Initial Public Offerings Law Review

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

NYSE American Options Customer Best Execution (“CUBE”) Mechanism Frequently Asked Questions

NYSE American Options Customer Best Execution (“CUBE”) Mechanism Frequently Asked Questions GENERAL INFORMATION 1. What is CUBE? CUBE is NYSE American Options’ (the “Exchange”) electronic crossing price improvement auction mechanism. CUBE is available for single-leg orders (“Single-Leg CUBE”) and complex orders (“Complex CUBE”) and offers exchange participants (“Participants”) the ability to seek price improvement for paired orders of any size. Additional information can be found in NYSE American Rules 971.1NY for Single-Leg CUBE and Rule 971.2NY for Complex CUBE. 2. What is a CUBE ‘Paired’ order? Paired orders are comprised of an ‘Initiating’ order -- i.e., the CUBE Order -- and a ‘Contra’ order. The orders may be made up of principal or solicited interest and are sent to the Exchange in a single CUBE order message; both the Initiating order and Contra order components are required to constitute a valid CUBE order, which is then evaluated for auction eligibility. Except for AON CUBE, where both Initiating and Contra orders may be canceled in certain circumstances where the AON order contingency is not met (see below), the Contra order guarantees execution of the Initiating order within an allowable execution range. 3. What is AON CUBE? AON CUBE provides All-or-None (“AON”) functionality for CUBE orders with a minimum of 500 contracts for Single-Leg AON CUBE, and with a minimum of 500 contracts on the smallest leg for a Complex AON CUBE. For additional information on AON CUBE, please see the ‘AON CUBE Supplemental Information’ section below. 4. How does the CUBE auction operate? On receipt of a valid CUBE/Contra order pairing, the Exchange broadcasts the auction via a Request for Quote (“RFQ”) message to subscribers of the Exchange’s market data (“XDP”) feeds. -

Membership Application for New York Stock Exchange LLC and NYSE

Membership Application for New York Stock Exchange LLC1 and NYSE American LLC 1 NYSE membership permits the Applicant Firm, upon approval of membership, to participate in the NYSE Bonds platform. TABLE OF CONTENTS Page Application Process and Fees 2-3 Information and Resources 3 Explanation of Terms 4-5 Section 1 – Organizational Profile 6 Section 2 – Applicant Firm Acknowledgement 7 Section 3 – Application Questions 8-9 Section 4 – Floor Based Business 10 Section 5 – Key Personnel 11 Section 6 – Additional Required Documentation and Information 12-14 Section 7 – Designation of Accountant 15 Section 8 – Required Organizational Documents and Language Samples / References 16 NYSE and NYSE American Equities Membership Application - October 2019 1 APPLICATION PROCESS Filing Requirements Prior to submitting the Application for New York Stock Exchange LLC (“NYSE”) and/or NYSE American LLC (“NYSE American”) membership, an Applicant Firm must file a Uniform Application for Broker-Dealer Registration (Form BD) with the Securities and Exchange Commission and register with the FINRA Central Registration Depository (“Web CRD®”). Application Submission Applicant Firm must complete and submit all applicable materials addressed within the application as well as the additional required documentation noted in Section 6 of the application. Application and supplemental materials should be sent electronically to [email protected]. Please ensure all attachments are clearly labeled. NYSE Applicant Firm pays one of the below application fees (one-time fee and non-refundable): Clearing Firm $20,000 (Self-Clearing firm or Clears for other firms) Introducing Firm $ 7,500 (All other firms fall within this category) Non-Public Firm $ 2,500 (On-Floor firms and Proprietary firms) Kindly make check payable to “NYSE Market (DE), Inc.” and submit the check with your initial application. -

Initial Public Offerings

November 2017 Initial Public Offerings An Issuer’s Guide (US Edition) Contents INTRODUCTION 1 What Are the Potential Benefits of Conducting an IPO? 1 What Are the Potential Costs and Other Potential Downsides of Conducting an IPO? 1 Is Your Company Ready for an IPO? 2 GETTING READY 3 Are Changes Needed in the Company’s Capital Structure or Relationships with Its Key Stockholders or Other Related Parties? 3 What Is the Right Corporate Governance Structure for the Company Post-IPO? 5 Are the Company’s Existing Financial Statements Suitable? 6 Are the Company’s Pre-IPO Equity Awards Problematic? 6 How Should Investor Relations Be Handled? 7 Which Securities Exchange to List On? 8 OFFER STRUCTURE 9 Offer Size 9 Primary vs. Secondary Shares 9 Allocation—Institutional vs. Retail 9 KEY DOCUMENTS 11 Registration Statement 11 Form 8-A – Exchange Act Registration Statement 19 Underwriting Agreement 20 Lock-Up Agreements 21 Legal Opinions and Negative Assurance Letters 22 Comfort Letters 22 Engagement Letter with the Underwriters 23 KEY PARTIES 24 Issuer 24 Selling Stockholders 24 Management of the Issuer 24 Auditors 24 Underwriters 24 Legal Advisers 25 Other Parties 25 i Initial Public Offerings THE IPO PROCESS 26 Organizational or “Kick-Off” Meeting 26 The Due Diligence Review 26 Drafting Responsibility and Drafting Sessions 27 Filing with the SEC, FINRA, a Securities Exchange and the State Securities Commissions 27 SEC Review 29 Book-Building and Roadshow 30 Price Determination 30 Allocation and Settlement or Closing 31 Publicity Considerations -

