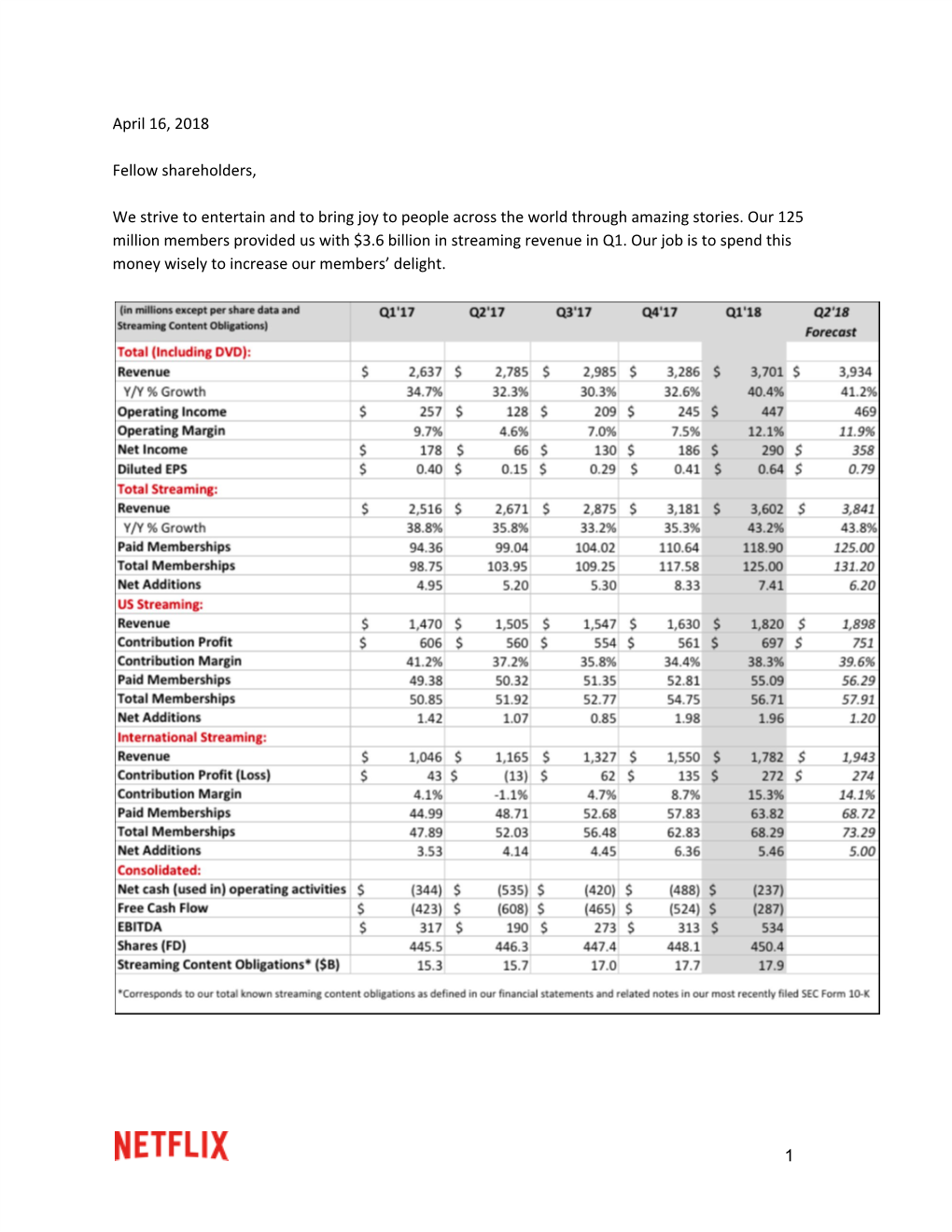

April 16, 2018 Fellow Shareholders, We Strive to Entertain and to Bring

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

February 26, 2021 Amazon Warehouse Workers In

February 26, 2021 Amazon warehouse workers in Bessemer, Alabama are voting to form a union with the Retail, Wholesale and Department Store Union (RWDSU). We are the writers of feature films and television series. All of our work is done under union contracts whether it appears on Amazon Prime, a different streaming service, or a television network. Unions protect workers with essential rights and benefits. Most importantly, a union gives employees a seat at the table to negotiate fair pay, scheduling and more workplace policies. Deadline Amazon accepts unions for entertainment workers, and we believe warehouse workers deserve the same respect in the workplace. We strongly urge all Amazon warehouse workers in Bessemer to VOTE UNION YES. In solidarity and support, Megan Abbott (DARE ME) Chris Abbott (LITTLE HOUSE ON THE PRAIRIE; CAGNEY AND LACEY; MAGNUM, PI; HIGH SIERRA SEARCH AND RESCUE; DR. QUINN, MEDICINE WOMAN; LEGACY; DIAGNOSIS, MURDER; BOLD AND THE BEAUTIFUL; YOUNG AND THE RESTLESS) Melanie Abdoun (BLACK MOVIE AWARDS; BET ABFF HONORS) John Aboud (HOME ECONOMICS; CLOSE ENOUGH; A FUTILE AND STUPID GESTURE; CHILDRENS HOSPITAL; PENGUINS OF MADAGASCAR; LEVERAGE) Jay Abramowitz (FULL HOUSE; GROWING PAINS; THE HOGAN FAMILY; THE PARKERS) David Abramowitz (HIGHLANDER; MACGYVER; CAGNEY AND LACEY; BUCK JAMES; JAKE AND THE FAT MAN; SPENSER FOR HIRE) Gayle Abrams (FRASIER; GILMORE GIRLS) 1 of 72 Jessica Abrams (WATCH OVER ME; PROFILER; KNOCKING ON DOORS) Kristen Acimovic (THE OPPOSITION WITH JORDAN KLEPPER) Nick Adams (NEW GIRL; BOJACK HORSEMAN; -

