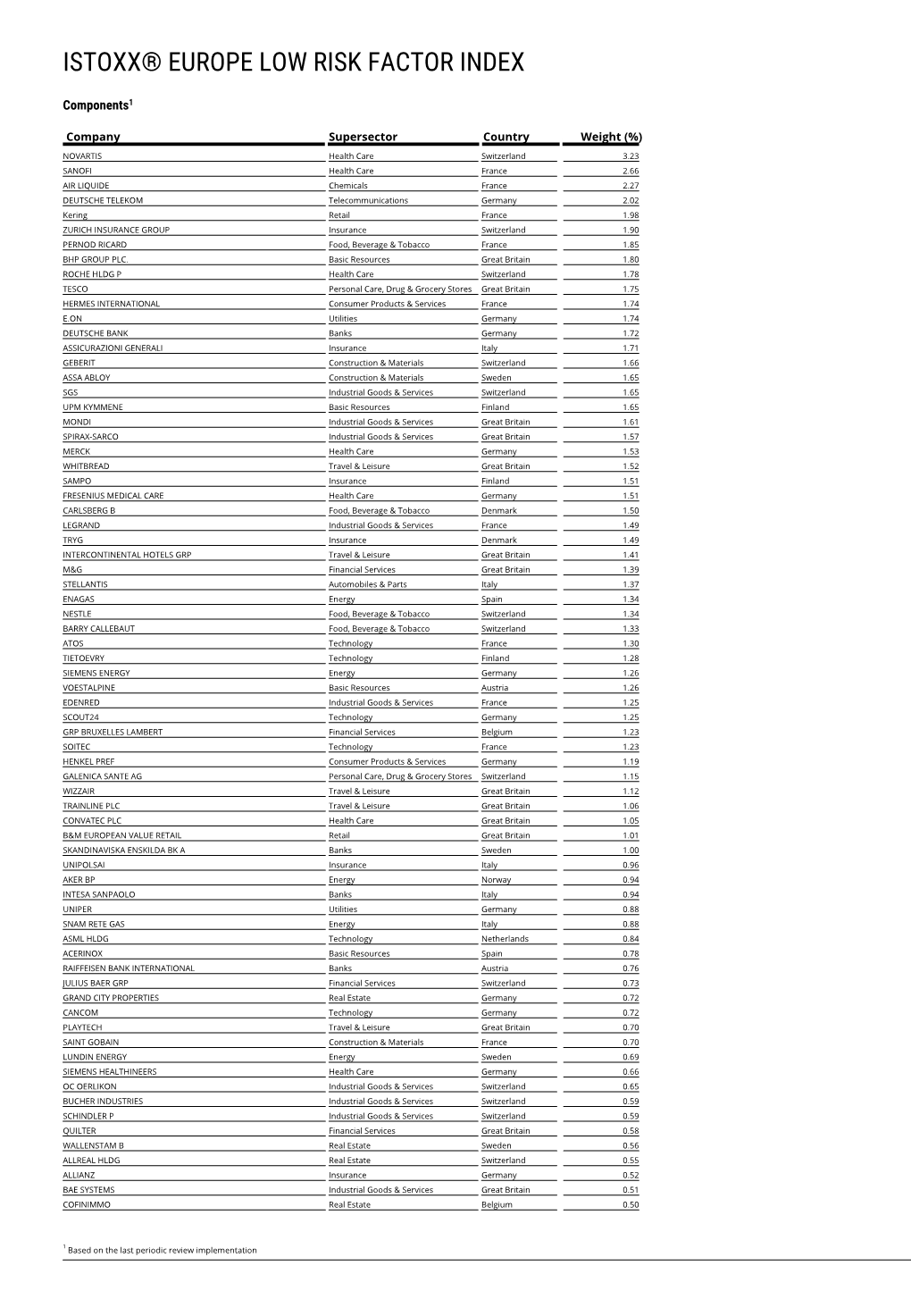

Istoxx® Europe Low Risk Factor Index

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

DXE Liquidity Provider Registered Firms

DXE Liquidity Provider Program Registered Securities European Equities TheCboe following Europe Limited list of symbols specifies which firms are registered to supply liquidity for each symbol in 2021-09-28: 1COVd - Covestro AG Citadel Securities GCS (Ireland) Limited (Program Three) DRW Europe B.V. (Program Three) HRTEU Limited (Program Two) Jane Street Financial Limited (Program Three) Jump Trading Europe B.V. (Program Three) Qube Master Fund Limited (Program One) Societe Generale SA (Program Three) 1U1d - 1&1 AG Citadel Securities GCS (Ireland) Limited (Program Three) HRTEU Limited (Program Two) Jane Street Financial Limited (Program Three) 2GBd - 2G Energy AG Citadel Securities GCS (Ireland) Limited (Program Three) Jane Street Financial Limited (Program Three) 3BALm - WisdomTree EURO STOXX Banks 3x Daily Leveraged HRTEU Limited (Program One) 3DELm - WisdomTree DAX 30 3x Daily Leveraged HRTEU Limited (Program One) 3ITLm - WisdomTree FTSE MIB 3x Daily Leveraged HRTEU Limited (Program One) 3ITSm - WisdomTree FTSE MIB 3x Daily Short HRTEU Limited (Program One) 8TRAd - Traton SE Jane Street Financial Limited (Program Three) 8TRAs - Traton SE Jane Street Financial Limited (Program Three) Cboe Europe Limited is a Recognised Investment Exchange regulated by the Financial Conduct Authority. Cboe Europe Limited is an indirect wholly-owned subsidiary of Cboe Global Markets, Inc. and is a company registered in England and Wales with Company Number 6547680 and registered office at 11 Monument Street, London EC3R 8AF. This document has been established for information purposes only. The data contained herein is believed to be reliable but is not guaranteed. None of the information concerning the services or products described in this document constitutes advice or a recommendation of any product or service. -

