Form 10-K Assertio Therapeutics, Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Companies in Attendance

COMPANIES IN ATTENDANCE Abbott Diabetes Care Archbow Consulting LLC Business One Technologies Abbott Laboratories ARKRAY USA BusinessOneTech AbbVie Armory Hill Advocates, LLC CastiaRX ACADIA Artia Solutions Catalyst Acaria Health Asembia Celgene Accredo Assertio Therapeutics Celltrion Acer Therapeutics AssistRx Center for Creative Leadership Acorda Therapeutics Astellas Pharma US Inc. Cigna Actelion AstraZeneca Cigna Specialty Pharmacy AdhereTech Athenex Oncology Circassia Advantage Point Solutions Avanir Coeus Consulting Group Aerie Pharmaceuticals Avella Coherus Biosciences AGIOS AveXis Collaborative Associates LLC Aimmune Theraputics Bank of America Collegium Akcea Therapeutics Bausch Health Corsica Life Sciences Akebia Therapeutics Bayer U.S. CoverMyMeds Alder BioPharmaceuticals Becton Dickinson Creehan & Company, Inc., an Inovalon Company Alexion Biofrontera CSL Behring Alkermes Biogen Curant Health Allergan Biohaven CVS Health Almirall BioMarin D2 Consulting Alnylam BioMatrix Specialty Pharmacy Daiichi Sankyo Amarin BioPlus Specialty Pharmacy DBV Technologies Amber Pharmacy Bioventus Deloitte Consulting LLP AmerisourceBergen Blue Cross Blue Shield Association Dendreon Amgen Blue Fin Group Dermira Amicus Therapeutics bluebird bio Dexcom Amneal Boehringer Ingelheim Diplomat Pharmacy Anthem Boston Biomedical Dova Applied Policy Bowler and Company Decision Resources Group Aquestive Therapeutics Braeburn Eisai Arbor Pharmaceuticals Bristol-Myers Squibb 1 electroCore Indivior Merz Pharmaceuticals EMD Serono Inside Rx Milliman Encore Dermatology, -

