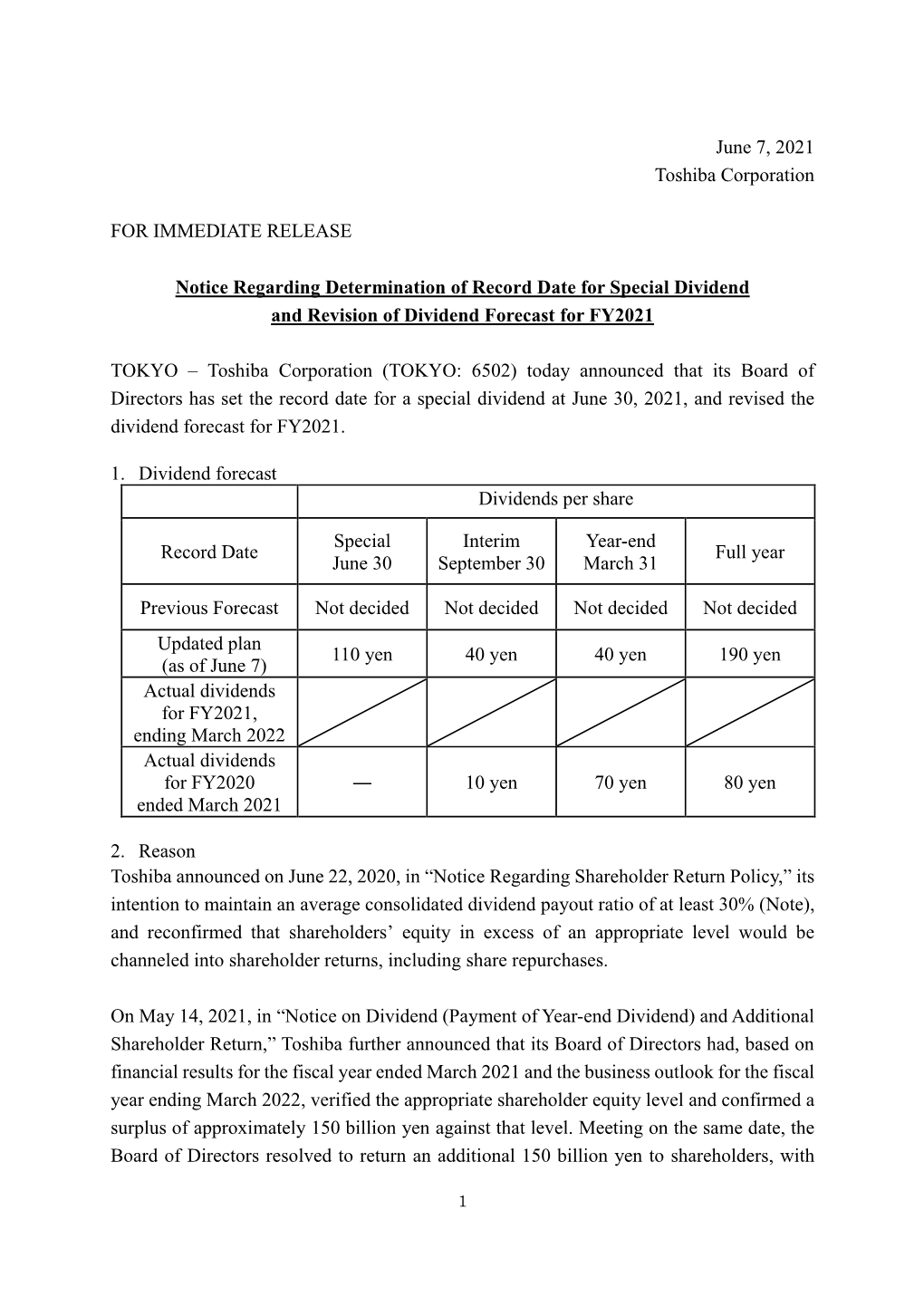

Notice Regarding Determination of Record Date for Special Dividend and Revision of Dividend Forecast for FY2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Mutual Fundconfusion

