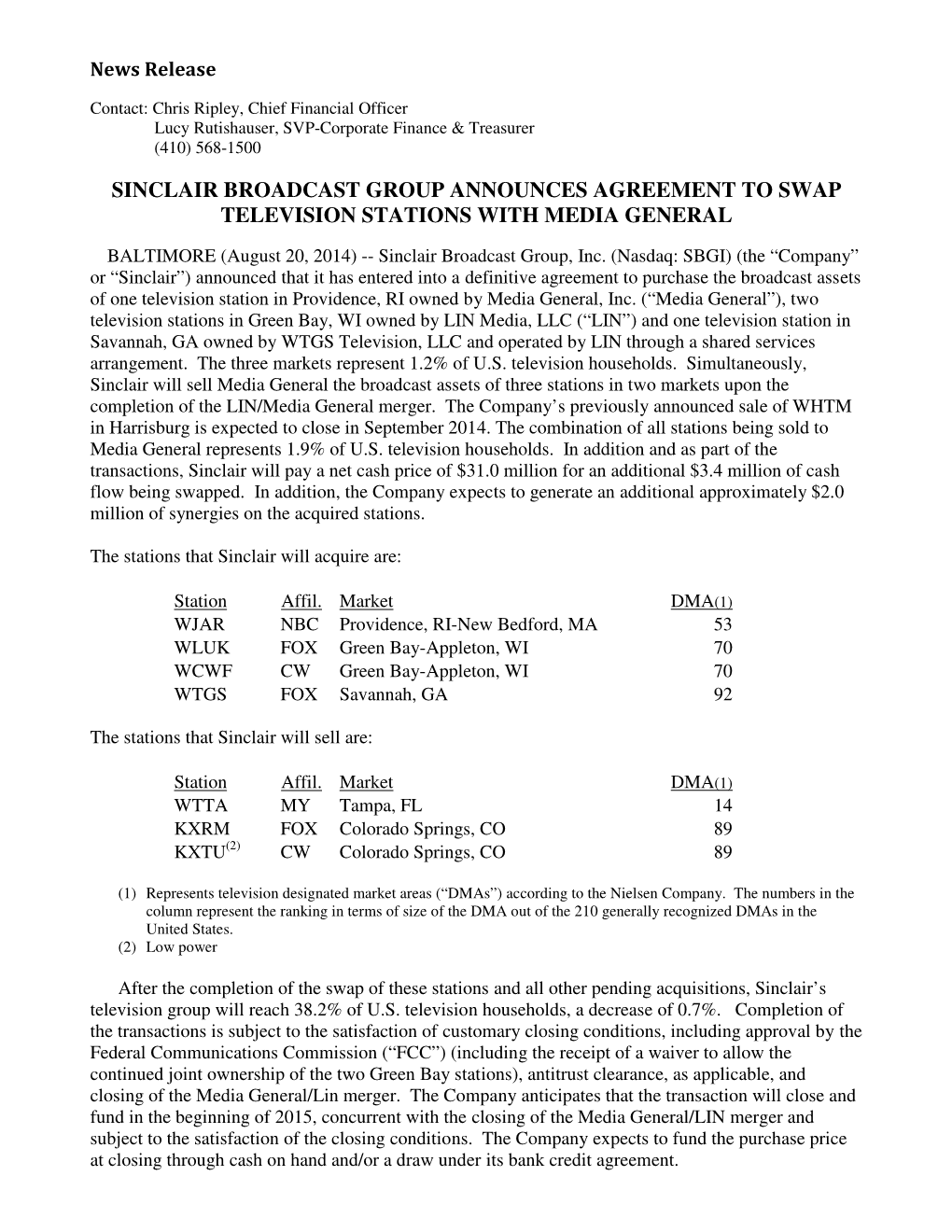

Swaps Press Release

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

PAINT V Eterans!

