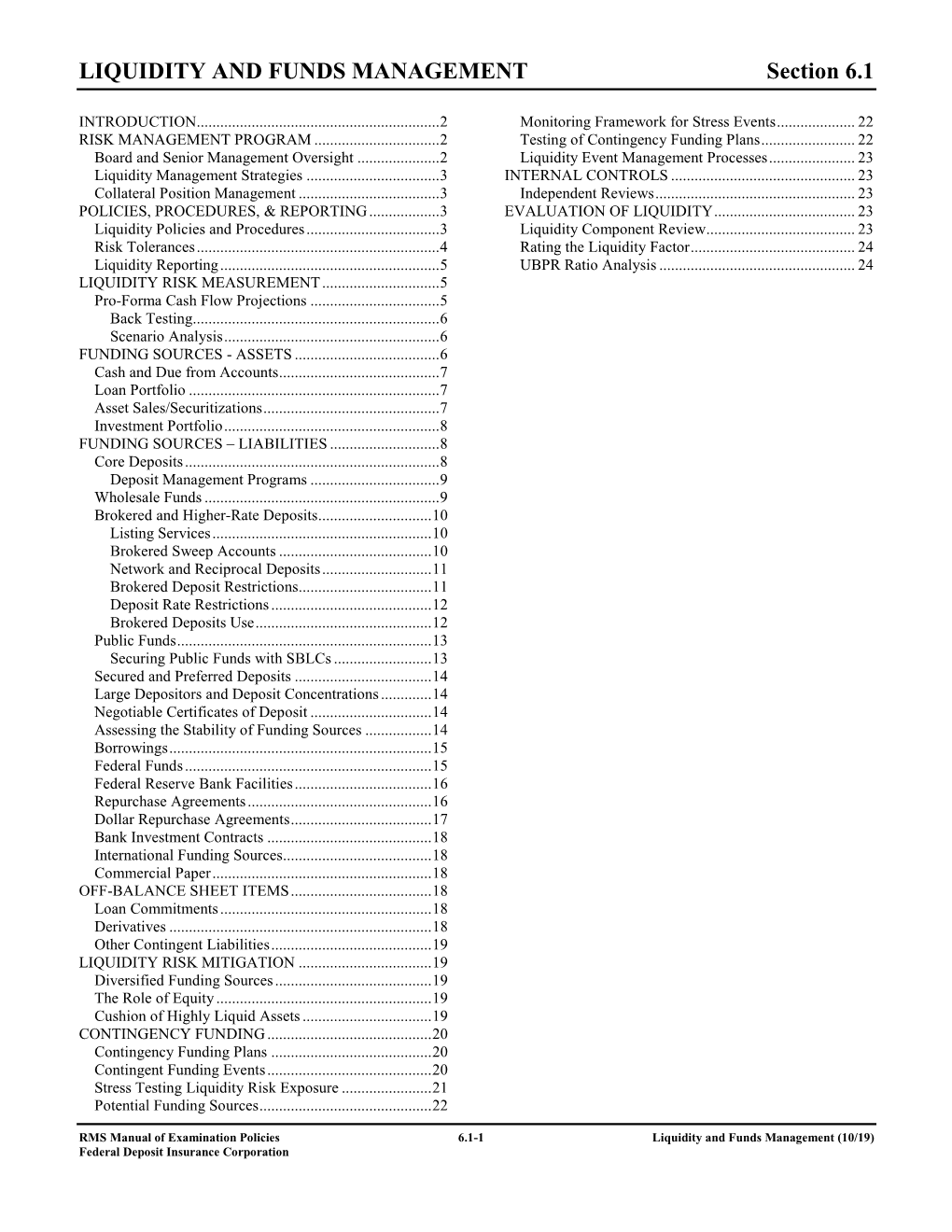

Section 6.1 Liquidity and Funds Management

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Analysis of Securitized Asset Liquidity June 2017 an He and Bruce Mizrach1