Statistical Yearbook 2019

STATISTICAL YEARBOOK 2019 Welcome to the 2019 BFI Statistical Yearbook. Compiled by the Research and Statistics Unit, this Yearbook presents the most comprehensive picture of film in the UK and the performance of British films abroad during 2018. This publication is one of the ways the BFI delivers on its commitment to evidence-based policy for film. We hope you enjoy this Yearbook and find it useful. 3 The BFI is the lead organisation for film in the UK. Founded in 1933, it is a registered charity governed by Royal Charter. In 2011, it was given additional responsibilities, becoming a Government arm’s-length body and distributor of Lottery funds for film, widening its strategic focus. The BFI now combines a cultural, creative and industrial role. The role brings together activities including the BFI National Archive, distribution, cultural programming, publishing and festivals with Lottery investment for film production, distribution, education, audience development, and market intelligence and research. The BFI Board of Governors is chaired by Josh Berger. We want to ensure that there are no barriers to accessing our publications. If you, or someone you know, would like a large print version of this report, please contact: Research and Statistics Unit British Film Institute 21 Stephen Street London W1T 1LN Email: [email protected] T: +44 (0)20 7173 3248 www.bfi.org.uk/statistics The British Film Institute is registered in England as a charity, number 287780. Registered address: 21 Stephen Street London W1T 1LN 4 Contents Film at the cinema -

