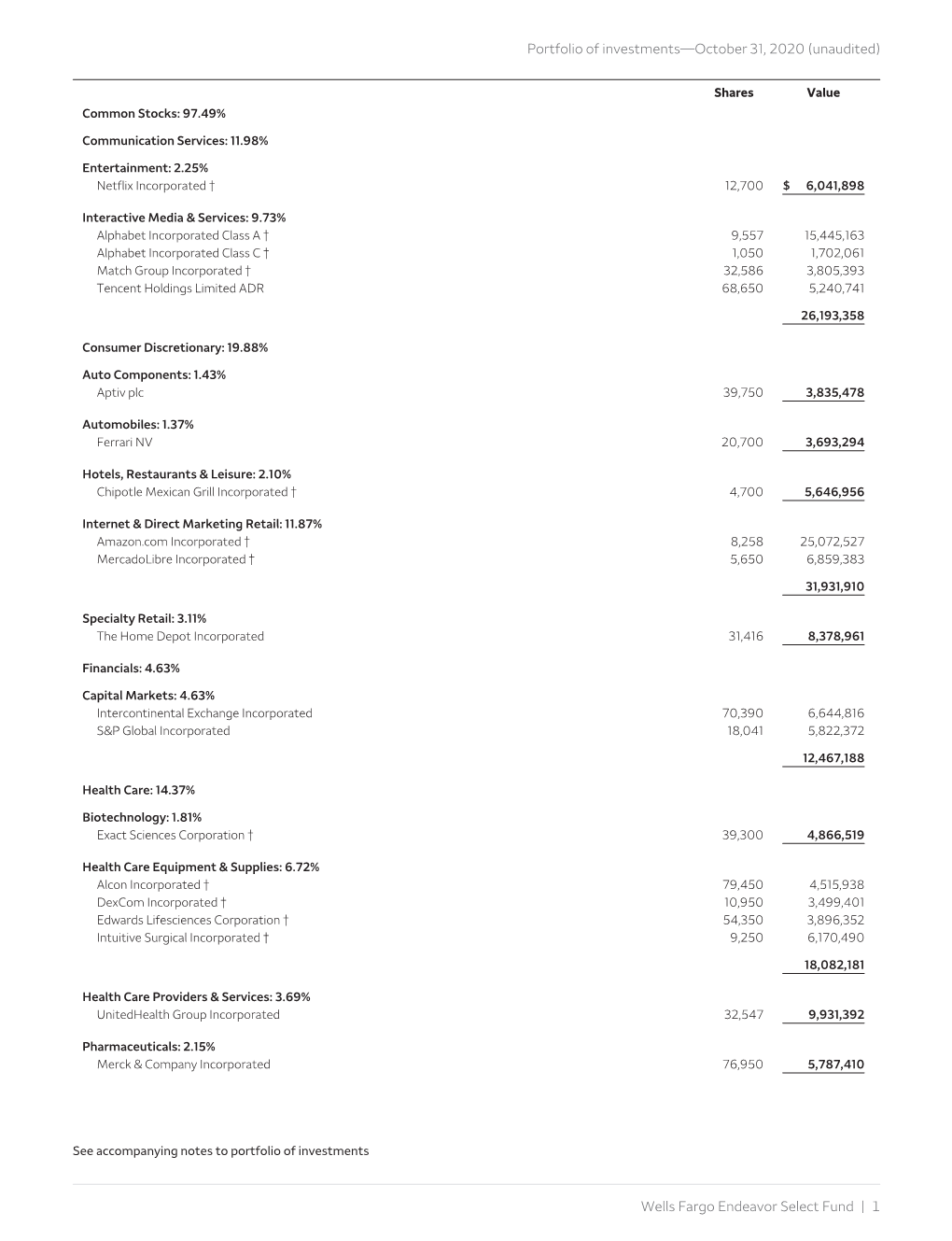

Wells Fargo Endeavor Select Fund | 1

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Becoming Legendary: Slate Financing and Hollywood Studio Partnership in Contemporary Filmmaking

