Weis Markets, Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Wellness at Retail: the Continuing Story

Wellness at Retail: The Continuing Story Expanding the delivery of health and wellness services thru retail channels has been a long-term trend in the United States. In our last article, Wellness at Retail: An Introduction, we traced highlights of this trend, including: the evolution of the health food industry into mainline grocery, i.e. Whole Foods; the integration of traditional healthcare services into large format retail, i.e. the appearance of clinics in chains like Kroger and Target; and the collaboration of retailers and insurance companies in the promotion of healthy eating, i.e. Go365 by Walmart and Humana. Since then, this trend has continued and, like everything around us, been deeply impacted by the COVID-19 pandemic. Pharmacy, and grocery in particular, have emerged as cornerstone brick-and- mortar retail formats, compelled to protect employees while serving increased customer demand. These essential retail workers have emerged as frontline heroes, risking their lives by reporting to work, and the retailers have assumed leadership roles within their communities, in protecting the public by providing PPE to staff and requiring all shoppers to wear masks. Many retailers have initiated new health and wellness offerings or expanded existing programs during the current crisis. Major retailers like Walmart and CVS(1), as well as independents like SpartanNash(2), have assisted in providing testing. Online nutrition services are expanding rapidly as grocers, like ShopRite(3) and Stop & Shop(4), have added digital dietitians, nutrition coaching, recipe demonstrations and other services. And Weis Markets has taken it a step farther with the addition of a video-chat platform providing counseling on the management of chronic conditions, like diabetes and high blood pressure, along with other nutrition services. -

Top Trends in Fresh BALANCING the STORE SIZE PENDULUM

Top Trends in Fresh BALANCING THE STORE SIZE PENDULUM Sally Lyons Wyatt, EVP, IRI Center-of-Store & Produce Vertical Jonna Parker, Principal, IRI Fresh Center of Excellence July 25, 2019 FMI is the trade association that serves as the voice of food retail. We assist food retailers in their role of feeding families and enriching lives. © 2019 Information Resources Inc. (IRI). Confidential and Proprietary. 2 The Association Our members are food retailers, wholesales and suppliers of all types and sizes FMI provides comprehensive programs, resources and advocacy for the food, pharmacy and grocery retail industry CONSUMER & FOOD SAFETY GOVERNMENT INDEPENDENT CENTER STORE COMMUNITY AFFAIRS & DEFENSE RELATIONS OPERATOR PRIVATE BRANDS SUPPLY CHAIN TECHNOLOGY ASSET COMMUNICATION EDUCATION FRESH FOODS HEALTH & WELLNESS INFORMATION RESEARCH SUSTAINABILITY WHOLESALER PROTECTION SERVICE © 2019 Information Resources Inc. (IRI). Confidential and Proprietary. 3 Fresh @ FMI FMI is committed to the growth and success of fresh companies and their partners. FMI provides resources and networks that support the interests of member companies throughout the global, fresh produce supply chain, including family-owned, private and publicly traded businesses as well as regional, national and international companies. Emphasis on Fresh ‒ Produce ‒ Meat ‒ Seafood ‒ Deli / In-Store, Fresh Prepared Foods, Assortments ‒ Bakery Rick Stein Fresh Foods ‒ Floral Vice President, Fresh Foods Food Marketing Institute [email protected] 202.220.0700 © 2019 Information Resources Inc. (IRI). Confidential and Proprietary. 4 FMI Fresh Foods Research and Education Networking Advocacy In-depth information, trends and insights Share ideas, explore best practices and Understand what is going on in to foster innovation, take advantage of develop business relations Washington and make your voice heard new opportunities and help develop winning strategies © 2019 Information Resources Inc. -

