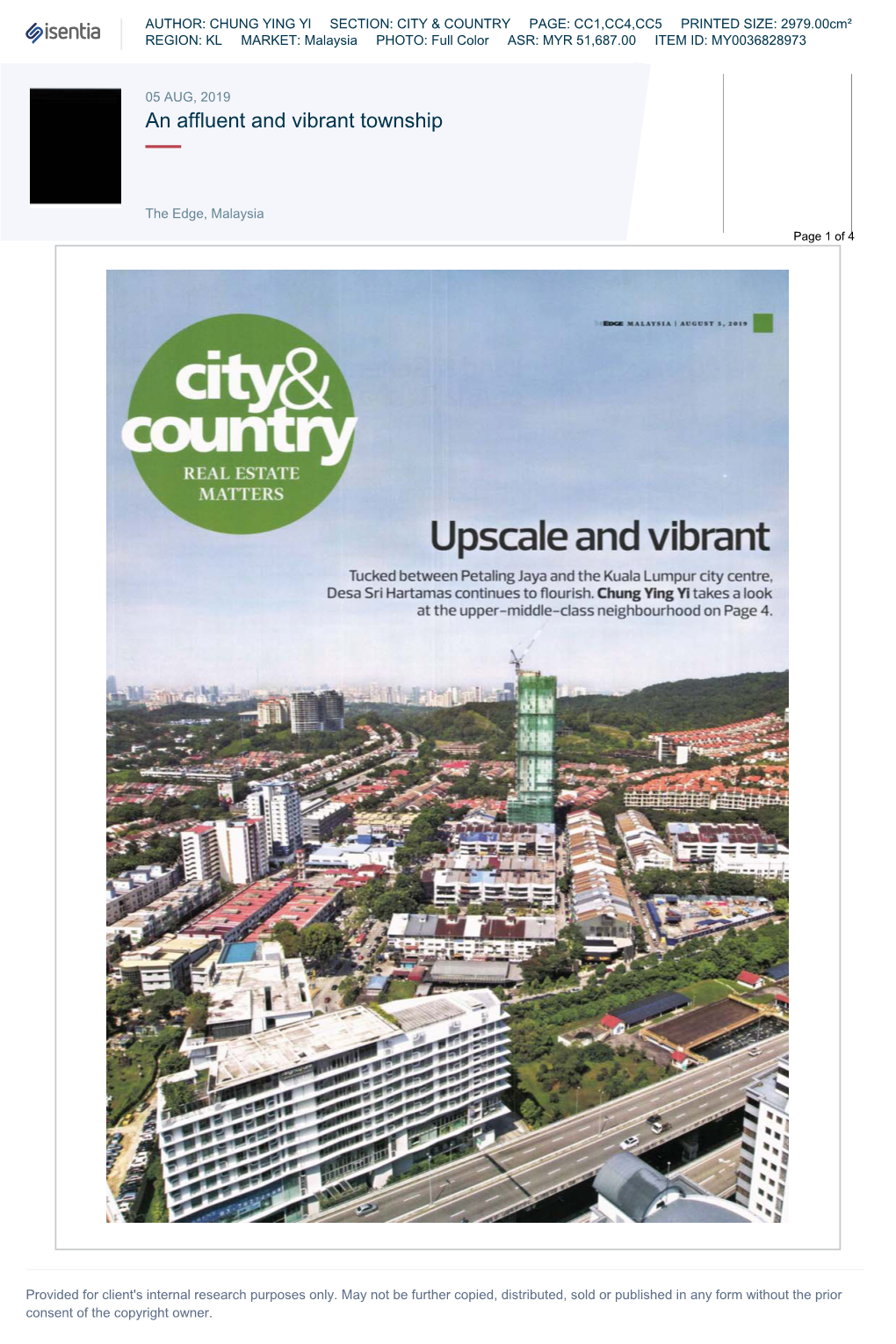

An Affluent and Vibrant Township

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Destination: Malaysia a Great Place to Own a Property Complimentary Copy

