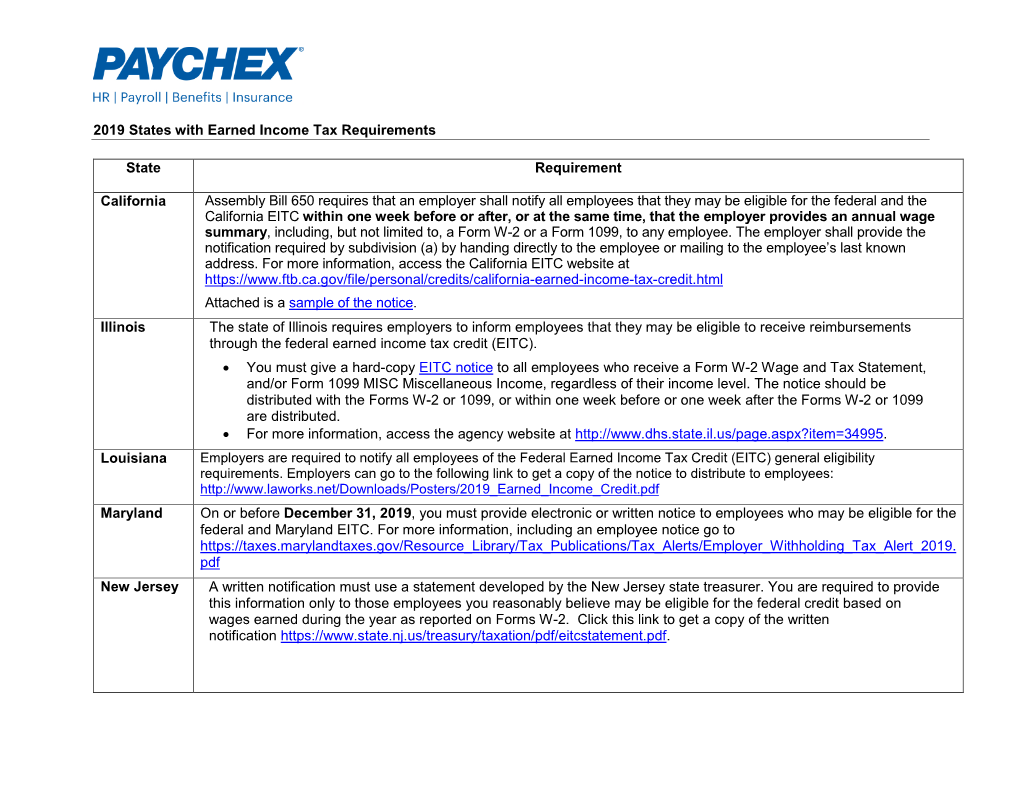

2019 States with Earned Income Tax Requirements

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Publication 974, Premium Tax Credit (PTC)

Userid: CPM Schema: tipx Leadpct: 100% Pt. size: 10 Draft Ok to Print AH XSL/XML Fileid: … tions/P974/2020/A/XML/Cycle04/source (Init. & Date) _______ Page 1 of 80 16:23 - 16-Apr-2021 The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing. Department of the Treasury Contents Internal Revenue Service Future Developments ....................... 1 Publication 974 Reminders ............................... 2 Cat. No. 66452Q Introduction .............................. 2 What Is the Premium Tax Credit (PTC)? ......... 3 Premium Tax Who Must File Form 8962 .................... 3 Who Can Take the PTC ...................... 4 Credit (PTC) Terms You May Need To Know ............... 4 For use in preparing Minimum Essential Coverage (MEC) ........... 8 Individuals Not Lawfully Present in the United 2020 Returns States Enrolled in a Qualified Health Plan ... 19 Determining the Premium for the Applicable Second Lowest Cost Silver Plan (SLCSP) ... 27 Allocating Policy Amounts for Individuals With No One in Their Tax Family .............. 27 Allocation of Policy Amounts Among Three or More Taxpayers ....................... 28 Alternative Calculation for Year of Marriage .... 38 Self-Employed Health Insurance Deduction and PTC ............................. 57 How To Get Tax Help ...................... 76 Index .................................. 80 Future Developments For the latest information about developments related to Pub. 974, such as legislation enacted after it was published, go to IRS.gov/Pub974. What’s New Health reimbursement arrangements (HRAs). Begin- ning in 2020, employers can offer individual coverage health reimbursement arrangements (individual coverage HRAs) to help employees and their families with their medical expenses. If you are offered an individual cover- age HRA, see Individual Coverage HRAs, later for more information on whether you can claim a PTC for you or a member of your family for Marketplace coverage. -

