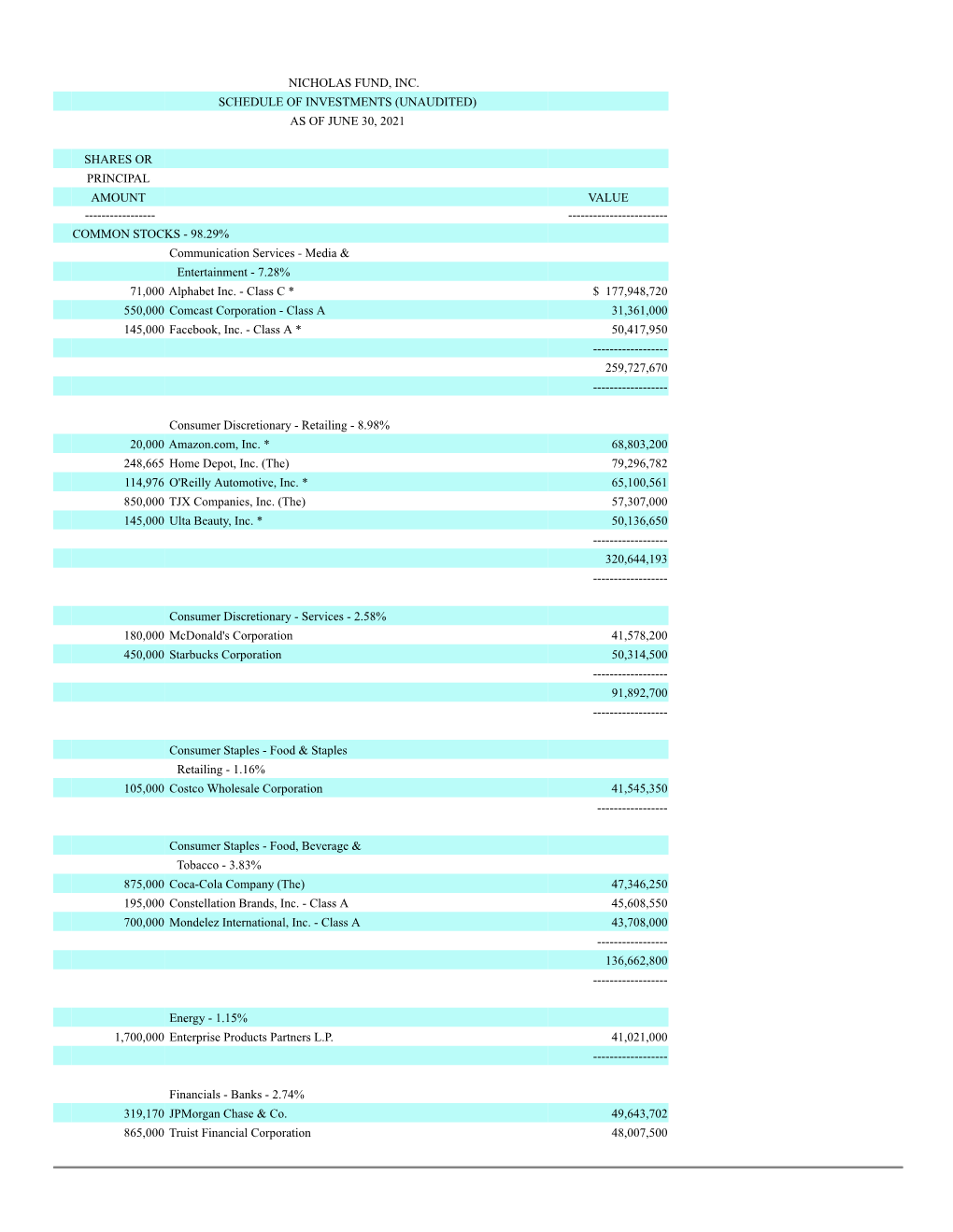

Nicholas Fund, Inc. Schedule of Investments (Unaudited) As of June 30, 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

