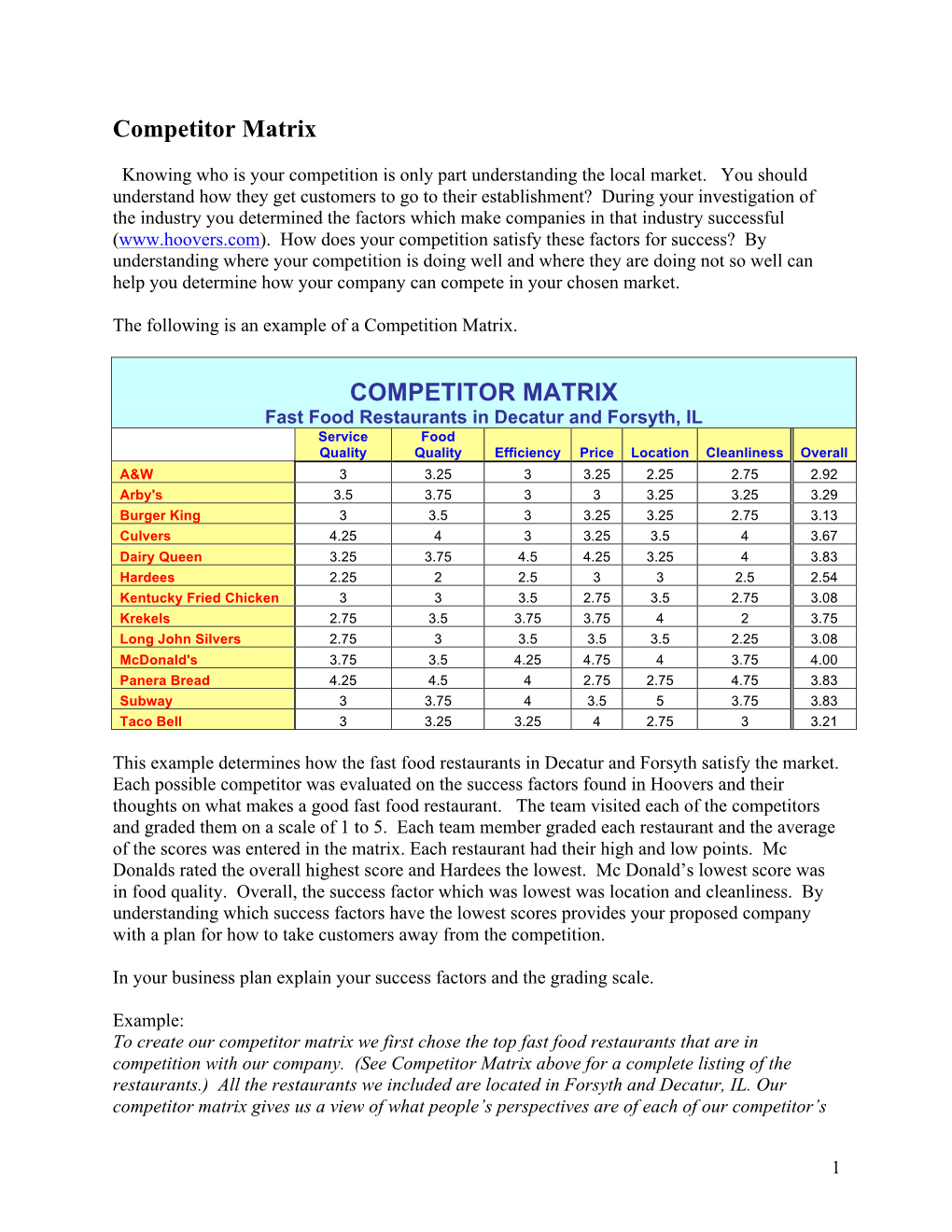

Competitor Matrix

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Chipotle Mexican Grill: Leavening Panera Bread's Sales? Downloaded from by IP Address 192.168.160.10 on 06/27/202