Destination: Malaysia A great place to own a property Complimentary copy. Complimentary copy. for sale. Not Destination: Malaysia Contents Chapter 1 Chapter 2 Chapter 4 Why choose Malaysia? 4 A fertile land for 17 What to do before 42 economic growth you buy? More bang for your buck 5 Ease of property purchase 7 Chapter 5 Tropical weather and 8 Malaysia My Second Home 44 disaster-free land Low cost of living, 9 Chapter 6 high quality of life Thrilling treats & tracks 48 Easy to adapt and fit in 10 Must-try foods 51 Safe country 11 Must-visit places 55 Fascinating culture 12 Chapter 3 and delicious food Where to look? 22 Quality education 13 KL city centre: 24 Quality healthcare 14 Where the action is services Damansara Heights: 26 The Beverly Hills of Malaysia Cyberjaya: Model 30 smart city Useful contact numbers 58 Desa ParkCity: KL’s 32 to have in Malaysia most liveable community Mont’Kiara: Expats’ darling 34 Advertorial Johor Bahru: A residential 37 Maker of sustainable 20 hot spot next to Singapore cities — Sunway Property Penang Island: Pearl 40 The epitome of luxury 28 of the East at DC residensi A beach Destination: on one of the many pristine Malaysia islands of Sabah, Malaysia. PUBLISHED IN JUNE 26, 2020 BY The Edge Property Sdn Bhd (1091814-P) Level 3, Menara KLK, No 1 Jalan PJU 7/6, Mutiara Damansara, 47810 Petaling Jaya, Selangor, Malaysia MANAGING DIRECTOR/ EDITOR-IN-CHIEF — Au Foong Yee EDITORIAL — Contributing Editor Sharon Kam Assistant Editor Tan Ai Leng Preface Copy Editors James Chong, Arion Yeow Writers lessed with natural property is located ranging Chin Wai Lun, Rachel Chew, beauty, a multi-cul- from as low as RM350,000 for any Natalie Khoo, Chelsey Poh tural society, hardly residential property in Sarawak Photographers any natural disas- to almost RM2 million for a landed Low Yen Yeing, Suhaimi Yusuf, ters and relatively home on Penang Island. -

Real Estate Highlights Kuala Lumpur - Penang - Johor Bahru • 1St Half 2008

Research Real Estate Highlights Kuala Lumpur - Penang - Johor Bahru • 1st Half 2008 Contents Kuala Lumpur Hotel • Condominium Market 2 • Office Market 5 • Retail Market 8 • Hotel Market 10 Penang Property Market 12 Retail Johor Bahru Property Market 14 Residential Office Executive Summary Kuala Lumpur • The high end condominium market stabilised in the first half of 2008 in terms of take up, capital values and rentals. • Rentals and occupancies of prime offices continued to rise due to the current tight supply of good quality office buildings. • Several retail centres located at fringes of KL City are undergoing refurbishment works to remain competitive. • The performance of the hotel industry had been resilient attributed to high tourist arrivals and receipts, which led to the increase in average room rates and occupancies. Penang • Most of the high end condominium projects which are nearing completion have been sold, with prices being revised upwards. • The retail industry performed well with higher tourist arrivals in Penang. • The asking rentals of newly completed offices with better IT facilities are ranging from RM2.50 to RM3.50 per sq ft per month. Johor • The high end residential market is gaining momentum with the positive development of Iskandar Malaysia. • Prime retail centres continued to enjoy growth in rentals and occupancies. • Office sector remains healthy at an average occupancy of 70%. 2 Real Estate Highlights - Kuala Lumpur | Penang | Johor Bahru • 1st Half 2008 Knight Frank Figure 1 Projection of Cumulative Supply Kuala Lumpur High End Condominium Market for High End Condominium (2008 - 2010) Market Indications 30,000 The high end condominium market generally stabilised during the first six months of the year with one 25,000 notable new project, The Regent Residences (across Twin Towers), recording prices in excess of RM2,500 per sq ft. -

