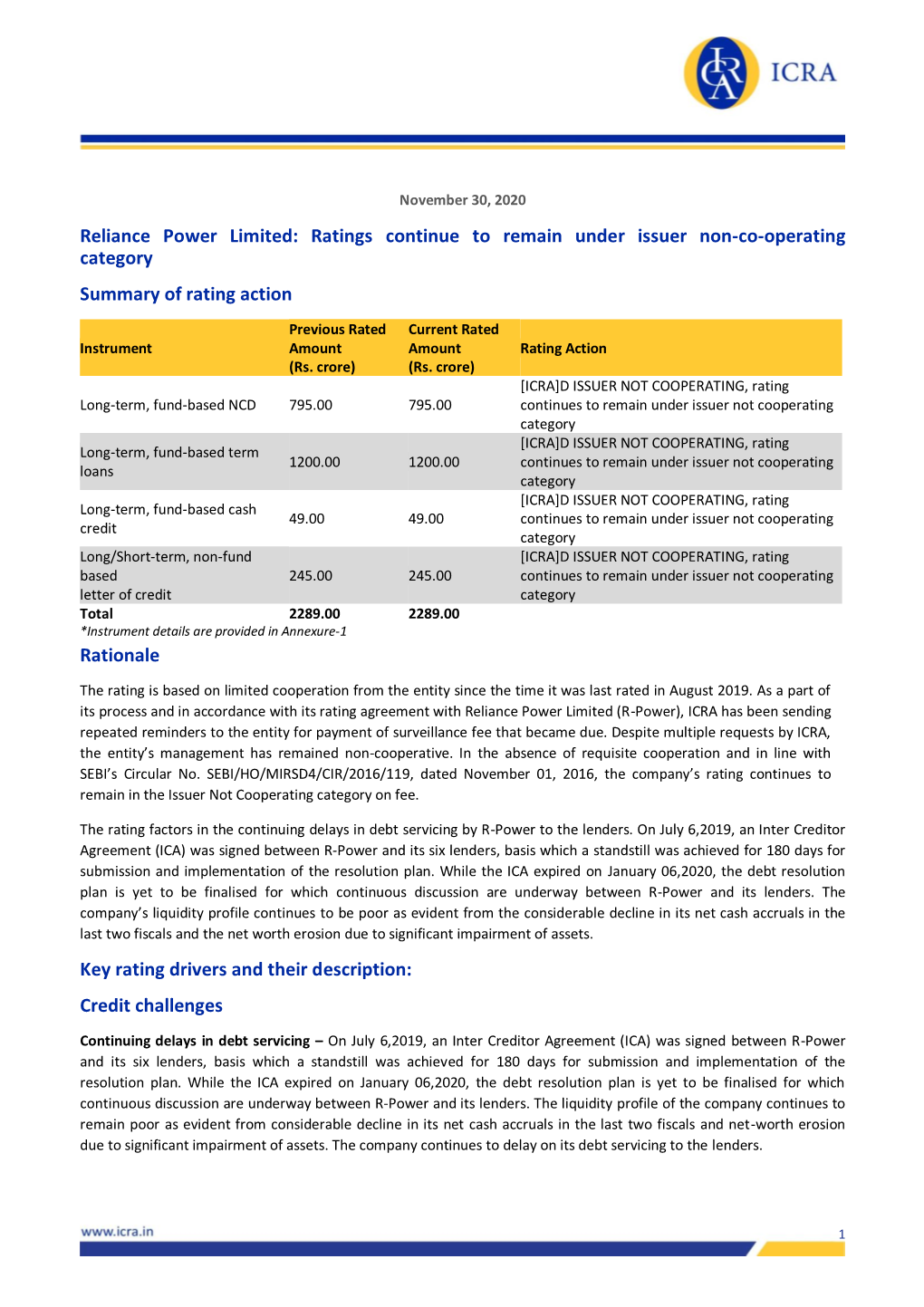

Reliance Power Limited: Ratings Continue to Remain Under Issuer Non-Co-Operating Category Summary of Rating Action

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Padma Vibhushan Shri Dhirubhai H. Ambani (28Th December, 1932 - 6Th July, 2002) Reliance Group - Founder and Visionary Profile