MORE INSIGHTS. MORE OFTEN. BETTER RETURNS. Richard Church [email protected] (203) 307-2581 Chipotle Mexican Grill: Leavening Panera Bread’s Sales? April 29th, 2016 DISCERN platform reveals: • Over 80% overlap between Chipotle and Panera in all regions within a 5-mile trade area • Other potential dining alternative beneficiaries from Chipotle challenges Chipotle Mexican Grill’s recent issues with food contamination and the resultant heavy losses of customers are widely known and do not appear to have ended judging by its first quarter earnings release. In its April 26 release Chipotle reported another significant decline in its same-store sales of 29.7%. Conversely, Panera reported a 6.2% increase for the same fiscal period. Key Takeaway As Chart 1 illustrates there appears to be a meaningful correlation between the trend of Chipotle’s same-store sales and Panera’s as Chipotle’s food contamination issues surfaced. This would largely be attributable to the high competition intensity between the chains as the illustrations below show. Chart 1. Chipotle & Panera Bread Comp-Store Sales Spread 30% 20% 10% CMG 0% PNRA -10% Spread -20% -30% 1Q15 2Q15 3Q15 4Q15 1Q16 Downloaded from www.hvst.com by IP address 192.168.160.10 on 09/26/2021 MORE INSIGHTS. MORE OFTEN. BETTER RETURNS. Illustration 1, which is from DISCERN’s database of retailer and restaurant locations, quantifies to what extent Chipotle and Panera overlap within their respective five mile trade area geographies. The data shows that Chipotle and Panera compete within the same five mile trade area in 86% of the total trade areas, a significant amount of restaurant overlap for 2 large competitors within the fast casual restaurant sector. -

Mary C. Egan and Drew Madsen Appointed to Noodles & Company

September 25, 2017 Mary C. Egan and Drew Madsen Appointed to Noodles & Company Board of Directors BROOMFIELD, Colo., Sept. 25, 2017 (GLOBE NEWSWIRE) -- Noodles & Company (NASDAQ:NDLS) today announced the appointment of Mary C. Egan and Drew Madsen as independent members of its Board of Directors effective September 22, 2017. Ms. Egan was also appointed to the Audit Committee of the Board of Directors. "We are pleased to announce the addition of two talented individuals to our Board of Directors," said Paul Murphy, Executive Chairman of Noodles & Company. "Both Mary and Drew are proven leaders, with significant strategic and operational experience in consumer-centric growth strategy and execution. We believe they will be invaluable resources to our entire organization as we focus on improving the performance and profitability of Noodles & Company." Ms. Egan co-founded and currently serves as CEO of Gatheredtable, a profitable consumer SaaS company offering customized meal planning. Prior to Gatheredtable, Ms. Egan served as Head of Global Strategy and Corporate Development at Starbucks, where she partnered with the senior leadership team to develop and execute corporate strategy, and led many successful strategic initiatives focusing on cost reduction, developing markets, digital, and food. Before joining Starbucks, Ms. Egan was a Managing Director at The Boston Consulting Group where she partnered with CEO's and boards of leading consumer brands to conceive and successfully drive aggressive growth strategies. While at BCG, she was a frequent global speaker on consumer-centric growth, and was featured in many news outlets, including The Wall Street Journal and The New York Times. -

Case 14 Outback Steakhouse: Going International*

CTAC14 4/17/07 14:02 Page 245 case 14 Outback Steakhouse: Going International* By 1995, Outback Steakhouse was one of the fastest growing and most acclaimed restaurant chains in North America. Astute positioning within the intensely- competitive US restaurant business, high quality of food and service, and a relaxed ambiance that echoed its Australian theme propelled the chain’s spectacular growth (see table 14.1). Chairman and co-founder Chris Sullivan believed that at the current rate of growth (around 70 new restaurants each year), Outback would be facing mar- ket saturation within five years. Outback’s growth opportunities were either to diversify into alternative restaurant concepts (it had already started its Carrabba’s Italian Grill restaurants) or to expand internationally: We can do 500–600 [Outback] restaurants, and possibly more over the next five years . [however] the world is becoming one big market, and we want to be in place so we don’t miss that opportunity. There are some problems, some challenges with it, but at this point there have been some casual restaurant chains that have gone [outside the United States] and their average unit sales are way, way above the sales level they enjoyed in the United States. So the potential is there. Obviously, there are some distribution issues to work out, things like that, but we are real excited about the future internationally. That will give us some potential outside the United States to continue to grow as well. In late 1994, Hugh Connerty was appointed President of Outback Inter- national to lead the company’s overseas expansion. -

