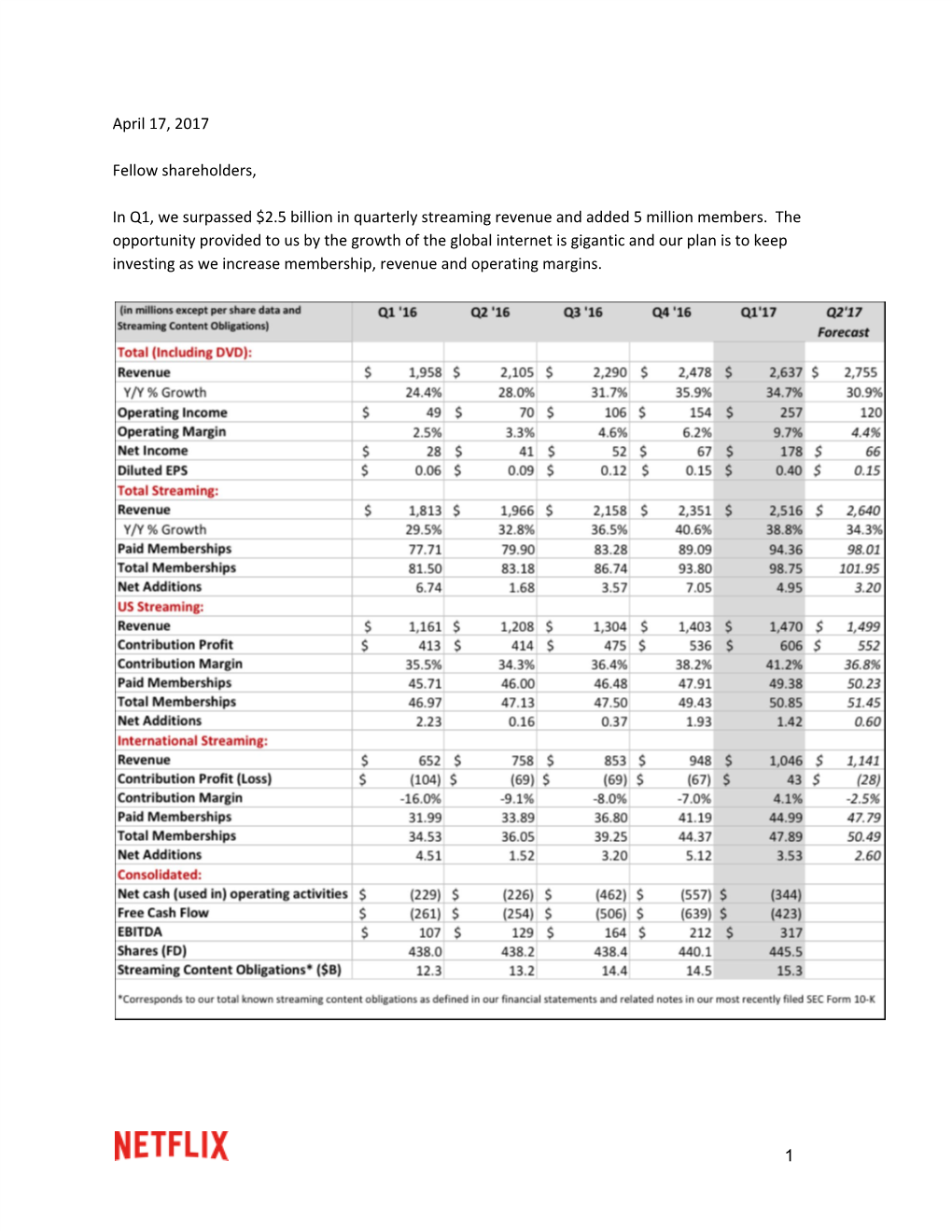

April 17, 2017 Fellow Shareholders, in Q1, We Surpassed $2.5 Billion In

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Hazel Reid (123) 456-7890 [email protected] 123 Your Street, Austin, TX 72345

