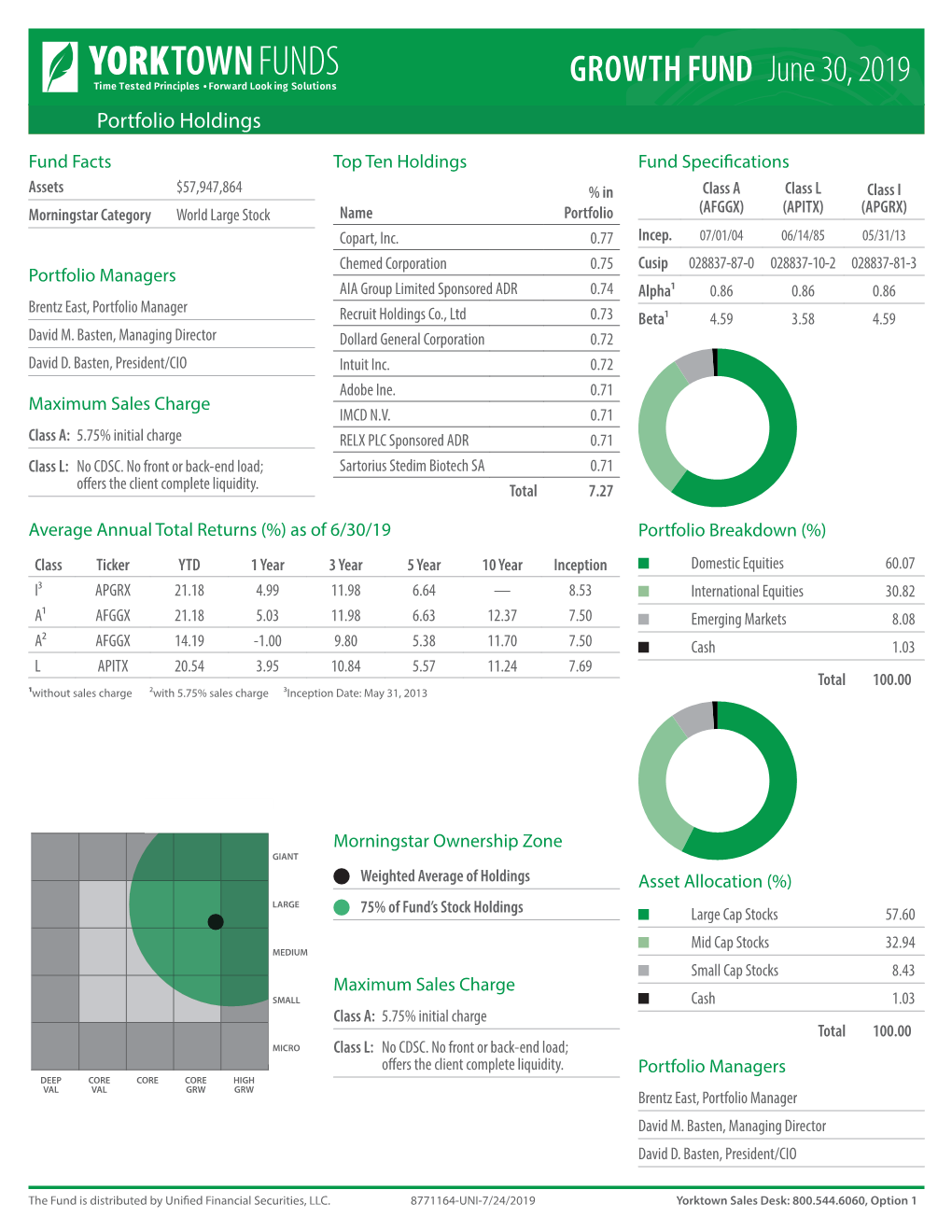

GROWTH FUND June 30, 2019 Time Tested Principles Forward Look Ing Solutions Portfolio Holdings

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

AUTOMOTIVE AFTERMARKET OUTLOOK and REFLECTIONS from OUR Nd 42 ANNUAL SYMPOSIUM October 29 – October 30, 2018

