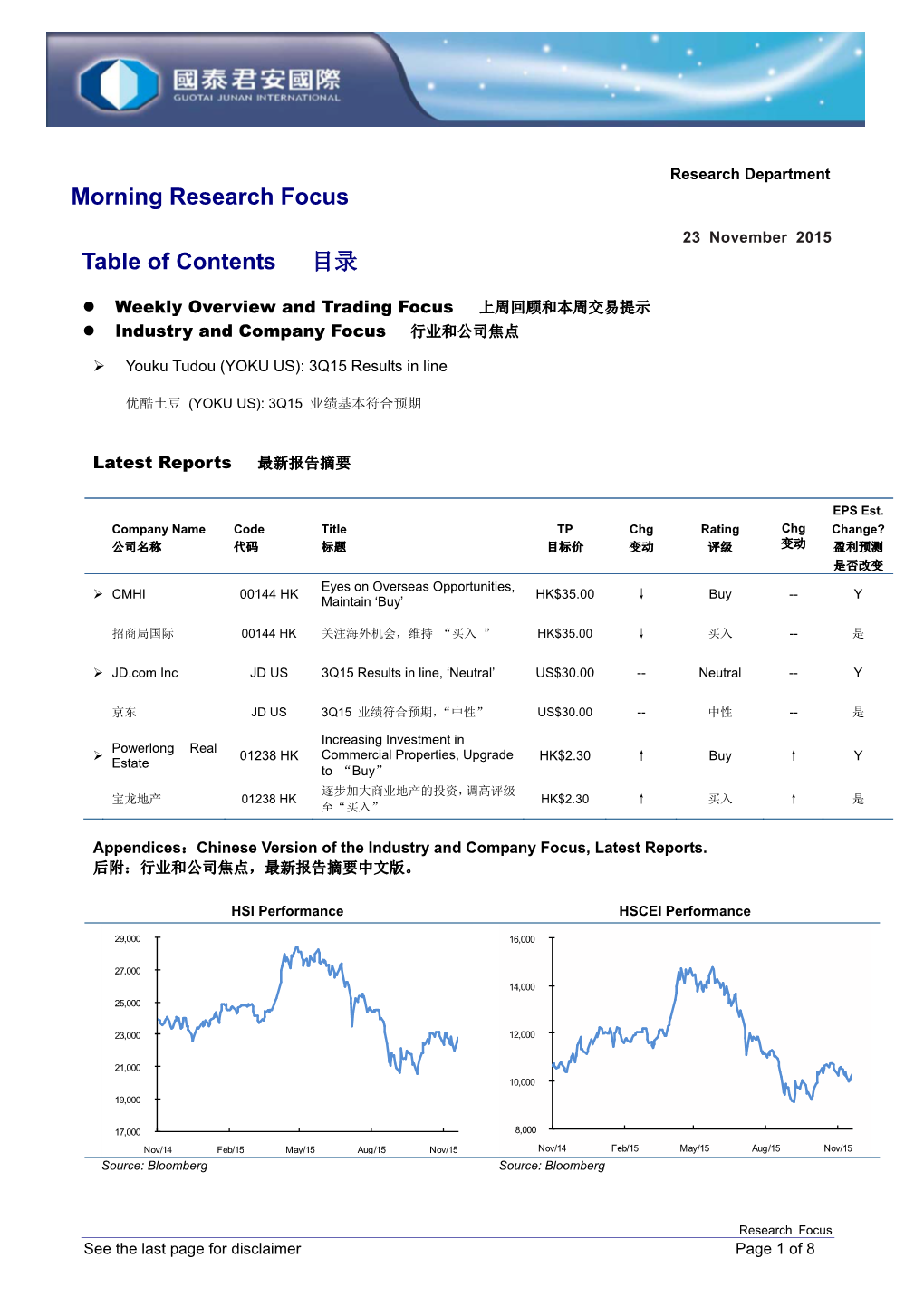

Morning Research Focus Table of Contents 目录

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Comments on SZ-HK Connect: Another Milestone for MMA 深港通评论:互联互通的又一里程碑事件

