Testing for Arbitrage Opportunities Within the Foreign Exchange Market

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Teaching the Bid-Ask Spread and Triangular Arbitrage for the Foreign Exchange Market Jeng-Hong Chen, Central State University, USA

American Journal of Business Education – Fourth Quarter 2018 Volume 11, Number 4 Teaching The Bid-Ask Spread And Triangular Arbitrage For The Foreign Exchange Market Jeng-Hong Chen, Central State University, USA ABSTRACT The foreign exchange (FX) market is an important chapter in international finance. Understanding the market microstructure is critical for learning the FX market. To assist students better understand the FX market microstructure, an instructor can use an event study with minute-by-minute quote data provided in the Excel assignment, asking students to investigate the impact of an event on the bid-ask spread and triangular arbitrage opportunities. This pedagogical paper provides two examples of making the Excel assignment for reference. Keywords: Foreign Exchange; Bid-Ask Spread; Triangular Arbitrage INTRODUCTION nderstanding the foreign exchange (FX) market is essential for learning international finance. Eun and Resnick (2015) describe the FX market’s structure, participants, and quotations. The FX market is a U decentralized or over-the-counter (OTC) market without common trading floor. The FX market is open 24 hours a day. There are several financial centers with different time zones in the world. When the trading of one currency is closed at one financial center, it continues on the other financial center with the different time zone. International banks serve as dealers who make a market by standing ready to buy or sell foreign currencies for their own accounts. The bid price represents the price a bank dealer is willing to buy for a currency and the ask price is the price a bank dealer is willing to sell for a currency. -

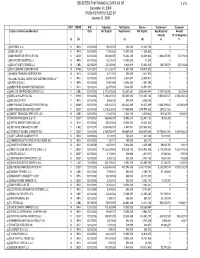

SELECTED FCM FINANCIAL DATA AS of December 31, 2008 FROM

SELECTED FCM FINANCIAL DATA AS OF 1 of 5 December 31, 2008 FROM REPORTS FILED BY January 31, 2009 B/D? DSRO A/O Adjusted Net Capital Excess Customers' Customer Futures Commission Merchant Date Net Capital Requirement Net Capital Seg Required Amount 4d(a)(2) Pt. 30 Required (a) (b) (c) (d) (e) (f) 1 3D FOREX, LLC N NFA 12/31/2008 18,931,722 500,000 18,431,722 0 0 2 ACM USA LLC N NFA 12/31/2008 11,575,482 10,000,000 1,575,482 0 0 3 ADM INVESTOR SERVICES INC N CBOT 12/31/2008 154,941,097 74,632,265 80,308,832 1,864,327,056 72,071,646 4 ADVANCED MARKETS LLC N NFA 12/31/2008 10,071,373 10,000,000 71,373 0 0 5 ADVANTAGE FUTURES LLC N CME 12/31/2008 25,081,866 6,446,918 18,634,948 188,738,579 32,311,026 6 AIG CLEARING CORPORATION N NYME 12/31/2008 321,823,187 11,903,795 309,919,392 0 0 7 ALARON TRADING CORPORATION N NFA 12/31/2008 3,711,574 500,000 3,211,574 0 0 8 ALLIANZ GLOBAL INVESTORS DISTRIBUTORS LLC * Y NFA 12/31/2008 27,457,078 6,847,647 20,609,431 0 0 9 ALPARI (US) LLC N NFA 12/31/2008 17,497,095 10,000,000 7,497,095 0 0 10 AMERIPRISE ADVISOR SERVICES INC Y NFA 12/31/2008 22,077,618 5,346,567 16,731,051 0 0 11 BANC OF AMERICA SECURITIES LLC Y CME 12/31/2008 3,171,801,285 166,357,841 3,005,443,444 1,007,978,026 16,837,469 12 BARCLAYS CAPITAL INC Y NYME 12/31/2008 7,878,067,153 500,000,000 7,378,067,153 5,993,650,575 2,976,258,742 13 BGC SECURITIES Y NFA 12/31/2008 8,855,236 500,000 8,355,236 0 0 14 BNP PARIBAS COMMODITY FUTURES INC N NYME 12/31/2008 322,615,874 242,242,565 80,373,309 2,668,759,643 445,566,495 15 BNP PARIBAS SECURITIES -