Movie List Please Dial 0 to Request

Movie List Please dial 0 to request. 200 10 Cloverfield Lane - PG13 38 Cold Pursuit - R 219 13 Hours: The Secret Soldiers of Benghazi - R 46 Colette - R 202 5th Wave, The - PG13 75 Collateral Beauty - PG13 11 A Bad Mom’s Christmas - R 28 Commuter, The-PG13 62 A Christmas Story - PG 16 Concussion - PG13 48 A Dog’s Way Home - PG 83 Crazy Rich Asians - PG13 220 A Star is Born - R 20 Creed - PG13 32 A Walk Among the Tombstones - R 21 Creed 2 - PG13 4 Accountant, The - R 61 Criminal - R 19 Age of Adaline, The - PG13 17 Daddy’s Home - PG13 40 Aladdin - PG 33 Dark Tower, The - PG13 7 Alien:Covenant - R 67 Darkest Hour-PG13 2 All is Lost - PG13 52 Deadpool - R 9 Allied - R 53 Deadpool 2 - R (Uncut) 54 ALPHA - PG13 160 Death of a Nation - PG13 22 American Assassin - R 68 Den of Thieves-R (Unrated) 37 American Heist - R 34 Detroit - R 1 American Made - R 128 Disaster Artist, The - R 51 American Sniper - R 201 Do You Believe - PG13 76 Annihilation - R 94 Dr. Suess’ How the Grinch Stole Christmas - PG 5 Apollo 11 - G 233 Dracula Untold - PG13 23 Arctic - PG13 113 Drop, The - R 36 Assassin’s Creed - PG13 166 Dunkirk - PG13 39 Assignment, The - R 137 Edge of Seventeen, The - R 64 At First Light - NR 88 Elf - PG 110 Avengers:Infinity War - PG13 81 Everest - PG13 49 Batman Vs. Superman:Dawn of Justice - R 222 Everybody Wants Some!! - R 18 Before I Go To Sleep - R 101 Everything, Everything - PG13 59 Best of Me, The - PG13 55 Ex Machina - R 3 Big Short, The - R 26 Exodus Gods and Kings - PG13 50 Billy Lynn’s Long Halftime Walk - R 232 Eye In the Sky - -

Television Academy Awards

2019 Primetime Emmy® Awards Ballot Outstanding Comedy Series A.P. Bio Abby's After Life American Housewife American Vandal Arrested Development Atypical Ballers Barry Better Things The Big Bang Theory The Bisexual Black Monday black-ish Bless This Mess Boomerang Broad City Brockmire Brooklyn Nine-Nine Camping Casual Catastrophe Champaign ILL Cobra Kai The Conners The Cool Kids Corporate Crashing Crazy Ex-Girlfriend Dead To Me Detroiters Easy Fam Fleabag Forever Fresh Off The Boat Friends From College Future Man Get Shorty GLOW The Goldbergs The Good Place Grace And Frankie grown-ish The Guest Book Happy! High Maintenance Huge In France I’m Sorry Insatiable Insecure It's Always Sunny in Philadelphia Jane The Virgin Kidding The Kids Are Alright The Kominsky Method Last Man Standing The Last O.G. Life In Pieces Loudermilk Lunatics Man With A Plan The Marvelous Mrs. Maisel Modern Family Mom Mr Inbetween Murphy Brown The Neighborhood No Activity Now Apocalypse On My Block One Day At A Time The Other Two PEN15 Queen America Ramy The Ranch Rel Russian Doll Sally4Ever Santa Clarita Diet Schitt's Creek Schooled Shameless She's Gotta Have It Shrill Sideswiped Single Parents SMILF Speechless Splitting Up Together Stan Against Evil Superstore Tacoma FD The Tick Trial & Error Turn Up Charlie Unbreakable Kimmy Schmidt Veep Vida Wayne Weird City What We Do in the Shadows Will & Grace You Me Her You're the Worst Young Sheldon Younger End of Category Outstanding Drama Series The Affair All American American Gods American Horror Story: Apocalypse American Soul Arrow Berlin Station Better Call Saul Billions Black Lightning Black Summer The Blacklist Blindspot Blue Bloods Bodyguard The Bold Type Bosch Bull Chambers Charmed The Chi Chicago Fire Chicago Med Chicago P.D. -

