Exchanges Advancing Sustainable Finance

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Market Highlights for First Half-Year 2012

23 July 2012 Market highlights for first half-year 2012 The size of global markets (the global market capitalization) increased by 5.3% in the first half of 2012. In Americas and Asia Pacific, the relative good performance of stock markets in the first half of 2012 (market capitalization up 9.1% and 4.6% respectively) was not sufficient for market capitalization to reach the levels observed one year ago, before the sharp decline in the summer 2011. In EAME region, the market capitalization in USD did not grow. It was mainly due to the lower performance of stock markets in Europe following the sovereign debt crisis as well as the exchange rates. In constant USD, the EAME region’s market capitalization did increase by 2.1% in the first half of 2012. In Asia Pacific region, the growth rate of market capitalization in constant USD1 was also higher (+6%) than in current USD. Growth in market capitalization is sometimes the result of an increased number of listed companies, but in the first half of 2011 the total number of listed companies at WFE level was steady. Decline of trading volumes on stock exchange Despite the higher market capitalization, the total value of share trading2 of WFE member exchanges continued to decrease significantly falling 14% in the first half of 2012 after an earlier drop of 4% in second half-year of 2011. The most significant decrease was observed in the Americas region (-20%). This was mostly due to US exchanges (accounting for 90% of the value of share trading) that decreased by 21%. -

Handbook for the Derivatives Market

HANDBOOK FOR THE DERIVATIVES MARKET Bolsa de Santiago February of 2020 Index 1. Applications of this Handbook ............................................................................................ 6 1.1. What is Bolsa de Santiago and CCLV’s Derivatives Market? .................................................... 6 1.2. Information in this Handbook ..................................................................................................... 6 2. Overview .......................................................................................................................................... 7 2.1. Statutory Regulations ................................................................................................................. 7 2.2. Tax Framework .......................................................................................................................... 9 2.3. International Investors ................................................................................................................ 9 2.4. Institutional Regulations ........................................................................................................... 11 2.5. Bolsa de Comercio’s Position .................................................................................................. 12 2.6. CCLV’s Position ....................................................................................................................... 13 2.7. Operating Model ..................................................................................................................... -

Santiago, February 1, 2021 Ger. Gen. No 04/2021

INTERNAL SIGNIFICANT EVENT Enel Américas S.A. Securities Registration Record No. 175 Santiago, February 1, 2021 Ger. Gen. No 04/2021 Mr. Joaquín Cortez Huerta Chairman Financial Market Commission Av. Libertador General Bernardo O’Higgins N°1449 Santiago, Chile Ref: Significant Event Dear Sir, In accordance with articles 9 and 10, paragraph two, under Securities Market Law No. 18,045, and as established under General Norm No. 30 of the Financial Market Commission (FMC), I, duly authorized, hereby inform you that today Enel Américas (“Enel Américas”), in relation to the Merger process approved by Enel Américas’ shareholders at the extraordinary shareholders’ meeting held on December 18, 2020, has been informed of the following: The international merger of the Italian company Enel Rinnovabili S.r.l. with the Chilean company EGP Américas S.p.A. took place today. Representatives of both companies have issued the same declaratory public deed, which they have found to be fully compliant with the formalities, requirements, and procedures applicable under Chilean and Italian law. Pursuant to the Merger, EGP Américas S.p.A. has acquired all the assets and liabilities of the Italian company Enel Rinnovabili S.r.l, including the businesses and non-conventional renewable energy generation assets that Enel Green Power S.p.A. owns and operates in Central and South America (except Chile). Similarly, all consents and authorizations granted by the relevant financial banks in Brazil have been obtained. Now that the Merger has taken place and the consents of the relevant financial banks in Brazil have been obtained, further conditions precedent of the Merger approved by Enel Américas’ shareholders on December 18, 2020, have been met. -

