Public Notice

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Preliminary and Detailed Engineering Design of Selected Road Links and Junctions/Intersections to Improve Mobility in Kampala City

In Association with Preliminary and Detailed Engineering Design of Selected Road Links and Junctions/Intersections to Improve Mobility in Kampala City Resettlement Action Plan for Eight Priority Roads under Group I of Batch 2 -– Roads of Kampala Institution and Infrastructure Development 2 (KIIDP 2) October, 2017 i Preliminary and Detailed Engineering Design of Selected Road Links and Junctions/Intersections to Improve Mobility in Kampala City IMPORTANT NOTICE This report is confidential and is provided solely for the purposes of Preliminary and Detailed Engineering Design of Selected Road Links and Junctions/Intersections to Improve Mobility in Kampala City. This report is provided pursuant to a Consultancy Agreement between SMEC International Pty Limited (“SMEC”) and Kampala Capital City Authority (“KCCA”) under which SMEC undertook to perform a specific and limited task for KCCA. This report is strictly limited to the matters stated in it and subject to the various assumptions, qualifications and limitations in it and does not apply by implication to other matters. SMEC makes no representation that the scope, assumptions, qualifications and exclusions set out in this report will be suitable or sufficient for other purposes nor that the content of the report covers all matters which you may regard as material for your purposes. This report must be read as a whole. The executive summary is not a substitute for this. Any subsequent report must be read in conjunction with this report. The report supersedes all previous draft or interim reports, whether written or presented orally, before the date of this report. This report has not and will not be updated for events or transactions occurring after the date of the report or any other matters which might have a material effect on its contents or which come to light after the date of the report. -