Market Notice Date: 14 November 2019 Market Notice Number: 112/2019

Market Notice Date: 14 November 2019 Market Notice Number: 112/2019 Equiduct Universe Change Please see today's changes below effective 18 November 2019: Trading Reporting MIC Settlement Trading Settlement Tick Size Change/ Security Name ISIN Home Market Symbol Country Currency Currency table Action ABB LTD ABBNz CH0012221716 XSWX EQTB CH CHF CHF ESMA_E Deletion ABB ABBs CH0012221716 XSTO EQTB SE SEK SEK ESMA_E Deletion ADECCO SA ADENz CH0012138605 XSWX EQTC CH CHF CHF ESMA_E Deletion AMS AG AMSz AT0000A18XM4 XSWX EQTC CH CHF CHF ESMA_E Deletion ARYZTA AG ARYNz CH0043238366 XSWX EQTB CH CHF CHF ESMA_E Deletion JULIUS BAER GRUPPE AG BAERz CH0102484968 XSWX EQTC CH CHF CHF ESMA_E Deletion BALOISE-HLDGS BALNz CH0012410517 XSWX EQTC CH CHF CHF ESMA_D Deletion BARRY CALLEBAUT AG BARNz CH0009002962 XSWX EQTC CH CHF CHF ESMA_D Deletion BB BIOTECH BBZAd CH0038389992 XETR EQTB DE EUR EUR ESMA_D Deletion BB BIOTECH BIONz CH0038389992 XSWX EQTB CH CHF CHF ESMA_D Deletion BASILEA PHARMACEUTICA AG BSLNz CH0011432447 XSWX EQTC CH CHF CHF ESMA_D Deletion BUCHER INDUSTRIES BUCNz CH0002432174 XSWX EQTC CH CHF CHF ESMA_D Deletion COMPAGNIE FINANCIERE RICHEMONT CFRz CH0210483332 XSWX EQTC CH CHF CHF ESMA_E Deletion CLARIANT CLNz CH0012142631 XSWX EQTC CH CHF CHF ESMA_E Deletion CEMBRA MONEY BANK AG CMBNz CH0225173167 XSWX EQTC CH CHF CHF ESMA_D Deletion CREDIT SUISSE GROUP AG CSGNz CH0012138530 XSWX EQTC CH CHF CHF ESMA_E Deletion DKSH HOLDING DKSHz CH0126673539 XSWX EQTC CH CHF CHF ESMA_D Deletion DORMA+KABA HOLDING AG DOKAz CH0011795959 XSWX EQTC CH CHF -

