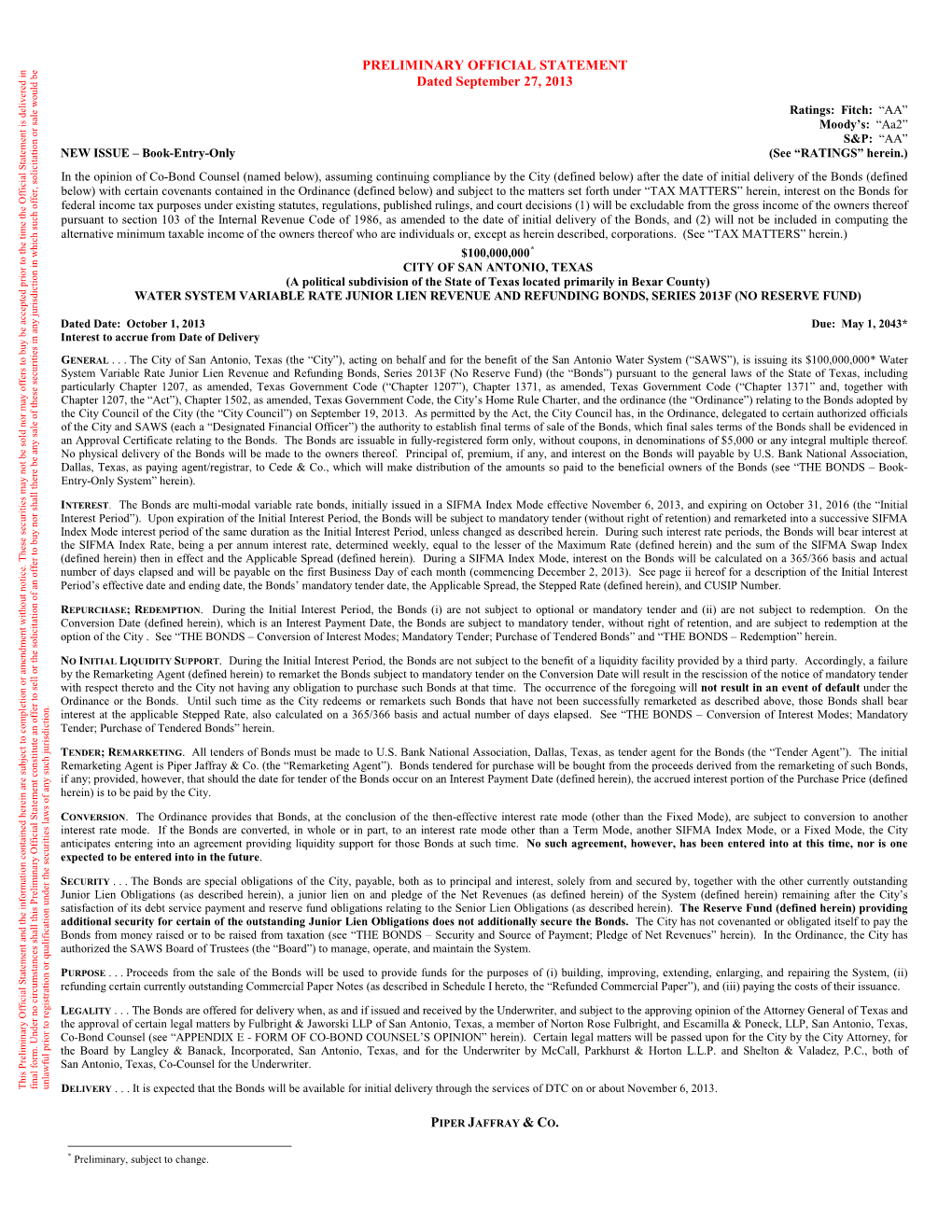

PRELIMINARY OFFICIAL STATEMENT Dated September 27, 2013

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Southside Networking Breakfast South San Antonio Chamber of Commerce Dr