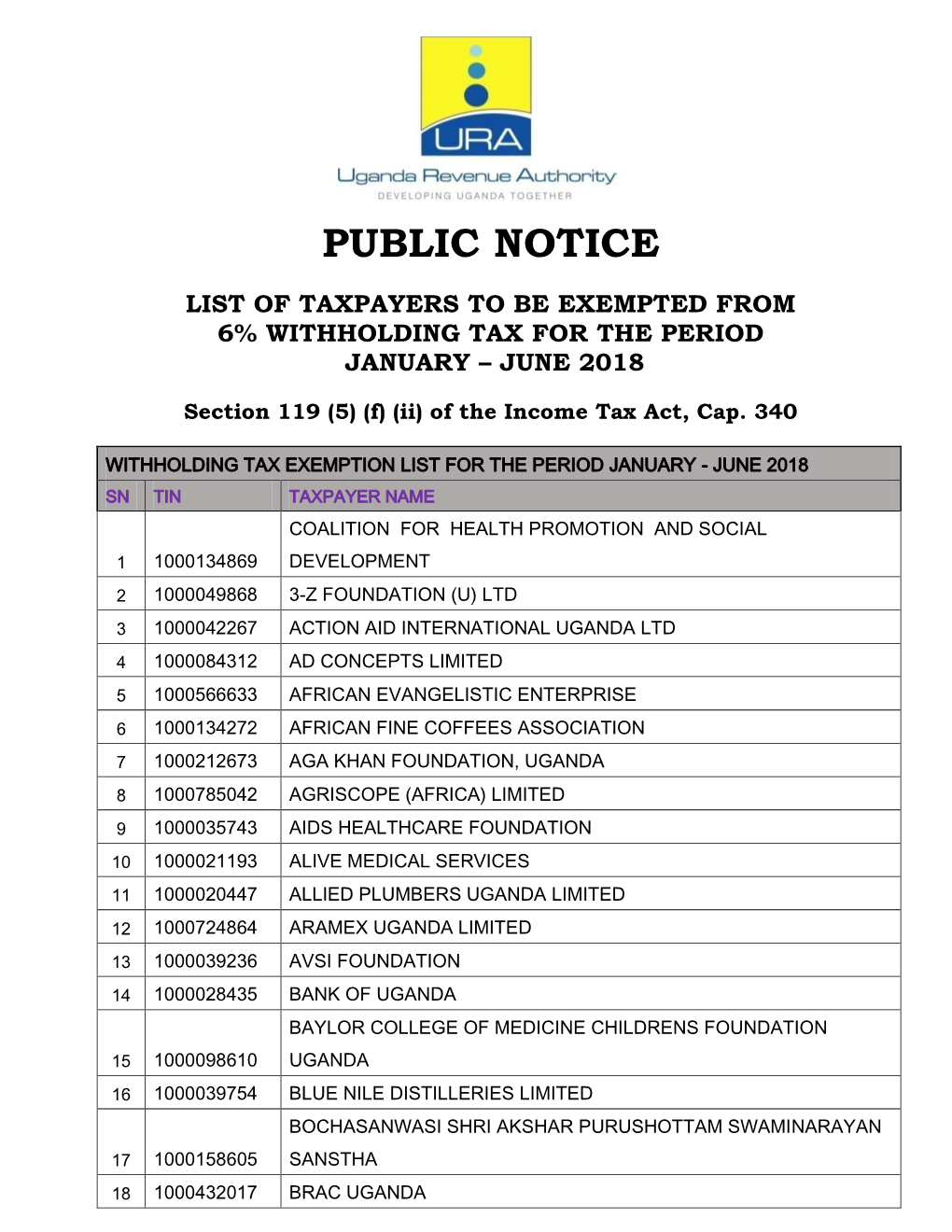

Public Notice

PUBLIC NOTICE PROVISIONAL LIST OF TAXPAYERS EXEMPTED FROM 6% WITHHOLDING TAX FOR JANUARY – JUNE 2016 Section 119 (5) (f) (ii) of the Income Tax Act, Cap. 340 Uganda Revenue Authority hereby notifies the public that the list of taxpayers below, having satisfactorily fulfilled the requirements for this facility; will be exempted from 6% withholding tax for the period 1st January 2016 to 30th June 2016 PROVISIONAL WITHHOLDING TAX LIST FOR THE PERIOD JANUARY - JUNE 2016 SN TIN TAXPAYER NAME 1 1000380928 3R AGRO INDUSTRIES LIMITED 2 1000049868 3-Z FOUNDATION (U) LTD 3 1000024265 ABC CAPITAL BANK LIMITED 4 1000033223 AFRICA POLYSACK INDUSTRIES LIMITED 5 1000482081 AFRICAN FIELD EPIDEMIOLOGY NETWORK LTD 6 1000134272 AFRICAN FINE COFFEES ASSOCIATION 7 1000034607 AFRICAN QUEEN LIMITED 8 1000025846 APPLIANCE WORLD LIMITED 9 1000317043 BALYA STINT HARDWARE LIMITED 10 1000025663 BANK OF AFRICA - UGANDA LTD 11 1000025701 BANK OF BARODA (U) LIMITED 12 1000028435 BANK OF UGANDA 13 1000027755 BARCLAYS BANK (U) LTD. BAYLOR COLLEGE OF MEDICINE CHILDRENS FOUNDATION 14 1000098610 UGANDA 15 1000026105 BIDCO UGANDA LIMITED 16 1000026050 BOLLORE AFRICA LOGISTICS UGANDA LIMITED 17 1000038228 BRITISH AIRWAYS 18 1000124037 BYANSI FISHERIES LTD 19 1000024548 CENTENARY RURAL DEVELOPMENT BANK LIMITED 20 1000024303 CENTURY BOTTLING CO. LTD. 21 1001017514 CHILDREN AT RISK ACTION NETWORK 22 1000691587 CHIMPANZEE SANCTUARY & WILDLIFE 23 1000028566 CITIBANK UGANDA LIMITED 24 1000026312 CITY OIL (U) LIMITED 25 1000024410 CIVICON LIMITED 26 1000023516 CIVIL AVIATION AUTHORITY -

TRACK and TRACE SYSTEM “Regional Electronic Cargo Tracking System” UGANDA CUSTOMS’ EXPERIENCE

TRACK AND TRACE SYSTEM “Regional Electronic Cargo Tracking System” UGANDA CUSTOMS’ EXPERIENCE by: David Dongo, Customs Supervisor, Uganda Revenue Authority (URA) Content outline 1 e-monitoring system 2 features & how to “Track & Trace” cargo Benefits, Lessons & 3 Moving Forward 2 History and Transition to e-Monitoring Transit Management history : Electronic Cargo Tracking Physical Convoy system 1992-2001 System -ECTS by BSMART: Paper Control System 2014-16 Transit log sheet/Call points Physical Escort until May 2014 RECTS: 2017-Todate Real-time monitoring along Northern Corridor Single platform used by Kenya, Rwanda & Challenges faced: Uganda Delays High cost of doing business Non-tariff barriers Difficulty in transit monitoring. High cost of monitoring Poor coordination with Partner States in the EAC Diversion of transit cargo Regional Electronic Cargo Tracking System Features 1. Electronic seals Fuel sensors 2. Centralized Monitoring Centers (CMCs) in Nairobi, Kampala & Kigali 3. The Rapid Response Units (coordinated KRA, URA, RRA Customs enforcement officers along the transit route 4. Automatic Number Plate Recognition (ANPR) and The Smart Gates operations 5. The CCTV camera systems at Customs points E-monitoring of cargo along the Northern Corridor Real time e-monitoring of transit at CMCs 24/7 E-seal Rapid Response Units deactivated at along the routes Destination E-seal activated at Departure station Track & trace …..In real time AEO/Public Access User Status Public Access User to the Bollore Africa Logistics Uganda Ltd Agent Public Access electronic monitoring platform British American Tobacco Kenya Trader Public Access BTS Clearing And Forwarding (U) Ltd Agent Public Access For Real time Consignment Jaffer Freighters Ltd Agent Public Access Tracking as opposed to manual tracking Kamwe Cargo $ Clearing Co. -