Kimberly Owczarski Becoming Legendary: Slate Financing and Hollywood Studio Partnership in Contemporary Filmmaking In June 2005, Warner Bros. Pictures announced Are Marshall (2006), and Trick ‘r’ Treat (2006)2— a multi-film co-financing and co-production not a single one grossed more than $75 million agreement with Legendary Pictures, a new total worldwide at the box office. In 2007, though, company backed by $500 million in private 300 was a surprise hit at the box office and secured equity funding from corporate investors including Legendary’s footing in Hollywood (see Table 1 divisions of Bank of America and AIG.1 Slate for a breakdown of Legendary’s performance at financing, which involves an investment in a the box office). Since then, Legendary has been a specified number of studio films ranging from a partner on several high-profile Warner Bros. films mere handful to dozens of pictures, was hardly a including The Dark Knight, Inception, Watchmen, new phenomenon in Hollywood as several studios Clash of the Titans, and The Hangoverand its sequel. had these types of deals in place by 2005. But In an interview with the Wall Street Journal, the sheer size of the Legendary deal—twenty five Legendary founder Thomas Tull likened his films—was certainly ambitious for a nascent firm. company’s involvement in film production to The first film released as part of this deal wasBatman an entrepreneurial endeavor, stating: “We treat Begins (2005), a rebooting of Warner Bros.’ film each film like a start-up.”3 Tull’s equation of franchise. Although Batman Begins had a strong filmmaking with Wall Street investment is performance at the box office ($205 million in particularly apt, as each film poses the potential domestic theaters and $167 million in international for a great windfall or loss just as investing in a theaters), it was not until two years later that the new business enterprise does for stockholders. -

Motion Picture License List of MPL Participating Theatrical Distributors & Producers

Motion Picture License List of MPL Participating Theatrical Distributors & Producers MAJOR HOLLYWOOD STUDIOS & AFFILIATED LABELS 20th Century Studios Paramount Pictures (f/k/a Twentieth Century Fox Film Corp.) Paramount Vantage Buena Vista Pictures Picturehouse Cannon Pictures Pixar Animation Studios Columbia Pictures Polygram Filmed Entertainment Dreamworks Animation SKG Republic Pictures Dreamworks Pictures RKO Pictures (Releases 2011 to present) Screen Gems PLEASE CHOOSE Dreamworks Pictures CATEGORY: (Releases prior to 2011) Searchlight Pictures (f/ka/a Fox Searchlight Pictures) Fine Line Features Sony Pictures Entertainment Focus Features Major Hollywood Studios STX Entertainment & Affiliated Labels Fox - Walden Touchstone Pictures Fox 2000 Films TV Tristar Pictures Fox Look Triumph Films Independent Hanna-Barbera United Artists Pictures Hollywood Pictures Faith-Based Universal Pictures Lionsgate Entertainment USA Films Lorimar Telepictures Children’s Walt Disney Pictures Metro-Goldwyn-Mayer (MGM) Studios Warner Bros. Pictures Spanish Language New Line Cinema Warner Bros. Television Nickelodeon Movies Foreign & International Warner Horizon Television Orion Pictures Warner Independent Pictures Paramount Classics TV 41 Entertaiment LLC Ditial Lifestyle Studios A&E Networks Productions DIY Netowrk Productions Abso Lutely Productions East West Documentaries Ltd Agatha Christie Productions Elle Driver Al Dakheel Inc Emporium Productions Alcon Television Endor Productions All-In-Production Gmbh Fabrik Entertainment Ambi Exclusive Acquisitions -

Ways Accompanies Our Review of Official Court Granted Certiorari

2764 125 SUPREME COURT REPORTER 545 U.S. 912 first and second displays to the third. Giv- Court of Appeals for the Ninth Circuit, 380 en the presumption of regularity that al- F.3d 1154, affirmed, and the Supreme ways accompanies our review of official Court granted certiorari. action, see n. 9, supra, the Court has iden- Holding: The Supreme Court, Justice tified no evidence of a purpose to advance Souter, held that one who distributes a religion in a way that is inconsistent with device with the object of promoting its use our cases. The Court may well be correct to infringe copyright, as shown by clear in identifying the third displays as the fruit expression or other affirmative steps taken of a desire to display the Ten Command- to foster infringement, is liable for the ments, ante, at 2740, but neither our cases resulting acts of infringement by third par- nor our history support its assertion that ties. such a desire renders the fruit poisonous. Vacated and remanded. * * * Justice Ginsburg filed concurring opinion For the foregoing reasons, I would re- in which Chief Justice Rehnquist and Jus- verse the judgment of the Court of Ap- tice Kennedy joined. peals. Justice Breyer filed concurring opinion in which Justice Stevens and Justice O’Con- , nor joined. 1. Copyrights and Intellectual Property O77 One infringes a copyright contribu- 545 U.S. 913, 162 L.Ed.2d 781 torily by intentionally inducing or encour- METRO–GOLDWYN–MAYER aging direct infringement and infringes STUDIOS INC., et al., vicariously by profiting from direct in- Petitioners, fringement while declining to exercise a v. -