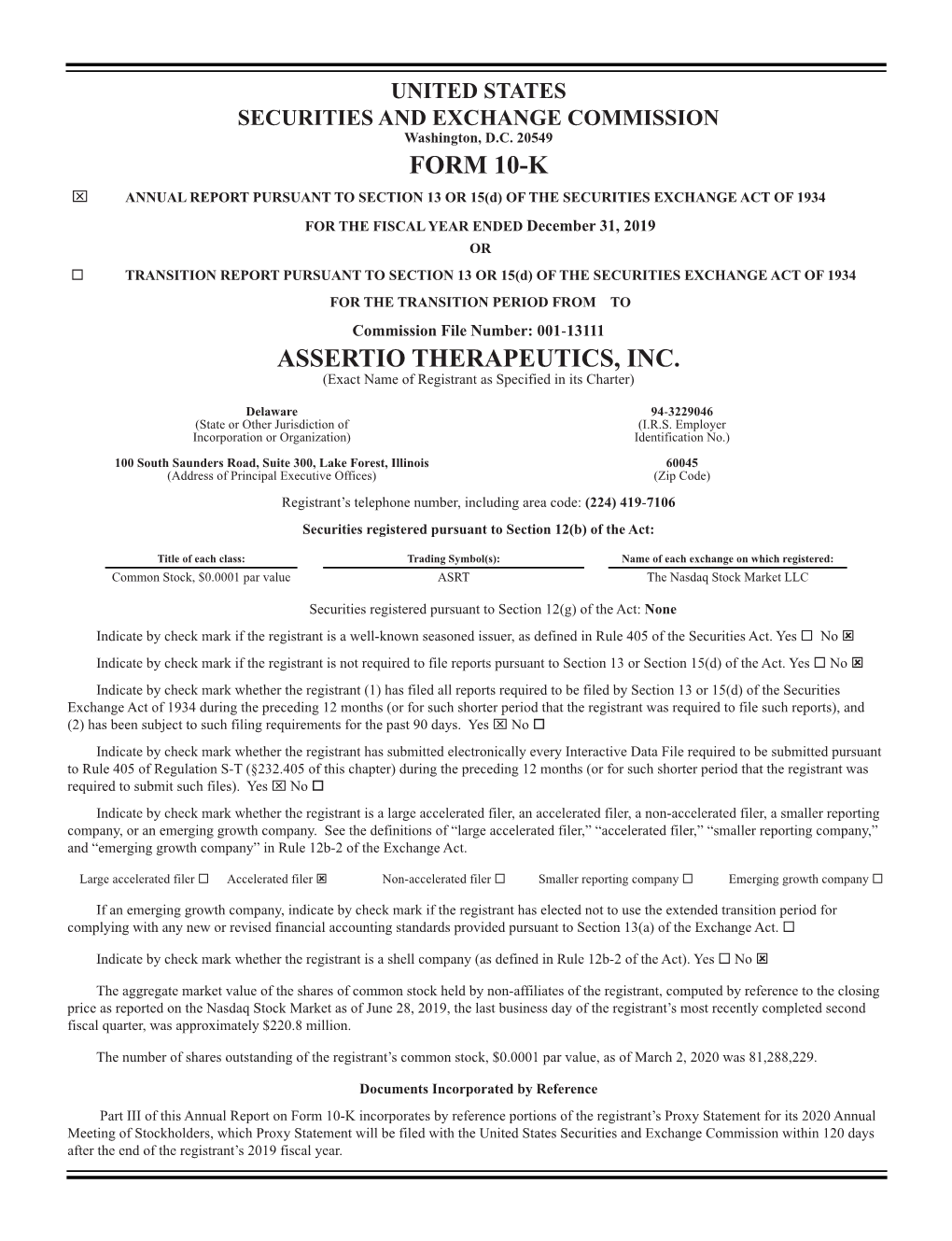

ASSERTIO THERAPEUTICS, INC. (Exact Name of Registrant As Specified in Its Charter) Delaware 94-3229046 (State Or Other Jurisdiction of (I.R.S

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark one) ፤ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2018 OR អ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from: to Commission File Number: 001-13111 ASSERTIO THERAPEUTICS, INC. (Exact Name of Registrant as Specified in its Charter) Delaware 94-3229046 (State or Other Jurisdiction of (I.R.S. Employer Incorporation or Organization) Identification No.) 100 South Saunders Road, Suite 300, Lake Forest, Illinois 60045 (Address of Principal Executive Offices) (Zip Code) Registrant’s telephone number, including area code: (224) 419-7106 Securities registered pursuant to Section 12(b) of the Act: Title of each class: Name of each exchange on which registered: Common Stock, $0.0001 par value The NASDAQ Stock Market LLC Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes អ No ፤ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes អ No ፤ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

HIGHLIGHTSOF PRESCRIBING INFORMATION These Highlights Do

HIGHLIGHTSOF PRESCRIBING INFORMATION • These highlights do not include all the information needed to use CAMBIA Hypertension: Patients taking some antihypertensive medications may safely and effectively. See full prescribing information for CAMBIA. have impaired response to these therapies when taking NSAIDs. Monitor blood pressure (5.4, 7) CAMBIA® (diclofenac potassium), for oral solution • Heart Failure and Edema: Avoid use of CAMBIA in patients with Initial U.S. Approval: 1988 severe heart failure unless benefits are expected to outweigh risk of worsening heart failure (5.5) WARNING: RISK OF SERIOUS CARDIOVASCULAR • Renal Toxicity: Monitor renal function in patients with renal or AND GASTROINTESTINAL EVENTS hepatic impairment, heart failure, dehydration, or hypovolemia. Avoid See full prescribing information for complete boxed warning use of CAMBIA in patients with advanced renal disease unless benefits are expected to outweigh risk of worsening renal function (5.6) Non-steroidal anti-inflammatory drugs (NSAIDs) cause an increased risk • Anaphylactic Reactions: Seek emergency help if an anaphylactic of serious cardiovascular thrombotic events, including myocardial reaction occurs (5.7) infarction and stroke, which can be fatal. This risk may occur early in treatment and may increase with duration of use (5.1) • Exacerbation of Asthma Related to Aspirin Sensitivity: CAMBIA is contraindicated in patients with aspirin-sensitive asthma. Monitor patients CAMBIA is contraindicated in the setting of coronary artery bypass with preexisting asthma (without aspirin sensitivity) (5.8) graft (CABG) surgery (4, 5.1) • Serious Skin Reactions: Discontinue CAMBIA at first appearance of skin rash or other signs of hypersensitivity (5.9). NSAIDs cause an increased risk of serious gastrointestinal (GI) adverse • Drug Reaction with Eosinophilia and Systemic Symptoms (DRESS): events including bleeding, ulceration, and perforation of the stomach or Discontinue and evaluate clinically (5.10) intestines, which can be fatal. -