AUTOMOTIVE AFTERMARKET OUTLOOK and REFLECTIONS from OUR Nd 42 ANNUAL SYMPOSIUM October 29 – October 30, 2018

GAMCO Investors, Inc. November 21, 2018 One Corporate Center Rye, NY 10580-1435 Tel (914) 921-5150 www.gabelli.com AUTOMOTIVE AFTERMARKET OUTLOOK AND REFLECTIONS FROM OUR nd 42 ANNUAL SYMPOSIUM October 29 – October 30, 2018 PRESENTING COMPANIES 10/31/2018 10/31/2017 11/1/2016 Company Exchange Ticker Price (a) Price (a) Price (a) AutoZone, Inc NYSE AZO $ 733.47 $ 589.50 $ 734.45 Boyd Group Income Fund (b) TSX BYD.UN 120.31 96.10 81.17 BYD Company Ltd (c) SHE 002594 46.79 62.79 55.57 Cooper Tire & Rubber Co. NYSE CTB 30.89 32.80 35.10 Dana, Inc. " DAN 15.47 30.49 15.00 Donaldson Company, Inc " DCI 51.28 47.21 35.46 Gentex Corporation NASDAQ GNTX 21.05 19.04 15.96 Genuine Parts Co. NYSE GPC 97.92 88.23 86.43 Lear Corporation " LEA 132.90 175.59 121.30 Monro, Inc. NASDAQ MNRO 74.40 49.35 53.32 Motorcar Parts of America, Inc " MPAA 21.18 28.91 26.19 Navistar International Corp NYSE NAV 33.49 42.31 23.01 O'Reilly Automotive, Inc NASDAQ ORLY 320.75 210.95 264.24 Penske Automotive Group NYSE PAG 44.02 46.62 42.83 Rush Enterprises, Inc. NASDAQ RUSHB 35.95 47.59 24.77 Standard Motor Products, Inc NYSE SMP 53.90 43.67 46.88 Superior Industries International, Inc. " SUP 9.83 15.55 22.95 Tenneco, Inc. " TEN 34.43 58.11 56.06 US Auto Parts Network, Inc. NASDAQ PRTS 1.19 2.56 2.27 Veoneer, Inc. -

Annual Report November 30, 2019 Ticker Symbol: YCGEX

YCG ENHANCED FUND a series of the YCG Funds Annual Report November 30, 2019 Ticker Symbol: YCGEX Beginning on January 1, 2021, as permitted by regulations adopted by the SEC, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund (defined herein) or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Fund’s website ( www.ycgfunds.com ), and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 855-444-YCGF (855-444-9243) or by sending an e-mail request to [email protected] . You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can call 855-444-YCGF (855-444-9243) or send an e-mail request to [email protected] to let the Fund know you wish to continue receiving paper copies of your shareholder reports. -