Rewarding Work: the Impact of the Earned Income Tax Credit in Greater Chicago

Center on Urban & Metropolitan Policy Rewarding Work: The Impact of the Earned Income Tax Credit in Greater Chicago Alan Berube and Benjamin Forman “...working Findings This year the federal Earned Income Tax Credit (EITC) will provide over $30 billion to families live 18.4 million low-income taxpayers across the U.S., making it the largest federal aid pro- gram for working poor families. An analysis of the spatial distribution of the EITC in the Chicago region shows that1: throughout ■ In 1998, the Chicago region bene- ■ The percentages of families earning fited from nearly three-quarters of a the EITC in the Chicago region and the Chicago billion dollars in federal EITC the city of Chicago were similar to refunds. Nearly 60 percent of the those for the ten largest metropoli- region’s $737 million in EITC tan areas and their central cities. The metropolitan refunds—$430 million—was earned by concentration of EITC dollars in the families living in the city of Chicago, city of Chicago was also comparable to much larger than the city’s share of the the median among cities in the ten area, and the region’s population (33 percent). largest metro areas. ■ Nearly half a million (470,000) low- ■ Transforming Illinois’ state EITC EITC is an income working families in the into a refundable tax credit would Chicago region earned an EITC in contribute millions of dollars to the 1998. About one-quarter of all taxpay- budgets of low-income working important source ers living in the city of Chicago earned families in the Chicago region. -

How Do State Earned Income Tax Credits Work?

TAX POLICY CENTER BRIEFING BOOK The State of State (and Local) Tax Policy SPECIFIC STATE AND LOCAL TAXES How do state earned income credits work? XXXX Q. How do state earned income tax credits work? A. In 2020, 28 states and the District of Columbia offered their own earned income tax credit (EITC). States typically set their credits as a percentage of the federal EITC. However, unlike the federal credit, some state EITCs are not refundable, which makes them much less valuable to very low-income families who rarely owe income tax. Twenty-eight states and DC offered their own earned income tax credit (EITC) in 2020. This does not include Washington’s credit which, while a part of the state’s tax code, has never been implemented or funded. If Washington did fund its credit, it would be the only state without an income tax to offer an EITC. In all but six states—Delaware, Hawaii, Ohio, Oklahoma, South Carolina, and Virginia—state EITCs, like the federal credit, are refundable. That is, if a refundable credit exceeds a taxpayer’s state income tax, the taxpayer receives the excess amount as a payment from the state. A nonrefundable EITC can only offset state income taxes, so the benefit is limited for low-income families with little taxable income. All states but one set their credits as a percentage of the federal credit, the exception being Minnesota, which calculates its credit as a percentage of income (table 1). State credits as a percentage of the federal credit ranged from 3 percent in Montana to a nonrefundable 62.5 percent in South Carolina. -

Key Elements of the U.S. Tax System

TAX POLICY CENTER BRIEFING BOOK Key Elements of the U.S. Tax System TAXES AND THE FAMILY What is the earned income tax credit? Q. What is the earned income tax credit? A. The earned income tax credit subsidizes low-income working families. The credit equals a fixed percentage of earnings from the first dollar of earnings until the credit reaches its maximum. The maximum credit is paid until earnings reach a specified level, after which it declines with each additional dollar of income until no credit is available. HOW THE EARNED INCOME TAX CREDIT WORKS The earned income tax credit (EITC) provides substantial support to low- and moderate-income working parents who claim a qualifying child based on relationship, age, residency, and tax filing status requirements. It previously provided very little support to workers without qualifying children (often called childless workers), but the American Rescue Plan (ARP) significantly expanded the credit for these workers through 2021. By design, the EITC only benefits people who work. Workers receive a credit equal to a per-centage of their earnings up to a maximum credit. Both the credit rate and the maximum credit vary by family size, with larger credits available to families with more children. In 2021, the maximum credit for families with one child is $3,618, while the maximum credit for families with three or more children is $6,728. The maximum credit for childless workers is $1,502, roughly triple what is was prior to the ARP. After the credit reaches its maximum, it remains flat until earnings reach the phaseout point. -

