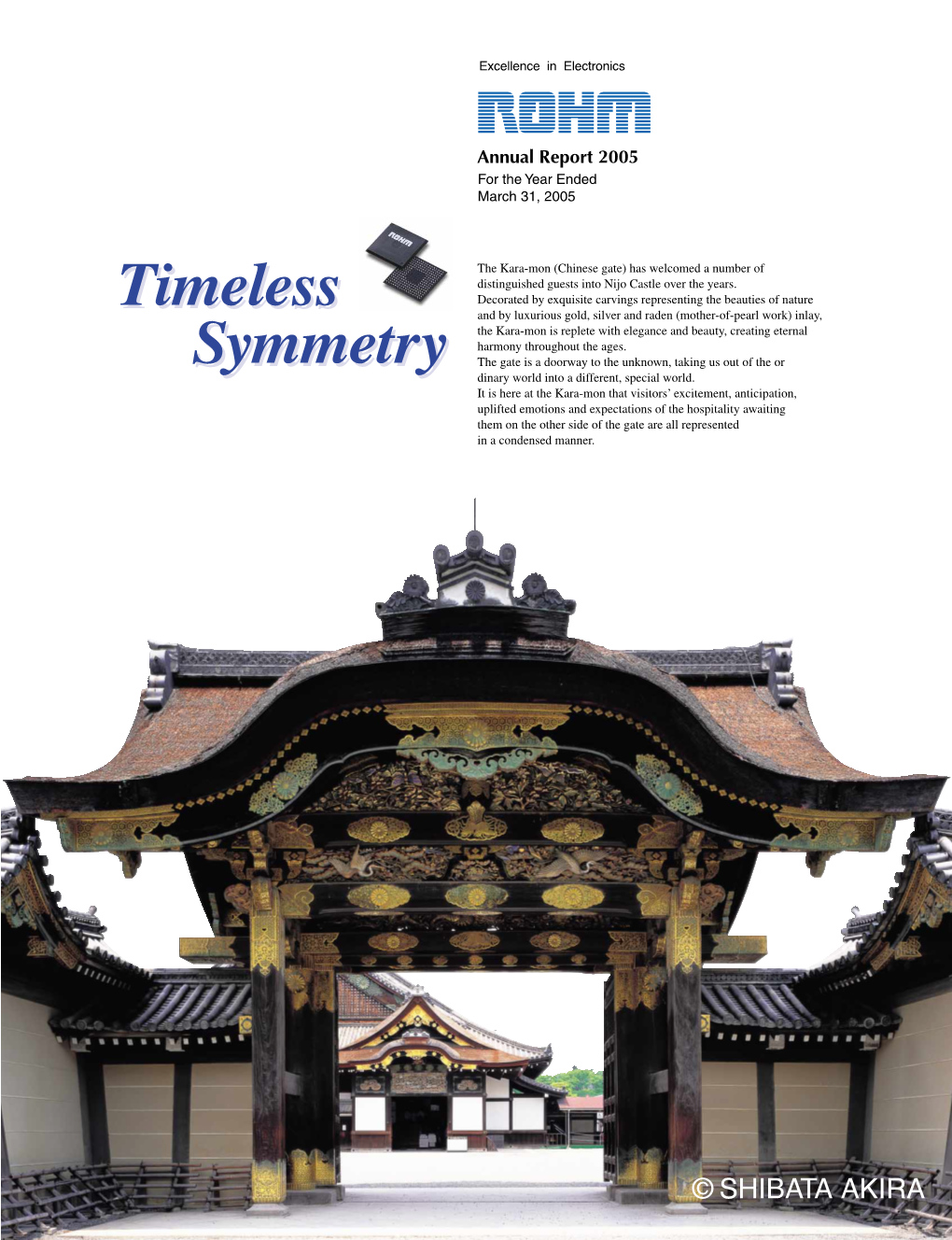

Annual Report 2005 for the Year Ended March 31, 2005

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Representations of Pleasure and Worship in Sankei Mandara Talia J