Global IPO Trends Report Is Released Every Quarter and Looks at the IPO Markets, Trends and Outlook for the Americas, Asia-Pacific and EMEIA Regions

When will the economy catch up with the capital markets? Global IPO trends: Q3 2020 ey.com/ipo/trends #IPOreport Contents Global IPO market 3 Americas 10 Asia-Pacific 15 Europe, Middle East, India and Africa 23 Appendix 29 About this report EY Global IPO trends report is released every quarter and looks at the IPO markets, trends and outlook for the Americas, Asia-Pacific and EMEIA regions. The current report provides insights, facts and figures on the IPO market for the first nine months of 2020* and analyzes the implications for companies planning to go public in the short and medium term. You will find this report at the EY Global IPO website, and you can subscribe to receive it every quarter. You can also follow the report on social media: via Twitter and LinkedIn using #IPOreport *The first nine months of 2020 cover completed IPOs from 1 January 2020 to 30 September 2020. All values are US$ unless otherwise noted. Subscribe to EY Quarterly IPO trends reports Get the latest IPO analysis direct to your inbox. GlobalGlobal IPO IPO trends: trends: Q3Q3 20202020 || Page 2 Global IPO market Liquidity fuels IPOs amidst global GDP contraction “Although the market sentiments can be fragile, the scene is set for a busy last quarter to end a turbulent 2020 that has seen some stellar IPO performance. The US presidential election, as well as the China-US relationship post-election, will be key considerations in future cross-border IPO activities among the world’s leading stock exchanges. Despite the uncertainties, companies and sectors that have adapted and excelled in the ‘new normal’ should continue to attract IPO investors. -

Announcing: Finalists Circle for the Prestigious M&A

GLOBAL MAJOR MARKETS CONGRATULATIONS to all the OUTSTANDING FINALISTS of the YEAR, 2014 ANNUAL AWARDS GALA DINNER June 12, 2014, New YORK, USA. Global M&A Network congratulates the distinguished group of finalists nominees for the one and only, GLOBAL MAJOR MARKETS, M&A ATLAS AWARDS. Prestigious awards exclusively honors excellence from all corners of the globe for executing M&A transactions valued above a billion dollars as always in the categories of: 40 Deal, 7 Outstanding Firm and 4 Global M&A Dealmakers of the Year awards. In a highly competitive process, a total of 185 transactions closed during January 2013 to January 31, 2014 were evaluated. From the pool of 185 deals, 106 deals are included in the finalists list. Eventually, only 40 deals will win at the annual awards gala. Prestige: Winning the M&A ATLAS AWARDS conveys a resounding message that the winner has accomplished the highest performance and excellence standards, worldwide. As always, the winners are selected independently for closing the best value-generating and game- changing transformational transactions based on identifiable criteria such as deal novelty/structure, sector/jurisdiction/market complexities, synergies/rationale/style, financial value, brand competitiveness, leadership, tenacity, resourcefulness and additional related metrics. Winners Circle Celebration: Winners are honored at the awards dinner trophy presentation ceremony held on June 12, 2014 at the Harvard Club of New York. WHAT to DO if you are among the coveted group of distinguished finalists? If you submitted nominations, please confirm your guest attendance for the annual Awards Gala Dinner, held on the evening of June 12, 2014, NY. -

Going Public Production Company Through Its a Shares

Co-published section: United Kingdom About NWR • A pure play hard-coal-mining and coke Going public production company through its A Shares. • A leading supplier of hard coal in the fastest growing region in Europe. Partial exits can benefit PE firms, as a £3.5 billion Czech IPO • Owns five established mines and two coking facilities in northeast Czech shows. Adam Levin and Claudine Ang of Dechert explain Republic. It is pursuing opportunities in n May 2008, the shares of New World cant minority stake, following which RPG Poland and elsewhere. Resources NV (NWR), a Dutch-incor- Industries acquired that majority investor (in • One of the largest industrial groups in the porated company (formerly a 2004) and took OKD private (in 2005), after Czech Republic in terms of assets and wholly-owned subsidiary of RPG a squeeze-out of minority interests. It was one revenues. IIndustries SE) with mining operations in the of the largest leveraged finance transactions in • Second largest private employer in the Czech Republic, were admitted to trading on Central Europe at that time. country with approximately 18,341 the London, Prague and Warsaw stock The restructuring that followed shows the employees and 3,563 contractors. exchanges. The offering, after exercise of the focus that private equity houses can bring to a greenshoe option, was approximately £1.3 business. This included: the consolidation of the billion (approximately $2.5 billion) resulting mining businesses within one entity, OKD, the Mining Division or its assets. The IPO was in a market capitalisation of about £3.5 bil- rather than the five entities within which the only with respect to the A Shares. -