Hazel Reid (123) 456-7890 [email protected] 123 Your Street, Austin, TX 72345 A pplicant Profile/Objective Sports-focused field and post-production assistant with a background in reality television, outdoor adventure, and professional football. Holds a bachelor’s in film from one of the top-ranking schools in both film and academics. Boasts diverse experience, including projects with two major TV networks, HBO, and Netflix. P rofessional Experience NFL Seasonal Production Assistant, NFL, Culver City, CA October 2019 – Present ● Develop and deliver all motion and still graphics for shows ● Generate headshots and action shot cutouts ● Serve as quality control for all elements prior to final delivery ● Ensure a factual display of player and team information NFL Documentary Production Assistant, “Hard Knocks,” HBO, Oakland, CA July 2019 – August 2019 ● Traveled with the crew and NFL team for joint practices and preseason games ● Logged and assisted in selecting footage ● Assisted in managing online content for the show ● Set up shot visuals and helped prep players for individual interviews Set Production Assistant, “American Ninja Warrior”, Los Angeles, CA August 2018 – June 2019 ● Stayed positive, alert, and ready to respond to requests for help at any time, despite shooting overnight ● Directed competitors to correct locations at the proper time ● Assisted in obstacle course setup and tear down ● Aided in training on location PAs ● Traveled with the crew to competition sites around the country Junior Production Assistant, Ultimate Beastmaster(Netflix), -

The Delta Perspective

Insights on OTT video in emerging markets Michelle Gwee - Senior Business Analyst Vincent Stevens - Senior Principal June 2017 THE DELTA PERSPECTIVE THE DELTA THE DELTA PERSPECTIVE Insights on OTT video in emerging markets Authors: Michelle Gwee - Senior Business Analyst Vincent Stevens - Senior Principal (Credits to Lin Zheng for content inputs) Recognising the huge potential of OTT video in emerging markets, various players have made their forays in recent years – most notably with Netflix’s 2016 entry into markets such as India, Indonesia and Malaysia. While there are no clear signs of a winner yet, we have compiled the top four insights that traditional TV players, OTT players and telcos must bear in mind when catering to emerging markets. 2 THE DELTA PERSPECTIVE Insight 1: TV screen to remain dominant with mobile as a secondary screen Although the prevalence of apps and smartphones has exploded in recent years, consumers are holding on to their time spent with a TV screen – even in developed markets (See Exhibit 1). Time spent on mobile devices is observed to be accretive and often a secondary screen while watching TV (sometimes passively). Large screens like TV remain important for watching long-form video, while small screens (smartphones) are used to access short-form content. Unlike the rapid disruption of the internet on newspapers/print media, traditional TV appears more resilient to its (smartphone) OTT alternative. Main reasons are: 1. Restrictive mobile data pricing for long-form streaming 2. TV as a family entertainment medium in regions with large household sizes 3. TV penetration exceeding smartphone penetration 4. -

Be the Light

16 Pages Thursday, May 7, 2020 ◆ Pacific Palisades, California $1.50 Be the Light Display Councilmember Bonin ‘ ’ Telephone Town Hall Honors Pali High Students Addresses Senior Concerns By SARAH SHMERLING Editor-in-Chief By LILY TINOCO having to wait for an available Reporter agent. ith campuses closed to students statewide and The fourth and final panelist Stay at Home orders in place, the end of the panel of guests joined Coun- was Molly Davies, vice president Wacademic year has been completely and totally up- cilmember Mike Bonin for a of the Elder Abuse Prevention and rooted—especially for those who are graduating. ATelephone Town Hall to address Ombudsman Services at WISE & Palisades Charter High School aimed to honor its issues and share resources related Healthy Aging. students with a #BeTheLight display, which included to seniors on Thursday, April 30. “We’re advocates for res- illuminating the stadium, pool and baseball field ar- “We have many folks on the idents who reside in nursing eas on Friday, May 1, at 8:20 p.m. (20:20 in Military line tonight and that’s because we homes, assisted living or care fa- Time). The display went on for 20 minutes and 20 have many, many, many seniors in cilities,” Davies said. “We cover seconds to honor Pali High students for what they’ve the city of Los Angeles in the 11th all of Los Angeles and our re- gone through in 2020 and the Class of 2020. District,” Bonin said. “We have sponsibilities are to identify and To further customize the display, 2020 was put over 33,000 seniors who live … investigate complaints that are on the scoreboard at both the pool and stadium. -