Southside Networking Breakfast South San Antonio Chamber of Commerce Dr. Robert Garza, President OUR MISSION To inspire, empower, and educate our community for leadership and success. Adopted by Alamo Colleges Board of Trustees December2014 Chartered in 1983 and classes officially began in Fall 1985. Who We Serve Fall Headcount Enrollment Source: IRES Student Profile 5 Impacting our Community High School Programs 6 Degrees Conferred Degrees and Certificates Awarded Source: District IRES - KPI Benchmark & THECB Accountability Report Students Employed and/or Enrolled Within 6 Months of Graduation Source: THECB: Texas Higher Educational Almanac 9 AlamoPROMISE Phase Recognitions Rising Star Award 2019 Aspen Prize for Community College Excellence Alamo Colleges District wins Malcolm Baldrige National Quality Award Programs New Program: Healthcare Administration Healthcare Administrator, Associate of Applied Science CAREER AREAS & EMPLOYMENT POSITIONS Employment in the healthcare industry in the Bexar County region is expected to increase 28% by 2024. The average entry-level hourly wage for healthcare administrators is $30.72. Dental Hygiene Launching in 2021 Most graduates can expect to make around $70,000 annually— $25,000 more per year than the average worker in south San Antonio. Coming Soon! Nursing on the Southside Capital Improvement Projects Gymnasium & Natatorium Multipurpose Building (Student Success, AMT, Dental Hygiene) Southside Education & Training Center (SETC) Business and Community Workshops were held July 25th to gain feedback on the center programs and services. Community & Student Connection Advocacy Symposium Inaugural Event CORE4 STEM Family Day Eggstravaganza Inaugural community egg hunt This event was made possible with support from the City of San Antonio, City of San Antonio District 4, Community First Health Plan, Eva’s Heroes, H-E-B, McLemore, South San Antonio Chamber of Commerce, AVANCE, CPS Energy, Palo Alto College Adult Learning Academy, S.H.A.R.E. -

Connecting with the FEB

COMMUNITYConnecting with the FEB. 2018 - FEB. 2019 | VOLUME 2 Connecting with the Community Feb. 2018 – Feb. 2019 Volume 2 Table of Contents Community ............................................................................................... Section 1 Executive Summary Stats Public Safety & Education CRU Customer Programs Fairs Council Districts 1 – 10 Suburban City Outreach Marketing & Comms Managed Accounts Citizens Advisory Committee Joint Base San Antonio Environmental Stakeholder Meetings ....................................................... Section 2 Executive Summary Meetings March 21, 2018 May 4, 2018 July 17, 2018 November 27, 2018 Marketing & Comms Table of Contents (continued) Technology Partnerships ............................................................................ Section 3 Executive Summary New Energy Economy Future of Energy Symposium City of the Future Global Lecture Series Smart SA Smart SA CEO Meetings EPIcenter Global Lecture Series III Marketing & Comms Education Outreach ................................................................................... Section 4 Executive Summary Stats Intern Programs Educational Alliance Marketing & Comms Board of Trustees Vacancy Information Sessions ....................................... Section 5 FY 2019 Events Marketing & Comms Executive Summary CONNECTING WITH THE COMMUNITY XYZ OVERVIEW: Our People First foundation remains at the forefront of all we do! Each year, for the last three years, we have continued to increase the level of our outreach to our Customers -

Original TMDL

Upper San Antonio River Watershed Protection Plan SSaa nn AAnnttoonniioo RRiivveerr AAuutthhoorriittyy BBeexxaarr RReeggiioonnaall WWaatteerrsshheedd MMaannaaggeemmeenntt PPaarrttnneerrsshhiipp TTeexxaass CCoommmmiissssiioonn oonn EEnnvviirroonnmmeennttaall QQuuaalliittyy James Miertschin & Associates, Inc. Parsons, Inc. JAMES MIERTSCHIN & ASSOCIATES, INC. ENVIRONMENTAL ENGINEERING P.O. BOX 162305 • AUSTIN, TEXAS 78716-2305 • (512) 327-2708 UPPER SAN ANTONIO RIVER WATERSHED PROTECTION PLAN Prepared For: San Antonio River Authority 100 East Guenther Street San Antonio, Texas 78204 and Bexar Regional Watershed Management Partnership Prepared in Cooperation With: Texas Commission on Environmental Quality The preparation of this report was financed through grants from the Texas Commission on Environmental Quality. Prepared By: James Miertschin & Associates, Inc. Parsons, Inc. December 2006 The Seal appearing on this document was authorized by Dr. James D. Miertschin, P.E. 43900 on 14 Dec 2006. TABLE OF CONTENTS Section Page LIST OF TABLES...............................................................................................................v LIST OF FIGURES ........................................................................................................... vi LIST OF ABREVIATIONS ............................................................................................. vii I. WPP SUMMARY...........................................................................................................1 1.0 INTRODUCTION ...................................................................................................1 -

