking reelection won another term, except for one. Republican Brad Schimel (WI) lost his bid for reelection. Attorneys General Running for Higher Office 9 incumbent attorneys general sought higher office, with only three (Maine, Missouri, and Ohio) succeeding in that effort. Cynthia Coffman (R-CO) lost her party’s nomination for governor; Janet Mills (D-ME) won the governorship; Lori Swanson (D-CO) lost her party’s nomination for governor; Josh Hawley (R-MO) won a seat in the US Senate; Adam Paul Laxalt (R-NV) lost his race for governor; Mike DeWine (R-OH) won his race for governor; Bill Schutte (R-MI) lost his race for governor; Marty Jackley (R-SD) lost his party’s nomination for governor; and Patrick Morrissey (R-WV) lost a race for a Senate seat and will thus remain as attorney general. -

Motion for Final Approval of Class Action Settlement Agreement

Case 1:17-cv-01622-MLB Document 77 Filed 08/21/20 Page 1 of 6 IN THE UNITED STATES DISTRICT COURT FOR THE NORTHERN DISTRICT OF GEORGIA ) DAVID ORR, HENRY CHAMBERLAIN, ) ANGELA MICKEL, and JENNIFER ) GRADY, individually and on behalf of all ) Case No.: 1:17-cv-01622-MLB others similarly situated, ) ) Plaintiffs, ) ) v. ) ) INTERCONTINENTAL HOTELS ) GROUP, PLC, INTER-CONTINENTAL ) HOTELS CORPORATION, and ) INTERCONTINENTAL HOTELS ) GROUP RESOURCES, INC., ) ) Defendants. ) PLAINTIFFS’ MOTION FOR FINAL APPROVAL OF CLASS ACTION SETTLEMENT AGREEMENT Plaintiffs David Orr, Henry Chamberlain, Angela Mickel, and Jennifer Grady (“Representative Plaintiffs”), individually and on behalf of the Settlement Class, by and through Lead Class Counsel, respectfully move this Honorable Court for entry of an Order: (i) finding the Settlement Agreement, ECF 70-2 (the “Settlement”), to be fair, reasonable, and adequate, and granting final approval of the Settlement; and 1 (ii) certifying the Settlement Class for settlement purposes only. 1 The definitions in the Settlement are incorporated herein by reference. Case 1:17-cv-01622-MLB Document 77 Filed 08/21/20 Page 2 of 6 Dated: August 21, 2020 Respectfully submitted, David Orr, Henry Chamberlain, Angela Mickel, and Jennifer Grady, individually and on behalf of all others similarly situated, /s/ David J. Worley David J. Worley Georgia Bar No. 776665 James M. Evangelista Georgia Bar No. 707807 EVANGELISTA WORLEY, LLC 500 Sugar Mill Road, Suite 245A Atlanta, GA 30350 Tel: (404) 205-8400 [email protected] [email protected] Ben Barnow (Pro hac vice) Illinois Bar No. 0118265 Erich P. Schork (Pro hac vice) Illinois Bar No. 6291153 Anthony L. -

