Stock Spirits Group Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Equity Outlook

ECONOMIC & STRATEGY RESEARCH 10 April 2017 Equity Research Extract from a report Equity Outlook Global equity market gets the green light ■ The global stock market followed its successful final quarter of last year and Miroslav Frayer shares also grew in 1Q17. The MSCI world equity index has increased more than (420) 222 008 567 miroslav_ frayer @kb.cz 6% since the beginning of the year. Richard Miřátský ■ The PSE’s PX index has slightly surpassed the performance of major U.S. and (420) 222 008 560 [email protected] European indexes. It has added more than 6% since January. In comparison with Jana Steckerová regional competitors, the Polish WIG20 became a clear winner, jumping 15%. On the (420) 222 008 524 jana _steckerova @kb.cz contrary, the Hungarian BUX’s profit of less than 1.5% has not enthused investors. ■ A positive for the PSE is the fact that we have found no company whose shares remained in the red in the first quarter of the year. Shares of petrochemical group Unipetrol became a clear winner, on the contrary, the largest issuance, CEZ, added the smallest gains from the Prague peloton. ■ The average daily trading volume for the past two quarters was more volatile. Nevertheless, it is evident that Moneta Money Bank’s entry supported trading activity on the domestic market. For the first three months, the newcomer became the No. 1 among the most traded stocks on the Prague Stock Exchange. ■ SG increased the weight of equities in its global portfolio from 58% to 63%. Improving macroeconomic environment, reflation and the structural switch from monetary to fiscal policy impetus in developed countries are strong incentives for investors to switch out of expensive bonds into equities. -

€30.0M €147.7M €68.8M €28.1M €274.6M

A leading owner and producer of premium branded spirits and liqueurs that are sold principally in Central and Eastern Europe Over 45 brands, exporting to more than Capitalising on key consumer trends 50 countries worldwide through own driving growth in spirits value in rd 1 distribution and 3 party arrangements Central and Eastern Europe: Global sales volumes total over 115 • Premiumisation million litres per year1 • Diversification of drinking occasions • Growing confidence in local provenance Wholly owned operations in Poland, the Czech Republic, Slovakia, Italy, Croatia and Bosnia & Herzegovina #2 in Poland in clear vodka and #1 in flavoured vodka and 2 State of the art production facilities in vodka-based liqueurs Poland, the Czech Republic and Germany #1 in the Czech Republic in spirits, rum, bitters and vodka3 Listed on the main market of the London #1 in Italy in vodka, vodka-based Stock Exchange liqueurs, limoncello, #2 in brandy4 Primary Markets 100% 54% 25% 10% 11% €274.6m €147.7m €68.8m €28.1m €30.0m 2016: €261.0m 2016: €136.9m 2016: €63.2m 2016: €29.4m 2016: €31.5m Group Poland Czech Republic Italy Other Stock Spirits Group No. 2 in vodka with No. 1 in spirits with 33.6% No.1 in vodka, flavoured Slovakia, Croatia, Bosnia is headquartered in 26.7% value share5 value share6 vodka-based liqueurs and and Herzegovina. the UK Core categories: vodka, Core categories: rum, limoncello. 5.6% value International exports: USA, flavoured vodka-based bitters, vodka, flavoured share of spirits7 Germany, Canada, UK, liqueurs, whisky vodka-based liqueurs, Core categories: vodka, Slovenia and other Balkan whisky flavoured vodka-based countries liqueurs, limoncello, brandy Sources 1. -

