Simon Property Group, Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Simon Property Group, Inc

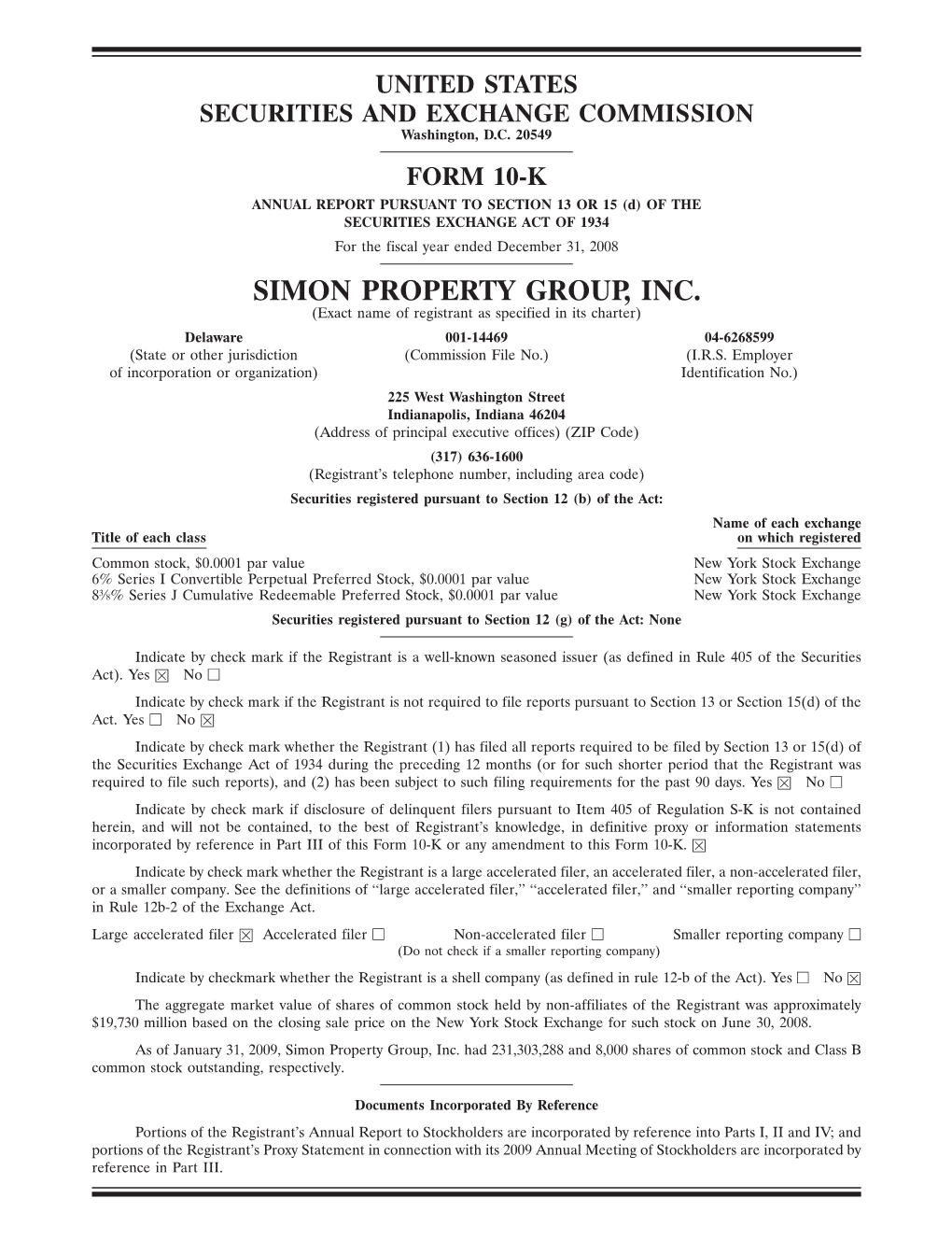

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2007 SIMON PROPERTY GROUP, INC. (Exact name of registrant as specified in its charter) Delaware 001-14469 04-6268599 (State or other jurisdiction of (Commission File No.) (I.R.S. Employer incorporation or organization) Identification No.) 225 West Washington Street Indianapolis, Indiana 46204 (Address of principal executive offices) (ZIP Code) (317) 636-1600 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12 (b) of the Act: Name of each exchange Title of each class on which registered Common stock, $0.0001 par value New York Stock Exchange 6% Series I Convertible Perpetual Preferred Stock, $0.0001 par value New York Stock Exchange 83⁄8% Series J Cumulative Redeemable Preferred Stock, $0.0001 par value New York Stock Exchange Securities registered pursuant to Section 12 (g) of the Act: None Indicate by check mark if the Registrant is a well-known seasoned issuer (as defined in Rule 405 of the Securities Act). Yes ፤ No អ Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes អ No ፤ Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Auburn (Worcester), Massachusetts Worcester the Heart of New England

BUSINESS CARD DIE AREA 225 West Washington Street Indianapolis, IN 46204 (317) 636-1600 simon.com Information as of 5/1/16 Simon is a global leader in retail real estate ownership, management and development and an S&P 100 company (Simon Property Group, NYSE:SPG). AUBURN (WORCESTER), MASSACHUSETTS WORCESTER THE HEART OF NEW ENGLAND Auburn Mall’s trade area includes Worcester, Massachusetts, the second largest city in New England. — Worcester marks the western edge of the Metro West/Boston market, and the trade area reaches south down to the Massachusetts-Connecticut line. — Auburn Mall enjoys suburban shoppers from a significant portion of Central Massachusetts. CULTURE MEETS COMMERCE — Higher education plays an important role in the Worcester community with its 16 colleges and universities including the highly ranked College of the Holy Cross, University of Massachusetts Medical School, Worcester Polytechnic Institute, Worcester State University, and Assumption College. — The Auburn Mall trade area displays the best of the city and country, from museums and