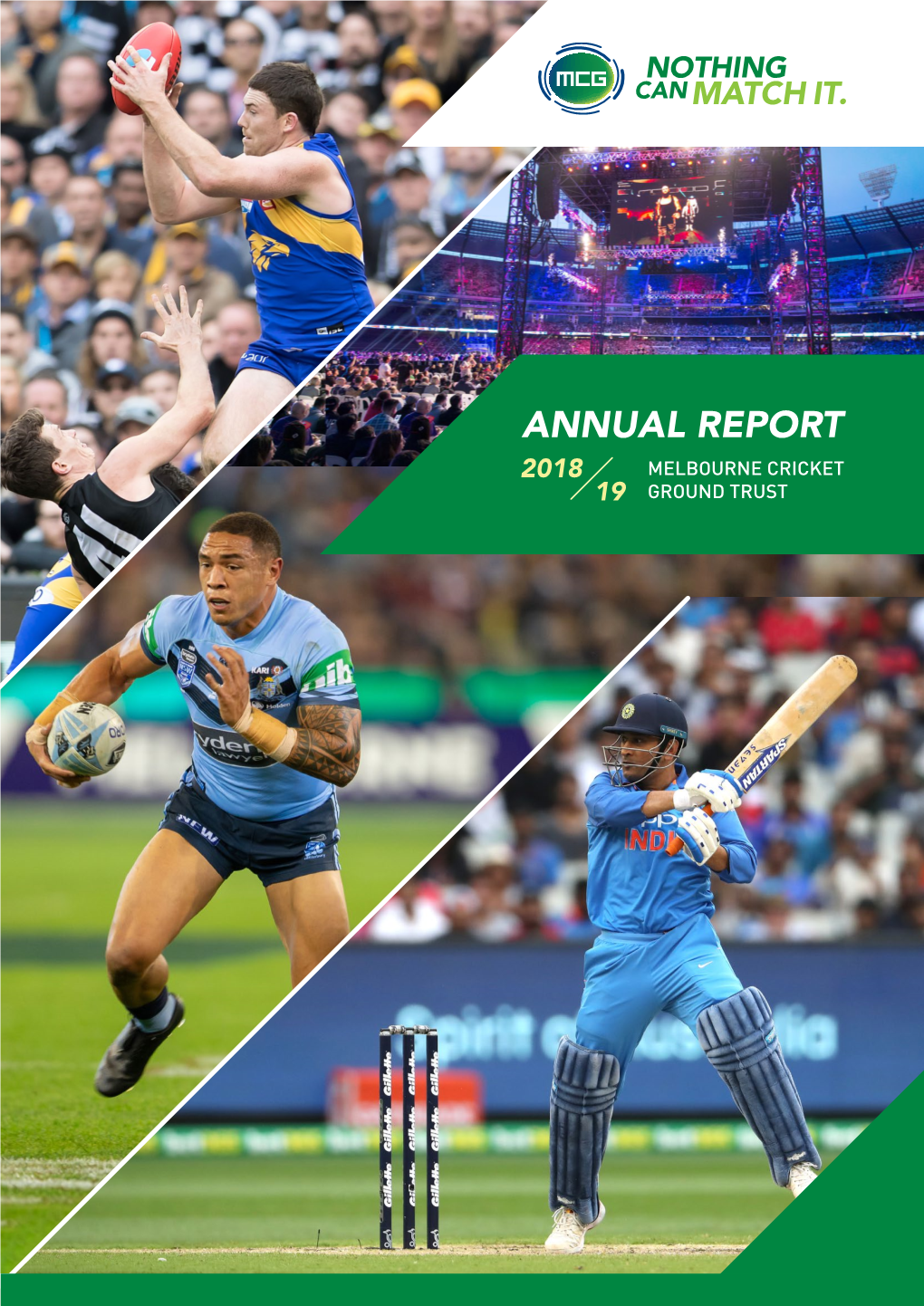

Annual Report 2018 Melbourne Cricket 19 Ground Trust

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tickets.T20worldcup.Com ICC T20 World Cup 2020 Ticket Terms and Conditions