Communications Annual Report 2015-16 Padma Vibhushan Shri Dhirubhai H. Ambani (28th December, 1932 - 6th July, 2002) Reliance Group - Founder and Visionary Profile Reliance Communications Limited is the flagship Company of Reliance Group, one of the leading business houses in India. Reliance Communications is India’s foremost and truly integrated telecommunications service provider. The Company has a customer base of over 111 million including over 2.6 million individual overseas retail customers. Reliance Communications corporate clientele includes over 39,000 Indian and multinational corporations including small and medium enterprises and over 290 global, regional and domestic carriers. Reliance Communications has established a pan-India, next generation, integrated (wireless and wireline), convergent (voice, data and video) digital network that is capable of supporting best-of-class services spanning the entire communications value chain, covering over 21,000 cities and towns and over 400,000 villages. Reliance Communications owns and operates the world’s largest next generation IP enabled connectivity infrastructure, comprising over 280,000 kilometers of fibre optic cable systems in India, USA, Europe, Middle East and the Asia Pacific region. Mission: Excellence in Communication Arena To attain global best practices and become a world-class communication service provider – guided by its purpose to move towards greater degree of sophistication and maturity. To work with vigour, dedication and innovation to achieve excellence in service, quality, reliability, safety and customer care as the ultimate goal. To earn the trust and confidence of all stakeholders, exceeding their expectations and make the Company a respected household name. To consistently achieve high growth with the highest levels of productivity. -

SIX MONTHLY COMPLIANCE REPORT of ENVIRONMENTAL CLEARANCE 2X300 THERMAL POWER PLANT at D3, D3 Part, MIDC, Butibori, Nagpur

SIX MONTHLY COMPLIANCE REPORT OF ENVIRONMENTAL CLEARANCE 2X300 THERMAL POWER PLANT At D3, D3 Part, MIDC, Butibori, Nagpur Submitted to: Regional Office, Ministry of Environment, Forest & Climate Change, Nagpur Central Pollution Control Board (CPCB), New Delhi Maharashtra Pollution Control Board (MPCB) -Mumbai/Nagpur Submitted by: Vidarbha Industries Power Limited D3, D3 Part, MIDC, Butibori, Nagpur-441122, Maharashtra PERIOD: 1st Jan 2019 – 30th June 2019 PREAMBLE 1 Vidarbha Industries Power Limited is operating 600 MW (2 x 300MW) Coal based Thermal Power Plant at D3, MIDC, Butibori, Nagpur (M.S.). 2 Long term PPA signed with R-Infra distribution for full ex Bus capacity of 546 MW. 3 Water commitment available from MIDC for 22 MLD for Phase–I and from Irrigation Department for 22 MLD for Phase-II. 4 Coal allocation is available from WCL. The Private Railway siding of 17 KMs from Sindhi Railway station to Plant developed by VIPL was already commissioned. The Coal requirements for the Plant Operations transported by Rail mode. Rarely, VIPL may have to depend on road transportation in case the WCL mine allocated does not have railway siding. 5 Permission from MSETCL for grid connectivity obtained for Phase-I & II. 6 All the 2 units of 300MW each have already achieved Commercial Operation. 7 All the operation related permits, including Environmental Clearance, Forest Clearance from MoEF&CC and Consent to Operate from Maharashtra Pollution Control Board are in place. 8 Environmental quality monitoring in & around the Plant site is being carried out by MoEF& CC & NABL approved Laboratory on a regular basis. 9 Three nos. -