GAMCO Investors, Inc. November 21, 2018 One Corporate Center Rye, NY 10580-1435 Tel (914) 921-5150 www.gabelli.com AUTOMOTIVE AFTERMARKET OUTLOOK AND REFLECTIONS FROM OUR nd 42 ANNUAL SYMPOSIUM October 29 – October 30, 2018 PRESENTING COMPANIES 10/31/2018 10/31/2017 11/1/2016 Company Exchange Ticker Price (a) Price (a) Price (a) AutoZone, Inc NYSE AZO $ 733.47 $ 589.50 $ 734.45 Boyd Group Income Fund (b) TSX BYD.UN 120.31 96.10 81.17 BYD Company Ltd (c) SHE 002594 46.79 62.79 55.57 Cooper Tire & Rubber Co. NYSE CTB 30.89 32.80 35.10 Dana, Inc. " DAN 15.47 30.49 15.00 Donaldson Company, Inc " DCI 51.28 47.21 35.46 Gentex Corporation NASDAQ GNTX 21.05 19.04 15.96 Genuine Parts Co. NYSE GPC 97.92 88.23 86.43 Lear Corporation " LEA 132.90 175.59 121.30 Monro, Inc. NASDAQ MNRO 74.40 49.35 53.32 Motorcar Parts of America, Inc " MPAA 21.18 28.91 26.19 Navistar International Corp NYSE NAV 33.49 42.31 23.01 O'Reilly Automotive, Inc NASDAQ ORLY 320.75 210.95 264.24 Penske Automotive Group NYSE PAG 44.02 46.62 42.83 Rush Enterprises, Inc. NASDAQ RUSHB 35.95 47.59 24.77 Standard Motor Products, Inc NYSE SMP 53.90 43.67 46.88 Superior Industries International, Inc. " SUP 9.83 15.55 22.95 Tenneco, Inc. " TEN 34.43 58.11 56.06 US Auto Parts Network, Inc. NASDAQ PRTS 1.19 2.56 2.27 Veoneer, Inc. -

Solactive Global Semiconductor Leaders Index

Public Solactive Global Semiconductor Leaders Index Semiconductors – the heart of digitalization Platforms & Services Public Why semiconductors are the heart of digitalization May 2021 Semiconductor chips can be found in nearly every electronic product … … and form the nerve center of emerging technologies: Artificial 5G intelli- Internet of Augmented Cloud gence Things reality computing 2 Public We are at the beginning of a new computing age May 2021 Semiconductor chips Growth drivers of computing power over time, 1960–2020E control electrical currents to process, store and transfer data. Alongside tech giants such as Apple, Google and Amazon, however, semiconductor companies are often overlooked as their work is more “backstage.” Yet they are at least as important for the digital economy of the 21st century. Source: Morgan Stanley Research as of January 2021 3 Public The 450-billion-dollar industry May 2021 The growth story of the semiconductor industry is arousing significant interest among investors. Global semiconductor sales have grown more than twice as fast as global GDP historically, transforming the sector into the 450-billion-dollar industry it is today. Semiconductor industry: sales trend in billions of dollars Source: Bloomberg, International Data Corporation as of December 31, 2020 4 Public B2B clients bringing greater stability May 2021 The semiconductor industry Previously Today was seen as volatile and unprofitable until the 2010s. For a few years now, Diversified markets: cars, industrial facilities, Core market: consumer -

Ranking of Stocks by Market Capitalization(As of End of Apr.2014) 1St Section

Ranking of Stocks by Market Capitalization(As of End of Apr.2014) 1st Section Rank Code Issue Market Capitalization \100mil. 1 7203 TOYOTA MOTOR CORPORATION 190,191 2 9984 SoftBank Corp. 91,130 3 8306 Mitsubishi UFJ Financial Group,Inc. 76,769 4 9437 NTT DOCOMO,INC. 70,800 5 7267 HONDA MOTOR CO.,LTD. 61,226 6 8316 Sumitomo Mitsui Financial Group,Inc. 57,028 7 9433 KDDI CORPORATION 48,812 8 8411 Mizuho Financial Group,Inc. 48,527 9 2914 JAPAN TOBACCO INC. 44,746 10 6954 FANUC CORPORATION 44,069 11 7751 CANON INC. 42,880 12 9432 NIPPON TELEGRAPH AND TELEPHONE CORPORATION 41,418 13 6902 DENSO CORPORATION 41,126 14 7201 NISSAN MOTOR CO.,LTD. 39,646 15 4502 Takeda Pharmaceutical Company Limited 36,230 16 3382 Seven & I Holdings Co.,Ltd. 35,732 17 6501 Hitachi,Ltd. 35,139 18 9983 FAST RETAILING CO.,LTD. 33,699 19 8802 Mitsubishi Estate Company,Limited 32,173 20 8058 Mitsubishi Corporation 30,226 21 5108 BRIDGESTONE CORPORATION 29,759 22 9020 East Japan Railway Company 29,439 23 6752 Panasonic Corporation 27,449 24 8801 Mitsui Fudosan Co.,Ltd. 26,627 25 8031 MITSUI & CO.,LTD. 26,504 26 4503 Astellas Pharma Inc. 25,978 27 4063 Shin-Etsu Chemical Co.,Ltd. 25,917 28 9022 Central Japan Railway Company 25,832 29 5401 NIPPON STEEL & SUMITOMO METAL CORPORATION 25,468 30 4689 Yahoo Japan Corporation 25,285 31 6503 Mitsubishi Electric Corporation 24,971 32 6861 KEYENCE CORPORATION 23,946 33 8766 Tokio Marine Holdings,Inc. -