Kenanga Islamic Fund

KENANGA ISLAMIC FUND ANNUAL REPORT For the Financial Year Ended 31 December 2019 cover.indd 1 3/16/20 2:28 PM KENANGA ISLAMIC FUND Contents Page Corporate Directory ii - iii Directory of Manager’s Offices iv Fund Information 1 Manager’s Report 2 - 6 Fund Performance 7 - 9 Trustee’s Report 10 Shariah Adviser’s Report 11 Independent Auditors’ Report 12 - 14 Statement by the Manager 15 Financial Statements 16 - 47 KIF_Revised13Mar2020.indd 1 16/3/2020 10:08:39 AM CORPORATE DIRECTORY Manager: Kenanga Investors Berhad Company No. 199501024358 (353563-P) Registered Office Business Office Level 17, Kenanga Tower Level 14, Kenanga Tower 237, Jalan Tun Razak 237, Jalan Tun Razak 50400 Kuala Lumpur, Malaysia 50400 Kuala Lumpur, Malaysia Tel: 03-2172 2888 Tel: 03-2172 3000 Fax: 03-2172 2999 Tel: 03-2172 3080 E-mail: [email protected] Website: www.KenangaInvestors.com.my Board of Directors Investment Committee Datuk Syed Ahmad Alwee Alsree (Chairman) Syed Zafilen Syed Alwee (Independent Syed Zafilen Syed Alwee (Independent Member) Director) Peter John Rayner (Independent Peter John Rayner (Independent Member) Director) Imran Devindran Abdullah (Independent Imran Devindran Abdullah (Independent Member) Director) Ismitz Matthew De Alwis Ismitz Matthew De Alwis Norazian Ahmad Tajuddin (Independent Norazian Ahmad Tajuddin (Independent Member) Director) Company Secretary: Norliza Abd Samad (MAICSA 7011089) Level 17, Kenanga Tower, 237, Jalan Tun Razak, 50400 Kuala Lumpur, Malaysia. External Fund Manager: Kenanga Islamic Investors Berhad Company No. 199701036457 (451957-D) Registered Office Business Office Level 17, Kenanga Tower Level 14, Kenanga Tower 237, Jalan Tun Razak 237, Jalan Tun Razak 50400 Kuala Lumpur, Malaysia 50400 Kuala Lumpur, Malaysia Tel: 03-2172 2888 Tel: 03-2172 3000 Fax: 03-2172 2999 Tel: 03-2172 3080 Trustee: Universal Trustee (Malaysia) Berhad Company No. -

For Sale - Kepong, Jalan Tar, Sri Hartamas, Subang, USJ, Jalan Ipoh, Kuala Lumpur

iProperty.com Malaysia Sdn Bhd Level 35, The Gardens South Tower, Mid Valley City, Lingkaran Syed Putra, 59200 Kuala Lumpur Tel: +603 6419 5166 | Fax: +603 6419 5167 For Sale - kepong, jalan tar, sri hartamas, Subang, USJ, Jalan Ipoh, Kuala Lumpur Reference No: 100728555 Tenure: Freehold Address: Subang, USJ, Kuala Lumpur Occupancy: Tenanted State: Kuala Lumpur Furnishing: Unfurnished Property Type: Shop Unit Type: Intermediate Asking Price: RM 1,600,000 Land Title: Commercial Built-up Size: 2,600 Square Feet Property Title Type: Individual Name: Ky Wan Built-up Price: RM 615.38 per Square Feet Posted Date: 12/03/2021 Company: Chester Properties - Sri Land Area Size: 20x70 Square Feet Hartamas (Ceased Operation) Land Area 22 x 80 Email: [email protected] Dimension: 2sty Freehold shop at Jalan Pinggiran USJ 1/8, LA 22x80 BU 2600sf, full tenant at 4500/mth (expiry no renew, owner will sell as vacant), for sale 1.6m Learn property investment before your money stuck, visit http://wanres.blogspot.com/ Pls contact k y wan 0196529886 for viewing. Other shops for sale Solaris Mont Kiara 3sty full tenant for sale 5m full tenant 4sty with lift full tenant for sale 7.5m full tenant Solaris Dutamas Upper ground + lower ground 5.7m ground floor 4.3m ground floor 3.5m upper ground 2.5m Other shops for investment - 3sty shop Neo Damansara partial tenan.... [More] View More Details On iProperty.com iProperty.com Malaysia Sdn Bhd Level 35, The Gardens South Tower, Mid Valley City, Lingkaran Syed Putra, 59200 Kuala Lumpur Tel: +603 6419 5166 | Fax: +603 6419 5167 For Sale - kepong, jalan tar, sri hartamas, Subang, USJ, Jalan Ipoh, Kuala Lumpur. -