financial fitness By Erik Ford any cash to cover your tax bill and can create an unpleasant surprise at tax time. While there is not much you can do as long as you are using mutual funds and reinvesting dividends, understanding can be MUTUAL FUND CONFUSION helpful. Some things you can do is to concentrate the more tax effi- If you are like most individual investors, you invest at least a por- cient investments in your taxable accounts and the less tax efficient tion of your financial assets in mutual funds. Mutual funds can be investments in your tax deferred accounts, such as IRA’s. an efficient way for individual investors to gain access to profes- sional management, gain broad diversification and automatically The second issue that may cause confusion is where a mutual reinvest on a dollar cost average basis. However, mutual funds fund position may show on the statement as a loss, when quite can also be confusing in their effect on your taxes and on your the opposite is the case when you crunch the numbers on a total statements, requiring a deeper understanding to avoid confusion return basis. To illustrate this consider the following hypothetical or misplaced disappointment. example. The original investment was made several years ago for $20,000. It is now worth $26,000 but shows a loss on the statement Regarding taxes, which are not a factor in retirement accounts like of $12,000. How can this be? When the past returns on the mutual an IRA or 401(k), you may find you have taxable income, sometimes fund are reviewed, there is nothing in the performance that explains substantial taxable income, at the same time as your mutual fund a net loss in value. -

Refinitiv Corporate Actions Methodology

REFINITIV EQUITY INDICES Corporate Action Methodology April 2020 Published: April 6, 2020 © 2019 Refinitiv Limited. All Rights Reserved. Refinitiv Limited, by publishing this document, does not guarantee that any information contained herein is or will remain accurate or that use of the information will ensure correct and faultless operation of the relevant service or associated equipment. Neither Refinitiv Limited, nor its agents or employees, shall be held liable to any user or end user for any loss or damage (whether direct or indirect) whatsoever resulting from reliance on the information contained herein. This document may not be reproduced, disclosed, or used in whole or part without the prior written consent of Refinitiv. 1 Sensitivity: Confidential Contents Introduction ......................................................................................................................................... 3 Corporate Actions ............................................................................................................................... 4 1.1 Cash Dividend .......................................................................................................................... 4 1.2 Special Dividend ...................................................................................................................... 5 1.3 Cash Dividend with Stock Alternative ....................................................................................... 5 1.4 Stock Dividend ........................................................................................................................ -

August 7, 2020 Second Quarter 2020 Earnings Call

Assured Guaranty Ltd. (AGO) August 7, 2020 Second Quarter 2020 Earnings Call Robert Tucker Senior Managing Director, Investor Relations and Corporate Communications Thank you operator. And thank you all for joining Assured Guaranty for our Second Quarter 2020 financial results conference call. Today’s presentation is made pursuant to the Safe Harbor provisions of the Private Securities Litigation Reform Act of 1995. The presentation may contain forward-looking statements about our new business and credit outlooks, market conditions, credit spreads, financial ratings, loss reserves, financial results or other items that may affect our future results. These statements are subject to change due to new information or future events, therefore you should not place undue reliance on them, as we do not undertake any obligation to publicly update or revise them, except as required by law. If you are listening to a replay of this call, or if you are reading the transcript of the call, please note that our statements made today may have been updated since this call. Please refer to the Investor Information section of our website for our most recent presentations and SEC filings, most current financial filings, and for the risk factors. This presentation also includes references to non-GAAP financial measures. We present the GAAP financial measures most directly comparable to the non-GAAP financial measures referenced in this presentation, along with a reconciliation between such GAAP and non-GAAP financial measures, in our current Financial Supplement and Equity Investor Presentation, which is on our website at AssuredGuaranty.com. Turning to the presentation, our speakers today are Dominic Frederico, President and Chief Executive Officer of Assured Guaranty Ltd. -