Annual Report November 30, 2019 Ticker Symbol: YCGEX

YCG ENHANCED FUND a series of the YCG Funds Annual Report November 30, 2019 Ticker Symbol: YCGEX Beginning on January 1, 2021, as permitted by regulations adopted by the SEC, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund (defined herein) or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Fund’s website ( www.ycgfunds.com ), and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 855-444-YCGF (855-444-9243) or by sending an e-mail request to [email protected] . You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can call 855-444-YCGF (855-444-9243) or send an e-mail request to [email protected] to let the Fund know you wish to continue receiving paper copies of your shareholder reports. -

MM .1.20 Clking

CL King Market Maker List AAXN Axon Enterprise, Inc. CROX Crocs, Inc. HELE Helen of Troy Limited MPAA Motorcar Parts of America, Inc. SBAC SBA Communications Corporation ADBE Adobe Inc. CSCO Cisco Systems, Inc. HIBB Hibbett Sports, Inc. MRVL Marvell Technology Group Ltd. SBUX Starbucks Corporation ADSK Autodesk, Inc. CSOD Cornerstone OnDemand, Inc. HLIT Harmonic Inc. MSFT Microsoft Corporation SCVL Shoe Carnival, Inc. ADTN ADTRAN, Inc. CTAS Cintas Corporation HSIC Henry Schein, Inc. MU Micron Technology, Inc. SGMS Scientific Games Corp AGNC AGNC Investment Corp. CTSH Cognizant Technology Solutions Corporation HSII Heidrick & Struggles International, Inc. NDLS Noodles & Company SHOO Steven Madden, Ltd. AIMC Altra Industrial Motion Corp. CVLT Commvault Systems, Inc. HSKA Heska Corporation NEOG Neogen Corporation SMPL The Simply Good Foods Company ALGT Allegiant Travel Company DAKT Daktronics, Inc. HSON Hudson Global, Inc. NLOK NortonLifeLock Inc. SMRT Stein Mart, Inc. AMZN Amazon.com, Inc. DECK Deckers Outdoor Corporation IART Integra LifeSciences Holdings Corporation NTUS Natus Medical Incorporated SMSI Smith Micro Software, Inc. ANDE The Andersons, Inc. DENN Denny's Corporation ICON Iconix Brand Group, Inc. ON ON Semiconductor Corporation SNBR Sleep Number Corporation ANGO AngioDynamics, Inc. DIOD Diodes Incorporated IDXX IDEXX Laboratories, Inc. OSUR OraSure Technologies, Inc. SQBG Sequential Brands Group, Inc. ANSS ANSYS, Inc. DISCA Discovery, Inc. ILMN Illumina, Inc. Holdings PACB Pacific Biosciences of California, Inc. SRDX Surmodics, Inc. AOBC American Outdoor Brands Corporation DISH DISH Network Corporation IMBI iMedia Brands, Inc. PATK Patrick Industries, Inc. STAF Staffing 360 Solutions, Inc. AOSL Alpha and Omega Semiconductor Limited DLTR Dollar Tree, Inc. IOSP Innospec Inc. PDCO Patterson Companies, Inc. -

Ranking of Stocks by Market Capitalization(As of End of Jan.2018)

