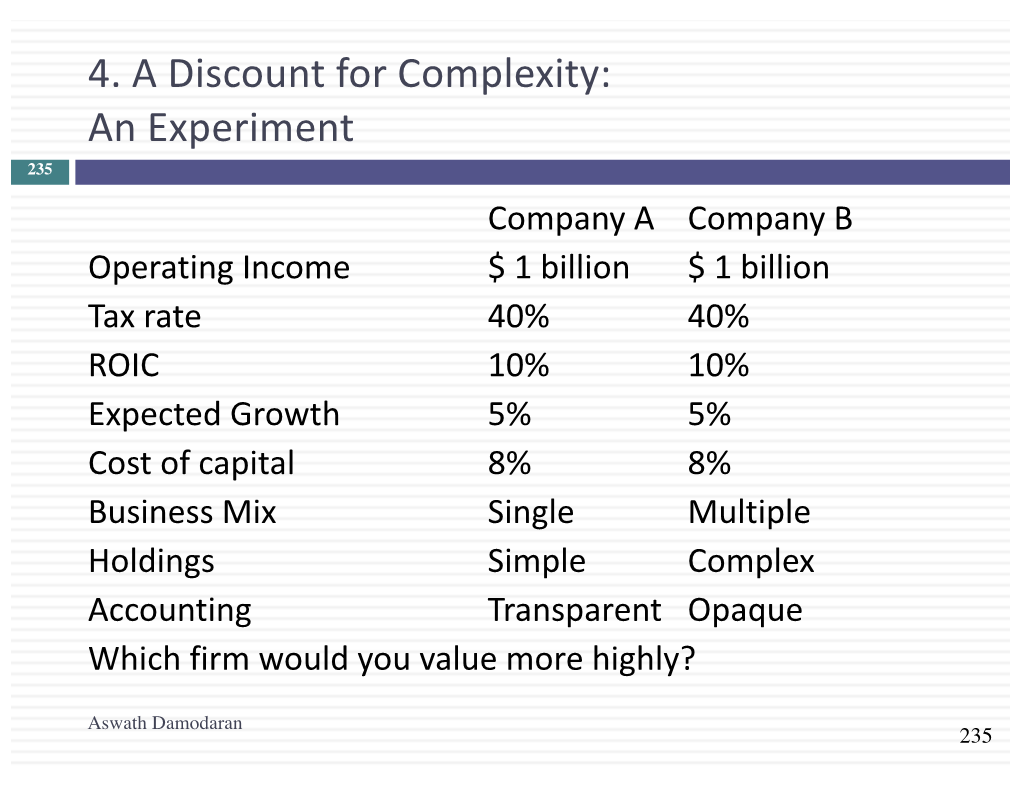

4. a Discount for Complexity: an Experiment

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Appendix 10 Glossary of Terms Related to Venture Capital and Other Private Equity Or Debt Financing

APPENDIX 10 GLOSSARY OF TERMS RELATED TO VENTURE CAPITAL AND OTHER PRIVATE EQUITY OR DEBT FINANCING 401(K) Plan: A type of qualified retirement plan in which employees make salary-reduced, pre-tax contributions to an employee trust. In many cases, the employer will match employee contributions up to a specified level. - A - Accredited Investor: Rule 501 of the SEC regulations defines an individual accredited investor as: “Any natural person whose individual net worth or joint net worth with that person’s spouse at the time of his purchase exceeds $1,000,000”; OR “Any natural person who had an individual income in excess of $200,000 in each of the two most recent years or joint income with that person’s spouse in excess of $300,000 in each of those years and has a reasonable expectation of reaching the same income level in the current year.” For the complete definition of “accredited investor,” see the SEC web site. Accrued Interest: The interest due on preferred stock or a bond since the last interest payment was made. ACRS: Accelerated Cost Recovery System. The IRS-approved method of calculating depreciation expense for tax purposes. Also known as Accelerated Depreciation. ADR: American Depositary Receipt (ADRs). A security issued by a U.S. bank in place of the foreign shares held in trust by that bank, thereby facilitating the trading of foreign shares in U.S. markets. Advisory Board: A group of external advisors to a private equity group or portfolio company. Advice provided varies from overall strategy to portfolio valuation. Less formal than a Board of Directors. -