Mapping Sacred Spaces: Representations of Pleasure and Worship in Sankei mandara Talia J. Andrei Submitted in partial fulfillment of the Requirements for the degree of Doctor of Philosophy in the Graduate School of Arts and Sciences Columbia University 2016 © 2016 Talia J.Andrei All rights reserved Abstract Mapping Sacred Spaces: Representations of Pleasure and Worship in Sankei Mandara Talia J. Andrei This dissertation examines the historical and artistic circumstances behind the emergence in late medieval Japan of a short-lived genre of painting referred to as sankei mandara (pilgrimage mandalas). The paintings are large-scale topographical depictions of sacred sites and served as promotional material for temples and shrines in need of financial support to encourage pilgrimage, offering travelers worldly and spiritual benefits while inspiring them to donate liberally. Itinerant monks and nuns used the mandara in recitation performances (etoki) to lead audiences on virtual pilgrimages, decoding the pictorial clues and touting the benefits of the site shown. Addressing themselves to the newly risen commoner class following the collapse of the aristocratic order, sankei mandara depict commoners in the role of patron and pilgrim, the first instance of them being portrayed this way, alongside warriors and aristocrats as they make their way to the sites, enjoying the local delights, and worship on the sacred grounds. Together with the novel subject material, a new artistic language was created— schematic, colorful and bold. We begin by locating sankei mandara’s artistic roots and influences and then proceed to investigate the individual mandara devoted to three sacred sites: Mt. Fuji, Kiyomizudera and Ise Shrine (a sacred mountain, temple and shrine, respectively). -

The Architecture of the Italian Renaissance

•••••••• ••• •• • .. • ••••---• • • - • • ••••••• •• ••••••••• • •• ••• ••• •• • •••• .... ••• .. .. • .. •• • • .. ••••••••••••••• .. eo__,_.. _ ••,., .... • • •••••• ..... •••••• .. ••••• •-.• . PETER MlJRRAY . 0 • •-•• • • • •• • • • • • •• 0 ., • • • ...... ... • • , .,.._, • • , - _,._•- •• • •OH • • • u • o H ·o ,o ,.,,,. • . , ........,__ I- .,- --, - Bo&ton Public ~ BoeMft; MA 02111 The Architecture of the Italian Renaissance ... ... .. \ .- "' ~ - .· .., , #!ft . l . ,."- , .• ~ I' .; ... ..__ \ ... : ,. , ' l '~,, , . \ f I • ' L , , I ,, ~ ', • • L • '. • , I - I 11 •. -... \' I • ' j I • , • t l ' ·n I ' ' . • • \• \\i• _I >-. ' • - - . -, - •• ·- .J .. '- - ... ¥4 "- '"' I Pcrc1·'· , . The co11I 1~, bv, Glacou10 t l t.:• lla l'on.1 ,111d 1 ll01nc\ S t 1, XX \)O l)on1c111c. o Ponrnna. • The Architecture of the Italian Renaissance New Revised Edition Peter Murray 202 illustrations Schocken Books · New York • For M.D. H~ Teacher and Prie11d For the seamd edillo11 .I ltrwe f(!U,riucu cerurir, passtJgts-,wwbly thOS<' on St Ptter's awl 011 Pnlladfo~ clmrdses---mul I lr,rvl' takeu rhe t>pportrmil)' to itJcorporate m'1U)1 corrt·ctfons suggeSLed to nu.• byfriet1ds mu! re11iewers. T'he publishers lwvc allowed mr to ddd several nt•w illusrra,fons, and I slumld like 10 rltank .1\ Ir A,firlwd I Vlu,.e/trJOr h,'s /Jelp wft/J rhe~e. 711f 1,pporrrm,ty /t,,s 11/so bee,r ft1ke,; Jo rrv,se rhe Biblfogmpl,y. Fc>r t/Jis third edUfor, many r,l(lre s1m1II cluu~J!eS lwvi: been m"de a,,_d the Biblio,~raphy has (IJICt more hN!tl extet1si11ely revised dtul brought up to date berause there has l,een mt e,wrmc>uJ incretlJl' ;,, i111eres1 in lt.1lim, ,1rrhi1ea1JrP sittr<• 1963,. wlte-,r 11,is book was firs, publi$hed. It sh<>uld be 110/NI that I haw consistc11tl)' used t/1cj<>rm, 1./251JO and 1./25-30 to 111e,w,.firs1, 'at some poiHI betwt.·en 1-125 nnd 1430', .md, .stamd, 'begi,miug ilJ 1425 and rnding in 14.10'. -

ISSM2020 –International Symposium on Semiconductor Manufacturing SPONSORSHIP December 15-16, 2020, Tokyo, Japan

