2018-19 Bulletin 1014

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

STATE LOCAL EDUCATION AGENCY (ENROLLMENTS > 1250) ENR. 504S RATE CONNECTICUT Newtown School District 4570 710 15.53% TEXAS

As a supplement to the corresponDing Zirkel analysis in the Educa'on Law Reporter, this compilaon, in DescenDing orDer of the percentage of 504-only stuDents, is baseD on the 2015-16 CRDC Data. To obtain the actual complete Data anD to request any correcbons, please go Directly to hdps://ocrData.eD.gov/ STATE LOCAL EDUCATION AGENCY (ENROLLMENTS > 1250) ENR. 504s RATE CONNECTICUT Newtown School District 4570 710 15.53% TEXAS Carrizo Springs Consol. InDep. School District 2254 325 14.41% CONNECTICUT Weston School District 2393 343 14.33% TEXAS Pittsburg InDep. School District 2472 335 13.55% TEXAS Pleasanton InDep. School District 3520 467 13.26% TEXAS Van Alstyne InDep. School District 1336 174 13.02% NEW JERSEY Hanover Park Regional High School District 1561 200 12.81% TEXAS Buna InDep. School District 1456 183 12.56% TEXAS Tatum InDep. School District 1687 208 12.32% TEXAS Crockett InDep. School District 1280 157 12.26% NEW YORK WinDsor Central School District 1697 208 12.25% TEXAS Hughes Springs InDep. School District 1266 153 12.08% TEXAS Pottsboro InDep. School District 4284 507 11.83% TEXAS Lake Dallas InDep. School District 3945 467 11.83% TEXAS NorthsiDe InDep. School District 105049 12425 11.82% TEXAS Kerrville InDep. School District 5038 592 11.75% TEXAS Gatesville InDep. School District 2853 335 11.74% TEXAS GoDley InDep. School District 1780 205 11.51% PENNSYLVANIA WallingforD-Swarthmore School District 3561 401 11.26% GEORGIA Wilkinson County Schools 1523 169 11.09% LOUISIANA Terrebonne Parish School District 18445 2039 11.05% NEW YORK Briarcliff Manor Union Free School District 1469 162 11.02% WASHINGTON Mercer IslanD School District 4423 485 10.96% TEXAS Community InDep. -

CFGF Magazine

COMMUNITY FOUNDATION OF GREATER FLINT WINTER 2020 PASSI N &Purpose Census 2020: What’s at Stake FROM THE PRESIDENT nspiring philanthropy is at the heart and the Ruth Mott Foundation for grants of our work. We take great pride in that support Census work.. Ibringing people together in a way that drives community investment and Our new strategic plan was adopted by the catalyzes the community’s spirit. We board in October, and our staff is beginning do this for the common good and in a to lean into the future of our work. We way that ensures all people are given an will build on our work on the water crisis, opportunity to thrive. and continue literacy initiatives and community development needs of Flint We are leading in a time when neighborhoods. The five-year plan will the challenges are large – and the accelerate an equitable and sustainable opportunities to make a profound impact improvement in the quality of life for all are even greater. Census 2020 is one Genesee County residents. example where we are partnering with nonprofit organizations to ensure a There is no question that we have a lot complete count for Flint and Genesee of work ahead of us, but we have many County. We’re keying our efforts on those opportunities to advance. We are poised hardest to count including communities of for accelerated growth while instilling a color, immigrants and young children. culture of innovation and a commitment to excellence. I hope you will embrace our Throughout the year we’ve met monthly vision of a vibrant and equitable Genesee with nonprofit organizations to break County where everyone can thrive. -

