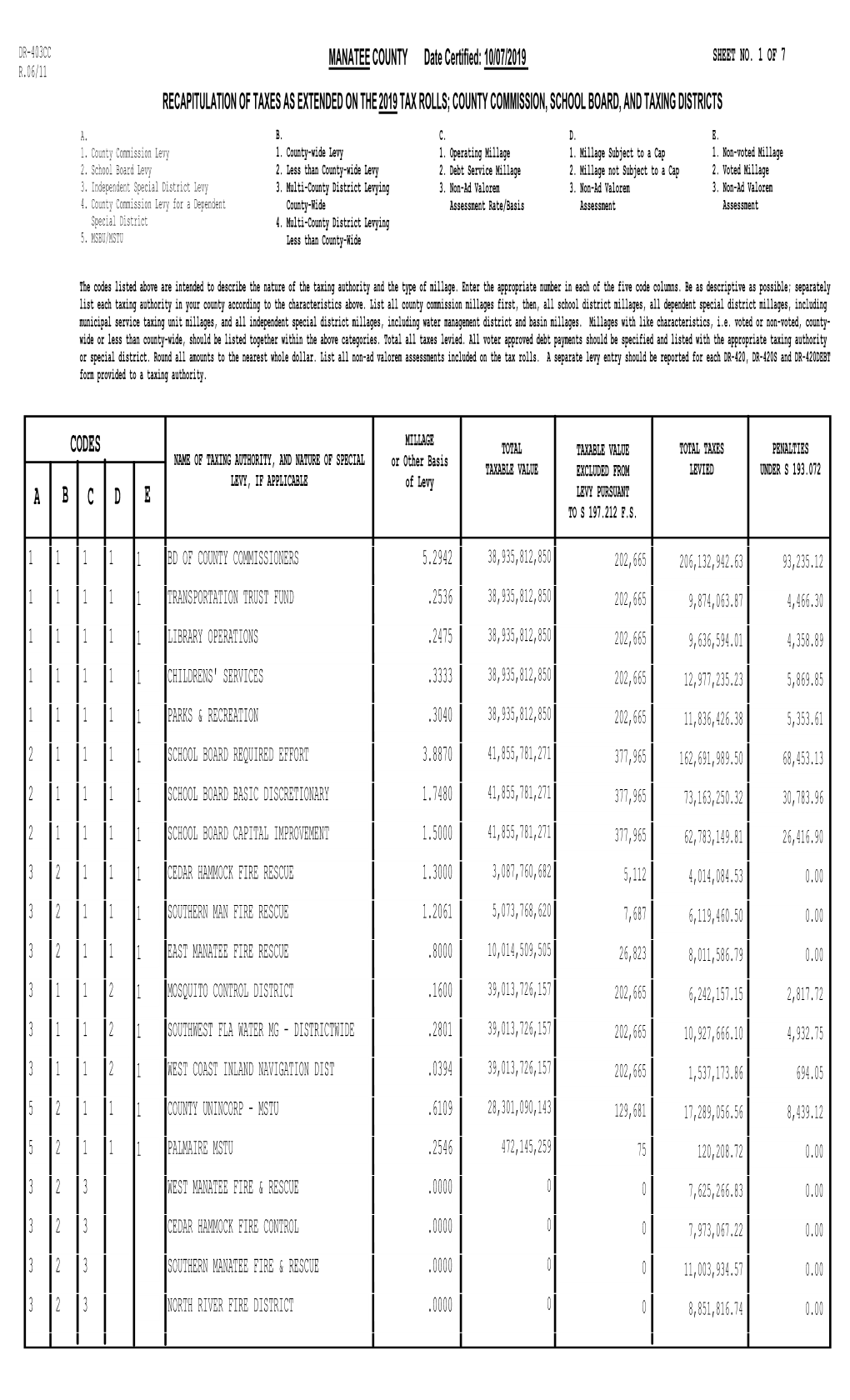

DR403CC – Total Taxes Levied

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Augustine on Manichaeism and Charisma