2003 - 2019 Top 200 Employers for CPT Students**

2003 - 2019 Top 200 Employers for CPT Students** **If a student is employed at the same Employer while in a different program, he/she will be counted multiple times for that employer. Top 200 Employer Names Number of Students Participating in CPT in 2003-2019 Amazon 9,302 Intel Corporation 6,453 Microsoft Corporation 6,340 Google 6,132 IBM 4,721 Deloitte 3,870 Facebook 3,810 Qualcomm Technologies, Inc 3,371 Ernst & Young 2,929 Goldman Sachs 2,867 Cummins 2,729 JP Morgan Chase 2,474 PricewaterhouseCoopers 2,295 Bank of America 2,241 Apple, Inc 2,229 Cisco System, Inc 2,133 Disney 2,041 Morgan Stanley 1,970 World Bank 1,956 Citigroup 1,904 Merrill Lynch 1,850 KPMG 1,464 Dell, Inc 1,448 Yahoo 1,403 Motorola 1,357 Tesla, Inc 1,314 eBay or PayPal 1,268 Kelly Services 1,195 EMC Corporation 1,119 NVIDIA Corporation 1,110 Walmart 1,108 Samsung Research America 1,102 Ericsson, Inc 1,100 Adobe Systems Incorporated 1,085 PRO Unlimited 1,042 Texas Instruments 1,022 Credit Suisse 1017 Barclays 970 Randstad 942 Sony 930 Schlumberger 928 McKinsey & Company 883 2003 - 2019 Top 200 Employers for CPT Students** **If a student is employed at the same Employer while in a different program, he/she will be counted multiple times for that employer. VMWare 868 Adecco 845 Philips 829 Deutsche Bank 797 Broadcom Corporation 791 HP, Inc 789 Oracle 789 Advanced Micro Devices, Inc 782 Micron Technology, Inc 775 Boston Consulting Group 755 CVS Pharmacy 741 Robert Bosch LLC 723 Bloomberg 711 State Street 705 Hewlett-Packard 702 Alcatel-Lucent 666 Oak Ridge Institute for Science and Education 662 Genentech 657 Symantec Corporation 657 Nokia 642 Aerotek, Inc 638 Los Alamos National Laboratory 638 LinkedIn 635 Tekmark Global Solutions LLC 634 Populus Group 624 Salesforce 623 SAP America, Inc 619 Juniper Network 609 Atrium 584 The Mathworks, Inc 582 Monsanto 581 Wayfair 580 Autodesk 571 Intuit 562 Wells Fargo 559 Synopsys, Inc 546 NEC Laboratories America, Inc. -

Graham & Doddsville

Page 2 Welcome to Graham & Doddsville We are pleased to bring ing, and management you the 41th edition of quality and capital allo- Graham & Doddsville. This cation. Mr. Kidd discuss- student-led investment es his early experiences publication of Columbia with the semiconductor Business School (CBS) is industry, which shaped co-sponsored by the Heil- his unique and successful brunn Center for Graham long-term approach to & Dodd Investing and the investing. Columbia Student Invest- ment Management Asso- We continue to bring you Meredith Trivedi, Man- ciation (CSIMA). stock pitches from cur- aging Director of the Heil- rent CBS students. In brunn Center. Meredith We first interviewed Ar- this issue, we feature leads the Center, cultivat- thur Young, portfolio three contest-winning ing strong relationships manager and co-founder pitches. Amitaabh Sahai with some of the world´s of Tensile Capital Manage- ('21) shares his long idea most experienced value ment. We discussed Mr. on DXC Technology investors and creating numerous learning oppor- Young’s investing princi- (DXC). Will Husic (‘22), tunities for students inter- ples and founding of Ten- Harrison Liftman (‘22), ested in value investing. sile, his approach to gen- and Cathy Yao (‘22) eralist value investing, share their buy thesis on idea generation, and Ten- Live Nation (LYV) as an sile’s unique blend of pub- attractive covid-19 re- lic and private investing. covery idea. Finally, Na- Mr. Young also shares his than Shapiro ('22), Le- views on the attractive vente Merczel ('22), Kyle aspects of investing in Heck ('22), Kirk Mahoney software businesses. ('22), and Vineet Ahuja ('21) share their long Next, we interviewed thesis on RealPage (RP). -

Mainstay Mackay S&P 500 Index Fund Annual Report

MainStay MacKay S&P 500 Index Fund Message from the President and Annual Report October 31, 2020 Beginning on January 1, 2021, paper copies of each MainStay Fund’s annual and semiannual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from MainStay Funds or from your financial intermediary. Instead, the reports will be made available on the MainStay Funds’website.Youwillbe notified by mail and provided with a website address to access the report each time a new report is posted to the website. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. At any time, you may elect to receive reports and other communications from MainStay Funds electronically by calling toll-free 800-624-6782, by sending an e-mail to [email protected], or by contacting your financial intermediary. You may elect to receive all future shareholder reports in paper form free of charge. If you hold shares of a MainStay Fund directly, you can inform MainStay Funds that you wish to receive paper copies of reports by calling toll-free 800-624-6782 or by sending an e-mail to [email protected]. If you hold shares of a MainStay Fund through a financial intermediary, please contact the financial intermediary to make this election. Your election to receive reports in paper form will apply to all MainStay Funds in which you are invested and may apply to all funds held with your financial intermediary. -