Panera Bread Co

Hospitality Review Volume 23 Article 4 Issue 1 Hospitality Review Volume 23/Issue 1 January 2005 Who Shook Big Mac?: Panera Bread Co. Kyuho Lee Virginia Polytechnic Institute and State University, [email protected] Melih Madanoglu Virginia Polytechnic Institute and State University, [email protected] Follow this and additional works at: https://digitalcommons.fiu.edu/hospitalityreview Part of the Hospitality Administration and Management Commons Recommended Citation Lee, Kyuho and Madanoglu, Melih (2005) "Who Shook Big Mac?: Panera Bread Co.," Hospitality Review: Vol. 23 : Iss. 1 , Article 4. Available at: https://digitalcommons.fiu.edu/hospitalityreview/vol23/iss1/4 This work is brought to you for free and open access by FIU Digital Commons. It has been accepted for inclusion in Hospitality Review by an authorized administrator of FIU Digital Commons. For more information, please contact [email protected]. Who Shook Big Mac?: Panera Bread Co. Abstract The uthora s identify the firm-specific orc e competencies that Panera Bread has relied on to achieve a competitive advantage in its business domain. The tudys illustrates how the company scans the dynamically changing environments and tailors their products and services in accordance with these changes. This article is available in Hospitality Review: https://digitalcommons.fiu.edu/hospitalityreview/vol23/iss1/4 Who shook Big Mac?: Panera Bread Co. by Kyuho Lee and Melih Madanoglil The authorr identi3 thefirm-per.~fir McDonald's Corporation, a company core competencier that Paizera Bread ha that has been in business since the relied on to achieve a comperitive 1950, reported irs historic firsr advantage in itr burinerr domain. -

11 Steps for Eating out With

EATING WITH FCS 11 Steps for Eating Out with FCS These ‘eating out’ tips will help make dinner parties, restaurant dining, company events, and other social eating situations less of a challenge for people with familial chylomicronemia syndrome. Before you dine out: While dining out: 10. Stay hydrated. And stay away from certain beverages Call ahead to get Make informed decisions Drinking plenty of water may not only nutrition facts and take control decrease the occurrence and severity of pancreatitis, but will also help keep 1. Find out what’s on the menu or 5. Share FCS wallet card w/ servers you feeling full. On the other hand, being served Let them know that you can get sick alcohol, sugary soft drinks, and fruit Ask the person in charge of an event if you eat any fat – or tell them you are juice may cause increases in or dinner party or check to see if the allergic to fat. triglycerides, so avoid those. restaurant has a menu posted online. Some provide nutrition facts on their 6. Skip items with FCS danger words After dining out: Take website. Words like fried, crispy, breaded, sautéed, in a butter sauce, au gratin, a moment to reflect 2. See if you can make special food and creamy indicate high-fat foods – preparation requests stay away from these food items. 11. Use this experience to make Don’t assume family, friends, or chefs the next one even better will make changes on the fly, though. 7. Narrow choices down to Think about what you enjoyed and Ask and confirm before you get there. -