Earned Income Tax Credit

Earned Income Tax Credit Informational Paper 3 Wisconsin Legislative Fiscal Bureau January, 2015 Earned Income Tax Credit Prepared by Rick Olin Wisconsin Legislative Fiscal Bureau One East Main, Suite 301 Madison, WI 53703 http://legis.wisconsin.gov/lfb Earned Income Tax Credit Introduction The earned income tax credit (EITC) is A nonrefundable Wisconsin credit was first offered at both the federal and state levels as a enacted in 1983 Wisconsin Act 27. The credit means of providing assistance to lower-income was set at 30% of the federal credit and was workers. The credit provides a supplement to the available only in 1984 and 1985, due to its repeal wages and self-employment income of such by 1985 Wisconsin Act 29, effective with the families and is intended to offset the impact of 1986 tax year. Three years later, 1989 Wisconsin the social security tax and increase the incentive Act 31 reinstated a refundable state earned in- to work. come credit, and for tax years 1989 through 1993, the state credit was calculated as a percent- The federal earned income tax credit has been age of the federal credit. Effective for tax year provided since 1975. In tax years 1991 through 1994, a separate, stand-alone state credit was es- 1993, supplemental credits were also provided tablished by 1993 Wisconsin Act 16, but 1995 for health insurance and children under the age of Wisconsin Act 27 modified the credit to again be one. The supplemental credits were eliminated calculated as a percentage of the federal credit. beginning in 1994 and the credit was extended to lower-income families without children as part of Both the federal and Wisconsin credits are the federal Revenue Reconciliation Act of 1993. -

Democrats Unveil COVID-19 Bill Text Ahead of Markup

News February 10, 2021 Democrats Unveil COVID-19 Bill Text Ahead of Markup On Feb. 8, House Ways and Means Committee Chair Richard Neal (D-MA) released text representing its portion of Democrats’ $1.9 trillion COVID-19 stimulus legislation, modeled after President Joe Biden’s American Rescue Plan. The legislation includes the following priorities: Employee Retention Tax Credit $1,400 Economic Impact Payments Enhanced Child Tax Credit (CTC), Child and Dependent Care Tax Credit (CDCTC), and Earned income Tax Credit (EITC) Expanded sick leave and paid leave credits COBRA Subsidies Increase in the Premium Tax Credit Repeal of election to allocate interest on a worldwide basis A minimum wage increase is included in the Education and Labor Committee’s section of the bill. The provision would gradually increase the minimum wage by 2025. It is unclear whether it will be able to survive procedural tests in the Senate. The Ways and Means Committee began marking up the legislation today, and it is expected to last through Friday although the Republicans have said they do not intend to offer so many amendments that it consumes all of that time. The committee will only meet and conduct business during regular hours—ending each day at 6 p.m. Once markups are complete, the House Budget Committee will combine the bills for a final vote. House Majority Leader Steny Hoyer (D-MD) said the House is aiming to pass the measure during the week of Feb. 22, so the Senate can vote on the measure before extended unemployment benefits expire on March 14. -

Using the Earned Income Tax Credit to Stimulate Local Economies

DIVERSE PERSPECTIVES ON CRITICAL ISSUES Using the Earned Income Tax Credit to Stimulate Local Economies By Alan Berube The Brookings Institution Traditionally viewed as an antipoverty program, the federal Earned Income Tax Credit (EITC) is increasingly regarded as a significant federal investment in local and regional economies. Over the 30 years of its existence the federal Earned Income Tax Credit (EITC) has been described The EITC already provides variously as a wage supplement, a program to reduce substantial economic tax burdens, an antipoverty tool, a welfare-to-work benefits to local and regional economies, but it could make program, and a form of labor market insurance. The an even larger impact. program has enjoyed expansions under both Republican and Democratic administrations, and in 2006, the EITC will provide more than $40 billion to low-income working families. The credit lifts nearly 5 million Americans above the poverty line each year. Moreover, because the EITC aids only those families with earnings from work, researchers have credited it with raising labor force participation levels and helping families transition from welfare to work.1 Yet a significant proportion of eligible workers continue to miss out on the credit. In response, a growing number of state and local officials have begun concerted efforts to __________________________ The Living Cities Policy Series consists of papers commissioned by Living Cities to stimulate serious conversation about issues important to America’s cities. The authors present a variety of perspectives that do not necessarily represent the views of Living Cities or its member organizations. Living Cities: The National Community Development Initiative is a consortium of major financial institutions, philanthropic foundations, and federal agencies investing collaboratively in the vitality of cities to increase opportunity and improve the lives of people in urban neighborhoods. -