Research Department 17 August, 2016 Shirley Gu 古乔艺 Gary Ching 程嘉伟 Grace Liu 刘谷 (86755) 2397 6718 (852) 2509 2665 (852) 2509 7516 [email protected] [email protected] [email protected] Comments on SZ-HK Connect: Another Milestone for MMA 深港通评论:互联互通的又一里程碑事件 Regulators announced Shenzhen-Hong Kong Stock Connect (SZ-HK Connect) Scheme. Chinese Premier Li Keqiang announced that the Shenzhen-Hong Kong Stock Connect plan had been approved by the Chinese government on 16 August 2016. On the same day, China Securities Regulatory Commission (CSRC) and Hong Kong’s Securities and Futures Commission (SFC) made a joint statement regarding the establishment of mutual market access (MMA) between Shenzhen and Hong Kong. The existing aggregate quota under the SH-HK Connect has been removed with immediate effect. According to the joint statement, the official launch of SZ-HK Connect is expected to be in 4 months time. Further details are as follows: 监管部门宣布深港通。中国国务院总理李克强在 8 月 16 日宣布,《深港通实施方案》已或得国务院批准。同日,中国 证监会及香港证监会联合发表关于建立深圳和香港互联互通的公告。即日起沪港通总额度取消,根据联合公告,深港 通正式推出时间预期由即日起计约 4 个月。其他细节如下: Details Shenzhen Southbound - All Hang Seng Composite LargeCap Index and Hang Seng Composite MidCap Index constituents. Connect - Any Hang Seng Composite SmallCap Index constituents with a market capitalisation of HK$5 billion or above - All SEHK-listed A+H shares - Daily Northbound quota: RMB10.5 billion - The investment quota may be adjusted by the parties in light of actual operational performance Shenzhen Northbound - All SZSE Component Index and SZSE Small/MidCap -

Novinky Asijského Filmu

Přehled asijské kinematografie, sezóna 2016/17 v j. a v. Asii, Filmy a TV seriály Skryté perly roku 2016 If Cats Disappeared from World Cold War 2 Super Express I Belonged to You Crosscurrent Mirzya The New Year‘s Eve of Old Lee If Cats Disappeared from World Režie: Akira Nagai Minutáž: 103 minut Žánr: drama, fantasy, indie Hrají: Takeru Sató, Aoi Mijazaki, Gaku Hamada, Eidži Okuda, Mieko Harada, Eita Okuno a další http://asianwiki.com/If_Cats_Disappeared_From_the_World Film určitě není pro naprosté začátečníky s japonskou, nebo asijskou kinematografií, představte si, že Vám zbývá strašlivě málo života a ďábel Vám nabídne nějaký čas navíc. Jenže musíte obětovat věci, nebo lidi. Jak by vypadal svět bez koček, filmů? Meditativní film plný odkazů na japonské indie filmy a klasiky let 90.tých, nefalšovaný doják, který určitě není pro každého. Nad mnoha svými žánrovými souptníky má však film výhodu v tom, že působí autenticky a doslova dýchá svojí atmosférou a životem. Cold War II Režie: Sunny Luk, Longman Leung Minutáž: 110 minut Žánr: krimi, akční Hrají: Aaron Kwok, Tony Leung Ka-fai, Yun fat Chow, Aarif Rahman, Eddie Peng, Charlie Yeung, Janice Man a další https://www.csfd.cz/film/79116-hon-zin-2/komentare/ Kasovní trhák Cold War se dočkal Jediné co může zamrzet, je nevyužití postavy svého pokračování, Hong Kong dodal Charlie Yeung, která je zde spíše na okrasu a opět kvalitní kriminálku, která má nemá žádný prostor něco ukázat. Uvidíte velmi solidní herecké výkony hong kongské oproti prvnímu dílu solidnější scénář. elity a tchaj-wanské star Eddie Penga. Tvůrci Téma boje o moc v policejním vedení rozpumpovali peněženky diváků opět Pokračuje, tentokrát nečekaně ve solidně, takže v roce 2019 můžeme očekávat filmu urve velký prostor nová třetí díl. -