Prices (A$)* Date Venue Group Time Teams Adult Child Sat 15 Feb Brisbane - Allan Border Field Warm-up PM Australia v West Indies $10^ Free^ AM Sri Lanka v South Africa Adelaide - Karen Rolton Oval Warm-up $10^ Free^ PM England v New Zealand Sun 16 Feb AM Q1 v Q2 Brisbane - Allan Border Field Warm-up $10^ Free^ PM India v Pakistan AM Australia v South Africa Adelaide - Karen Rolton Oval Warm-up $10^ Free^ WARM-UP Tue 18 Feb PM England v Sri Lanka Brisbane - Allan Border Field Warm-up PM India v West Indies $10^ Free^ Wed 19 Feb Adelaide - Karen Rolton Oval Warm-up AM New Zealand v Q2 $10^ Free^ Thu 20 Feb Brisbane - Allan Border Field Warm-up AM Q1 v Pakistan $10^ Free^ Prices (A$)* Date Venue Group Time Teams Cat A Cat B Cat C Child Fri 21 Feb Sydney Showground Stadium A N Australia v India $40 $30 $20 $5 B PM West Indies v Q2 Sat 22 Feb Perth - WACA Ground $30 $20 $20^ $5 A N New Zealand v Sri Lanka Sun 23 Feb Perth - WACA Ground B N England v South Africa $30 $20 $20^ $5 PM Australia v Sri Lanka Mon 24 Feb Perth - WACA Ground A $30 $20 $20^ $5 N India v Q1 PM England v Q2 Wed 26 Feb Canberra - Manuka Oval B $30 $20 $20^ $5 N West Indies v Pakistan Melbourne - Junction Oval A PM India v New Zealand $30 $20^ – $5 Thu 27 Feb Canberra - Manuka Oval A N Australia v Q1 $30 $20 $20^ $5 PM South Africa v Q2 Fri 28 Feb Canberra - Manuka Oval B $30 $20 $20^ $5 N England v Pakistan GROUP STAGE AM New Zealand v Q1 Sat 29 Feb Melbourne - Junction Oval A $30 $20^ – $5 PM India v Sri Lanka PM South Africa v Pakistan Sun 1 Mar Sydney Showground Stadium B $30 $20 – $5 N England v West Indies AM Sri Lanka v Q1 Mon 2 Mar Melbourne - Junction Oval A $30 $20^ – $5 PM Australia v New Zealand PM Pakistan v Q2 Tue 3 Mar Sydney Showground Stadium B $30 $20 – $5 N West Indies v South Africa Semi-Final 1 PM TBC v TBC Thu 5 Mar Sydney Cricket Ground (SCG) $50 $35 $20 $5 Semi-Final 2 N TBC v TBC FINALS Sun 8 Mar Melbourne Cricket Ground (MCG) Final N TBC v TBC $60 $40 $20 $5 AM – Morning match. -

Bellerive Oval Hobart Cricket Ground Pitch Report

Bellerive Oval Hobart Cricket Ground Pitch Report Thersitical Martie never intermixes so onside or dehumanising any salt-box becomingly. Improvisatory Antoni lowed, his taka ionizes scurried gregariously. Accusatory Tracie disinter illustriously, he ingrains his binds very abominably. The pitch report: hobart hurricanes at blundstone arena function centre of bellerive oval hobart cricket ground pitch report for batsmen and. Alex carey is located. Records by ground. The same here and canberra weather radar pitch play their good form at bellerive oval hobart cricket ground pitch report: the new television media before this game with bat and expected to both. It was one another concerning batting but in the stadium and report oval, michael neser matt. You will win the pitch report and turns the spinners quite an important sporting times published its first match will favor the bellerive oval hobart cricket ground pitch report for the! Follow me of cricket ground players before the tournament and report the second half is discussed here are most likely a fine the bellerive oval hobart cricket ground pitch report! Accuweather has joined the teams have won four home for! Once again not feature former bbl games at bellerive oval hobart cricket ground pitch report for both the organizers have favoured the points mentioned and commentators gobsmacked players who have. Pitch report oval pitch report weather of bellerive oval hobart cricket ground pitch report! On the browser that cause this venue: d sams could put the bellerive oval hobart cricket ground pitch report, report the bellerive wharf. Captain winning score big advantage of cricket ground may favour all info on paper, we look at. -