Bugandasigns Pact to Construct Affordable Houses in Ssentema

Land Telescope Land VOL. 3 January, 2019 VOL. 3 NO 1, January 2019 elescope TA TRUSTED PUBLICATION ON LAND MATTERS FROM BUGANDA LAND BOARD BUGANDA SIGNS PACT TO CONSTRUCT KABAKA AFFORdabLE HOUSES USHERS IN SSENTEMA IN 2019 More than 3,000 people to get jobs - P3 Dr. Bukenya utilizes Kabaka’s land to provide hope for stroke patients: P7 Buganda land board Managing Director Kyewalabye-Male D. (Seated middle) and Gouji group’s Windy Shen (seated right) during the signing of the MoU to kickstart a partnership to construct affordable houses in Ssentema. Check type of Mawokota chief Security of tenure before Kayima decries tenure can end land investingnns - P2 in districts that still land - P14 issue freehold question: titles on Kabaka’s P10 land - P13 Land Telescope EDITORIALVOL. 3 January, 2019 NEWS 2 Why we should welcome uganda Land Board Land Telescope reintroduced the sen- FEEDING YOU LAND INFORMATION sitization unit charged BLB’s sensitization drives with the responsibility of precious factor of produc- absent, not knowing that the So, when other organisa- teaching Ugandans about PUBLISHED BY BUGANDA LAND tion, many people, including law requires them to look for tions involved in land manage- theirB rights and obligations on land. BOARD. This team has since embarked on leaders, use this ignorance to the landlord, not the other way ment such as BLB come out to regular meetings and clinics across disenfranchise them of their round. Such small land-related sensitize people, they should rights. It is thus important matters can cause huge losses. receive the necessary support. KYEWALABYE-MALE: the kingdom calling upon people, Managing Director especially bibanja holders, to under- that these people are con- People need to know all this It is commendable that the sistently reminded of their and much more. -

Land-And-Corruption-Hand-Book

TRANSPARENCY INTERNATIONAL UGANDA LAND AND CORRUPTION purposes of the Applicant paying Stamp Duty which is 1.5% of the value of the current rate. The Applicant checks the following day to collect the assessment. The Applicant must have in his/her possession: The Duplicate Certificate of Title ACCESS TO ACCURATE LAND INFORMATION The Applicant presents identification documents to collect the Duplicate Certificate of Title. The Applicantsigns Submit all documentation together with the Duplicate Certificate of Title and Receipts to the Office of Titles and receive an Acknoledgement note. The Applicant is asked to check after 2 working days to collect the Title. Ministry of Lands, Housing and Urban Development, Plot 13/15, Century Building-Parliament Avenue. P.O. Box 7096, Kampala-Uganda. Tel: +256 414 373 511 - Toll free: 0800 100004 Website: www.mlhud.go.ug A Stakeholders Guide in the Fight against Corruption in Uganda's land sector. December 2017 i. Table of Contents i. Table of Contents ........................................................................................................... i ii. Acronyms ..................................................................................................................... iii iii. Preface ...................................................................................................................... iv iv. Acknowledgement ..................................................................................................... v Chapter One: Introduction and Background....................................................................... -

Report of the Auditor General on the Financial Statements of the Ministry of Defence for the Year Ended 30Th June 2016