News Release

NEWS RELEASE Telestream Vantage Enables Automated and Lower Cost IMF Packaging Workflows Vantage IMF Producer enables automated IMF workflows plus support for IMSC-1 Subtitles Nevada City, California, February 24, 2020 – Telestream®, a leading provider of workflow automation, media processing, quality monitoring and test and measurement solutions for the production and distribution of video, today announced Vantage IMF Producer, a Vantage option that automates the creation of IMF (Interoperable Master Format) packages from Adobe® Premiere® Pro CC. IMF packages are the preferred method to deliver show masters to companies like Netflix, 20th Century Studios, Disney and many others. Through the use of automated processing, editing staff can focus on the creative functions of storytelling and pacing without worrying about the complexities of the IMF delivery format. IMF is a SMPTE standard for providing a single, interchangeable master file format and structure for the distribution of content between businesses around the world. IMF provides a framework for creating a true file-based final master. Part of the Vantage Media Processing Platform, IMF Producer automates the creation of all files required in an IMF package from a single output render of an Adobe Premiere Pro timeline. In addition to generating the primary package, editors can create additional sequences, which become supplemental IMF packages that contain different versions of audio, subtitles, edit points, Dolby Vision HDR metadata and more. “The ability to manage IMF workflows in an application like Adobe Premiere Pro is an economical and highly powerful way of managing IMF supplemental package requirements,” says Scott Matics, Director of Product Planning at Telestream. -

Endeavor Pulls the Plug on Its IPO in the Eleventh Hour

cc Thursday, September 26, 2019 latimes.com/news Endeavor pulls the plug on its IPO in the eleventh hour By RYAN FAUGHNDER, STACY PERMAN TIMES STAFF WRITERS Endeavor Group Holdings Inc., the owner of talent agency WME- IMG and mixed martial arts league UFC, has canceled plans for its highly anticipated initial public offering, reversing course the day before its stock was ex- pected to begin trading on Wall Street, the company said Thurs- day, citing hazardous “market conditions.” The dramatic retreat came as Endeavor, run by Chief Executive Ari Emanuel of WME-IMG, left, with sportscaster Jim Gray, and Tony and Margaret McGregor, parents of UFC fighter Conor McGregor, in Ari Emanuel, appeared to rethink 2017. (Ethan Miller / Getty Images) its plans amid concerns that inves- tors were cool on the stock and “Endeavor will continue to million by selling about 19.4 mil- given the weakening of the broad- evaluate the timing for the pro- lion shares for $30 to $32 a share. er IPO market. This month, office posed offering as market condi- Endeavor, backed by private leasing firm We Co., the parent of tions develop,” Endeavor said in a equity firm Silver Lake Partners, WeWork, withdrew its planned statement. was expected to become the first IPO. Earlier in the day, Endeavor talent agency owner to go public, Peloton Interactive Inc., a com- lowered the targeted price range of making it the subject of much pany that sells internet- its shares, according to a regulato- speculation in Hollywood. Silver connectedindoor exercise equip- ry filing. The Beverly Hills com- Lake Partners declined to com- ment, on Thursday saw its stock pany had expected to offer 15 mil- ment on the aborted IPO. -

Modpathol2016223.Pdf

Modern Pathology (2017) 30, 160–168 160 © 2017 USCAP, Inc All rights reserved 0893-3952/17 $32.00 Editorial #InSituPathologists: how the #USCAP2015 meeting went viral on Twitter and founded the social media movement for the United States and Canadian Academy of Pathology David Cohen1, Timothy Craig Allen2, Serdar Balci3, Philip T Cagle1, Julie Teruya-Feldstein4, Samson W Fine5, Dibson D Gondim6, Jennifer L Hunt7, Jack Jacob8, Kimberly Jewett9, Xiaoyin ‘Sara’ Jiang10, Keith J Kaplan11, Ibrahim Kulac12, Rashna Meunier13, Nicole D Riddle14, Patrick S Rush15, Jennifer Stall16, Lauren N Stuart17, David Terrano18, Ed Uthman19, Matthew J Wasco20, Sean R Williamson21, Roseann I Wu22 and Jerad M Gardner7 1Department of Pathology and Genomic Medicine, Houston Methodist Hospital, Houston, TX, USA; 2Department of Pathology, The University of Texas Medical Branch, Galveston, TX, USA; 3Department of Pathology, Yildirim Beyazit University Faculty of Medicine, Ankara, Turkey; 4Department of Pathology, Icahn School of Medicine, Mount Sinai Health System, New York, NY, USA; 5Department of Pathology, Memorial Sloan Kettering Cancer Center, New York, NY, USA; 6Department of Pathology, Indiana University School of Medicine, Indianapolis, IN, USA; 7Department of Pathology, University of Arkansas for Medical Sciences, Little Rock, AR, USA; 8Department of Pathology, Montefiore Medical Center, Bronx, NY, USA; 9Kimberly Jewett Consulting, Inc., Plainfield, IL, USA; 10Department of Pathology, Duke University, Durham, NC, USA; 11Publisher, tissuepathology.com, Charlotte, -