Religions 2012, 3, 808–816; doi:10.3390/rel3030808 OPEN ACCESS religions ISSN 2077-1444 www.mdpi.com/journal/religions Article Augustine on Manichaeism and Charisma Peter Iver Kaufman Jepson School, University of Richmond, Room 245, Jepson Hall, 28 Westhampton Way, Richmond, VA 23173, USA; E-Mail: [email protected] Received: 5 June 2012; in revised form: 28 July 2012 / Accepted: 1 August 2012 / Published: 3 September 2012 Abstract: Augustine was suspicious of charismatics‘ claims to superior righteousness, which supposedly authorized them to relay truths about creation and redemption. What follows finds the origins of that suspicion in his disenchantment with celebrities on whom Manichees relied, specialists whose impeccable behavior and intellectual virtuosity were taken as signs that they possessed insight into the meaning of Christianity‘s sacred texts. Augustine‘s struggles for self-identity and with his faith‘s intelligibility during the late 370s, 380s, and early 390s led him to prefer that his intermediaries between God and humanity be dead (martyred), rather than alive and charismatic. Keywords: arrogance; Augustine; charisma; esotericism; Faustus; Mani; Manichaeism; truth The Manichaean elite or elect adored publicity. Augustine wrote the first of his caustic treatises against them in 387, soon after he had been baptized in Milan and as he was planning passage back to Africa, where he was born, raised, and educated. Baptism marked his devotion to the emerging mainstream Christian orthodoxy and his disenchantment with the Manichees‘ increasingly marginalized Christian sect, in which, for nine or ten years, in North Africa and Italy, he listened to specialists—charismatic leaders and teachers. -

OPUS IMPERFECTUM AUGUSTINE and HIS READERS, 426-435 A.D. by MARK VESSEY on the Fifth Day Before the Kalends of September [In

OPUS IMPERFECTUM AUGUSTINE AND HIS READERS, 426-435 A.D. BY MARK VESSEY On the fifth day before the Kalends of September [in the thirteenth consulship of the emperor 'Theodosius II and the third of Valcntinian III], departed this life the bishop Aurelius Augustinus, most excellent in all things, who at the very end of his days, amid the assaults of besieging Vandals, was replying to I the books of Julian and persevcring glorioi.islyin the defence of Christian grace.' The heroic vision of Augustine's last days was destined to a long life. Projected soon after his death in the C,hronicleof Prosper of Aquitaine, reproduccd in the legendary biographies of the Middle Ages, it has shaped the ultimate or penultimate chapter of more than one modern narrative of the saint's career.' And no wonder. There is something very compelling about the picture of the aged bishop recumbent against the double onslaught of the heretical monster Julian and an advancing Vandal army, the ex- tremity of his plight and writerly perseverance enciphering once more the unfathomable mystery of grace and the disproportion of human and divine enterprises. In the chronicles of the earthly city, the record of an opus mag- num .sed imperfectum;in the numberless annals of eternity, thc perfection of God's work in and through his servant Augustine.... As it turned out, few observers at the time were able to abide by this providential explicit and Prosper, despite his zeal for combining chronicle ' Prosper, Epitomachronicon, a. 430 (ed. Mommsen, MGH, AA 9, 473). Joseph McCabe, .SaintAugustine and His Age(London 1902) 427: "Whilst the Vandals thundered at the walls Augustine was absorbed in his great refutation of the Pelagian bishop of Lclanum, Julian." Other popular biographers prefer the penitential vision of Possidius, hita Augustini31,1-2. -

Annual Permit Report for the C-4 Emergency Detention Basin

2013 South Florida Environmental Report Appendix 5-3 Appendix 5-3: Annual Permit Report for the C-4 Emergency Detention Basin Permit Report (May 1, 2011–April 30, 2012) Rick Householder Contributors: Shi Kui Xue, Matt Powers, Christopher King, and John Leslie SUMMARY Based on Florida Department of Environmental Protection (FDEP) permit reporting guidelines, Table 1 lists key permit-related information associated with this report. Table 2 lists attachments included with this report. Table A-1 in Attachment A lists the specific pages, tables, graphs, and attachments where project status and annual reporting requirements are addressed. This annual report satisfies the reporting requirements specified in the latest modified permit. Table 1. Key permit-related information. Project Name: C-4 Emergency Detention Basin Permit Numbers: EI 13-0192729-001 and EI 13-0192729-004 Issue and Expiration Dates: EI 13-0192729-001 Issued: 9/10/2002; Expires: 9/9/2007 EI 13-0192729-002 Issued: 2/14/2003 EI 13-0192729-003 Issued: 3/4/2003 EI 13-0192729-004 Issued: 9/26/2003; Expires: 9/25/2008 EI 13-0192729-008 Issued: 2/3/2005 EI 13-0192729-010 Issued: 7/2/2007 EI 13-0192729-011 Issued: 9/25/2008 EI 13-0192729-013 Issued: 2/20/2012 Project Phase: I & II Permit Condition Requiring 20 (in EI 13-0192729-013) Annual Monitoring Report: Relevant Period of Record: May 1, 2011 – April 30, 2012 Rick Householder Report Lead: [email protected] 561-682-6582 John Leslie Permit Coordinator: [email protected] 561-682-6476 App. 5-3-1 Appendix 5-3 Volume III: Annual Permit Reports Table 2. -

