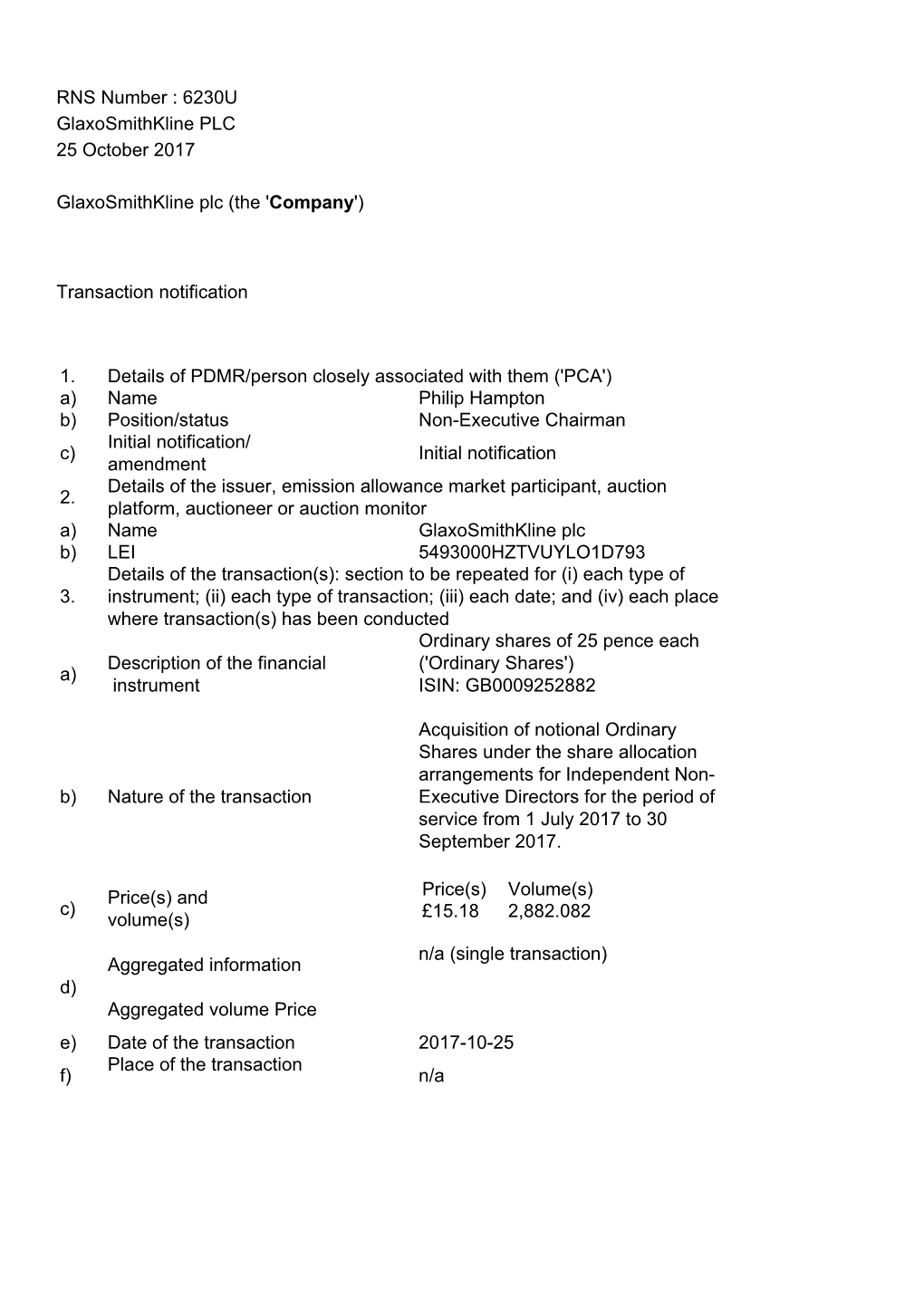

Transaction Notification 1. Details O

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, D.C

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 SCHEDULE 13D Under the Securities Exchange Act of 1934 (Amendment No. 2)* GENOCEA BIOSCIENCES, INC. (Name of Issuer) Common Stock, Par Value $0.001 (Title of Class of Securities) 372427 10 4 (CUSIP Number) Victoria A. Whyte GlaxoSmithKline plc 980 Great West Road Brentford, Middlesex TW8 9GS England Telephone: +44 (0)208 047 5000 Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications) July 30, 2015 (Date of Event which Requires Filing of this Statement) If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐ Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule.13d-7 for other parties to whom copies are to be sent. * The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes). -

