Econ 302–Summer 2016 Rogayeh Tabrizi Econ 302: Microeconomics II

Total Page:16

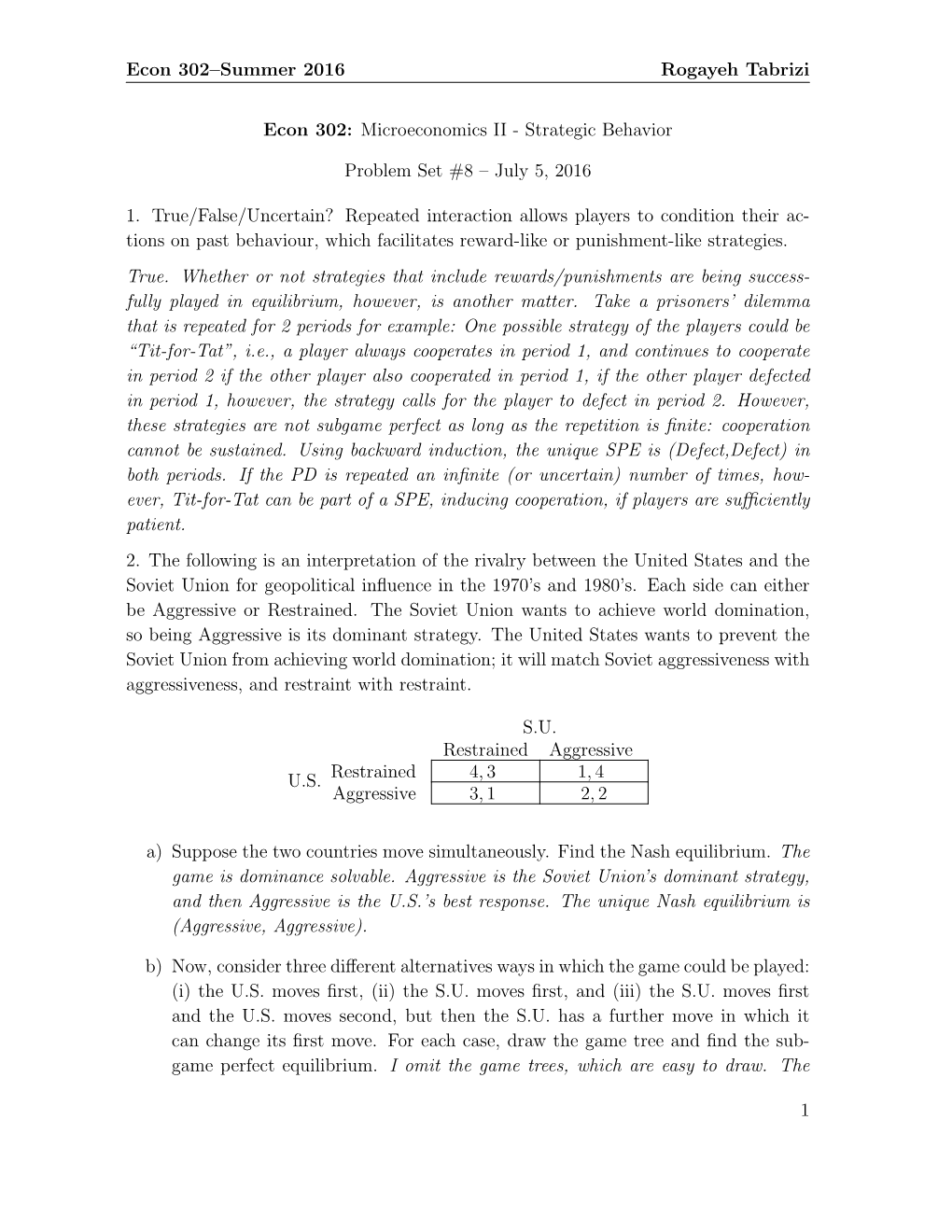

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A Process Algebraic Form to Represent Extensive Games 1