Kuala Lumpur

Powered by Powered by Kuala Lumpur Residential Market Update January 2019 The formation of a new government following Malaysia’s recent general election is already having a positive impact Economic indicators on the economy. Nominal quarterly GDP growth for Malaysia, Malaysia-wide unemployment, inflation and the overnight policy rate Consumer sentiment has been improving following the three month tax holiday, with the introduction of the GDP Quarter-on- Malaysia Overnight zero-rating of the Goods and Services Tax (GST), effective 1.7% Quarter Growth 3.25% Policy Rate from 1st June 2018, and the re-introduction of the Sales and Q2 2018 September 2018 Services Tax (SST) on 1st September 2018. This has been reinforced by strong employment and a low inflation rate; in Unemployment Rate Inflation Rate August 2018, unemployment levels stood at 3.4% and the 3.4% August 2018 0.2% August 2018 inflation rate was low at 0.2%. In the second quarter of 2018, the Business Conditions Index Nominal GDP growth Unemployment Rate Inflation Rate 6% (BCI), published by the Malaysian Institute of Economic Research, hit its highest level for the past 13 quarters at 5% 116.3 points. In addition, the continuing development of Kuala 4% Lumpur’s new financial district, Tun Razak Exchange, looks set 3% to further boost Malaysia’s growing financial services sector. 2% Keeping pace with rapid urbanisation is the development 1% progress of transport infrastructure in Greater Kuala Lumpur 0% (GKL). The completed and on-going Light Rail Transit (LRT) and Mass Rapid Transit (MRT) lines are enhancing mobility and -1% connectivity within the region, and helping to transform GKL -2% into a sustainable and liveable metropolis. -