Dear Mr. Martin, Please See Attached in Response to Your Public Records

From: Curtis, Christopher To: [email protected] Subject: Your Public Records Request Date: Thursday, September 10, 2020 5:10:00 PM Attachments: Angelo Martin Letter 2.pdf FACEBOOK LETTER PRESS PLAN UPDATE (Letter Attached) 8_4(JRD).pdf FACEBOOK LETTER PRESS PLAN UPDATE (AND TEMPLATE RELEASE) 8_3(JRD).pdf FB Letter - Final.pdf Multistate Letter to Facebook - sign ons due COB 7_22.pdf RE_ Multistate Letter to Facebook - sign ons due COB 7_27.pdf RE_ Multistate Letter to Facebook - sign ons due COB 7_28 .pdf RE_ Multistate Letter to Facebook - sign ons due COB 7_29 (JRD).pdf RE_ Multistate Letter to Facebook - sign ons due COB 8_4.pdf Dear Mr. Martin, Please see attached in response to your public records request. Thank you. Best, Christopher Christopher J. Curtis Chief, Public Protection Division Office of the Attorney General State of Vermont 109 State Street Montpelier, VT 05609 802-828-5586 PRIVILEGED & CONFIDENTIAL COMMUNICATION: This communication may contain information that is privileged, confidential, and exempt from disclosure under applicable law. DO NOT read, copy or disseminate this communication unless you are the intended addressee. If you are not the intended recipient (or have received this E-mail in error) please notify the sender immediately and destroy this E-mail. Please consider the environment before printing this e-mail. THOMAS J. DONOVAN, JR. TEL: (802) 828-3171 ATTORNEY GENERAL http://www.ago.vermont.gov JOSHUA R. DIAMOND DEPUTY ATTORNEY GENERAL SARAH E.B. LONDON CHIEF ASST. ATTORNEY GENERAL STATE OF VERMONT OFFICE OF THE ATTORNEY GENERAL 109 STATE STREET MONTPELIER, VT 05609-1001 September 10, 2020 Mr. -

State of New Jersey PHILIP D

State of New Jersey PHILIP D. MURPHY OFFICE OF THE ATTORNEY GENERAL GURBIR S. GREWAL Governor DEPARTMENT OF LAW AND PUBLIC SAFETY Attorney General PO Box 080 TRENTON, NJ 08625-0080 SHEILA Y. OLIVER Lt. Governor March 31, 2020 Via E-mail The Honorable Russell T. Vought Acting Director Office of Management and Budget 725 17th Street NW Washington, DC 20503 E-mail: [email protected]; [email protected] Dear Acting Director Vought: As COVID-19, the disease caused by a novel coronavirus, has spread throughout the United States, the Secretary of Health and Human Services declared a public health emergency on January 31, 2020, and the President declared a national emergency on March 13, 2020. While the federal Government is mobilizing, state and local governments across the country have been wholly dedicated to responding to the emergency and combatting the spread of this deadly virus, and daily life in our communities has been upended by the need to maintain social distancing. In light of these circumstances, we, the undersigned Attorneys General from New Jersey, Colorado, Connecticut, Delaware, the District of Columbia, Hawaii, Iowa, Maine, Maryland, Massachusetts, Michigan, Minnesota, Nevada, New Mexico, New York, North Carolina, Oregon, Pennsylvania, Rhode Island, Vermont, and Virginia, request that the Office of Management and Budget act now to prioritize regulations that are responsive to the COVID-19 pandemic, including its economic impact, while generally freezing all new and pending regulations other than those that address emergency situations or other urgent circumstances relating to health, safety, financial, or national security matters, or that are required by statutory or judicial deadlines. -

