Form 604 Notice of Change of Interests of Substantial Holder

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Form 605 Notice of Ceasing to Be a Substantial Holder

Form 605 Corporations Act 2001 Section 671B Notice of ceasing to be a substantial holder To: Company Name/Scheme: ARISTOCRAT LEISURE LIMITED ACN/ARSN: 002 818 368 1. Details of substantial holder Name: Commonwealth Bank of Australia ACN 123 123 124 (CBA) and its related bodies corporate listed in annexure A The holder ceased to be a substantial holder on: 04/04/2018 The previous notice was given to the company on: 05/04/2018 The previous notice was dated: 03/04/2018 2. Changes in relevant interests Particulars of each change in, or change in the nature of, a relevant interest of the substantial holder or an associate in voting securities of the company or scheme, since the substantial holder was last required to give a substantial holding notice to the company or scheme are as follows: Person whose Class and Date of Consideration given in Person's votes relevant interest Nature of change number of change relation to change affected changed securities affected See annexure B to this notice 1 3. Changes in association The persons who have become associates of, ceased to be associates of, or have changed the nature of their association with, the substantial holder in relation to voting interests in the company or scheme are as follows: Name and ACN/ARSN (if applicable) Nature of association 2 4. Addresses The addresses of persons named in this form are as follows: Name Address Avanteos Investments Limited ACN 096 259 Ground Floor Tower 1, 201 Sussex Street, Sydney, NSW, 2000, Australia 979 CBA Markets Limited ACN 003 485 952 Ground Floor Tower 1, 201 Sussex Street, Sydney, NSW, 2000, Australia Colonial First State Asset Management Ground Floor Tower 1, 201 Sussex Street, Sydney, NSW, 2000, Australia (Australia) Limited ACN 114 194 311 First State Investments (Singapore) ACN 38 Beach Road, #06-11 South Beach Tower, SINGAPORE, 189767 196900420D Realindex Investments Pty Limited ACN 133 Ground Floor Tower 1, 201 Sussex Street, Sydney, NSW, 2000, Australia 312 017 3 5. -

2013/14: a Very Good Year

Economic Insights Economics | July 1 2014 2013/14: A very good year Economic & financial perspectives A good year: Total returns on Australian shares (All Ordinaries Accumulation index) rose by 17.6 per cent in 2013/14 after lifting by 20.7 per cent in 2012/13 – the best back-to back returns in seven years. Other returns higher: Returns on dwellings are up 14.7 per cent while returns on government bonds have lifted by 5.4 per cent. A rare event – bonds, property and shares have all lifted over the past year. Financial markets: The Aussie dollar held in a US11 cent range over 2013/14, the smallest range in eight years. The cash rate stands at a 54-year low of 2.50 per cent with only one change in the year – the quarter percent rate cut in August 2013. Impressive economic credentials: The economy is recording ‘above-average’ growth; inflation is contained; interest rates are at 54-year lows; and the current account deficit is the best (lowest) in 34 years. The report is useful to assist investors start planning for 2014/15 What does it all mean? Overall, it has been a positive year, despite a raft of challenges such as geopolitical events (Egypt, Tunisia, Libya, Ukraine and Iraq, to name a few), the Federal Election, the shutdown of the US Government and even weather events like the harsh winter experienced in the Northern Hemisphere. Returns on shares, residential property and bonds have all lifted over the past year while interest rates and the Aussie dollar have ended little-changed on a year ago. -

Commsec Financial Services Guide

Financial Services Guide | 1 CommSec Financial Services Guide Issue Date 08 July 2021 2 | Financial Services Guide The provider of the services described in this Financial Services Guide is the Australian Financial Services Licensee Commonwealth Securities Limited ABN 60 067 254 399 Australian Financial Services Licence Number: 238814 Registered Office: Ground Floor, Tower 1, 201 Sussex Street Sydney NSW 2000. Contents Section One Commonwealth Securities Limited Part One 1 Important Information 1 Financial Services Guide 1 Other documents you may receive from us 1 Who are we? 2 What financial services and products do we offer? 2 How do you obtain our services? 3 How can you transact with us? 3 Personal advice on financial products 3 If we previously provided you with financial product advice 4 How do you pay for our services? 4 How are we remunerated for the services we provide? 4 Initial commissions paid to CommSec 4 Ongoing commissions paid to CommSec 4 How are our representatives remunerated? 5 Associations with related Product Issuers 6 Remuneration that may be received by Associated Parties Third Party Agreements 7 How is my customer information dealt with? 7 What should I do if I have a complaint? 8 How do we manage our compensation arrangements? 8 Part Two 9 Important information 9 Financial Services Guide 9 Fees and Charges 9 Trading in Australian Listed Shares and Derivatives 10 Trading in ETFs using the CommSec Pocket App 11 Fees and Charges for Margin Lending 11 Other Fees and Charges 11 CommSecIRESS Platform and additional -