Euro Stoxx® Multi Premia Index

EURO STOXX® MULTI PREMIA INDEX Components1 Company Supersector Country Weight (%) SARTORIUS STEDIM BIOTECH Health Care France 1.59 IMCD Chemicals Netherlands 1.25 VOPAK Industrial Goods & Services Netherlands 1.15 BIOMERIEUX Health Care France 1.04 REMY COINTREAU Food, Beverage & Tobacco France 1.03 EURONEXT Financial Services France 1.00 HERMES INTERNATIONAL Consumer Products & Services France 0.94 SUEZ ENVIRONNEMENT Utilities France 0.94 BRENNTAG Chemicals Germany 0.93 ENAGAS Energy Spain 0.90 ILIAD Telecommunications France 0.89 DEUTSCHE POST Industrial Goods & Services Germany 0.88 FUCHS PETROLUB PREF Chemicals Germany 0.88 SEB Consumer Products & Services France 0.87 SIGNIFY Construction & Materials Netherlands 0.86 CARL ZEISS MEDITEC Health Care Germany 0.80 SOFINA Financial Services Belgium 0.80 EUROFINS SCIENTIFIC Health Care France 0.80 RATIONAL Industrial Goods & Services Germany 0.80 AALBERTS Industrial Goods & Services Netherlands 0.74 KINGSPAN GRP Construction & Materials Ireland 0.73 GERRESHEIMER Health Care Germany 0.72 GLANBIA Food, Beverage & Tobacco Ireland 0.71 PUBLICIS GRP Media France 0.70 UNITED INTERNET Technology Germany 0.70 L'OREAL Consumer Products & Services France 0.70 KPN Telecommunications Netherlands 0.68 SARTORIUS PREF. Health Care Germany 0.68 BMW Automobiles & Parts Germany 0.68 VISCOFAN Food, Beverage & Tobacco Spain 0.67 SAINT GOBAIN Construction & Materials France 0.67 CORBION Food, Beverage & Tobacco Netherlands 0.66 DAIMLER Automobiles & Parts Germany 0.66 PROSIEBENSAT.1 MEDIA Media Germany 0.65 -

Fund Holdings

Wilmington International Fund as of 7/31/2021 (Portfolio composition is subject to change) ISSUER NAME % OF ASSETS ISHARES MSCI CANADA ETF 3.48% TAIWAN SEMICONDUCTOR MANUFACTURING CO LTD 2.61% DREYFUS GOVT CASH MGMT-I 1.83% SAMSUNG ELECTRONICS CO LTD 1.79% SPDR S&P GLOBAL NATURAL RESOURCES ETF 1.67% MSCI INDIA FUTURE SEP21 1.58% TENCENT HOLDINGS LTD 1.39% ASML HOLDING NV 1.29% DSV PANALPINA A/S 0.99% HDFC BANK LTD 0.86% AIA GROUP LTD 0.86% ALIBABA GROUP HOLDING LTD 0.82% TECHTRONIC INDUSTRIES CO LTD 0.79% JAMES HARDIE INDUSTRIES PLC 0.78% DREYFUS GOVT CASH MGMT-I 0.75% INFINEON TECHNOLOGIES AG 0.74% SIKA AG 0.72% NOVO NORDISK A/S 0.71% BHP GROUP LTD 0.69% PARTNERS GROUP HOLDING AG 0.65% NAVER CORP 0.61% HUTCHMED CHINA LTD 0.59% LVMH MOET HENNESSY LOUIS VUITTON SE 0.59% TOYOTA MOTOR CORP 0.59% HEXAGON AB 0.57% SAP SE 0.57% SK MATERIALS CO LTD 0.55% MEDIATEK INC 0.55% ADIDAS AG 0.54% ZALANDO SE 0.54% RIO TINTO LTD 0.52% MERIDA INDUSTRY CO LTD 0.52% HITACHI LTD 0.51% CSL LTD 0.51% SONY GROUP CORP 0.50% ATLAS COPCO AB 0.49% DASSAULT SYSTEMES SE 0.49% OVERSEA-CHINESE BANKING CORP LTD 0.49% KINGSPAN GROUP PLC 0.48% L'OREAL SA 0.48% ASSA ABLOY AB 0.46% JD.COM INC 0.46% RESMED INC 0.44% COLOPLAST A/S 0.44% CRODA INTERNATIONAL PLC 0.41% AUSTRALIA & NEW ZEALAND BANKING GROUP LTD 0.41% STRAUMANN HOLDING AG 0.41% AMBU A/S 0.40% LG CHEM LTD 0.40% LVMH MOET HENNESSY LOUIS VUITTON SE 0.39% SOFTBANK GROUP CORP 0.39% NOVARTIS AG 0.38% HONDA MOTOR CO LTD 0.37% TOMRA SYSTEMS ASA 0.37% IMCD NV 0.37% HONG KONG EXCHANGES & CLEARING LTD 0.36% AGC INC 0.36% ADYEN -