Ranking of Stocks by Market Capitalization(As of End of Jan.2018) 1st Section Rank Code Issue Market Capitalization \100mil. 1 7203 TOYOTA MOTOR CORPORATION 244,072 2 8306 Mitsubishi UFJ Financial Group,Inc. 115,139 3 9437 NTT DOCOMO,INC. 105,463 4 9984 SoftBank Group Corp. 98,839 5 6861 KEYENCE CORPORATION 80,781 6 9432 NIPPON TELEGRAPH AND TELEPHONE CORPORATION 73,587 7 9433 KDDI CORPORATION 71,225 8 7267 HONDA MOTOR CO.,LTD. 69,305 9 8316 Sumitomo Mitsui Financial Group,Inc. 68,996 10 7974 Nintendo Co.,Ltd. 67,958 11 7182 JAPAN POST BANK Co.,Ltd. 66,285 12 6758 SONY CORPORATION 65,927 13 6954 FANUC CORPORATION 60,146 14 7751 CANON INC. 58,005 15 6902 DENSO CORPORATION 54,179 16 4063 Shin-Etsu Chemical Co.,Ltd. 53,624 17 8411 Mizuho Financial Group,Inc. 52,124 18 6594 NIDEC CORPORATION 52,025 19 9983 FAST RETAILING CO.,LTD. 51,647 20 4502 Takeda Pharmaceutical Company Limited 50,743 21 7201 NISSAN MOTOR CO.,LTD. 49,108 22 8058 Mitsubishi Corporation 48,497 23 2914 JAPAN TOBACCO INC. 48,159 24 6098 Recruit Holdings Co.,Ltd. 45,095 25 5108 BRIDGESTONE CORPORATION 43,143 26 6503 Mitsubishi Electric Corporation 42,782 27 9022 Central Japan Railway Company 42,539 28 6501 Hitachi,Ltd. 41,877 29 9020 East Japan Railway Company 41,824 30 6301 KOMATSU LTD. 41,162 31 3382 Seven & I Holdings Co.,Ltd. 39,765 32 6752 Panasonic Corporation 39,714 33 4661 ORIENTAL LAND CO.,LTD. 38,769 34 8766 Tokio Marine Holdings,Inc. -

Directory of Japanese Companies Located in Texas

Directory of Japanese Companies Located in Texas Consulate-General of Japan in Houston JETRO Houston 2020.12 Directory of Japanese Companies Located in Texas Inquiries All parties interested in companies included in this directory should contact those companies directly. For inquiries regarding this directory that are not related to specific companies, please contact the following: JETRO Houston [email protected] Despite our best efforts to provide up-to-date and accurate information in this brochure, the Consulate-General of Japan in Houston and the Japan External Trade Organization (JETRO) Houston decline any responsibility for inaccurate, incomplete, or outdated information that may be printed in this pamphlet, and expressly disclaim any liability for errors or omissions in its contents. The Consulate-General of Japan in Houston and JETRO Houston are not liable for any damages which may occur as a result of using this directory. Directory of Japanese Companies Located in Texas Greetings We would like to extend our congratulations on the publication of The appeal of Texas has grown more and more apparent to the Directory of Japanese Companies Located in Texas. Japan, as the state welcomes its companies and residents alike with open arms and a friendly “Howdy!” We would like Over the last few years, the number of Japanese companies in nothing more than to nurture those bonds of friendship. Texas has grown rapidly. The pace has been especially quick over the last 5 years, with an average annual growth rate of 8%. The This directory was created with the aim of further expanding total number of Japanese companies in Texas increased to a and deepening the partnership between Japanese and US record-high of 436, according to our own internal survey in 2019. -

Printmgr File

Portfolio of investments—September 30, 2020 (unaudited) Shares Value Common Stocks: 60.14% Communication Services: 6.52% Diversified Telecommunication Services: 1.00% AT&T Incorporated 11,482 $ 327,352 CenturyLink Incorporated 1,585 15,993 Verizon Communications Incorporated 6,652 395,727 739,072 Entertainment: 1.24% Activision Blizzard Incorporated 1,237 100,135 Electronic Arts Incorporated † 462 60,249 Live Nation Entertainment Incorporated † 227 12,231 Netflix Incorporated † 712 356,021 Take-Two Interactive Software Incorporated † 181 29,905 The Walt Disney Company 2,919 362,190 920,731 Interactive Media & Services: 3.33% Alphabet Incorporated Class A † 484 709,350 Alphabet Incorporated Class C † 473 695,121 Facebook Incorporated Class A † 3,889 1,018,529 TripAdvisor Incorporated 0 0 Twitter Incorporated † 1,269 56,471 2,479,471 Media: 0.81% Charter Communications Incorporated Class A † 240 149,842 Comcast Corporation Class A 7,297 337,559 Discovery Incorporated Class A † 257 5,595 Discovery Incorporated Class C † 495 9,702 DISH Network Corporation Class A † 396 11,496 Fox Corporation Class A 556 15,473 Fox Corporation Class B 253 7,076 Interpublic Group of Companies Incorporated 624 10,402 News Corporation Class A 623 8,734 News Corporation Class B 194 2,712 Omnicom Group Incorporated 343 16,979 ViacomCBS Incorporated Class B 901 25,237 600,807 Wireless Telecommunication Services: 0.14% T-Mobile US Incorporated † 933 106,698 Consumer Discretionary: 6.93% Auto Components: 0.07% Aptiv plc 435 39,881 BorgWarner Incorporated 331 12,823 52,704 Automobiles: 0.14% Ford Motor Company 6,277 41,805 General Motors Company 2,018 59,713 101,518 See accompanying notes to portfolio of investments. -

