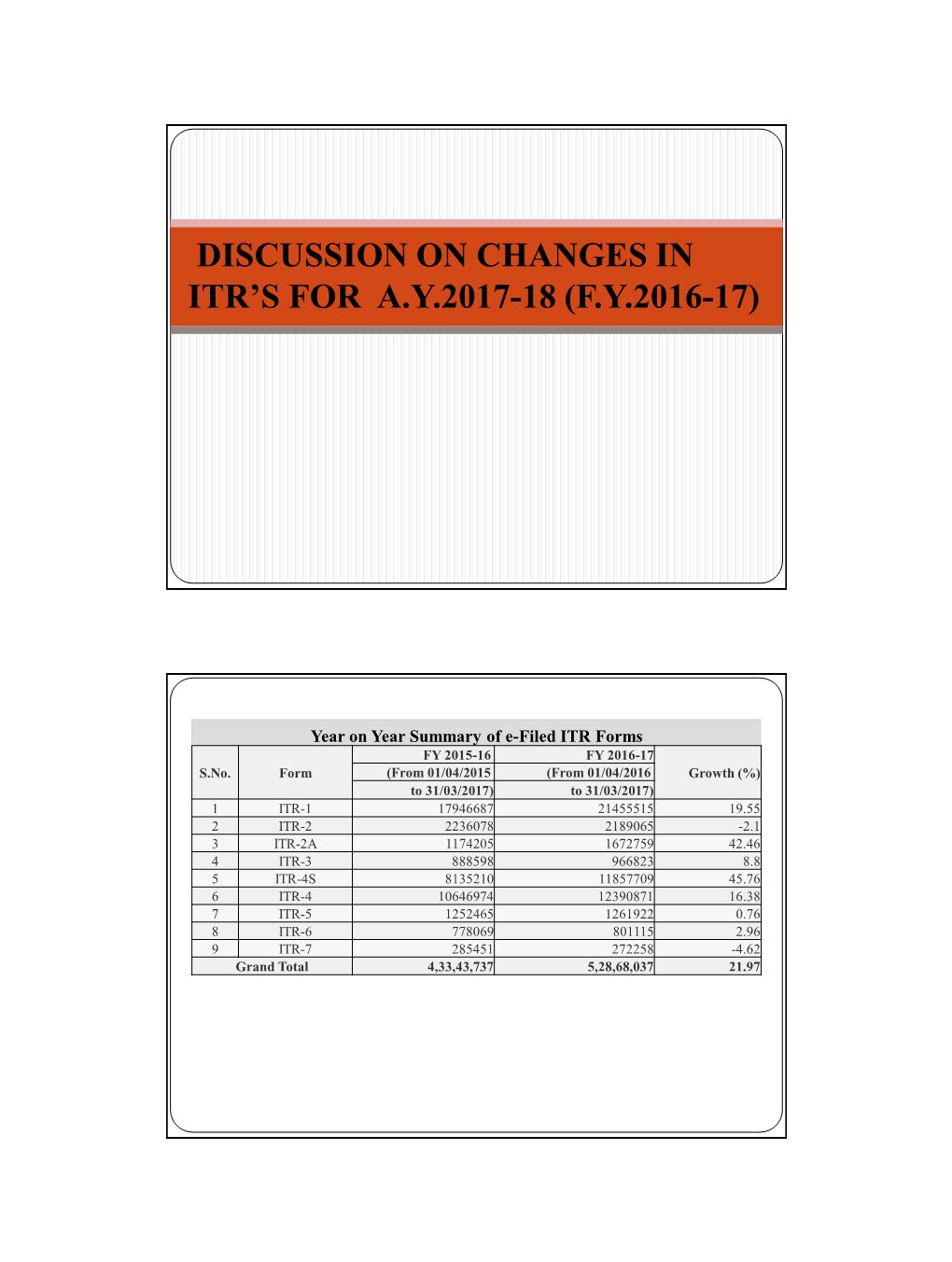

Discussion on Changes in Itr's for Ay2017-18

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Trends and Issues in Tax Policy and Reform in India

M. GOVINDA RAO National Institute of Public Finance and Policy R. KAVITA RAO National Institute of Public Finance and Policy Trends and Issues in Tax Policy and Reform in India ax systems the world over have undergone significant changes during Tthe last twenty years as many countries across the ideological spectrum and with varying levels of development have undertaken reforms. The wave of tax reforms that began in the mid-1980s and accelerated in the 1990s was motivated by a number of factors. In many developing countries, pressing fiscal imbalance was the driving force. Tax policy was employed as a principal instrument to correct severe budgetary pressures.1 In others, the transition from a planned economy to a market economy necessitated wide- ranging tax reforms. Besides efficiency considerations, these tax reforms had to address the issues of replacing public enterprise profits with taxes as a principal source of revenue and of aligning tax policy to change in the development strategy. Another motivation was the internationalization of economic activities arising from increasing globalization. On the one hand, globalization entailed significant reduction in tariffs, and replacements had to be found for this important and relatively easily administered revenue source. On the other, globalization emphasized the need to minimize both efficiency and compliance costs of the tax system. The supply-side tax reforms of the Thatcher-Reagan era also had their impact on the tax reforms in developing countries. The evolution of the Indian tax system was driven by similar concerns and yet, in some ways, it is different and even unique. Unlike most develop- ing countries, which were guided in their tax reforms by multilateral agencies The authors are grateful to Shankar N. -