Modification of the Warrants Pricing Model and Validation Analysis

International Journal of Business and Management February, 2008 Modification of the Warrants Pricing Model and Validation Analysis Jinlong Chen & Qinhong Li College of Business Administration, Huaqiao Unversity, Quanzhou 362021, China Tel: 86-595-2269 2437 E-mail: [email protected] Abstract Based on the previous study in this article, modified Black-Sholes model was more suitable for the domestic warrants price, and calculated 6 warrants’ price in the listed time, It also confirmed the rationality of the model comparing the pricing theory with the actual market price. The result of the computation of the modified warrant price model shows that though in the warrant market the realistic price deviates from theoretical price, the deviations of realistic and theoretical prices is smaller from May, 2006 to May, 2007. Keywords: Call warrants, Black-Sholes model, Market present status 1. Introduction Has been published since the Black-Sholes option valuation model (Black, Scholes, 1973) for its computation convenience and the theoretically consummation, it is widely applied. At the same time the researchers have studied it deeply because of its strict supposition and expanded its assumptions greatly and made it more realistic. Now the warrant pricing theory research is generally based on the B-S option valuation model. Merton relaxed the assumption on the risk-free interest rate as constant and the pricing model that allows rate is a random variable (Merton., 1973). Under the assumption of the effective capital market, Galai and Schneller (Galai, Schneller, 1987) put forward warrant pricing model considering the flow of the dilution effect through the analysis of single-phase and multi-phase framework and inspected that the warrants issued affected the firm value. -

Goldman Sachs & Co. LLC Bofa Securities Cowen

Table of Contents Filed Pursuant to Rule 424(b)(5) Registration No. 333-236489 The information in this preliminary prospectus supplement is not complete and may be changed. A registration statement relating to these securities has been filed with the Securities and Exchange Commission and is effective. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell these securities and they are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted. Subject to Completion Preliminary Prospectus Supplement dated May 18, 2020 PROSPECTUS SUPPLEMENT (To prospectus dated February 18, 2020) $400,000,000 Common Stock We are offering up to $400,000,000 of our common stock in this offering. Our common stock is quoted on the Nasdaq Global Select Market under the symbol “BLUE.” On May 15, 2020, the last reported sale price of our common stock was $56.66 per share, as reported on the Nasdaq Global Select Market. Investing in our common stock involves risks. See “Risk Factors” beginning on page S-13 of this prospectus supplement and in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020, which is incorporated herein by reference. Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense. Per Share Total Public offering price $ $ Underwriting discounts and commissions $ $ Proceeds, before expenses, to bluebird bio, Inc. -

Taronis Technologies Acquisition

Taronis Technologies Acquisition Continuing with build-and-buy strategy Alternative energy 5 February 2019 Taronis Technologies (formerly MagneGas) has continued with its ‘buy- and-build’ strategy, recently completing the acquisition of one of the Price US$2.99 largest remaining independent industrial gas and welding supply Market cap US$28m distributors in East Texas for $2.5m in cash. Together with the acquisitions completed during 2018, this takes the group closer to achieving its goal of Net cash (US$m) at end September 2018 0.9 creating a profitable platform for selling metal-cutting gases and Shares in issue (after 20:1 9.3m associated products. The cash generated from gas sales will be used to reverse share split) help commercialise its proprietary technology for renewable fuel Free float 99.9% gasification and water decontamination. Code MNGA Revenue EBITDA PBT* EPS* DPS EV/Sales Primary exchange NASDAQ Year end (US$m) (US$m) (US$m) (US$) (US$) (x) Secondary exchange N/A 12/16 3.6 (9.6) (10.3) (620.5)** 0.0 7.5 12/17 3.7 (10.3) (11.0) (306.2)** 0.0 7.3 Share price performance 12/18e 10.0 (11.5) (13.7) (4.29)** 0.0 2.7 12/19e 18.8 (5.6) (7.3) (0.79)** 0.0 1.4 Note: *PBT and EPS are normalised, excluding amortisation of acquired intangibles, exceptional items and share-based payments. **Adjusted for reverse share splits. Acquisition strengthens presence in key geography In January, Taronis completed the acquisition of a substantial independent industrial gas and welding supply distributor in East Texas, thus adding c $3.7m annualised sales and strengthening its retail network in the key Greater Texas region. -