California Et Al V. Mcaleenan

Case 2:19-cv-07390 Document 1 Filed 08/26/19 Page 1 of 126 Page ID #:1 1 XAVIER BECERRA Attorney General of California 2 MICHAEL L. NEWMAN Senior Assistant Attorney General 3 SARAH E. BELTON Supervising Deputy Attorney General 4 VIRGINIA CORRIGAN (SBN 292035) VILMA PALMA-SOLANA (SBN 267992) 5 MARISOL LEÓN (SBN 298707) REBEKAH A. FRETZ (SBN 300478) 6 JULIA HARUMI MASS (SBN 189649) Deputy Attorneys General 7 1515 Clay Street, 20th Floor P.O. Box 70550 8 Oakland, CA 94612-0550 Telephone: (510) 879-3300 9 Fax: (510) 622-2270 E-mail: [email protected] 10 Attorneys for Plaintiff State of California 11 (Additional counsel listed on signature page) 12 13 IN THE UNITED STATES DISTRICT COURT 14 FOR THE CENTRAL DISTRICT OF CALIFORNIA WESTERN DIVISION 15 16 17 STATE OF CALIFORNIA, Case No. 18 COMMONWEALTH OF MASSACHUSETTS, STATE OF 19 CONNECTICUT, STATE OF DELAWARE, DISTRICT OF COLUMBIA, COMPLAINT FOR 20 STATE OF ILLINOIS, STATE OF DECLARATORY AND MAINE, STATE OF MARYLAND, STATE INJUNCTIVE RELIEF 21 OF MICHIGAN, STATE OF MINNESOTA, STATE OF NEVADA, 22 STATE OF NEW JERSEY, STATE OF NEW MEXICO, STATE OF NEW YORK, 23 STATE OF OREGON, COMMONWEALTH OF 24 PENNSYLVANIA, STATE OF RHODE ISLAND, STATE OF VERMONT, 25 COMMONWEALTH OF VIRGINIA, and STATE OF WASHINGTON, 26 Plaintiffs, 27 v. 28 COMPLAINT FOR DECLARATORY AND INJUNCTIVE RELIEF Case 2:19-cv-07390 Document 1 Filed 08/26/19 Page 2 of 126 Page ID #:2 1 KEVIN K. MCALEENAN, in his official capacity as Acting Secretary of 2 Homeland Security; U.S. -

State Attorney Generals Matter

State Attorneys General Matter AG Practice & Investigations State Attorneys General The role of state AGs is unique among elected officials in the U.S. - the state's chief legal officer - investigative powerhouse - consumer protection arbiter and enforcer - prosecutor - multi- jurisdictional litigation - policy advocate. 2 1 Each Attorney General has legal authority per state and federal law [parens patriae per 15 U.S.C. §15c] • Traditional Role of the State AG: • Day to Day counsel for the State and the executive branch of government • Federalism and preemption concerns • Authority often includes: • Issuing legal opinions • Enforcing state Sunshine laws • Defending [or challenging] state and/or federal law and administrative actions • Handling capital criminal appeals and actions before the U.S. Supreme Court • Enforcing Medicaid Fraud, Cybersecurity/Privacy laws, environmental laws, antitrust laws and consumer protection laws • Revoking corporate charters 3 Expanded Role of the State AG: • Aggressive [partisan] investigations and litigation • President Obama • Pro/anti federal statutes and regulatory action, e.g. EPA, CFPB, ACA • 1st Phase President Trump • Pro/anti federal and state statutes regulatory action, e.g. EPA, CFPB, ACA, marijuana, immigration • 2nd Phase President Trump • Emoluments clause • Emergency Declaration to fund border wall • Nation-wide District Court injunctions • Aspiring Governors, Senators & Presidents • Arizona, California, Connecticut, Maine, New York, North Carolina, Ohio, South Carolina, Wyoming 4 2 State -

State of Minnesota Office of the Attorney General 102 State Capitol St

STATE OF MINNESOTA OFFICE OF THE ATTORNEY GENERAL 102 STATE CAPITOL ST. PAUL, MN 55155-1609 KEITH ELLISON TELEPHONE: (651) 296-6197 ATTORNEY GENERAL September 23, 2019 Rep. Zoe Lofgren Rep. Ami Bera Chair, Subcommittee on Immigration Chair, Subcommittee on Oversight and Citizenship and Investigations House Judiciary Committee House Foreign Affairs Committee 1401 Longworth House Office Building 1727 Longworth House Office Building Washington, DC 20515 Washington, DC 20515 Rep. Pramila Jayapal Rep. Lee Zeldin Vice Chair, Subcommittee on Immigration Ranking Member, Subcommittee on and Citizenship Oversight and Investigations House Judiciary Committee House Foreign Affairs Committee 1510 Longworth House Office Building 2441 Rayburn House Office Building Washington, DC 20515 Washington, DC 20515 Re: NO BAN Act, H.R. 2214/S. 1123 Dear Chair Lofgren, Chair Bera, Vice Chair Jayapal, and Ranking Member Zeldin: We are a group of state attorneys general who value the contributions of Muslim immigrants and families to our states and value the non-discriminatory ideals upon which this country was founded. As a result, we urge you to endorse the NO BAN Act, H.R. 2214/S. 1123. When Congress enacted the Immigration and Nationality Act in 1965, it defined clearly that our immigration laws cannot discriminate on the basis of race, sex, nationality, places of birth, or places of residence. For more than half a century, Congress has conferred authority on each president to create immigration policies that are reasonable and limited to the standards enacted by Congress. Congress never intended for this delegation of authority to be limitless and unbounded. Nevertheless, the U.S. Supreme Court found last year that President Trump acted within his authority under the Immigration and Nationality Act when he issued his third travel ban (Proclamation No. -