Governance and Remuneration 2014

Governance & remuneration reportStrategic In this section Our Board 72 Our Corporate Executive Team 76 Chairman’s letter 78 Corporate governance framework 79 Board report to shareholders Oversight and stewardship in 2014 and future actions 80 remuneration & Governance Leadership and effectiveness 82 Committee reports Audit & Risk 86 Nominations 92 Corporate Responsibility 94 Remuneration report Chairman’s annual statement 96 Annual report on remuneration 97 2014 Remuneration policy report 119 Financial statements Financial Investor information Investor GSK Annual Report 2014 71 Our Board Strategic reportStrategic Diversity Experience International experience Composition Tenure (Non-Executives) % % % % Scientific 19 Global 75 Executive 19 Up to 3 years 39 % % % % Finance 31 USA 100 Non-Executive 81 3-6 years 15 % % % % Industry 50 Europe 94 Male 69 7-9 years 23 % % % EMAP 63 Female 31 Over 9 years 23 Sir Christopher Gent 66 Skills and experience Chairman Sir Christopher has many years of experience of leading global businesses and a track record of delivering outstanding performance Governance & remuneration & Governance Nationality in highly competitive industries. He was appointed Managing Director British of Vodafone plc in 1985 and then became its Chief Executive Officer Appointment date in 1997 until his retirement in 2003. Sir Christopher was also a 1 June 2004 and as Chairman Non-Executive Director of Ferrari SpA and a member of the British on 1 January 2005 Airways International Business Advisory Board. Committee membership External appointments Corporate Responsibility Sir Christopher is a Senior Adviser at Bain & Co. Committee Chairman, Nominations, Remuneration and Finance Sir Philip Hampton 61 Skills and experience Chairman Designate Prior to joining GSK, Sir Philip chaired major FTSE 100 companies including J Sainsbury plc. -

Annual Report of Proxy Voting Record Date

ANNUAL REPORT OF PROXY VOTING RECORD DATE OF REPORTING PERIOD: JULY 1, 2018 - JUNE 30, 2019 FUND: VANGUARD FTSE 100 UCITS ETF --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- ISSUER: 3i Group Plc TICKER: III CUSIP: G88473148 MEETING DATE: 6/27/2019 FOR/AGAINST PROPOSAL: PROPOSED BY VOTED? VOTE CAST MGMT PROPOSAL #1: ACCEPT FINANCIAL STATEMENTS AND ISSUER YES FOR FOR STATUTORY REPORTS PROPOSAL #2: APPROVE REMUNERATION REPORT ISSUER YES FOR FOR PROPOSAL #3: APPROVE FINAL DIVIDEND ISSUER YES FOR FOR PROPOSAL #4: RE-ELECT JONATHAN ASQUITH AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #5: RE-ELECT CAROLINE BANSZKY AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #6: RE-ELECT SIMON BORROWS AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #7: RE-ELECT STEPHEN DAINTITH AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #8: RE-ELECT PETER GROSCH AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #9: RE-ELECT DAVID HUTCHISON AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #10: ELECT COLINE MCCONVILLE AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #11: RE-ELECT SIMON THOMPSON AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #12: RE-ELECT JULIA WILSON AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #13: REAPPOINT ERNST & YOUNG LLP AS AUDITORS ISSUER YES FOR FOR PROPOSAL #14: AUTHORISE BOARD ACTING THROUGH THE ISSUER YES FOR FOR AUDIT AND COMPLIANCE COMMITTEE TO FIX REMUNERATION OF AUDITORS PROPOSAL #15: AUTHORISE EU POLITICAL DONATIONS AND ISSUER YES FOR FOR EXPENDITURE PROPOSAL #16: AUTHORISE ISSUE -

What Makes a Great Chief Executive? What Makes a Great Chief Executive? Material Consists of 80% Recycled Certification

