Magic Quadrant for Digital Commerce

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

HCL Software's

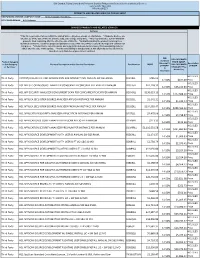

IBM Branded, Fujistu Branded and Panasonic Branded Products and Related Services and Cloud Services Contract DIR-TSO-3999 PRICING SHEET PRODUCTS AND RELATED SERVICES PRICING SHEET RESPONDING VENDOR COMPANY NAME:____Sirius Computer Solutions_______________ PROPOSED BRAND:__HCL Software__________________________ BRANDED PRODUCTS AND RELATED SERVICES Software * This file is generated for use within the United States. All prices shown are US Dollars. * Products & prices are effective as of the date of this file and are subject to change at any time. * HCL may announce new or withdraw products from marketing after the effective date of this file. * Nothwithstanding the product list and prices identified on this file, customer proposals/quotations issued will reflect HCL's current offerings and commercial list prices. * Product list is not all inclusive and may not include products removed from availability (sale) or added after the date of this update. * Product availability is not guaranteed. Not all products listed below are found on every State/Local government contract. DIR DIR CUSTOMER Customer Product Category PRICE (MSRP- Discount % Description or SubCategory Product Description and/or Service Description Part Number MSRP DIR CUSTOMER off MSRP* of MSRP or Services* DISCOUNT Plus (2 Admin Fee) Decimals) HCL SLED Third Party CNTENT/COLLAB ACC AND WEBSPH PRTL SVR INTRANET PVU ANNUAL SW S&S RNWL E045KLL $786.02 14.50% $677.09 Price HCL SLED Third Party HCL APP SEC OPEN SOURCE ANALYZER CONSCAN PER CONCURRENT EVENT PER ANNUM D20H6LL $41,118.32 -

Investor Release

INVESTOR RELEASE Noida, India, October 23rd, 2019 Revenue at INR 17,528 crores; up 6.7% QoQ & 17.9% YoY Net Income at INR 2,651 crores; up 19.4% QoQ & 4.4% YoY Revenue at US$ 2,486 mn; up 5.2% QoQ & 18.4% YoY Revenue in constant currency up 6.0% QoQ & 20.5% YoY Net Income at US$ 376 mn; up 17.7% QoQ & 5.5% YoY Financial Highlights 2 Corporate Overview 4 Performance Trends 5 Financials in US$ 14 Revenue Analysis at Company Level 17 Constant Currency Reporting 18 Client Metrics 19 Headcount 20 Cash and Cash Equivalents, Investments & Borrowings 20 Financials in ` 21 Appendix: Computation Formulae 23 - 1 - (Amount in ` Crores) GROWTH PARTICULARS Q2 FY’20 QoQ YoY REVENUE 17,528 6.7% 17.9% EARNINGS BEFORE INTEREST & TAX (EBIT) 3,497 24.6% 17.9% NET INCOME 2,651 19.4% 4.4% (Amount in US $ Million) GROWTH PARTICULARS Q2 FY’20 QoQ YoY REVENUE 2,486 5.2% 18.4% REVENUE GROWTH (CONSTANT CURRENCY) 6.0% 20.5% EARNINGS BEFORE INTEREST & TAX (EBIT) 496 22.9% 18.8% NET INCOME 376 17.7% 5.5% Mode 1-2-3 Highlights QOQ GROWTH REVENUE REVENUE EBIT PARTICULARS (IN CONSTANT (IN US$ MN) MIX MARGIN CURRENCY) MODE 1 1,665 67.0% 20.0% 1.2% MODE 2 455 18.3% 14.0% 3.0% MODE 3 365 14.7% 27.1% 42.0% Total 2,486 100.0% 20.0% 6.0% - 2 - Key Highlights − HCL’s strong growth at 20.5% YoY in constant currency, led by double digit growth across Segments. -