Tesla, Inc.: the Automotive Business Analysis Senior Honors Thesis

Tesla, Inc.: The Automotive Business Analysis Senior Honors Thesis Presented to Undergraduate Program in Business Ben Gomes-Casseres, Primary Advisor and Michael McKay, Second Reader Awarded Honors By Nikita Ivanchenko December 2017 Copyright by Nikita Ivanchenko Table of Contents Executive Summary .............................................................................................................3 Background, History and Business Description ..................................................................6 Introduction ........................................................................................................................11 Part I: Financial Analysis ........................................................................... 13 1. Income Statement .......................................................................................................13 Automotive revenue ........................................................................................................14 Cost of automotive revenues ..........................................................................................17 Operating expenses ........................................................................................................24 Stock-based compensation and interest expenses ..........................................................29 2. Cash Flow Statement ..................................................................................................32 Part II: Key Value Drivers ......................................................................... -

AT&T | Warner Media Tobacco Depiction Policy Warner Media

AT&T | Warner Media Tobacco Depiction Policy Warner Media, LLC firmly believes in freedom of expression and actively supports the creative vision of producers, writers, directors, actors and others involved in making feature films. Consistent with this belief, Warner Media’s film studios, Warner Bros. Pictures and New Line Cinema (together, the “Studios”), work closely with creative talent to produce and distribute for theatrical release feature films that appeal to a wide array of audiences. At the same time, the Studios strive to produce and distribute feature films in a responsible manner and remain sensitive to public concerns, industry practices and public health regulations and research in this area as they develop and change over time. Accordingly, the Studios endeavor to reduce or eliminate the depiction of smoking and tobacco products/brands in their feature films, unless there is a compelling creative reason for such depictions. The Studios’ practices currently include the following: 1. The Studios do not enter into any product placement or promotion arrangements with respect to tobacco products/brands for any theatrical feature film they produce and distribute in the United States. 2. The Studios endeavor to reduce or eliminate depictions of smoking and tobacco products/brands in any theatrical feature film produced and distributed in the United States that is expected to be rated “G”, “PG” or “PG-13”, unless (a) the depiction involves a character who is a literary or an actual historical figure known to have used tobacco products; (b) the depiction is otherwise warranted for reasons of compelling literary or historical accuracy; or (c) the depiction is part of a conspicuous anti-smoking reference. -

First Look Program 2021

WELCOME to FIRST LOOK 2021 Welcome to the First Look Festival of 2021! One of my great pleasures as Dean of the School of Cinematic Arts is being able to introduce our festival films each year, and congratulate all the deserving students who contributed to them. This year I am especially proud of the determination and dedication inherent in these projects, as they were completed within the limitations of Covid 19 protocols. Despite this, the work you will see here is of the highest quality, and many will go on to tour the film festival circuit and win awards in the year ahead. They will also serve as calling cards for the talented young professionals who are graduating from the School and launching careers as filmmakers. Our students always depend on their family and friends to help them through their programs. Filmmaking is a challenging endeavor, and it takes a village of encouragement to have the confidence needed to bring a project to fruition. This year our students truly needed support, as our campus was shut down and many of them had to return home. Despite not being able to meet in person, the filmmakers found ways to collaborate. And as their films will attest, did so brilliantly! So please enjoy this year’s festival. And congratulations to all the students whose names appear in the end credits of these films. Elizabeth M. Daley Steven J. Ross/Time Warner Professor and Dean USC School of Cinematic Arts I firmly believe that film has been the major art form of the 20th century, and will continue to have a powerful influence on our culture and society. -