Teacher Appreciation Students Handout.Pdf

Teacher Appreciation Week st th May 1 -5 Monday, May1 In the morning stop by the table in the lunch room and write a quick message to your MVP. Tuesday, May 2 Wear your favorite team jersey Wednesday, May 3 Give the staff a high five for a game well played Thursday, May 4 Bring your MVP’S one of their favorite things (Some of the Staff’s Favorite Things are listed on the attached page) Friday, May 5 Wear Elysian gear Parents can volunteer by clicking the link on the PTO Facebook Page. Favorite Things K-Lanchbury K- Richert K-Horner 1st -Hodges Salty Snack Sour cream & onion chips Salt/Vinegar Chips Chex Mix Jerky Candy Tootsie rolls Cinnamon Bears Bottlecaps Reeses Soft Drink Dr. Pepper Black Ice Tea Diet Coke Dr. Pepper Gum Spearmint Mint Mint Cinnamon Restaurant Olive Garden/Windmill Rio Sabina’s Panda Express/Taco Treat/anything downtown Texas Roadhouse Coffee Shop Starbucks Any City Brew Ice Cream Shop Baskin Robbins Any Spinners Flower Daisy Daisy Sunflower Sent Apple Cinnamon Anything Light Fall Scents Nail Salon Paris Nails Paris Nails Book Store Amazon Amazon Barnes & Noble Gift cards $5-20 Anywhere/ target/Hobby Lobby Coffee/ Hobby Lobby Albertsons/ A Restaurant City Brew/ Lucky’s Market 1st Wetsch 2nd Oravsky 2nd Irigoin 2nd Morris Salty Snack Cashews Trail Mix Pretzels/Caramel Popcorn Candy Dove Chocolate Snickers Licorice (red or chocolate) Soft Drink Pepsi Diet Coke/Diet Pepsi Gum Mint Bubble Gum Restaurant Any Mexican Food Tarantino’s/Any Non-Chain Eatery Anything with Burritos Red Robin/Jimmy Johns/Wild Ginger/Jakes Coffee Shop City Brew Starbucks Ice Cream Shop Big Dipper Cold Stone Flower Any Sent Flower Sent Nail Salon Tanz Things Book Store Barnes & Noble/Amazon Barnes & Noble Barnes & Noble Gift cards $5-20 Any amount Amazon City Brew/ Amazon Starbucks/Target 3rd Falcon 3rd Verbeck 4th Tieszen 4th Ewen Salty Snack Pretzel Peanuts Candy Reeces/Snickers Snickers/Caramel Skittles Soft Drink Diet Pepsi Dr. -

Chipotle Mexican Grill and Panera Bread 777 South Federal Highway | Deerfield Beach, FL 33441

NW Subject Property Chipotle Mexican Grill and Panera Bread 777 South Federal Highway | Deerfield Beach, FL 33441 Brand New Construction Two-Tenant Retail Strip Center | Brand New 10 Year Lease | Rare, Fort Lauderdale Metro Acquisition Opportunity | 10% Rental Escalations Every 5 Years | Directly on N Federal Highway (39,682 VPD) | NNN Leases Confidentiality and Restricted Use Agreement Offered Exclusively by This Confidential Offering Memorandum (“COM”) is provided by Stan Johnson Company (“SJC”), solely for your Brad Feller consideration of the opportunity to acquire the commercial property described herein (the “Property”). This COM Senior Director may be used only as stated herein and shall not be used for any other purpose, or in any other manner, without [email protected] prior written authorization and consent of SJC. P: +1 312.240.0194 This COM does not constitute or pertain to an offer of a security or an offer of any investment contract. This Isaiah Harf COM contains descriptive materials, financial information and other data compiled by SJC for the convenience Director of parties who may be interested in the Property. Such information is not all inclusive and is not represented to [email protected] include all information that may be material to an evaluation of the acquisition opportunity presented. SJC has P: +1 312.777.2437 not independently verified any of the information contained herein and makes no representations or warranties of any kind concerning the accuracy or completeness thereof. All summaries and discussions of documentation Blaise Bennett and/or financial information contained herein are qualified in their entirety by reference to the actual documents Associate and/or financial statements, which upon request may be made available. -