Northside Independent School District FY 19-20 Payments from 2/1/2020 Through 2/29/2020

Northside Independent School District FY 19-20 Payments from 2/1/2020 through 2/29/2020 Vendor Name Check Date Check Amount Total Paid 1ST CHOICE RESTAURANT EQUIPMENT & SUPPLY $ 775.50 27-Feb-20 775.50 2W INTERNATIONAL LLC $ 32,000.00 13-Feb-20 32,000.00 A-1 SPORTS CENTER INC $ 4,524.99 13-Feb-20 1,144.00 20-Feb-20 381.00 25-Feb-20 2,999.99 ABBOTT, BRYAN E. $ 460.00 04-Feb-20 210.00 06-Feb-20 135.00 27-Feb-20 115.00 ABBOTT, SHELLY RENEE $ 280.89 06-Feb-20 90.00 27-Feb-20 190.89 ABC-CLIO INC $ 2,710.00 04-Feb-20 2,710.00 ABDO PUBLISHING CO $ 1,147.40 13-Feb-20 1,147.40 ACADEMIC LEARNING COMPANY, LLC DBA VELAZQUEZ PRESS $ 2,119.63 20-Feb-20 125.33 25-Feb-20 1,994.30 ACCREDITED LOCK AND DOOR HARDWARE CO. $ 7,498.54 06-Feb-20 890.00 11-Feb-20 189.84 13-Feb-20 2,948.00 18-Feb-20 1,992.00 20-Feb-20 488.70 27-Feb-20 990.00 ACCUCUT, LLC. $ 94.00 06-Feb-20 94.00 ACCURATE LABEL DESIGNS, INC. $ 150.95 13-Feb-20 150.95 ACE MART RESTAURANT SUPPLY CO. $ 4,504.60 06-Feb-20 180.81 18-Feb-20 911.64 20-Feb-20 3,183.74 25-Feb-20 187.73 27-Feb-20 40.68 ACKELS, LAURIE H. $ 90.56 11-Feb-20 90.56 ACKLES, KRISTA $ 176.87 06-Feb-20 176.87 ACLSA, LLC $ 3,320.00 18-Feb-20 3,320.00 ACM BODY & FRAME INC. -

Participants in the Source Water Protection Program

Generated by the DWIP Team Texas Source Water Protection Program Participants This list contains all of the PWS systems known to have implemented source water protection programs. The PWS ID number is used to identify each respective water system. PWS ID Public Water System Name Last Updated 0010018 B C Y WSC 1/31/2001 0010028 SLOCUM WSC 8/1/1996 0010030 WALSTON SPRINGS WSC 1/31/2001 0020001 CITY OF ANDREWS 8/31/2012 0030001 CITY OF DIBOLL 8/31/2013 0030015 FORT STANLEY AREA WATER UTILITY 6/1/2006 0030016 ANGELINA WSC 10/22/1996 0030019 CENTRAL WCID OF ANGELINA COUNTY 1/31/2001 0030026 M & M WSC 3/31/1995 0030028 REDLAND WSC 6/30/1998 0030029 WOODLAWN WSC 6/1/2005 0030042 LAKEVIEW 6/1/2005 0030053 TX AIRSTREAM HARBOR WATER 5/1/2005 0030094 POLLOK‐REDTOWN WSC 0050001 CITY OF ARCHER CITY 6/1/2001 0050013 WINDTHORST WSC 6/1/2001 0050013 WINDTHORST WSC 7/1/2001 0060001 CLAUDE MUNICIPAL WATER SYSTEM 10/31/1994 0070002 CITY OF JOURDANTON 7/31/1993 0070003 CITY OF PLEASANTON 7/26/2010 0080002 CITY OF SEALY 11/30/1992 0090001 MULESHOE MUNICIPAL WATER SYSTEM 4/30/1998 0100011 BANDERA COUNTY FWSD 1 7/1/1997 0100012 CITY OF BANDERA 7/1/1997 0100015 MEDINA CHILDRENS HOME 7/1/1999 0100016 FLYING L RANCH PUD 7/1/1999 0100017 BANDERA RIVER RANCH 1 7/31/2000 0100019 TPWD LOST MAPLES SNA 7/1/1999 0100021 BANDINA CHRISTIAN YOUTH CAMP 7/1/1999 0100023 CAMP SIONITO BUSINESS 7/1/1999 0100025 BANDERA ISD BANDERA HIGH SCHOOL 7/1/1999 0100027 MAYAN DUDE RANCH 7/1/1999 0100028 DIXIE DUDE RANCH 7/1/1999 0100030 BLUE MEDINA WATER 1/31/2001 0100037 LAKE MEDINA SHORES 6/30/2005 0100040 BANDERA HOMESTEAD CONDOMINIUMS 7/31/1999 0100043 MHC MEDINA LAKE CAMPGROUNDS 5/30/2000 0100045 BANDERA ISD ALKEK ELEMENTARY 7/1/1999 0100046 PIPE CREEK JUNCTION CAFE 7/1/1999 Generated by the DWIP Team Texas Source Water Protection Program Participants This list contains all of the PWS systems known to have implemented source water protection programs. -