The Ruin of the Roman Empire

7888888888889 u o u o u o u THE o u Ruin o u OF THE o u Roman o u o u EMPIRE o u o u o u o u jamesj . o’donnell o u o u o u o u o u o u o hjjjjjjjjjjjk This is Ann’s book contents Preface iv Overture 1 part i s theoderic’s world 1. Rome in 500: Looking Backward 47 2. The World That Might Have Been 107 part ii s justinian’s world 3. Being Justinian 177 4. Opportunities Lost 229 5. Wars Worse Than Civil 247 part iii s gregory’s world 6. Learning to Live Again 303 7. Constantinople Deflated: The Debris of Empire 342 8. The Last Consul 364 Epilogue 385 List of Roman Emperors 395 Notes 397 Further Reading 409 Credits and Permissions 411 Index 413 About the Author Other Books by James J. O’ Donnell Credits Cover Copyright About the Publisher preface An American soldier posted in Anbar province during the twilight war over the remains of Saddam’s Mesopotamian kingdom might have been surprised to learn he was defending the westernmost frontiers of the an- cient Persian empire against raiders, smugglers, and worse coming from the eastern reaches of the ancient Roman empire. This painful recycling of history should make him—and us—want to know what unhealable wound, what recurrent pathology, what cause too deep for journalists and politicians to discern draws men and women to their deaths again and again in such a place. The history of Rome, as has often been true in the past, has much to teach us. -

(12) Patent Application Publication (10) Pub. No.: US 2015/0351457 A1 Liu (43) Pub

US 20150351457A1 (19) United States (12) Patent Application Publication (10) Pub. No.: US 2015/0351457 A1 Liu (43) Pub. Date: Dec. 10, 2015 (54) ELECTRONIC CIGARETTE AND METHOD Publication Classification FOR ADJUSTING FLOW RATE OF GAS FLOW OF ELECTRONIC CGARETTE (51) Int. Cl. A24F 47/00 (2006.01) (71) Applicants:Qiuming Liu, (US); KIMREE (52) U.S. Cl. HI-TECH INC., RoadTown Tortola CPC .................................... A24F 47/008 (2013.01) (VG) (57) ABSTRACT An electronic cigarette comprises a cigarette rod with a bat (72) Inventor: Qiuming Liu, Shenzhen (CN) tery, an atomizer configured to atomize tobacco oil contained therein, and an airflow path configured to enable the air to (21) Appl. No.: 14/759,369 flow into the atomizer. A pressure regulating valve unit arranged in the airflow path includes a floating sphere con (22) PCT Fled: Jan. 3, 2014 figured to close or open the airflow path according to an airflow direction and to adjust the airflow rate flowing into the (86) PCT NO.: PCT/CN2014/0701 12 airflow path. By means of arranging the pressure regulating S371 (c)(1), valve, it is able to control the airflow rate flowing into the (2) Date: Jul. 6, 2015 atomizer, hence adjust the amount of Smoke Sucked to change tastes of smoking and meet users different needs. Moreover, when blowing to the electronic cigarette, the pressure regu (30) Foreign Application Priority Data lating valve unit will be in a closed state to avoid tobacco oil Jan. 5, 2013 (CN) ................. PCT/CN2013/07.0053 inside the atomizer flowing to the battery and a control board. -