ITR-6 Notified Form AY 2021-22 0.Pdf

[भाग II—ख赍ड 3(i)] भारतकाराजपत्र:असाधारण 343 INDIAN INCOME TAX RETURN [For Companies other than companies claiming exemption Assessment Year ITR-6 under section 11] (Please see rule 12 of the Income-tax Rules,1962) FORM (Please refer instructions) 2 0 2 1 - 2 2 Part A-GEN GENERAL Name PAN Is there any change in the company’s name? If yes, please furnish the old name Corporate Identity Number (CIN) issued by MCA Flat/Door/Block No Name of Premises/Building/Village Date of incorporation Date of commencement of (DD/MM/YYYY) business (DD/MM/YYYY) / / / / Road/Street/Post Office Area/Locality Type of company (Tick any one) (i) Domestic Company (ii) Foreign Company Town/City/District State Pin code/Zip code If a public company write 6, and if private company write 7 (as defined in PERSONAL INFORMATION PERSONAL Country section 3 of The Companies Act) Office Phone Number with STD code/ Mobile No. 1 Mobile No. 2 Email Address-1 Email Address-2 139(1)- On or Before due date, 139(4)- After due date, 139(5)- Revised Return, (a) Filed u/s (Tick)[Please see instruction ] 92CD-Modified return, 119(2)(b)- after condonation of delay Or filed in response to notice u/s 139(9), 142(1), 148, 153A, 153C If revised/ defective/Modified, then enter Receipt No (b) ___ /___/____ and Date of filing original return (DD/MM/YYYY) If filed, in response to notice u/s 139(9)/142(1)/148/153A/153C or order u/s 119(2)(b), enter Unique Number /Document (c) / / Identification Number and date of such notice/order, or if filed u/s 92CD enter date of advance pricing -

Goods and Service Tax (Gst) Concept & Status Central Board of Indirect Taxes and Customs (Cbic) Department of Revenue Minist

GOODS AND SERVICE TAX (GST) CONCEPT & STATUS CENTRAL BOARD OF INDIRECT TAXES AND CUSTOMS (CBIC) DEPARTMENT OF REVENUE MINISTRY OF FINANCE GOVERNMENT OF INDIA AS ON 01st August, 2019 1 | 58 The uniform system of taxation, which, with a few exceptions of no great consequence, takes place in all the different parts of the United Kingdom of Great Britain, leaves the interior commerce of the country, the inland and coasting trade, almost entirely free. The inland trade is almost perfectly free, and the greater part of goods may be carried from one end of the kingdom to the other, without requiring any permit or let-pass, without being subject to question, visit, or examination from the revenue officers. ……This freedom of interior commerce, the effect of uniformity of the system of taxation, is perhaps one of the principal causes of the prosperity of Great Britain; every great country being necessarily the best and most extensive market for the greater part of the productions of its own industry. If the same freedom, in consequence of the same uniformity, could be extended to Ireland and the plantations, both the grandeur of the state and the prosperity of every part of the empire, would probably be still greater than at present” – Adam Smith in ‗Wealth of Nations‘ 2 | 58 1. INTRODUCTION: Whether it was uniformity of taxation and consequent free interior trade or possession of ‗the jewel in the crown‘ at the root of prosperity of Britain is debatable, nonetheless the words of father of modern economics on the benefits of uniformity of system of taxation cannot be taken too lightly. -

Asia Tax Bulletin Autumn 2019 in This Edition

Asia Tax Bulletin Autumn 2019 In This Edition We are pleased to present the Autumn 2019 edition of our firm’s Asia Tax Bulletin. Dear reader, I’m happy to present this edition of our We hope you will enjoy reading about these quarterly Asia Tax Bulletin, reporting on and other developments and as always significant tax related developments in appreciate any suggestions for improvement. Southeast Asia, Greater China, Japan, Korea Please do not hesitate to contact us if you have CHICAGO SAN FRANCISCOand India. Included in this edition is the interN EWany YORK questions about taxation in Asia. BEIJING alia the trade war between the PRC and theW ASHINGTON DC PALO ALTO With kind regards, USA, transfer pricing circulars issued by theCHARLOTTE TOKYO LOS ANIRDGE inL ESHong Kong, India’s tax changesHOUS TON Pieter de Ridder SHANGHAI proposed in the recent government Budget for DUBAI 2019/2020 as well as the proposed tax reform, HANOI HONG KONG CFCMEXICO changes and CITY tax incentives in Indonesia, Korea’s Budget proposals, service tax BANGKOK developments in Malaysia and tax reform HO CHI MINH CITY Pieter de Ridder measuresAM Ein theR IPhilippines.CAS Partner, Mayer Brown LLP +65 6327 0250 SINGAPORE Singapore is one step closer to implementing [email protected] the long awaited Variable Capital Company legislation, which will effectively put it on a par with the company law of the British Virgin BRASÍLIA* Islands. Thailand introduced a VAT on foreign * ecommerce operators and is encouraging RIO DE JANEIRO foreign talent to relocate to Thailand by SÃO PAULO* offering attractive tax benefits. -