2019 Signature Event Booklet

2019 industryIndustry partnershipspartnerships Industry Partner Recommendations to Participating Industy Increase Student Social Mobility: Partners: • Offer more educational opportunities to explore various careers and existing jobs • Build confidence, initiative, and social networks Career Action Program at UTSA • Better preparation in Workforce Training skills; communication, organization, basic Do-Seum University of Texas- San Antonio ............................................................................................................. ............................................................................................................. phone etiquette, power skills, group work, life skills, and work ethic San Antonio Chamber of Commerce TAMUSA • More opportunities for internships, practicums, and mentorships for interested students ............................................................................................................. Texas A&M University-San Antonio Left Step Right Step ............................................................................................................. in communication, media, law, and insurance ............................................................................................................. SAPD • More knowledge on healthcare policies, procedures, and politics VIA Initiative San Antonio Police Department ............................................................................................................. ............................................................................................................ -

IN the UNITED STATES BANKRUPTCY COURT for the EASTERN DISTRICT of VIRGINIA RICHMOND DIVISION ) in Re

Case 21-30209-KRH Doc 349 Filed 03/26/21 Entered 03/26/21 21:03:19 Desc Main Document Page 1 of 172 IN THE UNITED STATES BANKRUPTCY COURT FOR THE EASTERN DISTRICT OF VIRGINIA RICHMOND DIVISION ) In re: ) Chapter 11 ) ALPHA MEDIA HOLDINGS LLC, et al.,1 ) Case No. 21-30209 (KRH) ) Debtors. ) (Jointly Administered) ) CERTIFICATE OF SERVICE I, Julian A. Del Toro, depose and say that I am employed by Stretto, the claims and noticing agent for the Debtors in the above-captioned cases. On March 15, 2021, at my direction and under my supervision, employees of Stretto caused the following document to be served via first-class mail on the service list attached hereto as Exhibit A, and via electronic mail on the service list attached hereto as Exhibit B: • Notice of Filing of Plan Supplement (Docket No. 296) Furthermore, on March 15, 2021, at my direction and under my supervision, employees of Stretto caused the following document to be served via first-class mail on the service list attached hereto as Exhibit C: • Notice of Filing of Plan Supplement (Docket No. 296 – Notice Only) Dated: March 26, 2021 /s/Julian A. Del Toro Julian A. Del Toro STRETTO 410 Exchange, Suite 100 Irvine, CA 92602 Telephone: 855-395-0761 Email: [email protected] 1 The Debtors in these chapter 11 cases, along with the last four digits of each debtor’s federal tax identification number, are: Alpha Media Holdings LLC (3634), Alpha Media USA LLC (9105), Alpha 3E Corporation (0912), Alpha Media LLC (5950), Alpha 3E Holding Corporation (9792), Alpha Media Licensee LLC (0894), Alpha Media Communications Inc. -