Quarterly Portfolio Holdings

T. Rowe Price Extended Equity Market Index Fund PEXMX 06/30/2021 (Unaudited) Portfolio of Investments Investments in Securities Coupon % Maturity Shares/Par Value ($) % of Net Assets 10X Genomics 13,000 2,545,660 0.183% 1-800-Flowers.com 7,768 247,566 0.018% 1Life Healthcare 14,500 479,370 0.034% 1st Source 8,652 401,972 0.029% 22nd Century 46,800 216,684 0.016% 2U 13,500 562,545 0.040% 3D Systems 26,350 1,053,210 0.076% 8x8 19,600 544,096 0.039% AAON 6,690 418,727 0.030% Aaron s 7,567 242,068 0.017% Abercrombie & Fitch 14,500 673,235 0.048% ABM Industries 11,150 494,503 0.035% Abraxas Petroleum 15,382 49,684 0.004% Acadia Healthcare 16,900 1,060,475 0.076% ACADIA Pharmaceuticals 25,800 629,262 0.045% Acadia Realty Trust, REIT 16,650 365,634 0.026% Acceleron Pharma 9,500 1,192,155 0.086% Acco Brands 21,900 188,997 0.014% AcelRx Pharmaceuticals 95,700 132,066 0.009% ACI Worldwide 20,300 753,942 0.054% Aclaris Therapeutics 25,400 446,024 0.032% ACM Research 2,800 286,216 0.021% ACRES Commercial Realty, REIT 15,332 246,232 0.018% Acuity Brands 6,300 1,178,289 0.085% Acushnet Holdings 7,475 369,265 0.026% Adamas Pharmaceuticals 33,700 177,936 0.013% Adams Resources & Energy 3,341 92,512 0.007% AdaptHealth 12,200 334,402 0.024% Adaptive Biotechnologies 15,500 633,330 0.045% Addus HomeCare 2,300 200,652 0.014% Adient 18,000 813,600 0.058% ADT 29,300 316,147 0.023% Adtalem Global Education 12,200 434,808 0.031% Advanced Drainage Systems 8,791 1,024,767 0.074% Advanced Energy Industries 5,750 648,083 0.047% Adverum Biotechnologies 46,900 164,150 -

Usaa Fund Holdings Usaa Nasdaq-100 Index Fund

USAA FUND HOLDINGS As of June 30, 2021 USAA NASDAQ-100 INDEX FUND CUSIP TICKER SECURITY NAME SHARES/PAR/CONTRACTS MARKET VALUE 00507V109 ATVI ACTIVISION BLIZZARD INC 229,531.00 21,906,438.64 00724F101 ADBE ADOBE INC 141,201.00 82,692,953.64 007903107 AMD ADVANCED MICRO DEVICES 358,915.00 33,712,885.95 015351109 ALXN ALEXION PHARMACEUTICALS 65,289.00 11,994,242.19 016255101 ALGN ALIGN TECHNOLOGY INC 23,377.00 14,283,347.00 02079K107 GOOG ALPHABET INC - CLASS C 62,814.00 157,431,984.48 02079K305 GOOGL ALPHABET INC - CLASS A 58,382.00 142,556,583.78 023135106 AMZN AMAZON.COM, INC. 97,900.00 336,791,664.00 025537101 AEP AEP CO., INC. 147,626.00 12,487,683.34 031162100 AMGN AMGEN, INC. 169,722.00 41,369,737.50 032654105 ADI ANALOG DEVICES, INC. 108,951.00 18,757,004.16 03662Q105 ANSS ANSYS INC 25,745.00 8,935,059.70 037833100 AAPL APPLE, INC. 3,239,420.00 443,670,963.20 038222105 AMAT APPLIED MATERIALS, INC. 269,988.00 38,446,291.20 052769106 ADSK AUTODESK, INC. 65,007.00 18,975,543.30 053015103 ADP AUTOMATIC DATA PROCESSING 125,698.00 24,966,136.76 056752108 BIDU BAIDU INC 76,539.00 15,606,302.10 09062X103 BIIB BIOGEN INC 44,474.00 15,400,011.98 09857L108 BKNG BOOKING HOLDINGS INC 12,127.00 26,534,967.43 11135F101 AVGO BROADCOM INC 120,612.00 57,512,626.08 12514G108 CDW CDW CORP OF DELAWARE 41,416.00 7,233,304.40 126408103 CSX CSX CORP. -