Download Annual Report 2013

Annual Report 2013 Our goal Our goal is to become Central and Eastern Europe’s leading spirits company – commanding a major stake in each of our core operating markets and making our presence felt in the wider global market. Contents Strategic report Chairman’s statement 02 Group at a glance 04 Our “millionaire” brands 06 Our heritage 08 Chief Executive Officer’s statement 10 Our business model 14 Strategy and KPIs 16 Our markets 18 HIGHLIGHTS Spirits market overview 20 Regional reviews Poland 22 17.4 m €340.5m Czech Republic 24 Italy 26 9 LITRE CASES NET SALES REVENUE Other 27 +11.4% +16.4% Operations 28 2012: 15.6m 9 litre cases 2012: €292.4m Our people 29 Corporate responsibility 30 €83.7m €47.7m Financial review 32 Principal risks 36 ADJUSTED EBITDA* OPERATING PROFIT Directors and +22.3% -44.2% Company Secretary 42 2012: €68.4m 2012: €85.4m Senior management 44 Corporate governance 46 Chairman’s letter 46 €74.4 m €8.9m Corporate governance framework 47 ADJUSTED EBIT* PROFIT FOR THE YEAR Audit Committee report 52 +26.7% -66.0% 2012: €58.7m 2012: €26.2m Nomination Committee report 56 Directors’ remuneration * Stock Spirits Group uses alternative performance measures as key financial indicators to assess the underlying performance of the Group. These include adjusted EBITDA, adjusted EBIT and adjusted free cash flow. report 57 The narrative in the Annual Report & Accounts is based on these alternative measures and an explanation is set out in note 7 to the consolidated financial statements included in the Annual Report & Accounts. -