Wat Een Drama

NUMMER 37 15 TM 21 SEPTEMBER 2018 PRIJS: € 2,75 NONDEJU! PAPILLON2018 KIPKIPPENVELPENV MET ‘ONZE’ BIJ HORRORR YORICK VAN THE NUN WAGENINGEN! BOER ZOEKT VROUWW EEN OVERVAL THUIS BIJ BOER AAD PAGINA’S EVA VAN DE WIJDEVEN STRIPS! GA JE VOELEN’ Op de planken in Judas LEZERSACTIE IK KAN NIET WACHTEN Exclusief weekend in Disneyland Paris eerst krijgen we de eestdagen nog en ja, 3-DAAGS dat is pas over een paar ARRANGEMENT maanden. Maar daarna VANAF gaat het snel – en voor je het weet staat het eerste weekend van €195 februari alweer voor e deur. Het Veronica gazine VIP Weekend in Disneyland Paris! Ook dit jaar heeft je lijfblad in samenwerking met Disneyland Paris een fantastisch – en voor alles: exclusief – arrangement voor je samengesteld. Ga daarom NU naar de boekhandel, koop een agenda en blok alvast het weekend van 1 tot en met 3 februari! LEZERSACTIE OM TE BOEKEN GA JE NAAR VERONICA MA EXCLUSIEF VOOR ALLE LEZERS: BELEEF DE MAGIE IN DISNEYLAND PARIS Ga met Disney figuren op de foto Hoe uniek dat VIP-weekend wel niet is? Nou, héél uniek.i k Kijk maar eens wat er allemaal in zit: Een toegangsbewijs voor de EXCLUSIEVE AVONDOPENSTELLING van het Walt Disney Studios Park op zaterdag 2 februari.Natuurlijk kun je ook gewoon overdag beide Disney Parken in, op alle drie de dagen. Ga gewoon zo vaak als je wilt. Twee overnachtingen in een heus Disney Hotel (inclusief ontbijtbuffet in je hotel of ontbijtpakket bij Disney’s Davy Crockett Ranch). Een meet & greet met Anna en Elsa uit Frozen (om maar een paar Disney-helden te noemen, want Mickey Mouse en Donald Duck lopen er natuurlijk ook gewoon rond). -

“Over-The-Top” Television: Circuits of Media Distribution Since the Internet

BEYOND “OVER-THE-TOP” TELEVISION: CIRCUITS OF MEDIA DISTRIBUTION SINCE THE INTERNET Ian Murphy A dissertation submitted to the faculty at the University of North Carolina at Chapel Hill in partial fulfillment of the requirements for the degree of Doctor of Philosophy in the Department of Communication. Chapel Hill 2018 Approved by: Richard Cante Michael Palm Victoria Ekstrand Jennifer Holt Daniel Kreiss Alice Marwick Neal Thomas © 2018 Ian Murphy ALL RIGHTS RESERVED ii ABSTRACT Ian Murphy: Beyond “Over-the-Top” Television: Circuits of Media Distribution Since the Internet (Under the direction of Richard Cante and Michael Palm) My dissertation analyzes the evolution of contemporary, cross-platform and international circuits of media distribution. A circuit of media distribution refers to both the circulation of media content as well as the underlying ecosystem that facilitates that circulation. In particular, I focus on the development of services for streaming television over the internet. I examine the circulation paths that either opened up or were foreclosed by companies that have been pivotal in shaping streaming economies: Aereo, Netflix, Twitter, Google, and Amazon. I identify the power brokers of contemporary media distribution, ranging from sectors of legacy television— for instance, broadcast networks, cable companies, and production studios—to a variety of new media and technology industries, including social media, e-commerce, internet search, and artificial intelligence. In addition, I analyze the ways in which these power brokers are reconfiguring content access. I highlight a series of technological, financial, geographic, and regulatory factors that authorize or facilitate access, in order to better understand how contemporary circuits of media distribution are constituted. -