Material consists of 80% recycled post-consumer fibre; 10% TCF (totally chlorine free); 10% ECF (elemental chlorine free). FSC certification. NAPM recycled certification. Paper mill accredited with ISO 9001 and ISO 14001 status. All responsibilities to the local environment and manufacturing processes are strictly monitored. The Whitehead Mann Leadership Debate Leadership Mann Whitehead The What makes a great Chief Executive? Chief great a makes What THE WHITEHEAD MANN LEADERSHIP DEBATE LEADERSHIP MANN WHITEHEAD THE What makes a great Chief Executive? Chief agreat What makes Contact Carol Leonard All rights reserved. No part of this publication Whitehead Mann is one of the world’s best-known leadership consultancies may be reproduced, stored in a retrieval system, working with clients to create value through people. As an independent, Whitehead Mann or transmitted in any form or by any means, international partnership, we work as a single team to deliver deep sector Ryder Court electronic, mechanical, photocopying, recording and functional expertise. We are authorities in the areas of leadership; CEO 14 Ryder Street or otherwise, without the express permission concerns; CEO characteristics and career issues at Board and CEO level. London SW1Y 6QB of the copyright owner. Our long track record is built on our contacts, judgement, the quality of our t +44 (0) 207 024 9000 © The Whitehead Mann Partnership LLP board placements and our ability to identify the CEOs of tomorrow. Over 90 f +44 (0) 207 024 9001 of Europe’s top 200 companies and most of the FTSE 100 companies and e [email protected] Fortune 500 organisations have retained Whitehead Mann. -

Congress Guide

INTERNATIONAL CONGRESS 2015 AMSTERDAM netherlands, 26–30 september CONGRESS GUIDE ERSCONGRESS.ORG ERS AMSTERDAM 2015 WelprogrammeCome TO amS outlineterDam ■ WELCOME FROM THE ERS PRESIDENT I am honoured to be hosting the 25th International Congress of the European Respiratory Society in my home city of Amsterdam. Amsterdam is famous for its international trade and it is fitting that the ERS Congress is held in a city that has reaped the benefits from an international outlook. It is imperative that we, as respiratory professionals, mirror this approach and work together as an international network to achieve our goal of promoting lung health and combating lung diseases. The scientific and educational programme promises to deliver a wealth of new material from all sections of respiratory health and disease. The Chairs of the Scientific and Education Councils, together with all the ERS officers, work on the programme throughout the year to ensure it delivers the very best results from the latest Professor Elisabeth Bel research, meeting the needs of respiratory professionals ERS PRESIDENT in all disciplines. This year we have taken the landmark decision to provide the congress scientific and educational programme in a digital format only. With the growth in digital platforms over the last ten years, there is no better time to provide our delegates with all the materials and tools needed in a digital format. Instead of a printed copy, the programme will be available on the Congress website where users can easily browse all the sessions, build their own personal itinerary, and download and print abstracts of interest. All these features will also be available on the Congress App, which is free to download and will be available from August. -

Engagement, Screening and Voting Report 2018

Engagement, Screening and Voting Report 2018 Carlota Garcia-Manas and Sheila Stefani Responsible Investment Team INTRODUCTION Contents Introduction .............................................................................................................................. 3 Engagement ............................................................................................................................. 5 Screening ............................................................................................................................... 12 Voting: Overview ..................................................................................................................... 14 Voting: Management Resolutions (UK) .................................................................................... 16 Overview ............................................................................................................................ 16 Remuneration (UK) ............................................................................................................. 17 Directors (UK) ..................................................................................................................... 18 Voting: Management Resolutions (Global) ............................................................................... 20 Overview ............................................................................................................................ 20 Remuneration (Global) ....................................................................................................... -

X-Ray Fluorescence Analysis Method Röntgenfluoreszenz-Analyseverfahren Procédé D’Analyse Par Rayons X Fluorescents

(19) & (11) EP 2 084 519 B1 (12) EUROPEAN PATENT SPECIFICATION (45) Date of publication and mention (51) Int Cl.: of the grant of the patent: G01N 23/223 (2006.01) G01T 1/36 (2006.01) 01.08.2012 Bulletin 2012/31 C12Q 1/00 (2006.01) (21) Application number: 07874491.9 (86) International application number: PCT/US2007/021888 (22) Date of filing: 10.10.2007 (87) International publication number: WO 2008/127291 (23.10.2008 Gazette 2008/43) (54) X-RAY FLUORESCENCE ANALYSIS METHOD RÖNTGENFLUORESZENZ-ANALYSEVERFAHREN PROCÉDÉ D’ANALYSE PAR RAYONS X FLUORESCENTS (84) Designated Contracting States: • BURRELL, Anthony, K. AT BE BG CH CY CZ DE DK EE ES FI FR GB GR Los Alamos, NM 87544 (US) HU IE IS IT LI LT LU LV MC MT NL PL PT RO SE SI SK TR (74) Representative: Albrecht, Thomas Kraus & Weisert (30) Priority: 10.10.2006 US 850594 P Patent- und Rechtsanwälte Thomas-Wimmer-Ring 15 (43) Date of publication of application: 80539 München (DE) 05.08.2009 Bulletin 2009/32 (56) References cited: (60) Divisional application: JP-A- 2001 289 802 US-A1- 2003 027 129 12164870.3 US-A1- 2003 027 129 US-A1- 2004 004 183 US-A1- 2004 017 884 US-A1- 2004 017 884 (73) Proprietors: US-A1- 2004 093 526 US-A1- 2004 235 059 • Los Alamos National Security, LLC US-A1- 2004 235 059 US-A1- 2005 011 818 Los Alamos, NM 87545 (US) US-A1- 2005 011 818 US-B1- 6 329 209 • Caldera Pharmaceuticals, INC. US-B2- 6 719 147 Los Alamos, NM 87544 (US) • GOLDIN E M ET AL: "Quantitation of antibody (72) Inventors: binding to cell surface antigens by X-ray • BIRNBAUM, Eva, R. -