2017 Tv Shows Quiz

2017 TV SHOWS QUIZ ( www.TriviaChamp.com ) 1> A brilliant military tactician, who plays the role of Capt. Gabriel Lorca on the TV series Star Trek - Discovery? a. Doug Jones b. David Semel c. Jason Isaacs d. Anthony Rapp 2> Created by David E. Kelley, what American drama HBO miniseries is based on a novel by Liane Moriarty. a. Big Little Lies b. Stranger Things c. The Good Place d. The Gifted 3> What new 2017 TV sitcom is a spin-off prequel to "The Big Bang Theory"? a. Young Raj b. Young Howard c. Young Sheldon d. Young Penny 4> Starring Freddie Highmore as Shaun Murphy, this TV show is based on a 2013 South Korean series of the same name. a. Feud b. Taboo c. Mr. Robot d. The Good Doctor 5> What 2017 HBO drama TV series tells the story of the legalization and subsequent rise of the porn industry in New York? a. Designated Survivor b. Ozark c. The Deuce d. This Is Us 6> Played by Anson Mount, what 2017 Marvel Comics TV series is centered on the character of Black Bolt? a. Bull b. American Gods c. Legends of Tomorrow d. Inhumans 7> Created by Liz Flahive and Carly Mensch, this Comedy-drama is based on the 1980s syndicated women's professional wrestling circuit. a. Iron Fist b. Powerless c. Harlots d. GLOW 8> What comedy-drama stars Seth MacFarlane, co-creator of the TV series American Dad, as Ed Mercer? a. American Housewife b. Nirvanna the Band the Show c. The Orville d. -

As Writers of Film and Television and Members of the Writers Guild Of

July 20, 2021 As writers of film and television and members of the Writers Guild of America, East and Writers Guild of America West, we understand the critical importance of a union contract. We are proud to stand in support of the editorial staff at MSNBC who have chosen to organize with the Writers Guild of America, East. We welcome you to the Guild and the labor movement. We encourage everyone to vote YES in the upcoming election so you can get to the bargaining table to have a say in your future. We work in scripted television and film, including many projects produced by NBC Universal. Through our union membership we have been able to negotiate fair compensation, excellent benefits, and basic fairness at work—all of which are enshrined in our union contract. We are ready to support you in your effort to do the same. We’re all in this together. Vote Union YES! In solidarity and support, Megan Abbott (THE DEUCE) John Aboud (HOME ECONOMICS) Daniel Abraham (THE EXPANSE) David Abramowitz (CAGNEY AND LACEY; HIGHLANDER; DAUGHTER OF THE STREETS) Jay Abramowitz (FULL HOUSE; MR. BELVEDERE; THE PARKERS) Gayle Abrams (FASIER; GILMORE GIRLS; 8 SIMPLE RULES) Kristen Acimovic (THE OPPOSITION WITH JORDAN KLEEPER) Peter Ackerman (THINGS YOU SHOULDN'T SAY PAST MIDNIGHT; ICE AGE; THE AMERICANS) Joan Ackermann (ARLISS) 1 Ilunga Adell (SANFORD & SON; WATCH YOUR MOUTH; MY BROTHER & ME) Dayo Adesokan (SUPERSTORE; YOUNG & HUNGRY; DOWNWARD DOG) Jonathan Adler (THE TONIGHT SHOW STARRING JIMMY FALLON) Erik Agard (THE CHASE) Zaike Airey (SWEET TOOTH) Rory Albanese (THE DAILY SHOW WITH JON STEWART; THE NIGHTLY SHOW WITH LARRY WILMORE) Chris Albers (LATE NIGHT WITH CONAN O'BRIEN; BORGIA) Lisa Albert (MAD MEN; HALT AND CATCH FIRE; UNREAL) Jerome Albrecht (THE LOVE BOAT) Georgianna Aldaco (MIRACLE WORKERS) Robert Alden (STREETWALKIN') Richard Alfieri (SIX DANCE LESSONS IN SIX WEEKS) Stephanie Allain (DEAR WHITE PEOPLE) A.C. -