3M Signon Letter

COMMONWEALTH of VIRGINIA Office of the Attorney General Mark R. Herring 202 North Ninth Street Attorney General Richmond, Virginia 23219 804-786-2071 FAX 804-225-4378 Mr. Michael F. Roman Chairman of the Board and Chief Executive Officer 3M 3M Center, Building 022014W-05 St. Paul, MN 55144-1000 Dear Mr. Roman: We, the undersigned Attorneys General, write to urge you to do more to combat inflated prices for N95 respirators and other desperately needed personal protective equipment (“PPE”). As a principal manufacturer of N95 respirators, we appreciate the initial steps 3M has taken to increase production of these vital masks for healthcare providers and to counter price gouging by those seeking to take advantage of the COVID-19 outbreak. But we believe enhanced measures should be taken to fight price gouging and get these medical supplies to those who need them. We look forward to working with you in this regard. As you know, there have been critical shortages of N95 respirators and other PPE due to the increased use and demand worldwide as a result of the COVID-19 pandemic. It is crucial that hospitals, healthcare workers, and first responders have access to these masks and other PPE and that they be able obtain them at reasonable prices so that they can care for patients with COVID-19 as well as others needing medical attention. You have represented that 3M has not increased the prices it charges for respirators as a result of the global crisis, and we thank you for your pledge not to increase current pricing for the respirators used to prevent the spread of the virus. -

2021 -- S 0281 State of Rhode Island

2021 -- S 0281 ======== LC001203 ======== STATE OF RHODE ISLAND IN GENERAL ASSEMBLY JANUARY SESSION, A.D. 2021 ____________ S E N A T E R E S O L U T I O N RESPECTFULLY REQUESTING THAT THE OFFICE OF THE POSTSECONDARY COMMISSIONER FORM A WORK GROUP TO CONDUCT A THOROUGH REVIEW INTO HOW RHODE ISLAND CAN PROTECT STUDENT LOAN BORROWERS Introduced By: Senators Gallo, and Lombardo Date Introduced: February 18, 2021 Referred To: Senate Education 1 WHEREAS, Outstanding education debt in the United States has tripled over the last 2 decade. As of 2020, student loan debt in the United States totals approximately $1.67 trillion; and 3 WHEREAS, The Federal Family Education Loan (FFEL) Program is a bank-based 4 federal loan program that is held by the Department of Education or guaranty agencies; and 5 WHEREAS, In Rhode Island, the average student loan debt is $31,781; and 6 WHEREAS, Nearly 7 million people with $138.57 billion in FFEL loans are held by 7 guaranty agencies and almost half of the outstanding defaulted student debt is from the FFEL 8 program; and 9 WHEREAS, Prior to the COVID-19 pandemic, the United States Department of 10 Education had removed protections for student loan borrowers, including barring debt collectors 11 from charging high fees, up to sixteen percent of the principal and accrued interest, on past-due 12 loans; and 13 WHEREAS, On March 20, 2020, the office of Federal Student Aid began providing 14 temporary relief due to the pandemic, however, how long those measures will continue is 15 unknown; and 16 WHEREAS, Rhode -