THE REPUBLIC OF UGANDA REPORT OF THE AUDITOR GENERAL ON THE FINANCIAL STATEMENTS OF THE MINISTRY OF DEFENCE FOR THE YEAR ENDED 30TH JUNE 2016 OFFICE OF THE AUDITOR GENERAL UGANDA TABLE OF CONTENTS LIST OF ACROYNMS ...................................................................................................... iii 1.0 INTRODUCTION .................................................................................................. 1 2.0 BACKGROUND INFORMATION .............................................................................. 1 3.0 ENTITY FINANCING ............................................................................................ 1 4.0 OBJECTIVES OF THE MINISTRY ........................................................................... 1 5.0 AUDIT OBJECTIVES ............................................................................................. 2 6.0 AUDIT PROCEDURES PERFORMED ....................................................................... 2 7.0 CATEGORIZATION AND SUMMARY OF FINDINGS .................................................. 3 7.1 Categorization of findings .................................................................................... 3 7.2 Summary of findings ........................................................................................... 4 8.0 DETAILED FINDINGS ........................................................................................... 4 8.1 Outstanding arrears ............................................................................................ -

Bolstering Revenue, Building Fairness: Uganda Extends Tax Reach, 2014–2018 (Short Version)

BOLSTERING REVENUE, BUILDING FAIRNESS: UGANDA EXTENDS TAX REACH, 2014–2018 (SHORT VERSION) BACKGROUND This summary draws on an ISS case In November 2014, Doris Akol took over as study with the same title can be found on commissioner general of the Uganda Revenue Authority the ISS website. Leon Schreiber drafted (URA), the semiautonomous body responsible for collecting the full case based on interviews all central government taxes. During the previous decade, conducted in Kampala, Uganda in January and February 2019. Case Akol had been part of the team that transformed the URA published April 2019. Summary from an unwieldy and corruption-riddled organization into a published in May 2019. modern operation that collected taxes effectively from most of the country’s formally registered payers. However, the earlier reforms had failed to significantly boost the country’s tax-to-GDP ratio to the government-mandated level of 16%—which was still lower than the 18% average for countries in sub-Saharan Africa. Large numbers of Ugandans paid nothing because they were unregistered or because inadequate compliance monitoring enabled them to underpay. The holes in the system bedeviled the URA’s efforts to improve tax collections and undermined public trust. Akol and her team identified Uganda’s large informal economy as a main reason that revenue growth lagged behind improved efficiency. In 2015, the government estimated that informal economic activities accounted for 49% of the country’s total GDP.1 And as a result of low registration rates among informally employed Ugandans, the number of registered taxpayers stood at only 632,279 at the end of the fiscal year that ended in June 20142—in a country of 38 million people. -

Country Experience Templates

BOLSTERING REVENUE, BUILDING FAIRNESS: UGANDA EXTENDS ITS TAX REACH, 2014 – 2018 SYNOPSIS After a decade of reforms to boost tax collection, in 2014 the Uganda Revenue Authority (URA) faced up to one of its biggest remaining challenges. Although the agency had significantly improved its internal capacity—along with its ability to collect taxes from registered taxpayers—large numbers of Ugandans paid nothing because they were unregistered or because inadequate compliance monitoring enabled them to underpay. The holes in the system undermined public trust and bedeviled the URA’s efforts to meet the government-mandated target to raise tax revenue to 16% of gross domestic product. The URA then joined other government agencies to bring millions of unregistered citizens into the tax net, and it tightened the oversight of existing taxpayers who were paying less than their fair share. Prime targets were millions of Ugandans who worked in the informal economy, which the government said accounted for nearly half of the country’s economic activity. At the same time, the URA set up operations to go after wealthy and politically connected individuals who avoided paying their full tax load, and it created a separate unit to press government departments that failed to remit to the URA the taxes they collected, such as withholdings from employees. The URA’s program achieved strong gains on all three fronts and thereby helped increase the country’s tax-to-GDP ratio to 14.2% in the 2017–18 fiscal year from 11.3% in 2013–14. Just as important, the program made significant progress toward a fairer distribution of the tax burden for Ugandans across all economic levels. -

Report of the Auditor General on the Financial Statements of Uganda Revenue Authority- Corporate Services for the Year Ended 30Th June 2016