Fifth-Century Athenian History and Tragedy

CHAPTER ONE Fifth-Century Athenian History and Tragedy Paula Debnar Prologue: 431 BCE the final months of the fourteenth of Elaphebolion during on the day to Bcfore dawn visitors alike made their way residents of Athens and archonship of Pythodorus, celebration of the City Dionysia. stir surrounded the theater. The usual buzz and had previewed the the tragic poet Euphorion the official opening of the festival, would Bcfore long overdue for a victory, about the Titan Prometheus. Euripides, his plays the satyr-play Reapers. and followed by offer Philoctetes, Dictys, earlier (433 BCE) Medea, with the festival. Two years excitement had to do had Not all of the alliance, and in so doing the Corcyraeans into Athenians had accepted and a the Corcyra's mother-city power in a with Corinth, embroiled themselves quarrel The Athenians had hoped Peloponnesian Leaguc. alliance, the contact ful member of Sparta's could avoid direct themselves to a defensive agreement they the Corinthians sent that by limiting misfired. In retaliation but their had of Corinthian forces, plan theirs but members with Potidacans (colonists of to help the forces the following year and their own forces trapped secede. with Potidaca besieged Athens' alliance) Then, in the fall, a full synod to invade Attica. Early had lobbied the Spartans broken in the city, they Years' Peace had been had voted that the Thirty Peloponnesian League ofthe to war. of the should go certain. Members and that league her allies was not yet with and the vote, war Sparta Greek world knew, despite Despite and as the heralds, - continued to exchange because of it the alliances - both force or perhaps world's finest as the hoplite be avoided; their reputation fall soon, war might were to their to to war. -

Dynamo™ Qpcr Kits Are a Superior Choice Dynamo Probe Qpcr Kit Is Designed for ™ for Quantitative Real-Time Analysis

™ DyNAmo qPCR Kits Engineered for qPCR DyNAmo™ Probe qPCR Kit Finnzymes’ DyNAmo™ qPCR Kits are a superior choice DyNAmo Probe qPCR Kit is designed for ™ for quantitative real-time analysis. These kits offer excellent quantitative real-time PCR with probe DyNAmo Probe qPCR Kit performance in detection and quantifi cation of DNA and detection. The kit is compatible with RNA sequences from various sources. DyNAmo qPCR Kit sequence specifi c probes, e.g. TaqMan® family contains optimized kits for both SYBR® Green and probes. The performance of the DyNAmo probe chemistries with various platforms. All DyNAmo Probe qPCR Kit is based on a hot start qPCR Kits are provided as convenient 2x master mixes - Tbr DNA polymerase. DyNAmo Probe only template and primers need to be added. Rox passive qPCR Kit is compatible with both block- reference dye is included in the kits as a separate tube (not based and capillary-based instruments. included in capillary kits F-420S/L and F-440S/L or block kit F-400S/L). All Finnzymes’ DyNAmo qPCR Kits contain dUTP and therefore UNG (uracil-N-glycosylase) treatment can be used to minimize the effect of carry-over contamination. Use DyNAmo™ 2-Step qRT-PCR Kits the table below to select the right kit for your purposes. DyNAmo qPCR Kit family includes 2-Step qRT-PCR kits for SYBR Green and probe chemistries for both block-based and capillary-based instruments. The kits contain all necessary ™ ® reagents for cDNA synthesis from various RNA sources and DyNAmo SYBR Green qPCR Kits for subsequent qPCR. Both random primers and oligo(dT) DyNAmo SYBR Green qPCR Kits primers are included in the kits. -