Reliance Communications Limited Dhirubhaiambani Knowledge

Reliance Communications Limited Tel : +91 022 3038 6286 DhirubhaiAmbani Knowledge City Fax: +91 022 3037 6622 Navi Mumbai - 400 710, India www.rcom.co.in September 06, 2019 BSE Limited National Stock Exchange of India Ltd. PhirozeJeejeebhoy Towers Exchange Plaza, C/1, Block G Dalal Street, Fort, Bandra - Kurla Complex, Bandra (East) Mumbai 400 001 Mumbai 400 051 BSE Scrip Code: 532712 NSE Scrip Symbol: RCOM Dear Sir(s), Sub: Notice of 15th Annual General Meeting and Annual Report 2018-19 This is to inform that the 15th Annual General Meeting of the members of Reliance Communications Limited (“Company”) shall be held on Monday, September 30, 2019 at 4:00 p.m. at Rama & Sundri Watumull Auditorium, Vidyasagar, Principal K. M. Kundnani Chowk, 124, Dinshaw Wachha Road, Churchgate, Mumbai – 400020 (“the AGM”). The Annual Report for the financial year 2018-19, including the Notice convening the AGM, as approved by the Interim Resolution Professional of the Company in the meeting dated May 27th, 2019 is attached herewith for your records. The Company will provide to its members the facility to cast their vote(s) on all resolutions set out in the Notice by electronic means ("e-voting") and through ballot at the venue of AGM. The e-voting communication giving instructions for e-voting, being sent along with the Annual Report is also enclosed. Thanking you. Yours faithfully, For Reliance Communications Limited Rakesh Gupta Company Secretary Encl: As above (Reliance Communications Limited is under Corporate Insolvency Resolution Process pursuant to the provisions of the Insolvency and Bankruptcy Code, 2016. Vide order dated June 21, 2019, the Hon’ble NCLT has replaced the interim resolution professional of the Company and with effect from June 28, 2019, its affairs, business and assets are being managed by, and the powers of the board of directors are vested in, the Resolution Professional, Mr. -

Annual Report (October 1, 2010-March 31, 2011) Dhirubhai H

Broadcast Network Annual Report (October 1, 2010-March 31, 2011) Dhirubhai H. Ambani (December 28, 1932 - July 6, 2002) Reliance Group - Founder and Visionary Reliance Broadcast Network Limited Reliance(formerly Broadcast Reliance Network Media World Limited Limited) Board of Directors Contents Page No. Shri Gautam Doshi Notice of Annual General Meeting ................................4 Shri Rajesh Sawhney Shri Anil Sekhri Directors’ Report ..............................................................8 Shri Darius Jehangir Kakalia Shri Pradeep Shah Management Discussion and Analysis ....................... 12 Shri Prasoon Joshi Practicing Company Secretary’s Certificate on Corporate Governance ......................... 18 Company Secretary and Manager Shri Gururaja Rao Corporate Governance Report ..................................... 19 Investor Information ..................................................... 29 Auditor M/s. Chaturvedi & Shah Auditors’ Report on Financial Statements .................. 35 Annexure to Auditors’ Report ...................................... 36 Registered Office Balance Sheet .............................................................. 38 401, 4th Floor, Infiniti Link Road, Oshiwara, Andheri West Mumbai 400 053 Profit and Loss Account ............................................... 39 Maharashtra, India Cash Flow Statement ................................................... 40 Registrar and Transfer Agent Schedules and Notes .................................................... 41 Karvy Computershare Private -

The Sasan Power Project in MP (Reliance ADAG Group)

The Sasan Power Project in MP (Reliance ADAG Group) Summary: • Location: Sasan, Madhya Pradesh, a 3,000 acre cluster of 5 villages Sidhikhurg, Sidhikala, Tiyara, Jhanjhi and Harrhawa containing a population of about 10,000 located approximately 25 km from three captive pithead coalmines. • Date Initiated: Feb 10, 2006 with the incorporation of Sasan Power limited (SPL). • Size: 3,960 MW coal-fired ultra mega power project (UMPP) - 6x660 MW • Annual Emmissions: 26,000-27,000 tonnes of carbon dioxide per year or 832 grams carbon dioxide per kilowatt hour • Local Displacement: About 6,000 people will lose their land and homes once the Rs 20,000-crore ($200 billion) project takes off. Both issues are critical because the green cover here belies the stark poverty of an area that has just one or two pakka (permanent) houses. Most farmers and daily labourers live in mud hutments. • Power Use: The states sharing the power are Madhya Pradesh (Lead Procurer) with a 37.50% share, followed by Punjab (15%), Uttar Pradesh (12.5%), Delhi (11.25%), Haryana (11.25%), Rajasthan (10%) and Uttarakhand (2.5%). • Ex-Im Support: After a reversal of an earlier decision to follow its low carbon policy US Exim bank gave approval for $600 million in loan guarantees. The reversal came with a “compromise” between Reliance and Ex-Im to generate 250 MW of renewable energy on site to address low carbon policy concerns. • Legal Controversy: Tata Power Company challenged the use of surplus coal from the captive coal mines for other projects of Anil Ambani-controlled Reliance Power. -