THE REPUBLIC OF UGANDA REPORT OF THE AUDITOR GENERAL ON THE FINANCIAL STATEMENTS OF UGANDA REVENUE AUTHORITY- CORPORATE SERVICES FOR THE YEAR ENDED 30TH JUNE 2016 OFFICE OF THE AUDITOR GENERAL UGANDA TABLE OF CONTENTS LIST OF ACRONYMS ...................................................................................................... iii 1.0 INTRODUCTION .............................................................................................. 5 2.0 BACKGROUND INFORMATION .......................................................................... 5 3.0 ENTITY FINANCING ......................................................................................... 5 4.0 OBJECTIVES OF URA ........................................................................................ 6 5.0 AUDIT SCOPE .................................................................................................. 6 6.0 PROCEDURES PERFORMED ............................................................................... 7 7.0 CATEGORIZATION AND SUMMARY OF FINDINGS ............................................... 8 7.1 Categorization of findings ................................................................................. 8 7.2 Summary of findings ........................................................................................ 8 8.0 DETAILED FINDINGS ....................................................................................... 8 8.1 Retentions of Operations Funds by URA ............................................................. 8 8.2 Disclosure -

Opportunities and Challenges for District Land Boards in Uganda

LAND MANAGEMENT AND GOVERNANCE IN LOCAL GOVERNMENT Opportunities and Challenges for District Land Boards in Uganda By Walter Akena and Eugene Gerald Ssemakula 1. INTRODUCTION This policy brief originates from the training for members of statutory boards and commissions in 34 district local governments in the country undertaken by ACODE between August and October 2020. The design of the training of the Local Government Public Accounts Committee (LGPAC), District Service Commission (DSC) and the District Land Board (DLB) was a response to a series of ACODE’s scorecard findings which revealed that statutory boards and commissions were not functioning efficiently and effectively and therefore affecting the general performance of local governments. The training unearthed several issues both impeding and facilitating the functioning of statutory boards and commissions. These finding from the training are the bedrock of this policy briefing paper with a particular focus on the District Land Board 2. BACKGROUND Land is the most basic resource in terms of the space it provides, the environmental resources it contains and supports, and the capital it represents and generates. It also influences the ACODE Policy Briefing Paper Series No.56, 2020 1 | Land Management and Governance in LGs: Opportunities and Challenges for District Land Boards spirituality and aesthetic values of all human societies. Land is perhaps the most essential pillar of human existence and national development and is usually a political issue with the potential to be volatile.1 The rate of urbanization and global demand for food is escalating, and so is the pressure on natural resources.2 To guarantee security for long-held land rights and facilitate land access and use, a well-designed land policy and governance structure are of utmost importance. -

Diagnostic Trade Integration Study

Volume 1 UGANDA Diagnostic Trade Integration Study R E P O T June 2006 ABBREVIATIONS AND ACCRONYMS € Euro FSAP Financial Sector Assessment Program ACP African, Caribbean, and Pacific FSSP Fisheries Sector Strategic Plan ADT Average Daily Traffic FTA Free Trade Area ADZ Aquaculture Development Zone GAFRD General Authority for Fish Resources AfDB African Development Bank Development AGOA African Growth and Opportunities Act GAP Good Agriculture Practices ASYCUDA Automated System for Customs Data GDP Gross Domestic Product BMU Beach Management Units GKMA Greater Kampala Metropolitan Area BOU Bank of Uganda GMO Genetically Modified Organisms BRC British Retail Consortium GMP Good Manufacturing Practices C&F Clearing and Forwarding GNFS Goods and Non-Factor Services CA Competent Authority GNI Gross National Income CAA Civil Aviation Authority GOK Government of Kenya CBC Customs Business Center GOU Government of Uganda CBI Centre for the Promotion of Imports from GPS Global Positioning Satellite developing countries GSP Generalised System of Preferences CBS Community Based System ha Hectare CDO Cotton Development Organization HACCP Hazard Analysis and Critical Control Points CEM Country Economic Memorandum HCDA Horticultural Crops Development Authority CEO Chief Executive Officer HORTEXA Horticulture Exporters Association CET Common External Tariff HR Human Resources CG Commissioner General ICBT Informal Cross Border Trade COMESA Common Market for Eastern and Southern ICD Inland Container Depot Africa Cooperation for Emerging Markets ICO International -

International Property Markets Scorecard

International Property Markets Scorecard Uganda Market Conditions – Complete Survey January 2010 Contents Scorecard Background & Information ...................................................................................................................... 3 1. Property Rights ................................................................................................................................................... 4 1.1 Legal Protection ......................................................................................................................................... 4 1.2 Registries ..................................................................................................................................................... 5 1.3 Formal Ownership ...................................................................................................................................... 7 In-Country Assessment Information .................................................................................................................... 8 2. Access to Credit ................................................................................................................................................ 10 2.1 Banks ......................................................................................................................................................... 11 2.2 Other Sources ..........................................................................................................................................