Districtprintout HB 4411 Enacted.Xlsx

Estimated District Impacts of Major Components of Public Act 48 of 2021, House Bill 4411, for FY 2021-22 Estimated Total $ FY 2021-22 FY 2021-22 Value of Found. Eliminate One- Section 22d Special Ed Bilingual 94% ISD Section ISD Total Recommended Foundation Incr. Not Adj. for Time Funding Isolated and 50% Increase (Est. 56(7) New Operations Estimated County Code District Nam Foundation Increase Enroll. $66pp Sec. 11d Rural Increase* Based off FY 21) Funding 4% Increase Increase ALCONA COUNTY 01010 ALCONA COMMUNITY SCHOOLS $8,700 $589 $393,911 ($45,159) $0 $7,481 $0 $0 $356,233 ALGER COUNTY 02010 AUTRAIN-ONOTA PUBLIC SCHOOLS $8,700 $559 $18,749 ($2,261) $0 $268 $0 $0 $16,756 ALGER COUNTY 02020 BURT TOWNSHIP SCHOOL DISTRICT $10,598 $171 $5,109 ($1,967) $152,592 $55 $0 $0 $155,790 ALGER COUNTY 02070 MUNISING PUBLIC SCHOOLS $8,700 $589 $358,660 ($42,244) $0 $9,355 $0 $0 $325,771 ALGER COUNTY 02080 SUPERIOR CENTRAL SCHOOL DISTRICT $8,700 $589 $191,083 ($21,830) $0 $5,819 $0 $0 $175,073 ALLEGAN COUNTY 03000 ALLEGAN AREA EDUCATIONAL SERVICE AGENCY $0 $0 $0 $0 $0 $61,392 $0 $527,186 $28,058 $616,636 ALLEGAN COUNTY 03010 PLAINWELL COMMUNITY SCHOOLS $8,700 $589 $1,609,236 ($181,543) $0 $32,128 $3,938 $0 $1,463,759 ALLEGAN COUNTY 03020 OTSEGO PUBLIC SCHOOLS $8,700 $589 $1,340,004 ($153,260) $0 $30,814 $785 $0 $1,218,343 ALLEGAN COUNTY 03030 ALLEGAN PUBLIC SCHOOLS $8,700 $589 $1,335,781 ($150,773) $0 $37,292 $3,584 $0 $1,225,884 ALLEGAN COUNTY 03040 WAYLAND UNION SCHOOLS $8,700 $589 $1,739,753 ($197,834) $0 $31,269 $4,691 $0 $1,577,878 ALLEGAN COUNTY -

MONROE COUNTY Schools of Choice ENROLLMENT PERIOD APRIL 1, 2021 - JUNE 25, 2021 ONLY

MONROE COUNTY Schools of Choice ENROLLMENT PERIOD APRIL 1, 2021 - JUNE 25, 2021 ONLY 2021-2022 Guidelines and Application What Parents Graduation/ and Guardians Step-By-Step Promotion Transportation and Timeline of the Important Dates Need to Know: Requirements and Information for The Schools Athletic Policies Application and Curriculum Process Parents of Choice Issues Application Process Deadlines TO REMEMBER To provide a quality education for all students in Monroe County, the Monroe County Schools of Choice STEP 1: Due June 25, 2021 Program is offered by the Monroe County Intermediate Application must be returned to the School District in cooperation with its constituent administration building of the resident districts. This program allows parents and students the district. choice to attend any public school in Monroe County, as STEP 2: July 9, 2021 determined by space available. Applicants are notified to inform them whether they have been accepted into Remember, a student must be released by his/her the Schools of Choice Program. resident district and be accepted by the choice district before he/she can enroll at the choice district. The STEP 3: August 6, 2021 Parents/guardians must formally accept student will not be able to start school unless ALL or reject acceptance into the Schools of paperwork is completed BEFORE THE START OF Choice Program. SCHOOL. The student must be formally registered at the choice district by Friday, August 13, 2021. STEP 4: August 13, 2021 Student must be formally registered at the choice school. The Schools of Choice Application Process WHAT PARENTS AND GUARDIANS NEED TO KNOW The application process for the • Students participating in this program • An application form must be completed Monroe County Schools of Choice who wish to return to their resident for each student wishing to participate school for the following year, must notify Program has been designed to the resident school district as soon in the choice program. -