Analysis of Securitized Asset Liquidity June 2017 An He and Bruce Mizrach1 1. Introduction This research note extends our prior analysis2 of corporate bond liquidity to the structured products markets. We analyze data from the TRACE3 system, which began collecting secondary market trading activity on structured products in 2011. We explore two general categories of structured products: (1) real estate securities, including mortgage-backed securities in residential housing (MBS) and commercial building (CMBS), collateralized mortgage products (CMO) and to-be-announced forward mortgages (TBA); and (2) asset-backed securities (ABS) in credit cards, autos, student loans and other miscellaneous categories. Consistent with others,4 we find that the new issue market for securitized assets decreased sharply after the financial crisis and has not yet rebounded to pre-crisis levels. Issuance is below 2007 levels in CMBS, CMOs and ABS. MBS issuance had recovered by 2012 but has declined over the last four years. By contrast, 2016 issuance in the corporate bond market was at a record high for the fifth consecutive year, exceeding $1.5 trillion. Consistent with the new issue volume decline, the median age of securities being traded in non-agency CMO are more than ten years old. In student loans, the average security is over seven years old. Over the last four years, secondary market trading volumes in CMOs and TBA are down from 14 to 27%. Overall ABS volumes are down 16%. Student loan and other miscellaneous ABS declines balance increases in automobiles and credit cards. By contrast, daily trading volume in the most active corporate bonds is up nearly 28%. -

Asset Securitization

L-Sec Comptroller of the Currency Administrator of National Banks Asset Securitization Comptroller’s Handbook November 1997 L Liquidity and Funds Management Asset Securitization Table of Contents Introduction 1 Background 1 Definition 2 A Brief History 2 Market Evolution 3 Benefits of Securitization 4 Securitization Process 6 Basic Structures of Asset-Backed Securities 6 Parties to the Transaction 7 Structuring the Transaction 12 Segregating the Assets 13 Creating Securitization Vehicles 15 Providing Credit Enhancement 19 Issuing Interests in the Asset Pool 23 The Mechanics of Cash Flow 25 Cash Flow Allocations 25 Risk Management 30 Impact of Securitization on Bank Issuers 30 Process Management 30 Risks and Controls 33 Reputation Risk 34 Strategic Risk 35 Credit Risk 37 Transaction Risk 43 Liquidity Risk 47 Compliance Risk 49 Other Issues 49 Risk-Based Capital 56 Comptroller’s Handbook i Asset Securitization Examination Objectives 61 Examination Procedures 62 Overview 62 Management Oversight 64 Risk Management 68 Management Information Systems 71 Accounting and Risk-Based Capital 73 Functions 77 Originations 77 Servicing 80 Other Roles 83 Overall Conclusions 86 References 89 ii Asset Securitization Introduction Background Asset securitization is helping to shape the future of traditional commercial banking. By using the securities markets to fund portions of the loan portfolio, banks can allocate capital more efficiently, access diverse and cost- effective funding sources, and better manage business risks. But securitization markets offer challenges as well as opportunity. Indeed, the successes of nonbank securitizers are forcing banks to adopt some of their practices. Competition from commercial paper underwriters and captive finance companies has taken a toll on banks’ market share and profitability in the prime credit and consumer loan businesses. -

Asset Pricing with Liquidity Risk∗

Asset Pricing with Liquidity Risk∗ Viral V. Acharyay and Lasse Heje Pedersenz First Version: July 10, 2000 Current Version: September 24, 2004 Abstract This paper solves explicitly an equilibrium asset pricing model with liq- uidity risk — the risk arising from unpredictable changes in liquidity over time. In our liquidity-adjusted capital asset pricing model, a security's re- quired return depends on its expected liquidity as well as on the covariances of its own return and liquidity with market return and market liquidity. In addition, the model shows how a negative shock to a security's liquidity, if it is persistent, results in low contemporaneous returns and high predicted future returns. The model provides a simple, unified framework for under- standing the various channels through which liquidity risk may affect asset prices. Our empirical results shed light on the total and relative economic significance of these channels. ∗We are grateful for conversations with Andrew Ang, Joseph Chen, Sergei Davydenko, Fran- cisco Gomes, Joel Hasbrouck, Andrew Jackson, Tim Johnson, Martin Lettau, Anthony Lynch, Stefan Nagel, Lubos Pastor, Tano Santos, Dimitri Vayanos, Luis Viceira, Jeff Wurgler, and semi- nar participants at London Business School, London School of Economics, New York University, the National Bureau of Economic Research (NBER) Summer Institute 2002, the Five Star Confer- ence 2002, Western Finance Association Meetings 2003, and the Texas Finance Festival 2004. We are especially indebted to Yakov Amihud and to an anonymous referee for help and many valuable suggestions. All errors remain our own. yAcharya is at London Business School and is a Research Affiliate of the Centre for Eco- nomic Policy Research (CEPR). -