Unica Content Integration Developer Guide

Unica Content Integration V12.1 Developer Guide Contents Chapter 1. Overview.......................................................................................................... 1 Plugins.................................................................................................................................... 1 Integration support and plugin development approach..................................................... 1 RESTful content search flow........................................................................................ 2 Non-RESTful content search flow................................................................................ 3 Chapter 2. Plugin development overview.......................................................................... 4 Components of plugin...........................................................................................................4 Service declarations.......................................................................................................5 Standard services........................................................................................................ 11 Service implementations.............................................................................................17 Chapter 3. Plugin Development SDK............................................................................... 24 Generic type parameters.................................................................................................... 24 Service invocation.............................................................................................................. -

B2B Ecommerce Benchmarking Report TABLE of CONTENTS

Magento Commerce B2B eCommerce Benchmarking Report TABLE OF CONTENTS INTRODUCTION 3 INTRODUCTION ORGANIZATIONAL DATA 4 It’s true. Change is the only constant... DIGITAL COMMERCE OFFERINGS 6 TRENDING TOWARDS TRANSPARENCY 8 DRIVE PURCHASE THROUGH PRODUCT 9 Since we began publishing our B2B Ecommerce Benchmarking Report This report takes a deeper look at the adoption—and in some cases CONNECTED CUSTOMER CARE 11 five years ago, we’ve seen a significant shift in the way manufacturers, the deprecation—of the features, functions, and tactics merchants wholesalers, and distributors approach their digital commerce are using in their ecommerce channels. With resources at a premium channels. Most of it for the better. across organizations, this report will serve as a tool to inform future CONTENT AND THE CUSTOMER JOURNEY 13 strategy and investment decisions. Adopting best practices won’t Businesses across large swaths of the industry have changed their create competitive differentiation, but they can prevent organizations focus, their strategies, and most importantly their mindsets. Many from falling further behind. CONCLUSION 15 are striving to become digital-first, starting at the organizational level. And yet, many other B2B companies have yet to substantively address their digital shortcomings for a variety of reasons—none of them compelling. For the leaders, this has led to more sophisticated ecommerce experiences that merge elements of consumer ecommerce sites (usability, transparency) with B2B-centric functionality that stem from an understanding that B2B buyer journeys, and the mechanisms to manage them on the back-end, are more complex. The gap between the haves and have-nots is widening. 2 Section Title 3 INTRODUCTION It’s true. -

Investor Release

INVESTOR RELEASE Noida, India, July 17th, 2020 Revenue at ` 17,841 crores; down 4.0% QoQ & up 8.6% YoY Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) margin at 25.6% Earnings Before Interest and Taxes (EBIT) margin at 20.5% Net Income at ` 2,925 crores; down 7.3% QoQ & up 31.7% YoY Revenue in Constant Currency; down 7.2% QoQ & up 1.0% YoY Revenue at US$ 2,356 mn; down 7.4% QoQ & 0.3% YoY Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) margin at 25.6% Earnings Before Interest and Taxes (EBIT) margin at 20.5% Net Income at US$ 386 mn; down 10.4% QoQ & up 20.9% YoY Revenue: We expect Revenue to increase QoQ by an average of 1.5% to 2.5% in constant currency for the next 3 quarters. Operating Margin (EBIT): We expect Operating Margin to be between 19.5% and 20.5% for FY’21. Financial Highlights 3 Corporate Overview 4 Performance Trends 5 Financials in US $ 18 Revenue Analysis at Company Level 21 Constant Currency Reporting 22 Client Metrics 23 Headcount 24 Cash and Cash Equivalents, Investments & Borrowings 24 Financials in ` 25 Appendix: Computation Formulae 27 - 1 - (Amount in ` Crores) Growth Particulars Q1 FY’21 Margin% QoQ YoY Revenue 17,841 -4.0% 8.6% EBITDA 4,566 25.6% -3.3% 34.3% EBIT 3,660 20.5% -5.7% 30.5% Net Income 2,925 16.4% -7.3% 31.7% (Amount in US $ Million) Growth Particulars Q1 FY’21 Margin% QoQ YoY Revenue 2,356 -7.4% -0.3% Revenue Growth (Constant Currency) -7.2% 1.0% EBITDA 603 25.6% -6.7% 23.2% EBIT 484 20.5% -8.9% 19.7% Net Income 386 16.4% -10.4% 20.9% Segment Highlights -