ISSM2020 –International Symposium on Semiconductor Manufacturing SPONSORSHIP December 15-16, 2020, Tokyo, Japan Shozo Saito Chairman, ISSM2020 Organizing Committee Device & System Platform Development Center Co., Ltd. Shuichi Inoue, ATONARP INC. It is our great pleasure to announce that The 28th annual International Symposium on Semiconductor Manufacturing (ISSM) 2020 will be held on December 15-16, 2020 at KFC Hall, Ryogoku, Tokyo in cooperation with e-Manufacturing & Design Collaboration Symposium (eMDC) which is sponsored by TSIA with support from SEMI and GSA. The program will feature keynote speeches by world leading speakers, timely and highlighted topics and networking sessions focusing on equipment/materials/software/services with suppliers' exhibits. ISSM continues to contribute to the growth of the semiconductor industry through its infrastructure for networking, discussion, and information sharing among the world's professionals. We would like you to cooperate with us by supporting the ISSM 2020. Please see the benefit of ISSM2020 sponsorship. Conference Overview Date: December 15-16, 2020 Location: KFC (Kokusai Fashion Center) Hall 1-6-1 Yokoami Sumidaku, Tokyo 130-0015 Japan +81-3-5610-5810 Co-Sponsored by: IEEE Electron Devices Society Minimal Fab Semiconductor Equipment Association of Japan (SEAJ) Semiconductor Equipment and Materials International (SEMI) Taiwan Semiconductor Industry Association (TSIA) Endorsement by: The Japan Society of Applied Physics Area of Interest: Fab Management Factory Design & Automated Material -

NA Rohs Bittium Code Description Manufacturer Manufacturer Partnro Layout Cell Status QTY Ref Designator 1 Not Defined Belmont PWB 0

# NA RoHS Bittium Code Description Manufacturer Manufacturer partnro Layout cell Status QTY Ref Designator 1 Not Defined Belmont PWB 0. Proposal 1 PWB 2 EU RoHS,EU RoHS,China RoHS IC LEVEL TRANS TXB0104 WCSP Texas Instruments TXB0104YZTR BGA12_1.4X1.9_P0.5 0. Not Defined 4 D1,D4,D5,D16 3 EU RoHS IC LTE module VZM20Q SMD Sequans VZM20Q 0. Proposal 1 D15 4 Not Defined IC GNSS UFBGA48 Sony CXD5600GF 0. Proposal 1 D13 5 Yes IC UART+USB TI QFN32 Future Technology Devices International Ltd FT232RQ 0. Not Defined 1 D17 6 Yes IC MUX ANALOG TS5A3154 TI DSBGA8 Texas Instruments TS5A3154YZPR 0. Not Defined 1 D26 7 Not Defined IC Flash Serial 8Mbit WLCSP8 Winbond W25Q80EWBYIG 0. Proposal 1 D14 8 EU RoHS RF SAW FILTER GPS/GLONASS SMD Murata SAFFB1G58KA0F0A FILTER5_1.1X0.9 0. Proposal 2 Z2,Z3 9 EU RoHS RF SAW FILTER GPS+GLONASS SMD TDK‐EPC Corporation B39162B9839P810 1. Approved for Design 1 Z4 10 EU RoHS,China RoHS CRYSTAL 32.768 kHz 10PPM SMD Abracon corporation ABS06‐32.768KHZ‐9‐1‐T 1. Approved for Design 1 Y1 11 EU RoHS TCXO 16.368MHz ‐30/+85C +‐0.5PPM SMD NIHON DEMPA KOGYO CO. (NDK) NT2016SA‐16.368M‐NSA3506A 1. Approved for Design 1 Z1 12 EU RoHS IC RF AMP 1550‐1615MHz SMD Infineon Technologies BGA725L6 TSLP‐6‐2 0. Proposal 1 N7 13 EU RoHS,China RoHS IC REG LDO 1V8 LP5907 SOT‐23 Texas Instruments LP5907MFX‐1.8/NOPB SOT23‐5_H1.45 0. Not Defined 1 N2 14 Yes IC REG +3V3 TPS73633DBVT SOT23 Texas Instruments TPS73633DBVT SSOP5 0. -