State of Rhode Island and Providence Plantations

State of Rhode Island and Providence Plantations JANUARY SESSION of the General Assembly begun and held at the State House in the City of Providence on Tuesday, the First day of January in the year of Our Lord Two Thousand and Nineteen. Volume 146, No.5 Tuesday, January 15, 2019 Fifth Legislative Day The Senate meets pursuant to adjournment and is called to order by the Honorable Dominick J. Ruggerio, President of the Senate, at 5:18 o’clock P.M. ROLL CALL The roll is called and a quorum is declared present with 37 Senators present and 1 Senator absent as follows: PRESENT –37: The Honorable President Dominick Ruggerio, and Senators, Algiere, Archambault, Bell, Cano, Ciccone, Conley, Coyne, Crowley, de la Cruz, DiPalma, Euer, Felag, Gallo, Goldin, Goodwin, Lawson, Lombardi, Lombardo, Lynch Prata, McCaffrey, McKenney, Metts, Miller, Morgan, Murray, Nesselbush, Paolino, Pearson, Picard, Quezada, Raptakis, Rogers, Satchell, Seveney, Sheehan, Valverde. ABSENT – 1: Senator Sosnowski. INVOCATION The Honorable President, by unanimous consent, presents Senator Ciccone, to deliver the invocation. (See Appendix for Invocation) PLEDGE OF ALLEGIANCE TO THE FLAG The Honorable President, by unanimous consent, presents Senator Ciccone, to lead the Senate in the pledge of allegiance to the flag. S.J. -- 2 JOURNAL Tuesday, January 15, 2019 APPROVAL OF RECORD The Senate Journal of the Forth Legislative Day of the 2019 proceedings is read in part. Upon suggestion of Senator Ciccone and by unanimous consent, further reading of the Journal is dispensed with and the Journal approved as recorded. GUESTS Upon the suggestion of Senator Lynch Prata and by unanimous consent, The Honorable President of the Senate, welcomes to the Chamber Family Court Magistrate Armand Manaco. -

Office of the Attorney General Facsimile No

BRIAN E. FROSH ELIZABETH F. HARRIS Attorney General Chief Deputy Attorney General CAROLYN QUATTROCKI Deputy Attorney General STATE OF MARYLAND OFFICE OF THE ATTORNEY GENERAL FACSIMILE NO. WRITER’S DIRECT DIAL NO. 410-576-7036 410-576-6300 May 12, 2020 SENT VIA EMAIL ONLY [email protected] [email protected] President Donald J. Trump The White House 1600 Pennsylvania Avenue, N.W. Washington, D.C. 20500 Dear President Trump: We, the undersigned Attorneys General of Maryland, California, Colorado, Delaware, the District of Columbia, Illinois, Maine, Massachusetts, Michigan, Minnesota, Nevada, New Jersey, New Mexico, New York, Oregon, Pennsylvania, Rhode Island, Virginia, Washington, and Wisconsin, write to express our urgent concern about the effect of your Executive Order invoking the Defense Production Act with respect to meat and poultry processing plants during the pandemic.1 The industry’s workers are risking their lives to maintain production in these facilities under extremely unsafe working conditions. Your action purporting to force plants to stay open and employees to continue working must be accompanied by the enforcement of standards to ensure the safety of these essential workers. Already considered some of the most dangerous workplaces in America,2 the crisis of COVID-19 outbreaks in the nation’s meat and poultry processing operations is dire and escalating. Recent reports indicate that over 10,000 COVID-19 cases have been tied to these outbreaks, and at least 45 workers have died. Infection clusters at forty plants have been so severe they have been 1https://www.whitehouse.gov/presidential-actions/executive-order-delegating-authority-dpa-respect-food- supply-chain-resources-national-emergency-caused-outbreak-covid-19/; Defense Production Act of 1950, 50 U.S.C.