Panera Bread and Au Bon Pain) and One on the West Cream Or Cheese

BY BONNIE LIEBMAN & JAYNE HURLEY cDonald’s is losing money. Last December, the fast- PANS Mfood giant posted its first quarterly loss since the com- ■ Turkey Artichoke Panini Sandwich. “Inspired by Italy, panini are sandwiches with fresh ingredients held between pany went public in 1965. Among the many explanations hearty bread and pressed on a hot grill,” says the menu. But both of Panera’s paninis have too much saturated fat (most- was one to make a nutritionist’s heart go all aflutter: “Time- ly from their cheese). The healthy-sounding Turkey pressed customers may increasingly be calorie- and fat-con- Artichoke Panini, for example, has as much saturated fat as a McDonald’s Big Mac (11 grams), but far more calories (850 scious and pickier about service and lifestyle issues…” ven- vs 590) and sodium (2,550 mg vs 1,090 mg). And that’s not tured The Washington Post. counting the potato chips that are served on the side. ■ Asiago Roast Beef Signature Sandwich. The Asiago As the fast-food chains stumble, what the industry calls “fast Roast Beef has 960 calories, 52 grams of fat (24 of them sat- casual” restaurants are gaining ground. No burger-and-fries urated), and 2,140 mg of sodium, not including the pickle spear and chips. That’s a Burger King Double Whopper, or buckets of chicken for these new upscale kids on the block. except the Roast Beef has twice as much sodium. Instead, you can order fast soups, salads, and sandwiches (or ■ Broccoli Cheddar Soup. The worst soup at Panera is one of a handful that are available every day. -

Nutrition Advice, but Calorie Needs Vary

Statement Concerning Suggested Daily Caloric Intake: The Dietary Guidelines for Americans recommend limiting saturated fat to 20 grams and sodium to 2,300 mg for a typical adult eating 2,000 daily. 2,000 calories a day is used for general nutrition advice, but calorie needs vary. Important Statement: Nutrition information is based on analysis by R-TECH and Commercial Testing Laboratory, Inc., and representative values from manufacturers, Genesis R&D® SQL and the USDA. Allergen information is provided by the ingredient or product manufacturer. The information in this assumes compliance by locations with ingredient requirements and standardized preparation procedures. Seasonal and manufacturer variations may also affect information. This brochure is for permanent menu items in DQ® approved system food restaurants (DQ Grill & Chill® or Brazier® locations). It does not apply to: (1) test items; (2) non-system food locations that sell food products not approved by DQ (you can identify approved system food locations by the DQ Grill & Chill, Brazier, or Limited Brazier signs or by asking the restaurant operator); (3) food restaurants in Texas, which have their own authorized food system and nutrition information; (4) soft-serve products in some New Jersey stores that use a soft-serve differing significantly in nutritional content from the standard DQ soft-serve, including increased butterfat content; (5) some location-specific menu items. If you have questions about a menu item, please contact the store operator or manager. NUTRITION Allergen Statement: DQ locations contain allergens that may come into contact with your food. Since allergens are present in every DQ location and cross-contact can easily occur, we cannot guarantee any item to be allergen free or the accuracy of the data as it relates to prepared menu items at a location. -

Parents' Report of Fast-Food Purchases for Their Children

Rudd UCONNRUDDCENTER.ORG Report September 2018 Parents’ Reports of Fast-Food Purchases for Their Children: Have They Improved? AUTHORS: Summary Jennifer L. Harris, PhD, MBA Fast-food consumption is associated with poor diet quality in youth.1-3 Therefore, improving Maia Hyary, MPA the nutritional quality of fast-food meals consumed by children is an important public health Nicole Seymour, MSW objective. In response to public health concerns, several of the largest fast-food restaurants Yoon Young Choi, MS have introduced policies to offer healthier drinks and/or sides with their kids’ meals. However, few research studies have examined the menu items that parents purchase for their children at fast-food restaurants or their attitudes about healthier kids’ meal offerings. The primary purpose of this study was to document parents’ reported fast-food purchases for their children (ages 2-11) and examine changes over time. Online surveys were conducted in 2010 (n=771 parents), 2013 (n=835 parents), and 2016 (n=871). Parents also provided detailed information about purchases of lunch or dinner for their child in the past week at one of the four largest fast-food restaurants (McDonald’s, Burger King, Wendy’s, or Subway) including specific menu items purchased and why they chose that restaurant. In 2016 only, the survey also asked for detailed information about visits to KFC, Dairy Queen, and Panera Bread (in addition to the four restaurants examined in 2010 and 2013), and parents reported their attitudes about restaurants’ healthier kids’ meal policies. All parents then reported the frequency of their visits to 16 fast-food restaurants with their children for any occasion. -