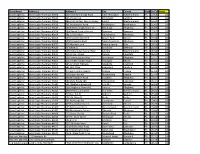

Topco Week 4

Store Name Address 1 Address 2 City County State Zip CodeDoses Giant Eagle Inc. Giant Eagle Pharmacy #0008 200 Tarentum Bridge Road New Kensington Westmoreland PA 15068 100 Giant Eagle Inc. Giant Eagle Pharmacy #0016 1451 Scalp Ave. Johnstown Cambria PA 15904 100 Giant Eagle Inc. Giant Eagle Pharmacy #0032 4810 Old William Penn Highway Export Westmoreland PA 15632 100 Giant Eagle Inc. Giant Eagle Pharmacy #0039 331 Washington Road Washington Washington PA 15301 100 Giant Eagle Inc. Giant Eagle Pharmacy #0047 100 Settlers Ridge Center Dr Pittsburgh Allegheny PA 15205 100 Giant Eagle Inc. Giant Eagle Pharmacy #0054 1606 North Center Avenue Somerset Somerset PA 15501 100 Giant Eagle Inc. Giant Eagle Pharmacy #0064 3812 O'Neil Blvd McKeesport Allegheny PA 15132 100 Giant Eagle Inc. Giant Eagle Pharmacy #0066 2650 Constitution Blvd. Beaver Falls Beaver PA 15010 100 Giant Eagle Inc. Giant Eagle Pharmacy #0068 5990 University Blvd. Moon Township Allegheny PA 15108 100 Giant Eagle Inc. Giant Eagle Pharmacy #0079 510 Marwalt Lane Roaring Spring Blair PA 16673 100 Giant Eagle Inc. Giant Eagle Pharmacy #0080 40 White St Brookville Jefferson PA 15825 100 Giant Eagle Inc. Giant Eagle Pharmacy #0082 1050 Mounntain Laurel Plaza Latrobe Westmoreland PA 15650 100 Giant Eagle Inc. Giant Eagle Pharmacy #0084 100 N Main Street Dubois Clearfield PA 15801 100 Giant Eagle Inc. Giant Eagle Pharmacy #0093 600 Towne Square Way Brentwood Allegheny PA 15227 100 Giant Eagle Inc. Giant Eagle Pharmacy #0094 3113 Green Garden Road Aliquippa Beaver PA 15001 100 Giant Eagle Inc. Giant Eagle Pharmacy #0095 18511 Smock Highway Meadville Crawford PA 16335 100 Giant Eagle Inc. -

Power of Meat 2018

The Power of Meat 2018 An in-depth look at the Meat at Retail through the shoppers’ eyes Presented by: Anne-Marie Roerink | 210 Analytics Rick Stein | FMI Made possible by: 1 FMI is the trade association that serves as the voice of food retail. We assist food retailers in their role of feeding families and enriching lives. The Association: Our members are food retailers, wholesales and suppliers of all types and sizes FMI provides comprehensive programs, resources and advocacy for the food, pharmacy and grocery retail industry CONSUMER & FOOD SAFETY GOVERNMENT INDEPENDENT CENTER STORE COMMUNITY AFFAIRS & DEFENSE RELATIONS OPERATOR PRIVATE BRANDS SUPPLY CHAIN TECHNOLOGY ASSET COMMUNICATION EDUCATION FRESH FOODS HEALTH & WELLNESS INFORMATION RESEARCH SUSTAINABILITY WHOLESALER PROTECTION SERVICE Fresh @ FMI FMI is committed to the growth and success of fresh companies and their partners. FMI provides resources and networks that support the interests of member companies throughout the global, fresh produce supply chain, including family-owned, private and publicly traded businesses as well as regional, national and international companies. Emphasis on fresh • Produce Rick Stein • Meat Vice President, Fresh Foods • Seafood Food Marketing Institute • Deli/In-store, fresh prepared foods and [email protected] Fresh Foods assortments 202.220.0700 • Bakery • Floral FMI Fresh Foods Research and Education Networking Advocacy In-depth information, trends and Share ideas, explore best Understand what is going on in insights to foster innovation, practices and develop business Washington and make your take advantage of new relations voice heard opportunities and help develop winning strategies FMI Fresh Excutive Committee (FEC) John Ruane (Chair) Dan Koch Nick Carlino Emily Coborn Ahold USA Associated Wholesale Grocers, Inc. -

Wmk Research Thesis 9-5-2018.Pdf

1 Full Legal Disclaimer This research presentation expresses our research opinions. You should assume that as of the publication date of any presentation, report or letter, Spruce Point Capital Management LLC (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our subscribers and clients has a short position in all stocks (and are long/short combinations of puts and calls on the stock) covered herein, including without limitation Weis Markets, Inc. (“WMK”), and therefore stand to realize significant gains in the event that the price of its stock declines. Following publication of any presentation, report or letter, we intend to continue transacting in the securities covered therein, and we may be long, short, or neutral at any time hereafter regardless of our initial recommendation. All expressions of opinion are subject to change without notice, and Spruce Point Capital Management does not undertake to update this report or any information contained herein. Spruce Point Capital Management, subscribers and/or consultants shall have no obligation to inform any investor or viewer of this report about their historical, current, and future trading activities. This research presentation expresses our research opinions, which we have based upon interpretation of certain facts and observations, all of which are based upon publicly available information, and all of which are set out in this research presentation. Any investment involves substantial risks, including complete loss of capital. Any forecasts or estimates are for illustrative purpose only and should not be taken as limitations of the maximum possible loss or gain. Any information contained in this report may include forward looking statements, expectations, pro forma analyses, estimates, and projections. -