Page 01 Nov 25.Indd

ISO 9001:2008 CERTIFIED NEWSPAPER Sunday 25 November 2012 11 Muharram 1434 - Volume 17 Number 5529 Price: QR2 Al Sada opens Cook and CNG fuelling Pietersen station defy India Business | 21 Sport | 32 www.thepeninsulaqatar.com [email protected] | [email protected] Editorial: 4455 7741 | Advertising: 4455 7837 / 4455 7780 Khalfan trains guns on Aljazeera Kenyan arrested over Dubai police chief accuses channel of ignoring protests in Egypt murder of US woman DOHA: Known for Brotherhood- DOHA: The law-enforcement Al Sharq briefly reported yes- bashing, outspoken Dubai Police agencies here have arrested terday that an ‘African national’ Chief, Dahi Khalfan, has now a Kenyan security guard sus- suspected of killing an ‘expatri- aimed his guns at Aljazeera pected of killing an American ate’ last week had been taken TV Channel and criticised it woman who was teaching at a into custody and that he had severely for what he claimed school in Al Wakra, US-based confessed to the crime. was the Channel turning a blind newspaper, The Morning Call, Jennifer, according to The eye to Friday’s protests against reported yesterday. Morning Call, had been teach- President Mohammed Mursi in The newspaper identified ing pre-school children in her Egypt. the victim as Jennifer Brown, Al Wakra school since last Khalfan said he had lost trust a 40-year-old woman from Jim September. in Aljazeera and called on fellow Thorpe, a borough in Carbon “She was a good kid, a beauti- GCC nationals to boycott the County, Pennsylvania, and said ful girl,” her father was quoted popular Arabic Channel. -

SPOT MARKETS for FOREIGN CURRENCY Markets by Location and by Currency Markets by Delivery Date

Spot Markets P. Sercu, International Finance: Theory into Practice Overview Part II The Currency Market and its Satellites Spot Markets P. Sercu, International Finance: Theory into Practice Overview Chapter 3 Spot Markets for Foreign Exchange Overview Spot Markets Exchange Rates P. Sercu, HC FC International The / Convention (—ours) Finance: Theory into The FC/HC Convention Practice Bid and Ask Primary and Cross Rates Overview Inverting bid and asks Major Markets for Foreign Exchange How Exchange Markets Work Markets by Location and by Currency Markets by Delivery Date The Law Of One Price in Spot Mkts Price Differences Across Market Makers Triangular Arbitrage and the LOP PPP Exchange Rates and Real Rates PPP Exchange Rates The Real Rate or Deviation from APPP Is the RER constant? Devs from RPPP What have we learned in this chapter? Overview Spot Markets Exchange Rates P. Sercu, HC FC International The / Convention (—ours) Finance: Theory into The FC/HC Convention Practice Bid and Ask Primary and Cross Rates Overview Inverting bid and asks Major Markets for Foreign Exchange How Exchange Markets Work Markets by Location and by Currency Markets by Delivery Date The Law Of One Price in Spot Mkts Price Differences Across Market Makers Triangular Arbitrage and the LOP PPP Exchange Rates and Real Rates PPP Exchange Rates The Real Rate or Deviation from APPP Is the RER constant? Devs from RPPP What have we learned in this chapter? Overview Spot Markets Exchange Rates P. Sercu, HC FC International The / Convention (—ours) Finance: Theory into The FC/HC Convention Practice Bid and Ask Primary and Cross Rates Overview Inverting bid and asks Major Markets for Foreign Exchange How Exchange Markets Work Markets by Location and by Currency Markets by Delivery Date The Law Of One Price in Spot Mkts Price Differences Across Market Makers Triangular Arbitrage and the LOP PPP Exchange Rates and Real Rates PPP Exchange Rates The Real Rate or Deviation from APPP Is the RER constant? Devs from RPPP What have we learned in this chapter? Overview Spot Markets Exchange Rates P. -