Report by Signatory Company

2017 DGA Episodic Director Diversity Report (by SIGNATORY COMPANY) Combined # Episodes # Episodes # Episodes # Episodes Combined Total # of Female + Directed by Male Directed by Male Directed by Female Directed by Female Male Female Signatory Company Title Female + Network Episodes Minority Male Caucasian % Male Minority % Female Caucasian % Female Minority % Unknown Unknown Minority % Episodes Caucasian Minority Caucasian Minority 50/50 Productions, LLC Workaholics 10 2 20% 8 80% 2 20% 0 0% 0 0% 0 0 Comedy Central ABC Studios American Crime 8 6 75% 2 25% 0 0% 2 25% 4 50% 0 0 ABC ABC Studios American Housewife 22 8 36% 13 59% 2 9% 5 23% 1 5% 1 0 ABC ABC Studios Catch, The 10 5 50% 5 50% 2 20% 2 20% 1 10% 0 0 ABC ABC Studios Code Black 16 4 25% 12 75% 1 6% 2 13% 1 6% 0 0 CBS ABC Studios Criminal Minds 22 9 41% 13 59% 5 23% 4 18% 0 0% 0 0 CBS ABC Studios Criminal Minds: Beyond 13 7 54% 6 46% 3 23% 4 31% 0 0% 0 0 CBS Borders ABC Studios Devious Maids 10 6 60% 4 40% 2 20% 4 40% 0 0% 0 0 Lifetime ABC Studios Grey's Anatomy 24 15 63% 9 38% 3 13% 2 8% 10 42% 0 0 ABC ABC Studios How To Get Away With 15 10 67% 5 33% 2 13% 3 20% 5 33% 0 0 ABC Murder ABC Studios Quantico 22 6 27% 16 73% 1 5% 4 18% 1 5% 0 0 ABC ABC Studios Real O'Neals, The 16 7 44% 9 56% 3 19% 3 19% 1 6% 0 0 ABC ABC Studios Scandal 16 9 56% 7 44% 1 6% 3 19% 5 31% 0 0 ABC Alameda Productions, LLC Love 12 4 33% 8 67% 0 0% 4 33% 0 0% 0 0 Netflix Altered Carbon Productions, LLC Altered Carbon 10 3 30% 7 70% 1 10% 2 20% 0 0% 0 0 Netflix And Action LLC Tyler Perry's If Loving You 22 22 100% 0 0% 22 100% 0 0% 0 0% 0 0 OWN is Wrong And Action LLC Tyler Perry's Love Thy 22 22 100% 0 0% 22 100% 0 0% 0 0% 0 0 OWN Neighbor And Action LLC Tyler Perry's The Haves 23 23 100% 0 0% 23 100% 0 0% 0 0% 0 0 OWN and the Have Nots And Action LLC Tyler Perry's Too Close to 16 16 100% 0 0% 16 100% 0 0% 0 0% 0 0 TLC Home Atlantic 2.1 Entertainment Group, Genius 10 4 40% 6 60% 2 20% 2 20% 0 0% 0 0 National Inc. -

O Marketing E O Monstro: Um Estudo Sobre O Marketing De Cloverfield

PRISMA.COM n.º 43 ISSN: 1646 - 3153 O marketing e o monstro: um estudo sobre o marketing de Cloverfield Marketing and the Monster: A Study on Cloverfield Marketing Luciano Augusto Toledo Universidade Presbiteriana Mackenzie. Brasil [email protected] Henrique Barros Universidade Presbiteriana Mackenzie. Brasil [email protected] Lucas Silva Universidade Presbiteriana Mackenzie. Brasil [email protected] Verônica Santos Universidade Presbiteriana Mackenzie. Brasil [email protected] Wilder Pinto Universidade Presbiteriana Mackenzie. Brasil [email protected] Resumo Abstract Para concorrer com grandes produções, os estúdios de To compete with major productions, low-budget Holly- Hollywood com baixo orçamento buscam investir em es- wood studios seek to invest in different strategies to pro- tratégias diferentes para promover suas produções e mote their productions and engage with their target au- engajar seu público-alvo. Dentro dessa proposta os pro- dience. Within this proposal, Cloverfield franchise pro- dutores da franquia Cloverfield desenvolveram, em ducers developed in 2008 a viral marketing-based strat- 2008, uma estratégia baseada em marketing viral. Com egy. By the Collective Subject Speech, the researchers a análise do Discurso do Sujeito Coletivo, os pesquisa- sought out to understand how this strategy was devel- dores se propuseram a entender como foi desenvolvi- oped, how it was implemented, and whether the film's vda a estratégia de marketing, como foi implementada e success was due to the implemented campaign. The re- sults obtained through qualitative analysis show that the PRISMA.COM (43) 2020, p. 170-192 DOI: https://doi.org/10.21747/16463153/43a9 170 PRISMA.COM n.º 43 ISSN: 1646 - 3153 se o sucesso do filme foi graças à campanha implemen- good results achieved by the film are due to the effi- tada. -