MS Information Technology and Management Internships 2016 – 2017 Academic Year

The University of Texas at Dallas 800 W. Campbell Road, SM 33 Richardson, TX 75080 972-883-2085 jindal.utdallas.edu/msitm MS Information Technology and Management Internships 2016 – 2017 Academic Year Fall Spring Summer 16 – 17 Total 2016 2017 2017 Number of Internships 223 170 293 686 Average Hourly Salary $20.24 $18.70 $20.16 $18.92 Average Number of 38 37 38 38 Hours per Week % of Internships in Texas 65% 75% 57% 64% % of Internships outside Texas 35% 25% 43% 36% Organization Name Internship Title A & A Marketing Group Marketing Analyst Intern A & A Marketing Group Marketing Analyst Intern A10 Networks Intern Product Marketing AARP PRI Applied Research Intern II - Applied Research Data Analytics AbbVie Inc. IT/Software Database – Graduate level Intern Academic Partnerships Data Science and Analytics Intern ADP Fall 2016 Internship - Major Account Services, Data Science ADT Security Services IT Business Analyst Intern Advanced Business Intelligence and Data Science Analytics Analytics Advanced Components Internship - Digital Analytics Intern Advanced Medical Technologies Business analyst Aerotek Intern Aerotek Intern Aerotek QA Data Integrity Intern Airbnb Software Engineer Intern Airbus Helicopters Business Development Intern Alacriti Sr. Java Developer Alcatel−Lucent USA Inc. Business Analyst for Partners − Co−Op Alliance Data Global Audit Intern Ally Clinical Diagnostics Business Intelligence Intern Amazon LLC Business Intelligence Engineer Intern American Airlines Senior Analyst Data Management and Reporting American Family Insurance R3814: Information (Data) Quality Student Intern American Medical Association Data Analytics Intern American Medical Association Data Analytics Intern American Medical Association Data Analytics Intern Amna Paryani CPA P.C Accounting Intern Amphora, Inc. -