Sunway Vivaldi, Sri Hartamas, Kuala Lumpur

iProperty.com Malaysia Sdn Bhd Level 35, The Gardens South Tower, Mid Valley City, Lingkaran Syed Putra, 59200 Kuala Lumpur Tel: +603 6419 5166 | Fax: +603 6419 5167 For Sale - Sunway Vivaldi, Sri Hartamas, Kuala Lumpur Reference No: 101062709 Tenure: Freehold Name: Melissa Low Address: Jalan 19/70A, Sri Hartamas, Occupancy: Tenanted Company: IQI Realty Sdn Bhd - Desa Sri 50480, Kuala Lumpur Furnishing: Partly furnished Hartamas State: Kuala Lumpur Unit Type: Penthouse Email: [email protected] Property Type: Condominium Land Title: Residential Asking Price: RM 6,000,000 Property Title Type: Strata Built-up Size: 9,085 Square Feet Facing Direction: South Built-up Price: RM 660.43 per Square Feet Posted Date: 07/09/2021 No. of Bedrooms: 5+3 Facilities: BBQ, Parking, Jogging track, No. of Bathrooms: 6 Playground, Squash court, Tennis court, Gymnasium, Swimming pool, 24-hours security, Club house, Jacuzzi, Sauna, Wading pool, Cafeteria Property Features: Kitchen cabinet,Balcony,Bath tub,Garden,Air conditioner ****GOOD VALUE FOR MONEY WITH AN AMAZING VIEW OVERLOOKING KLCC , KL TOWER, HARTAMAS AND BANGSAR- AVAILABLE FOR SALE******** IMAGES ARE ACTUAL IMAGES OF THE UNIT UNIT IS CURRENTLY TENANTED, NATURALLY LIGHTED AND VERY WELL VENTILATED ****** VIEW TO APPRECIATE ***** DESCRIPTIONS: -Within easy reach to shopping malls, business centers, walking distance to Garden International school, cafe, restaurants, medical center and golf clubs. GARDEN INTERNATIONAL SCHOOL - 2 mins / < 1 km PUBLIKA - 5 mins / 3.4 km DAMANSARA HEIGHTS - 8 mins / 4 km BANGSAR - 10 mins / 8 km KL CITY CENTRE - 15 m.... [More] View More Details On iProperty.com iProperty.com Malaysia Sdn Bhd Level 35, The Gardens South Tower, Mid Valley City, Lingkaran Syed Putra, 59200 Kuala Lumpur Tel: +603 6419 5166 | Fax: +603 6419 5167 For Sale - Sunway Vivaldi, Sri Hartamas, Kuala Lumpur No photo available for this listing. -

Malaysia Real Estate Highlights

RESEARCH REAL ESTATE HIGHLIGHTS 1ST HALF 2015 KUALA LUMPUR PENANG JOHOR BAHRU KOTA KINABALU KUALA LUMPUR HIGH END CONDOMINIUM MARKET (MPC) meeting in May in an effort to support economic growth and domestic HIGHLIGHTS consumption. • Softening demand in the SUPPLY & DEMAND high-end condominium With the completion of seven notable segment amid a cautious projects contributing an additional market. 1,296 units [includes projects that are physically completed but pending Madge Mansions issuance of Certificate of Completion • Lower volume of transactions and Compliance (CCC)], the cumulative expected to come on-stream. The KL in 1Q2015. supply of high end condominiums in City locality will account for circa 35% Kuala Lumpur stands at 39,610 units. (1,310 units) of the new supply; followed • Developers with niche high by Mont’ Kiara / Sri Hartamas with Approximately 45% (582 units) of the new 34% (1,256 units); KL Sentral / Pantai / end residential projects in KL completions are located in the Ampang Damansara Heights with 20% (734 units); City review products, pricing Hilir / U-Thant area, followed by some and the remaining 11% (425 units) from and marketing strategies in 26% (335 units) in the locality of KL City; the locality of Ampang Hilir / U-Thant. a challenging market with 16% (204 units) from the locality of KL lacklustre demand, impacted Sentral / Pantai / Damansara Heights Notable projects slated for completion by a general slowdown in the area; and 14% (175 units) from the Mont’ in KL City include Face Platinum Suites, economy, tight lending Kiara / Sri Hartamas locality. Le Nouvel, Mirage Residences as well as guidelines, weaker job market the delayed project of Crest Jalan Sultan The three completions in Ampang Hilir amongst other reasons. -