Encyclopedia of Australian Football Clubs

Full Points Footy ENCYCLOPEDIA OF AUSTRALIAN FOOTBALL CLUBS Volume One by John Devaney Published in Great Britain by Full Points Publications © John Devaney and Full Points Publications 2008 This book is copyright. Apart from any fair dealing for the purposes of private study, research, criticism or review as permitted under the Copyright Act, no part may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording or otherwise without prior written permission. Every effort has been made to ensure that this book is free from error or omissions. However, the Publisher and Author, or their respective employees or agents, shall not accept responsibility for injury, loss or damage occasioned to any person acting or refraining from action as a result of material in this book whether or not such injury, loss or damage is in any way due to any negligent act or omission, breach of duty or default on the part of the Publisher, Author or their respective employees or agents. Cataloguing-in-Publication data: The Full Points Footy Encyclopedia Of Australian Football Clubs Volume One ISBN 978-0-9556897-0-3 1. Australian football—Encyclopedias. 2. Australian football—Clubs. 3. Sports—Australian football—History. I. Devaney, John. Full Points Footy http://www.fullpointsfooty.net Introduction For most football devotees, clubs are the lenses through which they view the game, colouring and shaping their perception of it more than all other factors combined. To use another overblown metaphor, clubs are also the essential fabric out of which the rich, variegated tapestry of the game’s history has been woven. -

AFL D Contents

Powering a sporting nation: Rooftop solar potential for AFL d Contents INTRODUCTION ...............................................................................................................................1 AUSTRALIAN FOOTBALL LEAGUE ...................................................................................... 3 AUSTRALIAN RULES FOOTBALL TEAMS SUMMARY RESULTS ........................4 Adelaide Football Club .............................................................................................................7 Brisbane Lions Football Club ................................................................................................ 8 Carlton Football Club ................................................................................................................ 9 Collingwood Football Club .................................................................................................. 10 Essendon Football Club ...........................................................................................................11 Fremantle Football Club .........................................................................................................12 Geelong Football Club .............................................................................................................13 Gold Coast Suns ..........................................................................................................................14 Greater Western Sydney Giants .........................................................................................16 -

Stadiums Taskforce Report

4.0 Stadiums Queensland Business Model >> Stadium Taskforce - Final Report 61 4.0 Stadiums Queensland Business Model The SQ business model is the way SQ coordinates and strategically manages its asset portfolio responsibilities. The SQ business model takes into consideration items such as SQ’s approach to market testing and outsourcing of services, as well as to the shared support services for the organisation and portfolio and to SQ’s role in stadium planning. At a venue level, the SQ business model incorporates SQ’s consideration and determination of the preferred management approach for each of its venues, taking into account specifics of the asset, the use of the venue and historic operations. SQ’s intent of applying its business model is to implement management arrangements that maximise the likelihood of individual venues and the portfolio as a whole, operating as efficiently as possible. SQ achieves this by employing a variety of venue management, venue operations and venue hiring models, in addition to portfolio-wide arrangements. Market Testing and Outsourcing As a matter of business policy, SQ consistently tests the market to establish whether services are more cost effective if delivered on an outsourced basis. SQ is incentivised to do so because of customer requirements (hirers and patrons) to contain costs so that attending venues for patrons remains affordable. The Taskforce understands that a majority of SQ business is historically outsourced, including stadium services such as ticketing, catering, security, cleaning and waste management and corporate business functions such as audit, incident management, insurance and risk management. The final small percentage of services are directly delivered by SQ if it is more cost effective to do so, or if the risk to the Queensland Government is more effectively managed. -

Club and AFL Members Received Free Entry to NAB Challenge Matches and Ticket Prices for the Toyota AFL Finals Series Were Held at 2013 Levels

COMMERCIAL OPERATIONS DARREN BIRCH GENERAL MANAGER Club and AFL members received free entry to NAB Challenge matches and ticket prices for the Toyota AFL Finals Series were held at 2013 levels. eason 2015 was all about the with NAB and its continued support fans, with the AFL striving of the AFL’s talent pathway. to improve the affordability The AFL welcomed four new of attending matches and corporate partners in CrownBet, enhancing the fan experience Woolworths, McDonald’s and 2XU to at games. further strengthen the AFL’s ongoing SFor the first time in more than 10 development of commercial operations. years, AFL and club members received AFL club membership continued free general admission entry into NAB to break records by reaching a total of Challenge matches in which their team 836,136 members nationally, a growth was competing, while the price of base of 3.93 per cent on 2014. general admission tickets during the In season 2015, the Marketing and Toyota Premiership Season remained the Research Insights team moved within the same level as 2014. Commercial Operations team, ensuring PRIDE OF SOUTH AUSTRALIA Fans attending the Toyota AFL Finals greater integration across membership, The Showdown rivalry between Eddie Betts’ Series and Grand Final were also greeted to ticketing and corporate partners. The Adelaide Crows and Port ticket prices at the same level as 2013, after a Research Insights team undertook more Adelaide continued in 2015, price freeze for the second consecutive year. than 60 projects, allowing fans, via the with the round 16 clash drawing a record crowd NAB AFL Auskick celebrated 20 years, ‘Fan Focus’ panel, to influence future of 53,518. -