ZIPSOR (Diclofenac Potassium) Capsules

NDA 022202/S-013, S-014 SUPPLEMENT APPROVAL FULFILLMENT OF POSTMARKETING REQUIREMENT Assertio Therapeutics, Inc. 100 S. Saunders Road Suite 300 Lake Forest, IL 60045 Attention: Clorey Toombs, RAC Executive Director, Regulatory Affairs Dear Ms. Toombs: Please refer to your supplemental new drug applications (sNDA) dated and received November 9, 2018, (S-013) and November 17, 2020, (S-014) and your amendments, submitted under section 505(b) of the Federal Food, Drug, and Cosmetic Act (FDCA) for ZIPSOR (diclofenac potassium) capsules. Prior Approval supplement S-013 expands the approved indication for relief of mild to moderate acute pain in pediatric patients 12 years of age and older. We also refer to our letter dated October 15, 2020, notifying you, under Section 505(o)(4) of the FDCA, of new safety information that we believe should be included in the labeling for nonsteroidal anti-inflammatory drug (NSAID) products. This information pertains to the serious risks of fetal renal dysfunction, oligohydramnios, neonatal renal impairment, and Drug Reaction with Eosinophilia and Systemic Symptoms (DRESS). Prior Approval supplement S-014 provides for safety labeling changes required under Section 505(o)(4) of the FDCA, consistent with our October 15, 2020, letter. APPROVAL & LABELING We have completed our review of these applications, as amended. They are approved, effective on the date of this letter, for use as recommended in the enclosed agreed- upon labeling. CONTENT OF LABELING As soon as possible, but no later than 14 days from the date of this letter, submit the content of labeling [21 CFR 314.50(l)] in structured product labeling (SPL) format using the FDA automated drug registration and listing system (eLIST), as described at Reference ID: 4799720 NDA 022202/S-013, S-014 Page 2 FDA.gov.1 Content of labeling must be identical to the enclosed labeling, with the addition of any labeling changes in pending “Changes Being Effected” (CBE) supplements, as well as annual reportable changes not included in the enclosed labeling. -

Collegium Pharmaceutical Inc

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 8-K CURRENT REPORT Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 Date of Report (Date of earliest event reported): February 6, 2020 COLLEGIUM PHARMACEUTICAL, INC. (Exact name of registrant as specified in its charter) Virginia 001-37372 03-0416362 (state or other jurisdiction (Commission (I.R.S. Employer of incorporation) File Number) Identification No.) 100 Technology Center Drive Suite 300 Stoughton, MA 02072 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (781) 713-3699 (Former name or former address, if changed since last report) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): ¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) ¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) ¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) ¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Indicated by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ¨ If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. -