Doing Data Differently

General Company Overview Doing data differently V.14.9. Company Overview Helping the global financial community make informed decisions through the provision of fast, accurate, timely and affordable reference data services With more than 20 years of experience, we offer comprehensive and complete securities reference and pricing data for equities, fixed income and derivative instruments around the globe. Our customers can rely on our successful track record to efficiently deliver high quality data sets including: § Worldwide Corporate Actions § Worldwide Fixed Income § Security Reference File § Worldwide End-of-Day Prices Exchange Data International has recently expanded its data coverage to include economic data. Currently it has three products: § African Economic Data www.africadata.com § Economic Indicator Service (EIS) § Global Economic Data Our professional sales, support and data/research teams deliver the lowest cost of ownership whilst at the same time being the most responsive to client requests. As a result of our on-going commitment to providing cost effective and innovative data solutions, whilst at the same time ensuring the highest standards, we have been awarded the internationally recognized symbol of quality ISO 9001. Headquartered in United Kingdom, we have staff in Canada, India, Morocco, South Africa and United States. www.exchange-data.com 2 Company Overview Contents Reference Data ............................................................................................................................................ -

Market Coverage Spans All North American Exchanges As Well As Major International Exchanges, and We Are Continually Adding to Our Coverage

QuoteMedia Data Coverage 1 03 Equities 04 International Equities 05 Options 05 Futures and Commodities 06-07 Market Indices 08 Mutual Funds, ETFs and UITs 09 FOREX / Currencies 10 Rates Data 11 Historical Data 12 Charting Analytics 13 News Sources 14 News Categories 15 Filings 16-17 Company Financials Data 18 Analyst Coverage and Earnings Estimates 18 Insider Data 19 Corporate Actions and Earnings 19 Market Movers 20 Company Profile, Share Information and Key Ratios 21 Initial Public Offerings (IPOs) 22 Contact Information 2 Equities QuoteMedia’s market coverage spans all North American exchanges as well as major international exchanges, and we are continually adding to our coverage. The following is a short list of available exchanges. North American New York Stock Exchange (NYSE) Canadian Consolidated Quotes (CCQ) • Level 1 • TSX Consolidated Level 1 • TSXV Consolidated Level 1 NYSE American (AMEX) Toronto Stock Exchange (TSX) Level 1 • Level 1 • Market by Price • Market By Order Nasdaq • Market By Broker • Level 1 • Level 2 Canadian Venture Exchange (TSXV) • Total View with Open View • Level 1 • Market by Price Nasdaq Basic+ • Market By Order • Level 1 • Market By Broker OTC Bulletin Board (OTCBB) Canadian Securities Exchange (CNSX) • Level 1 • Level 1 • Level 2 • Level 2 OTC Markets (Pinks) Canadian Alternative Trading Systems • Level 1 • Alpha Level 1 and Level 2 • Level 2 • CSE PURE Level 1 and Level 2 Cboe One • Nasdaq Canada Level 1 and Level 2 • Nasdaq CX2 Level 1 and Level 2 Cboe EDGX • Omega Canada Level 1 and Level 2 • LYNX Level 1 and Level 2 London Stock Exchange (LSE) • NEO and LIT • Level 1 • Instinet Canada (dark pool) • Level 2 • LiquidNet Canada (dark pool) • TriAct MatchNow (dark pool) 3 Equities Cont. -