Implementing Tax Credits for Affordable Health Insurance Coverage

Implementing Tax Credits for Affordable Health Insurance Coverage Alan Weil Implementing Tax Credits for Affordable Health Insurance Coverage Contents Conclusion Continuity ofCoverage Flow ofFunds Reconciliation Families UsingtheCredit oftheCredit Determining theValue Disseminating, Receiving,andPr Designing the Tax Credit Application Credit Designing theTax views pr BlueShield of MassachusettsFoundation.The bytheBlueCross wasprovided Funding forthisreport Population The Target Introduction Massachusetts Foundation [email protected]. Additional copies ofthisr orstaff. officers, esented her . e ar e eport are available upon request. Please contact the Blue Cross BlueShieldof Pleasecontact theBlueCross availableupon request. eport are those oftheauthorandshouldnot beattributedtotheFoundationoritsdir . ocessing theApplication . ectors, 16 15 14 12 9 9 8 5 4 3 2 Implementing Tax Credits for Affordable Health Insurance Coverage Introduction 2 1 Shield ofMassachusetts Foundation,June2005.http://www.roadmaptocoverage.org/pdfs/BCBSF_Roadmap2005.pdf. “Building theRoadmaptoCoverage:Policy ChoicesandtheCostCoverageImplications,”Boston,MA:Blue Cross Blue MA: BlueCr Table 1. Structure of Tax Credits ofTax 1.Structure Table Roadmap insurance coverageinMassachusetts. purchasing pool. insurance coverage,buttheycanonlybeusedforcoverageobtainedthroughanew affordable. Eligiblefamiliescanapplythesetaxcredits towardthepriceofhealth to lowandmoderateincomefamiliesdesignedmakepurchasinghealthinsurance the systemandtimeresourceburdenborne -

Shopping for Subsidies: How Wal-Mart Uses Taxpayer Money To

Shopping for Subsidies: How Wal-Mart Uses Taxpayer Money to Finance Its Never-Ending Growth by Philip Mattera and Anna Purinton with Jeff McCourt, Doug Hoffer, Stephanie Greenwood & Alyssa Talanker May 2004 Good Jobs First 1311 L Street NW Washington, DC 20005 202-626-3780 www.goodjobsfirst.org © 2004 Good Jobs First. All rights reserved. 2 Table of Contents Note to Readers......................................................................................................5 Acknowledgments ..................................................................................................6 Executive Summary ................................................................................................7 Introduction .........................................................................................................11 I. Tracking Wal-Mart’s Use of Public Money .........................................................13 II. A Wide Assortment of Subsidies ......................................................................15 III. Retail Store Findings .......................................................................................18 IV. Distribution Center Findings...........................................................................26 V. Public Policy Options........................................................................................31 Appendix A: Model Language for Restricting Retail Subsidies .............................33 Appendix B: Descriptions of Subsidy Deals (arranged by state and city)..............35 -