Financial Technology Sector Summary

Financial Technology Sector Summary February 11, 2016 Financial Technology Sector Summary Financial Technology Sector Summary Table of Contents I. GCA Savvian Overview II. Market Summary III. Payments / Banking IV. Securities / Capital Markets / Data & Analytics V. Healthcare / Insurance 2 Financial Technology Sector Summary I. GCA Savvian Overview 3 Financial Technology Sector Summary GCA Savvian Overview Independent Investment Bank Focused on Growth Sectors of the Global Economy » Leading provider of mergers and acquisitions, 7+ AREAS OF INDUSTRY EXPERTISE private capital agency and capital markets advisory services, and private funds services Financial Technology Business & Tech Enabled Services » Headquarters in San Francisco and offices in Media & Digital Media Industrial Technology New York, London, Tokyo, Osaka, Singapore, Telecommunications Healthcare Mumbai, and Shanghai » Majority of U.S. senior bankers previously with Goldman Sachs, Morgan Stanley, Robertson Stephens, and JPMorgan 100+ CROSS - BORDER TRANSACTIONS » Senior level attention and focus, extensive transaction experience and deep domain insight 20+ REPRESENTATIVE COUNTRIES » Focused on providing strategic advice for our clients’ long-term success 580+ CLOSED TRANSACTIONS » 225+ investment banking professionals $145BN+ OF TRANSACTION VALUE 4 Financial Technology Sector Summary GCA Savvian Overview Financial Technology Landscape » GCA Savvian divides Financial Technology Financial Technology into three broad categories − Payments & Banking − Securities & Capital Markets -

Triangular Arbitrage • Covered Interest Arbitrage

Chapter 7 International Arbitrage And Interest Rate Parity 6A. 1 Key Objectives To explain the conditions that will lead to various forms of currency arbitrage, along with the currency realignments that will occur in response; and To explain the concept of interest rate parity, and how parity condition prevents foreign exchange arbitrage opportunities. 6A. 2 International Arbitrage • Arbitrage can be defined as capitalizing on a discrepancy in quoted prices to make a risk-free profit. • The effect of arbitrage on demand and supply is to cause prices to realign, such that risk-free profit is no longer feasible. • International Arbitragers play a critical role in facilitating exchange rate equilibrium. They try to earn a risk-free profit whenever there is exchange rate disequilibrium. 6A. 3 International Arbitrage • As applied to foreign exchange and international money markets, international arbitrage (i.e., taking risk-free positions by buying and selling currencies simultaneously) takes three major forms: • locational arbitrage • triangular arbitrage • covered interest arbitrage 6A. 4 Locational Arbitrage • Locational arbitragers try to offset spot bid-ask exchange rate disequilibrium • Locational arbitrage is possible when a bank’s buying price (bid price) is higher than another bank’s selling price (ask price) for the same currency. Example Bank C Bid Ask Bank D Bid Ask NZ$ $.635 $.640 NZ$ $.645 $.650 Buy NZ$ from Bank C @ $.640, and sell it to Bank D @ $.645. Profit = $.005/NZ$. 6A. 5 Triangular Arbitrage • Triangular arbitragers try to offset cross-rate disequilibrium • Triangular arbitrage is possible when a cross exchange rate (exchange rate between two foreign currencies) quoted by a bank differs from the cross rate calculated from dollar-based spot rate quotes. -

Algorithmic Trading in the Foreign Exchange Market

Rise of the Machines: Algorithmic Trading in the Foreign Exchange Market Alain Chaboud, Benjamin Chiquoine, Erik Hjalmarsson, Clara Vega Chaboud and Vega are with the Federal Reserve Board in Washington, DC; Chiquoine is with the Stanford Management Company, Stanford, CA. Hjalmarsson is with the Centre for Finance at University of Gothenburg and Queen Mary University of London. Executive Summary The use of algorithmic trading (AT), where computers monitor markets and manage the trading process at high frequency, has become common in major financial markets in recent years, beginning in the U.S. equity market in the 1990s. Since the introduction of algorithmic trading, there has been widespread interest in understanding the potential impact it may have on market dynamics, particularly recently following several trading disturbances in the equity market blamed on computer- driven trading. While some have highlighted the potential for more efficient price discovery, others have expressed concern that it may lead to higher adverse selection costs and excess volatility. In our study, we analyze the effect algorithmic (“computer”) trades and non-algorithmic (“human”) trades have on the informational efficiency of foreign exchange prices. In particular, we look at two distinct aspects of (in-)efficiency in the foreign exchange market: triangular arbitrage opportunities and “excess” volatility in high-frequency returns. We rely on a novel data set consisting of several years (September 2003 to December 2007) of minute-by-minute trading data from Electronic Broking Services (EBS) in three currency pairs: the euro-dollar, dollar-yen, and euro-yen. The data represent a large share of spot interdealer transactions across the globe in these exchange rates, with EBS widely considered to be the primary site of price discovery in these currency pairs during our sample period. -