The Dark Side of Bank Wholesale Funding

The Dark Side of Bank Wholesale Funding Rocco Huang Lev Ratnovski Federal Reserve Bank of Philadelphia International Monetary Fund September 2009 Abstract Commercial banks increasingly use short-term wholesale funds to supplement traditional retail deposits. Existing literature mainly points to the "bright side" of wholesale funding: sophisticated …nanciers can monitor banks, disciplining bad ones but re…nancing solvent ones. This paper models a "dark side" of wholesale funding. In an environment with a costless but imperfect signal on bank project quality (e.g., credit ratings, performance of peers), short-term wholesale …nanciers have lower incentives to conduct costly information acquisition, and instead may withdraw based on negative but noisy public signals, triggering ine¢ cient liquidations. We show that the "dark side" of wholesale funding dominates the "bright side" when bank assets are more arm’s length and tradable (leading to more relevant public signals and lower liquidation costs): precisely the attributes of a banking sector with securitizations and risk transfers. The results shed light on the recent …nancial turmoil, explaining why some wholesale …nanciers did not provide market discipline ex-ante and exacerbated liquidity risks ex-post. Email addresses: [email protected], [email protected]. We thank two referees, Viral Acharya (the Editor), Stijn Claessens, and Charles Kahn for very helpful comments. We also ap- preciate the useful comments from the participants of the Cleveland Fed Conference on Identifying and Resolving Financial Crises, Basel Committee-CEPR-JFI Workshop on Risk Transfer Mechanisms and Financial Stability, RUG-DNB-JFS Conference on Micro and Macro Perspectives on Financial Stability, CREDIT conference (Venice), IMF-World Bank conference on Risk Analysis and Risk Management, Bank of Canada workshop on Securitized Instruments, CesIfo-Bundesbank conference on Risk Trans- fer, Federal Reserve System Committee on Financial Structure and Regulation, and European Banking Center conference on Financial Stability. -

Liquidity Risk Management

BASEL III FRAMEWORK Liquidity Risk Management Rules and Guidelines November 2018 Table of Contents TABLE OF CONTENTS ...................................................................................................................................... 2 LIST OF ACRONYMS ......................................................................................................................................... 4 PART I – LIQUIDITY RISK MANAGEMENT FRAMEWORK ............................................................... 5 1. BACKGROUND AND OVERVIEW ............................................................................................................................ 5 2. SCOPE OF APPLICATION ...................................................................................................................................... 5 3. STATEMENT OF OBJECTIVES ................................................................................................................................ 5 4. ONGOING LIQUIDITY MANAGEMENT ................................................................................................................... 5 5. MEASURING AND MONITORING LIQUIDITY REQUIREMENTS ............................................................................. 7 6. MANAGING MARKET ACCESS .............................................................................................................................. 9 7. CONTINGENCY PLANNING ................................................................................................................................... -

IBOR to RFR Transition

Changing the world’s most important number IBOR to RFR transition March 2021 home.kpmg/in 2 Foreword For more than three decades, London Interbank all 35 LIBOR settings at once, giving firms a Offered Rate (‘LIBOR’) has been integrated in clear set of deadlines across all currencies and financial markets, serving as the benchmark tenors. FCA issued that all seven tenors for for borrowings, loans and derivative contracts. both euro and Swiss franc LIBOR, overnight, LIBOR has hence been called the ‘world’s one-week, two-month and 12-month sterling most important number’ as it is hardwired LIBOR, spot next, one-week, two-month and in all financial activities, such as treasury, 12-month yen LIBOR and one-week and two- risk management, accounting including month U.S. dollar LIBOR will permanently hedge accounting, valuation and commercial cease immediately after 31 December 2021. contracts. Following the global financial crisis, Overnight and 12-month U.S. dollar LIBOR regulators discovered that the banks entrusted settings publication will cease immediately after to set the rates underpinning hundreds of 30 June 2023. trillions of dollars of financial assets had been In response, the regulators and market manipulating them to their advantage, raising participants across the globe have been questions about the future sustainability of developing new benchmarks to replace Libor LIBOR. Regulators globally have signaled clearly by the end of 2021. With 31 December 2021, that institutions should transition away from in plain sight, and FCA announcement on the Interbank Offered Rate (IBOR) to alternative LIBOR cessation, preparation for the transition overnight risk-free rates (RFRs). -