List of Execution Venues

List of Execution Venues Version 2.0 Effective January 2019 Bank of America Merrill Lynch (“BofAML”) (including its affiliates) uses the following execution venues when obtaining best execution as defined by MiFID. The list detailed below is not exhaustive and may be subject to change and reissued from time to time, as set out in BofAML’s Policy. BofAML may also use other execution venues where it deems appropriate from time to time in accordance with the guidelines set out in the Policy. Regulated Markets of which MLI is a direct member and MTFs Asset class Region accessed by MLI Aquis UK Equities EMEA Athex Group Equities EMEA Bloomberg UK Equities EMEA Borsa Italiana Equities EMEA Cboe UK Equities EMEA Deutsche Borse Xetra Equities EMEA Equiduct Equities EMEA Euronext Amsterdam Equities EMEA Euronext Brussels Equities EMEA Euronext Paris Equities EMEA Euronext Lisbon Equities EMEA Irish Stock Exchange Equities EMEA ITG Posit Equities EMEA London Stock Exchange Equities EMEA NASDAQ OMX Nordic- Copenhagen Equities EMEA NASDAQ OMX Nordic – Helsinki Equities EMEA NASDAQ OMX Nordic – Stockholm Equities EMEA Oslo Børs Equities EMEA Six Swiss Exchange Equities EMEA Tel Aviv Stock Exchange Equities EMEA Trade Web UK Equities EMEA Version 2.0 – January 2019 ©2019 Bank of America Corporation 1 Proprietary List of Execution Venues Version 2.0 Effective January 2019 Turquoise Equities EMEA UBS Equities EMEA Warsaw Stock Exchange Equities EMEA Wiener Börse Equities EMEA Regulated Markets of which BofASE is/will be a direct member and MTFs that are/will be accessed by BofASE subject to BofASE Asset class Region membership approval. -

Exchanges Maturing in Their Sustainability Efforts

WFE Sustainability Survey May 2018 WFE SustainabilityExchanges Survey MayMaturing 2018 Exchangesin Their Maturing Sustainability in Their SustainabilityEfforts Efforts Contents 1. Executive Summary………………………………………………………………………………………………….3 2. Introduction….………….………………………………………………………………………………………………4 3. Survey Results and Discussions………………………………………………………………………….……5 3.1 Exchanges and Sustainability…………………………………………………….…………………………..5 3.2 Transparency and Reporting…………………………………………………….……….…………………..9 3.3 Sustainability Products and Investor Demand……………………………………………………...11 4. Concluding Remarks: Exchanges Maturing in Their ESG Efforts…………………………...13 Annex 1: Survey Approach………………………………………………………………………………………………...14 Annex 2: Survey Respondents…………………………………………………………………………………..……….15 Annex 3: Additional Responses……………………………………………………………………………………….…16 Annex 3: Survey Questionnaire……………………………………………………………………………………….…18 2 1. Executive Summary As sustainable finance becomes increasingly mainstream, exchanges are expanding the scope and extent of their involvement. This 2017 survey of the World Federation of Exchanges' membership examines exchanges sustainability initiatives and highlights exchange efforts to improve ESG disclosure by listed companies, and to enable the financing of a transition to a more sustainable economy. For the first time this year, the WFE asked members about their efforts in relation to the United Nations Sustainable Development Goals (UN SDGs) and the Recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD). -

PRESS RELEASE Contacts: Deborah Fuhr Tel: +44-777-5823-111

PRESS RELEASE Contacts: Deborah Fuhr Tel: +44-777-5823-111 [email protected] Women in ETFs and Five Partner Organizations Ring the Bell for Gender Equality at 34 Stock Exchanges Around the World (4, March 2016) – For the second year in a row, Women in ETFs (WE) will ring the bells at stock exchanges around the world to celebrate International Women’s Day (8 March). This year, WE is partnering with five other organizations in a growing momentum behind gender equality. WE is leading 15 of the 34 stock exchange bell ringings at which WE will also host speakers to present the business case for women’s economic empowerment. To commemorate International Women’s Day, 34 stock exchanges from around the world joined Women in ETFs, UN Global Compact, UN Women, the Sustainable Stock Exchanges (SSE) Initiative, IFC, and the World Federation of Stock Exchanges, to “Ring the Bell for Gender Equality,” raising awareness about the business case for women’s economic empowerment and the opportunities for the private sector to advance gender equality and sustainable development. “There is a natural synergy for WE to celebrate International Women’s Day,” said Joanne Hill, Co- Founder and Co-President of WE and Head of Institutional Investment Strategy at ProShares. “Stock exchanges are a key industry partner in the Exchange Traded Fund industry globally with whom WE and its members maintain strong ongoing relationships in our chapters around the globe. Stock exchanges provide a natural high-visibility platform in which to amplify the gender equality message”, continued Hill. “Studies such as the new survey by the Peterson Institute for International Economics of 21,980 publicly traded companies in 91 countries demonstrates that the presence of more female leaders in top positions of corporate management correlates with increased profitability of these companies” said Deborah Fuhr, Co-Founder of WE and Managing Partner of ETFGI. -