Metro-Goldwyn-Mayer Short Story

FOUR OUT OF TEN WINS! The record speaks for itself! There can be no question as to which company won the Quigley Short Subject Annual Exhibitor Vote. The results appeared on Page 21 of Motion Picture Herald, issue of Jan. 11, 1941, as follows: M-G-M 4 Next Company 3 Next Company 1 Next Company 1 Next Company 1 Leadership means doing the unusual first! Here's M-G-M's newest idea: Watch for this great short Tapping an unexplored field, subject! Short story masterpieces at last "THE On the screen— the first is HAPPIEST MAN 'THE HAPPIEST MAN ON EARTH" ON EARTH" One of M-G-M's most important steps featuring In years of short subject leadership. PAUL KELLY VICTOR KILLIAN Get ready for PETE SMITH'S "PENNY TO THE RESCUE," another Prudence Penny cookery The O. Henry Memorial comedy in Technicolor. It's swell. Also CAREY WILSON'S "MORE ABOUT NOSTRADAMUS/' Award -Winning Short Story a sequel to the prediction short that fascinated the nation. Scanned from the collections of The Library of Congress Packard Campus for Audio Visual Conservation www.loc.gov/avconservation Motion Picture and Television Reading Room www.loc.gov/rr/mopic Recorded Sound Reference Center www.loc.gov/rr/record 7 Quicker'n a wink' playing on the current program with 'Escape' is proving a sensation of unusual quality. Comments from our patrons are most enthusiastic. The sub- ject is a rare blending of scientific and entertaining units into an alto- gether delightful offering that is definitely boxoffice. This is an as- sured fact based on the number of calls we are receiving to inquire the screening time of the subject." BRUCE FOWLER, Mgr. -

Let's Get Ready to Unbundle!

LET’S GET READY TO UNBUNDLE! It’s Time for the UFC to Offer Individual Fights for Purchase Nick Cornor Abstract A bedrock principle of U.S. Copyright law normally dictates that when a person steals your original work of authorship, a court should issue an injunc- tion and require the violator to pay damages. For centuries this principle has sufficed; however, a lack of deep-pocket defendants and continued lobbying efforts by internet service providers have made this principle untenable when applied to illegal online streaming. This is especially true for the Ultimate Fighting Championship (UFC), a mixed martial arts promoter that has seen its live broadcasts pirated over the internet at an alarming rate, thereby threaten- ing the bulk of its revenue. This Comment advocates that the UFC unbundle its current pay- per-view business model in favor of charging market-based prices for each individual fight. The primary benefit of this approach includes increased rev- enue for the UFC by enticing consumers away from illegal online streaming with lower prices. Potential adjacent benefits include reforming fighter com- pensation schemes, incentivizing fighters to promote their own individual fights, easing controversies regarding unionization efforts by the fighters, and providing the UFC with greater marketing data. Therefore, by unbundling its business model, the UFC will ultimately be able to bypass the shortcomings of U.S. Copyright law and take the lead in a digital media landscape already changing at lightning speeds. * J.D., South Texas College of Law Houston; M.A., University of Oklahoma, 2013; B.S. University of Texas at Arlington, 2008. -

Vertically Integrated Supply Chain of Batteries, Electric Vehicles

sustainability Review Vertically Integrated Supply Chain of Batteries, Electric Vehicles, and Charging Infrastructure: A Review of Three Milestone Projects from Theory of Constraints Perspective Michael Naor 1,* , Alex Coman 2 and Anat Wiznizer 1 1 School of Busines Administration, Hebrew University, Jerusalem 9190501, Israel; [email protected] 2 School of Computer Science, Academic College of Tel Aviv-Yaffo, Tel Aviv 61000, Israel; [email protected] * Correspondence: [email protected] Abstract: This research utilizes case study methodology based on longitudinal interviews over a decade coupled with secondary data sources to juxtapose Tesla with two high-profile past mega- projects in the electric transportation industry, EV-1 and Better Place. The theory of constraints serves as a lens to identify production and market bottlenecks for the dissemination of electric vehicles. The valuable lessons learned from EV1 failure and Better Place bankruptcy paved the way for Tesla’s operations strategy to build gigafactories which bears a resemblance to Ford T mass production last century. Specifically, EV1 relied on external suppliers to develop batteries, while Better Place was dependent on a single manufacturer to build cars uniquely compatible with its charging infrastructure, whereas Tesla established a closed-loop, green, vertically integrated supply chain consisting of batteries, electric cars and charging infrastructure to meet its customers evolving needs. The analysis unveils several limitations of the Tesla business model which can impede its Citation: Naor, M.; Coman, A.; Wiznizer, A. Vertically Integrated worldwide expansion, such as utility grid overload and a shortage of raw material, which Tesla Supply Chain of Batteries, Electric strives to address by innovating advanced batteries and further extending its vertically integrated Vehicles, and Charging Infrastructure: supply chain to the mining industry.