A Process Algebraic Form to Represent Extensive Games Department of Mathematical Sciences, Sharif University of Technology, P. O. Box 11365-9415, Tehran, Iran Complex and Multi Agent System Lab Omid Gheibi∗, Rasoul Ramezaniany (alphabetical order) Abstract We present an agent-based display of extensive games inspired by concepts in process theory and process algebra. In games with lots of agents, it is a good strategy to explain the behavior of each agent individually by an adequate process (called process- game), and then obtain the whole of the game through parallel composition of these process-games. We propose a method based on agent-based display (introduced in this paper) to find the Nash equilibrium of extensive games in linear space complexity by deploying a revision of depth first search. Keywords: Extensive games, Nash equilibrium, process theory, process algebra 1 Introduction The word processes refers to behavior of a system (a game, a protocol, a machine, a software, and so on). The behavior of a system is the total of actions performed in the system and the order of their executions. The process theory [8] makes it possible to model the behavior of a system with enormous complexity through modeling the behavior of its components. Then using the process algebra [3] [9] [5] [7] [1] [15], we can code the process theory terms and definitions and take the advantage of the algebra such as automating calculations and running algorithms using parallel computing techniques. The process algebra has vast variety of applications in diverse fields such as performance evaluation [6], safety critical systems [13], network protocols [2] and biology [14]. -

Game Theory - Solution Set

1 Faculty of Mathematics Centre for Education in Waterloo, Ontario N2L 3G1 Mathematics and Computing Grade 6 Math Circles Fall 2014 - October 28/29, 2014 Game Theory - Solution Set 1. Provide your own definition of Game Theory. Answers may vary. Game theory is the study of two or more people making decisions in a common situation to get the best outcome for themselves, an outcome that is affected by each person's decision. 2. Explain why the Nash Equilibrium is the best decision for both suspects in the \Prisoner's Dilemma". Answers may vary. The Nash Equilibrium is the best decision for both suspects in the \Pris- oner's Dilemma", because neither suspect could become better off, and leave the other person worse off, by individually changing their decision. 3. The game is defined as follows: • Two hunters go out to catch meat. • There are two rabbits in the range and one stag. The hunters can each bring the equip- ment necessary to catch one type of animal. • The stag has more meat than the rabbits combined, but both hunters must chase the stag to catch it. • Rabbit hunters can catch all of their prey by themselves. • The values in the table represent the amount of meat (in pounds) the hunters will get for each given outcome. 2 Hunter 2 Stag Rabbit Hunter 1 Stag 3,3 0,2 Rabbit 2,0 1,1 Using the Nash Equilibrium of this game, what is the best decision the hunters can make? If there is more than one best decision, explain the pros and cons of each. -

Games Due: Tuesday, October 30, at Beginning of Class Reading: Course Notes, Sections 4.1 and 4.2

University of Illinois Fall 2018 ECE 586BH: Problem Set 4: Problems and Solutions Extensive form (aka sequential) games Due: Tuesday, October 30, at beginning of class Reading: Course notes, Sections 4.1 and 4.2 1. [Variations of pirate game] Five pirates, A, B, C, D, E, in a boat at sea must decide how to allocate 100 gold coins among themselves. The pirates are lettered in order of seniority, with A being the most senior. The pirate protocol is that the most senior pirate proposes an allocation of coins to all pirates, with a nonnegative integer number of coins going to each pirate. Then all pirates, including the proposer, vote on the proposal. If a majority (meaning strictly more than half the number voting) approve the proposal, then the proposal is implemented and the game ends. Otherwise, the proposer is thrown overboard and votes no more, and the remaining pirates use the same protocol again, with the most senior remaining pirate being the next proposer, and so on. Pirates base decisions on four factors. First, each pirate prefers to not be thrown overboard, even if the pirate receives no coins. Second, given a pirate is not thrown overboard, the pirate prefers to have more coins. Third, if in any round the pirate would do as well to vote either way, the pirate will vote no in order to increase the chance the proposer is thrown overboard. Finally, pirates follow the protocol, but otherwise don't trust each other and so can't enter into binding side agreements with each other. -