Release-Notes-En.Pdf

COREMEDIA CONTENT CLOUD Release Notes Release Notes Release Notes | Copyright CoreMedia GmbH © 2021 CoreMedia GmbH Ludwig-Erhard-Straße 18 20459 Hamburg International All rights reserved. No part of this manual or the corresponding program may be reproduced or copied in any form (print, photocopy or other process) without the written permission of CoreMedia GmbH. Germany Alle Rechte vorbehalten. CoreMedia und weitere im Text erwähnte CoreMedia Produkte sowie die entsprechenden Logos sind Marken oder eingetragene Marken der CoreMedia GmbH in Deutschland. Alle anderen Namen von Produkten sind Marken der jeweiligen Firmen. Das Handbuch bzw. Teile hiervon sowie die dazugehörigen Programme dürfen in keiner Weise (Druck, Fotokopie oder sonstige Verfahren) ohne schriftliche Genehmigung der CoreMedia GmbH reproduziert oder vervielfältigt werden. Unberührt hiervon bleiben die gesetzlich erlaubten Nutzungsarten nach dem UrhG. Licenses and Trademarks All trademarks acknowledged. September 19, 2021 (Release 10.2104) COREMEDIA CONTENT CLOUD ii Release Notes | 1. Preface ................................................................................ 1 1.1. Audience .................................................................... 2 1.2. Typographic Conventions ................................................. 3 2. Overview ............................................................................. 4 3. Software License Agreement Changes ............................................ 6 4. Release Information ................................................................ -

In the United States District Court for the Eastern District of Texas Marshall Division

Case 2:21-cv-00094 Document 1 Filed 03/17/21 Page 1 of 26 PageID #: 1 IN THE UNITED STATES DISTRICT COURT FOR THE EASTERN DISTRICT OF TEXAS MARSHALL DIVISION § CXT SYSTEMS, INC., § Case No. Plaintiff, § § JURY TRIAL DEMANDED v. § § ADVANCE AUTO PARTS, INC., § § Defendant. § § COMPLAINT FOR PATENT INFRINGEMENT Plaintiff CXT Systems, Inc. (“CXT” or “Plaintiff”), for its Complaint against Defendant Advance Auto Parts, Inc. (“AAP” or “Defendant”), alleges as follows: THE PARTIES 1. CXT is a corporation organized and existing under the laws of the State of Texas, with its principal place of business located at 100 West Houston Street, Marshall, Texas 75670. 2. Upon information and belief, Defendant is a corporation organized and existing under the laws of Delaware, with its principal place of business located at 4006 Market at North Hills Street, Raleigh, NC 27609. Defendant may be served with process through its registered agent, David Barringer, located at 414 West Randol Mill Road, Arlington, Texas 76011. 3. On information and belief, Defendant maintains regular and established places of business within this Judicial District including at least the following locations: 4901 Main Street, The Colony, TX 75056; 1225 Coit Road, Plano, TX 75075; 1890 K Avenue, Suite 100, Plano, TX 75074; 104 West University Drive, McKinney, TX 75069; 900 Dallas Drive, Denton, TX 76205; 2802 New Boston Road, Texarkana, TX 75501; 205 West Gentry Parkway, Tyler, TX 75702; 1701 Case 2:21-cv-00094 Document 1 Filed 03/17/21 Page 2 of 26 PageID #: 2 West Frank Avenue, Lufkin, TX 75904. Upon information and belief, Defendant employs individuals in this Judicial District involved in the sales and marketing of its products. -