----————— ----—'--} n P ------- Radio Program Automobiles Automotive Automotive Bus. Services Employment Rentals SATURDAY, MAY 23 (Central and Eastern Standard Time) (Daylight Saving Time One Hour Later) / 15 Garages & Serv. Stations 27 Heating, Plumbing 35 Help Wanted—Male 65 Houses Note: All programs to key and basic,chains or groups thereof unless speci- fied; coast to coast (c to c) designation includes all available stations. Roofing lubrication. Texas Serv- WANTED—School Boys who are FURNISHED COTTAGE. 524 West Stations reserve to WASHING, right chafcge programs without previous notice. P. M. Browns- Used Cars ice Station. 14th and Elizaebth, RIDLEY'S PLUMBING and Tin Qowin school for routes in St. Charles. Apply on premise* (RED) NETWORK cent. East. Dependable ville. Write The Circulation Dept., ^■IBC-WEAF phone 1177. W-33 Shop, phone 161. All work guar- ®fc6IC — East; weaf wlw weel wtl<? 2:30— 3:30—Portland Isle of Dreams The Brownsville Herald. W-75 67 Room and Board 3:00— 4:00—The anteed. U-28 wjar wtag wcsh kyw whio wfbr wrc Captivators Orchest. KEYS MADE—Automobile electrical 3:15— 4:15—Tom wgy wben wcae wtam wwj wsai; Mid: Broadhurst’s Story 1933 Chevrolet 4-door and 3:30— Sedan..$395.00 service, brake Landreth’s, ROOMING — Brownsville Sheet 38 Wanted— ROOM BOARD, reasonable! ksd wrr.aq well who wow wdaf 4:30—Melodies from Motor City lining. Help 4:00— 5:00—Frederic Wm. Talk 1030 Levee. V-75 Phone 289. 8th meals family style. Mr* Hol- MIDWEST—wood wire Wile, 0 Metal Works. Male or Female 4:15— 5:15—Parade of Youth — Glen — wood NORTHWEST «. -

Nexstar Broadcasting Group, Inc. Annual Report 2018

Nexstar Broadcasting Group, Inc. Annual Report 2018 Form 10-K (NASDAQ:NXST) Published: March 1st, 2018 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549 FORM 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 for the fiscal year ended December 31, 2017 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 for the transition period from to . Commission File Number: 000-50478 NEXSTAR MEDIA GROUP, INC. (Exact Name of Registrant as Specified in Its Charter) Delaware 23-3083125 (State of Organization or Incorporation) (I.R.S. Employer Identification No.) 545 E. John Carpenter Freeway, Suite 700, Irving, Texas 75062 (Address of Principal Executive Offices) (Zip Code) (972) 373-8800 (Registrant’s Telephone Number, Including Area Code) Securities Registered Pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Class A Common Stock, $0.01 par value per share NASDAQ Global Select Market Securities Registered Pursuant to Section 12(g) of the Act: None Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒ Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that it was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

As of November 27, 2019 Full Interim Station List Lineup America's Thanksgiving Parade® Presented by Art Van Thursday, November 28, 2019

Media Matters Group 28411 Northwestern Hwy, Ste. 175 Southfield, MI. 48034 (248)353-6627 Phone (248)353-6668 Fax As of November 27, 2019 Full Interim Station List Lineup America's Thanksgiving Parade® presented by Art Van Thursday, November 28, 2019 Rank Station Affiliation Ch. City Day Date Time 6 KOFY IND 20.1 San Franciso-Oakland-San Jose TBA 7 WJAL IND 68.1 Washington, DC (Hagerstown) TBA 8 KUBE IND 57.1 Houston TBA WATC Thu 28-Nov 3pm-4pm 10 IND 46.1 Atlanta Thu 30-Nov 2pm-3pm 11 KAZT IND 7.1 Phoenix (Prescott) Thu 28-Nov 8am-9am 12 WTTA MY 38.1 Tampa-St. Petersburg-Sarasota Thu 28-Nov 10am-11am 14 WDIV NBC 4.1 Detroit Thu 28-Nov 9am-12n 15 KSTP ABC 5.1 Minneapolis-St. Paul TBA 16 WPLG ABC 10.1 Miami-Ft. Lauderdale TBA 17 KMGH ABC 7.1 Denver TBA 19 WEWS ABC 5.1 Cleveland-Akron-Canton Sun 1-Dec 5-6pm 20 KOVR CBS 13.1 Sacramento-Stockton-Modesto TBA 21 WBTV CBS 3.1 Charlotte Thu 28-Nov 1230pm-130pm 22 KATU ABC 2.1 Portland TBA 23 KDNL ABC 31.1 St. Louis TBA 24 WTAE ABC 4.1 Pittsburgh TBA 25 WNDY MY 23.1 Indianapolis TBA 26 WNUV CW 54.1 Baltimore Sat 30-Nov 1pm-2pm 27 WLFL CW 22.1 Raleigh-Durham-Fayetteville TBA 28 WTVF CBS 5.1 Nashville TBA 29 KGTV ABC 10.1 San Diego Thu 28-Nov 11am-12pm 28-Nov 4pm-5pm 30 KUCW CW 30.1 Salt Lake City TBA 31 KSAT ABC 12.1 San Antonio Thu 28-Nov 9am-10am 32 KMCI IND 41.1 Kansas City TBA 34 WCMH NBC 4.1 Columbus, OH TBA 35 WISN ABC 12.1 Milwaukee TBA 36 WTCN MY 43.2 West Palm Beach TBA 38 WMYA MY 28.1 Greenville-Spartanburg-Asheville Sun 1-Dec 1pm-2pm 39 KVCW CW 33.2 Las Vegas Sun 1-Dec 6pm-7pm Sun 15-Dec 4pm-5pm 40 KVUE ABC 33.1 Austin TBA 41 WJXT IND 42.1 Jacksonville Thu 28-Nov 9am-12n 42 WVEC ABC 13.1 Norfolk-Portsmouth-Newport News Thu 28-Nov 10am-11am 43 KTUL ABC 10.1 Oklahoma City TBA 45 WOOD/WOTV ABC 41.1 Grand Rapids-Kalamzoo-Battle Creek Thu 28-Nov 9am-12n 46 KRQE FOX 13.2 Albuquerque-Santa Fe TBA 48 WMYO MY 58.1 Louisville TBA 49 WCWG CW 20.1 Greenboro-High Point-Winston Salem TBA 50 WHNO IND 20.1 New Orleans TBA 52 WLNO CW 23.1 Buffalo TBA 53 WXCW CW 45.2 Ft. -