Quorum Analysis for the “Pirate Game” Problem⋆

Quorum Analysis for the \Pirate Game" Problem? Ilya Chernov1 and Evgeny Ivashko1;2 1 Institute of Applied Mathematical Research, Karelian Research Center of the Russian Academy of Sciences, Petrozavodsk, Russia 2 Petrozavodsk State University fchernov,[email protected] http://mathem.krc.karelia.ru/ Abstract. The \Pirate game" is a popular mathematical puzzle, the problem aimed at demonstration of backward induction. It is also a shin- ing example of non-cooperative behaviour of rational agents in mathe- matical game theory. A linearly ordered crew votes for the captain's sharing offer. The captain needs the approval by a given fraction of the crew called quorum at the minimal cost. In this paper, we present the comprehensive quorum analysis on strategies and payoffs for the \Pirate game" problem, for any crew size and any quorum. Keywords: Pirate Game · Puzzle for Pirates · Quorum Analysis · Non- Cooperative Game Theory 1 Introduction and Related Work The \Pirate game" (also known as the \Puzzle for pirates") is a well-known widely-used mathematical puzzle, which often stirs up disputes3. The first ap- pearing of the problem in scientific literature seems to be in the book by E. Mou- lin [6] as an example; we found no earlier publications of this problem. The \Pirate game" is the following4: There are five rational pirates (in strict order of seniority A, B, C, D and E) who found 100 gold coins. They must decide how to distribute them. The pirate world's rules of distribution say that the most senior pirate first proposes a plan of distribution. The pirates, including the proposer, then vote on whether to accept this distribution. -

Designing a Virtual Reality Game for the Pediatric Patient-Player Experience

Navigating the Pixelated Waters of Voxel Bay: Designing a Virtual Reality Game for the Pediatric Patient-Player Experience Thesis Presented in Partial Fulfillment of the Requirements for the Degree Master of Fine Arts in the Graduate School of The Ohio State University By Alice Grishchenko Graduate Program in Design Ohio State University 2017 Thesis Committee: Alan Price Maria Palazzi Jeremy Patterson Copyright by Alice Grishchenko ©2017 All Rights Reserved Abstract Voxel Bay is a virtual reality game created in collaboration with Nationwide Children’s Hospital to distract pediatric hemophilia patients from the anxiety related to the prophylaxis infusion procedure they must undergo regularly. This paper documents answers to the question when designing a game to serve as a pain management distraction technique for pediatric patients, what factors should be considered for the overall experience of the patient-player, clinicians and caregivers, and what may be unique or different from conventional approaches to game development? The answers to the research question are presented in context to the development of Voxel Bay. They are a list of factors to be considered and a documentation of my contribution to the project. The game design concepts discussed include spatial level design for virtual reality and ways to world build without cut scenes. This paper also mentions the hardware configuration used to create an entertaining hands-free system without sacrificing the integrity of the player’s medical experience. After an exploration of these concepts, the paper describes the novel processes used to realize them. The design choices and process documentation are supported by a review of research precedents regarding virtual reality as a distraction tool for medical settings as well as games designed to be used with breathing peripherals, games that use a networked system with different user roles and games that directly inspired the design of Voxel Bay. -

1. Characteristics of an Oligopoly, Which Can Be Demonstrated by Game Theory, Include Which of the Following? I

1. Characteristics of an oligopoly, which can be demonstrated by game theory, include which of the following? I. Collusion can increase oligopolists’ profits. II. Oligopolistic firms are interdependent. III. Few barriers to entry exist. a. I only b. II only c. III only d. I and II only e. I, II, and III 2. Which of the following is true of a cartel? a. Customers substitute away from the good when the price increases. b. Individual cartel members are tempted to cheat on the agreement. c. Although the total gain to cartel members is positive, all members lose when everyone sticks to the agreement. d. Some firms will reduce output in an effort to lower costs of production. e. Oligopolistic behavior is generally predictable as production occurs where MC=MR. Questions 3 and 4 refer to Royal’s Fast Food this payoff matrix: High price Low price High price 120, 85 150, 120 Brewer’s Fast Food Low price 65, 100 50, 80 3. Based on the payoff matrix above, which of the following statements is true? a. Brewer’s has a dominant strategy to choose high prices. b. Brewer’s has a dominant strategy to choose low prices. c. Royal’s has a dominant strategy to choose high prices. d. Royal’s has a dominant strategy to choose low prices. e. Neither restaurant has a dominant strategy. 4. What is the Nash equilibrium in the game above? a. Both fast food restaurants choose high prices. b. Both fast food restaurants choose low prices. c. Brewer’s chooses high and Royal’s chooses low. -