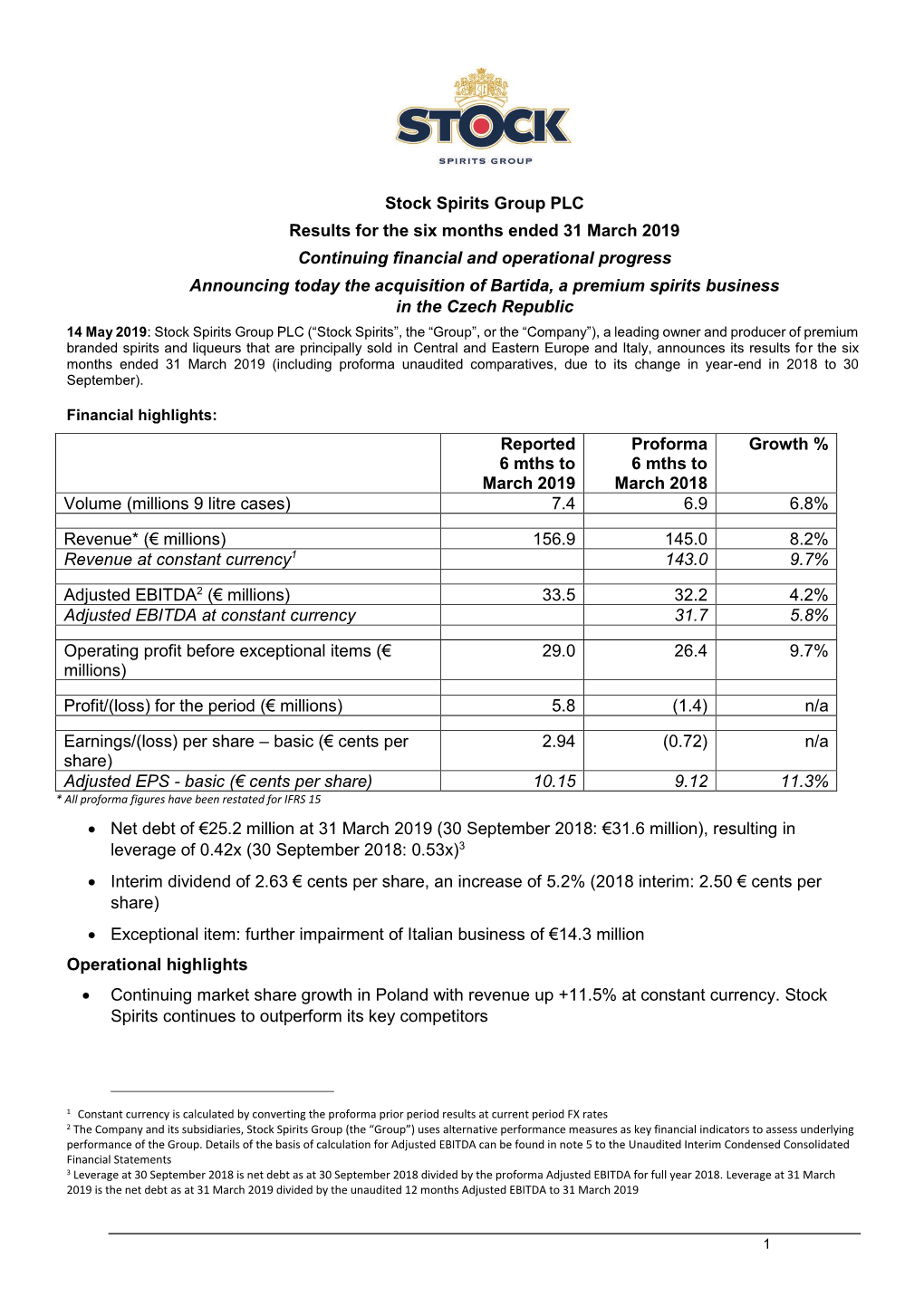

Stock Spirits Group PLC Results for the Six Months Ended 31 March

Stock Spirits Group PLC Results for the six months ended 31 March 2021 Continued resilience in a challenging trading environment 12 May 2021: Stock Spirits Group PLC (“Stock Spirits” or the “Company” or the “Group”), a leading owner and producer of branded spirits and liqueurs that are principally sold in Central and Eastern Europe and Italy, announces its results for the six months ended 31 March 2021. Financial and operational highlights Reported Reported All values in € millions unless otherwise six months six months stated to March to March % 2021 2020 Movement Volume (millions 9 litre cases) 8.3 8.1 +2.0% Revenue 183.4 189.6 -3.3% Revenue at constant currency1 +0.3% Adjusted EBITDA2 44.5 45.6 -2.4% Adjusted EBITDA at constant currency +1.7% Operating profit before exceptional items 37.9 38.8 -2.3% Profit for the period 28.1 14.7 +91.6% Earnings per share – basic (€ cents per 14.11 7.41 +90.4% share) Adjusted EPS – basic3 (€ cents per share) 14.11 14.38 -1.9% Net debt 38.3 55.4 -30.9% • Year-on-year growth in market shares in the off-trade in our core markets of Poland and the Czech Republic - a resilient performance despite COVID-19 lockdowns closing or heavily restricting the on-trade channel for almost the entire period (6% of the Group’s revenue in the first half compared to a normal level of 15%) • Continuing positive momentum in Poland, our largest market (57% of Group revenue), achieving a five-year-high value market share of 30.7% as at March 20214 in the important vodka category, with revenue up +4.3% and EBITDA up +6.8% on a constant currency basis • Czech business (25% of Group revenue) has been impacted the most by on-trade closure, and local competition has increased: revenue declined by 13.6% and EBITDA by 21.2% both 1 Constant currency is calculated by converting the prior period results at current period FX rates 2 The Company and its subsidiaries, Stock Spirits Group (the “Group”) uses alternative performance measures as key financial indicators to assess underlying performance of the Group. -

Annual Report & Accounts

Stock Spirits Group PLC Solar House Stock Spirits Group PLC Mercury Park Wooburn Green Buckinghamshire HP10 0HH United Kingdom Annual Report & Accounts www.stockspirits.com Tel: +44 1628 648500 Fax: +44 1628 521366 2016 Annual Report & Accounts 2016 Our goal is to become Central and Eastern Europe’s leading spirits company, commanding a major stae in each o or core operan markets and making our presence felt in the wider global market. Strategic reviewGroup at a glance Our core brands Regional reviews Financial statements Page 02 Page 00 Page 26 Page 30 Page 102 Strategic review eional reies Governance Financial statements Chairman’s statement 05 Poland 30 Directors and Company Consolidated income ie ecutie cers Czech Republic 34 Secretary 56 statement 104 statement 09 Italy 36 Senior Management 58 Consolidated statement o comreensie income 10 Group at a glance 16 ter 3 ororate oernance Consolidated statement ur business model 1 erations 3 airmans leer 60 o nancial osition 106 Strategy and KPIs 20 ur eole 3 ororate oernance Consolidated statement ur marets 22 framework 61 Corporate responsibility 40 of changes in equity 108 irits maret oerie 2 udit ommiee reort 6 Financial reie 3 Consolidated statement omination ommiee ur core brands 26 rincial riss and iabilit o cas os 10 reort 3 statement 48 Notes to the consolidated Directors remuneration nancial statements 110 reort Shareholders’ Directors’ report 91 inormaon 171 Statement of Directors’ seul lins 12 resonsibilities Independent auditor’s report 96 trateic reie oernance Financial statements Stock Spirits Group Annual Report & Accounts 2016 01 erie Financial highlights 12.3m €261.0 m 9 litre cases otal net sales reenue (2015: 11.8 million 9 litre cases) (2015: €262.6 million) €40.1m €28.4m eratin rot rot or te ear 201 1million (2015: €19.4 million) 19. -