2019 Annual Report Annual 2019

a force for good. 2019 ANNUAL REPORT ANNUAL 2019 1, cours Ferdinand de Lesseps 92851 Rueil Malmaison Cedex – France Tel.: +33 1 47 16 35 00 Fax: +33 1 47 51 91 02 www.vinci.com VINCI.Group 2019 ANNUAL REPORT VINCI @VINCI CONTENTS 1 P r o l e 2 Album 10 Interview with the Chairman and CEO 12 Corporate governance 14 Direction and strategy 18 Stock market and shareholder base 22 Sustainable development 32 CONCESSIONS 34 VINCI Autoroutes 48 VINCI Airports 62 Other concessions 64 – VINCI Highways 68 – VINCI Railways 70 – VINCI Stadium 72 CONTRACTING 74 VINCI Energies 88 Eurovia 102 VINCI Construction 118 VINCI Immobilier 121 GENERAL & FINANCIAL ELEMENTS 122 Report of the Board of Directors 270 Report of the Lead Director and the Vice-Chairman of the Board of Directors 272 Consolidated nancial statements This universal registration document was filed on 2 March 2020 with the Autorité des Marchés Financiers (AMF, the French securities regulator), as competent authority 349 Parent company nancial statements under Regulation (EU) 2017/1129, without prior approval pursuant to Article 9 of the 367 Special report of the Statutory Auditors on said regulation. The universal registration document may be used for the purposes of an offer to the regulated agreements public of securities or the admission of securities to trading on a regulated market if accompanied by a prospectus or securities note as well as a summary of all 368 Persons responsible for the universal registration document amendments, if any, made to the universal registration document. The set of documents thus formed is approved by the AMF in accordance with Regulation (EU) 2017/1129. -

Portfolio of Investments

PORTFOLIO OF INVESTMENTS CTIVP® – Lazard International Equity Advantage Fund, September 30, 2020 (Unaudited) (Percentages represent value of investments compared to net assets) Investments in securities Common Stocks 97.6% Common Stocks (continued) Issuer Shares Value ($) Issuer Shares Value ($) Australia 6.9% Finland 1.0% AGL Energy Ltd. 437,255 4,269,500 Metso OYJ 153,708 2,078,669 ASX Ltd. 80,181 4,687,834 UPM-Kymmene OYJ 36,364 1,106,808 BHP Group Ltd. 349,229 9,021,842 Valmet OYJ 469,080 11,570,861 Breville Group Ltd. 153,867 2,792,438 Total 14,756,338 Charter Hall Group 424,482 3,808,865 France 9.5% CSL Ltd. 21,611 4,464,114 Air Liquide SA 47,014 7,452,175 Data#3 Ltd. 392,648 1,866,463 Capgemini SE 88,945 11,411,232 Fortescue Metals Group Ltd. 2,622,808 30,812,817 Cie de Saint-Gobain(a) 595,105 24,927,266 IGO Ltd. 596,008 1,796,212 Cie Generale des Etablissements Michelin CSA 24,191 2,596,845 Ingenia Communities Group 665,283 2,191,435 Electricite de France SA 417,761 4,413,001 Kogan.com Ltd. 138,444 2,021,176 Elis SA(a) 76,713 968,415 Netwealth Group Ltd. 477,201 5,254,788 Legrand SA 22,398 1,783,985 Omni Bridgeway Ltd. 435,744 1,234,193 L’Oreal SA 119,452 38,873,153 REA Group Ltd. 23,810 1,895,961 Orange SA 298,281 3,106,763 Regis Resources Ltd. -

ANNUAL REPORT 2006 10,000 250 0 0 0 0 02 03 04 05 06 02 03 04 05 06 02 03 04 05 06 02 03 04 05 06 1 Adjusted to Exclude Sale of Assets