Securitization, Monetary Policy and Bank Stability

Securitization, Monetary Policy and Bank Stability Mohamed Bakousha,1,∗, Tapas Mishraa,2, Simon Wolfea,3, aSouthampton Business School, University of Southampton, UK Abstract We provide new evidence about the effect of securitization activities on bank stability and systemic risk in the run-up to and following the global financial crisis by consid- ering the role of monetary policy interest rates. In so doing, we propose S{score as a new measure of the net effect of securitization activities on bank stability. Analyzing the dynamics of this measure at the individual bank level and the banking system level shows that securitization activities have a destabilizing effect on banks. We also find that securitization increases commonality of asset returns among banks leading to increased interconnectedness and systemic risk. We also find that low monetary policy interest rates in the aftermath of the global financial crisis have mitigated the destabilizing effect of securitization on banks. Keywords: Securitization, Bank Profitability, Bank Risk, Bank Stability, Systemic Risk; Monetary Policy JEL Classification: G21; G10 ∗Corresponding Author (Email: [email protected]). 1Mohamed Bakoush is an Assistant Professor in Banking and Finance, Southampton Business School, University of Southampton. (Email: [email protected]) 2Tapas Mishra is a Professor of Banking and Finance, Southampton Business School, University of Southampton. (Email: [email protected]) 3Simon Wolfe is a Professor of Banking and Finance, Southampton Business School, University of Southampton.(Email: [email protected]) Preprint submitted to Elsevier December 31, 2019 1. Introduction Securitization has fundamentally altered the way in which financial intermediation is organized as it has provided banks with an innovative way to improve efficiency and performance. -

COVID-19 Impact on Bank Liquidity Risk Management and Response

COVID-19 impact on bank liquidity risk management and response Overview As a result of COVID-19 and the actions In response to the recent adverse market the economy during adverse situations taken by governments and businesses activity, the Federal Reserve Board such as the impacts of COVID-19 and to to help mitigate the impact, financial (the Fed) has taken steps to stabilize the enable banks to continue lending. The Fed is institutions have been challenged in their financial markets through the purchase of encouraging banks to use their capital and ability to manage and report on their Treasuries and government guaranteed liquidity buffers as they make loans available liquidity positions and funding capabilities. mortgage-backed securities, reviving to households and businesses affected by Regulatory requirements put in place the Primary Dealer Credit Facility to offer the COVID-19 restrictions, assuming this after 2008 were designed to improve loans to securities firms, reestablishing lending is done in a safe and sound manner2. banks’ ability to meet funding obligations the Money Market Mutual Fund Facility, by establishing liquidity buffers, and to and substantially expanding its repo Industry challenges in liquidity implement contingency funding plans operations1 The Fed has also encouraged and funding risk management (CFPs) to guide banks during times of crisis. banks to start borrowing from its discount However, recent equity market volatility, window and regulators have extended the Although the Fed has taken steps to stabilize liquidity tightening, widening funding timeline for certain regulatory requirements the market and make funding available, spreads, operational fails, and (e.g. the Current Expected Credit Losses many banks have already activated their other challenges have put significant implementation) in an effort to reduce CFPs and are actively managing and pressure on bank liquidity some pressure on bank resources. -

Statement on Funding and Liquidity Risk Management

DEPARTMENT OF THE TREASURY Office of the Comptroller of the Currency [Docket ID OCC-2010-0004] FEDERAL RESERVE SYSTEM [Docket No. OP-1362] FEDERAL DEPOSIT INSURANCE CORPORATION DEPARTMENT OF THE TREASURY Office of Thrift Supervision [Docket ID OTS-2010-0005] NATIONAL CREDIT UNION ADMINISTRATION Interagency Policy Statement on Funding and Liquidity Risk Management AGENCIES: Office of the Comptroller of the Currency, Treasury (OCC); Board of Governors of the Federal Reserve System (FRB); Federal Deposit Insurance Corporation (FDIC); Office of Thrift Supervision, Treasury (OTS); and National Credit Union Administration (NCUA). ACTION: Final Policy Statement SUMMARY: The OCC, FRB, FDIC, OTS, and NCUA (the agencies) in conjunction with the Conference of State Bank Supervisors (CSBS), are adopting this policy statement. The policy statement summarizes the principles of sound liquidity risk management that the agencies have issued in the past and, when appropriate, supplements them with the “Principles for Sound Liquidity Risk Management and Supervision” issued by the Basel Committee on Banking Supervision (BCBS) in September 20081. This policy statement emphasizes supervisory expectations for all depository institutions including banks, thrifts, and credit unions. DATES: This policy statement is effective on [INSERT DATE 60 DAYS FROM DATE OF PUBLICATION IN FEDERAL REGISTER]. Comments on the Paperwork Reduction Act burden estimates only may be submitted on or before [INSERT DATE 30 DAYS FROM DATE OF PUBLICATION IN FEDERAL REGISTER]. FOR FURTHER INFORMATION CONTACT: OCC: Kerri Corn, Director for Market Risk, Credit and Market Risk Division, (202) 874- 5670 or J. Ray Diggs, Group Leader: Balance Sheet Management, Credit and Market Risk Division, (202) 874-5670. -