SECTOR UPDATES July 2011 SECTOR UPDATES July 2011

SECTOR UPDATES July 2011 SECTOR UPDATES July 2011 Contents … (1/2) Auto and auto components Aviation Banking Biotechnology Infrastructure Media and Entertainment FMCG Healthcare IT & ITeS Power Pharmaceuticals 2 SECTOR UPDATES July 2011 Contents … (2/2) Real estate Retail Steel Telecom Tourism & Hospitality 3 AUTO AND AUTO COMPONENTS Sector Updates July 2011 Auto and auto components … (1/2) • Czech auto major Skoda is set to launch five products in the country over the next two years to increase its presence in India. Apart from launching a refurbished Laura, it will launch, by the end of this year, a premium mid-sized sedan, Rapid. Also on the anvil are plans to launch smaller versions of its sports utility vehicle (SUV) Yeti, in both petrol and diesel variants, and a small car tagged between Rs 3 lakh and Rs 5 lakh. With these launches, the company, which currently covers 30 per cent of the passenger vehicles market in the country, is looking to gain between 4 and 6 per cent share over the next few years, according to the company. • The demand for two-wheelers from the stable of six of the eight domestic motorcycle manufacturers rose 16 per cent in June to over 880,000 units, compared to 761,000 units in June 2010. Analysts attributed the increase in demand to a hike in petrol prices, which made two-wheelers more cost- effective. Hero Honda, the country's biggest two-wheeler maker, recorded total sales of 512,224 units to dealers in June — up 20 per cent from 426,454 units in the year-ago period. -

Annual Report 2010-11 Dhirubhai H

Annual Report 2010-11 Dhirubhai H. Ambani (December 28, 1932 - July 6, 2002) Reliance Group - Founder and Visionary Profile Reliance Communications Limited is the flagship Company of Reliance Group, one of the leading business houses in India. Reliance Communications is India’s foremost and truly integrated telecommunications service provider. The Company, with a customer base of 142 million as on March 31, 2011 including over 2.5 million individual overseas retail customers, ranks among the Top 4 Telecom companies in the world by number of customers in a single country. Reliance Communications corporate clientele includes over 35,000 Indian and multinational corporations including small and medium enterprises and over 800 global, regional and domestic carriers. Reliance Communications has established a pan-India, next generation, integrated (wireless and wireline), convergent (voice, data and video) digital network that is capable of supporting best-of-class services spanning the entire communications value chain, covering over 24,000 towns and 600,000 villages. Reliance Communications owns and operates the world’s largest next generation IP enabled connectivity infrastructure, comprising over 2,77,000 kilometers of fibre optic cable systems in India, USA, Europe, Middle East and the Asia Pacific region. Mission: Excellence in Communication Arena To attain global best practices and become a world-class communication service provider – guided by its purpose to move towards greater degree of sophistication and maturity. To work with vigour, dedication and innovation to achieve excellence in service, quality, reliability, safety and customer care as the ultimate goal. To earn the trust and confidence of all stakeholders, exceeding their expectations and make the Company a respected household name. -

Reliance Power Limited Reliance Power Limited

Reliance Power Limited Registered Office: H Block, 1st Floor, Dhirubhai Ambani Knowledge City, Navi Mumbai 400 710 Tel. no. : +91 22 3303 1000, Fax no.: +91 22 3303 3662 Website: www.reliancepower.co.in, E-mail id: [email protected] Power CIN: L40101MH1995PLC084687 PLEASE complete THIS Attendance slip AND HAND it over at THE ENTRANCE OF THE MEETING HALL ATTENDANCE SLIP *DP Id. Name & Address of the registered Shareholder Regd. Folio No. / *Client Id. No. of Share(s) held (*Applicable for Members holding Shares in electronic form) I hereby record my presence at the 22nd ANNUAL GENERAL MEETING of the Members of Reliance Power Limited held on Tuesday, September 27, 2016 at 4.00 P.M. or soon after the conclusion of the annual general meeting of Reliance Infrastructure Limited convened on the same day, whichever is later, at Birla Matushri Sabhagar, 19, New Marine Lines, Mumbai 400 020. Member’s / Proxy’s Signature .............................................................................. TEAR HERE ......................................................................................... PROXY FORM Reliance Power Limited Registered Office: H Block, 1st Floor, Dhirubhai Ambani Knowledge City, Navi Mumbai 400 710 Tel no.: +91 22 3303 1000, Fax no.: +91 22 3303 3662 Website: www.reliancepower.co.in, E-mail id: [email protected] Power CIN: L40101MH1995PLC084687 FORM NO. MGT-11 [Pursuant to Section 105(6) of the Companies Act, 2013 and Rule 19(3) of the Companies (Management and Administration) Rules, -