THE YEAR 2006 PRODUCTION (BOEPD) PROFIT (MSEK) 1 EBITDA (MSEK) CASH FLOW (MSEK) 40,000 1,000 3,000 3,000 30,000 750 2,000 2,000 20,000 500 1,000 1,000 ANNUAL REPORT 2006 10,000 250 0 0 0 0 02 03 04 05 06 02 03 04 05 06 02 03 04 05 06 02 03 04 05 06 1 Adjusted to exclude sale of assets 2006 SUMMARY 4Average production of 29,400 boepd (33,100 boepd) LUNDIN PETROLEUM AB ANNUAL REPORT PETROLEUM AB ANNUAL LUNDIN 4Operating income of MSEK 4,414.5 (MSEK 4,190.2) 4Net profi t of MSEK 794.4 (MSEK 994.0) 4Operating cash fl ow of MSEK 2,271.0 (MSEK 2,627.4) 4EBITDA MSEK 2,731.5 (MSEK 2,782.6) 4Diluted earnings per share SEK 2.81 (SEK 3.87) 4Debt/equity ratio 12% (9%) 2005 in brackets 4Reserves increased by 29% 4The Oudna fi eld development in Tunisia successfully completed, onstream in November 4Ongoing development of the Alvheim fi eld in Norway 2006 OUTLOOK 2007 4Capital budget for development and exploration over MUSD 530 Corporate Head Offi ce President’s Offi ce 4Development projects – MUSD 290: Lundin Petroleum AB (publ) Lundin Petroleum AB (publ) - Norway Alvheim fi eld, onstream 2007 Hovslagargatan 5 5 chemin de la Pallanterie - Norway Volund fi eld, onstream 2009 SE-111 48 Stockholm CH-1222 Vésenaz - United Kingdom, Broom fi eld, development drilling Sweden Switzerland - United Kingdom, Heather fi eld, development drilling Telephone: 46-8-440 54 50 Telephone: 41-22-595 10 00 - United Kingdom, Thistle fi eld, redevelopment Telefax: 46-8-440 54 59 Telefax: 41-22-595 10 05 - Russia, ongoing development drilling - France, Villeperdue fi eld -

Barry Callebaut “Cost Plus” Model Has Proven to Be Robust

Barry Callebaut 9-month key sales figures 2010/11 July 2011 Agenda Company and Industry Overview First 9 months highlights Outlook July 2011 Barry Callebaut 9 months key sales figures 2 Barry Callebaut is present in all of the stages of the chocolate industry value chain Cocoa Cocoa beans Plantations 80% Cocoa liquor ~54% ~46% Cocoa powder Cocoa butter BC core activity + Sugar, Milk, others + Sugar, Milk, + Sugar, Milk, fats, others others Powder mixes Compound/Fillings Chocolate couverture Customers: Food Manufactures Chocolatiers, Bakeries, Vending Dist. Etc July 2011 Barry Callebaut 9 months key sales figures 3 Barry Callebaut at a glance FY-2010 Sales Volume by Region FY-2010 Sales Volume by Product Group Food Service Global Sourcing & / Retail Cocoa Customers 16% 27% Consumer Products 10% Asia Europe Gourmet 4% 58% & Specialties 10% Food Cocoa Manufacturers 16% 64% Americas 22% Industrial Customers 73% FY-2010 Sales Volume: 1,3 mn tonnes FY-2010 Sales: CHF 5,213mn FY-2010 EBIT: CHF 370.4 mn FY-2010 Net Profit: CHF 251.7 mn July 2011 Barry Callebaut 9 months key sales figures 4 Barry Callebaut is the market leader in the open market Global Industrial Chocolate market in 2009 = 5,400,000 tonnes* (Long-term average annual market growth of approx 2-3%) Open market Integrated market Competitors Big 4 chocolate Others players 40% 49% 51% 80% Outsourced (long-term volumes) *BC estimates July 2011 Barry Callebaut 9 months key sales figures 5 Global leader in chocolate manufacturing Barry Callebaut is one of the of the top three cocoa grinders and the largest manufacturer of industrial chocolate, with estimated market share of 40% of sales volumes in the open market for industrial chocolate Cocoa Grinders Open Market for Chocolate ADM Barry Callebaut Kraft/ Cadbury Barry Callebaut Mars Cargill Nestlé Petra Foods Hershey Blommer Cargill Kraft/Cadbury Blommer ADM Nestlé Lindt Cémoi Ferrero Ferrero Other players 0 100 200 300 400 500 600 700 -100 100 300 500 700 900 1100 Volume ('000 MT) Sales Volume ('000 MT) Source: Barry Callebaut 2009/10 estimates (both charts). -