mansions, to skiing and wildlife sanctuaries. Over 40 cultural organizations of every genre like the Worcester Art Museum, The American Antiquarian Society, and Worcester historical and concert venues including Mechanics Hall, Tuckerman Hall, Hanover Theatre, and the DCU Center are nearby. — Corporate headquarters in the area include Hanover Insurance Company–5,000 employees; UMass Memorial and UMass Memorial Medical Center–4,580 employees; Saint-Gobain Abrasives and Ceramic Materials–2,900 employees; Reliant Medical–2,500 employees; New England Financial–2,000 employees; Community Healthcare–1,950 employees; Mapfre Insurance–1,800 employees; and St. Vincent Hospital–1,250 employees. -

FY 2003) F275064 (FY 2004) F281187 (FY 2005) Promulgated: June 14, 2007

COMMONWEALTH OF MASSACHUSETTS APPELLATE TAX BOARD MAYFLOWER EMERALD SQUARE, LLC v. BOARD OF ASSESSORS OF THE TOWN OF NORTH ATTLEBOROUGH Docket Nos.: F265867 (FY 2002) F271250 (FY 2003) F275064 (FY 2004) F281187 (FY 2005) Promulgated: June 14, 2007 These are appeals filed under the formal procedure pursuant to G.L. c. 58A, § 7 and c. 59, §§ 64 and 65 from the refusal of the appellee to abate taxes on certain real estate in the Town of North Attleborough assessed under G.L. c. 59, §§ 11 and 38 for Fiscal Years 2002 through 2005, inclusive. Commissioner Gorton heard these appeals. With Commissioner Gorton materially participating in the deliberations of these appeals1, Chairman Hammond and Commissioners Scharaffa, Egan, Rose, and Mulhern joined in 1 On September 11, 2006, Commissioner Gorton was sworn as a temporary member of the Appellate Tax Board pursuant to G.L. c. 58A, § 1, his status as a member of the Board having terminated on that date with the appointment and qualification of his successor. See G.L. c. 30, § 8. As detailed later in these Findings of Fact and Report (“Findings”), Commissioner Gorton’s material participation in the deliberation of these appeals included, inter alia, drafting and distributing proposed Findings giving a detailed report on the evidence and his observations as to witness credibility. He also made oral presentations of his recommendations to the Board members. ATB 2007-421 the decision for the appellant and adopted the recommendations of the hearing officer. These findings of fact and report are made on the Appellate Tax Board’s (“Board’s”) own motion under G.L. -