Viewed and Hired More Than 2,000 Associates Who Were Previously Employed at the Acquired Locations

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) [X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 30, 2017 OR [ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from __________to_________ Commission File Number 1-5039 WEIS MARKETS, INC. (Exact name of registrant as specified in its charter) PENNSYLVANIA 24-0755415 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.) 1000 S. Second Street P. O. Box 471 Sunbury, Pennsylvania 17801-0471 (Address of principal executive offices) (Zip Code) Registrant's telephone number, including area code: (570) 286-4571 Registrant's web address: www.weismarkets.com Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common stock, no par value New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X] Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X] Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Check out the Full List Here

LID License # Licensee Premises Premises Address County 65797WEP WEP16185 GIANT FOOD STORES LLC GIANT FOOD STORES LLC 44 NATURAL SPRINGS RD, GETTYSBURG PA 17325-7502 Adams County 69257WEP WEP2973 CAMPUS BOOKSTORE INC CAMPUS BOOKSTORE INC 3610 5TH AVE, PITTSBURGH PA 15213-3404 Allegheny County 61390WEP WEP8805 GIANT EAGLE INC GIANT EAGLE INC 100 SETTLERS RIDGE CENTER DR, PITTSBURGH PA 15205 Allegheny County 61811WEP WEP13059 GIANT EAGLE INC GIANT EAGLE INC 155 TOWNE CENTRE DR, WEXFORD PA 15090-5613 Allegheny County 61812WEP WEP1178 GIANT EAGLE INC GIANT EAGLE INC 1029 WEST VIEW PARK DR, WEST VIEW PA 15229-1772 Allegheny County 61814WEP WEP19145 GIANT EAGLE INC GIANT EAGLE INC 9901 MOUNTAIN VIEW DR, WEST MIFFLIN PA 15122-2469 Allegheny County 61816WEP WEP4547 GIANT EAGLE INC GIANT EAGLE INC 420 E WATERFRONT DR, HOMESTEAD PA 15120-1143 Allegheny County 61818WEP WEP3084 GIANT EAGLE INC GIANT EAGLE INC 4010 MONROEVILLE BLVD, MONROEVILLE PA 15146-2506 Allegheny County 63494WEP WEP14562 GIANT EAGLE INC GIANT EAGLE INC 7000 OXFORD DR, BETHEL PARK PA 15102-1863 Allegheny County 63761WEP WEP10251 GIANT EAGLE INC GIANT EAGLE INC 1671 BUTLER PLANK RD, GLENSHAW PA 15116-1744 Allegheny County 63898WEP WEP5528 GIANT EAGLE INC GIANT EAGLE INC 5055 LIBRARY RD, BETHEL PARK PA 15102-4215 Allegheny County 64155WEP WEP10768 GIANT EAGLE INC GIANT EAGLE INC 5 QUAKER VILLAGE SHOPPING CENTER, LEETSDALE PA 15056-1206 Allegheny County 64225WEP WEP8501 GIANT EAGLE INC GIANT EAGLE INC 9805 MCKNIGHT RD, PITTSBURGH PA 15237-6012 Allegheny County 66442WEP WEP6113 GIANT EAGLE INC GIANT EAGLE INC 998 HAYDEN BLVD, ELIZABETH PA 15037-2512 Allegheny County 67498WEP WEP9973 GIANT EAGLE INC GIANT EAGLE INC 5550 CENTRE AVE, PITTSBURGH PA 15232-1206 Allegheny County 67918WEP WEP9820 GIANT EAGLE INC GIANT EAGLE INC 5990 UNIVERSITY BLVD STE 4, CORAOPOLIS PA 15108-4229 Allegheny County 70761WEP WEP9941 GIANT EAGLE INC GIANT EAGLE INC 410 CHESTNUT ST, CARNEGIE PA 15106 Allegheny County 63251WEP WEP10303 GIANT EAGLE, INC. -