Form 2462 SBA NEGOTIATED ADDEND

SBA SBA FRANCHISE FRANCHISE IS AN SBA IDENTIFIER IDENTIFIER MEETS FTC ADDENDUM SBA ADDENDUM - NEGOTIATED CODE Start CODE BRAND DEFINITION? NEEDED? Form 2462 ADDENDUM Date NOTES When the real estate where the franchise business is located will secure the SBA-guaranteed loan, the Collateral Assignment of Lease and Lease S3606 #The Cheat Meal Headquarters by Brothers Bruno Pizza Y Y Y N 10/23/2018 Addendum may not be executed. S2860 (ART) Art Recovery Technologies Y Y Y N 04/04/2018 S0001 1-800 Dryclean Y Y Y N 10/01/2017 S2022 1-800 Packouts Y Y Y N 10/01/2017 S0002 1-800 Water Damage Y Y Y N 10/01/2017 S0003 1-800-DRYCARPET Y Y Y N 10/01/2017 S0004 1-800-Flowers.com Y Y Y 10/01/2017 S0005 1-800-GOT-JUNK? Y Y Y 10/01/2017 Lender/CDC must ensure they secure the appropriate lien position on all S3493 1-800-JUNKPRO Y Y Y N 09/10/2018 collateral in accordance with SOP 50 10. S0006 1-800-PACK-RAT Y Y Y N 10/01/2017 S3651 1-800-PLUMBER Y Y Y N 11/06/2018 S0007 1-800-Radiator & A/C Y Y Y 10/01/2017 1.800.Vending Purchase Agreement N N 06/11/2019 S0008 10/MINUTE MANICURE/10 MINUTE MANICURE Y Y Y N 10/01/2017 1. When the real estate where the franchise business is located will secure the SBA-guaranteed loan, the Addendum to Lease may not be executed. -

Kids' Meal Menu Items

Kids' meal menu items Energy density Healthy beverages NPI Artifical Part of Serving Serving Total calories Energy density (% sugar by Total Saturated Trans Sugar Sodium Fiber Protein NPI score sweetenersa Restaurant Meal name kids' meal Individual item size (g) size (oz) (Kcal) (kcal/g) weight) fat (g) fat (g) fat (g) (g) (mg) (g) (g) Score McDonald's Happy Meal Main Dish Hamburger 100 - 250 2.5 - 9 3.5 0.5 6 520 2 12 50 McDonald's Happy Meal Main Dish Cheeseburger 114 - 300 2.6 - 12 6 0.5 6 750 2 15 40 Chicken McNuggets (4 piece) McDonald's Happy Meal Main Dish with hot mustard sauce 92 - 250 2.7 - 14.5 2 0 6 650 2 11 70 Chicken McNuggets (4 piece) McDonald's Happy Meal Main Dish with barbeque sauce 92 - 240 2.6 - 12 2 0 10 660 0 10 70 Apple dippers (without low fat ● McDonald's Happy Meal Side Dish caramel dip) 68 - 35 0.5 - 0 0 0 6 - 0 0 78 Apple dippers with low fat ● McDonald's Happy Meal Side Dish caramel dip 89 - 105 1.2 - 0.5 0 0 15 35 0 0 66 ● McDonald's Happy Meal Side Dish French fries- small 71 - 230 3.2 - 11 1.5 0 0 160 3 3 66 ● McDonald's Happy Meal Beverage 1% low fat milk jug 236 8 100 0.4 5% 2.5 1.5 0 12 125 0 8 72 ● McDonald's Happy Meal Beverage 1% low fat chocolate milk jug 236 8 170 0.7 11% 3 1.5 0 25 150 1 9 70 ● McDonald's Happy Meal Beverage Minute Maid apple juice box 200 6.8 100 0.5 11% 0 0 0 22 15 0 0 76 McDonald's Happy Meal Beverage Coca-Cola Classic 355 12 110 0.3 8% 0 0 0 29 5 0 0 68 ● McDonald's Happy Meal Beverage Diet Coke 355 12 0 0.0 0% 0 0 0 0 15 0 0 70 McDonald's Happy Meal Beverage Sprite 355 12 110