2019-20 Bulletin 1014

2019-20 BULLETIN 1014 Michigan Public School Districts Ranked By Selected Financial Data Published March 2021 Michigan State Board of Education Casandra E. Ulbrich, President Pamela Pugh, Vice President Tiffany D. Tilley, Secretary Tom McMillin, Treasurer Judith Pritchett, NASBE Delegate Ellen Cogen Lipton Nikki Snyder Jason Strayhorn Ex Officio Members Gretchen Whitmer Governor Michael F. Rice, Ph.D. State Superintendent FOREWORD The Bulletin 1014 is prepared to provide financial and statistical information relating to Michigan public schools. Caution should be exercised in using these data. Figures presented in this publication were supplied by each school district, and the Michigan Department of Education is not responsible for the validity of the data provided. Sound conclusions can be drawn only when the data elements are used in proper context. A glossary of the terms used in the headings of the bulletin and other general and specific terms common to school financial data is included. The printed version of the Bulletin 1014 publication contains financial information grouped by statewide and major membership groupings only. A chart labeled "Bulletin 1014 Insert" gives a synopsis of the membership grouping data. A file with the Bulletin 1014 information is available via the Michigan Department of Education website. The address is http://www.michigan.gov/mde/0,1607,7-140--21514--,00.html. Primary distribution is via electronic means. Statement of Compliance with Federal Law The Michigan Department of Education (MDE) is in compliance with Title IX of the Education Amendments of 1972, as amended, 20 U.S.C. 1681 et seq. (Title IX), and its implementing regulation, at 34 C.F.R. -

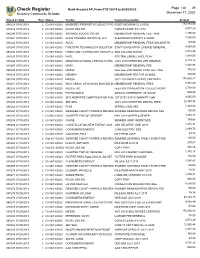

2019 20 Accounts Payable Check Register

Page 1 of 29 Check Register Bank Account AP, From 07/01/2019 to 06/30/2020 Kearsley Community Schools December 17, 2020 Check # / Date Run Status Vendor Invoice Description Amount 080238 07/01/2019 2 Clr 06/18/2020 MASB/SEG PROPERTY/CASUALTY PO FLEET INSURANCE 2019/20 134,984.00 080239 07/01/2019 2 Clr 06/18/2020 RICOH USA INC COPIER LEASE 7/11-8/10 4,573.29 080240 07/01/2019 1 Clr 06/18/2020 ADVANCE EDUCATION INC MEMBERSHIP RENEWAL FEE - KHS 1,200.00 080241 07/01/2019 1 Clr 06/18/2020 ALICE TRAINING INSTITUTE, LLC ELEARNING SUPPORT & MAINT 1,660.00 080242 07/01/2019 1 Clr 06/18/2020 ASCD MEMBERSHIP RENEWAL FEES-WALWORTH 169.00 080243 07/01/2019 1 Clr 06/18/2020 FIVE-STAR TECHNOLOGY SOLUTION STAFF EVALUATION LICENCE RENEWAL 4,500.00 080244 07/01/2019 1 Clr 06/18/2020 FRONTLINE TECHNOLOGY GROUP LL SUB CALLING 2019/20 3,883.40 080245 07/01/2019 1 Clr 06/18/2020 HUDL FOOTBALL/BBALL HUDL PLAY 1,549.00 080246 07/01/2019 1 Clr 06/18/2020 MADISON NATIONAL LIFE INS CO INC JULY 2019 CERTIFIED LIFE INSURAN 4,114.12 080247 07/01/2019 1 Clr 06/18/2020 MASA MEMBERSHIP RENEWAL FEE 1,438.96 080248 07/01/2019 1 Clr 06/18/2020 MASSP REG FEE FOR MASSP CONF-OETTING 750.00 080249 07/01/2019 1 Clr 06/18/2020 MEMSPA MEMBERSHIP FEE FOR D.HIBBS 320.00 080250 07/01/2019 1 Clr 06/18/2020 MESSA JULY 2019 HEALTH FEES CERTIFIED 176,550.87 080251 07/01/2019 1 Clr 06/18/2020 MICH ASSOC OF SCHOOL BOARDS,IN MEMBERSHIP RENEWAL FEES 5,551.00 080252 07/01/2019 1 Clr 06/18/2020 NEOLA, INC FEE FOR CONVERSION TO ELECTRONIC 2,700.00 080253 07/01/2019 1 Clr 06/18/2020 PAYSCHOOLS -