Reliance Power Limited (We Were Originally Incorporated As Bawana Power Private Limited on January 17, 1995

Prospectus Please read Section 60 of the Companies Act, 1956 100% Book Built Offer Dated January 19, 2008 Reliance Power Limited (We were originally incorporated as Bawana Power Private Limited on January 17, 1995. For details of the change in our name and registered office, see “History and Certain Corporate Matters” on page 126 of this Prospectus.) Registered and Corporate Office: H Block, First Floor, Dhirubhai Ambani Knowledge City, Navi Mumbai 400 710, Maharashtra Company Secretary and Compliance Officer: Mr. Paresh Rathod Tel: (91 22) 3038 6010; Fax: (91 22) 3037 6633; Email: [email protected]; Website: www.reliancepower.co.in PUBLIC ISSUE OF 260,000,000 EQUITY SHARES OF Rs. 10 EACH OF RELIANCE POWER LIMITED (“RELIANCE POWER” OR THE “COMPANY” OR THE “ISSUER”) FOR CASH AT A PRICE OF Rs. 450# PER EQUITY SHARE (INCLUDING A SHARE PREMIUM OF Rs. 440# PER EQUITY SHARE) AGGREGATING TO Rs. 115,632 MILLION (NET OF RETAIL DISCOUNT) (THE “ISSUE”). THE ISSUE COMPRISES A NET ISSUE TO THE PUBLIC OF 228,000,000 EQUITY SHARES AGGREGATING TO Rs. 101,232 MILLION (NET OF RETAIL DISCOUNT) ("THE NET ISSUE") AND A PROMOTERS’ CONTRIBUTION OF 32,000,000 EQUITY SHARES AGGREGATING Rs. 14,400 MILLION. THE ISSUE WILL CONSTITUTE 11.5% OF THE POST ISSUE PAID-UP CAPITAL OF THE COMPANY AND THE NET ISSUE WILL CONSTITUTE 10.1% OF THE POST ISSUE PAID-UP CAPITAL OF THE COMPANY. ISSUE PRICE: Rs. 450 PER EQUITY SHARE OF FACE VALUE Rs. 10 EACH# THE ISSUE PRICE IS 45 TIMES THE FACE VALUE # A discount of Rs. -

Annual Report 2017-18 (Abridged) Padma Vibhushan Shri Dhirubhai H

Annual Report 2017-18 (Abridged) Padma Vibhushan Shri Dhirubhai H. Ambani (28th December, 1932 - 6th July, 2002) Reliance Group - Founder and Visionary Profile Reliance Infrastructure Limited (RInfra), Constituent of the Reliance Group was incorporated in 1929 and is one of the largest infrastructure companies, developing projects through various Special Purpose Vehicles (SPVs) in several high growth sectors such as power, roads, metro rail and airport in the infrastructure space and in the defence sector. RInfra is a major player in providing Engineering, Procurement and Construction (EPC) services for developing power, infrastructure, metro and road projects. RInfra is also a leading utility Company having presence across the value chain of power businesses i.e. generation, transmission, distribution and power trading. Mission: Excellence in Infrastructure • To attain global best practices and become a world-class Company. • To create world-class assets and infrastructure to provide the platform for faster, consistent growth for India to become a major world economic power. • To achieve excellence in service, quality, reliability, safety and customer care. • To earn the trust and confidence of all customers and stakeholders, exceeding their expectations and make the Company a respected household name. • To work with vigour, dedication and innovation with total customer satisfaction as the ultimate goal. • To consistently achieve high growth with the highest levels of productivity. • To be a technology driven, efficient and financially sound organisation. • To be a responsible corporate citizen nurturing human values and concern for society, the environment and above all people. • To contribute towards community development and nation building. • To promote a work culture that fosters individual growth, team spirit and creativity to overcome challenges and attain goals. -