Finance Act, 2021 and Intimate the Assessing Officer, in the Prescribed Manner, About Such Withdrawal

FINANCE BILL, 2021 PROVISIONS RELATING TO DIRECT TAXES Introduction The provisions of Finance Bill, 2021 (hereafter referred to as "the Bill"), relating to direct taxes seek to amend the Income-tax Act, 1961 (hereafter referred to as 'the Act'), Prohibition of Benami Property Transactions Act, 1988 (hereafter referred to as ―PBPT Act‖), Finance (No 2) Act, 2004 and Finance Act, 2016 and the Direct Tax Vivad se Vishwas Act, 2020 to continue reforms in direct tax system through tax-incentives, removing difficulties faced by taxpayers and rationalization of various provisions. With a view to achieving the above, the various proposals for amendments are organized under the following heads:— (A) Rates of income-tax; (B) Tax incentives; (C) Removing difficulties faced by taxpayers; (D) Rationalisation of various provisions. DIRECT TAXES A. RATES OF INCOME-TAX I. Rates of income-tax in respect of income liable to tax for the assessment year 2021-22. In respect of income of all categories of assessee liable to tax for the assessment year 2021-22, the rates of income-tax have either been specified in specific sections (like section 115BAA or section 115BAB for domestic companies, 115BAC for individual/HUF and 115BAD for cooperative societies) or have been specified in Part I of the First Schedule to the Bill. There is no change proposed in tax rates either in these specific sections or in the First Schedule. The rates provided in sections 115BAA or 115BAB or 115BAC or 115BAD for the 1 2 assessment year 2021-22 would be same as already enacted. Similarly rates laid down in Part III of the First Schedule to the Finance Act, 2020, for the purposes of computation of ―advance tax‖, deduction of tax at source from ―Salaries‖ and charging of tax payable in certain cases for the assessment year 2021-22 would now become part I of the first schedule. -

Taxation in India

Page 1 AARAMBH - Start to Quality Answer Writing Features 4 Questions Per Day for 5 Days a Week for next 8 Weeks. ( Self Evaluation ) 4 Full Length Tests with Evaluation. Complete Coverage Syllabus through Question. Lecture on Answer Writing. Focus on Structuring of answers and Brainstorming Personal Mentoring by Dr.Sudarshan Sir. Documents on Quotes, Diagrams, Examples. Limited Number of Students. Course start from 24th May 2021 Offer Price: 4999/- ( Only 100 admissions ) Schedule: https://bit.ly/33JQmsu Enrol here : https://targetupsc.in/courses/detail/79 Page 2 Table of Contents Taxation In India .................................................................................................................. 4 What is a Tax ? ................................................................................................................. 4 Adam Smith’s 4 Canons of taxation .................................................................................. 4 Methods Of Taxation ......................................................................................................... 4 Progressive taxation ...................................................................................................... 4 Regressive Tax .............................................................................................................. 4 Proportional Tax............................................................................................................. 5 Retrospective Taxation: ................................................................................................ -

Tax Revenue in India: Trends and Issues

Tax Revenue in India: Trends and Issues Pratap Singh ISBN 978-81-940398-4-6 © 2019, Copyright Reserved The Institute for Social and Economic Change, Bangalore Institute for Social and Economic Change (ISEC) is engaged in interdisciplinary research in analytical and applied areas of the social sciences, encompassing diverse aspects of development. ISEC works with central, state and local governments as well as international agencies by undertaking systematic studies of resource potential, identifying factors influencing growth and examining measures for reducing poverty. The thrust areas of research include state and local economic policies, issues relating to sociological and demographic transition, environmental issues and fiscal, administrative and political decentralization and governance. It pursues fruitful contacts with other institutions and scholars devoted to social science research through collaborative research programmes, seminars, etc. The Working Paper Series provides an opportunity for ISEC faculty, visiting fellows and PhD scholars to discuss their ideas and research work before publication and to get feedback from their peer group. Papers selected for publication in the series present empirical analyses and generally deal with wider issues of public policy at a sectoral, regional or national level. These working papers undergo review but typically do not present final research results, and constitute works in progress. Working Paper Series Editor: A V Manjunatha Tax Revenue in India: Trends and Issues Pratap Singh∗ Abstract India has a federal tax structure. Centre, states and local bodies collect taxes as per the scheme laid down under the Constitution, more particularly under the seventh schedule. Article 265, however, puts restrictions on this power and states that “No tax shall be levied or collected except by the authority of law”.