Published on 7 October 2016 1. Constituents Change the Result Of

The result of periodic review and component stocks of TOPIX Composite 1500(effective 31 October 2016) Published on 7 October 2016 1. Constituents Change Addition( 70 ) Deletion( 60 ) Code Issue Code Issue 1810 MATSUI CONSTRUCTION CO.,LTD. 1868 Mitsui Home Co.,Ltd. 1972 SANKO METAL INDUSTRIAL CO.,LTD. 2196 ESCRIT INC. 2117 Nissin Sugar Co.,Ltd. 2198 IKK Inc. 2124 JAC Recruitment Co.,Ltd. 2418 TSUKADA GLOBAL HOLDINGS Inc. 2170 Link and Motivation Inc. 3079 DVx Inc. 2337 Ichigo Inc. 3093 Treasure Factory Co.,LTD. 2359 CORE CORPORATION 3194 KIRINDO HOLDINGS CO.,LTD. 2429 WORLD HOLDINGS CO.,LTD. 3205 DAIDOH LIMITED 2462 J-COM Holdings Co.,Ltd. 3667 enish,inc. 2485 TEAR Corporation 3834 ASAHI Net,Inc. 2492 Infomart Corporation 3946 TOMOKU CO.,LTD. 2915 KENKO Mayonnaise Co.,Ltd. 4221 Okura Industrial Co.,Ltd. 3179 Syuppin Co.,Ltd. 4238 Miraial Co.,Ltd. 3193 Torikizoku co.,ltd. 4331 TAKE AND GIVE. NEEDS Co.,Ltd. 3196 HOTLAND Co.,Ltd. 4406 New Japan Chemical Co.,Ltd. 3199 Watahan & Co.,Ltd. 4538 Fuso Pharmaceutical Industries,Ltd. 3244 Samty Co.,Ltd. 4550 Nissui Pharmaceutical Co.,Ltd. 3250 A.D.Works Co.,Ltd. 4636 T&K TOKA CO.,LTD. 3543 KOMEDA Holdings Co.,Ltd. 4651 SANIX INCORPORATED 3636 Mitsubishi Research Institute,Inc. 4809 Paraca Inc. 3654 HITO-Communications,Inc. 5204 ISHIZUKA GLASS CO.,LTD. 3666 TECNOS JAPAN INCORPORATED 5998 Advanex Inc. 3678 MEDIA DO Co.,Ltd. 6203 Howa Machinery,Ltd. 3688 VOYAGE GROUP,INC. 6319 SNT CORPORATION 3694 OPTiM CORPORATION 6362 Ishii Iron Works Co.,Ltd. 3724 VeriServe Corporation 6373 DAIDO KOGYO CO.,LTD. 3765 GungHo Online Entertainment,Inc. -

Organic Architecture and Frank Lloyd Wright

Elizabethtown College First Year Seminar FYS100 Section A ORGANIC ARCHITECTURE and FRANK LLOYD WRIGHT Fall 2021 Basic principles of architecture and urban design including sustainable design and mitigating environmental impacts. Major emphasis on Frank Lloyd Wright’s “Organic Architecture” and his life and selected works (from his ~500 built designs) in Wisconsin (mostly rural), Illinois (mostly Chicago), New York, Pennsylvania, California, Arizona, Japan (a major influence), and Italy (Tuscany). Born in 1867 soon after the Civil war, he lived through two World Wars and the Great Depression. He died in 1959 at the beginning of the Space Race. An Introduction to Site Analysis & Design, Landscape Architecture, Architecture Theory, Architectural Materials & Methods, and Passive Architectural Illumination, Solar, HVAC, and Acoustical Design. Joseph T Wunderlich PhD Mondays 11:00AM-12:20 in E273 Wednesdays 11:00AM at locations stated below Fridays 11:00AM-12:20 in E273 All lectures, readings, and videos may be tested; and many should be referenced in your semester paper. Some content may be duplicated for fault-tolerance, variable access (software & device), and availability to the public on My website and My YouTube channel. Assignments, readings, and announcements will be posted in Canvas. Pre-semester Orientation (8/20-8/22) ▪ Sat: “Roundtable #1: Electronic Resources” (with your peer mentors) – look for announcement from Peer-Mentor for location WEEK 1 (8/23-8/27) ▪ Mon: LECTURE: Course expectations Upcoming Wunderlich book on Frank Lloyd -

MATERIAL and ORNAMENT in KATSURA and Nlkko DANABUNTROCK University of Illinois at Chicago