Student Mobility in Flint Community Schools

Student Mobility in the Flint Community School District By Troy Rosencrants Table of Contents Executive Summary ................................................................................................ i Introduction ............................................................................................................ 1 Data Analysis ......................................................................................................... 2 Data .............................................................................................................. 2 Student Counts ............................................................................................. 2 Student Mobility .......................................................................................... 3 Comparison of ACS data and student counts .............................................. 4 Discussion/Conclusions ......................................................................................... 8 References ............................................................................................................ 10 Appendices ........................................................................................................... 11 Executive Summary . Student mobility can be an issue in many urban areas where the population is predominantly minority and are low-income. Schools districts in Genesee County and, specifically, Flint Community Schools have declined in student population recently. During the period of declining student population -

Est Foundation Allowances Conference.Xlsx

FY 2017-18 Foundation Allowances and FY 2018-19 Estimated Conference Foundation Allowances Conference Committee Est. FY 2017-18 FY 2018-19 Estimated District Foundation Foundation Increase Per County Code District Name Allowance Allowance Pupil ALCONA 01010 ALCONA COMMUNITY SCHOOLS $7,631 $7,871 $240 ALGER COUNTY 02010 AUTRAIN-ONOTA PUBLIC SCHOOLS $7,668 $7,905 $237 ALGER COUNTY 02020 BURT TOWNSHIP SCHOOL DISTRIC $10,187 $10,307 $120 ALGER COUNTY 02070 MUNISING PUBLIC SCHOOLS $7,631 $7,871 $240 ALGER COUNTY 02080 SUPERIOR CENTRAL SCHOOL DIST $7,631 $7,871 $240 ALLEGAN COUNTY 03010 PLAINWELL COMMUNITY SCHOOLS $7,631 $7,871 $240 ALLEGAN COUNTY 03020 OTSEGO PUBLIC SCHOOLS $7,631 $7,871 $240 ALLEGAN COUNTY 03030 ALLEGAN PUBLIC SCHOOLS $7,631 $7,871 $240 ALLEGAN COUNTY 03040 WAYLAND UNION SCHOOLS $7,631 $7,871 $240 ALLEGAN COUNTY 03050 FENNVILLE PUBLIC SCHOOLS $7,631 $7,871 $240 ALLEGAN COUNTY 03060 MARTIN PUBLIC SCHOOLS $7,631 $7,871 $240 ALLEGAN COUNTY 03070 HOPKINS PUBLIC SCHOOLS $7,631 $7,871 $240 ALLEGAN COUNTY 03080 SAUGATUCK PUBLIC SCHOOLS $8,340 $8,460 $120 ALLEGAN COUNTY 03100 HAMILTON COMMUNITY SCHOOLS $7,631 $7,871 $240 ALLEGAN COUNTY 03440 GLENN PUBLIC SCHOOL DISTRICT $8,174 $8,358 $184 ALLEGAN COUNTY 03900 INNOCADEMY ALLEGAN CAMPUS $7,631 $7,871 $240 ALLEGAN COUNTY 03902 OUTLOOK ACADEMY $7,631 $7,871 $240 ALPENA 04010 ALPENA PUBLIC SCHOOLS $7,631 $7,871 $240 ANTRIM COUNTY 05010 ALBA PUBLIC SCHOOLS $7,631 $7,871 $240 ANTRIM COUNTY 05035 CENTRAL LAKE PUBLIC SCHOOLS $7,973 $8,178 $205 ANTRIM COUNTY 05040 BELLAIRE PUBLIC SCHOOLS $7,917 -