Retrans Blackouts 2010-2018

Retransmission Consent Blackouts 2010-2018 OWNER OF DATES OF BLACKOUT STATION(S) BLACKED MVPD DMA NAME(S) NETWORKS DOWN State OUT 6/12/16-9/5/16 Tribune Broadcasting DISH National WGN - 2/3/17 Denali Media DIRECTV AncHorage, AK CBS AK 9/21/17 Denali Media DIRECTV AncHorage, AK CBS AK 9/21/17 Denali Media DIRECTV Juneau-Stika, AK CBS, NBC AK General CoMMunication 12/5/17 Vision Alaska Inc. Juneau, AK ABC AK 3/4/16-3/10/16 Univision U-Verse Fort SMitH, AK KXUN AK 3/4/16-3/10/16 Univision U-Verse Little Rock-Pine Bluff, AK KLRA AK 1/2/2015-1/16/2015 Vision Alaska II DISH Fairbanks, AK ABC AK 1/2/2015-1/16/2015 Coastal Television DISH AncHorage, AK FOX AK AncHorage, AK; Fairbanks, AK; 1/5/2013-1/7/2013 Vision Alaska DIRECTV Juneau, AK ABC AK 1/5/2013-1/7/2013 Vision Alaska DIRECTV Fairbanks, AK ABC AK 1/5/2013-1/7/2013 Vision Alaska DIRECTV Juneau, AK ABC AK 3/13/2013- 4/2/2013 Vision Alaska DIRECTV AncHorage, AK ABC AK 3/13/2013- 4/2/2013 Vision Alaska DIRECTV Fairbanks, AK ABC AK 3/13/2013- 4/2/2013 Vision Alaska DIRECTV Juneau, AK ABC AK 1/23/2018-2/2/2018 Lockwood Broadcasting DISH Huntsville-Decatur, AL CW AL SagaMoreHill 5/22/18 Broadcasting DISH MontgoMery AL ABC AL 1/1/17-1/7/17 Hearst AT&T BirMingHaM, AL NBC AL BirMingHaM (Anniston and 3/3/17-4/26/17 Hearst DISH Tuscaloosa) NBC AL 3/16/17-3/27/17 RaycoM U-Verse BirMingHaM, AL FOX AL 3/16/17-3/27/17 RaycoM U-Verse Huntsville-Decatur, AL NBC AL 3/16/17-3/27/17 RaycoM U-Verse MontgoMery-SelMa, AL NBC AL Retransmission Consent Blackouts 2010-2018 6/12/16-9/5/16 Tribune Broadcasting DISH -