I1996 ACSA European Conference Copenhagen MATERIAL AND ORNAMENT IN KATSURA AND NlKKO DANABUNTROCK University of Illinois at Chicago INTRODUCTION tea master. Robert Treat Paine and Alexander Soper dated it to the Momoyama period, which is generally agreed to have ended The Katsura Detached Palace and the Toshogu at around 1617, while others date the earliest construction to about Nikko could not be more different. Katsura, a retrear outside 1616, under the supervision ofprince Toshihito, with construc- Kyoto constructed in the early seventeenth century, was built for tion continuing through 1655, supervised by Prince Toshitada. Prince Hachijo Toshihito, the younger brother of Emperor The recent two-volume encyclopedia published by Kodansha Goyozei; built in the shoin and sukiya styles, materials are used dates the original Old Shoin and some small structures to plainly and left unpainted; ornament and color are kept to a between 1620 and 1625 and remainingconstruction to between minimum.' By contrast, the Toshogu, built between I616 and 1641 and 1662, again splitting credit for supervision between 1617 to enshrine Tokugawa Ieyasu and reconstructed between the two princes.Wther recent scholarship roughly shares this 1634 and 1636 by the third Shogun, Tokugawa Iemitsu, is an dating and sequence. ornamental orgy: there are a total of 5,173 distinct carvings and At Katsura, ornament is minimal and limited; instead, surfaces are a riot of color.' materials are used decoratively to achieve a rich effect. Although Yet these two buildings share a place in time and some the paulownia and the chrysanthemum, both signifying Prince of the best artisans ofthe day are known to have worked on both. -

Introduction This Exhibition Celebrates the Spectacular Artistic Tradition

Introduction This exhibition celebrates the spectacular artistic tradition inspired by The Tale of Genji, a monument of world literature created in the early eleventh century, and traces the evolution and reception of its imagery through the following ten centuries. The author, the noblewoman Murasaki Shikibu, centered her narrative on the “radiant Genji” (hikaru Genji), the son of an emperor who is demoted to commoner status and is therefore disqualified from ever ascending the throne. With an insatiable desire to recover his lost standing, Genji seeks out countless amorous encounters with women who might help him revive his imperial lineage. Readers have long reveled in the amusing accounts of Genji’s romantic liaisons and in the dazzling descriptions of the courtly splendor of the Heian period (794–1185). The tale has been equally appreciated, however, as social and political commentary, aesthetic theory, Buddhist philosophy, a behavioral guide, and a source of insight into human nature. Offering much more than romance, The Tale of Genji proved meaningful not only for men and women of the aristocracy but also for Buddhist adherents and institutions, military leaders and their families, and merchants and townspeople. The galleries that follow present the full spectrum of Genji-related works of art created for diverse patrons by the most accomplished Japanese artists of the past millennium. The exhibition also sheds new light on the tale’s author and her female characters, and on the women readers, artists, calligraphers, and commentators who played a crucial role in ensuring the continued relevance of this classic text. The manuscripts, paintings, calligraphy, and decorative arts on display demonstrate sophisticated and surprising interpretations of the story that promise to enrich our understanding of Murasaki’s tale today. -

Facilitation of Information Transfer on Chemicals in Products

Facilitation of Information Transfer on Chemicals in Products The Ministry of Economy, Trade and Industry (METI) developed ‘chemSHERPA’ [kémʃéərpə] as a new information transfer scheme for chemicals in products throughout their supply chains. METI hopes that the dissemination of chemSHERPA may contribute to reduce the workload of both providers and recipients of the information. From the beginning of the development of chemSHERPA, METI has been in communication with international bodies such as the IEC and the IPC, etc., with the aim of developing chemSHERPA into not only a Japanese standard but also an International standard. To make it a de-facto standard, METI has introduced this scheme to international organizations and governments of other countries for their active use. The Joint Article Management Promotion Consortium (JAMP) is a governing body for chemSHERPA from April 2016 and see a shift to chemSHERPA. We believe many companies are preparing towards implementing chemSHERPA. Based on the efforts mentioned above, the following companies and company groups have agreed with the dissemination of chemSHERPA, and METI will continue to work with JAMP and companies to spread the use of chemSHERPA to internal as well as external supply chains as needed.(Please contact us if any company or company group has interest in putting its name below.) It should be noted, the use of the provision of data entry support tools is free of charge in principle with the aim of promoting wider use of chemSHERPA. [Contact information] Chemical Management Policy Division Manufacturing Industries Bureau Ministry of Economy, Trade and Industry [email protected] 03-3501-0080 (direct) 03-3501-1511 (ex. -