Vaneck Vectors ETF Trust Form NPORT-EX Filed 2019-09-25

SECURITIES AND EXCHANGE COMMISSION FORM NPORT-EX Filing Date: 2019-09-25 | Period of Report: 2019-07-31 SEC Accession No. 0001752724-19-129945 (HTML Version on secdatabase.com) FILER VanEck Vectors ETF Trust Mailing Address Business Address 666 THIRD AVENUE, 9TH 666 THIRD AVENUE, 9TH CIK:1137360| IRS No.: 000000000 | Fiscal Year End: 1231 FLOOR FLOOR Type: NPORT-EX | Act: 40 | File No.: 811-10325 | Film No.: 191113335 NEW YORK NY 10017 NEW YORK NY 10017 212-293-2000 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document VANECK VECTORS AMT-FREE INTERMEDIATE MUNICIPAL INDEX ETF SCHEDULE OF INVESTMENTS July 31, 2019 (unaudited) Principal Amount Value MUNICIPAL BONDS: 98.8% Alabama: 0.8% Alabama Federal Aid Highway Finance Authority (RB) $ 540,000 4.00%, 09/01/24 (c) $ 595,960 945,000 5.00%, 09/01/24 (c) 1,116,073 400,000 5.00%, 09/01/24 (c) 469,188 Alabama Federal Aid Highway Finance Authority, Series A (RB) 940,000 5.00%, 09/01/26 (c) 1,137,503 10,000 5.00%, 09/01/26 (c) 12,069 715,000 5.00%, 09/01/27 (c) 883,118 250,000 5.00%, 09/01/27 (c) 307,430 150,000 5.00%, 09/01/27 190,730 280,000 5.00%, 09/01/27 (c) 347,262 100,000 Alabama Federal Aid Highway Finance Authority, Series B (RB) 5.00%, 09/01/25 121,968 Alabama Public School and College Authority, Series B (RB) 535,000 5.00%, 07/01/24 (c) 629,010 540,000 5.00%, 07/01/24 (c) 636,865 Auburn University, Series A (RB) 10,000 5.00%, 06/01/26 (c) 12,208 25,000 5.00%, 06/01/26 (c) 30,662 860,000 Board of Trustees of the University -

Alamo College District Bond

TO: ALAMO COLLEGE DISTRICT BOARD OF TRUSTEES FROM: SAN ANTONIO CHAMBER OF COMMERCE BOARD OF DIRECTORS SUBJECT: 2017 ALAMO COLLEGES BOND ELECTION STATUS: ADOPTED DATE: FEBRUARY 23, 2017 RECOMMENDATION: The Board of Directors of the San Antonio Chamber of Commerce has adopted the following statement as policy: STATEMENT: The San Antonio Chamber of Commerce supports the $450 million bond for the Alamo Colleges District (ACD). Improvements to current school facilities will account for a significant portion of the proposed bond expenditures. These improvements will impact each of the campuses of the ACD. The proposed renovations include replacing aging infrastructure systems that in most cases is more than 25 years old, redeveloping interiors and exteriors and repurposing some of these aging facilities. The bond will also fund new facilities to address anticipated population growth and the community’s educational priorities including the second CAST Center focused on manufacturing and construction. These renovations will enable the District to provide facilities and technology built to support cutting edge education and training for our community. BACKGROUND: What is a Bond Election? In the same way homeowners borrow money in the form of a mortgage to finance the purchase of a home, a school district borrows money in the form of bonds to finance construction and renovation of schools. Both are repaid over time, but in order for a district to sell bonds, it must go to the voters for approval. ACD is the 2nd (per annual unduplicated HC per THECB) largest community college district in the state of Texas with a student population amongst the 5 campuses and dual-credit students of approximately 87,277 students and 6,224 employees with approximately 2,734 of them educators. -

Series 2009 Revenue and Refunding Bonds

OFFICIAL STATEMENT Dated January 22, 2009 Ratings: Moody’s: “Aa2” S&P: “AA” Fitch: “AA” NEW ISSUE – Book-Entry-Only See (“RATINGS” herein) In the opinion of Co-Bond Counsel (named below), assuming continuing compliance by the City (defined below) after the date of initial delivery of the bonds described below (the “Bonds”) with certain covenants contained in the Ordinance authorizing the Bonds and subject to the matters set forth under “TAX MATTERS” herein, interest on the Bonds for federal income tax purposes under existing statutes, regulations, published rulings, and court decisions (1) will be excludable from the gross income of the owners thereof pursuant to section 103 of the Internal Revenue Code of 1986, as amended to the date of initial delivery of the Bonds, and (2) will not be included in computing the alternative minimum taxable income of individuals or, except as described herein, corporations. See “TAX MATTERS” herein. $163,755,000 CITY OF SAN ANTONIO, TEXAS WATER SYSTEM REVENUE AND REFUNDING BONDS, SERIES 2009 Dated Date: January 15, 2009 Due: May 15, as shown on inside cover PAYMENT TERMS . Interest on the $163,755,000 City of San Antonio, Texas Water System Revenue and Refunding Bonds, Series 2009 (the “Bonds”) will accrue from January 15, 2009 (the “Dated Date”) and will be payable on May 15 and November 15 of each year, commencing May 15, 2009, and will be calculated on the basis of a 360-day year consisting of twelve 30-day months. The definitive Bonds will be initially registered and delivered only to Cede & Co., the nominee of The Depository Trust Company, New York, New York (“DTC”), acting as a securities depository (the “Securities Depository”), pursuant to the Book-Entry-Only System described herein. -