The Earned Income Tax Credit (EITC): How It Works and Who Receives It

The Earned Income Tax Credit (EITC): How It Works and Who Receives It Updated January 12, 2021 Congressional Research Service https://crsreports.congress.gov R43805 SUMMARY R43805 The Earned Income Tax Credit (EITC): How It January 12, 2021 Works and Who Receives It Margot L. Crandall-Hollick The Earned Income Tax Credit (EITC) is a refundable tax credit available to eligible Acting Section Research workers earning relatively low wages. Because the credit is refundable, an EITC Manager recipient need not owe taxes to receive the benefit. Eligibility for and the amount of the EITC are based on a variety of factors, including residence and taxpayer ID Gene Falk requirements, the presence of qualifying children, age requirements for those without Specialist in Social Policy qualifying children, and the recipient’s investment income and earned income. Taxpayers with income above certain thresholds are ineligible for the credit. These Conor F. Boyle income thresholds vary based on marital status and number of qualifying children. Analyst in Social Policy The EITC depends on a recipient’s earned income. Specifically, the EITC phases in as a percentage of earned income (the “credit rate”) until the credit amount reaches its maximum level. The EITC then remains at its maximum level over a subsequent range of earned income, between the “earned income amount” and the “phaseout amount threshold.” Finally, the credit gradually decreases to zero at a fixed rate (the “phaseout rate”) for each additional dollar of adjusted gross income (AGI) (or earned income, whichever is greater) above the phaseout amount threshold. The specific values of these EITC parameters (e.g., credit rate, earned income amount) vary depending on several factors, including the number of qualifying children a taxpayer has and the taxpayer’s marital status, as illustrated in the figure and table below. -

WALMART on TAX DAY How Taxpayers Subsidize America’S Biggest Employer and Richest Family

WALMART ON TAX DAY How Taxpayers Subsidize America’s Biggest Employer and Richest Family April 2014 Americans for Walmart on Tax Day Tax FairnessPage 1 Americans for Tax Fairness is a diverse coalition of 400 national and state organi- zations that collectively represent tens of millions of members. The organization was formed on the belief that the country needs comprehensive, progressive tax reform that results in greater revenue to meet our growing needs. ATF is playing a central role in Washington and in the states on federal tax-reform issues. Americans for Tax Fairness 1726 M Street NW Suite 1100 Washington, D.C. 20036 www.AmericansForTaxFairness.org WALMART ON TAX DAY: How Taxpayers Subsidize America’s Biggest Employer and Richest Family Introduction On tax day, when millions of American taxpayers and small businesses pay their fair share to support critical public services and the economy, they will also get stuck with a multi-billion dollar tax bill to cover the massive subsidies and tax breaks that benefit the country’s largest employer and richest family. Walmart is the largest private employer in the United States,1 with 1.4 million employees.2 The company, which is number one on the Fortune 500 in 2013 and number two on the Global 500,3 had $16 billion in profits last year on revenues of $473 billion.4 The Walton family, which owns more than 50 percent of Walmart shares,5 reaps billions in annual dividends from the company.6 The six Walton heirs are the wealthiest family in America, with a net worth of $148.8 billion.7 Collectively, these six Waltons have more wealth than 49 million American families combined.8 This report finds that the American public is providing enormous tax breaks and tax subsidies to Walmart and the Walton family, further boosting corporate profits and the family’s already massive wealth at everyone else’s expense. -

Familytaxcredits Tax Year 2016

FAMILYTAXCREDITS TAX YEAR 2016 FAMILIES IN NEW YORK GET THE TAX CREDITS YOU DESERVE! You work hard to support your family. Whether or not you owe any income tax, you could get thousands of dollars back in tax credits. You could qualify for: • Up to $2,100 from the federal Child and Dependent Care Tax Credit, up to $2,310 from the New York State Child and Dependent Care Tax Credit, and up to $1,733 from the New York City Child and Dependent Care Tax Credit. • Up to $6,269 from the federal Earned Income Tax Credit, up to $1,881 from the New York State Earned Income Tax Credit, and up to $313 from the New York City Earned Income Tax Credit. • Up to $1,000 per child from the federal Child Tax Credit and up to $330 per child from the Empire State Child Tax Credit. • A Premium Tax Credit to help you purchase health insurance through the Health Insurance Marketplace. • If you need help paying for health insurance in 2017, you can get the Premium Tax Credit as soon as you sign up through the Marketplace. Most people need to sign up by February 2017—so go to healthcare.gov or call (800) 318-2596 today for more information. • If you purchased insurance through the Marketplace in 2016 and received an advance payment of the Premium Tax Credit, you must file a tax return for 2016. TO GET THESE CRedits, YOU MUst FILE A TAX RETURN. Find out where you can get FREE help with your taxes by calling the IRS toll-free at (800) 906-9887.