User's Manual

User’s Manual 78K0/IB2 Fluorescent Ballast Evaluation Board Target Device 78K0/IB2 Microcontroller ZBB-CE-09-0011-E Data Published March 2009 © NEC Electronics Corporation 1/25 z The information in this document is current as of March, 2009. The information is subject to change without notice. For actual design-in, refer to the latest publications of NEC Electronics data sheets or data books, etc., for the most up-to-date specifications of NEC Electronics products. Not all products and/or types are available in every country. Please check with an NEC Electronics sales representative for availability and additional information. z No part of this document may be copied or reproduced in any form or by any means without the prior written consent of NEC Electronics. NEC Electronics assumes no responsibility for any errors that may appear in this document. z NEC Electronics does not assume any liability for infringement of patents, copyrights or other intellectual property rights of third parties by or arising from the use of NEC Electronics products listed in this document or any other liability arising from the use of such products. No license, express, implied or otherwise, is granted under any patents, copyrights or other intellectual property rights of NEC Electronics or others. z Descriptions of circuits, software and other related information in this document are provided for illustrative purposes in semiconductor product operation and application examples. The incorporation of these circuits, software and information in the design of a customer's equipment shall be done under the full responsibility of the customer. NEC Electronics assumes no responsibility for any losses incurred by customers or third parties arising from the use of these circuits, software and information. -

Facilitation of Information Transfer on Chemicals in Products

Facilitation of Information Transfer on Chemicals in Products The Ministry of Economy, Trade and Industry (METI) has developed ‘chemSHERPA’ [kémʃéərpə] as a new information transfer scheme for chemicals in products throughout their supply chains. METI hopes that the dissemination of chemSHERPA may contribute to reduce the workload of both providers and recipients of the information. From the beginning of the development of chemSHERPA, METI has been in communication with international bodies such as the IEC and the IPC, etc., with the aim of developing chemSHERPA into not only a Japanese standard but also an International standard. To make it a de-facto standard, METI has introduced this scheme to international organizations and governments of other countries for their active use. The Joint Article Management Promotion Consortium (JAMP) will be a governing body for chemSHERPA from April 2016 and METI expects to see an orderly, step-by-step shift to chemSHERPA over the two years transition period. Accordingly JAMP has a plan to finish renewing the substances list in the existing JAMP scheme by the end of March of 2018. We believe many companies will begin advance preparations towards implementing chemSHERPA. Based on the efforts mentioned above, the following companies and company groups have agreed with the dissemination of chemSHERPA, and METI will continue to work with companies to spread the use of chemSHERPA to internal as well as external supply chains.(Please contact us if any company or company group has interest in putting its name below.) It should be noted, the use of the provision of data entry support tools is free of charge in principle with the aim of promoting wider use of chemSHERPA. -

CSR Report 2013

CSR Report 2013 We def ine CSR as “Putting Smiles on the Faces of Everyone Nintendo Touches.” This CSR report is a digest version of the activities Nintendo has been working on to achieve our CSR goal. Please refer to the Nintendo Co., Ltd. website for more detailed information about our CSR activities. We welcome your opinions and comments about the CSR Report 2013 on our website. Digest Version (this report) C S R R e p o r t 2 0 13 Detailed Version (website) http://www.nintendo.co.jp/csr/en/ Nintendo Overview Reporting Scope The scope of this report covers the activities and data of the Company Name Nintendo Group (Nintendo Co., Ltd. and its main consolidated Nintendo Co., Ltd. subsidiaries). Any information not within this scope is explicitly Location identif ied as such. For the purposes of this report, the term “Nintendo” refers to the entire Nintendo Group. Nintendo Co., Ltd. is 11-1 Hokotate-cho, Kamitoba, Minami-ku, Kyoto, Japan referred to by its complete name. Founded September 1889 Reporting Period This report mainly covers activities in f iscal year 2012 (from April Incorporated 2012 through March 2013), in addition to some recent activities and November 1947 some activities prior to f iscal year 2012. Capital 10,065,400,000 yen Publication Date Publication date of English report: July 2013 Net Sales (consolidated) (The next English report will be published in July 2014) 635,422,000,000 yen (f iscal year ended March 2013) Number of Consolidated Employees 5,080 employees (as of the end of March 2013) Business Description Manufacture and sale of home leisure equipment CSR Repor t 2013 President’s Message Expanding Smile Network Over Generations, Genders and Geographic Locations People of all ages, speaking dif ferent languages and representing various cultures, are learning to understand each other through the enjoyment of Nintendo products.