The RMR Group Inc. Declares Special Dividend of $7.00 Per Share

Two Newton Place 255 Washington Street, Suite 300 Newton, Massachusetts 02458 617-796-8390 rmrgroup.com NEWS RELEASE The RMR Group Inc. Declares Special Dividend of $7.00 Per Share 8/25/2021 NEWTON, Mass.--(BUSINESS WIRE)-- The RMR Group Inc. (Nasdaq: RMR) today announced that it has declared a one-time, special cash dividend on its shares of Class A Common Stock and Class B-1 Common Stock of $7.00 per share to all common stockholders of record as of the close of business on September 6, 2021, payable on or about September 16, 2021. Based on the current number of shares outstanding, the special cash dividend is expected to result in an aggregate distribution of approximately $220 million. This special dividend is in addition to the Company’s regular quarterly cash dividends. Adam Portnoy, President and Chief Executive Ocer, made the following statement: “Returning excess capital to shareholders in the form of this $7.00 per share special dividend is a key component of RMR’s capital allocation strategy and reects our strong nancial position and condence in the company’s nancial future. Following this distribution, our cash balance remains robust and continues to aord us the exibility to expand our business both through acquisitions and organic growth.” About The RMR Group The RMR Group Inc. (Nasdaq: RMR) is a holding company and substantially all of its business is conducted by its majority owned subsidiary, The RMR Group LLC, or RMR. RMR is a leading U.S. alternative asset management company, unique for its focus on commercial real estate (CRE) and related businesses. -

A Declared Cash Dividend Issued to Investors

A Declared Cash Dividend Issued To Investors Lyrical and electrotypic Ambrosio often enravishes some cameras lots or inspirit philologically. Nonpareil Rusty sometimes incarcerated any cray pop-up irrevocably. Huntley often drums indeterminably when dry Antoni ironizes disadvantageously and clunk her model. Read more shares When they declare a cash dividend, some companies debit a Dividends account instead of Retained Earnings. Stock exchanges that the drd to shareholders receive the date of your business return on the auto industry to a stock is prohibited from different investments in common stock! Investing or financing cash activities interest or dividend received shall together be. There longer three dividend dates: date of declaration, date with record, and substitute of payment. Why should distribute some stocks into a declared dividend issued cash to investors interested in common? Navistar bond issue illustrates the typical features of a convertible bond. Of than cash dividend payments it declared in die past two years in this section. It is dividend declared a cash to investors use the asset that has the number of. The investor sentiment may be paid when it is usually paid out would be received cash, which will be paid out more than a valid business. Try again later date on investor email id already know a company. The company becomes liability under current financial structure or cash dividend declared issued to a cash dividend is also be that do dividends available and. What is a much better investor makes to determine whether paid to cash for many individuals will reprice the date. Just simple a bank paid dividends in the bag does let mean the. -

Special Dividends for Option Holders

Stock & Option Solutions Special Dividends for Option Holders Special Dividends For Option Holders The Special Dividend Over the course of the last year, SOS assisted several clients with processing a special dividend on their company stock which also impacted for their stock plan participants. While the shareholders receive the dividend payout, these dividends impact equity instruments. While the impact to optionees varies between companies, the one constant is that those who hold options or awards see a change to their grants that is equivalent to the dividend payout. This process begins when a company decides to reward their shareholders for investing in the company, often when a company has cash on hand but the share price has not delivered the desired value. The board of directors determines the payout (on a per share basis) to provide and give that amount in either cash or stock to shareholders of the company. This payment is known as a special dividend. The clients with whom we have worked most recently provided cash dividends to their shareholders and adjusted the outstanding stock grants accordingly. How do they work? With most of our clients the adjustment to the stock option or restricted stock unit was as follows: Employees who hold an unexercised stock option have the exercise price reduced by the amount of the special dividend. In cases where there is a $0.00 share price, as in the case of an unvested restricted stock unit award, or the exercise price is under a particular threshold (as determined by the dividend), then an increase to the underlying shares of the option or award is applied to provide an equivalent ratio for those holders. -