IOA Two-Year Progress Report

Two-Year Progress Report TABLE OF CONTENTS INTRODUCTION . 1 HISTORY OF THE IOA. 2 OPIOID BUSINESS RISKS: THE BUSINESS CASE FOR THE IOA . 5 IOA ENGAGEMENT STRATEGY AND COMPANIES . 8 KEY GOVERNANCE PROPOSALS FOR OPIOID SUPPLY CHAIN COMPANIES . 10 OPIOID BUSINESS RISKS BEYOND THE UNITED STATES . 17 APPENDIX 1 . 19 APPENDIX 2 . 20 APPENDIX 3 . 21 APPENDIX 4 . 22 APPENDIX 5 . 23 ENDNOTES . 27 INTRODUCTION This report summarizes the work of the Investors for • 26 negotiated settlements on governance issues Opioid Accountability (IOA) from July 1, 2017 to reached by companies and IOA members prior to a July 31, 2019. The IOA is a diverse global coalition vote of shareholders. of 57 members representing public, faith-based, labor, and sustainability funds, as well as investment • 4 negotiated settlements on governance issues managers, with $4 trillion in collective assets under reached by companies and IOA members following a management and advisement. The report covers the vote of shareholders. following topics: • 2 companies created a board level committee • The Business Case for the IOA; dedicated to oversight of opioids. • IOA Engagement Strategy & Companies; • 12 companies issued or committed to issue board risk reports. • Key Governance Proposals for Opioid Companies; • 10 companies adopted a misconduct clawback • Global Opioid Business Risks beyond the United policy. States; and • 3 companies agreed to separate the Chairman from • IOA Results by Company. CEO position. • 3 companies addressed executive compensation incentives by factoring in calculations of legal costs. Coalition Highlights by • 80 percent vote received for lobbying resolution filed the Numbers by IOA member United Church Funds at Mallinckrodt, • 57 members joined in fewer than two years. -

Investment Portfolio 2019

Teachers’ Retirement System of the City of New York Contents Introduction . .1 Statement of Total Investments for the Pension Fund . .3 Statement of Total Investments for the Diversified Equity Fund . .7 Statement of Total Investments for the Balanced Fund . .117 Statement of Total Investments for the International Equity Fund . .121 Statement of Total Investments for the Inflation Protection Fund . .161 Statement of Total Investments for the Socially Responsive Equity Fund . .165 Summary of Investment Managers . .169 Introduction The Teachers’ Retirement System of the City of New York (TRS) is pleased to present you with our Investment Portfolios publication for the fiscal year ended June 30, 2019. This publication lists the name and value of each investment that TRS held in its six investment programs at the closing of the fiscal year. Cash, receivables, and collateral from securities-lending transactions are assets of TRS but not of the investment programs; therefore, they are not included in this report. TRS’ investments as of June 30, 2019 are described briefly below: The Pension Fund consists of U.S. and international equities and fixed-income instruments, with smaller allocations made to private equity and real estate investments. It contains the City’s contributions toward TRS members’ retirement allowances (pension reserves) and members’ contributions to the Qualified Pension Plan (QPP). It also includes the assets of the Fixed Return Fund, an investment option for members that provides a fixed rate of return, determined by the New York State Legislature in accordance with applicable laws. The Diversified Equity Fund invests primarily in the stocks of U.S. -

Antibe Therapeutics ATE-TSXV: $0.29 White Paper on ATB-346 Phase II Performance Affirms Our Speculative BUY Positive View on Drug Potential – Spec BUY $1.40 Target

29 August 2018 Healthcare & Biotechnology Antibe Therapeutics ATE-TSXV: $0.29 White Paper On ATB-346 Phase II Performance Affirms Our Speculative BUY Positive View On Drug Potential – Spec BUY $1.40 Target Event: ON-based drug developer Antibe Therapeutics posted a white paper on its website Projected Return: 383% yesterday that provides added granularity on data derived from its completed 244-patient Valuation: NPV, 20x EPS, 12.5x Phase II gastroduodenal ulceration rate trial, comparing its hydrogen sulfide-releasing EV/EBITDA naproxen analog drug ATB-346 to naproxen itself at doses at which naproxen is, and ATB-346 (F2025 estimates, 40% discount rate) is predicted to, confer measurable symptomatic relief in knee osteoarthritis pain. In parallel, Antibe reported FQ119 financial data for the June-end quarter this morning, data that is less impactful on our valuation than ATB-346 development activities, but we will provide relevant commentary below. Bottom line: Our fundamental investment thesis on Antibe’s pipeline of hydrogen sulfide- releasing pain therapies, and specifically of cyclooxygenase-1-inhibiting non-steroidal anti- inflammatory drugs (NSAIDs) for which GI ulceration is a recognized side effect, is unchanged and we remain positive on how the firm’s lead drug ATB-346 performed in recent Phase II GI ulceration rate testing and could subsequently perform in pending Phase II knee osteoarthritis pain testing, for which we expect final pain data by FQ120 (CQ219). We are maintaining our Speculative BUY rating and PT of $1.40 on ATE, with our valuation still based on NPV (40% discount rate that will become increasingly conservative as ATB-346 advances through Phase II testing) and multiples of our F2025 adjusted EBITDA/fd EPS forecasts ($165.6M/$0.41, respectively). -