TYSON GEE Citi-ZEN • ISSUE 46

ISSUE 46 • July - September 2018 Living Life Large The RuMa’s Master Chef TYSON GEE CiTi-ZEN • ISSUE 46 Ireka Development Management Sdn Bhd Level 18, Wisma Mont’ Kiara No. 1, Jalan Kiara, Mont’ Kiara 50480 Kuala Lumpur T +603.6411.6388 F +603.6411.6383 W i-zen.com.my E [email protected] GREETINGS TO OUR CiTi-ZEN CONTENTS READERS! Steak-ing His Claim There is a lot of excitement in the air as we approach the finishing line for 1 On Kuala Lumpur the opening of The RuMa Hotel and Residences located in the heart of KLCC, towards the end of the year. The RuMa Hotel’s pre-opening team Progress Intelligence On The are in place and everyone is poised to get started, including the chef 4 RuMa Hotel And Residences de cuisine, Tyson Gee who is featured in this issue. He will be cooking up a storm in KL’s latest restaurant, ATAS and you can read all about his A World Away From The Everyday plans for this exciting new modern Malaysian eatery. 5 - KaMi Mont’ Kiara Official Launch Another exciting event which took place in June was the official launch of our latest Japanese-inspired development in upscale Mont’ Kiara, IREKA CARES - 6 Outing For Openhands Children KaMi Residences which you can also read about in this issue. The launch generated much interest and we are pleased that over 50% have been booked by keen buyers. The prime location and guaranteed rental Kopitiam News - Packing A Punch income for 6 years are clear winners with the savvy buyers. -

Social Network Urban Lounging

URBAN LOUNGING A FEAST FOR THE SENSES, YEARNINGS & CRAVINGS QUENCHED STEAL AWAY & Brilliant retail atriums in the integrated mall lend itself to shopping in leisure, BE CHARMED INSTEAD with a selection that will tease your whims and tickle your emotions. BY CHANCE ENCOUNTERS Amidst restful revelry, sail into languid daydreams in hideaways of artful & greens. AN ELEGANT CANVAS TO SET THE SCENE FOR LIFE’S EVER-CHANGING COMPOSITIONS SOCIAL Functional and flexible resort home living in 700 to 1,900 sf layouts. NETWORK Embellished for fulfillment with quality built-ins and dual-key unit option. WE DON’T MEET PEOPLE BY CHANCE, THEY ARE MEANT TO CROSS OUR PATHS. Recharge, bond and rejoice in Senada’s 2-acre Sky Park Garden. The perfect balance of indoor and outdoor recreation facilities – swimming pool, jacuzzi, jogging deck, gymnasium, and function room – shape carefree memories and special occasions. please propose... TQ BENEATH THE FACADE LOVE UNFOLDING EVERY HOUR LIVES UNCOVERED EVERY DAY A multi-faceted development that evokes strong emotions. Guarded with round-the-clock security, this prestigious development nestles comfortably on the pristine fairways of one of Asia’s best golf courses, TPC Kuala Lumpur. Neighbouring suburbs such as Bukit Tunku, Damansara Heights, a prime Taman Tun Dr Ismail, Sri Hartamas, Mont’ Kiara and Bangsar It will elevate you with new sensations and presents location are amongst Kuala Lumpur’s most established. Alya’s gloss is further refreshing sights, sounds, tastes and experiences. SET WITHIN KUALA LUMPUR’S enhanced by world-class amenities like international schools, From residential to retail to business, it promises MOST AFFLUENT WESTERN SUBURB, shopping malls and commercial centres, all close by. -

Integrated Management of Malaysian Road Network Operations Through ITS Initiatives: Issues, Potentials and Challenges

Integrated management of Malaysian road network operations through ITS Initiatives: issues, potentials and challenges Moazzem Hossain Malaysia University of Science and Technology (MUST) GL33, Kelana Square, Kelana Jaya, PJ 47301, Selangor, Malaysia [email protected] Abstract During the last twenty five years, rapid urbanization and industrialization have resulted considerable growth of Malaysian highway network. Apart from few specialized industrial zones, most of the industrial zones are established in close proximity of the urban areas in order to ensure the smooth supply of manpower especially for the dominating manufacturing sectors. This phenomenon resulted in a number of large regional units of transport demand base involving high private motorized trips and truck dependent freight trips. The growth of car and truck trips especially in the regions including sea ports is putting tremendous pressure on the capacity of these regions’s road network which cannot be subdued by only physical extension of the network which often proved to be costly also. As a result, a number of such regions e.g. Klang Valley, Penang and Johor Baru are experiencing the problems of congestion, accidents and air pollution on their highway network. In many developed countries integrated intelligent transport system (ITS) initiatives applied to these sorts of regional bases have been claimed to be successful in alleviating those problems in a cost-effective manner. This paper will investigate the issues related to such integrated application of ITS initiatives in Malaysia on a regional basis with particular focus on Klang Valley region. Starting from the basic ITS functionality, the paper will identify the potential focus areas such as data gathering, data communication among and across jurisdictions, System flexibility, smart use of alternative routes, public-private collaboration and integration of public-private agencies in terms of regional ITS operational needs. -