15% $3.8Bn 10,000

ONLINE RETAILER MARKET DASHBOARD A PERPETUAL EDGE ON GROWTH 15% 10,000 $3.8bn How Tectrade is enabling a major retailer to speed up the delivery of new Channel shift is The company offers In 2019, this retail sector offerings to their target market in order to sustain growth. significant in this market an extended range of was worth over $3.8 with 15% of 2019’s sales over 10,000 products billion – an increase of Our Client: is evolving its online retail website to take advantage of containerisation to made online – on its online shopping almost 20% over the last drastically reduce the time taken to release new functionality. The new transactional double the level in 2015. website. five years. shopping system will also reduce operational overheads. CONTEXT CHALLENGE SOLUTION OUTCOMES “WITH HIGH PROCESSING DEMANDS FROM CUSTOMER INTERACTIONS, As an omni-channel retailer, our The current e-commerce platform is By moving to a containerised version The success of this containerisation client must exploit new technology based on HCL Commerce (formerly of the application, our client can initiative can be measured across CONTAINERS OFFER A WIDE RANGE to enhance offerings in store as IBM WebSphere). The version exploit the advantages of this recent several factors: well as online. deployed is essentially a very large technology. OF ADVANTAGES, FROM BETTER • Deployment processes have been monolithic Java application. In today’s fast moving e-commerce By breaking the application into decreased by 60%. HANDLING OF ORDER PEAKS environment, the company has Our client wants to introduce new smaller units, different areas of • Deployment frequency has been seen dramatic growth online, feature and function at pace, but functionality are isolated from each THROUGH TO IMMENSE REDUCTIONS increased by a factor of four – raising revenues by 35% over the this is hampered by the unwieldy other. -

HCL(IBM) Commerce

HCL Commerce This course teaches programming essentials for IBM WebSphere Commerce Version 8. Through in-depth lectures and hands-on exercises, you’ll learn the skills and knowledge needed to customize an IBM WebSphere Commerce Version 8 site. Topics include an introduction to the integrated development environment for WebSphere Commerce, which is built upon Rational Application Developer V9.5. From there, you’ll develop and configure storefronts. In addition, you’ll learn how to build custom business logic and handing data through the command framework, business object document (BOD) processing framework, and Enterprise JavaBeans (EJBs). You’ll also be introduced to many of the new features that are provided in WebSphere Commerce V8. These features include: how to develop for the presentation layer, business logic layer, data service layer, and persistence layer of WebSphere Commerce using Spring, Struts framework with related concepts like responsive web design. To complete the experience, you’ll learn the basics of integrating WebSphere Commerce with other systems in a service-oriented architecture (SOA) and Web services. Duration : 5 Days Classroom | 40 hours Online • WebSphere Commerce architecture • WebSphere Commerce Data model and schema • WebSphere Commerce Developer toolkit • WebSphere Commerce Presentation layer o Customizing StoreFront Pages • WebSphere Commerce Business logic layer o Customizing Store Business Logic • WebSphere Commerce Persistence layer o Creating a new WC EJB • WebSphere Commerce Data Service layer o Extending -

Connector for HCL Commerce Manual

COREMEDIA CONTENT CLOUD Connector for HCL Commerce Manual Connector for HCL Commerce Manual Connector for HCL Commerce Manual | Copyright CoreMedia GmbH © 2021 CoreMedia GmbH Ludwig-Erhard-Straße 18 20459 Hamburg International All rights reserved. No part of this manual or the corresponding program may be reproduced or copied in any form (print, photocopy or other process) without the written permission of CoreMedia GmbH. Germany Alle Rechte vorbehalten. CoreMedia und weitere im Text erwähnte CoreMedia Produkte sowie die entsprechenden Logos sind Marken oder eingetragene Marken der CoreMedia GmbH in Deutschland. Alle anderen Namen von Produkten sind Marken der jeweiligen Firmen. Das Handbuch bzw. Teile hiervon sowie die dazugehörigen Programme dürfen in keiner Weise (Druck, Fotokopie oder sonstige Verfahren) ohne schriftliche Genehmigung der CoreMedia GmbH reproduziert oder vervielfältigt werden. Unberührt hiervon bleiben die gesetzlich erlaubten Nutzungsarten nach dem UrhG. Licenses and Trademarks All trademarks acknowledged. September 19, 2021 (Release 2104 ) CONTENT CLOUD ii Connector for HCL Commerce Manual | 1. Preface ................................................................................ 1 1.1. Audience .................................................................... 2 1.2. Typographic Conventions ................................................. 3 1.3. Change Record ............................................................ 5 2. Overview ............................................................................