Communication of Statistical Uncertainty to Non-Expert Audiences

Communication of Statistical Uncertainty to Non-expert Audiences A thesis submitted for the degree of Master of Philosophy (Mathematics) by Jessie Roberts B.Sc. Biotechnology Innovation, Queensland University of Technology School of Mathematical Sciences Science and Engineering Faculty Queensland University of Technology Australia 2019 Contents Acknowledgementsv Declaration vii Abstract ix 1 Introduction1 1.1 Aims and objectives ................................. 6 1.2 The Australian Cancer Atlas ............................. 7 1.3 Research contributions ............................... 8 1.4 Thesis structure ................................... 8 2 Literature Review 11 2.1 Uncertainty ..................................... 12 2.2 Why is Uncertainty Information important to decision-makers? .......... 21 2.3 Communicating Statistical Uncertainty ....................... 24 2.4 Uncertainty communication ............................ 32 2.5 Uncertainty Communication design ........................ 34 2.6 Spatial epidemiology and disease mapping .................... 37 3 Research Activity 1.A: Grey literature review of internet published cancer maps. 43 3.1 Introduction ..................................... 43 3.2 Aim and Research Question ............................. 44 3.3 Methods ....................................... 45 3.4 Summary findings .................................. 46 3.5 Implications for the Australian Cancer Atlas .................... 53 3.6 Conclusion ...................................... 55 ii CONTENTS 4 Research Activity 1.B: -

The Impact of Art Style on Video Games

University of Central Florida STARS Honors Undergraduate Theses UCF Theses and Dissertations 2021 The Impact of Art Style on Video Games Eric Sarver University of Central Florida Part of the Game Design Commons Find similar works at: https://stars.library.ucf.edu/honorstheses University of Central Florida Libraries http://library.ucf.edu This Open Access is brought to you for free and open access by the UCF Theses and Dissertations at STARS. It has been accepted for inclusion in Honors Undergraduate Theses by an authorized administrator of STARS. For more information, please contact [email protected]. Recommended Citation Sarver, Eric, "The Impact of Art Style on Video Games" (2021). Honors Undergraduate Theses. 875. https://stars.library.ucf.edu/honorstheses/875 THE IMPACT OF ART STYLE ON VIDEO GAMES by ERIC CHRISTIAN SARVER A thesis submitted in partial fulfillment of the requirements for the Honors in the Major Program in Games and Interactive Media in the College of the Sciences and in the Burnett Honors College at the University of Central Florida Orlando, Florida Spring Term 2021 ABSTRACT The focus of this thesis is to explore the impact of art styles on video-games. This was done so that I could contribute something more to the digital media industry regarding this topic, and show people unique data sets that may help guide them in the right direction if they are looking for answers to questions they may have about art styles and their impact on the success of games. This was done through a study that was conducted via an online survey, where results were taken from student participants over the age of 18 in the GAIM program at UCF. -

The Effects of Piracy and Counterfeiting in the Video Games Industry

Department of Business and Management MSc in Management Course of Digital Innovation The Effects of Piracy and Counterfeiting in the Video Games Industry SUPERVISOR CANDIDATE Prof Paolo Spagnoletti Alessandro Piacentini 665731 CO-SUPERVISOR Prof Maria Isabella Leone Academic Year 2017/2018 Contents Introduction ............................................................................................................................................... 4 CHAPTER I Video Games Industry Overview ....................................................................................... 5 Brief History of the Video Games Industry .......................................................................................... 5 Present years and future trends .............................................................................................................. 7 CHAPTER II Academic Review ............................................................................................................ 15 Piracy, Copyright and Digital Rights Management (DRM) ................................................................ 15 Copyright ......................................................................................................................................... 15 Legal or business strategy solutions ................................................................................................ 21 Internet distribution and the P2P system ......................................................................................... 23 Information -

