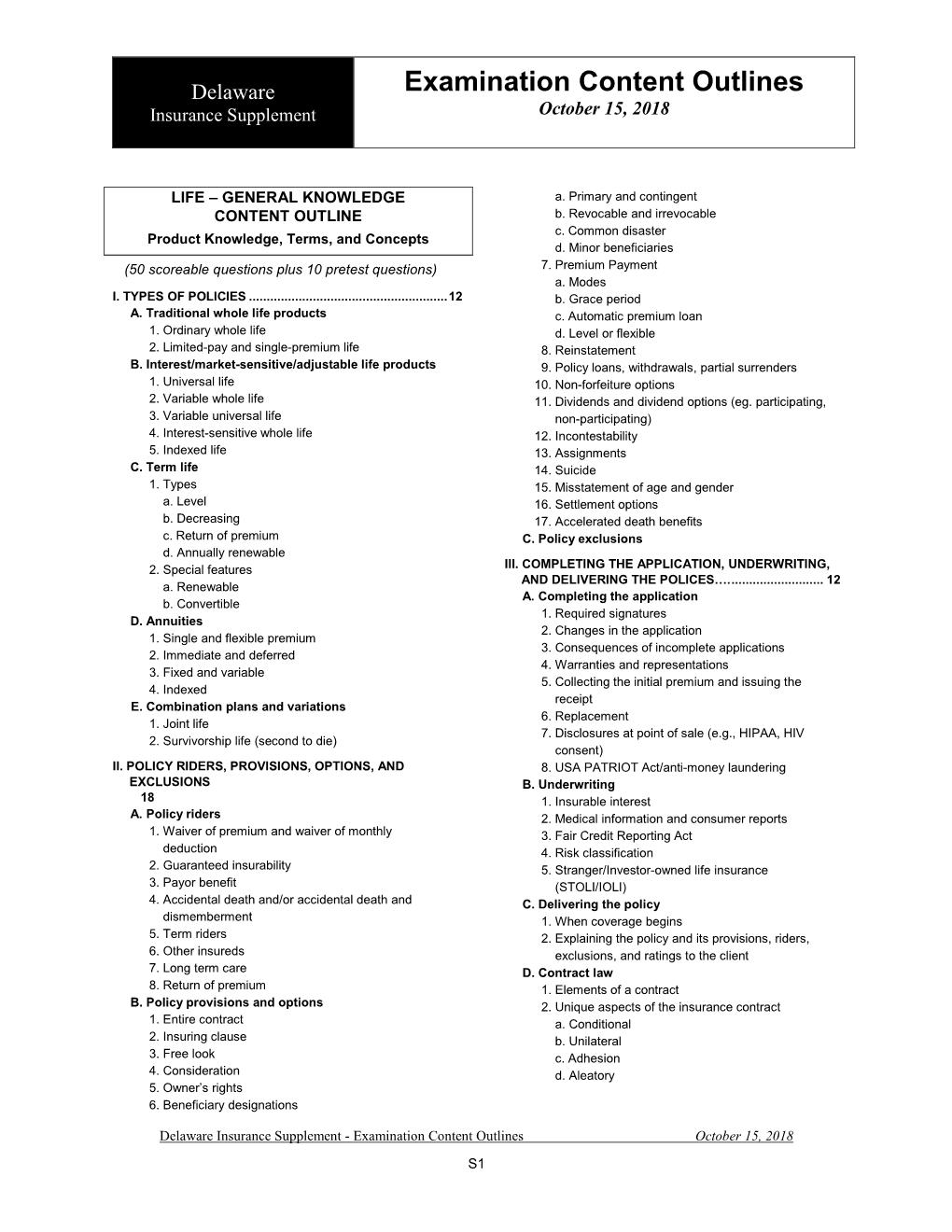

Pearson Vue Delaware Insurance Examination Content Outlines

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sunday Best Bets

Sunday SUNDAY PRIME TIME APRIL 8 S1 – DISH S2 - DIRECTV Best Bets 6 PM 6:30 7 PM 7:30 8 PM 8:30 9 PM 9:30 10 PM 10:30 11 PM 11:30 S1 S2 WSAZ WSAZ NBC News Dateline NBC Harry's Law "The Celebrity Apprentice "Ad Hawk" A celebrity WSAZ :35 Storm 3 3 NBC News Lying Game" (N) goes on a tirade against a teammate. (N) News Stories WLPX 5:30 < Space Cowboys ('00) Tommy Lee Jones, Clint < The Visitor ('07) Haaz Sleiman, Richard Jenkins. A < Rebound ('05) ION Eastwood. NASA recruits hotshot pilots to repair a satellite. professor finds a couple living in his NY apartment. Martin Lawrence. 29 - 5:00 < Out of Bounds World's Funniest Masters of Illusion < Freeway ('96) Reese Witherspoon. A Crook and Music TV10 - - ('03) Sophia Myles. Moments troubled young girl flees the foster-care system. Chase Row WCHS Eyewit- World America's Funniest Once Upon a Time GCB "Turn the Other GCB "Sex Is Divine" Eyewit- :35 Ent. ABC ness News News Home Videos "7:15 a.m." Cheek" (N) (N) ness News Tonight 8 8 WVAH Big Bang Two and a The Cleveland The B.Burger Family American Eyewitness News at Wrestling Ring of FOX Theory Half Men Simpsons Show Simpsons "Torpedo" Guy Dad 10 p.m. Honor 11 11 WOWK 2:00 Golf Masters 60 Minutes The Amazing Race (N) The Good Wife "The CSI: Miami "Habeas 13 News Cold Case CBS Tournament (L) Death Zone" Corpse" (SF) (N) Weekend 13 13 WKYT 2:00 Golf Masters 60 Minutes The Amazing Race (N) The Good Wife "The CSI: Miami "Habeas 27 :35 CBS Tournament (L) Death Zone" Corpse" (SF) (N) NewsFirst Courtesy - - WHCP < The Addams Family A greedy lawyer < Addams Family Values The family must Met Your Met Your The King The King CW tries to plunder the family's fortune. -