Proshares Trust Ii Prospectus S

Filed pursuant to Rule 424(b)(3) Registration No. 333-253088 PROSHARES TRUST II Common Units of Beneficial Interest Proposed Maximum Aggregate Offering Price Title of Securities to be Registered Benchmark Per Fund ProShares VIX Short-Term Futures ETF (VIXY) S&P 500® VIX Short-Term Futures Index $ 1,128,860,082 ProShares Ultra VIX Short-Term Futures ETF (UVXY) S&P 500® VIX Short-Term Futures Index $ 6,066,240,184 ProShares Short VIX Short-Term Futures ETF (SVXY) S&P 500® VIX Short-Term Futures Index $ 1,418,967,805 ProShares Trust II (the “Trust”) is a Delaware statutory trust organized into separate series. The Trust may from time to time offer to sell common units of beneficial interest (“Shares”) of any or all of the series of the Trust listed above (each, a “Fund” and collectively, the “Funds”) or other series of the Trust. Shares represent units of fractional undivided beneficial interest in and ownership of a series of the Trust. Each Fund’s Shares are offered on a continuous basis. The Shares of each Fund are listed for trading on Cboe BZX Exchange, Inc. (the “Exchange”) under the ticker symbol shown above next to each Fund’s name. Please note that the Trust has series other than the Funds. The ProShares VIX Short-Term Futures ETF (the “Matching Fund”) seeks investment results, before fees and expenses, that match the performance of the S&P 500 ® VIX Short-Term Futures Index (the “Index”). The ProShares Short VIX Short-Term Futures ETF (the “Short Fund”) seeks daily investment results, before fees and expenses, that correspond to one-half the inverse (-0.5x) of the performance of the Index for a single day, not for any other period. -

The Foreign Exchange Markets Spot Quotes, Bid-Ask Spreads, Spot

Week 3 The Foreign Exchange Markets Spot quotes, bid-ask spreads, triangular arbitrage. Forward rates FINOPMGT 413 Spot and Forward Markets • Foreign exchange trading occurs in two separate, but connected, markets: Spot and the Forward market. • Spot market: Buying and selling of f/x with settlibidfdlement in 2 business days from today. • Forward market: Settlement occurs at some future dtdate. – That is, you may enter into a forward contract to buy 10 million Yen 90 days from today . FINOPMGT 413 F/X Rate Quotes • We can view F/X rates as quotes in direct or indirect terms. • Direct: a direct f/x quote is in units of domestic currency per unit of foreign currency [DC/FC]. – For exampp,le, a q uote of the USD-British Pound is direct for the US$ if it is quoted as 1.9631US$/BP. • Indirect: an indirect f/x quote is in units of foreign currency per unit of domestic currency [FC/DC]. – Example: 106.86 Yen/US$ is an indirect quote for the US$ (but direct quote for the Yen). • We will interpret every quote as being “direct”: DC/FC. Therefore , we will always think of whichever country is in the denominator as being the “foreign” country. Please always remember this convention. FINOPMGT 413 Appreciation/Depreciation • A currency is said to appreciate (depreciate) against a foreign currency if you can buy more (less) foreign currency per unit of domestic currency . • Examples: The WSJ reported the following on Wednesday – “Yesterday afternoon in New York, the euro was at $1.4635 from $1. 4827 late Monda y” . -

A Non-Linear Analysis of Operational Risk and Operational Risk Management in Banking Industry