Constraining Dominant Shareholders' Self-Dealing: the Legal Framework in France, Germany, and Italy Pierre-Henri Conac University of Luxembourg

Fordham Law School FLASH: The Fordham Law Archive of Scholarship and History Faculty Scholarship 2007 Constraining Dominant Shareholders' Self-dealing: The Legal Framework in France, Germany, and Italy Pierre-Henri Conac University of Luxembourg Luca Enriques Harvard Law School Martin Gelter Fordham University School of Law, [email protected] Follow this and additional works at: http://ir.lawnet.fordham.edu/faculty_scholarship Part of the Business Organizations Law Commons, International Law Commons, and the Securities Law Commons Recommended Citation 4 ECFR 491 (2007) This Article is brought to you for free and open access by FLASH: The orF dham Law Archive of Scholarship and History. It has been accepted for inclusion in Faculty Scholarship by an authorized administrator of FLASH: The orF dham Law Archive of Scholarship and History. For more information, please contact [email protected]. Constraining Dominant Shareholders' Self-Dealing: The Legal Framework in France, Germany, and Italy by PIERRE-HENRI CONAc*, LUCA ENRIQUES**, MARTIN GELTER*** All jurisdictions supply corporations with legal tools to prevent or punish asset diversion by those, whether managers or dominant shareholders, who are in control. As previous research has shown, these rules, doctrines and re- medies arefar from uniform across jurisdictions,possibly leading to significant differences in the degree of investor protection they provide. Comparative research in this field is wrought with difficulty. It is tempting to compare corporate laws by taking one benchmark jurisdiction,typically the US, and to assess the quality of other corporate law systems depending on how much they replicate some prominent features. We take a different perspective and de- scribe how three major continental European countries (France, Germany, and Italy) regulate dominant shareholders' self-dealing by looking at all the possible rules, doctrines and remedies available there. -

Some Thoughts on Stock Dilution Part 1 $TPB

Some Thoughts on Stock Dilution Part 1 $TPB Note: this article started out as one article, but I decided to split it into two separate articles and link the two of them to 1) make it easier to link to specific ideas in the future, 2) break up what was becoming a long article, and 3) because #pageviews. You can find Part 2 here. I spent a good deal of time last week looking at Turning Point Brands (TPB). It’d been on my list for a while (from this VIC write up), and the upcoming close of the Reynolds / British American Tobacco deals plus some press around smokeless tobacco made me want to look a bit deeper. And I found a lot to like: 1. Roll up opportunity: TPB seemed to have all the makings of an interesting platform / acquisition company. They operated in a very fragmented industry, and the early results from their recent acquisitions seemed to indicate they were not only buying at attractive prices but also had the opportunity for pretty large synergies with their purchases through significantly expanding their distribution. a. TPB is controlled by Standard General, who made a fortune pursuing a similar strategy with Media General, so there’s some trust that the controlling shareholder would be very focused on generating strong shareholder returns and had experience pursuing the roll up strategy. b. Management mentioned several times that they had a great “plug and play” opportunity to leverage their SG&A while increasing distribution. c. TPB also had a decent amount of NOLs ($39m), which would boost cash flow and allow for more acquisitions. -