MAX HEAVENRICH-VASSILOS Max.Heavenrich.Vassilos@G Mail.Com (847) 868-4490

MAX HEAVENRICH-VASSILOS [email protected] (847) 868-4490 Relevant Work Experience CULTURE SHOCK TV LOS ANGELES, CALIFORNIA Producer and Co-Creator May 2013 – Current Started this production company to develop pitch materials for a range of show concepts. Although we have not sold a show to date, our content has gotten us meetings with every major network and production company. Orchestrated complicated and technical shoots on miniscule budgets, including: helicopters, rock-climbing, 40’+ yacht, etc. NATPE (NATIONAL ASSOCIATION OF TELEVISION PROGRAM EXECUTIVES) LOS ANGELES, CALIFORNIA Producer, Production Coordinator Jul 2012 – Jan 2017 Produced six shows, including four major international conferences in Miami. Managed communication and assets for over 190 VIPs in each conference. Improved deliverable rate to nearly 100%, the highest since my involvement. Worked with such talent as: Norman Lear, Quincy Jones, Ted Sarandos, Tom Forman, Charlie Corwin, Steve Harvey, and many more. ULTIMATE BEASTMASTER, SEASON 2 - NETFLIX LOS ANGELES, CALIFORNIA Challenge PA / Water Safety Nov 2016 – Nov 2016 Built and installed obstacles. Tested course before the contestants. Facilitated all water rescues. SAVE OUR SHELTER, SEASON 2 - CW LOS ANGELES, CALIFORNIA Producer Apr 2016 – Oct 2016 Built a production team from the ground up. Recruited international production partners, and negotiated a multi-million dollar international contract. Engineered production efficacies to save production over a million dollars in cost. Coordinated outreach to brands. Negotiated terms and worked with production to ensure that both the brand and the show were held to the highest representation. PROJECT DAD - TLC / DISCOVERY FAMILY / DISCOVERY LIFE LOS ANGELES, CALIFORNIA Sponsorship Producer Apr 2016 – Oct 2016 Coordinated outreach to brands that align with the core message of the show. -

Q3 2016 Netflix Inc Earnings Call on October 17, 2016 / 9:00PM

Client Id: 77 THOMSON REUTERS STREETEVENTS EDITED TRANSCRIPT NFLX - Q3 2016 Netflix Inc Earnings Call EVENT DATE/TIME: OCTOBER 17, 2016 / 9:00PM GMT THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us ©2016 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies. Client Id: 77 OCTOBER 17, 2016 / 9:00PM, NFLX - Q3 2016 Netflix Inc Earnings Call CORPORATE PARTICIPANTS David Wells Netflix, Inc. - CFO Reed Hastings Netflix, Inc. - CEO Ted Sarandos Netflix, Inc. - Chief Content Officer CONFERENCE CALL PARTICIPANTS Ben Swinburne Morgan Stanley - Analyst Scott Devitt Stifel Nicolaus - Analyst PRESENTATION QUESTIONS AND ANSWERS David Wells - Netflix, Inc. - CFO Welcome to the Netflix Q3 2016 earnings call. I'm David Wells, CFO, and joining me on the Company side today is Reed Hastings, our CEO; and Ted Sarandos, our Chief Content Officer. Interviewing us will be Scott Devitt from Stifel, sorry, Scott Devitt from Stifel and Ben Swinburne from Morgan Stanley. Ben in his fourth interview before he passes the baton. Before we get started, we will be making forward-looking statements. Actual results may vary. Ben, I think you have the first question. Over to you. Ben Swinburne - Morgan Stanley - Analyst Thank you very much. Reed, maybe we could start by focusing in on the international strength this quarter. Typically, I think you and your colleagues have downplayed the impact of originals, but in the letter you really called out the benefit of -- on acquisitions from your original content. -

Stand Up, Fight Back!

Stand Up, Fight Back! The Stand Up, Fight Back campaign is a way for Help Support Candidates Who Stand With Us! the IATSE to stand up to attacks on our members from For our collective voice to be heard, IATSE’s members anti-worker politicians. The mission of the Stand Up, must become more involved in shaping the federal legisla- Fight Back campaign is to increase IATSE-PAC con- tive and administrative agenda. Our concerns and inter- tributions so that the IATSE can support those politi- ests must be heard and considered by federal lawmakers. cians who fight for working people and stand behind But labor unions (like corporations) cannot contribute the policies important to our membership, while to the campaigns of candidates for federal office. Most fighting politicians and policies that do not benefit our prominent labor organizations have established PAC’s members. which may make voluntary campaign contributions to The IATSE, along with every other union and guild federal candidates and seek contributions to the PAC from across the country, has come under attack. Everywhere from Wisconsin to Washington, DC, anti-worker poli- union members. To give you a voice in Washington, the ticians are trying to silence the voices of American IATSE has its own PAC, the IATSE Political Action Com- workers by taking away their collective bargaining mittee (“IATSE-PAC”), a federal political action commit- rights, stripping their healthcare coverage, and doing tee designed to support candidates for federal office who away with defined pension plans. promote the interests of working men and women. The IATSE-PAC is unable to accept monies from Canadian members of the IATSE. -