Estratégias Mediáticas Digitais Digital Media

N º 4 3 N O V E M B R O 2 0 2 0 N O V E M B E R 2 0 2 0 EDIÇÃO ESPECIAL SPECIAL EDITION E S T R A T É G I A S M E D I Á T I C A S D I G I T A I S D I G I T A L M E D I A S T R A T E G I E S DIRECTORA DIRECTOR ELISA CERVEIRA EDIÇÃO ESPECIAL SPECIAL EDITION E S T R A T É G I A S M E D I Á T I C A S D I G I T A I S D I G I T A L M E D I A S T R A T E G I E S EDITORES EDITORS VASCO RIBEIRO THAÏS DE MENDONÇA JORGE JOÃO FIGUEIRA CAPA: Ilustração: Heitor Alvelos, 2020 REVISTA PRISMA.COM ISSN: 1646-3153 DOI: https://doi.org/10.21747/16463153/43 Peridiocidade: Semestral Directora Director Elisa Cerveira Conselho Editorial Editorial Board António Machuco Rosa, Universidade do Porto, Faculdade de Letras, Portugal Armando Malheiro da Silva, Universidade do Porto - Faculdade de Letras, Portugal Fernando Zamith, Universidade do Porto - Faculdade de Letras, Portugal Helena Sousa, Universidade do Minho, Instituto de Ciências Sociais, Portugal Maria Manuela Cardoso, Instituto Politécnico do Porto, ISCAP, Portugal Óscar Mealha, Universidade de Aveiro, Departamento de Comunicação e Arte, Portugal Paulo Faustino, Universidade do Porto, Faculdade de Letras, Portugal Gestão de informação Information management Sara Jesus Gomes Pereira, Universidade do Minho, Instituto de Ciências Sociais, Portugal Mariana Paula Martins Selas, Universidade do Porto - Faculdade de Letras, Portugal Raquel Graça, Universidade do Porto - Faculdade de Letras, Portugal Comissão Científica Editorial Comission Alfredo Pena-Vega, IIAC, Institut Interdisciplinaire d'Anthropologie du -

2016 FEATURE FILM STUDY Photo: Diego Grandi / Shutterstock.Com TABLE of CONTENTS

2016 FEATURE FILM STUDY Photo: Diego Grandi / Shutterstock.com TABLE OF CONTENTS ABOUT THIS REPORT 2 FILMING LOCATIONS 3 GEORGIA IN FOCUS 5 CALIFORNIA IN FOCUS 5 FILM PRODUCTION: ECONOMIC IMPACTS 8 6255 W. Sunset Blvd. FILM PRODUCTION: BUDGETS AND SPENDING 10 12th Floor FILM PRODUCTION: JOBS 12 Hollywood, CA 90028 FILM PRODUCTION: VISUAL EFFECTS 14 FILM PRODUCTION: MUSIC SCORING 15 filmla.com FILM INCENTIVE PROGRAMS 16 CONCLUSION 18 @FilmLA STUDY METHODOLOGY 19 FilmLA SOURCES 20 FilmLAinc MOVIES OF 2016: APPENDIX A (TABLE) 21 MOVIES OF 2016: APPENDIX B (MAP) 24 CREDITS: QUESTIONS? CONTACT US! Research Analyst: Adrian McDonald Adrian McDonald Research Analyst (213) 977-8636 Graphic Design: [email protected] Shane Hirschman Photography: Shutterstock Lionsgate© Disney / Marvel© EPK.TV Cover Photograph: Dale Robinette ABOUT THIS REPORT For the last four years, FilmL.A. Research has tracked the movies released theatrically in the U.S. to determine where they were filmed, why they filmed in the locations they did and how much was spent to produce them. We do this to help businesspeople and policymakers, particularly those with investments in California, better understand the state’s place in the competitive business environment that is feature film production. For reasons described later in this report’s methodology section, FilmL.A. adopted a different film project sampling method for 2016. This year, our sample is based on the top 100 feature films at the domestic box office released theatrically within the U.S. during the 2016 calendar -