From the Past

G reater B ay A rea Blast from the Past Snapshots of a China Gone Past Follow 城市漫步 Us on WeChat 粤港澳大 Now 湾区英文 版 9 月份 : 国内统一刊号CN 11-5234/GO China Intercontinental Press Advertising Hotline 400 633 8308 that's guangzhou SEPTEMBER 2020 that's shenzhen AD AD AD WWW.THATSMAGS.COM | SEPTEMBER 2020 | 1 《城市漫步》 粤港澳大湾区 英文月刊 主管单位 : 中华人民共和国国务院新闻办公室 Supervised by the State Council Information Office of the People’s Republic of China 主办单位 : 五洲传播出版社 地址 : 北京西城月坛北街 26 号恒华国际商务中心南楼 11 层文化交流中心 11th Floor South Building, Henghua lnternational Business Center, 26 Yuetan North Street, Xicheng District, Beijing http://www.cicc.org.cn 社长 President: 董青 Dong Qing 期刊部负责人 Supervisor of Magazine Department: 付平 Fu Ping 编辑 Editor: 朱莉莉 Zhu Lili 发行 Circulation: 李若琳 Li Ruolin Editor-in-Chief Ryan Gandolfo 甘德发 Arts and Lifestyle Editor Phoebe Kut 吉蓁蓁 Contributors Rakini Bergundy, Matthew Bossons, Joshua Cawthorpe, Bruce Connolly, Larold Davidson, Dale Dolson, Tom Glover, Lindsey Fine, Doris Kee, Dr. Stephen Misch JY INTERNATIONAL CULTURAL COMMUNICATION Guangzhou 广州均盈国际文化传播有限公司 广州市麓苑路 42 号大院 2 号楼 610 室 邮政编码 : 510095 Rm 610, No. 2 Building, Area 42, Luyuan Lu, Guangzhou. Post Code: 510095 电话 : 020-8358 6125 传真 : 020-8357 3859 - 816 Shanghai 上海广告代理 电话 :021-6541 6111 Shenzhen 深圳广告代理 电话 : 0755-3665 4903 Beijing 北京广告代理 电话 : 010-8639 4209 General Manager Henry Zeng 曾庆庆 National Editorial Director Ned Kelly Operations Manager Rachel Tong 童日红 Finance Assistant Sunnie Lü 吕敏瑜 Senior Designer Felix Chen 陈引全 Sales Managers Tina Zhou 周杨, Emma Cao 曹艺凡 National Sales Projects Supervisor Wesley Zhang 张炜 Sales and Advertising Linda Chen 陈璟琳 , Celia Chen 陈琳 , Betty Wang 王斌然 , Rason Wu 伍瑞鑫, Kathy Chen 陈燕筠,Alice Zeng 曾爱淳,Vince Jiao 焦东东,Anita Wang 王靓安 Marketing Supervisor Peggy Ni 倪佩琪 Marketing Executive Wyle Yuan 袁咏妍 General enquiries and switchboard (020) 8358 6125 / [email protected] Editorial (020) 8358 9847 ext 808 / [email protected] Sales (Guangzhou) (020) 8358 9847 ext 802 / [email protected] Distribution/Subscription (020) 8358 7749 ext 828 Listings & Events (Guangzhou) (020) 8358 9847 ext 808. -

GTJA INTERNATIONAL Universe-20150529

GUOTAI JUNAN INTERNATIONAL Universe Weekly Update 国泰君安国际研究股票每周更新 29 May 2015 Code Company name Changes in the past week Earnings Est. chg? YOKU US YOUKU TUDOU Rating is downgraded from accumulate to neutral; 6 to 18 months target price is revised upwards from USD22.00 to USD26.00 Y 01109 HK CR LAND - R 6 to 18 months target price is revised upwards from 28.70 to 29.40 Y QIHU US QIHOO 360 6 to 18 months target price is revised downwards from USD96.00 to USD75.00 Y HMIN US HOME INNS & HOTEL Rating is downgraded from accumulate to neutral; 6 to 18 months target price is revised downwards from USD29.00 to USD28.50 Y 01186 HK CHINA RAIL CONS - H 6 to 18 months target price is revised upwards from 11.50 to 16.50 Y 00992 HK LENOVO GROUP - R 6 to 18 months target price is revised upwards from 13.80 to 14.70 Y 00005 HK HSBC HOLDINGS Rating is neutral; 6 to 18 months target price is 77.89 Y 00322 HK TINGYI Rating is downgraded from neutral to reduce; 6 to 18 months target price is revised downwards from 17.00 to 15.50 Y 02357 HK AVICHINA - H Initial coverage; Rating is accumulate; 6 to 18 months target price is 13.50 N 03800 HK GCL-POLY ENERGY Rating is downgraded from buy to reduce; 6 to 18 months target price is revised downwards from 2.80 to 1.80 Y 01138 HK CHINA SHIP DEV - H 6 to 18 months target price is revised upwards from 6.50 to 7.60 Y 00688 HK CHINA OVERSEAS - R Rating is upgraded from accumulate to buy; 6 to 18 months target price is revised upwards from 24.26 to 36.43 Y 01117 HK CHINA MODERN DAIRY Rating is downgraded from buy to neutral;