Basel III: the Net Stable Funding Ratio (NSFR)

This standard has been integrated into the consolidated Basel Framework: https://www.bis.org/basel_framework/ Basel Committee on Banking Supervision Basel III: the net stable funding ratio October 2014 This publication is available on the BIS website (www.bis.org). © Bank for International Settlements 2014. All rights reserved. Brief excerpts may be reproduced or translated provided the source is stated. ISBN 978-92-9131-964-0 (print) ISBN 978-92-9131-960-2 (online) Contents I. Introduction ................................................................................................................................................................................ 1 II. Definition and minimum requirements ........................................................................................................................... 2 A. Definition of available stable funding ..................................................................................................................... 3 B. Definition of required stable funding for assets and off-balance sheet exposures ............................. 6 III. Application issues for the NSFR ....................................................................................................................................... 13 A. Frequency of calculation and reporting ............................................................................................................... 13 B. Scope of application ................................................................................................................................................... -

Basel III: the Liquidity Coverage Ratio and Liquidity Risk Monitoring Tools

This standard has been integrated into the consolidated Basel Framework: https://www.bis.org/basel_framework/ Basel Committee on Banking Supervision Basel III: The Liquidity Coverage Ratio and liquidity risk monitoring tools January 2013 This publication is available on the BIS website (www.bis.org). © Bank for International Settlements 2013. All rights reserved. Brief excerpts may be reproduced or translated provided the source is cited. ISBN 92-9131- 912-0 (print) ISBN 92-9197- 912-0 (online) Contents Introduction ............................................................................................................................ 1 Part 1: The Liquidity Coverage Ratio ..................................................................................... 4 I. Objective of the LCR and use of HQLA ......................................................................... 4 II. Definition of the LCR ..................................................................................................... 6 A. Stock of HQLA ..................................................................................................... 7 1. Characteristics of HQLA ............................................................................. 7 2. Operational requirements ........................................................................... 9 3. Diversification of the stock of HQLA.......................................................... 11 4. Definition of HQLA ................................................................................... -

Liquidity (Risk) Concepts Definitions and Interactions

WORKING PAPER SERIES NO 1008 / FEBRUARY 2009 LIQUIDITY (RISK) CONCEPTS DEFINITIONS AND INTERACTIONS by Kleopatra Nikolaou WORKING PAPER SERIES NO 1008 / FEBRUARY 2009 LIQUIDITY (RISK) CONCEPTS DEFINITIONS AND INTERACTIONS 1 by Kleopatra Nikolaou 2 In 2009 all ECB publications This paper can be downloaded without charge from feature a motif http://www.ecb.europa.eu or from the Social Science Research Network taken from the €200 banknote. electronic library at http://ssrn.com/abstract_id=1333568. 1 This paper was written in partial fulfilment of the ECB Graduate Program 2006. The author is indebted for useful conversations and constructive comments to Nuno Cassola. The author would also like to thank the participant of the ECB Graduate Program Presentation Series, as well as the Editorial Board of the ECB Working Paper Series for useful comments. The author alone is responsible for any errors that may remain and for the views expressed in the paper. 2 European Central Bank, Kaiserstrasse 29, D-60311 Frankfurt am Main, Germany; email: [email protected] © European Central Bank, 2009 Address Kaiserstrasse 29 60311 Frankfurt am Main, Germany Postal address Postfach 16 03 19 60066 Frankfurt am Main, Germany Telephone +49 69 1344 0 Website http://www.ecb.europa.eu Fax +49 69 1344 6000 All rights reserved. Any reproduction, publication and reprint in the form of a different publication, whether printed or produced electronically, in whole or in part, is permitted only with the explicit written authorisation of the ECB or the author(s). The views expressed in this paper do not necessarily refl ect those of the European Central Bank.