Appendix B - Product Name Sorted by Applicant

JUNE 2021 - APPROVED DRUG PRODUCT LIST B - 1 APPENDIX B - PRODUCT NAME SORTED BY APPLICANT ** 3 ** 3D IMAGING DRUG * 3D IMAGING DRUG DESIGN AND DEVELOPMENT LLC AMMONIA N 13, AMMONIA N-13 FLUDEOXYGLUCOSE F18, FLUDEOXYGLUCOSE F-18 SODIUM FLUORIDE F-18, SODIUM FLUORIDE F-18 3M * 3M CO PERIDEX, CHLORHEXIDINE GLUCONATE * 3M HEALTH CARE INC AVAGARD, ALCOHOL (OTC) DURAPREP, IODINE POVACRYLEX (OTC) 3M HEALTH CARE * 3M HEALTH CARE INFECTION PREVENTION DIV SOLUPREP, CHLORHEXIDINE GLUCONATE (OTC) ** 6 ** 60 DEGREES PHARMS * 60 DEGREES PHARMACEUTICALS LLC ARAKODA, TAFENOQUINE SUCCINATE ** A ** AAA USA INC * ADVANCED ACCELERATOR APPLICATIONS USA INC LUTATHERA, LUTETIUM DOTATATE LU-177 NETSPOT, GALLIUM DOTATATE GA-68 AAIPHARMA LLC * AAIPHARMA LLC AZASAN, AZATHIOPRINE ABBVIE * ABBVIE INC ANDROGEL, TESTOSTERONE CYCLOSPORINE, CYCLOSPORINE DEPAKOTE ER, DIVALPROEX SODIUM DEPAKOTE, DIVALPROEX SODIUM GENGRAF, CYCLOSPORINE K-TAB, POTASSIUM CHLORIDE KALETRA, LOPINAVIR NIASPAN, NIACIN NIMBEX PRESERVATIVE FREE, CISATRACURIUM BESYLATE NIMBEX, CISATRACURIUM BESYLATE NORVIR, RITONAVIR SYNTHROID, LEVOTHYROXINE SODIUM ** TARKA, TRANDOLAPRIL TRICOR, FENOFIBRATE TRILIPIX, CHOLINE FENOFIBRATE ULTANE, SEVOFLURANE ZEMPLAR, PARICALCITOL ABBVIE ENDOCRINE * ABBVIE ENDOCRINE INC LUPANETA PACK, LEUPROLIDE ACETATE ABBVIE ENDOCRINE INC * ABBVIE ENDOCRINE INC LUPRON DEPOT, LEUPROLIDE ACETATE LUPRON DEPOT-PED KIT, LEUPROLIDE ACETATE ABBVIE INC * ABBVIE INC DUOPA, CARBIDOPA MAVYRET, GLECAPREVIR NORVIR, RITONAVIR ORIAHNN (COPACKAGED), ELAGOLIX SODIUM,ESTRADIOL,NORETHINDRONE ACETATE -