Wilmington Funds Holdings Template DRAFT

Wilmington International Fund as of 5/31/2021 (Portfolio composition is subject to change) ISSUER NAME % OF ASSETS TAIWAN SEMICONDUCTOR MANUFACTURING CO LTD 2.82% ISHARES MSCI CANADA ETF 2.43% SAMSUNG ELECTRONICS CO LTD 1.97% TENCENT HOLDINGS LTD 1.82% DREYFUS GOVT CASH MGMT-I 1.76% MSCI INDIA FUTURE JUN21 1.68% AIA GROUP LTD 1.05% HDFC BANK LTD 1.05% ASML HOLDING NV 1.03% ISHARES MSCI EUROPE FINANCIALS ETF 1.02% USD/EUR SPOT 20210601 BNYM 1.00% ALIBABA GROUP HOLDING LTD 0.95% DSV PANALPINA A/S 0.90% TECHTRONIC INDUSTRIES CO LTD 0.88% JAMES HARDIE INDUSTRIES PLC 0.83% INFINEON TECHNOLOGIES AG 0.73% BHP GROUP LTD 0.67% SIKA AG 0.64% MEDIATEK INC 0.60% NOVO NORDISK A/S 0.56% OVERSEA-CHINESE BANKING CORP LTD 0.55% CSL LTD 0.55% LVMH MOET HENNESSY LOUIS VUITTON SE 0.54% RIO TINTO LTD 0.53% DREYFUS GOVT CASH MGMT-I 0.53% MIDEA GROUP CO LTD 0.53% TOYOTA MOTOR CORP 0.52% PARTNERS GROUP HOLDING AG 0.52% SAP SE 0.51% ADIDAS AG 0.49% NAVER CORP 0.49% HITACHI LTD 0.49% MERIDA INDUSTRY CO LTD 0.47% ZALANDO SE 0.47% SK MATERIALS CO LTD 0.47% CHINA PACIFIC INSURANCE GROUP CO LTD 0.45% HEXAGON AB 0.45% LVMH MOET HENNESSY LOUIS VUITTON SE 0.44% JD.COM INC 0.44% TOMRA SYSTEMS ASA 0.44% DREYFUS GOVT CASH MGMT-I 0.44% SONY GROUP CORP 0.43% L'OREAL SA 0.43% EDENRED 0.43% AUSTRALIA & NEW ZEALAND BANKING GROUP LTD 0.43% NEW ORIENTAL EDUCATION & TECHNOLOGY GROUP INC 0.42% HUAZHU GROUP LTD 0.41% CRODA INTERNATIONAL PLC 0.40% ATLAS COPCO AB 0.40% ASSA ABLOY AB 0.40% IMCD NV 0.40% HUTCHMED CHINA LTD 0.40% JARDINE MATHESON HOLDINGS LTD 0.40% HONG KONG EXCHANGES -

FTSE Developed Europe

2 FTSE Russell Publications 19 August 2021 FTSE Developed Europe Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 1&1 AG 0.01 GERMANY Avast 0.03 UNITED Cnp Assurance 0.02 FRANCE 3i Group 0.14 UNITED KINGDOM Coca-Cola HBC AG 0.06 UNITED KINGDOM Aveva Group 0.05 UNITED KINGDOM A P Moller - Maersk A 0.1 DENMARK KINGDOM Coloplast B 0.19 DENMARK A P Moller - Maersk B 0.15 DENMARK Aviva 0.19 UNITED Colruyt 0.03 BELGIUM A2A 0.03 ITALY KINGDOM Commerzbank 0.07 GERMANY Aalberts NV 0.05 NETHERLANDS AXA 0.43 FRANCE Compagnie Financiere Richemont SA 0.55 SWITZERLAND ABB 0.51 SWITZERLAND B&M European Value Retail 0.06 UNITED Compass Group 0.33 UNITED KINGDOM ABN AMRO Bank NV 0.04 NETHERLANDS KINGDOM BAE Systems 0.21 UNITED Acciona S.A. 0.03 SPAIN Continental 0.14 GERMANY KINGDOM Accor 0.06 FRANCE ConvaTec Group 0.05 UNITED Baloise 0.06 SWITZERLAND Ackermans & Van Haaren 0.03 BELGIUM KINGDOM Banca Mediolanum 0.02 ITALY ACS Actividades Cons y Serv 0.06 SPAIN Covestro AG 0.1 GERMANY Banco Bilbao Vizcaya Argentaria 0.36 SPAIN Adecco Group AG 0.09 SWITZERLAND Covivio 0.04 FRANCE Banco Santander 0.58 SPAIN Adevinta 0.04 NORWAY Credit Agricole 0.14 FRANCE Bank Pekao 0.03 POLAND Adidas 0.63 GERMANY Credit Suisse Group 0.22 SWITZERLAND Bankinter 0.03 SPAIN Admiral Group 0.08 UNITED CRH 0.35 UNITED Banque Cantonale Vaudoise 0.02 SWITZERLAND KINGDOM KINGDOM Barclays 0.35 UNITED Adyen 0.62 NETHERLANDS Croda International 0.12 UNITED KINGDOM KINGDOM Aegon NV 0.06 NETHERLANDS Barratt Developments 0.09 UNITED Cts Eventim 0.03 GERMANY Aena SME SA 0.1 SPAIN KINGDOM Cyfrowy Polsat SA 0.02 POLAND Aeroports de Paris 0.03 FRANCE Barry Callebaut 0.07 SWITZERLAND Daimler AG 0.66 GERMANY Ageas 0.09 BELGIUM BASF 0.64 GERMANY Danone 0.37 FRANCE Ahold Delhaize 0.26 NETHERLANDS Bayer AG 0.53 GERMANY Danske Bank A/S 0.1 DENMARK AIB Group 0.02 IRELAND Bechtle 0.04 GERMANY Dassault Aviation S.A. -