0411 NOVDEC Corpbd.Indd

The Real IMPACT Of Stock Dilution by Aaron Brown and Brian Cumberland While the business press looks at the issue Typically, dilution is calculated by adding up all the of stock options from the executive pay and stock outstanding under employee stock plans and expensing angle, large investors are more con- any stock available for future awards under such cerned with options’ “overhang” impact—how plans. This is then divided by the company’s com- big mega-option plans could dilute their share mon shares outstanding. This overhang calculation holdings. The authors suggest that boards look is commonly used by investors, Wall Street analysts, beyond basic overhang measures to judge the company management, and corporate boards to help options’ true “IMPACT.” understand the impact of employee stock programs on shareholders. During the 1980s and 1990s, stock options were virtually an “inalienable right” for many workers Institutional investors today look far more throughout the U.S. This mind-set started with the closely at measures of whether a stock pro- investment community and spread to Corporate gram is excessive, liberal, costly or excessively America. Executives needed some tie to shareholders dilutive. and the best alternative from an accounting perspec- tive was stock options. Advisory groups are providing advice to insti- While shareholders rode the bandwagon of align- tutions on how to vote for company-sponsored ing management with themselves, the proportionate proposals to increase stock available for employee interest of their shares was being diluted, sometimes compensation programs. For example, Institutional as much as five percent or more annually. Not only Shareholder Services (ISS) weighs both shareholder did companies have to beat historical growth, but value transfer and voting power dilution, and overall they also had to beat the annual dilution from their dilution must be in line with industry norms with stock programs. -

Practice Guide: IPO Vs RTO by Paul a Zaman MBA, MSC

Practice Guide: IPO vs RTO By Paul A Zaman MBA, MSC Discussion of key points of differentiation raises funds, or vendor shares, which means the company between reverse take overs (RTO), initial does not get additional funding but only the original owner. The RTO process also known as a reverse merger involves public offerings (IPO) and Secondary offerings a company that has already been listed, either still trading or (SO) and acquisitions. suspended. It is a financial transaction that results in a privately held company becoming a publicly held company Overview of the issues involved in listing, secondary without going the traditional route of filing a prospectus and offerings and acquisitions from an equity market and undertaking an initial public offering (IPO). The listed investor perspective. company has an installed share registry and investor base. The RTO process is like a reverse takeover of a listed 1) Equity Market – Initial Public Offering (IPO) Scenario: Initial Public offering – new share placement An unlisted company must get itself well understood and liked by the equity market investors and have good analyst coverage. This is achieved by having pro-active senior management engagement with the equity market and an effective financial investor relations function. After this, initial public offerings very likely to be liked and supported by the equity market, giving rise to overall firmness and an upward trend in share price. If the company is unknown, misunderstood, and not supported by good analysts, the offerings are likely to be dis-liked and unsupported by the equity market, giving rise to continuous prolonged weakness and a downward trend in share price. -

Pulse Biosciences, Inc. Subscription Rights to Purchase up To

TABLE OF CONTENTS Filed Pursuant to Rule 424(b)(4) Registration No. 333-237577 PROSPECTUS Pulse Biosciences, Inc. Subscription Rights to Purchase Up to 4,279,600 of Units at the Initial Price Each Unit Consisting of 1 Share of Common Stock and 0.15 Warrants to Purchase Shares of Common Stock (and Up to 641,940 of Shares of Common Stock Underlying the Warrants at the Initial Price) Pulse Biosciences, Inc. is distributing at no charge to the holders of our common stock, par value $0.001 per share, non- transferable subscription rights to purchase up to 4,279,600 of Units at the Initial Price (as defined below) with an aggregate offering value of up to $30,000,000. The subscription price per Unit shall be equal to the lesser of (i) $7.01 (the “Initial Price”) and (ii) the volume weighted average price of our common stock for the five trading day period through and including the Expiration Date (as defined below) (the “Alternate Price”), as provided herein. Each stockholder will receive one subscription right entitling the holder to purchase 0.20506537 Units at the Initial Price, for each share of our common stock owned at 5:00 p.m., Eastern Time, on May 14, 2020. Each Unit shall consist of one share of our common stock and 0.15 warrants to purchase shares of our common stock. Each warrant will be exercisable for one share of our common stock at an exercise price that shall be equal to the subscription price for the Units. To the extent that the Alternate Price is lower than the Initial Price, we will sell additional Units, but we will not sell fractional Units. -

Glossary of Terms Related to Angel Investors, Venture Capital and Other Private Equity Or Debt Financings