Acquisition of Tribune Media Company

Acquisition of Tribune Media Company Enhancing Nexstar’s Position as North America’s Leading Local Media Company December 3, 2018 Disclaimer Forward-Looking Statements This Presentation includes forward-looking statements. We have based these forward-looking statements on our current expectations and projections about future events. Forward-looking statements include information preceded by, followed by, or that includes the words "guidance," "believes," "expects," "anticipates," "could," or similar expressions. For these statements, Nexstar Media and Tribune Media claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. The forward-looking statements contained in this presentation, concerning, among other things, the ultimate outcome, benefits and cost savings of any possible transaction between Nexstar Media and Tribune Media and timing thereof, and future financial performance, including changes in net revenue, cash flow and operating expenses, involve risks and uncertainties, and are subject to change based on various important factors, including the timing of and any potential delay in consummating the proposed transaction; the risk that a condition to closing of the proposed transaction may not be satisfied and the transaction may not close; the risk that a regulatory approval that may be required for the proposed transaction is delayed, is not obtained or is obtained subject to conditions that are not anticipated, the risk of the occurrence of any -

Nexstar Media Group Stations(1)

Nexstar Media Group Stations(1) Full Full Full Market Power Primary Market Power Primary Market Power Primary Rank Market Stations Affiliation Rank Market Stations Affiliation Rank Market Stations Affiliation 2 Los Angeles, CA KTLA The CW 57 Mobile, AL WKRG CBS 111 Springfield, MA WWLP NBC 3 Chicago, IL WGN Independent WFNA The CW 112 Lansing, MI WLAJ ABC 4 Philadelphia, PA WPHL MNTV 59 Albany, NY WTEN ABC WLNS CBS 5 Dallas, TX KDAF The CW WXXA FOX 113 Sioux Falls, SD KELO CBS 6 San Francisco, CA KRON MNTV 60 Wilkes Barre, PA WBRE NBC KDLO CBS 7 DC/Hagerstown, WDVM(2) Independent WYOU CBS KPLO CBS MD WDCW The CW 61 Knoxville, TN WATE ABC 114 Tyler-Longview, TX KETK NBC 8 Houston, TX KIAH The CW 62 Little Rock, AR KARK NBC KFXK FOX 12 Tampa, FL WFLA NBC KARZ MNTV 115 Youngstown, OH WYTV ABC WTTA MNTV KLRT FOX WKBN CBS 13 Seattle, WA KCPQ(3) FOX KASN The CW 120 Peoria, IL WMBD CBS KZJO MNTV 63 Dayton, OH WDTN NBC WYZZ FOX 17 Denver, CO KDVR FOX WBDT The CW 123 Lafayette, LA KLFY CBS KWGN The CW 66 Honolulu, HI KHON FOX 125 Bakersfield, CA KGET NBC KFCT FOX KHAW FOX 129 La Crosse, WI WLAX FOX 19 Cleveland, OH WJW FOX KAII FOX WEUX FOX 20 Sacramento, CA KTXL FOX KGMD MNTV 130 Columbus, GA WRBL CBS 22 Portland, OR KOIN CBS KGMV MNTV 132 Amarillo, TX KAMR NBC KRCW The CW KHII MNTV KCIT FOX 23 St. Louis, MO KPLR The CW 67 Green Bay, WI WFRV CBS 138 Rockford, IL WQRF FOX KTVI FOX 68 Des Moines, IA WHO NBC WTVO ABC 25 Indianapolis, IN WTTV CBS 69 Roanoke, VA WFXR FOX 140 Monroe, AR KARD FOX WTTK CBS WWCW The CW WXIN FOX KTVE NBC 72 Wichita, KS -

Station ID Time Zone Long Name FCC Code 10021 Eastern D.S. AMC AMC 10035 Eastern D.S

Furnace IPTV Media System: EPG Support For Furnace customers who are subscribed to a Haivision support program, Haivision provides Electronic Program Guide (EPG) services for the following channels. If you need additional EPG channel support, please contact [email protected]. Station ID Time Zone Long Name FCC Code Station ID Time Zone Long Name FCC Code 10021 Eastern D.S. AMC AMC 10035 Eastern D.S. A & E Network AETV 10051 Eastern D.S. BET BET 10057 Eastern D.S. Bravo BRAVO 10084 Eastern D.S. CBC CBC 10093 Eastern D.S. ABC Family ABCF 10138 Eastern D.S. Country Music Television CMTV 10139 Eastern D.S. CNBC CNBC 10142 Eastern D.S. Cable News Network CNN 10145 Eastern D.S. HLN (Formerly Headline News) HLN 10146 Eastern D.S. CNN International CNNI 10149 Eastern D.S. Comedy Central COMEDY 10153 Eastern D.S. truTV TRUTV 10161 Eastern D.S. CSPAN CSPAN 10162 Eastern D.S. CSPAN2 CSPAN2 10171 Eastern D.S. Disney Channel DISN 10178 Eastern D.S. Encore ENCORE 10179 Eastern D.S. ESPN ESPN 10183 Eastern D.S. Eternal Word Television Network EWTN 10188 Eastern D.S. FamilyNet FAMNET 10222 Eastern D.S. Galavision Cable Network GALA 10240 Eastern D.S. HBO HBO 10243 Eastern D.S. HBO Signature HBOSIG 10244 Pacific D.S. HBO (Pacific) HBOP 10262 Central D.S. Fox Sports Southwest (Main Feed) FSS 10269 Eastern D.S. Home Shopping Network HSN 10309 Pacific D.S. KABC ABC7 KABC 10317 Pacific D.S. KINC KINC 10328 Central D.S. KARE KARE 10330 Central D.S. -