Drug Formulary

Drug Formulary Manufacturer: Medication: Manufacturer: Medication: ABBVIE Androgel ASSERTIO THERAPEUTICS Cambria ABBVIE Creon ASSERTIO THERAPEUTICS Gralise ABBVIE Humira ASSERTIO THERAPEUTICS Nucynta ER ADAPT PHARMA Narcan ASSERTIO THERAPEUTICS Zipsor AKORN Azasite ASTELLAS Myrbetriq AKORN Cosopt ASTELLAS Vesicare ALFASIGMA USA Cerefolin ASTRAZENECA Bevespi ALFASIGMA USA Deplin ASTRAZENECA Byduron ALFASIGMA USA Metanx ASTRAZENECA Daliresp ALLERGAN Acuvail ASTRAZENECA Farxiga ALLERGAN Alphagam ASTRAZENECA Movantik ALLERGAN Androderm ASTRAZENECA Tudorza ALLERGAN Bystolic ASTRAZENECA LP Brilanta ALLERGAN Combigan ASTRAZENECA LP Pulmicort ALLERGAN Delzicol ASTRAZENECA LP Symbicort ALLERGAN Fetzima AVANIR PHARMACEUTICALS, LLC Nuedexta ALLERGAN Gelnique AVANIR PHARMACEUTICALS, LLC Onzetra ALLERGAN Lastacaft BAUSCH HEALTH Alrex ALLERGAN Linzess BAUSCH HEALTH Aplenzin ALLERGAN Lumigan BAUSCH HEALTH Ativan ALLERGAN Namenda XR BAUSCH HEALTH Besivance ALLERGAN Namzaric BAUSCH HEALTH Elidel ALLERGAN Pylera BAUSCH HEALTH Istalol ALLERGAN Rapaflo BAUSCH HEALTH Lotemax ALLERGAN Savella BAUSCH HEALTH Luzu ALLERGAN Viberzi BAUSCH HEALTH Prolenza ALLERGAN Viibyrd BAUSCH HEALTH Relistor ALMATICA Napelan BAUSCH HEALTH Trulance AMARIN PHARMA Vascepa BAUSCH HEALTH Wellbutrin XL AMGEN Corlanor BIODELIVERY SCIENCES Belbuca AMGEN Repatha BIODELIVERY SCIENCES Bunavil AMNEAL SPECIALTY Zomig BIOVENTUS Supartz ANTARES PHARMA Otrexup B-M SQUIBB U.S. (PRIMARY CARE) Coumadin ARBOR PHARMACEUTICALS Edarbi B-M SQUIBB U.S. (PRIMARY CARE) Eliquis ARBOR PHARMACEUTICALS Edarbyclor -

MED-Project Participating Drug Companies - King County Washington, March 2020

MED-Project Participating Drug Companies - King County Washington, March 2020 Drug Company Name Parent Company 3M Corporation 3M Corporation 3M Drug Delivery Systems 3M Corporation 3M ESPE 3M Corporation 3M Health Care 3M Corporation 3M Personal Care 3M Corporation AbbVie Inc. AbbVie Inc. ACADIA Pharmaceuticals Inc. ACADIA Pharmaceuticals Inc. Accord Healthcare Inc. Accord Healthcare Inc. Acorda Therapeutics, Inc. Acorda Therapeutics, Inc. Acorda Therapeutics, Inc. Acorda Therapeutics, Inc. Actavis Generics Teva Pharmaceuticals USA, Inc. Actavis Pharma, Inc. (only for labeler code 52544) Allergan, Inc. Actelion Johnson & Johnson Adapt Pharma Inc. Adapt Pharma Inc. Advanced Vision Research Inc. d.b.a. Akorn Consumer Health Akorn, Inc. Advantice Health Advantice Health Aegerion Pharmaceuticals, Inc. Aegerion Pharmaceuticals, Inc. Afaxys Inc. Afaxys Inc. Afaxys Pharmaceuticals (a division of Afaxys Inc.) Afaxys Inc. Affordable Pharmaceuticals LLC Sebela Pharmaceuticals Inc. Ajanta Pharma USA Inc. Ajanta Pharma USA Inc. AkaRx, Inc., dba Dova Pharmaceuticals AkaRx, Inc., dba Dova Pharmaceuticals Akebia Therapeutics, Inc. Akebia Therapeutics, Inc. Akorn Animal Health, Inc. Akorn, Inc. Akorn, Inc. Akorn, Inc. Akrimax Pharmaceuticals, LLC Akrimax Pharmaceuticals, LLC AKRON COATING & ADHESIVES AKRON COATING & ADHESIVES Alaven Pharmaceuticals LLC Mylan Inc. Alcon Laboratories, Inc. Novartis Group Companies Alembic Pharmaceuticals Inc. Alembic Pharmaceuticals Inc. Allergan Sales, LLC Allergan, Inc. Allergan USA, Inc. Allergan, Inc. Allergan, Inc. Allergan, Inc. Almaject, Inc. Alvogen Pharma US, Inc. Almatica Pharma, Inc. Alvogen Pharma US, Inc. Almirall LLC Almirall LLC Alphapharm Pty Ltd Mylan Inc. Alva-Amco Pharmacal Companies, Inc. Alva-Amco Pharmacal Companies, Inc. Alvogen Pharma US, Inc. Alvogen Pharma US, Inc. Alvogen, Inc. Alvogen Pharma US, Inc. AMAG Pharma USA, Inc. -