KKR Appoints Gianemilio Osculati As Senior Advisor

KKR Appoints Gianemilio Osculati as Senior Advisor October 30, 2008 – Kohlberg Kravis Roberts & Co. ("KKR") today announces that it has appointed Gianemilio Osculati as a Senior Advisor to the firm. Henry R. Kravis said: "Gianemilio's extensive experience in Italy, coupled with his unique network and relationships will bring significant value to our business and enhance KKR's franchise in this market. Gianemilio also brings a tremendous depth of operational expertise which underpins a key value that KKR brings to its portfolio companies". Mr. Osculati, who will be based in Italy, will work closely with KKR Director Mattia Caprioli with a view to further developing KKR's investment opportunities in the country. Gianemilio Osculati said: "I look forward to working with a group of world-class investment professionals to identify opportunities that will deliver value for investors while also strengthening businesses in Italy". KKR has been active in the Italian market for several years. In November 2007, KKR successfully completed the sale of FL Selenia SpA, the manufacturer and distributor of automotive lubricants, to Petronas, a Malaysian petroleum company, in a transaction valued in excess of €1 billion. Since December 2002, KKR and investment company Wendel have jointly controlled Italy-based electrical equipment manufacturer Bticino through their investment in Legrand. In April 2007, KKR partnered with Italian entrepreneur Stefano Pessina to acquire Alliance Boots, a global pharmacy-led health and beauty group, in the largest ever European leveraged buyout valued in excess of £11 billion. About Gianemilio Osculati Mr. Osculati is presently Chairman of Valore SpA, a diversified financial holding company, a position he has held since 2006. -

Active Ownership Report: H1 2021 Danske Bank Asset Management August 2021 Active Ownership Report

Active Ownership Report: H1 2021 Danske Bank Asset Management August 2021 Active Ownership Report When customers entrust us with their assets and savings, it is our duty to serve their interests by providing investment solutions with the goal to deliver competitive and long-term performance. Our firm commitment to Responsible Investment is an integral part of this duty. It is about making better-informed investment decisions – addressing issues of risk, problems, and dilemmas, and influencing portfolio companies through active ownership to contribute to a positive outcome. Active ownership – through direct dialogue, collaborative engagement and voting at the annual general meetings – is an important part of our ability to create long-term value to the companies we invest in and to our investors. We believe it is more responsible to address material sustainability matters as investors rather than refraining from investing when issues of concern arise, leaving the problem to someone else to solve. Our investment teams are the change agents who can impact companies to manage risks and opportunities. The aim of our Active Ownership Report covering three parts ‘Engagements’, ‘Collaborative Engagements’ and ‘Voting’ is to provide our customers and stakeholders with regular updates on our progress and results. The three parts of the report Part 1: Engagements Part 2: Voting Part 3: Collaborative Engagements 2 Where to get additional information Responsible Investment Policy Our Responsible Investment Journey click here click here Active Ownership