2019 Annual Report

A TEAM 2019 ANNU AL RE P ORT Letter to our Shareholders Sinclair Broadcast Group, Inc. Dear Fellow Shareholders, BOARD OF DIRECTORS CORPORATE OFFICERS ANNUAL MEETING David D. Smith David D. Smith The Annual Meeting of stockholders When I wrote you last year, I expressed my sincere optimism for the future of our Company as we sought to redefine the role of a Chairman of the Board, Executive Chairman will be held at Sinclair Broadcast broadcaster in the 21st Century. Thanks to a number of strategic acquisitions and initiatives, we have achieved even greater success Executive Chairman Group’s corporate offices, in 2019 and transitioned to a more diversified media company. Our Company has never been in a better position to continue to Frederick G. Smith 10706 Beaver Dam Road grow and capitalize on an evolving media marketplace. Our achievements in 2019, not just for our bottom line, but also our strategic Frederick G. Smith Vice President Hunt Valley, MD 21030 positioning for the future, solidify our commitment to diversify and grow. As the new decade ushers in technology that continues to Vice President Thursday, June 4, 2020 at 10:00am. revolutionize how we experience live television, engage with consumers, and advance our content offerings, Sinclair is strategically J. Duncan Smith poised to capitalize on these inevitable changes. From our local news to our sports divisions, all supported by our dedicated and J. Duncan Smith Vice President INDEPENDENT REGISTERED PUBLIC innovative employees and executive leadership team, we have assembled not only a winning culture but ‘A Winning Team’ that will Vice President, Secretary ACCOUNTING FIRM serve us well for years to come. -

The Impact of Corporate Newsroom Culture on News Workers & Community Reporting

Portland State University PDXScholar Dissertations and Theses Dissertations and Theses Spring 6-5-2018 News Work: the Impact of Corporate Newsroom Culture on News Workers & Community Reporting Carey Lynne Higgins-Dobney Portland State University Follow this and additional works at: https://pdxscholar.library.pdx.edu/open_access_etds Part of the Broadcast and Video Studies Commons, Journalism Studies Commons, and the Mass Communication Commons Let us know how access to this document benefits ou.y Recommended Citation Higgins-Dobney, Carey Lynne, "News Work: the Impact of Corporate Newsroom Culture on News Workers & Community Reporting" (2018). Dissertations and Theses. Paper 4410. https://doi.org/10.15760/etd.6307 This Dissertation is brought to you for free and open access. It has been accepted for inclusion in Dissertations and Theses by an authorized administrator of PDXScholar. Please contact us if we can make this document more accessible: [email protected]. News Work: The Impact of Corporate Newsroom Culture on News Workers & Community Reporting by Carey Lynne Higgins-Dobney A dissertation submitted in partial fulfillment of the requirements for the degree of Doctor of Philosophy in Urban Studies Dissertation Committee: Gerald Sussman, Chair Greg Schrock Priya Kapoor José Padín Portland State University 2018 © 2018 Carey Lynne Higgins-Dobney News Work i Abstract By virtue of their broadcast licenses, local television stations in the United States are bound to serve in the public interest of their community audiences. As federal regulations of those stations loosen and fewer owners increase their holdings across the country, however, local community needs are subjugated by corporate fiduciary responsibilities. Business practices reveal rampant consolidation of ownership, newsroom job description convergence, skilled human labor replaced by computer automation, and economically-driven downsizings, all in the name of profit. -

Nexstar Broadcasting Proposes to Acquire Media General for $14.50 Per Share in Accretive Cash and Stock Transaction Valued at $4.1 Billion