Financial Statements 2019

FINANCIAL STATEMENTS 2019 MANAGEMENT REPORT - 2019 Dear Shareholders, B3 S.A. - Brasil, Bolsa, Balcão (“B3” or “Company”) hereby submits for your appreciation the Management Report regarding the activities performed in 2019. HIGHLIGHTS OF THE YEAR 2019 consolidated a new era for the financial and capital markets in Brazil. Driven by historically low interest rates and supported by B3's infrastructure, our customers were able to substantially increase their business opportunities, creating operational records in both the listed and over-the-counter markets. The average daily traded volume in the cash equities market totaled R$16.7 billion (against R$11.9 billion in 2018) and the average daily volume on the listed derivatives market was 3.9 million contracts (against 3.0 million in 2018). The new level reached by the Brazilian capital markets is also demonstrated by the almost R$90 billion raised through 42 public equity offerings during the year and by the more than 70% growth in the average number of accounts in the cash equities depository, mainly in retail accounts. To enable this market expansion with the level of excellence expected by its clients, B3 intensified its initiatives on three strategic pillars: i) operational excellence, ii) services and product development, and iii) pricing and tariff model, always focusing on the client, and maintaining the commitment to its responsibility before the regulatory bodies and society, as a financial market infrastructure. The availability of the platforms, a key metric for assessing B3's operational integrity and strength, registered 99.96% in 2019, as a result of the Company's continuing investments in cutting-edge technology that guarantees increased capacity and performance gains, as well as of the efficiency produced by the consolidation of its data centers. -

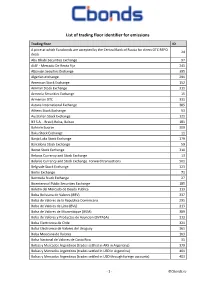

List of Trading Floor Identifier for Emissions

List of trading floor identifier for emissions Trading floor ID A price at which Eurobonds are accepted by the Central Bank of Russia for direct OTC REPO 24 deals Abu Dhabi Securities Exchange 97 AIAF - Mercado De Renta Fija 241 Albanian Secuities Exchange 395 Algerian exchange 291 American Stock Exchange 152 Amman Stock Exchange 311 Armenia Securities Exchange 15 Armenian OTC 331 Astana International Exchange 385 Athens Stock Exchange 53 Australian Stock Exchange 121 B3 S.A. - Brasil, Bolsa, Balcao 181 Bahrain Bourse 309 Baku Stock Exchange 11 Banja Luka Stock Exchange 179 Barcelona Stock Exchange 59 Beirut Stock Exchange 310 Belarus Currency and Stock Exchange 13 Belarus Currency and Stock Exchange. Forward transactions 501 Belgrade Stock Exchange 123 Berlin Exchange 71 Bermuda Stock Exchange 27 Bicentennial Public Securities Exchange 185 Boletin del Mercado de Deuda Publica 113 Bolsa Boliviana de Valores (BBV) 337 Bolsa de Valores de la Republica Dominicana 295 Bolsa de Valores de Lima (BVL) 213 Bolsa de Valores de Mozambique (BVM) 389 Bolsa de Valores y Productos de Asuncion (BVPASA) 313 Bolsa Electronica de Chile 321 Bolsa Electronica de Valores del Uruguay 361 Bolsa Mexicana de Valores 103 Bolsa Nacional de Valores de Costa Rica 31 Bolsas y Mercados Argentinos (trades settled in ARS in Argentina) 379 Bolsas y Mercados Argentinos (trades settled in USD in Argentina) 401 Bolsas y Mercados Argentinos (trades settled in USD through foreign accounts) 403 - 1 - ©Cbonds.ru Trading floor ID BondSpot 69 Borsa Istanbul (International Bonds -