Erste Stock Europe Emerging

ERSTE STOCK EUROPE EMERGING Jointly owned fund pursuant to the InvFG Semi-Annual Report 2020 ERSTE STOCK EUROPE EMERGING Contents General Information about the Investment Firm ������������������������������������������������������������������������������������������������������������������ 3 Asset Allocation ����������������������������������������������������������������������������������������������������������������������������������������������������������������������� 4 Statement of Assets and Liabilities as of 30 November 2020 �������������������������������������������������������������������������������������������� 5 2 Semi-Annual Report 2020 General Information about the Investment Firm The company Erste Asset Management GmbH Am Belvedere 1, A-1100 Vienna Telephone: +43 05 0100-19777, fax: +43 05 0100-919777 Registered capital EUR 2�50 million Shareholders Erste Group Bank AG (64�67%) Erste Bank der österreichischen Sparkassen AG (22�17%) Steiermärkische Bank und Sparkassen Aktiengesellschaft (3�30%) Tiroler Sparkasse Bankaktiengesellschaft Innsbruck (1�74%) DekaBank Deutsche Girozentrale, Frankfurt (1�65%) „Die Kärntner“ Trust-Vermögensverwaltungsgesellschaft m� b� H� & Co KG (1�65%) Salzburger Sparkasse Bank Aktiengesellschaft (1�65%) Sieben Tiroler Sparkassen Beteiligungsgesellschaft m� b� H� (1�65%) NÖ-Sparkassen Beteiligungsgesellschaft m� b� H� (0�76%) VIENNA INSURANCE GROUP AG Wiener Versicherung Gruppe (0�76%) Supervisory Board Rudolf SAGMEISTER (Chairman) Thomas SCHAUFLER (Deputy Chairman) Harald GASSER Gerhard GRABNER -

WOOD's Winter in Prague

emerging europe conference WOOD’s Winter in Prague Tuesday 5 December to Friday 8 December 2017 Please join us for our flagship event - now in its6th year - spanning 4 jam-packed days. We expect to host over 180 companies representing more than 15 countries. NEW: attending company (not covered) snapshotsattached! Click here ! For more information please contact your WOOD sales representative: Tuesday: Energy, Industrials and Materials Registration closes Warsaw +48 222 22 1530 Wednesday: TMT and Utilities on 10 November! Prague +420 222 096 453 Thursday: Consumer, Healthcare and Real Estate London +44 20 3530 7685 Friday: Diversified and Financials [email protected] Invited Companies by country Bolded confirmed Austria MOL Group PGNiG Sistema Ukraine AT & S OTP Bank PKN Orlen Tinkoff Bank Astarta Atrium Waberer’s International PKO BP TMK Industrial Milk Erste Group Bank Wizz Air PKP Cargo TransContainer Company Immofinanz PZU VTB Ferrexpo PORR Iraq Tauron X5 Kernel Raiffeisen International Genel Energy Warsaw Stock MHP Strabag Exchange Serbia Telekom Austria Kazakhstan Wirtualna Polska Belgrade Stock United Kingdom Uniqa Insurance Group Nostrum Oil & Gas Work Service Exchange Kaz Minerals Vienna Insurance Steppe Cement NIS Stock Spirits Group Romania Croatia Lithuania Banca Transilvania Slovenia Podravka Siauliu Bankas Bucharest Stock Gorenje Exchange Krka Conpet Czech Republic Poland Petrol SPEAKERS DIGI CEZ Agora Sava Re Ms. Charlotte Ruhe Electrica MD for Central Europe CME Alior Bank Zavarovalnica Triglav Fondul Proprietatea & the Baltics, EBRD CSOB AmRest Medlife Mr. Leszek Balcerowicz Kofola Asseco Poland Sweden Professor, Warsaw Nuclearelectrica Medicover Komercni Banka Bank Millennium School of Economics OMV Petrom Moneta Money Bank Bank Pekao Vostok Emerging and Chairman of FOR Sphera Finance O2 Czech Republic Budimex Mr. -