Q4 2016 Netflix Inc Earnings Call on January 18, 2017 / 10:00PM

Client Id: 77 THOMSON REUTERS STREETEVENTS EDITED TRANSCRIPT NFLX - Q4 2016 Netflix Inc Earnings Call EVENT DATE/TIME: JANUARY 18, 2017 / 10:00PM GMT THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us ©2017 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies. Client Id: 77 JANUARY 18, 2017 / 10:00PM, NFLX - Q4 2016 Netflix Inc Earnings Call CORPORATE PARTICIPANTS David Wells Netflix Inc. - CFO Reed Hastings Netflix Inc. - CEO Ted Sarandos Netflix Inc. - Chief Content Officer CONFERENCE CALL PARTICIPANTS Scott Devitt Stifel Nicolaus - Analyst Doug Mitchelson UBS - Analyst PRESENTATION David Wells - Netflix Inc. - CFO Welcome to the Netflix Q4 2016 earnings call. I am David Wells, the CFO. Joining me from the Company is Reed Hastings, our CEO, and Ted Sarandos, our Chief Content Officer. Interviewing us on today's call, or interview, is Doug Mitchelson from UBS and Scott Devitt from Stifel Nicolaus. A cautionary note that we will be making forward-looking statements; actual results may vary. Scott, I think you have the first question, so over to Scott. QUESTIONS AND ANSWERS Scott Devitt - Stifel Nicolaus - Analyst Yes, thanks, David. First question for Reed. Just an outstanding quarter both domestically and internationally, relative to expectation from a subscriber standpoint. And there is so much focus on international given the opportunity there to grow the Business, as well as the way you have built out the international business with some more mature markets that you have been in for quite some time. -

For Pictures and Information About a Movie Go to and Type in the Movie Title

Downloaded from: justpaste.it/movielist For Pictures and Information about a movie go to http://www.imdb.com and type in the movie title. Last update: 1/11/16 New Movies / HD Quality: The Last Witch Hunter [2015] Anomalisa [2015] Solace [2015] The Diary of a Teenange Girl [2015] Contracted: Phase II [2015] Woodlawn [2015] Sisters [2015] "Hardcoded Subs" Trumbo [2015] Suffragette [2015] Diablo [2016] Captive [2015] The Big Short [2015] The Hateful 8 [2015] Knight of Cups [2015] Burnt [2015] Chi-Raq [2015] Standoff [2016] Spectre [2015] Irrational Man [2015] Bridge of Spies [2015] Concussion [2015] The Martian [2015] The Good Dinosaur [2015] Joy [2015] Legend [2015] Creed [2015] The Revenant [2015] Anguish [2015] Sicario [2015] Brooklyn [2015] A Perfect Day [2015] The Peanuts Movie [2015] Paranormal Activity: The Ghost Dimension [2015] The Bad Education Movie [2015] The Visit [2015] A Walk In The Woods [2015] Mojave [2015] The Intern [2015] American Hero [2015] Dixieland [2015] The Ridiculous 6 [2015] The Perfect Guy [2015] Crimson Peak [2015] The Wave [2015] Pan [2015] Applesauce [2015] Pawn Sacrifice [2014] Scouts Guide to the Zombie Apocalypse [2015] Sleeping With Other People [2015] War Room [2015] Goosebumps [2015] Life [2015] Goodbye To All That [2014] The Keeping Room [2014] The Wannabe [2015] The Walk [2015] Lost In The Sun [2015] Always Watching: A Marble Hornets Story [2015] Mistress America [2015] Absolutely Anything [2015] Sinister 2 [2015] The Little Prince [2015] Love [2015] Hotel Transylvania 2 [2015] Submerged [2015] A Christmas -