NEXSTAR BROADCASTING PROPOSES TO ACQUIRE MEDIA GENERAL FOR $14.50 PER SHARE IN ACCRETIVE CASH AND STOCK TRANSACTION VALUED AT $4.1 BILLION Proposal Provides 30% Premium to Media General Shareholders Combining Nexstar and Media General Would Create Leading Pure-Play Broadcaster with Enhanced Scale and Substantial Free Cash Flow Combination Would Be Well Positioned To Deliver Superior Immediate and Long-Term Shareholder Value Compared to Proposed Media General/Meredith Combination IRVING, Texas, September 28, 2015 – Nexstar Broadcasting Group, Inc. (Nasdaq: NXST) announced today a proposal to acquire Media General, Inc. (NYSE: MEG) for $10.50 per share in cash and a fixed ratio of 0.0898 Nexstar shares per Media General share. The proposal, currently valued at $14.50 per Media General share, was submitted today in a letter to the Media General Board. It represents a premium of 30% to Media General’s closing stock price on September 25. Perry Sook, Chairman, President and CEO of Nexstar, said, “The transaction we are proposing would be a transformational event for both Nexstar and Media General shareholders and would deliver superior, immediate and long-term value to Media General’s shareholders compared with Media General’s proposed acquisition of Meredith. “Our proposal provides a significant premium to Media General’s shareholders, including a cash component nearly equal to Media General’s current share price. Our proposal would also enable Nexstar and Media General shareholders to participate in the near- and long-term upside of a pure-play broadcasting company with expanded audience reach, a more diversified portfolio, and a significantly stronger financial profile, including substantial free cash flow per share, led by a proven broadcast and digital media management team. -

Broadcasters in the Internet Age

G.research, LLC November 27, 2018 One Corporate Center Rye, NY 10580-1422 g.research Tel (914) 921-5150 www.gabellisecurities.com Broadcasters in the Internet Age Brett Harriss G.research, LLC 2018 (914) 921-8335 -Please Refer To Important Disclosures On The Last Page Of This Report- G.research, LLC November 27, 2018 One Corporate Center Rye, NY 10580-1422 g.research Tel (914) 921-5150 www.gabellisecurities.com OVERVIEW The television industry is experiencing a tectonic shift of viewership from linear to on-demand viewing. Vertically integrated behemoths like Netflix and Amazon continue to grow with no end in sight. Despite this, we believe there is a place in the media ecosystem for traditional terrestrial broadcast companies. SUMMARY AND OPINION We view the broadcasters as attractive investments. We believe there is the potential for consolidation. On April 20, 2017, the FCC reinstated the Ultra High Frequency (UHF) discount giving broadcasters with UHF stations the ability to add stations without running afoul of the National Ownership Cap. More importantly, the current 39% ownership cap is under review at the FCC. Given the ubiquitous presence of the internet which foster an excess of video options and media voices, we believe the current ownership cap could be viewed as antiquated. Should the FCC substantially change the ownership cap, we would expect consolidation to accelerate. Broadcast consolidation would have the opportunity to deliver substantial synergies to the industry. We would expect both cost reductions and revenue growth, primarily in the form of increased retransmission revenue, to benefit the broadcast stations and networks. -

2012 NABJ Diversity Census an Examination of Television Newsroom Management

2012 2012 NABJ Diversity Census An examination of Television Newsroom Management By Bob Butler National Association of Black Journalists PREFACE Five years ago, in the absence of any information, NABJ set out to research and report the true state of newsroom management diversity. The result was the Television Newsroom Management Diversity Census. Many have now come to depend on this important document to determine the true health and viability of diversity within today’s newsrooms. The report is not only for the public and those who work in the industry, but also corporations and employers who are charged with assessing the realities of these circumstances. The 2012 Television Newsroom Management Diversity Census is comprised of two reports. The first report studies the diversity of news managers at 295 stations owned by different 19 companies. There are more than 700 such stations nationwide and it is our intent to eventually document every television newsroom in the country. The second report examines the diversity of newsroom managers and executives at broadcast and cable news networks. Unlike the local station, which broadcast to their respective markets, the networks provide news to the entire country. You may notice that ABC, CBS, Fox and NBC are mentioned in both reports. These networks own 51 stations that were included in the stations report. The information within the local station report is not included nor factored into the national news networks report. The demographic data retrieved is inspired by Section 257 of the amended Communications Act of 1934, which requires the FCC to “identify and eliminate, through regulatory action, market entry barriers for entrepreneurs and other small businesses in the provision and ownership of telecommunications and information services.” NABJ is the only source in the country that collects employment census data, which is a critical component in determining if those barriers exist.