Press Release

PRESS RELEASE Issued: Tuesday 20 September 2016, London UK – LSE Announcement Emma Walmsley to succeed Andrew Witty as Chief Executive Officer of GlaxoSmithKline GSK today announces that Emma Walmsley, currently Chief Executive Officer (CEO) of GSK’s Consumer Healthcare division, is appointed GSK CEO Designate and will succeed Andrew Witty as GSK CEO, when he retires on 31March 2017. Emma will join the GSK Board of Directors from 1 January 2017. Emma is currently CEO of GSK Consumer Healthcare, one of the world’s largest consumer health companies, established in 2015 following completion of GSK’s three-part transaction with Novartis. Prior to this, Emma was President of GSK Consumer Healthcare and has been a member of GSK’s Corporate Executive Team since 2011. Emma joined GSK in 2010 from L’Oreal where, over the course of her 17-year career, she held a variety of marketing and general management roles in the UK, Europe and USA. From 2007 she was based in Shanghai as General Manager, Consumer Products for L’Oreal China. Philip Hampton, GSK Chairman, said: “I am very pleased to announce Emma’s appointment, after what has been a very thorough and rigorous global selection process carried out by the GSK Board of Directors. Emma is an outstanding leader with highly valuable experience of building and running major global businesses and a strong track record of delivering growth and driving performance in healthcare. Under Andrew’s leadership, GSK has successfully developed into a company with market-leading positions in pharmaceuticals, vaccines and consumer healthcare. These provide excellent platforms for sustainable, long-term growth, and we are confident Emma will successfully build on these strengths.” Emma Walmsley said: “I am delighted and honoured to be appointed GSK’s next CEO. -

Annual Report 2015

Annual Report 2015 2015 saw substantial progress to accelerate new product sales growth and strengthen our Pharmaceuticals, Vaccines and Consumer Healthcare businesses Overview of 2015 Strategic report “ In 2015, we made substantial progress to accelerate new product sales growth, integrate new businesses in Vaccines and Consumer Healthcare and restructure our global Pharmaceuticals business. This progress means the Group is well positioned to return to core earnings growth in 2016.” Sir Andrew Witty, Chief Executive Officer Governance & remunerationPerformance Financial statements summary Investor information £23.9bn £10.3bn £5.7bn £3.9bn Group turnover Total operating profit Core operating profit Cash dividends paid (up 6% CER/up 1% CER (up >100% CER) a (down 9% CER/down 3% in 2015 pro-forma) a CER pro-forma)a £2.0bn 174.3p 75.7p 10 0 % New product sales b Total earnings per share Core earnings per share Markets now operating (up >100%) (up >100%, primarily (down 15% CER, primarily new commercial model reflecting impact of reflecting short-term dilution transaction gains) of the Novartis transaction)a ~40 20 ~13 % 1st Potential new medicines Potential to file up to Estimated internal In Access to Medicine and vaccines profiled at R&D 20 assets with regulators rate of return in R&D Index event, 80% of which have by 2020 in 2015 potential to be first-in-classc Footnotes a We use a number of adjusted measures to report the performance of our business, as described on page 54. These include core results, CER growth rates and pro-forma CER growth rates. A reconciliation of total results to core results is set out on page 62. -