Inventory Control Form Titanium Cannulated Humeral Nail-EX System

Inventory Control Form Titanium Cannulated Humeral Nail-EX System Patient Information: SYNTHES (USA) SYNTHES (Canada) Ltd. To Order: (800) 523-0322 To Order: (800) 668-1119 Date: Hospital: Surgeon: Procedure: Implants 7 mm Titanium Cannulated Proximal 11 mm Titanium Cannulated Humeral Humeral Nail-EX, Sterile Nail-EX, Sterile LENGTH LENGTH LENGTH 04.001.210S 150 mm 04.001.618S 190 mm 04.001.632S 260 mm 04.001.620S 200 mm 04.001.634S 270 mm 04.001.622S 210 mm 04.001.636S 280 mm 9 mm Titanium Cannulated Proximal 04.001.624S 220 mm 04.001.638S 290 mm Humeral Nail-EX, Sterile 04.001.626S 230 mm 04.001.640S 300 mm 04.001.628S 240 mm 04.001.642S 310 mm LENGTH 04.001.410S 150 mm 04.001.630S 250 mm 04.001.644S 320 mm Titanium End Cap with T25 StarDrive for 11 mm Titanium Cannulated Proximal Titanium Humeral Nail-EX Spiral Blade◊ Humeral Nail-EX, Sterile LENGTH 04.001.000 0 mm extension 04.001.610S 150 mm 04.001.001 5 mm extension 04.001.002 10 mm extension 04.001.003 15 mm extension 7 mm Titanium Cannulated Humeral Nail-EX, Sterile LENGTH LENGTH Titanium Spiral Blade for Titanium 04.001.218S 190 mm 04.001.232S 260 mm Humeral Nails◊ 04.001.220S 200 mm 04.001.234S 270 mm LENGTH LENGTH 04.001.222S 210 mm 04.001.236S 280 mm 462.634 34 mm 462.646 46 mm 04.001.224S 220 mm 04.001.238S 290 mm 462.636 36 mm 462.648 48 mm 04.001.226S 230 mm 04.001.240S 300 mm 462.638 38 mm 462.650 50 mm 04.001.228S 240 mm 04.001.242S 310 mm 462.640 40 mm 462.652 52 mm 04.001.230S 250 mm 04.001.244S 320 mm 462.642 42 mm 462.654 54 mm 462.644 44 mm 9 mm Titanium Cannulated Humeral Nail-EX, Sterile LENGTH LENGTH 04.001.418S 190 mm 04.001.432S 260 mm 04.001.420S 200 mm 04.001.434S 270 mm 04.001.422S 210 mm 04.001.436S 280 mm 04.001.424S 220 mm 04.001.438S 290 mm 04.001.426S 230 mm 04.001.440S 300 mm 04.001.428S 240 mm 04.001.442S 310 mm 04.001.430S 250 mm 04.001.444S 320 mm Synthes is a trademark of Synthes, Inc. -

GPSMAP 400 Series Owner’S Manual © 2007 Garmin Ltd

GPSMAP 400 series owner’s manual © 2007 Garmin Ltd. or its subsidiaries Garmin International, Inc. Garmin (Europe) Ltd. Garmin Corporation 1200 East 151st Street, Liberty House No. 68, Jangshu 2nd Road, Olathe, Kansas 66062, USA Hounsdown Business Park, Shijr, Taipei County, Taiwan Tel. (913) 397.8200 or (800) 800.1020 Southampton, Hampshire, SO40 9RB UK Tel. 886/2.2642.9199 Fax (913) 397.8282 Tel. +44 (0) 870.8501241 (outside the UK) Fax 886/2.2642.9099 0808 2380000 (within the UK) Fax +44 (0) 870.8501251 All rights reserved. Except as expressly provided herein, no part of this manual may be reproduced, copied, transmitted, disseminated, downloaded or stored in any storage medium, for any purpose without the express prior written consent of Garmin. Garmin hereby grants permission to download a single copy of this manual onto a hard drive or other electronic storage medium to be viewed and to print one copy of this manual or of any revision hereto, provided that such electronic or printed copy of this manual must contain the complete text of this copyright notice and provided further that any unauthorized commercial distribution of this manual or any revision hereto is strictly prohibited. Information in this document is subject to change without notice. Garmin reserves the right to change or improve its products and to make changes in the content without obligation to notify any person or organization of such changes or improvements. Visit the Garmin Web site (www.garmin.com) for current updates and supplemental information concerning the use and operation of this and other Garmin products. -

Backed by Chauvet Built with TRUSST®: CT290-430S (3M Truss Stick) CT290-410S (1M Truss Stick)

Backed by Chauvet Built with TRUSST®: CT290-430S (3m truss stick) CT290-410S (1m truss stick) Godskitchen Christmas Party at the HMV Institute - Birmingham, UK 2 EVERY TRUSST® STICK HAS A STORY Every stick has a story. Let’s build one together. TRUSST®gives you the tools to enhance events and live performance experiences with ease of setup, maximum flexibility, maximum safety and maximum impact. TRUSST®gives you the wings to imagine and create with sticks, arcs, corners, base plates, angles and accessories of varied dimensions and configurations to suit most design demands. TRUSST®gives you peace of mind with tested products made from sturdy 6082-T6 alloy aluminum by certified SLV welders. All TRUSST® sticks are inspected and certified to meet stringent TÜV safety standards; they work seamlessly with other truss brands that utilize the same standard conical connectors. Every TRUSST® stick has at least one story. We can’t wait to hear yours. Connect with us and share. Backed by Chauvet 3 STICKS 1 3m (9.84ft) CT290-430S 2 2.5m (8.20ft) CT290-425S 3 2m (6.56ft) 1 2 3 4 5 CT290-420S 4 1.5m (4.92ft) CT290-415S 5 1m (3.28ft) CT290-410S 6 .5m (1.64ft) CT290-405S 7 .25m (0.82ft) 6 7 8 9 10 CT290-402S ARCS 3m (9.84ft) 90˚Arc 8 CT290-430CIR-90 2m (6.56ft) 90˚Arc 9 CT290-420CIR-90 10 1.5m (4.92ft) 180˚Arc 11 12 13 14 15 CT290-415CIR-180 CORNERS 11 6-Way Corner Block CT290-6WAYC 12 2-Way 90° Corner CT290-490C 16 17 13 3-Way “T” Junction CT290-43TC TRUSST® CT-290 series easily mates with 14 3-Way 90° Corner CT290-4390C other major brands of truss of the same size and conical connection. -