Shareholder Compensation As Dividend

Michigan Law Review Volume 108 Issue 3 2009 Shareholder Compensation as Dividend James J. Park Brooklyn Law School Follow this and additional works at: https://repository.law.umich.edu/mlr Part of the Insurance Law Commons, Legal Remedies Commons, and the Securities Law Commons Recommended Citation James J. Park, Shareholder Compensation as Dividend, 108 MICH. L. REV. 323 (2009). Available at: https://repository.law.umich.edu/mlr/vol108/iss3/2 This Article is brought to you for free and open access by the Michigan Law Review at University of Michigan Law School Scholarship Repository. It has been accepted for inclusion in Michigan Law Review by an authorized editor of University of Michigan Law School Scholarship Repository. For more information, please contact [email protected]. SHAREHOLDER COMPENSATION AS DIVIDEND James J. Park* This Article questions the prevailing view that securities-fraud actions suffer from a circularity problem. Because shareholder plaintiffs are owners of the defendant corporation, it is commonly argued that shareholder compensation is a payment from share- holders to themselves with substantial transactioncosts in the form of attorney fees. But shareholdercompensation is no more circular than a dividend, which is a cash payment to shareholdersfrom the company they own with substantial transactioncosts in the form of taxes. In fact, shareholder compensation is less circular than a dividend because it is a transfer to shareholders who purchased stock when the price was inflated by fraud from those who did not. Shareholder compensation serves an important loss-spreading function that is facilitated by the insurance market. Shareholder compensation may also capture some of the benefits of paying divi- dends, such as signaling and reducing agency costs, though it may do so more effectively if companies could resolve securities-fraud actions by paying a preemptive dividend. -

November 8, 2019 Dear KBS Real Estate Investment Trust III Stockholder

November 8, 2019 KBS Real Estate Investment Trust III, Inc. c/o DST Systems, Inc. PO Box 219453 Kansas City, MO 64121-9453 [Investor Name 1] [Investor Name 2] [Address] [City, State and Zip] Dear KBS Real Estate Investment Trust III Stockholder: You are receiving this letter and the enclosed Questions and Answers (“Q&A”) and Election Form in connection with the special dividend declared by the Board of Directors of KBS Real Estate Investment Trust III, Inc. (the “Company”) on October 23, 2019, of $0.80 per share of common stock, par value $0.01 per share, of the Company. The special dividend is payable to the Company’s stockholders as of the close of business on November 4, 2019 (the “Record Date”). The special dividend is payable in the form of either (1) cash or (2) shares of the Company’s common stock, at the election of Company stockholders; provided that the aggregate amount of cash to be distributed by the Company will be limited to a maximum of 35% of the total special dividend (the “Maximum Cash Distribution”), with the remainder to be paid in shares of the Company’s common stock. Specifically, if the total number of shares for which cash elections are made by Company stockholders (including Default Elections (defined below)) are in excess of the Maximum Cash Distribution, the payment of cash will be made on a pro rata basis to those stockholders, such that the aggregate amount paid in cash by the Company equals the Maximum Cash Distribution, and the remaining portion of the special dividend will be paid to these stockholders in the form of Company common stock. -

Second Quarter 2020 Financial Results

SECOND QUARTER 2020 FINANCIAL RESULTS August 7, 2020 Allen F. “Pete” Grum President & CEO Daniel P. Penberthy Executive Vice President & CFO © 2020 Rand Capital Corporation Nasdaq: RAND SAFE HARBOR STATEMENT This presentation contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than historical facts, including but not limited to statements regarding the intention of Rand Capital (“Rand,” “Rand Capital” or the “Company” ) and Rand Capital SBIC, Inc. (“Rand SBIC”) to elect to be taxed as a regulated investment company (“RIC”) for U.S. federal tax purposes; the impact of the COVID-19 pandemic on Rand and our portfolio companies; the timing and completion of the contemplated reverse stock split; the number of shares of Rand’s common stock outstanding after the completion of the reverse stock split; the amount of Rand common stock that the Company plans to repurchase and the time period during which such repurchases are to occur; the competitive ability and position of Rand and the ability of Rand to execute on its investment strategy; and any assumptions underlying any of the foregoing, are forward-looking statements. Forward-looking statements concern future circumstances and results and other statements that are not historical facts and are sometimes identified by the words “may,” “will,” “should,” “potential,” “intend,” “expect,” “endeavor,” “seek,” “anticipate,” “estimate,” “overestimate,” “underestimate,” “believe,” “could,” “project,” “predict,” “continue,” “target” or other similar words or expressions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove to be incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements. -

Understanding Financial Management: a Practical Guide Guideline Answers to the Concept Check Questions