Radio Shack Closing Locations

Radio Shack Closing Locations Address Address2 City State Zip Gadsden Mall Shop Ctr 1001 Rainbow Dr Ste 42b Gadsden AL 35901 John T Reid Pkwy Ste C 24765 John T Reid Pkwy #C Scottsboro AL 35768 1906 Glenn Blvd Sw #200 - Ft Payne AL 35968 3288 Bel Air Mall - Mobile AL 36606 2498 Government Blvd - Mobile AL 36606 Ambassador Plaza 312 Schillinger Rd Ste G Mobile AL 36608 3913 Airport Blvd - Mobile AL 36608 1097 Industrial Pkwy #A - Saraland AL 36571 2254 Bessemer Rd Ste 104 - Birmingham AL 35208 Festival Center 7001 Crestwood Blvd #116 Birmingham AL 35210 700 Quintard Mall Ste 20 - Oxford AL 36203 Legacy Marketplace Ste C 2785 Carl T Jones Dr Se Huntsville AL 35802 Jasper Mall 300 Hwy 78 E Ste 264 Jasper AL 35501 Centerpoint S C 2338 Center Point Rd Center Point AL 35215 Town Square S C 1652 Town Sq Shpg Ctr Sw Cullman AL 35055 Riverchase Galleria #292 2000 Riverchase Galleria Hoover AL 35244 Huntsville Commons 2250 Sparkman Dr Huntsville AL 35810 Leeds Village 8525 Whitfield Ave #121 Leeds AL 35094 760 Academy Dr Ste 104 - Bessemer AL 35022 2798 John Hawkins Pky 104 - Hoover AL 35244 University Mall 1701 Mcfarland Blvd #162 Tuscaloosa AL 35404 4618 Hwy 280 Ste 110 - Birmingham AL 35243 Calera Crossing 297 Supercenter Dr Calera AL 35040 Wildwood North Shop Ctr 220 State Farm Pkwy # B2 Birmingham AL 35209 Center Troy Shopping Ctr 1412 Hwy 231 South Troy AL 36081 965 Ann St - Montgomery AL 36107 3897 Eastern Blvd - Montgomery AL 36116 Premier Place 1931 Cobbs Ford Rd Prattville AL 36066 2516 Berryhill Rd - Montgomery AL 36117 2017 280 Bypass -

Where Brands & Communities Come Together

WHERE BRANDS & COMMUNITIES COME TOGETHER 2b SM SM SM SM 2013 ANNUAL REPORT PAGE ii PAGE v PAGE viii FROM THE FINANCIAL INVESTMENT CHAIRMAN & CEO HIGHLIGHTS HIGHLIGHTS PAGE xi PAGE xii PAGE 1 SUSTAINABILITY BOARD OF 10-K HIGHLIGHTS DIRECTORS AND MANAGEMENT PAGE 46 Management’s Discussion & Analysis PAGE 66 Financial Statements Simon Property Group, Inc. (NYSE: SPG) is an S&P100 company and a leader in the global retail real estate industry. SCALE LARGEST GLOBAL OWNER OF RETAIL REAL ESTATE QUALITY ICONIC, IRREPLACEABLE PROPERTIES IN GREAT LOCATIONS INVESTMENT ACTIVE PORTFOLIO MANAGEMENT INCREASES PRODUCTIVITY AND RETURNS GROWTH CORE BUSINESS AND STRATEGIC ACQUISITIONS DRIVE PERFORMANCE EXPERIENCE DECADES OF EXPERTISE IN DEVELOPMENT, OWNERSHIP, MANAGEMENT ii iii FROM THE CHAIRMAN & CEO Dear Fellow Stockholders, First and foremost, if I may, let me start by thanking my colleagues for delivering a record-breaking year to you, our stockholders. From our maintenance and management staff to our leasing and development personnel at headquarters and all in between, everyone did their part in delivering these impressive results. The quality of the people at Simon Property Group (“SPG”) and, of course, our properties combined to generate record-setting results. Our funds from operations (“FFO”) increased from a strong 2012 by 10.9% to $8.85 per share. Since the great recession, the growth per share of FFO has totaled 76%. We increased our dividend for 2013 by 13.4% to a total of $4.65 per common share, an increase of 79% since the great recession, and with the recent increase in the first quarter of 2014 to $1.25 per share we are now on track to pay $5.00 per share this year. -