Ordinance No. 2015-37

ORDINANCE NO. 2015-37 ORDINANCE GRANTING AN EXCLUSIVE FRANCHISE TO PROGRESSIVE WASTE SOLUTIONS OF FL., INC., A FLORIDA CORPORATION, FOR THE COLLECTION OF RESIDENTIAL MUNICIPAL SOLID WASTE, AS THE COMPANY WITH THE HIGHEST RANKED BEST OVERALL PROPOSAL PURSUANT TO REQUEST FOR PROPOSAL NO. 2014-15-9500-00-002, FOR A TERM BEGINNING UPON EXECUTION OF THE EXCLUSIVE FRANCHISE AGREEMENT BY THE PARTIES AND ENDING ON SEPTEMBER 30, 2019, WITH AN AUTOMATIC RENEWAL TERM THEREAFTER OF FIVE YEARS, BEGINNING ON OCTOBER 1, 2019 AND ENDING ON SEPTEMBER 30, 2023, AND SUBSEQUENT RENEWALS AT THE OPTION OF THE PARTIES, FOR A TERM OF ONE YEAR EACH, WITH A CUMULATIVE DURATION OF ALL SUBSEQUENT RENEWALS AFTER THE FIRST RENEWAL TERM NOT EXCEEDING A TOTAL OF FIVE YEARS; APPROVING THE TERMS OF THE EXCLUSIVE FRANCHISE IN SUBSTANTIAL CONFORMITY WITH THE AGREEMENT ATTACHED HERETO AND MADE A PART HEREOF AS EXHIBIT '·t··; AND AUTHORIZING THE MAYOR AND THE CITY CLERK, AS ATTESTING WITNESS, ON BEHALF OF THE CITY, TO EXECUTE THE EXCLUSIVE FRANCHISE AGREEMENT; REPEALING ALL ORDINANCES OR PARTS OF ORDINANCES IN CONFLICT HEREWITH; PROVIDING PENALTIES FOR VIOLATION HEREOF; PROVIDING FOR A SEVERABILITY CLAUSE; AND PROVIDING FOR AN EFFECTIVE DATE. WHEREAS, the City issued a request for proposals ("'RFP") for certain types of Solid Waste Collection Services; and ORDINANCE NO. 2015-37 Page 2 WHEREAS, Progressive Waste Solutions of FL, Inc. ("'Progressive Waste") submitted a proposal in response to the City's RFP (RFP No. 2014-15-9500-00-002); and WHEREAS, the City has relied upon -