Certification of School Taxable Value R

Reset Form Print Form DR-420S CERTIFICATION OF SCHOOL TAXABLE VALUE R. 5/13 Rule 12D-16.002, FAC Effective 5/13 Provisional Year : 2016 County : COLLIER Name of School District : COLLIER COUNTY SCHOOL DIST SECTION I : COMPLETED BY PROPERTY APPRAISER. SEND TO SCHOOL DISTRICT 1. Current year taxable value of real property for operating purposes $ 80,746,163,457 (1) 2. Current year taxable value of personal property for operating purposes $ 1,792,820,087 (2) 3. Current year taxable value of centrally assessed property for operating purposes $ 122,550 (3) 4. Current year gross taxable value for operating purposes (Line 1 plus Line 2 plus Line 3) $ 82,539,106,094 (4) Current year net new taxable value (Add new construction, additions, rehabilitative improvements increasing assessed value by at least 100%, annexations, and tangible 5. $ (5) personal property value over 115% of the previous year's value. Subtract deletions.) 2,144,881,545 6. Current year adjusted taxable value (Line 4 minus Line 5) $ 80,394,224,549 (6) 7. Prior year FINAL gross taxable value from prior year applicable Form DR-403 Series $ 74,452,720,954 (7) Does the taxing authority levy a voted debt service millage or a millage voted for 2 years 8. or less under s. 9(b), Article VII, State Constitution? Yes ✔ No (8) (If yes, complete and attach form DR-420DEBT, Certification of Voted Debt Millage.) Property Appraiser Certification I certify the taxable values above are correct to the best of my knowledge. SIGN Signature of Property Appraiser : Date : HERE Electronically Certified by Property Appraiser 6/28/2016 10:00 AM SECTION II : COMPLETED BY SCHOOL DISTRICTS. -

ARCHITECTURAL HARDWARE Door Pulls • Stops • Push Bars • Flush Bolts • Door Edgings

ARCHITECTURAL HARDWARE Door Pulls • Stops • Push Bars • Flush Bolts • Door Edgings CAPABILITIES FOR OVER 45 YEARS, Burns has been manufacturing door hardware and providing customers with a wide variety of high-quality architectural door trim. Decades of manufacturing experience have allowed us to develop the techniques and skills required to produce aesthetically appealing and functional solutions to customer challenges. Our main focus is to continually improve our designs and efficiency so we are able to offer you outstanding product quality and value for many years to come. CUSTOM CAPABILITIES - We take great pride in manufacturing custom products created for architects, contractors and building owners throughout the world. Our design team can customize many of our cataloged products and existing designs or create an entirely new design based on your specifications. Custom products are produced with an emphasis on quality, precision and elegant appeal. Visit our website at www.burnsmfg.com for additional information. 1 S T TABLE OF CONTENts EN Page 3 Methods of Fastening Information T Page 4 Finish Codes Section A: Pulls/Push Plates/Pull Plates Page A1-A8 Door Pulls Page A9 Flush Pulls Page A10-A11 Push Plates Page A12 Decorative Push Plates, Combination Push/Pulls and Cylinder Pulls Page A13-A16 Pull Plates TABLE OF CON OF TABLE Section B: Door Edgings/Corner Guards/Door Plates Page B1 Door Edgings Page B2-B3 Door Edge Templates Page B4 Corner Guards Page B5 Kick Plates, Mop Plates and Armor Plates Section C: Push Bars/Push and Pull