University of Wollongong Research Online University of Wollongong Thesis Collection 2017+ University of Wollongong Thesis Collections 2017 A non-linear analysis of operational risk and operational risk management in banking industry Yifei Li University of Wollongong Follow this and additional works at: https://ro.uow.edu.au/theses1 University of Wollongong Copyright Warning You may print or download ONE copy of this document for the purpose of your own research or study. The University does not authorise you to copy, communicate or otherwise make available electronically to any other person any copyright material contained on this site. You are reminded of the following: This work is copyright. Apart from any use permitted under the Copyright Act 1968, no part of this work may be reproduced by any process, nor may any other exclusive right be exercised, without the permission of the author. Copyright owners are entitled to take legal action against persons who infringe their copyright. A reproduction of material that is protected by copyright may be a copyright infringement. A court may impose penalties and award damages in relation to offences and infringements relating to copyright material. Higher penalties may apply, and higher damages may be awarded, for offences and infringements involving the conversion of material into digital or electronic form. Unless otherwise indicated, the views expressed in this thesis are those of the author and do not necessarily represent the views of the University of Wollongong. Recommended Citation Li, Yifei, A non-linear analysis of operational risk and operational risk management in banking industry, Doctor of Philosophy thesis, School of Accounting, Economics and Finance, University of Wollongong, 2017. -

Execution Risk and Arbitrage Opportunities in the Foreign Exchange Markets

NBER WORKING PAPER SERIES EXECUTION RISK AND ARBITRAGE OPPORTUNITIES IN THE FOREIGN EXCHANGE MARKETS Takatoshi Ito Kenta Yamada Misako Takayasu Hideki Takayasu Working Paper 26706 http://www.nber.org/papers/w26706 NATIONAL BUREAU OF ECONOMIC RESEARCH 1050 Massachusetts Avenue Cambridge, MA 02138 January 2020 The views expressed herein are those of the authors and do not necessarily reflect the views of the National Bureau of Economic Research. At least one co-author has disclosed a financial relationship of potential relevance for this research. Further information is available online at http://www.nber.org/papers/w26706.ack NBER working papers are circulated for discussion and comment purposes. They have not been peer-reviewed or been subject to the review by the NBER Board of Directors that accompanies official NBER publications. © 2020 by Takatoshi Ito, Kenta Yamada, Misako Takayasu, and Hideki Takayasu. All rights reserved. Short sections of text, not to exceed two paragraphs, may be quoted without explicit permission provided that full credit, including © notice, is given to the source. Execution Risk and Arbitrage Opportunities in the Foreign Exchange Markets Takatoshi Ito, Kenta Yamada, Misako Takayasu, and Hideki Takayasu NBER Working Paper No. 26706 January 2020 JEL No. F31,G12,G14,G15,G23,G24 ABSTRACT With the high-frequency data of firm quotes in the transaction platform of foreign exchanges, arbitrage profit opportunities—in the forms of a negative bid-ask spread of a currency pair and triangular transactions involving three currency pairs—can be detected to emerge and disappear in the matter of seconds. The frequency and duration of such arbitrage opportunities have declined over time, most likely due to the emergence of algorithmic trading. -

Banking Litigation Law Review Banking Litigation Law Review

the Banking Litigation Law Review Law Litigation Banking Banking Litigation Law Review Fourth Edition Editor Deborah Finkler Fourth Edition Fourth lawreviews © 2020 Law Business Research Ltd Banking Litigation Law Review Fourth Edition Reproduced with permission from Law Business Research Ltd This article was first published in December 2020 For further information please contact [email protected] Editor Deborah Finkler lawreviews © 2020 Law Business Research Ltd PUBLISHER Tom Barnes SENIOR BUSINESS DEVELOPMENT MANAGER Nick Barette BUSINESS DEVELOPMENT MANAGER Joel Woods SENIOR ACCOUNT MANAGERS Pere Aspinall, Jack Bagnall ACCOUNT MANAGERS Olivia Budd, Katie Hodgetts, Reece Whelan PRODUCT MARKETING EXECUTIVE Rebecca Mogridge RESEARCH LEAD Kieran Hansen EDITORIAL COORDINATOR Tommy Lawson PRODUCTION AND OPERATIONS DIRECTOR Adam Myers PRODUCTION EDITOR Felicia Rosas SUBEDITOR Martin Roach CHIEF EXECUTIVE OFFICER Nick Brailey Published in the United Kingdom by Law Business Research Ltd, London Meridian House, 34–35 Farringdon Street, London, EC4A 4HL, UK © 2020 Law Business Research Ltd www.TheLawReviews.co.uk No photocopying: copyright licences do not apply. The information provided in this publication is general and may not apply in a specific situation, nor does it necessarily represent the views of authors’ firms or their clients. Legal advice should always be sought before taking any legal action based on the information provided. The publishers accept no responsibility for any acts or omissions contained herein. Although