APPENDIX D LAPD FINAL MONITOR REPORT Office of the Independent Monitor: Final Report June 11, 2009

Letter of Interest - External Force Investigation Team Jeff Schlanger - March 30, 2021 APPENDIX D LAPD FINAL MONITOR REPORT Office of the Independent Monitor: Final Report June 11, 2009 OFFICE OF THE INDEPENDENT MONITOR OF THE LOS ANGELES POLICE DEPARTMENT FINAL REPORT Issued June 8, 2009 FINAL REPORT Issued June 11, 2009 Office of the Independent Monitor: Final Report June 11, 2009 Report Contents I. INTRODUCTION......................................................................................................................... 1 A. HISTORY ................................................................................................................................... 2 B. INVOLVED ENTITIES................................................................................................................... 3 The U.S. Department of Justice.................................................................................................... 3 The City of Los Angeles ................................................................................................................ 4 The Board of Police Commissioners ............................................................................................. 4 The LAPD ..................................................................................................................................... 5 The Office of the Inspector General ............................................................................................. 5 The Office of the Independent Monitor ...................................................................................... -

Religion and Popular Culture

ular ular Fall 2017 Fall Dr. Lynn S. Neal Course Texts: [email protected] Bruce Forbes & Jeffrey Mahan, eds., Religion and Popular I do not check email after 5pm Culture in America, Revised Edition [F&M] or on weekends, please plan Other readings available via Sakai accordingly. **Please bring assigned readings to each class** OH: Wed. & Fri. 11-12 Religion 267 PopReligion and Culture Course Description: “At work and at play, human In recent decades, many have predicted the demise of religion and the authenticity is at “death of God.” Indeed, many seem to embrace science and rationality stake in over faith and the supernatural, yet religion remains and permeates American American society, particularly popular culture. This raises a number of religion and questions: What is popular culture? What role is religion playing in it? Why? popular culture. How do we assess combinations of the sacred and the secular? What does Religion is the it all mean? Throughout the semester, this courses promises to answer real thing, but, as these questions by investigating four themes—religion IN popular culture, we already know popular culture IN religion, popular culture AS religion, and religion and from the world of popular culture in dialogue. These themes structure the course and advertising, Coca-Cola is also represent the dominant patterns in thinking about the popular and the the real thing.” pious. By examining numerous sources, topics, and dilemmas, from Star Trek fandom to religious games to Madonna, we’ll be investigating the ~David Chidester meaning of religion in the American religious landscape. Advice for Religion 267 wearing a The course requirements provide you with an opportunity to explore topics , and issues in more depth and are designed to help you realize the course objectives. -

Ordinance 2021-02

TOWNSHIP OF WANTAGE ORDINANCE #02-2021 AN ORDINANCE TO AMEND CHAPTER 3, POLICE REGULATIONS NOISE ORDINANCE I. Declaration of Findings and Policy WHEREAS, excessive sound is a serious hazard to the public health, welfare, safety, and the quality of life; and, WHEREAS, a substantial body of science and technology exists by which excessive sound may be substantially abated; and, WHEREAS, the people have a right to, and should be ensured of, an environment free from excessive sound. Now THEREFORE, it is the policy of Township of Wantage to prevent excessive sound that may jeopardize the health, welfare, or safety of the citizens or degrade the quality of life. This Ordinance shall apply to the control of sound originating from sources within the Township of Wantage. II. Definitions The following words and terms, when used in this Ordinance, shall have the following meanings, unless the context clearly indicates otherwise. Terms not defined in this Ordinance have the same meaning as those defined in N.J.A.C. 7:29. “Construction” means any site preparation, assembly, erection, repair, alteration or similar action of buildings or structures. “dBC” means the sound level as measured using the “C” weighting network with a sound level meter meeting the standards set forth in ANSI S1.4-1983 or its successors. The unit of reporting is dB(C). The “C” weighting network is more sensitive to low frequencies than is the “A” weighting network. “Demolition” means any dismantling, destruction or removal of buildings, structures, or roadways. “Department” means the New Jersey Department of Environmental Protection. “Emergency work” means any work or action necessary at the site of an emergency to restore or deliver essential services including, but not limited to, repairing water, gas, electricity, telephone, sewer facilities, or public transportation facilities, removing fallen trees on public rights -of-way, dredging navigational waterways, or abating life-threatening conditions or a state of emergency declared by a governing agency. -