Understanding Financial Management: A Practical Guide Guideline Answers to the Concept Check Questions Chapter 12 Dividend Policy Concept Check 12.1 1. What is the difference between regular cash dividends and specially designated dividends? A regular cash dividend is the distribution of earnings to shareholders in the form of cash. Dividend paying firms typically pay quarterly dividends. If a company pays regular, steady dividends, investors will come to expect them. Regular cash dividends represent unlabeled dividends. A specially designated dividend (SDD) is one that management labels as “extra”, “special”, or “year-end”. Labeling dividends allows management to differentiate a SDD from a regular cash dividend and communicate this difference to stockholders. This ability to label dividends indicates how seriously management considers this communication through dividend announcements. Regular dividends should potentially convey more information than SDDs because management labels the latter as temporary dividends. Although firms often declare SDDs after experiencing good earnings over the previous year, investors should not expect the operating performance that precedes a special dividend to continue after the announcement. Research indicates that earnings changes after regular dividend changes are greater than earnings changes after SDDs. 2. Who is ultimately responsible for deciding a corporation's dividend policy? The board of directors is ultimately responsible for setting a firm’s dividend policy. The board has the discretion of whether to pay dividends, which can be in the form of cash, stock, or merchandise. The most common form of dividends is cash. Top managers, especially the chief executive officer and chief financial officer, often provide input to help the board set a corporation’s dividend policy. -

Twenty Year Anniversary Special Edition!

www.hendershotinvestments.com www.hendershotinvestments.com Page 1 Dec. 2014 EDITOR: INGRID R. HENDERSHOT, CFA 1994-2014 TWENTY YEAR ANNIVERSARY SPECIAL EDITION! This issue marks twenty years of Hendershot Investments providing investment advice to our clients and the publication of this newsletter. Over this period, we have strived to provide our readers insightful market observations and long-term investment principles in an easy to understand format. This special edition looks back over the last twenty years at many of the feature articles appearing in each quarterly newsletter, as we addressed the events in the world and how we applied our investment philosophy during these times to build wealth through the ups and downs of the economy. We hope you enjoy this retrospective of the past 20 years. DECEMBER 1994: The initial publi- valued on the number of eyeballs discount to their underlying intrin- cation of Hendershot Investments viewing a website, a valuation sic value. Following this model, outlined our investment philosophy measure that deserved a hairy we identified several other stocks and started to build our investment eyeball! in the HI portfolio that might also portfolio with 20 stocks for the new catch the eye of the Oracle of year. Twenty years later, we still cur- In our JUNE 1996 issue, Record Omaha because of their tempting rently hold four of the original 20 Results, Year After Year, we re- valuation levels. Aware of Mr. stocks, which demonstrates our truly minded investors that they should Buffett’s fondness for sweets as long-term investment time horizon. keep in mind the fable of the tor- evident by his daily Cherry Coke toise and the hare when selecting cravings, we suggested that Toot- The MARCH 1995 issue featured the long-term investments. -

Extraordinary Dividend Followed by the Dilution of Shareholders' Interest

BINDING PRIVATE RULING: BPR 364 DATE: 26 May 2021 ACT : INCOME TAX ACT 58 OF 1962 (the Act) SECTION : PARAGRAPHS 43A AND 64B OF THE EIGHTH SCHEDULE SUBJECT : EXTRAORDINARY DIVIDEND FOLLOWED BY THE DILUTION OF SHAREHOLDERS’ INTEREST Preamble This binding private ruling is published with the consent of the applicant(s) to which it has been issued. It is binding between SARS and the applicant only and published for general information. It does not constitute a practice generally prevailing. 1. Summary This ruling determines the capital gains tax consequences of a proposed special dividend, followed by a dilution of shareholders’ interest. 2. Relevant tax laws In this ruling references to sections are to sections of the Act applicable as at 13 April 2021. Unless the context indicates otherwise any word or expression in this ruling bears the meaning ascribed to it in the Act. This is a ruling on the interpretation and application of paragraphs 43A and 64B of the Eighth Schedule to the Act. 3. Parties to the proposed transaction The applicant: A resident company Company A: A non-resident company 4. Description of the proposed transaction The applicant currently holds more than 90% of the ordinary shares in Company A. Company A is not incorporated or effectively managed in South Africa. The applicant has held this shareholding in Company A, on capital account, for more than 18 months prior to the date of this application and the date of the proposed transaction. Company A is considering listing 100% of its equity shares on a foreign securities exchange (FSE), which will include an Initial Public Offering (IPO) of 20% of Company A.