Appendix F: Glossary of Terms GLOSSARY OF TERMS RELATED TO ANGEL INVESTORS, VENTURE CAPITAL AND OTHER PRIVATE EQUITY OR DEBT FINANCINGS 401(K) Plan: A type of qualified retirement plan in which employees make salary-reduced, pre-tax contributions to an employee trust. In many cases, the employer will match employee contributions up to a specified level. - A - Accredited Investor: Rule 501 of the SEC regulations defines an individual accredited investor as: “Any natural person whose individual net worth or joint net worth with that person’s spouse at the time of his purchase exceeds $1M”; OR “Any natural person who had an individual income in excess of $200,000 in each of the two most recent years or joint income with that person’s spouse in excess of $300,000 in each of those years and has a reasonable expectation of reaching the same income level in the current year.” For the complete definition, see the SEC website. Accrued Interest: The interest due on preferred stock or a bond since the last interest payment was made. Accelerated Cost Recovery System (“ACRS” or “Accelerated Depreciation”): The IRS-approved method of calculating depreciation expense for tax purposes. American Depositary Receipt (“ADR”): A security issued by a U.S. bank in place of the foreign shares held in trust by that bank, thereby facilitating the trading of foreign shares in U.S. markets. Advisory Board: A group of external advisors to a private equity group or portfolio company. Advice provided varies from overall strategy to portfolio valuation. Less formal than a Board of Directors. -

Canadian Action Filings.Pdf

I am David Nelson of the CMKX Shareholders Coalition for Justice, I represent a large group of investor in CMKM Diamonds Inc. who would like an investigation into Canadian firms knowingly selling unregistered securities in CMKX stock, a company listed on the pink sheets of the OTC market in the United States, but revoked by the SEC in October 2005. Tens of thousands of shareholders, many Canadians, are victims of corrupt insiders of their company, corrupt brokers, including Canadian brokers, and victims of a completely corrupt regulatory system. The fact is the Securities and Exchange Commission was well aware massive naked shorting was occurring in Canada as a part of a fraud ring with cohorts on Wall Street. The authorities were also fully aware of the massive naked shorting in CMKX stock in particular. In evidence entered to the Honourable Vic Toews, the Coalition documented the massive collusion between the SEC and Canadian brokers to directly sell unregistered or counterfeit securities in the market in general and to knowingly facilitate the sale of unregistered or counterfeit shares in CMKX stock. The coalition has asked the Honourable Vic Toews to call for a public inquiry into the largest fraud ever and its cover up, as CMKX was only one stock out of thousands of victims. The RCMP has the coalition evidence now and Mr. Toews response to the coalition is forth coming per Mr. Ron Cannan, my personal MP. The evidence entered into the Minister of Public Safety clearly shows that the stock market was naked shorted into the trillions, the SEC admits it themselves in their own meeting notes entered to Mr. -

Demystifying Modern Convertible Notes a Special Four-Part Series: Part I

NAVIGATING CONVERTIBLES: Demystifying Modern Convertible Notes A special four-part series: Part I PROSPECT NEWS INTERVIEWS Greg P. Rodgers, Arash Aminian Baghai, LATHAM & WATKINS Latham & Watkins Latham & Watkins Rebecca Melvin Prospect News Latham & Watkins attorneys discuss their new primer and convertibles business By Rebecca Melvin office of Latham & Watkins and a member of New York, Aug. 30 – Two members of Latham the Capital Markets Practice, and Arash Aminian & Watkins LLP’s convertibles team have written Baghai, counsel in the Los Angeles office of a primer aimed at gathering in one place as many Latham & Watkins and a member of the Capital answers to frequently asked questions on the Markets Practice, sat down with Prospect News subject of convertible notes issuance as possible. to discuss some of its themes. The following is With that report published earlier in August, its the first of a four-part series resulting from that authors, Greg P. Rodgers, partner in the New York discussion. REGARDING Prospect News: Let’s start with some questions about Latham’s own convertibles business and the origins of your report, Demystifying Modern Convertible Notes. Was this the first THE AUTHORS’ report that you worked on together? NEW REPORT Greg: It is. Both Arash and I have been practicing in this area [of convertibles] for a long time. I am a ’97 graduate from law school and did my first convertible deal in ’99, so it’s coming up on two decades. And I have been doing deals with Arash for quite a long time, including when he worked at another firm and then when he came over to Latham & Watkins.