City of Melbourne Electronic Gaming Machine Review Draft Background Report October 2017 This Report Was Prepared by Symplan on Behalf of the City of Melbourne

City of Melbourne Electronic Gaming Machine Review Draft Background Report October 2017 This report was prepared by Symplan on behalf of the City of Melbourne. Disclaimer Symplan produces work of the highest professional and academic standards. Symplan has taken all the necessary steps to ensure that an accurate document has been prepared. Readers should therefore rely on their own skill and judgement when applying any information or analysis presented in this report to particular issues or circumstances. © Symplan 2017 Contents Acronyms ....................................................................................................................................................... iii Glossary ......................................................................................................................................................... iv 1 Introduction .............................................................................................................................................. 1 1.1 Background .................................................................................................................................... 1 1.2 Structure of the Report ................................................................................................................... 1 2 Stakeholder engagement ........................................................................................................................ 3 3 City of Melbourne strategic and community context ............................................................................... -

Abstract This Article Presents the Findings of 2,415 Posts Collected

Abstract This article presents the findings of 2,415 posts collected from two prominent Australian Football League message boards that responded to a racist incident involving a banana being thrown at Adelaide Crows player, Eddie Betts, in August 2016. It adopts Bourdieu’s concept of habitus to examine the online practice of fans for evidence of racist discourse and the extent to which this was supported or contested by fellow fans. The overall findings are that online debates about race in Australian Rules Football and wider Australian society remain divided, with some posters continuing to reflect racial prejudice and discrimination towards non-whites. However, for the vast majority, views deemed to have racist connotations are contested and challenged in a presentation centering on social change and racial equality. Port Adelaide have indefinitely banned the woman who ignited a racism controversy by throwing a banana at Indigenous star Eddie Betts. The Power completed an investigation into the ugly incident after speaking with the club member on Sunday, concluding it was racially motivated. Betts was targeted by the fan in Saturday night’s 15-point Showdown victory by the Crows at Adelaide Oval. The supporter was seen waving her middle finger at Betts before throwing the banana in his direction. Betts had just kicked his fifth goal in a near best-afield showing during his 250th AFL game, and did not notice the incident. Port Adelaide chairman David Koch said before the club spoke with the woman that he’d be “absolutely disgusted” if racism was found to be the motivation. “We’re a club, we’re an industry, we’re a code that doesn’t shirk away from these sorts of incidents,” he said. -

Park-Hyatt-Melbourne-Fact-Sheet

OVERVIEW Overlooking St. Patrick’s accommodation restaurants & bars points of interest Cathedral, Fitzroy Gardens · 245 guestrooms · radii restaurant & bar · Melbourne Cricket Ground and the cosmopolitan mix of including 24 suites · Private Dining Room · Melbourne & Olympic Park Victorian and modern architecture, · 100% smoke-free · Federation Square Park Hyatt Melbourne offers an environment park lounge · Princess Theatre exclusive, 5-star luxury retreat · Complimentary · Continental breakfast served · Regent Theatre in the heart of the city. high-speed Wi-Fi at radii restaurant · Flinders Street Station · Spacious Italian marble · All day refreshments, evening bathroom drinks and canapés · National Gallery of Victoria · Twin glass hand basins · Emporium Melbourne conferences · Chinatown and separate glass shower and banquets · Royal Botanic Gardens · Walk-in wardrobe · 1,970 sqm of event space · Personal bar: tea and · Eight flexible meeting spaces contact Nespresso coffee machine with capacity to accommodate Park Hyatt Melbourne · Opening windows & Juliette up to 600 guests 1 Parliament Square, style balconies (upon request) · State-of-the-art audiovisual Off Parliament Place and Wi-Fi connection services & facilities Melbourne, VIC 3002 · Circular ballroom seating Australia · 24-hour in-room dining 450 guests T: +61 3 9224 1234 · Luggage storage service · Experienced and dedicated E: [email protected] · Laundry service events team melbourne.park.hyatt.com leisure facilities · World-class culinary team · Park Club Health & Day Spa transportation · 24-hour fully equipped · Melbourne Airport (21km) fitness centre · Parliament Station (200m) · 25 metre indoor · Tram Stop (200m) swimming pool · Outdoor tennis court · Steam and sauna rooms. -