Larger Than Life: Communicating the Scale of Prehistoric CG Animals

Larger than Life: Communicating the Scale of Prehistoric CG Animals Valentina Feldman Digital Media Antoinette Westphal College of Media Arts and Design Drexel University Philadelphia, PA 19104 [email protected] Abstract — Since the earliest days of cinema, toying with the This statement can hardly be applied to filmmakers, who perception of scale has given filmmakers the ability to create have historically paid great attention to differences of size. spectacular creatures that could never exist in the physical world. The perception of scale is one of the most widely manipulated With the flexibility of CG visual effects, this trend has persisted in aspects of “movie magic,” and has been so since the earliest the modern day, and blockbuster movies featuring enormous monsters are just as popular as ever. The trend of scaling days of cinema. Films featuring impossibly gigantic creatures creatures to impossible proportions for dramatic effect becomes have dominated the box office since the record-breaking problematic when filmmakers use this technique on non-fictional release of King Kong (1933) [LaBarbera, 2003]. Perhaps creatures. Prehistoric animals in particular have very few unsurprisingly, the trend of giant monsters has only continued scientifically accurate appearances in popular culture, which with the advancement of visual effects technology. Movie means that films such as Jurassic Park play an enormous role in monsters are growing bigger and bigger, and moviemakers determining the public’s view of these animals. When filmmakers arbitrarily adjust the scale of dinosaurs to make them appear show no signs of stopping their ceaseless pursuit of cinematic more fearsome, it can be detrimental to the widespread gigantism. -

Report by Show Title

2017 DGA Episodic Director Diversity Report (by SHOW TITLE) Combined # Episodes # Episodes # Episodes # Episodes Combined TotAl # of FemAle + Directed by Male Directed by Male Directed by FemAle Directed by FemAle Male FemAle Title FemAle + Studio Network Episodes Minority Male CaucasiAn % Male Minority % FemAle CaucasiAn % FemAle Minority % Unknown Unknown Minority % Episodes CaucasiAn Minority CaucasiAn Minority 100, The 12 4 33% 8 67% 2 17% 2 17% 0 0% 0 0 Warner Bros Companies CW 12 Monkeys 8 6 75% 2 25% 5 63% 1 13% 0 0% 0 0 NBC Universal Syfy 13 Reasons Why 13 11 85% 2 15% 7 54% 2 15% 2 15% 0 0 Paramount Pictures Corporation Netflix 24: Legacy 11 2 18% 9 82% 0 0% 2 18% 0 0% 0 0 Twentieth Century Fox FOX A.P.B. 11 4 36% 7 64% 2 18% 1 9% 1 9% 0 0 Twentieth Century Fox FOX Affair, The 10 1 10% 9 90% 0 0% 1 10% 0 0% 0 0 Showtime Pictures Development Showtime Company Altered Carbon 10 3 30% 7 70% 1 10% 2 20% 0 0% 0 0 Skydance Pictures, LLC Netflix American Crime 8 6 75% 2 25% 0 0% 2 25% 4 50% 0 0 Disney/ABC Companies ABC American Gods 9 2 22% 7 78% 1 11% 1 11% 0 0% 0 0 Fremantle Productions, Inc. Starz! American Gothic 13 7 54% 6 46% 3 23% 2 15% 2 15% 0 0 CBS Companies CBS American Horror Story 10 8 80% 2 20% 2 20% 5 50% 1 10% 0 0 Twentieth Century Fox FX American Housewife 22 8 36% 13 59% 2 9% 5 23% 1 5% 1 0 Disney/ABC Companies ABC Americans, The 13 6 46% 7 54% 2 15% 3 23% 1 8% 0 0 Twentieth Century Fox FX Andi Mack 13 3 23% 10 77% 2 15% 0 0% 0 0% 0 1 Disney/ABC Companies Disney Channel Angie Tribeca 10 3 30% 7 70% 1 10% 1 10% 1 10% 0 0 Turner Films, Inc.