International Visitor Handbook Cummings School of Veterinary Medicine Tufts University

International Visitor Handbook Cummings School of Veterinary Medicine Tufts University 200 Westboro Road, North Grafton, MA 01536 International Visitor Handbook 1 This page intentionally left blank. International Visitor Handbook 2 Welcome Message from the Dean Dear Visitor, I am delighted that you have decided to visit the Cummings School of Veterinary Medicine at Tufts University. We are committed to making your experience a positive one. The Cummings School is proud to be a leader in global One Health and values its many partnerships with veterinary, medical, public health and environmental colleagues around the world. We feel that international visitors enrich the educational experience of our academic community, increase our global awareness, and provide valuable cross-cultural interactions. We are committed to expanding our perspectives on global One Health in order to enhance the health and well-being of animals, humans and the environment worldwide. I encourage you to take advantage of all we offer; attend campus events, meet new people, ask questions and, if time permits, explore the surrounding cities both near and far: Worcester, Boston, New York City, Washington D.C. and Providence. We are pleased that you will be joining us and look forward to welcoming you to Cummings School. Sincerely, Deborah T. Kochevar, DVM, PhD Dean and Henry and Lois Foster Professor Cummings School of Veterinary Medicine International Visitor Handbook 3 This page intentionally left blank. International Visitor Handbook 4 Table of Contents INTRODUCTION -

Major Shopping Center Locator

Major Shopping Center Locator Rhose Island Mall Latitude: 41.72024 650 Bald Hill Rd, Warwick, Rhode Island, 02886 Longitude: -71.4836 Ring: 60 mile radius Source: Directory of Major Malls, Inc. Total Major Shopping Centers 104 Total GLA 46,257,794 Total Stores 4,142 Distance from site Year GLA in Major Shopping Center Name and Address in miles Open square feet Type and Number of Stores Rhode Island Mall 0.18 E 1967 579,499 Rts. 113 & 2 Warwick, RI 02886 Enclosed, 102 Stores Anchors: Sears, Walmart, Kohl©s Warwick Mall 0.48 NE 1970 1,000,000 Rts. 2 & 5 Warwick, RI 02886 Enclosed, 90 Stores Anchors: Macy©s, JCPenney, Target, Old Navy The Greenwood Shops 0.99 E 2006 247,934 Route 113 @ Route 5 Warwick, RI 02886 N/A, 20 Stores Anchors: Lowe©s, Super Stop & Shop Warwick Shopping Center 1.59 S 200,000 Bald Hill Rd. (Rte. 2) & Centerville Rd. (Rte Warwick, RI 02889 N/A, 11 Stores Anchors: Vacant, Bob©s Discount Furniture, Michaels, Jo-Ann Fabrics & Craft Leviton Place 2.00 E 2014 305,000 Jefferson Blvd. & Airport Connector Warwick, RI 02886 N/A, 0 Stores Anchors: None Chapel View 2.78 NE 2006 460,000 Rte. 2 & Sockanosett Cross Rd. Cranston, RI 02920 N/A, 26 Stores Anchors: Shaw©s Garden City Center 3.06 NE 1949 500,000 Rte. 2 (New London Ave.) & Sockanossett Cross Cranston, RI 02920 N/A, 65 Stores Anchors: Whole Foods Market, Vacant, Vacant 2, Of®ceMax The Centre of New England 5.18 SW 2004 1,087,130 New London Turnpike Coventry, RI 02893 Enclosed, 20 Stores Anchors: Walmart Supercenter, Home Depot, BJ©s Wholesale Club Data Note: n/a means data was not reported. -