Memorandum of Association & Articles of Association

Memorandum of Association & Articles of Association Memorandum of Association & Articles of Association Reliance Power Limited Registered Office H Block, 1st Floor, Dhirubhai Ambani Knowledge City, Navi Mumbai 400 710 INDEX Page Nos. Certificates of Incorporation and other certificates Memorandum of Association 1 – 17 Articles of Association 1 - 28 Interpretation 1 Share capital and variation of rights 2 Lien 4 Call on shares 6 Transfer of shares 7 Transmission of shares 8 Forfeiture of Shares 9 Alteration of capital 11 Joint Holders 12 Capitalisation of profits 13 Buy-back of shares 15 General meetings 15 Proceeding at general meetings 15 Adjournment of meeting 17 Voting rights 18 Proxy 1911 Board of Directors 19 Powers of Board 21 Promoters 21 Proceedings of the Board 22 Chief Executive Officer, Manager, Company Secretary and Chief Financial Officer 23 Registers 23 The Seal 24 Dividends and Reserve 24 Accounts 26 Winding up 26 Indemnity and Insurance 27 General Power 27 High Court Orders A) Merger of Reliance Public Utility Private Limited with Reliance Power 1-16 Limited B) Composite Scheme of Arrangement between Reliance Natural 1-40 Resources Limited and Reliance Power Limited and Atos Trading Private Limited and Atos Mercantile Private Limited and Coastal Andhra Power Infrastructure Limited and Reliance Prima Limited and Reliance Futura Limited and their respective Shareholder and Creditors C) Merger of Sasan Power Infraventures Private Limited with Reliance 1-19 Power Limited D) Amalgamation of Sasan Power Infrastructure Limited with Reliance 1-18 Power Limited E) Amalgamation of Reliance Clean Energy Private Limited with 1-19 Reliance Power Limited F) Amalgamation of Reliance Clean Power Private Limited with Reliance 1-18 Power Limited THE COMPANIES ACT, 1956 Company Limited by Shares Memorandum of Association of Reliance Power Limited* I. -

Sasan Power Limited Transferred to Reliance Power Limited

Reliance Energy Centre, Santa Cruz (E), Mumbai 400 055, India Tel: +91 22 3009 9999, Fax: +91 22 3009 9775, www.rel.co.in Sasan Power Limited transferred to Reliance Power Limited • Reliance Power to build Sasan 4,000 MW Ultra Mega Power Project • 4,000 MW UMPP involving a capital outlay of over Rs. 20,000 crore to come up at Sasan, Madhya Pradesh • India’s largest domestic coal based power project • Project awarded through international competitive bidding process • Lowest levelised Benchmark Tariff of Rs 1.196 per unit New Delhi, 7th August, 2007: Reliance Power Limited, an associate of Reliance Energy Limited today formally acquired Sasan Power Limited, the SPV formed to implement the 4000 MW Sasan UMPP in Madhya Pradesh. The transfer agreements were exchanged in the presence of group Chairman Anil D Ambani and Hon’ble Minister of Power Shri. Sushilkumar Shinde at a function in the capital today. Commenting on the take over, Mr. Anil D Ambani, Chairman Reliance Energy said ““We are already committed to investing over Rs. 60,000 crore in the next few years for creating new generation capacities in the country. Our plans in this space have received a further huge impetus today with the take over of the Sasan project.” “But more than any numbers or statistics, ultra mega power projects like Sasan will shape India’s future because they embody a bold new way of approaching and tackling the underdevelopment of the country’s power sector. Sasan will showcase our capabilities in creating best-of-class infrastructure, revolutionalize tariffs and set new benchmarks of efficiency and competitiveness in power generation.” “ Along with the transfer Sasan Power signed the Power Purchase agreements (PPA’s) with 14 procurers from the 7 states which would off take power from the project.