WOOD's Winter in Prague

emerging europe conference WOOD’s Winter in Prague Tuesday 5 December to Friday 8 December 2017 Please join us for our flagship event - now in its6th year - spanning 4 jam-packed days. We expect to host over 160 companies representing more than 15 countries. Click here ! For more information please contact Registration closes your WOOD sales representative: Tuesday: Energy, Industrials and Materials Warsaw +48 222 22 1530 Wednesday: TMT and Utilities on 10 November! Prague +420 222 096 453 Thursday: Consumer, Healthcare and Real Estate London +44 20 3530 7685 Friday: Diversified and Financials [email protected] Invited Companies by country Bolded confirmed Austria Iraq PGE PIK Lokman Hekim AT & S DNO PGNiG Polymetal International Migros Ticaret Atrium Genel Energy PKN Orlen Polyus Otokar BUWOG Kazakhstan PKO BP Raven Russia Pegasus Airlines DO&CO KMG EP PKP Cargo Rosneft Petkim Erste Group Bank Nostrum Oil & Gas Prime Car Management Rostelecom Reysas REIT Immofinanz Steppe Cement PZU Rusal Sabanci Holding OMV Lithuania Synthos Severstal Sisecam PORR Siauliu Bankas Tauron Sistema Tat Gida Raiffeisen International Poland Warsaw Stock Exchange Surgutneftegas TAV Strabag Agora Wirtualna Polska Tatneft Tekfen Holding Telekom Austria Alior Bank Work Service Tinkoff Bank Teknosa Uniqa Insurance Group Amica Romania TMK Torunlar REIC Vienna Insurance AmRest Banca Transilvania TransContainer Tofas Warimpex Asseco Poland Bucharest Stock Exchange VTB TSKB Croatia Bank Millennium Conpet X5 Tumosan Podravka Bank Pekao DIGI Yandex Turcas Petrol Czech -

€312.4M €171.7M €32.5M €26.9M €81.3M

A leading owner and producer of premium branded spirits and liqueurs that are sold principally in Central and Eastern Europe and Italy. Over 45 brands, exporting to more than Capitalising on key consumer trends 50 countries worldwide through own driving growth in spirits value in rd 1 distribution and 3 party arrangements Italy and Central & Eastern Europe: Global sales volumes total over 125 • Premiumisation million litres per year1 • Diversification of drinking occasions • Growing confidence in local provenance Wholly owned operations in Poland, the Czech Republic, Slovakia, Italy, Croatia and Bosnia & Herzegovina #2 in Poland in clear vodka and #2 in flavoured vodka and vodka- State of the art production facilities in based liqueurs2 Poland, Italy, Ireland, the Czech Republic #1 in the Czech Republic in spirits, and Germany rum, bitters and vodka3 Listed on the main market of the London #1 in Italy in vodka, vodka-based Stock Exchange liqueurs, limoncello, #2 in brandy4 Primary Markets Revenue provided in total and by segment5 100% 55% 26% 9% 10% €312.4m €171.7m €81.3m €26.9m €32.5m 2018: €282.4m 2018: €152.6m 2018: €73.2m 2018: €25.8m 2018: €30.9m Group Poland Czech Republic Italy Other Stock Spirits Group is No. 2 in vodka with 29.5% No. 1 in spirits with 34.3% No.1 in vodka, flavoured Slovakia, Croatia, Bosnia headquartered in the UK value share5 value share6 vodka-based liqueurs and and Herzegovina. Core categories: vodka, Core categories: rum, limoncello. 6.9% value International exports: USA, flavoured vodka-based bitters, vodka, flavoured share of spirits7 Germany, Canada, UK, liqueurs, whisky vodka-based liqueurs, Core categories: vodka, Slovenia and other Balkan whisky grappa, flavoured vodka- countries based liqueurs, limoncello, brandy Sources 5. -