Sustainability

SUSTAINABILITY REPORT 2020 We also worked very hard in 2020 to Expanding our product During a time of record We continue to increase address the acute needs of our customers donation program to include consumption of meals at our selection of healthy FOREWORD and communities. The pandemic saw the dairy and frozen items and home, we also helped our products and expanded our loss of more than 10 million jobs, causing a participating in community customers save money successful Weis By Nature record number of American households with giveaways to provide milk through our various price program, offering products children to be considered food insecure. and meat to community reduction programs that are certified organic or The United States Department of Agriculture members in need led us to including our Low, Low contain no artificial flavors, reported that demand at food banks set a company record of Price program. We preservatives, colors or Dear Friends, increased 54 percent. nearly 2.3 million pounds of expanded the program ingredients. As a private food donated. in 2020 to reduce the brand program, it offers prices on 60 high-demand brand name quality for less. While 2020 has been a year of great sadness produce items. and challenge for our country, I look back with extreme pride at the thousands of We focused on conserving resources and reducing waste. In 2020, we: Weis associates who embraced their roles We mobilized our staff to respond as essential workers during the COVID-19 to challenges in their communities pandemic. Improved energy Replaced 27 of Instituted a new Celebrated the Developed four posed by COVID-19, and they did not efficiency in our older trucks. -

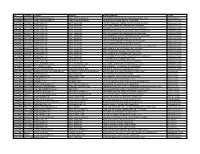

Topco Week 7

Wk 7 Store Name Address 1 Address 2 City County State Zip Moderna Redner's Markets Inc 110 Northside Commons Palmyra Lebanon PA 17078 100 Redner's Markets Inc 3 Gold Star Plaza Shenandoah Schuylkill PA 17976 100 Redner's Markets Inc 22 Forest Dr Hegins Schuylkill PA 17938 100 Giant Eagle Inc. Giant Eagle Pharmacy #2455 3220 Leechburg Road Lower Burrell Westmoreland PA 15068 100 Giant Eagle Inc. Giant Eagle Pharmacy #0010 8901 State Route 30 North Huntingdon Westmoreland PA 15642 100 Giant Eagle Inc. Giant Eagle Pharmacy #0016 1451 Scalp Ave. Johnstown Cambria PA 15904 100 Giant Eagle Inc. Giant Eagle Pharmacy #0023 100 Buffalo Plaza Sarver Butler PA 16055 100 Giant Eagle Inc. Giant Eagle Pharmacy #0032 4810 Old William Penn HighwayExport Westmoreland PA 15632 100 Giant Eagle Inc. Giant Eagle Pharmacy #0039 331 Washington Road Washington Washington PA 15301 100 Giant Eagle Inc. Giant Eagle Pharmacy #0040 5550 Centre Ave Pittsburgh Allegheny PA 15232 100 Giant Eagle Inc. Giant Eagle Pharmacy #0041 41 Towne Center Drive Leechburg Westmoreland PA 15656 100 Giant Eagle Inc. Giant Eagle Pharmacy #0042 206 Seven Fields Blvd Seven Fields Butler PA 16046 100 Giant Eagle Inc. Giant Eagle Pharmacy #0043 155 Towne Centre Drive Wexford Allegheny PA 15090 100 Giant Eagle Inc. Giant Eagle Pharmacy #0045 9805 McKnight Road Pittsburgh Allegheny PA 15237 100 Giant Eagle Inc. Giant Eagle Pharmacy #0046 344 Goucher St. Johnstown Cambria PA 15905 100 Giant Eagle Inc. Giant Eagle Pharmacy #0047 100 Settlers Ridge Center Dr Pittsburgh Allegheny PA 15205 100 Giant Eagle Inc. Giant Eagle Pharmacy #0052 132 Ben Avon Heights Road Pittsburgh Allegheny PA 15237 100 Giant Eagle Inc. -