Joint Press Release for 2017 Event

FOR IMMEDIATE RELEASE MCISD CONTACT: Jennifer LaDuke September 29, 2017 734.322.2720 [email protected] BDC CONTACT: Tim C. Lake 734.241.8081 [email protected] Local manufacturers to host plant tours for students in celebration of Manufacturing Day Events designed to expand knowledge and improve public perception of manufacturing career opportunities Monroe. MI — Multiple manufacturers across the region will open their doors simultaneously to celebrate National Manufacturing Day (MFG Day) on Oct. 6, 2017. These events are part of an effort to change perceptions about today’s manufacturing environment and draw attention to the outstanding opportunities that a career in manufacturing can provide. The Monroe County Intermediate School District (MCISD) and the Monroe County Business Development Corporation (BDC) are coordinating Monroe County’s efforts in a region-wide initiative, covering Hillsdale, Jackson, Lenawee, Livingston, Monroe and Washtenaw counties, with the goal of exposing 1,000 middle and high school students to local manufacturing career opportunities in one day. In Monroe County, we have eleven manufacturers participating: Accuworx, Automatic Handling, Fischer Tool & Die, Fluid Equipment Design Company (Fedco), Gerdau, Hanwha, Midway Products Group, Premier Industries, Spiratex and Ventower Industries. “We appreciate our manufacturing community taking the time from their business schedules to open their shop floors to our students,” said Tim Lake President and CEO of the Monroe County Business Development Corporation. “Allowing our students to tour and ask questions about the various careers associated in todays advanced manufacturing environment is extremely helpful as students explore various careers,” Lake continued. Schools from all nine districts will be participating which include Airport Community Schools, Bedford Public Schools, Dundee Community Schools, Ida Public Schools, Jefferson Schools, Mason Consolidated Schools, Monroe Public Schools, Summerfield Schools and Whiteford Agricultural Schools. -

Fiscal Year 2019 Title I Grants to Local Educational Agencies

Fiscal Year 2019 Title I Grants to Local Educational Agencies - MICHIGAN No data No data No data LEA ID District FY 2019 Title I Allocation 2601890 Adams Township School District 48,702 2601920 Addison Community Schools 176,777 2601950 Adrian City School District 1,065,733 2601980 Airport Community School District 592,071 2602010 Akron-Fairgrove Schools 109,502 2621810 Alanson Public Schools 122,097 2602040 Alba Public Schools 54,249 2602160 Alcona Community Schools 294,838 2602190 Algonac Community School District 320,379 2602220 Allegan Public Schools 500,720 2602520 Allen Park Public Schools 302,176 2602550 Allendale Public School District 199,237 2602640 Alma Public Schools 638,109 2602670 Almont Community Schools 106,882 2602730 Alpena Public Schools 1,090,796 2602790 Anchor Bay School District 444,963 2602820 Ann Arbor Public Schools 1,992,536 2603060 Arenac Eastern School District 145,018 2603240 Armada Area Schools 52,311 2603270 Arvon Township School District 0 2603480 Ashley Community Schools 81,924 2603510 Athens Area Schools 187,809 2603540 Atherton Community Schools 343,521 2603570 Atlanta Community Schools 150,532 2603600 Au Gres-Sims School District 142,341 2603660 Autrain-Onota Public Schools 28,736 2603690 Avondale School District 291,470 2600017 Bad Axe Public Schools 272,994 2603810 Baldwin Community Schools 718,564 2603870 Bangor Public Schools 455,527 2603960 Bangor Township School District 8 14,476 2603900 Bangor Township Schools 515,938 2603990 Baraga Area Schools 129,234 2604020 Bark River-Harris School District -