HHA Board Meeting Minutes January 8, 2020 Meeting Called to Order

HHA Board Meeting Minutes January 8, 2020 Meeting called to order: 7:04 pm Attendees: Brent Gawlik, President Kathleen Haley, Marketing & Communications Rep Mike Anderson, Treasurer Ed Moore, MAHA Rep Meredith Long, Secretary Kristine Lucius, Adray Rep Lindsey Moungkhoun, Squirt Rep Jabez Waalkes, Apparel Sean Long, Peewee Rep Approval of December 2020 Meeting Minutes Motion: Ed Moore Second: Jabez Waalkes Motion Carries. Minutes to be published to website. Financial Report: Mike Anderson, Treasurer Current Balances as of 01.08.2020 . House: $ 3329.60 . Travel: $ 5687.06 . Scrip: $ 11,174.90 Uncollected Invoice Totals as of 01.08.2020; . House: Invoiced $ 57,250, Uncollected $ 35,779 (37% of fees collected) . Travel: Invoiced $ 113,805, Uncollected $ 59,434.45 . Payment solution for next year No formal registration or team appointment until first payment received No participation on house teams until first payment received 10-day grace period to submit payment at the beginning of each month before credit card is used for an auto draft December expenditures were largely ice invoices, officiating payments, and tournaments Current projected shortfall: $ 3000 Email from Brent to families through team managers for uncollected fees to be sent this week. Scrip credits ($ 9500) to be applied to all eligible accounts 01.10.2020. Anticipate 75% of monies to go towards travel accounts February Action Item: Revisit Sports Engine payment platform to create new system for 2020 Spring Hockey season: 01.08.20 Squirt Rep: Lindsey Moungkhoun Try Hockey For Free . 10 participants, half were repeats from the first THFF . Next national date: 02.22.2020 Volunteers (Lindsey) Ice Time/Book with rink: 11:00-11:50 am (Brent) Promotional Materials (Kathleen) Equipment Check for next THFF date (Board 02.05.20) MAHA Report: Ed Moore Match Penalties . -

Lost and Found Wherever the Kam May Take Me Scattered Showers Our Own Lance Cpl

SEPTEMBER 4, 2009 VOLUME 39, NUMBER 35 WWW.MCBH.USMC.MIL Hawaii Marine DOG GONE ORDER Cpl. Danny H. Woodall Combat Correspondent recently released Marine Corps Order prohibits full or mixed breeds of Pit ABulls, Rottweilers and canid/wolf hybrids aboard Marine Corps installations. According to the order, the rise in own- ership of large dog breeds with a predispo- sition toward aggressive or dangerous behavior, coupled with the increased risk of tragic incidences involving these dogs, has prompted the commandant of the Marine Corps to issue a new change to Marine Photos by Lance Cpl. John P. Hitesman Corps Order P11000.22. The change to the Marines from Golf Company, 2nd Battalion, 3rd Marine Regiment, Marine Expeditionary Brigade-Afghanistan, take cover from enemy fire during the begin- order was made to provide for the health, ning of a patrol to search the city of Dehana, Helmand province, Afghanistan during Operation Eastern Resolve II August 13. safety and tranquility of all residents of family housing areas Corpswide. There have been several fatal incidents of dog attacks on Marine Corps bases, said Island Warriors take Dehana back from Lt. Col. Jeffrey S. Tontini, base inspector. The movement to ban aggressive breeds of dogs emanated from these attacks. Taliban forces during Eastern Resolve II The order also states that a Veterinary Corps Officer or civilian veterinarian will determine the “majority breed” of a dog in They have taxed the local citizens and used Prior to Eastern Resolve II, the citizens of Lance Cpl. John P. Hitesman the absence of formal breed identification. -