July 15, 2020 Agenda

NEWTON PLANNING BOARD NEWTON MUNICIPAL BUILDING 39 Trinity Street, Newton, NJ 07860 AGENDA July 15, 2020 Please take notice that the Town of Newton, Planning Board (the “Board”) will hold a public hearing remotely, thru ZOOM, on July 15, 2020 at 7:00 p.m. to review and take formal action upon Development applications, and various items as follows: SUNSHINE STATEMENT “Adequate notice of this meeting of the Newton Planning Board has been provided in accordance with the Open Public Meetings Act (Chapter 231.P.L. 1975).” RULES No new testimony after 10:30 p.m. Comments from each member of the public are limited to 5 minutes during the public portion of the meeting. OATH OF OFFICE None SALUTE TO THE FLAG & ROLL CALL Mr. Flaherty Mr. Marion Mr. Wink Mrs. Vrahnos Mrs. Hall-Romer Mrs. Diglio Mr. Flynn Mr. Russo, Jr. Mr. Ragsdale Mr. Couce Mr. Schick Mr. Le Frois CONSIDERATION OF MINUTES June 17, 2020 HISTORIC RESOLUTIONS None RESOLUTIONS: Weis Markets, Inc. (#P-3-2020) 119 Water Street Block: 9.03, Lot: 16 The Resolution grants approval for a use variance and preliminary and final site plan approval with related bulk variances, to construct a gas station. OLD BUSINESS None NEW BUSINESS: Newton Commons Condo Association, Inc. (#P-1-2020) Portion of Common Area between 63 Plainfield Avenue & 68 Plainfield Avenue Block: 12.01, Lot: 1 & Block: 12.09, Lot 1 T-3 Zone The Applicant is requesting a minor subdivision and D-2 variance. (Applicant has requested an extension from the May 20, 2020, June 17, 2020 and the July 15, 2020 meetings and to be carried -

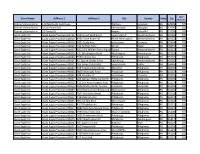

Grocery Store 541 Monroe Ave

Updated 6/1/2021 Name Address City State Zip M & P MINI MARKET 174 CENTRAL AVE. PASSAIC NJ 07055 EL MANANTIAL II 142 S. BROAD ST. WOODBURY NJ 08096 MJ CORNER DELI & GROCERY, INC 133 N. MUNN AVE. EAST ORANGE NJ 07017 POPULAR SUPER DELI 468 FOURTH AVE. NEWARK NJ 07107 TULCINGO DELI AND GROCERY 2 CORP 256 OCEAN AVE. LAKEWOOD NJ 08701 LOS AMIGOS DELI & GROCERY 638 LIBERTY ST. TRENTON NJ 08611 MERY SUPERMARKET, LLC 101-103 1ST STREET ELIZABETH NJ 07206 QUISQUEYA SUPERMARKET 249 MADISON AVE. PERTH AMBOY NJ 08861 A & E SUPERMARKET 585 SOMERSET ST. SOMERSET NJ 08873 BROOKDALE SUPERMARKET 89 BROOKDALE AVE. NEWARK NJ 07106 DREAMER'S SUPERMARKET 71 7TH AVE. NEWARK NJ 07104 AMEZQUITA DELI & GROCERY, LLC 126 GOVERNOR ST. PATERSON NJ 07501 BELLA VISTA GROCERY, LLC 126 HOPE AVE. PASSAIC NJ 07055 BELLA VISTA SUPERMARKET 752 RIVER STREET PATERSON NJ 07524 EL BODEGON INC. 119-21 BROADWAY AVE. PASSAIC NJ 07055 LATINO MINI MARKET 207 E. MAIN ST. BOUND BROOK NJ 08805 LATINO MINI MARKET II 38 MAIN ST. FLEMINGTON NJ 08822 NORFOLK GROCERY 151 NORFOLK ST. NEWARK NJ 07103 SCARPAZI'S ONE STOP DELI 96 N. VIRGINIA AVE. PENNS GROVE NJ 08069 LAS PALMAS SUPERMARKET 6155 BERGENLINE AVE. WEST NEW YORK NJ 07093 TORRES & RODRIGUEZ DELI 21 ROEBLING AVE. TRENTON NJ 08611 TU PAIS SUPERMARKET 101 ANDERSON ST. TRENTON NJ 08611 BRIDGETON FOOD & GAS, LLC 176 N. PEARL ST. BRIDGETON NJ 08302 NOVEDADES ESPINOZA 37 S. LAUREL ST. BRIDGETON NJ 08302 AZCONA SANHICAN, LLC 2 SANHICAN DRIVE TRENTON NJ 08618 LA TAPATIA 703 MAIN STREET ASBURY PARK NJ 07712 JJ MINI MARKET 855 MONROE AVE. -

WEIS MARKETS, INC. (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) [X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 26, 2015 OR [ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from __________to_________ Commission File Number 1-5039 WEIS MARKETS, INC. (Exact name of registrant as specified in its charter) PENNSYLVANIA 24-0755415 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.) 1000 S. Second Street P. O. Box 471 Sunbury, Pennsylvania 17801-0471 (Address of principal executive offices) (Zip Code) Registrant's telephone number, including area code: (570) 286-4571 Registrant's web address: www.weismarkets.com Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common stock, no par value New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X] Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X] Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.