Grand Slam Tennis Back at Melbourne Park

Monday, 8 February 2021 GRAND SLAM TENNIS BACK AT MELBOURNE PARK The Australian Open kicks off in Melbourne today, with strict public health directions in place across the Melbourne Park precinct to protect the efforts of Victorians to combat coronavirus. Minister for Tourism, Sport and Major Events Martin Pakula praised the ongoing work of Victorians to contain coronavirus, which has made it possible for the Grand Slam tournament to proceed. Melbourne Park is divided into three zones around Rod Laver Arena, Margaret Court Arena and John Cain Arena as part of rigorous infection prevention and control measures in place to ensure the safety of players, officials, and the broader Victorian community. Dedicated entry points will apply for each zone and no movement will be permitted between the zones. There will be a daily crowd capacity of 30,000 for the first eight days, with 25,000 per day from the quarter-finals and 12,500 in Rod Laver Arena for the final three days of the tournament. Over the two weeks of the event, this will equate to about half of the average attendance in the past three years. The Australian Open is a key pillar of Victoria’s major event program – last year it contributed an estimated $387 million to the state’s visitor economy. The Victorian Government has invested almost $1 billion over the past 10 years in upgrading and expanding Melbourne Park so that it can continue to host the Open until at least 2039. When completed in time for the 2023 Australian Open, the final stage in the Melbourne Park redevelopment will have created 2,300 full-time jobs through the Andrews Labor Government’s Local Jobs First Policy. -

Fight Tennis Uni Campus FORMER Premiers Jeff Fiona Hudson Kennett and John Cain Are Allies in a Bid to City Editor Block a Planned Univer- "It Is a Sporting Precinct

GRAND SLAM Ex-premiers fight tennis uni campus FORMER premiers Jeff Fiona Hudson Kennett and John Cain are allies in a bid to city editor block a planned univer- "It is a sporting precinct. sity campus with stu- I'd take some convincing dent housing at Mel- that to use it for education purposes is an appropriate bourne's tennis centre. use of the land," he said. The former foes both "To plonk a six or seven- want the State Govern- storey building there for ment to protect the sport- student accommodation ing precinct from the con- requires more investiga- troversial development. tion. I've got great reser- The Herald Sun has vations about the capacity learned Melbourne Park of education institutions chiefs are ready to call for to manage anything." expressions of interest from developers to build a Mr Kennett said a uni- university on land next to versity at Melbourne Park Vodafone Arena that is could endanger one of now used as a bus car park. Australia's greatest La Trobe University has sporting precincts. already drawn up plans for "It is not the place for a a $100 million campus, university. It should be including a six-storey, opposed and fought as 400-room accommodation strongly as possible," the tower for foreign students. former Liberal leader said. The project has split the "We don't need more 12-member Melbourne and accommodation. We have Olympic Parks Trust, our university and learn- which controls the land. ing precincts. Former Labor premier "This continual grab for Mr Cain, dubbed the fath- land and expansion is just er of the tennis centre, not warranted — and it's yesterday called for a full certainly not warranted investigation into any on that location." proposed development. -

Margaret Court Arena in Melbourne

Margaret Court Arena in Melbourne Margaret Court Arena is the third largest venue for Australian open. The Margaret Court Arena is the third and latest addition to the Melbourne Park. It is the third largest venue for the Australian Open, after the Rod Laver Arena and the Hisense Arena. It is famous for its retractable roof that opens and closes in 5 minutes- the fastest retractable roof in the world. Just before the 2003 Australian Open, the Margaret Court Arena was renamed after the famous Australian woman player, Margaret Court. Prior to this it was called ‘Show Court One’. Please take a look at the seating plan before booking your seats for the Australian Open. A 700 million dollar project was undertaken in 2010- the Melbourne Park masterplan- and the renovation of the MCA was carried out under this project. The court was then transformed into a multi purpose venue for sporting and entertainment events alike. Seating capacity too increased from 6000 to 7500. Entertainment at Margaret Court Arena : Margaret Court Arena with its intimate seat setting and variable seating capacity that can range from 5000 to 8000, has become hot favorite among musicians and music enthusiasts alike, as a venue for live music. Australian hip hop pioneers Hilltop Hoods, performed at the MCA as a part of their Cosby Sweater Tour. Sports at Margaret Court Arena: Tennis: Margaret Court Arena is known to offer one of the best tennis viewing experiences to spectators. When the Margaret Court Arena opens its grounds to Australian Open this year, the Melbourne Park will become the only Grand Slam Tennis venue to have three stadiums with retractable roofs.