B3 Transfers Equities to Its Multi-Asset Clearing Platform

Press release 29 August 2017 B3 transfers equities to its multi-asset clearing platform Cinnober’s real-time clearing solution now handles post trading process for both the equities and the derivatives markets in Brazil • BRL 21 billion of collateral returned to the market (approx. USD 6,4 billion) • Phase two completed of major Post-Trade Integration Project going from two clearinghouses to one for equities and derivatives • More efficient risk management by analyzing the risk on entire portfolios B3 (the Brazilian exchange and clearinghouse) successfully launched on Monday the equities, corporate bonds, and equities lending markets on its new multi-asset clearing platform. The clearing solution is delivered by Cinnober, built on its TRADExpress RealTime Clearing system. The migration of the equities clearinghouse was the target for phase two of B3’s Post-Trade Integration Project that will consolidate B3’s originally four clearinghouses into one integrated entity (managing equities, derivatives, government and corporate debt securities and FX). Derivatives and OTC products were the first to launch on the new platform in phase one. With the new integrated clearinghouse, B3 manages risk more efficiently. By analyzing the risk on entire portfolios, the clearinghouse can compensate if an investor has opposite positions in the same underlying asset across product groups and markets. When financial and commodity derivatives, along with OTC products, migrated to the new clearinghouse in phase one, the total systemic benefit in terms of margin release amounted to around BRL 20 billion. The estimated effect from Monday’s launch of phase two is BRL 21 billion of collateral that was returned to the market with complete preservation of the clearinghouse’s safety system. -

LIVK Merger Announcement with Agilethought Press Release

AgileThought, a pure-play digital solutions provider that delivers high-end software development at scale, to list on Nasdaq through a business combination with LIV Capital Acquisition Corp. • AgileThought is a leading pure play provider of agile-first software, end-to-end digital transformation and consulting services to Fortune 1000 customers with diversity across end-markets and industry verticals • AgileThought delivers high-end software development at scale under a uniquely competitive onshore and nearshore business model that leverages talent from the U.S., Mexico and other Latin American countries to serve U.S. corporations • The business combination between AgileThought and LIV Capital Acquisition Corp. (“LIVK”) (the “Transaction”) values the combined company at a proforma enterprise value of approximately $482 million and is expected to provide approximately $124 million in primary gross proceeds to AgileThought, including $81 million of cash held in LIVK’s trust account (assuming no redemptions in connection with the Transaction), and a fully committed $43 million investment by PIPE investors and LIV Capital at $10.00 per share. The fully committed investment will, at funding, satisfy the minimum cash requirement to close the Transaction • The Transaction will enhance AgileThought’s position at the forefront of the more than $750 billion digital transformation services market in the U.S., offering one of a kind, agile software development capabilities with onshore and nearshore delivery • The Transaction is expected to close in the third quarter of 2021 subject to LIVK’s shareholders approval and other customary conditions. Following the closing of the Transaction, the combined company will remain listed on Nasdaq under the new ticker symbol AGIL • AgileThought and LIVK will host a joint investor conference call to discuss the details of the proposed Transaction on May 10, 2021 at 11:00 AM EST. -

Frequently Asked Questions About the 20% Rule and Non-Registered Securities Offerings

FREQUENTLY ASKED QUESTIONS ABOUT THE 20% RULE AND NON-REGISTERED SECURITIES OFFERINGS issuance, equals or exceeds 20% of the voting power understanding the 20% Rule outstanding before the issuance of such stock; or (2) the number of shares of common stock to be issued is, or will be upon issuance, equal to or in excess What is the 20% rule? of 20% of the number of shares of common stock The “20% rule,” as it is often referred to, is a corporate outstanding before the transaction. “Voting power governance requirement applicable to companies listed outstanding” refers to the aggregate number of on nasdaq, the nYSe or the nYSe American LLC votes that may be cast by holders of those securities (“nYSe American”) (collectively, the “exchanges”). outstanding that entitle the holders thereof to vote each exchange has specific requirements applicable generally on all matters submitted to the issuer’s to listed companies to receive shareholder approval securityholders for a vote. before they can issue 20% or more of their outstanding common stock or voting power in a “private offering.” However, under nYSe Rule 312.03(c), the situations The exchanges also require shareholder approval in in which shareholder approval will not be required connection with certain other transactions. Generally: include: (1) any public offering for cash, or (2) any issuance involving a “bona fide private financing,1” if • Nasdaq Rule 5635(d) requires shareholder approval such private financing involves a sale of: (a) common for transactions, other than “public offerings,” -