Malaysia Real Estate Highlights

RESEARCH REAL ESTATE HIGHLIGHTS 2ND HALF 2016 KUALA LUMPUR PENANG JOHOR BAHRU KOTA KINABALU HIGHLIGHTS KUALA LUMPUR HIGH END CONDOMINIUM MARKET Despite the subdued market, there were noticeably more ECONOMIC INDICATORS launches and previews in the TABLE 1 second half of 2016. Malaysia’s Gross Domestic Product Completion of High End (GDP) grew 4.3% in 3Q2016 from 4.0% Condominiums / Residences in in 2Q2016, underpinned by private 2H2016 The secondary market, however, expenditure and private consumption. continues to see lower volume Exports, however, fell 1.3% in 3Q2016 of transactions due to the weak compared to a 1.0% growth in 2Q2016. economy and stringent bank KL Trillion lending guidelines. Amid growing uncertainties in the Jalan Tun Razak external environment, a weak domestic KL City market and continued volatility in the 368 Units The rental market in locations Ringgit, the central bank has maintained with high supply pipeline and a the country’s growth forecast for 2016 at weak leasing market undergoes 4.0% - 4.5% (2015: 5.0%). correction as owners and Le Nouvel investors compete for the same Headline inflation moderated to 1.3% in Jalan Ampang 3Q2016 (2Q2016: 1.9%). pool of tenants. KL City 195 Units Unemployment rate continues to hold steady at 3.5% since July 2016 (2015: The review period continues to 3.1%) despite weak labour market see more developers introducing conditions. Setia Sky creative marketing strategies and Residences - innovative financing packages Bank Negara Malaysia (BNM) lowered the Divina Tower as they look to meet their sales Overnight Policy Rate (OPR) by 25 basis Jalan Raja Muda KL City target and clear unsold stock. -

Understand Costs for Government to Take Over Highway Concessions - Dr M BERNAMA 25/02/2019

Understand costs for government to take over highway concessions - Dr M BERNAMA 25/02/2019 KLANG, Feb 25 (Bernama) -- Prime Minister Tun Dr Mahathir Mohamad has urged the public to understand the costs that have to be borne by the government to take over highway concessions from the concessionaires. He said this was important because the process of acquiring highway concessions involved the people's money, collected via taxes. “The government needs to buy a highway, but with whose money? It’s the money from tax collected from the people...Then the roads, which must be maintained from time to time, (costs for them) will also be borne by the government and no longer by the concession companies. “This also means that some of the taxes we collected must be used to maintain the roads, depriving the government of money for other projects that are also necessary,” he said at a press conference after officiating a Metrod Holdings Bhd plant here, today. Dr Mahathir said this in response to public criticisms after the government issued a statement on talks with Gamuda Berhad to take over four highway concessions that the company had a majority stake in, namely the Shah Alam Expressway (KESAS), Damansara-Puchong Expressway (LDP), Sprint Expressway and the Stormwater Management and Road Tunnel (SMART Tunnel). Among the criticisms were that the government did not take over the highway concession from PLUS Malaysia Bhd and for introducing ‘congestion charges’ instead of the outright abolition of tolls. According to a statement issued by the Prime Minister’s Office on Saturday, the government intends to abolish the existing toll mechanism when it successfully takes over the concession of the four expressways.