Solomon Pond Mall: a Simon Mall

BUSINESS CARD DIE AREA 225 West Washington Street Indianapolis, IN 46204 (317) 636-1600 simon.com Information as of 5/1/16 Simon is a global leader in retail real estate ownership, management and development and an S&P 100 company (Simon Property Group, NYSE:SPG). MARLBOROUGH (BOSTON), MASSACHUSETTS HIGH TECH MEETS HIGH FASHION Located in the suburban Boston town of Marlborough, Massachusetts, Solomon Pond Mall attracts shoppers from the Worcester/Metro West and Boston markets, which has a combined population of five million people. — Business thrives in the area, with a well-educated population and several life-sciences and biotechnology headquarters. Just minutes from the center, corporate parks along I-495 contribute to the significant daytime office traffic. — Residential property in the area is primarily affluent, suburban homes. The area also features several country clubs. — Nine Worcester colleges, with a combined enrollment of approximately 36,000 undergraduate and graduate students, are located within a 15-minute drive to the mall. — Marlborough has the largest number of hotel rooms in the Metro West. Its 1,660 hotel rooms translates to 545,360 room nights available in hotels such as Hilton Garden Inn, Marriott Courtyard and Residence Inn, Embassy Suites, and Best Western Royal Plaza Hotel and Trade Center. THE BUSINESS OF BUSINESS Marlborough boasts a flourishing business community. — Several prominent biotechnology and life sciences companies have been locating or relocating their corporate headquarters in Marlborough. These companies include Boston Scientific, CeQur, GE Healthcare Life Sciences, Hologic, LFB USA, New England Crogenic Center, Quest Diagnostic, Whole Foods Market, and Wind River Environmental. -

Wrentham, Massachusetts

WRENTHAM, MASSACHUSETTS PROPERTY OVERVIEW WRENTHAM VILLAGE PREMIUM OUTLETS® WRENTHAM, MA MAJOR METROPOLITAN AREAS SELECT TENANTS Boston: 30 miles north Saks Fifth Avenue OFF 5TH, Barneys New York Warehouse, Mass Turnpike Providence, RI: 20 miles south Bloomingdale’s - The Outlet Store, 7 For All Mankind, AllSaints, Armani, Banana Republic Factory Store, Burberry, Burton, Coach, RETAIL Elie Tahari Outlet, Gap Factory Store, HUGO BOSS, Karen Millen, kate spade new york, Kenneth Cole Company Store, LACOSTE Outlet, GLA (sq. ft.) 660,000; 170 stores Michael Kors Outlet, Movado Company Store, NikeFactoryStore, Polo Ralph Lauren Factory Store, Reebok, Restoration Hardware, Salvatore Ferragamo, Swarovski, Theory, Tommy Hilfiger Company Store, OPENING DATES Tory Burch, Under Armour, Vince. Opened 1997 Expanded 1998, 1999, 2000 TOURISM / TRAFFIC WRENTHAM VILLAGE Wrentham enjoys close proximity to the city of Boston, the state capital PARKING RATIO PREMIUM OUTLETS of Massachusetts. Boston is the regional home of many federal agencies WRENTHAM, MA 6.1:1 as well as being an international and regional financial hub. Boston is also the home of world-renown medical and research facilities. Boston is one of the most economically powerful cities in the world with a $365 billion RADIUS POPULATION economy, the 6th largest in the U.S. and 12th in the world. Boston is home 15 miles: 817,336 to 350,000 college students from around the world. Over 21 million 30 miles: 4,370,044 tourists visit Boston annually, including 1.4 million international tourists 45 miles: 6,324,056 (excluding Canadian and Mexican tourists) spending an estimated $10 billion. AVERAGE HH INCOME LOCATION / DIRECTIONS 30 miles: $94,137 Intersection of I-495 and Rte. -