Initial Public Offering (Ipo) and Listing Process on the Sehk with Highlights

September 2019 RESEARCH REPORT INITIAL PUBLIC OFFERING (IPO) AND LISTING PROCESS ON THE SEHK WITH HIGHLIGHTS CONTENTS Page Summary ........................................................................................................................................ 1 1. General requirements for listing in Hong Kong ......................................................................... 2 1.1 Main Board listing conditions ........................................................................................... 2 1.2 Shareholding structures for listing in Hong Kong ............................................................. 3 Jurisdictions acceptable as place of incorporation ............................................... 3 Shareholding structures of Mainland companies seeking to list in Hong Kong ..... 3 Red-chip structure ............................................................................................... 4 Variable Interest Entity (VIE) structure ................................................................. 5 H-share structure ................................................................................................. 6 1.3 Listing of H-shares: An update ........................................................................................ 9 H-share companies have become an important part of the Hong Kong stock market ................................................................................................................. 9 Successful implementation of the H-share full circulation pilot programme -

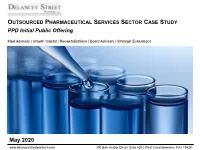

PPD Initial Public Offering

OUTSOURCED PHARMACEUTICAL SERVICES SECTOR CASE STUDY PPD Initial Public Offering M&A Advisory | Growth Capital | Recapitalizations | Board Advisory | Strategic Evaluations May 2020 www.delanceystreetpartners.com 300 Barr Harbor Drive | Suite 420 | West Conshohocken | PA | 19428 PPD INITIAL PUBLIC OFFERING Transaction Overview PPD (NASDAQ: PPD) Stock Price Performance $34.00 On February 5, 2020, Pharmaceutical Product $33.00 2/11/20 Closing Price: $32.87 Development (PPD) announced it raised $1.86 billion in its $32.00 initial public offering (IPO) $31.00 The company announced it priced 60 million primary shares of its common stock at the top end of its targeted range or $27.00 per share $30.00 2/6/20 Opening Price: $30.99 ‒ The underwriters simultaneously exercised the greenshoe option, $29.00 offering an additional 9 million primary shares of PPD’s common stock $28.00 at the IPO price, resulting in total IPO shares and gross proceeds of 69 million and $1.86 billion, respectively $27.00 3/6/20 Closing Price: $28.60 ‒ Implied Enterprise Value of $13.1 billion $26.00 ‒ Implied Enterprise Value / LTM Adjusted EBITDA multiple of 16.9x $25.00 PPD used the net proceeds from the offering to redeem a portion of its 5-Mar 1-Mar 2-Mar 3-Mar 4-Mar 6-Mar 7-Feb 8-Feb 9-Feb senior notes that were due to retire in 2022 and will use any remaining 6-Feb 11-Feb 10-Feb 12-Feb 13-Feb 14-Feb 15-Feb 16-Feb 17-Feb 18-Feb 19-Feb 20-Feb 21-Feb 22-Feb 23-Feb 24-Feb 25-Feb 26-Feb 27-Feb 28-Feb 29-Feb proceeds for general corporate purposes On February 6th, shares -

Leveraged Buyouts, and Mergers & Acquisitions

Chepakovich valuation model 1 Chepakovich valuation model The Chepakovich valuation model uses the discounted cash flow valuation approach. It was first developed by Alexander Chepakovich in 2000 and perfected in subsequent years. The model was originally designed for valuation of “growth stocks” (ordinary/common shares of companies experiencing high revenue growth rates) and is successfully applied to valuation of high-tech companies, even those that do not generate profit yet. At the same time, it is a general valuation model and can also be applied to no-growth or negative growth companies. In a limiting case, when there is no growth in revenues, the model yields similar (but not the same) valuation result as a regular discounted cash flow to equity model. The key distinguishing feature of the Chepakovich valuation model is separate forecasting of fixed (or quasi-fixed) and variable expenses for the valuated company. The model assumes that fixed expenses will only change at the rate of inflation or other predetermined rate of escalation, while variable expenses are set to be a fixed percentage of revenues (subject to efficiency improvement/degradation in the future – when this can be foreseen). This feature makes possible valuation of start-ups and other high-growth companies on a Example of future financial performance of a currently loss-making but fast-growing fundamental basis, i.e. with company determination of their intrinsic values. Such companies initially have high fixed costs (relative to revenues) and small or negative net income. However, high rate of revenue growth insures that gross profit (defined here as revenues minus variable expenses) will grow rapidly in proportion to fixed expenses.