SAMS/Fidreports/Indirectratessummary.Rdl Page 1 / 22 Michigan Department of Education Local District Indirect Cost Rates

*** Final *** Michigan Department of Education *** Final *** Local District Indirect Cost Rates for School Year 2018-2019 Based on 2016-2017 Costs R0418 Rate Summary Report * * ** District Restricted Unrestricted Medicaid Code District Name Rate Rate Rate 01010 Alcona Community Schools 6.45 17.03 17.03 02010 AuTrain-Onota Public Schools 12.60 21.95 21.95 02020 Burt Township School District 3.81 20.22 20.22 02070 Munising Public Schools 5.02 18.36 19.23 02080 Superior Central School District 4.67 13.99 12.65 03000 Allegan Area Educational Service Agency 11.75 23.05 26.06 03010 Plainwell Community Schools 2.34 14.74 13.86 03020 Otsego Public Schools 2.65 14.73 13.60 03030 Allegan Public Schools 1.80 12.37 12.36 03040 Wayland Union Schools 3.80 15.38 15.37 03050 Fennville Public Schools 3.78 22.90 22.63 03060 Martin Public Schools 5.37 18.99 19.36 03070 Hopkins Public Schools 3.96 16.78 14.02 03080 Saugatuck Public Schools 5.29 13.66 13.66 03100 Hamilton Community Schools 1.56 8.77 8.77 03440 Glenn Public School District 9.90 64.11 63.24 03902 Outlook Academy 3.55 7.24 7.24 04000 Alpena-Montmorency-Alcona ESD 15.63 15.17 15.17 04010 Alpena Public Schools 3.32 15.15 13.81 05010 Alba Public Schools 4.95 19.27 17.30 05035 Central Lake Public Schools 0.00 12.26 12.26 05040 Bellaire Public Schools 2.85 18.43 17.61 05060 Elk Rapids Schools 3.35 12.50 12.50 05065 Ellsworth Community School 2.31 8.33 8.33 05070 Mancelona Public Schools 4.47 17.50 19.63 06010 Arenac Eastern School District 2.26 19.18 21.61 06020 Au Gres-Sims School District 3.03 14.08 -

Headlines a News Report for Michigan Education Leaders Superintendent Evaluation Tool Based on Requirements of Law, Including Requirement for Teacher Evaluations

March 20, 2012 Headlines A News Report for Michigan Education Leaders Superintendent evaluation tool based on requirements of law, including requirement for teacher evaluations ASB is pleased to provide a evaluations, here are some lessons room that matters. new superintendent evalua- from the March issue of the American • Measure student engagement. tionM tool that's based on the evalua- School Board Journal that can help Teachers who initiate and sustain tion requirements of Section 1249 of guide you: student engagement are those the Revised School Code. Not only • Know what and how to evaluate. who are helping students learn. does the law require school boards to You must have a map that defines As the American School Board Jour- annually evaluate their superinten- what teacher effectiveness looks nal writes, “policymakers and teach- dent’s job performance taking into like. account student data, but also teacher • It’s all about student learning. If Evaluation, continued on page 10 evaluations. Developing a teacher students aren’t learning, nothing evaluation tool and completing evalu- else matters. ations for all teachers and adminis- • Measure teaching. Teachers must trators must be considered as part of be observed. It’s not who teach- your superintendent evaluation. ers are or what their backgrounds As your district considers its teacher are, but what they do in the class- Strategic leader appointed to MASB Board t the recent meeting of the memberships in many state and MASB Board of Directors, the national organizations and has been INSIDE THIS ISSUE: BoardA voted to appoint Tim Detwiler, involved at the local, state and national Northview Public Schools to fill the levels.