COUNTY of LUBBOCK Plaintiff

Filed 11/12/2019 12:00 AM Barbara Sucsy District Clerk Lubbock County, Texas 2019537688 MS CAUSE NO. __________________ COUNTY OF LUBBOCK § IN THE DISTRICT COURT § Plaintiff, § § vs. § § ________ JUDICIAL DISTRICT TEVA PHARMACEUTICAL INDUSTRIES, § LTD.; § TEVA PHARMACEUTICALS USA, INC.; § CEPHALON, INC.; § ALLERGAN PLC f/k/a ACTAVIS PLC; § ALLERGAN FINANCE, LLC f/k/a § LUBBOCK COUNTY, TEXAS ACTAVIS, INC. f/k/a WATSON § PHARMACEUTICALS, INC.; § ALLERGAN SALES, LLC; § ALLERGAN USA INC.; § WATSON LABORATORIES, INC.; § ACTAVIS LLC; § ACTAVIS PHARMA INC. f/k/a WATSON § PHARMA, INC.; § ACTAVIS LABORATORIES UT, INC. f/k/a § WATSON LABORATORIES, INC.; § JANSSEN PHARMACEUTICALS, INC. f/k/a § ORTHO-MCNEIL-JANSSEN § PHARMACEUTICALS, INC. f/k/a JANSSEN § PHARMACEUTICA, INC.; § JOHNSON & JOHNSON; § NORAMCO, INC.; § ASSERTIO THERAPEUTICS, INC. f/k/a § DEPOMED, INC.; § ENDO HEALTH SOLUTIONS INC.; § ENDO PHARMACEUTICALS INC.; § PAR PHARMACEUTICAL, INC.; § PAR PHARMACEUTICAL COMPANIES, § INC.; § ABBVIE INC.; § KNOLL PHARMACEUTICAL COMPANY; § MALLINCKRODT PLC; § MALLINCKRODT LLC; § SPECGX LLC; § MYLAN INC.; § MYLAN INSTITUTIONAL INC.; § MYLAN PHARMACEUTICALS INC.; § MYLAN SPECIALTY L.P.; § LUBBOCK COUNTY’S ORIGINAL PETITION AND REQUESTS FOR DISCLOSURE Page 1 of 151 MYLAN BERTEK PHARMACEUTICALS § INC.; § MISSION PHARMACAL COMPANY; § MCKESSON CORPORATION; § MCKESSON MEDICAL-SURGICAL INC.; § CARDINAL HEALTH, INC.; § CARDINAL HEALTH 110, LLC; § AMERISOURCEBERGEN CORPORATION; § AMERISOURCEBERGEN DRUG § CORPORATION; § ADVANCED PHARMA, INC. d/b/a § AVELLA OF HOUSTON; § and, § DOES 1 – 99, INCLUSIVE, § § Defendants. § LUBBOCK COUNTY’S ORIGINAL PETITION AND REQUESTS FOR DISCLOSURE Plaintiff, the County of Lubbock, by and through the undersigned attorneys (hereinafter “Lubbock County” or “County”), files this Original Petition and Requests for Disclosure against Defendants Teva Pharmaceutical Industries, LTD., Teva Pharmaceuticals USA, Inc., Cephalon, Inc., Allergan PLC f/k/a Actavis PLC, Allergan Finance, LLC f/k/a Actavis, Inc.