View Annual Report

Investing in our brands Stock Spirits Group PLC Annual Report & Accounts 2018 Stock Spirits Group PLC · Annual Report & Accounts 2018 Stock Spirits is a major force in Central and Eastern European spirits With a major stake in each of our core operating markets and with a growing presence in the wider global market, we have more than 45 brands and export internationally to more than 50 countries worldwide. 2018 Financial highlights 9 month financial highlights: Stock Spirits has changed its reporting date to 30 September. In this Annual Report & Accounts, the Group is reporting on a 9 month period to 30 September 2018, with the year to 31 December 2017 reported as a comparative. Volume in 9 litre cases Revenue Adjusted EBITDA3 9 mth Sept 9 mth Sept 9 mth Sept 9.1 m €193.8m €35.8m (12 mth Dec 2017: 13.1m) (12 mth Dec 2017: €269.8m)1 (12 mth Dec 2017: 56.3m) Profit for the period Basic earnings per share Dividends per share 9 mth Sept 9 mth Sept 9 mth Sept2 €19.3 m 9.71€cents 8.51 €cents (12 mth Dec 2017: €11.3m) (12 mth Dec 2017: 5.72 €cents) (12 mth Dec 2017: 8.10 €cents) Source(s): 1. The Group has adopted IFRS 15 using the retrospective method and, as such, 2017 reported revenue has been restated. S Statutory period See note 3 in the financial statements on page 108 Due to our year-end change, figures calculated 2. Interim dividend of 2.50 €cents paid on 21 September 2018 and proposed final dividend for the 9 month period to based on our statutory periods are denoted by 30 September 2018 of 6.01 €cents this symbol throughout the report -

Stock Spirits Group PLC Preliminary Results 2Nd December 2020

PLC Preliminary results Wednesday, 2nd December 2020 PLC Preliminary results Wednesday, 2nd December 2020 Operator: Good morning everyone and welcome to the Stock Spirits Group PLC Preliminary Results Conference Call. At this time, all participants are in a listen-only mode. After the speaker presentation, there will be a question-and-answer session. To ask a question during the session, you will need to press star one on your telephone. I must advise you that this conference is being recorded today. I would now like to hand the conference over to your speaker today, Mr Mirek Stachowicz. Please go ahead, sir. Introduction Mirek Stachowicz CEO, Stock Spirits Group Thank you. Good morning, everyone, and thank you for joining us for our 2020 Full Year Results. We have this morning published our reported numbers for the 12 months to 30th September 2020, and all comparative figures for the 12 months to September 2019 have been restated to align with the new IFRS 16 requirements. As usual, I'm joined today by Paul Bal, our CFO. Agenda Moving to slide two and the agenda for today. I will slide by – excuse me, I will start by providing a brief summary of the year, then give you an update on what COVID-19 has meant for Stock Spirits whilst also reminding you of our differentiated and unique business model. I'll then take you through the business review for the period including an update on the performance in each region before handing over to Paul to talk you through the finances in detail. -

Stock Spirits Group PLC Year-End 2017 Results

Stock Spirits Group PLC Year-end 2017 Results 7 March 2018 Disclaimer This presentation has been prepared by Stock Spirits Group PLC (“Stock Spirits Group” or the “Group”). By attending the meeting where the presentation is made, or by reading the presentation slides, you agree to be bound by the following conditions. This presentation contains forward looking statements, which are based on the Stock Spirits Group Board's current expectations and assumptions and may involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. These statements typically contain words such as “anticipate”, “assume”, “believe”, “expect”, “plan”, “intend” and words of similar substance. The forward looking statements contained in this presentation are based on past trends or activities and should not be taken as a representation that such trends or activities will continue in the future. It is believed that the expectations reflected in these statements are reasonable, but they may be affected by a number of variables which could cause actual results or trends to differ materially, including, but not limited to: conditions in the market, market position of the companies comprising the Stock Spirits Group, earnings, financial position, cash flows, return on capital and operating margins, anticipated investments and economic conditions; the Group's ability to obtain capital/additional finance; a reduction in demand by customers; an increase in competition; an unexpected decline in revenue or profitability; legislative, fiscal and regulatory developments, including, but not limited to, changes in environmental and health and safety regulations; exchange rate fluctuations; retention of senior management; the maintenance of labour relations; fluctuations in the cost of raw material and other input costs; and operating and financial restrictions as a result of financing arrangements.