How Stock Exchanges Can Grow Green Finance a Voluntary Action Plan

The SSE is organized by: HOW STOCK EXCHANGES CAN GROW GREEN FINANCE A VOLUNTARY ACTION PLAN www.SSEinitiative.org NOTE ABOUT THE SSE The designations employed and the presentation of the material in The SSE initiative is organized by UNCTAD, UN Global Compact, this paper do not imply the expression of any opinion whatsoever on UN Environment Finance Initiative and the UN-supported Principles the part of the Secretariat of the United Nations concerning the legal for Responsible Investment. The initiative was launched in 2009 by status of any country, territory, city or area, or of its authorities, or the United Nations Secretary-General as a peer-to-peer learning concerning the delimitation of its frontiers or boundaries. platform for exploring how exchanges (in collaboration with policymakers, regulators, investors and companies) can promote This paper is intended for learning purposes. The inclusion of responsible investment for sustainable development. company names and examples does not constitute an endorsement of the individual exchanges or organisations by UNCTAD, UN Global Compact, UNEP or PRI. Material in this paper may be freely quoted or reprinted, but acknowledgement is requested. A copy of the publication containing the quotation or reprint should be sent to [email protected]. ACKNOWLEDGEMENTS This paper was prepared in the context of the United Nations Sustainable Stock Exchanges (SSE) initiative, a joint initiative of UNCTAD, UN Global Compact, UNEP Finance Initiative and the UN-supported Principles for Responsible Investment. The paper was prepared by Tiffany Grabski (UNCTAD & PRI) and Anthony Miller (UNCTAD) with substantive contributions from Richard Bolwijn (UNCTAD), Danielle Chesebrough (PRI & UN Global Compact), Elodie Feller (UN Environment FI), Will Martindale (PRI), and Melanie Paty (PRI), with additional research support from Kan Li and Peter Wey (interns). -

2018 SSE Report on Progress

The SSE is a UN Partnership Program of: 2018 REPORT ON PROGRESS A paper prepared for the Sustainable Stock Exchanges 2018 Global Dialogue 2018 REPORT ON PROGRESS NOTE Additional substantive contributions were received from Richard Bolwijn (UNCTAD), Danielle Chesebrough The designations employed and the presentation of (PRI & UN Global Compact), Elodie Feller (UNEP FI) the material in this paper do not imply the expression of and Will Martindale (PRI). any opinion whatsoever on the part of the Secretariat of the United Nations concerning the legal status of This paper is presented as an informal contribution any country, territory, city or area, or of its authorities, to the discussions at the SSE Global Dialogue on 23 or concerning the delimitation of its frontiers or October 2018, which takes place within the UNCTAD boundaries. World Investment Forum in Geneva, Switzerland. The views expressed in this paper are those of UNCTAD, This paper is intended for learning purposes. The the UN Global Compact, UN Environment and the PRI inclusion of company names and examples does not unless otherwise stated. constitute an endorsement of the individual exchanges or organisations by the United Nations Conference on The manuscript was edited by Mark Nicholls. The Trade and Development (UNCTAD), the UN Global report was typeset and the charts and infographics Compact, UN Environment or the Principles for designed by Pablo Cortizo. Responsible Investment (PRI). Material in this paper may be freely quoted or reprinted, ABOUT THE SSE but acknowledgement is requested. A copy of the publication containing the quotation or reprint should The SSE initiative is a UN Partnership Programme be sent to [email protected].