Philosophy of Economics

Philosophy of Economics Jurgen¨ Landes juergen [email protected] jlandes.wordpress.com Room 129 Winter Term 2017 Summary We all are economic actors and exchange goods or services for money on a daily basis. In this course we will look at basic philosophical questions relating to economics. We shall be interested in - among other topics - rational actions and rational actor models, human well-being and game theory. Assessment REGISTRATION FOR EXAMS AND TERM PAPERS IN THE CURRENT WIN- TER TERM: Please, register for this course via the LSF system by FEBRUARY 9, 2018. Assessment: 50% presentation, 50% essay. Topic of presentation and essay are chosen by the student. It makes sense to present and write on the same topic. Presentations are mainly assessed with respect to the communication of ideas / concepts / arguments. Please format as .pdf-files. Deadline for essay submission: Friday, 16. Mar. 2018. No references = No marks = FAIL. Essays should be around 10 pages (20,000 characters), clearly structured, contain a well-argued for original philosophical claim, and refer to relevant literature. 1 When sending the essay please also provide instructions how your grades are recorded (email to a coordinator, paper certificate, online system, etc.). An essay is submitted, AFTER I confirm the receipt via email. After I confirm the submission, it will still take me some time before I read and graded your work. 2 Week by Week Week 1: Introduction Suggested Readings: Any introduction on the philosophy of economics, e.g., [Reiss, 2013, Chapters 1 & 8]. Week 2: Decision Making a` la Savage – Rational Actions Suggested Readings: Savage[1972], SEP on Decision Theory, Section 1 of SEP on Descriptive Decision Theory, http://www.econ2.jhu.edu/people/Karni/savageseu.pdf. -

Quantum Pirates

Quantum Pirates A Quantum Game-Theory Approach to The Pirate Game Daniela Fontes Instituto Superior T´ecnico [email protected] Abstract. In which we develop a quantum model for the voting system in the mathematical puzzle created by Omohundro and Stewart - \A puzzle for pirates ", also known as Pirate Game. This game is a multi-player version of the game \Ultimatum ", where the players (Pirates), must distribute fixed number of gold coins according to some rules. The classic game has a pure strategy Nash Equilibrium, however the game is maximally entangled, we could not find a pure strategy Nash Equilibrium. These results corroborate other quantum game theory models. Keywords: Quantum Game Theory; Pirate Game; Quantum Mechanics; Quantum Computing; Game Theory; Probability Theory 1 Introduction The rationale behind building a quantum version of a Game Theory and/or Statistics problem lays in bringing phenomena like quantum superposition, and entanglement into known frameworks. Converting known classical problems into quantum games is relevant to the familiarize with the potential differences these models bring. Also modelling games with quantum mechanics rules may also aid the development of new algorithms that would be ideally deployed using quantum computers [1]. From the point of view of Quantum Cognition (a domain that seeks to introduce Quantum Mechanics Concepts in the field of Cognitive Sciences), these games are approached from the perspective of trying to model the mental state of the players in a quantum manner. The Prisoner's Dilemma is an example of a problem that has been modelled in order to explain discrepancies from the theoretical results of the classical Game Theory approach and the way humans play the game [2]. -

Game Architecture and Design: a New Edition

00 3634_FM_Intro 9/30/03 10:14 AM Page i Game Architecture and Design: A New Edition Contents at a Glance I Game Design III Game Architecture 1 First Concept 3 16 Current Development Methods 433 2 Core Design 35 17 Initial Design 457 3 Gameplay 59 18 Use of Technology 511 4 Detailed Design 87 19 Building Blocks 553 5 Game Balance 105 20 Initial Architecture Design 607 6 Look and Feel 141 21 Development 637 7 Wrapping Up 171 22 The Run-Up to Release 687 8 The Future of Game Design 197 23 Postmortem 719 24 The Future of Game Development 747 II Team Building and Management 9 Current Methods of Team Management 227 IV Appendixes 10 Roles and Divisions 245 A Sample Game Design Documents 785 11 The Software Factory 263 B Bibliography and References 887 12 Milestones and Deadlines 293 Glossary 893 13 Procedures and “Process” 327 Index 897 14 Troubleshooting 367 15 The Future of the Industry 409 00 3634_FM_Intro 9/30/03 10:14 AM Page ii 00 3634_FM_Intro 9/30/03 10:14 AM Page iii Game Architecture and Design: A New Edition Andrew Rollings Dave Morris 800 East 96th Street, 3rd Floor, Indianapolis, Indiana 46240 An Imprint of Pearson Education Boston • Indianapolis • London • Munich • New York • San Francisco 00 3634_FM_Intro 9/30/03 10:14 AM Page iv Game Architecture and Design: A New Edition Publisher Stephanie Wall Copyright © 2004 by New Riders Publishing Production Manager All rights reserved. No part of this book shall be reproduced, Gina Kanouse stored in a retrieval system, or transmitted by any means— electronic, mechanical, photocopying, recording, or otherwise— Senior Project Editor without written permission from the publisher, except for the Kristy Hart inclusion of brief quotations in a review.