Meeting Called to Order by SAC Chairman. Fabia Reid Introduced As New Committee Secretary; SAC Committee Back to Full Strength

14 November 2018 Meeting Minutes 1600: Meeting called to order by SAC Chairman. Fabia Reid introduced as new committee secretary; SAC Committee back to full strength. 1610: SAC Vice Chairman reviewed old business & previous minutes placing emphasis on parent questions. College night went pretty well; financial aid, among other things, was discussed. Parent Questions: 1. One grade per week policy? There is no DODEA requirement. Guidance from NMHS Principal is “timely submission of grades on Gradespeed” to provide an accurate depiction of what students’ grades are. If there is a particular concern that a parent may have, parents are encouraged to first contact their child’s teacher(s), request a conference at any time, & if necessary, contact the school Principal for final resolution.” 1b. “Part of the concern about grades referred to student athletes that travel. Reviews are completed on Tuesday, sometimes the grades aren’t reflected on Gradespeed or there is only one or a couple of grades.” The Principal offered that during a recent staff meeting, the Athletic Director specifically reviewed the eligibility requirements to identify what constitutes an eligible student at the beginning of the sport season, & what the school is required to do as far as monitoring for the next consecutive three weeks. The Athletic Director pushed to get grades “in by Friday so that they can be pulled by Tuesday because it takes a couple of hours for grades to come in.” NMHS Principal shared that “While there is some teacher responsibility, there are also responsibilities for the students to understand that work must be turned in on Friday because that is the real hard deadline. -

Three Better Bay Forums on Tap

BAY SCHOOLS JOIN STATEWIDE ‘WALK-IN’ LOCAL | A3 PANAMA CITY LOCAL & STATE | A3 BAY RESIDENTS SHOW ANGER TO RUBIO REP Thursday, April 18, 2019 www.newsherald.com @The_News_Herald facebook.com/panamacitynewsherald 75¢ Three Better Bay forums on tap Next week’s events to the future of the community and 25 — The News Herald p.m. They will be held at the Get involved tackle post-Michael remains in flux. will be hosting a series of Bay County Government military, housing, Many residents, and offi- forums on major issues in our Center, and streamed live on All three forums will mental health questions cials, still have questions community. Similar to our A The News Herald’s Facebook start at 6 p.m. and end about what lies ahead, par- Better Bay forum in Decem- page. The events are free, at 7:30 p.m. They will be News Herald staff report ticularly as we head into the ber, all questions will be but we ask those who wish held at the Bay County next hurricane season. And submitted in advance through to attend to obtain a ticket in Government Center, and PANAMA CITY — Six as the local newspaper, we our Bay Asked, We Answered advance. streamed live on The months after Hurricane believe it’s our job to get you series. On April 22, we will hold an News Herald’s Facebook Michael, Bay County still answers. All events will start at 6 page. is facing serious issues and Next week — April 22, 23 p.m. and will end at 7:30 See FORUMS, A4 Michael’s Angels Husfelt: ‘We’ve got to get help take fi ght to Tally for our people’ By Eryn Dion comes to a close May 3 and [email protected] the two chambers enter @PCNHErynDion into conference to hash out the budget, Bay County PANAMA CITY — The Superintendent Bill Husfelt clock is winding down on put the odds at “50/50” if the state’s legislative ses- the county would see the sion, and on the hope that money. -