Netflix E a Estética Do Banco De Dados

UNIVERSIDADE PRESBITERIANA MACKENZIE CENTRO DE EDUCAÇÃO, FILOSOFIA E TEOLOGIA PROGRAMA DE PÓS-GRADUAÇÃO EM EDUCAÇÃO, ARTE E HISTÓRIA DA CULTURA Helena Zanella Prates Netflix e a estética do banco de dados São Paulo 2017 Helena Zanella Prates Netflix e a estética do banco de dados Dissertação apresentada ao Programa de Pós- Graduação em Educação, Arte e História da Cultura da Universidade Presbiteriana Mackenzie, e à banca examinadora, como requisito à obtenção de título de Mestre em Educação, Arte e História da Cultura. Orientadora: Prof.ª Dra. Jane de Almeida São Paulo 2017 P912n Prates, Helena Zanella. Netflix e a estética do banco de dados / Helena Zanella Prates. 107 f. : il. ; 30 cm Dissertação (Mestrado em Educação, Arte e História da Cultura) – Universidade Presbiteriana Mackenzie, São Paulo, 2018. Orientador: Jane Mary Pereira Almeida Bibliografia: f. 93-96. 1. Estética do banco de dados. 2. Internet Tv. 3. Tv conectada. 4. Convergência. 5. Novas mídias. 6. Internet. 7. Netflix. 8. Audiovisual. I. Almeida, Jane Mary Pereira, orientador. II. Título. CDD 791.45 Agradecimentos À CAPES/PROSUP e à Universidade Presbiteriana Mackenzie, pela bolsa concedida no período de um ano, incentivo fundamental para a conclusão desta pesquisa; À professora Jane de Almeida pela generosidade e pelo incentivo constante ao conhecimento; Ao Armando Prates pela constante generosidade e pelo sólido apoio ao meu crescimento pessoal e profissional. Ao Mateus Teixeira e demais amigos que conheci durante o mestrado pelo apoio e pela alegria do convívio. Resumo A convergência da internet com a televisão faz surgir uma “nova mídia”, que tem sido chamada de “Internet TV” (HUNT, URIBE, 2015) ou “TV Conectada” (BRENNAN, 2013), a presente pesquisa pretende avaliar se tal convergência está também ocorrendo em relação às linguagens desses meios. -

2018 Nycc 2018

NYCC 2018 NYCC 2018 THURSDAY SCHEDULE THURSDAY SCHEDULE EVENTS 2018 The Hammerstein Ballroom Main Stage Presented by Cosplay Central Stage - TIME at the Manhattan Center Verizon Room 1A02 Room 1A06 Room 1A10 Room 1A18 Room 1A21 Room 1A24 Room 1B03 Room 1C03 River Pavilion, 4th Fl TIME 10:00AM 10:00AM 11:00 AM 11:00 AM Junta-position the Politics Geek & Sundry: Welcome The Building Blocks of Harry Potter and the The Official Aspen Comics 11:15 AM of Modern Speculative to the Wednesday Club, 11:15 AM Quality Characters Cursed Child 15-Year Anniversary Panel Fiction Science Channel Presents New York! 11:30 AM 11:00 AM - 12:00 PM 11:00 AM - 12:00 PM 11:00 AM - 12:00 PM 11:30 AM Jon Glaser Still Loves Gear 11:00 AM - 12:00 PM Mythical Beasts: Real or 11:00 AM - 12:00 PM 11:45 AM 11:15 AM - 12:15 PM Imagined? 11:45 AM 11:15 AM - 12:15 PM 12:00 PM Representing Comic Book 12:00 PM Creator Clients In 2018: A 12:15 PM The Kubert School Guide to Contractual and 12:15 PM Women in [Everything]: SuperheroIRL! Join the MARVEL: Making Comics Presents: The Business of IP Issues 12:30 PM Intersectional Feminism 12:30 PM Real-Life Justice League the Marvel Way Art - Education, Comics, *Requires CLE Registration Official Viz Media Panel Webtoon Presents Across Genres 12:45 PM 12:15 PM - 1:15 PM “Caster,” Featuring Entertainment is LGBTQ 12:15 PM - 1:15 PM and Graphic Design 11:00 AM - 2:00 PM 12:45 PM LEGO® DC Super-Villains: 12:15 PM - 1:30 PM 12:15 PM - 1:15 PM 1:00 PM Common 12:30 PM - 1:30 PM 12:15 PM - 1:15 PM 1:00 PM Meet the Talent Behind the 12:30