JPX-Nikkei Index 400 Constituents (Applied on August 31, 2021) Published on August 6, 2021 No

JPX-Nikkei Index 400 Constituents (applied on August 31, 2021) Published on August 6, 2021 No. of constituents : 400 (Note) The No. of constituents is subject to change due to de-listing. etc. (Note) As for the market division, "1"=1st section, "2"=2nd section, "M"=Mothers, "J"=JASDAQ. Code Market Divison Issue Code Market Divison Issue 1332 1 Nippon Suisan Kaisha,Ltd. 3048 1 BIC CAMERA INC. 1417 1 MIRAIT Holdings Corporation 3064 1 MonotaRO Co.,Ltd. 1605 1 INPEX CORPORATION 3088 1 Matsumotokiyoshi Holdings Co.,Ltd. 1719 1 HAZAMA ANDO CORPORATION 3092 1 ZOZO,Inc. 1720 1 TOKYU CONSTRUCTION CO., LTD. 3107 1 Daiwabo Holdings Co.,Ltd. 1721 1 COMSYS Holdings Corporation 3116 1 TOYOTA BOSHOKU CORPORATION 1766 1 TOKEN CORPORATION 3141 1 WELCIA HOLDINGS CO.,LTD. 1801 1 TAISEI CORPORATION 3148 1 CREATE SD HOLDINGS CO.,LTD. 1802 1 OBAYASHI CORPORATION 3167 1 TOKAI Holdings Corporation 1803 1 SHIMIZU CORPORATION 3231 1 Nomura Real Estate Holdings,Inc. 1808 1 HASEKO Corporation 3244 1 Samty Co.,Ltd. 1812 1 KAJIMA CORPORATION 3254 1 PRESSANCE CORPORATION 1820 1 Nishimatsu Construction Co.,Ltd. 3288 1 Open House Co.,Ltd. 1821 1 Sumitomo Mitsui Construction Co., Ltd. 3289 1 Tokyu Fudosan Holdings Corporation 1824 1 MAEDA CORPORATION 3291 1 Iida Group Holdings Co.,Ltd. 1860 1 TODA CORPORATION 3349 1 COSMOS Pharmaceutical Corporation 1861 1 Kumagai Gumi Co.,Ltd. 3360 1 SHIP HEALTHCARE HOLDINGS,INC. 1878 1 DAITO TRUST CONSTRUCTION CO.,LTD. 3382 1 Seven & I Holdings Co.,Ltd. 1881 1 NIPPO CORPORATION 3391 1 TSURUHA HOLDINGS INC. 1893 1 PENTA-OCEAN CONSTRUCTION CO.,LTD. -

Central San Diego Credit Tenant Net Leased Investment Opportunity

for sale central san diego credit tenant net leased investment opportunity 10655 Roselle Street SAN DIEGO, CA 92121 INVESTMENT HIGHLIGHTS THE TENANT • CREDIT SINGLE TENANT, NET-LEASED INVESTMENT OPPORTUNITY FILMETRICS • Leased thru 3/1/2024 w/ 3.5% annual escalations (one 3-year option @ FMV) • ± 22,275 SF HQ Creative Office Building • ± 39,204 SF Land Area THE WORLD’S SALES LEADER IN THIN-FILM THICKNESS MEASUREMENT • 60KW Solar Panels w/ Four EV Charging Stations Filmetrics, Inc., a KLA company, is a prime supplier of thin-film measurement and 3D optical surface profilers to • Retrofitted dimmable LED lighting throughout nearly every manufacturer of high-tech hardware in the world. 10655 Roselle Street is the headquarter location. Filmetrics operates six application labs in Los Angeles, Santa Clara, Rochester, Germany, South Korea and • Enclosed bicycle lockers and a shower for employees who bike to work Taiwan. • Ample parking KLA Corporation is a capital equipment company based in Milpitas, California. It supplies process control and • Central to Carmel Valley, Del Mar, UTC, Sorrento Mesa, Torrey Pines yield management systems for the semiconductor industry and other related nanoelectronics industries. The and La Jolla company’s products and services are intended for all phases of wafer, reticle, integrated circuit (IC) and packag- • Easy access to I-5, I-805 and CA 56 ing production, from research and development to final volume manufacturing. • Walk to Sorrento Valley Coaster Station KLA IS AN S&P 500 AND NASDAQ 100 COMPANY WITH A MARKET CAP OF OVER $27.8 BILLION. THEY HAVE OVER 10,000 EMPLOYEES AND REVENUES OVER $4 BILLION. -