Academic Programs . . . 46 Performance Bass

Academic Calendar . 4 About LACM . 6 CONTENTS LACM Educational Programs . 9 Administration . 10 Admissions . 11 Tuition & Fees . 13 Financial Aid . 16 Registrar . 20 International Student Services . 26 Academic Policies & Procedures . 27 Student Life . 30 Career Services . 32 Campus Facilities – Security . 33 Rules of Conduct & Expectations . 35 Health Policies . 36 Grievance Policy & Procedures . 39 Change of Student Status Policies & Procedures . 41 Collegiate Articulation & Transfer Agreements . 44 Academic Programs . 46 Performance Bass . 46 Brass & Woodwind . 52 Drums . 58 Guitar . 64 Vocal . 70 Music Composition Songwriting . 76 Music Production Composing for Visual Media . 82 Music Producing & Recording . 86 Music Industry Music Business . 92 Course Descriptions . 98 Department Chairs & Faculty Biographies . 138 SPRING 2015 (APRIL 6 – JUNE 19) SUMMER 2015 (JULY 6 – SEPTEMBER 18) January 26-30: Registration Period for April 27-May 1: Registration Period for Upcoming Quarter Upcoming Quarter April 6: Quarter Begins May 26: Tuition Deadline for Continuing Students February 23: Tuition Deadline for Continuing Students July 3: Independence Day (Observed), Campus Closed May 25: Memorial Day, Campus Closed July 6: Quarter Begins June 15–19: Exams Week September 7: Labor Day, Campus Closed June 19: Quarter ends September 14-18: Exams Week September 18: Quarter Ends September 19: Graduation ACADEMIC CALENDAR FALL 2015 (OCTOBER 5 – DECEMBER 18) WINTER 2016 (JANUARY 4 – MARCH 18) July 27-31: Registration Period for October 26-30: Registration Period for Upcoming Quarter Upcoming Quarter August 24: Tuition Deadline for Continuing November 23: Tuition Deadline for Continuing Students Students October 5: Quarter Begins January 4: Quarter Begins Nov. 11: Veterans, Campus Closed January 18: MLK Jr. -

Candidate Information Bulletin

PSI licensure:certification 3210 E Tropicana Las Vegas, NV 89121 E-mail: [email protected] https://home.psiexams.com/#/home STATE OF OREGON DIVISION OF FINANCIAL REGULATION CANDIDATE INFORMATION BULLETIN Examinations by PSI licensure: certification ................... 2 Reporting to the Examination Site ............................ 11 Examination and Licensure Requirements ..................... 2 Required Identification .............................. 11 Examination Payment and Scheduling Procedures ............ 4 Security Procedures .................................. 11 On-line Testing at a PSI test site ..................... 4 Taking the Examination by Computer ........................ 12 Testing remotely ........................................ 8 Identification Screen ................................. 12 Telephone Scheduling .................................. 9 Tutorial ................................................. 12 Rescheduling/Canceling an Examination ............ 9 Exam Question Screen ............................... 12 Retaking a Failed Examination ........................ 9 Remote Online Proctored Exam .................... 12 Missed Appointment or Late Cancellation ........... 9 Examination Review .................................. 13 Exam Accommodations ................................. 9 Score Reporting .................................................. 13 Emergency Examination Center Closing ............. 9 Tips for Preparing for your License Examination ........... 14 Social Security Confidentiality ..................... -

ANNUAL INTELLECTUAL PROPERTY REPORT to CONGRESS February 2019 * * *

ANNUAL INTELLECTUAL PROPERTY REPORT TO CONGRESS February 2019 * * * UNITED STATES INTELLECTUAL PROPERTY ENFORCEMENT COORDINATOR IPEC ANNUAL INTELLECTUAL PROPERTY REPORT TO CONGRESS: This report is submitted pursuant to 15 U.S.C. §8114. During the past two years, President Trump and his Administration have worked to promote strong intellectual property rights protection and enforcement, both domestically and abroad. As part of an integrated approach, the Trump Administration views our intellectual property strategy, policy and enforcement efforts, together, as key to helping secure the future of our innovative economy and to maintaining our competitive advantage. The Trump Administration’s Annual Intellectual Property Report to Congress, developed by the Office of the U.S. Intellectual Property Enforcement Coordinator, brings together the combined and coordinated efforts of the White House, the Departments of Commerce, Justice, Homeland Security, State, Treasury, Health and Human Services, and Agriculture, the Office of the U.S. Trade Representative, and the U.S. Copyright Office. This report was originally mandated to be submitted by the U.S. Intellectual Property Enforcement Coordinator a decade ago by the Prioritizing Resources and Organization for Intellectual Property Act of 2008, and builds upon that framework to provide an overview of the Trump Administration’s intellectual property enforcement strategy and policy efforts. For the United States’ approach to intellectual property and innovation policy to be successful, it must continue to be a combined effort that includes all branches of government, the private sector, and our international partners. The Trump Administration continues to build on past strategic efforts in all areas of intellectual property policy, including patents, copyrights, trademarks and trade secrets, both domestically and abroad.