Forward P/E for S&P 500 Companies (Sorted High to Low) APA Apache

Forward P/E for S&P 500 Companies (sorted High to Low) APA Apache 301.2 NEE Nextera Energy 25.5 WMB Williams Companies 20.2 MCHP Microchip Technology 15.7 IP International Paper 11.7 NBL Noble Energy 283.6 CHD Church & Dwight 25.4 STZ Constellation Brands 20.2 GLW Corning 15.7 KR Kroger 11.7 HES Hess 245.6 SPGI S&P Global 25.2 WYNN Wynn Resorts 20.1 UNH UnitedHealth 15.7 HCA HCA Healthcare 11.7 AIV Apartment Investment & Mgt 144.8 RSG Republic Services 25.1 MDLZ Mondelez 20.1 DE Deere & Co 15.6 BK Bank of New York Mellon 11.6 SBAC SBA Communications 112.9 INFO IHS Markit 24.9 QCOM Qualcomm 20.0 NOC Northrop Grumman 15.6 STX Seagate Technology 11.6 UDR UDR 110.5 FAST Fastenal 24.9 EMR Emerson Electric Co 19.9 CNP CenterPoint Energy 15.6 PRGO Perrigo 11.5 PEAK Healthpeak Properties 96.6 VMC Vulcan Materials 24.9 FLS Flowserve 19.8 DVN Devon Energy 15.5 STT State Street 11.5 DLR Digital Realty Trust 77.1 SHW Sherwin‐Williams 24.7 JBHT J B Hunt Transport Services 19.8 GIS General Mills 15.5 CE Celanese 11.5 MAC Macerich 72.4 TTWO Take‐Two Interactive Software 24.7 AAPL Apple 19.7 UPS United Parcel Service 15.4 RJF Raymond James Financial 11.4 EQIX Equinix 70.6 APD Air Products and Chemicals 24.7 KMI Kinder Morgan 19.7 ETN Eatonoration 15.3 CNC Centene 11.4 AMZN Amazon.com 65.7 DHR Danaher 24.7 SO Southern Co 19.7 AMCR Amcor 15.3 ABC AmerisourceBergen 11.3 MKTX Marketaxess 62.3 GOOGL Alphabet 24.5 LEG Leggett & Platt 19.5 HAL Halliburton 15.3 IPG Interpublic Group of Companies 11.2 SLG SL Green Realty 60.8 ACN Accenture PLC 24.5 KSU Kansas -

Fund Holdings As of 06/30/2021 Massmutual Blue Chip Growth Fund T

Fund Holdings As of 06/30/2021 MassMutual Blue Chip Growth Fund T. Rowe Price | Loomis Sayles Prior to 5/1/2021, the Fund name was MassMutual Select Blue Chip Growth Fund. Fund Shares or Par Position Market Security Name Ticker CUSIP Weighting (%) Amount Value ($) Amazon.com Inc AMZN 023135106 9.19 121,040 416,396,966 Facebook Inc Class A FB 30303M102 7.08 922,947 320,917,901 Alphabet Inc Class C GOOG 02079K107 5.35 96,724 242,421,296 Microsoft Corp MSFT 594918104 5.19 868,620 235,309,158 Visa Inc Class A V 92826C839 4.20 814,608 190,471,643 NVIDIA Corp NVDA 67066G104 3.69 208,867 167,114,487 Salesforce.com Inc CRM 79466L302 2.63 487,958 119,193,501 Alphabet Inc Class A GOOGL 02079K305 2.48 45,998 112,317,456 Apple Inc AAPL 037833100 2.45 810,745 111,039,635 Alibaba Group Holding Ltd ADR BABA 01609W102 2.22 443,540 100,586,001 Boeing Co BA 097023105 1.97 372,842 89,318,030 Autodesk Inc ADSK 052769106 1.97 305,694 89,232,079 Oracle Corp ORCL 68389X105 1.79 1,040,455 80,989,017 Deere & Co DE 244199105 1.79 229,470 80,936,364 The Walt Disney Co DIS 254687106 1.52 393,009 69,079,192 Intuit Inc INTU 461202103 1.51 139,527 68,391,950 PayPal Holdings Inc PYPL 70450Y103 1.46 226,624 66,056,364 Intuitive Surgical Inc ISRG 46120E602 1.43 70,664 64,985,441 Monster Beverage Corp MNST 61174X109 1.40 693,644 63,364,379 Novartis AG ADR NVS 66987V109 1.32 656,056 59,858,549 Illumina Inc ILMN 452327109 1.17 111,761 52,886,423 ServiceNow Inc NOW 81762P102 1.16 95,683 52,582,593 Starbucks Corp SBUX 855244109 1.15 464,789 51,968,058 Expeditors International -

PORTFOLIO of INVESTMENTS CTIVP® – Morgan Stanley Advantage Fund, March 31, 2021 (Unaudited) (Percentages Represent Value of Investments Compared to Net Assets)