Parnassus Mid Cap Growth Fund Commentary

Parnassus Mid Cap Growth Fund Commentary Second Quarter 2020 Ticker: Investor Shares - PARNX Ticker: Institutional Shares - PFPRX As of June 30, 2020, the net asset value (“NAV”) of the Parnassus Mid Cap Growth Fund – Investor Shares was $50.99, resulting in a gain of 25.78% for the second quarter. During the quarter, we transitioned the Fund from a multi cap strategy to a mid cap growth strategy. To reflect the new strategy, our benchmark changed from the S&P 500 Index (“S&P 500”) to the Russell Midcap Growth Index (“Russell Midcap Growth”). We completed the transition mid-quarter, and the Fund’s 25.78% return for the second quarter was between the Average Annual Total Returns (%)1 S&P 500’s return of 20.54% and the Russell Midcap Gross Net Growth’s return of 30.26%. The Fund was substantially 1Y 3Y 5Y 10Y Expense Expense Ratio Ratio ahead of the 21.12% increase for the Lipper Multi-Cap PARNX 9.23 7.88 8.65 13.73 0.84 0.84 Core Funds Average, which represents the average PFPRX 9.37 8.04 8.81 13.82 0.68 0.68 multi cap core funds followed by Lipper (“Lipper S&P 500 Average”). We anticipate that Lipper will eventually 7.51 10.73 10.73 13.99 — — Index change the Fund’s peer group to reflect the new Russell strategy. Midcap 11.91 14.76 11.60 15.09 — — Growth Index Lipper To the left is a table that summarizes the performance Multi-Cap 2.89 7.17 7.28 11.56 — — of the Parnassus Mid Cap Growth Fund, S&P 500, Core Funds Average Russell Midcap Growth and Lipper Average. -

Security Name Market Value Apple Inc. $669,723.81 Microsoft Corporation $541,938.38 Amazon.Com, Inc

Security Name Market Value Apple Inc. $669,723.81 Microsoft Corporation $541,938.38 Amazon.com, Inc. $428,460.13 Facebook, Inc. Class A $201,160.99 Alphabet Inc. Class A $197,390.94 Alphabet Inc. Class C $196,512.97 Taiwan Semiconductor Manufacturing Co., Ltd. $174,778.55 Tesla Inc $166,222.44 Tencent Holdings Ltd. $159,610.32 Alibaba Group Holding Ltd. $146,148.97 JPMorgan Chase & Co. $145,702.81 Johnson & Johnson $135,500.49 Visa Inc. Class A $116,713.66 Samsung Electronics Co., Ltd. $113,906.22 Walt Disney Company $111,149.66 NVIDIA Corporation $110,259.00 Berkshire Hathaway Inc. Class B $107,266.84 UnitedHealth Group Incorporated $102,365.05 Mastercard Incorporated Class A $102,242.62 Procter & Gamble Company $99,475.11 Nestle S.A. $98,369.12 Cisco Systems, Inc. $96,024.77 PayPal Holdings Inc $93,953.59 Home Depot, Inc. $90,337.09 Bank of America Corp $87,762.11 Intel Corporation $81,044.17 Verizon Communications Inc. $74,326.41 Comcast Corporation Class A $70,530.31 ASML Holding NV $70,329.61 Netflix, Inc. $69,655.14 Abbott Laboratories $68,944.36 Roche Holding Ltd $67,444.18 Costco Wholesale Corporation $66,473.37 Adobe Inc. $64,468.83 AT&T Inc. $64,336.45 Novartis AG $62,301.00 Pfizer Inc. $60,456.81 Merck & Co., Inc. $59,669.30 Daimler AG $59,376.56 Coca-Cola Company $58,504.71 Thermo Fisher Scientific Inc. $57,921.92 United Parcel Service, Inc. Class B $57,674.42 salesforce.com, inc.