Annual Report 2015

Annual Report 2015 2015 saw substantial progress to accelerate new product sales growth and strengthen our Pharmaceuticals, Vaccines and Consumer Healthcare businesses Overview of 2015 Strategic report “ In 2015, we made substantial progress to accelerate new product sales growth, integrate new businesses in Vaccines and Consumer Healthcare and restructure our global Pharmaceuticals business. This progress means the Group is well positioned to return to core earnings growth in 2016.” Sir Andrew Witty, Chief Executive Officer Governance & remunerationPerformance Financial statements summary Investor information £23.9bn £10.3bn £5.7bn £3.9bn Group turnover Total operating profit Core operating profit Cash dividends paid (up 6% CER/up 1% CER (up >100% CER) a (down 9% CER/down 3% in 2015 pro-forma) a CER pro-forma)a £2.0bn 174.3p 75.7p 10 0 % New product sales b Total earnings per share Core earnings per share Markets now operating (up >100%) (up >100%, primarily (down 15% CER, primarily new commercial model reflecting impact of reflecting short-term dilution transaction gains) of the Novartis transaction)a ~40 20 ~13 % 1st Potential new medicines Potential to file up to Estimated internal In Access to Medicine and vaccines profiled at R&D 20 assets with regulators rate of return in R&D Index event, 80% of which have by 2020 in 2015 potential to be first-in-classc Footnotes a We use a number of adjusted measures to report the performance of our business, as described on page 54. These include core results, CER growth rates and pro-forma CER growth rates. A reconciliation of total results to core results is set out on page 62. -

GSK Annual Report 2019 01 Our Business Model Continued

Annual Report 2019 Contents We are a science-led Strategic report Our business model 01 global healthcare company Chairman’s statement 03 CEO’s statement 04 Financial performance 06 Our long-term priorities 09 Our purpose Our culture 10 To improve the quality of human life by helping people do more, feel better, Key performance indicators 11 live longer. Industry trends 12 Stakeholder engagement 15 Our goal Pharmaceuticals 17 To become one of the world’s most innovative, best-performing and trusted Vaccines 23 healthcare companies. Consumer Healthcare 27 Trust 30 Our strategy Risk management 43 To bring differentiated, high-quality and needed healthcare products Group financial review 49 to as many people as possible, with our three global businesses, scientific Corporate Governance and technical know-how and talented people. Chairman’s Governance statement 76 Our long-term priorities Our Board 78 Our Corporate Executive Team 82 Our priorities are underpinned by our ambition to build a more performance- Responsible leadership 84 focused culture, aligned to our values and expectations. Division of responsibilities 90 Innovation Composition, succession We invest in scientific and technical excellence to develop and launch and evaluation 92 a pipeline of new products that meet the needs of patients, payers Nominations Committee report 92 and consumers. Audit, risk and internal control 96 Audit & Risk Committee report 96 Performance Science Committee report 107 We deliver growth-based performance by investing effectively in our Corporate Responsibility business, developing our people and executing competitively. Committee report 109 Trust Section 172 statement 111 We are a responsible company and commit to use our science and Directors' report 113 technology to address health needs, make our products affordable Remuneration report and available and to be a modern employer. -

Annual Report 2017

Annual Report Image HIV virus 2 017 GSK Annual Report 2017 GSK is a science-led global healthcare company In the Strategic report Our new CEO discusses Measuring performance 2017 performance and our and managing risk new long-term priorities See pages 05–07 See pages 18–21 How we create Innovation and Performance long-term value in each of our three businesses See pages 08–09 See pages 22–41 Industry trends How our three businesses together contribute to our Trust priority See pages 10–11 See pages 42–51 Our new long-term priorities: Financial review Innovation, Performance and Trust See pages 12–17 See pages 52–78 Cover image Cautionary statement 30 years after developing the first HIV See the inside back cover of this document medicine, our research into treatment and for the cautionary statement regarding prevention of HIV continues. We remain forward-looking statements. at the forefront of helping people living with HIV, driving innovation and working with communities all over the world. 01 GSK Annual Report 2017 Strategic report Governance and remuneration Financial statements Investor information Our financial performance in 2017a £30.2bn AER +8% £6.7bn AER +51% Group turnover CER +3% New product salesb CER +44% £4.1bn AER +57% £8.6bn AER +12% Total operating profit CER +39% Adjusted operating profit CER +5% 31.4p AER +67% 111.8p AER +11% Total earnings per share CER +36% Adjusted earnings per share CER +4% £6.9bn £3.4bn £3.9bn 80p Net cash flow from Free cash flow Dividends declared 2017 dividend operating activities for 2017 per