PORTFOLIO OF INVESTMENTS CTIVP® – Morgan Stanley Advantage Fund, March 31, 2021 (Unaudited) (Percentages represent value of investments compared to net assets) Investments in securities Common Stocks 96.5% Common Stocks (continued) Issuer Shares Value ($) Issuer Shares Value ($) Communication Services 22.7% Financials 1.9% Entertainment 6.4% Capital Markets 1.9% Activision Blizzard, Inc. 359,640 33,446,520 Intercontinental Exchange, Inc. 122,891 13,724,467 (a) Spotify Technology SA 276,623 74,121,133 S&P Global, Inc. 68,633 24,218,526 (a) Take-Two Interactive Software, Inc. 107,857 19,058,332 Total 37,942,993 Total 126,625,985 Total Financials 37,942,993 Interactive Media & Services 16.3% Health Care 14.1% (a) Facebook, Inc., Class A 234,280 69,002,488 Health Care Equipment & Supplies 6.1% (a) IAC/InterActiveCorp 324,346 70,159,283 Danaher Corp. 96,321 21,679,931 (a) Match Group, Inc. 231,613 31,818,994 Intuitive Surgical, Inc.(a) 135,695 100,270,463 (a) Twitter, Inc. 2,012,287 128,041,822 Total 121,950,394 ZoomInfo Technologies, Inc., Class A(a) 534,575 26,140,718 Health Care Technology 4.9% Total 325,163,305 Veeva Systems Inc., Class A(a) 371,669 97,094,810 Total Communication Services 451,789,290 Pharmaceuticals 3.1% Consumer Discretionary 9.8% Royalty Pharma PLC, Class A 930,093 40,570,656 Internet & Direct Marketing Retail 8.9% Zoetis, Inc. 132,741 20,904,053 Amazon.com, Inc.(a) 34,845 107,813,218 Total 61,474,709 Chewy, Inc., Class A(a) 521,171 44,148,395 Total Health Care 280,519,913 Farfetch Ltd., Class A(a) 478,801 25,386,029 Industrials 3.3% Total 177,347,642 Aerospace & Defense 2.3% Textiles, Apparel & Luxury Goods 0.9% HEICO Corp., Class A 407,352 46,275,187 lululemon athletica, Inc.(a) 60,708 18,619,751 Industrial Conglomerates 1.0% Total Consumer Discretionary 195,967,393 Roper Technologies, Inc. -

381 Internships 261 Employers

MS Information Technology and Management Internships 2020-2021 381 Internships 261 Employers Fall 2020 Summer 2021 123 Internships 101 Internships Average Salary – 22.51 Average Salary – 26.98 Spring 2021 157 Internships Average Salary – 22.80 Company Title 3S Business Corporation SAP Consultant 7-Eleven Inc (Irving TX) Intern ACORD Junior Business Analyst Intern ActiveReservoir Software Development Intern Advanced Micro Devices Intern Advanced Micro Devices Intern Advanced Technology Consulting Service Inc. Data Analyst Intern Aezion Inc. Business Analyst Agile Directive Business Intelligence Developer Agile Directive Business Intelligence Developer AIM7 Data Scientist Allegiant Air Internship Alliance Data Global Audit Intern Alliance Data Intern, IT Compliance Analyst Amata Green, LLC Data Analyst Intern Amazon Data Engineer Intern Amazon.com Services LLC Data Engineer Intern Amdocs Inc Performance engineering Expert American College of Emergency Physicians IT, Big Data, Analytics, Scripting, Invoicing Intern AmerisourceBergen Data Analyst Amgen Graduate Intern - Business Analyst AmplifAI Solutions, Inc. Product Analyst Intern Anthem, Inc. Business Analyst Intern Apilation.ai Data Analyst Intern Apilation.ai Data Analyst Intern Apple Apple Cloud Services (ACS) Engineering Intern Applied Concepts, Inc. Internship - IT Applied Concepts, Inc. Internship - IT Applied Concepts, Inc. Internship - IT Applied Concepts, Inc. Internship - IT Applied Concepts, Inc. Internship - IT Applied Concepts, Inc. Internship - IT Programmer-Analyst Applines