Merrimack, New Hampshire

MERRIMACK, NEW HAMPSHIRE PROPERTY OVERVIEW MERRIMACK PREMIUM OUTLETS® MERRIMACK, NH 95 Manchester MAJOR METROPOLITAN AREA SELECT TENANTS 93 Merrimack Manchester: 9 miles north Saks Fifth Avenue OFF 5TH, Bloomingdale’s - The Outlet Store, NEW HAMPSHIRE Nashua Nashua: 10 miles south American Eagle Outfitters, Banana Republic Factory Store, Calvin Klein 3 Boston, MA: 35 miles south MASSACHUSETTS Company Store, Coach, Cole Haan Outlet, Columbia Sportswear, Gap 3 Industrial Dr Exit 10 Continental Blvd. Outlet, GUESS Factory, J.Crew Factory, LOFT, Michael Kors Outlet, . RETAIL Nike Factory Store, Polo Ralph Lauren Factory Store, Tommy Hilfiger 495 Company Store, Under Armour, vineyard vines Tpke. 190 GLA (sq. ft.) 409,000; 100 stores F. E. Everett Boston TOURISM / TRAFFIC 90 OPENING DATE 290 Centrally located in southern New Hampshire, the center is 30 miles MERRIMACK Opened 2012 north of Boston, the eighth largest DMA in the country. New Hampshire PREMIUM OUTLETS Atlantic Ocean is a sought after shopping destination since it has no sales tax and is MERRIMACK, NH RADIUS POPULATION surrounded by other states that have high sales tax. Daily travel of the F.E. Everett Turnpike is estimated by the state to be 61,200 vehicles. 15 miles: 579,854 Many tourists are drawn to the area to visit New Hampshire’s natural 30 miles: 1,808,485 tourist attractions including fall foliage, world-class skiing in the White 45 miles: 4,956,980 Mountains, and the over 143 lakes in the Lakes Region. Locals from New Hampshire and Massachusetts account for 60% of the shopper base; tourists from Canada make up as much as 25% of the shoppers; and AVERAGE HH INCOME the remaining 15% are international travelers visiting seasonally and as 30 miles: $98,695 currency values fluctuate. -

United States Securities and Exchange Commission Washington, D.C

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-Q QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15 (D) OF THE SECURITIES EXCHANGE ACT OF 1934 For the quarterly period ended June 30, 1999 SIMON PROPERTY GROUP, INC. SPG REALTY CONSULTANTS, INC. -------------------------- ---------------------------- (Exact name of registrant as (Exact name of registrant as specified in its charter) specified in its charter) Delaware Delaware -------- -------- (State of incorporation (State of incorporation or organization) or organization) 001-14469 001-14469-01 --------- ------------ (Commission File No.) (Commission File No.) 046268599 13-2838638 --------- ---------- (I.R.S. Employer Identification No.) (I.R.S. Employer Identification No.) National City Center National City Center 115 West Washington Street, 115 West Washington Street, Suite 15 East Suite 15 East Indianapolis, Indiana 46204 Indianapolis, Indiana 46204 --------------------------- --------------------------- (Address of principal (Address of principal executive offices) executive offices) (317) 636-1600 (317) 636-1600 -------------- -------------- (Registrant's telephone number, (Registrant's telephone number, including area code) including area code) Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES [X] NO [ ] As of August 7, 1999, 170,276,561 shares of common stock, par value $0.0001 per share, 3,200,000 shares of Class B common stock, par value $0.0001 per share, and 4,000 shares of Class C common stock, par value $0.0001 per share of Simon Property Group, Inc. -

Securities and Exchange Commission Form 8-K

QuickLinks -- Click here to rapidly navigate through this document SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 8-K CURRENT REPORT Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 Date of Report (Date of earliest event reported): February 5, 2004 SIMON PROPERTY GROUP, INC. (Exact name of registrant as specified in its charter) Delaware 001-14469 046268599 (State or other jurisdiction (Commission (IRS Employer of incorporation) File Number) Identification No.) 115 WEST WASHINGTON STREET 46204 INDIANAPOLIS, INDIANA (Zip Code) (Address of principal executive offices) Registrant's telephone number, including area code: 317.636.1600 Not Applicable (Former name or former address, if changed since last report) Item 7. Financial Statements and Exhibits Financial Statements: None Exhibits: Page Number in Exhibit No. Description This Filing 99.1 Supplemental Information as of December 31, 2003 5 99.2 Earnings Release for the quarter ended December 31, 2003 52 Item 9. Regulation FD Disclosure On February 6, 2004, the Registrant made available additional ownership and operation information concerning the Registrant, Simon Property Group, L.P., and properties owned or managed as of December 31, 2003, in the form of a Supplemental Information package, a copy of which is included as an exhibit to this filing. The Supplemental Information package is also available upon request as specified therein. Item 12. Results of Operation and Financial Condition On February 5, 2004, the Registrant issued a press release containing information on earnings for the quarter ended December 31, 2003 and other matters. A copy of the press release is included as an exhibit to this filing.