Texas Ethics Commission 2006 List of Registered Lobbyists with Employers/Clients (Emp/C) Sorted by Concern Name

TEXAS ETHICS COMMISSION 2006 LIST OF REGISTERED LOBBYISTS WITH EMPLOYERS/CLIENTS (EMP/C) SORTED BY CONCERN NAME Employer/Client Concern Mailing Address Lobbyist Lobbyist Address Compensation Type Amount Termination Date (OSI) EYETECH Inc 3 Times Square 12th Floor New York, NY 10036 Catron, Marsha 1001 Congress Ave Suite 100 Austin, TX 78701 Prospective Less Than $10,000.00 12/31/2006 Gonzalez, Luis E. 1001 Congress Avenue Suite 100 Austin, TX 78701 Prospective $50,000 - $99,999.99 12/31/2006 McPartland Matz, Laura 1001 Congress Avenue Suite 100 Austin, TX 78701 Prospective $50,000 - $99,999.99 12/31/2006 Santos, Frank R. 1001 Congress Avenue Suite 100 Austin, TX 78701 Prospective $50,000 - $99,999.99 12/31/2006 21st Century Insurance Company of the , TX Southwest Sandin, Tracyle 6301 Owensmouth Avenue Corporate Legal Woodland Hills, Prospective Less Than $10,000.00 12/31/2006 CA 91367 24 Hour Fitness USA Inc. 12647 Alcosta Boulevard Suite 500 San Ramon, CA 94583 Goodell-Polan, Deborah P.O. Box 50272 Austin, TX 78763 Paid Less Than $10,000.00 12/31/2006 2428 Partners L. P. 5400 LBJ Freeway Suite 1560 Dallas, TX 75240 Brown, J. E. Buster P.O. Box 426 Austin, TX 78767 Prospective $25,000 - $49.999.99 12/31/2006 2428 Partners LP 5400 LBJ Freeway Suite 1560 Dallas, TX 75240 Phenix, William G. P.O. Box 684551 Austin, TX 78768-4551 Prospective Less Than $10,000.00 12/31/2006 3M Company 3M Center Building 225-5S-08 St. Paul, MN 55144-1000 Eschberger, Brenda 98 San Jacinto Boulevard Suite 1200 Austin, TX 78701 Paid Less Than $10,000.00 12/31/2006 Johnson, Michael J. -

2018 President's Repor

University Roundup | p.8 Spotlight on Students | p.20 Faculty Research in Action | p.34 The Power of Place | p.42 2018 PRESIDENT’SReport The Power of Place SUNDAY APRIL 28 FREE & OPEN TO THE PUBLIC ONE UNIVERSITY WAY SAN ANTONIO, TEXAS 78224 FESTIVALDECASCARONES.COM MUSIC | FOOD | DRINKS KIDS' ZONE CASCARONES SMASH 2 PRESIDENT’S Report 2018 TABLE OF CONTENTS Features Departments National 6 Recognition University Roundup | A&M-SA 8 7 | in the News Campus 22 | Life Spotlight Faculty & Staff 20 on Students 28 | Achievements University 38 | Traditions Alumni Faculty Research 48 | Update in Action 34 Advancement 53 | Update Community 60 | Connections COVER STORY Financial 42 The Power of Place 62 | Overview On the Cover Texas A&M University-San Antonio (A&M-SA) was founded at a specific time, in a specific location, to provide excellent education to the underserved communities on the city’s South Side. As the University celebrates its 10-year anniversary in 2019, A&M-SA continues to embrace and celebrate the history and rugged beauty of its campus along with its rich cultural heritage and enduring military legacy. Photograph by Nan Palmero. TEXAS A&M UNIVERSITY-San Antonio 3 chancellor’s message Texas A&M University-San Antonio (A&M-SA) is on a mission: To provide high-quality, affordable education to all its students, particularly those from South San Antonio’s historically under-represented population. This mission is built into the bricks of The Senator Frank L. Madla Building, and the grand copper doors of the Central Academic Building. It’s alive in the military-connected students the University serves, and in the diverse artwork hung throughout campus.