Notice Given in Accordance with Australian Securities and Investments Commission’S Exemption from Subsection 259C(2) of the Corporations Act 2001

Notice given in accordance with Australian Securities and Investments Commission’s Exemption from Subsection 259C(2) of the Corporations Act 2001 To: Market Announcements Office, ASX Limited 20 Bridge Street Sydney NSW 2000 Commonwealth Bank of Australia (ABN 48 123 123 124) (the “Company”, of Ground Floor Tower 1, 201 Sussex Street, Sydney, NSW, 2000, Australia) gives notice of the aggregated percentage of voting shares in the Company in respect of which it and its controlled entities have the power to control voting or disposal, and have a net economic exposure, in accordance with the terms of an exemption granted by the Australian Securities and Investments Commission pursuant to subsection 259C(2) of the Corporations Act (“Exemption”). 1. Previous Notice Particulars of these aggregated percentages at the time at which it was last required to give a notice to the Australian Securities Exchange (“the ASX”) are contained in the notice given to the ASX on: 25 September 2020 The notice was dated: 23 September 2020 2. Issued Share Capital 1,774,096,410 ordinary shares in the capital of the Company have been issued as at 23 December 2020 3. Aggregated percentage of voting shares The aggregated percentage total of voting shares in respect of which the Company and its controlled entities have the power to control voting or disposal is: 1.89% of the total number of voting shares on issue. The aggregated percentage total of voting shares in respect of which the Company and its controlled entities have a net economic exposure as defined in the Exemption is: 0.00% of the total number of voting shares on issue. -

Insights from Commonwealth Bank of Australia

Mechanisms for Creating Successful BPM Governance: Insights from Commonwealth Bank of Australia Wasana Bandara1, John C Merideth2, Angsana Techatassanasoontorn3, Paul Mathiesen1, Dan O’Neill2 1 Information Systems School, Queensland University of Technology, Australia 2 Enterprise Systems, Commonwealth Bank, Australia 3 Faculty of Business, Economics and Law, Auckland University of Technology Abstract. This case comprehensively documents the journey of Commonwealth Bank of Australia’s (CBA) approach to develop effective BPM governance that pene- trates the whole organization. The ‘right’ BPM Governance approach was essen- tial to progress with their enterprise-wide Business Process Management (BPM) efforts. This rich case study of one of the largest banks in the Australian Finance sector demonstrates a range of governance mechanisms taken to achieve effective BPM governance across the organization. Their journey suggests that both verti- cal governance and horizontal coordination mechanisms with a dedicated unit on process excellence are necessary to achieve transformation toward a process-cen- tric organization. The learnings from this case study can be applied by other or- ganizations when designing and executing their BPM governance efforts. Keywords: Business Process Management, governance, process governance, process owners, enterprise-wide, end-to-end processes, case study 1 Introduction Business Process Management (BPM) governance refers to the guiding principles that define roles and responsibilities in decision making (Rosemann & Vom Brocke, 2015). BPM governance often entails various mechanisms including vertical structures used to organize and manage activities as well as lateral relations, processes, and rules for coordinating and control across business process activities (Markus & Jacobson, 2015). It is imperative to recognize that different business process governance mechanisms have advantages and disadvantages. -

Form 605 Notice of Ceasing to Be a Substantial Holder

Form 605 Corporations Act 2001 Section 671B Notice of ceasing to be a substantial holder To: Company Name/Scheme: ARISTOCRAT LEISURE LIMITED ACN/ARSN: 002 818 368 1. Details of substantial holder Name: Commonwealth Bank of Australia ACN 123 123 124 (CBA) and its related bodies corporate listed in annexure A The holder ceased to be a substantial holder on: 27/04/2018 The previous notice was given to the company on: 12/04/2018 The previous notice was dated: 11/04/2018 2. Changes in relevant interests Particulars of each change in, or change in the nature of, a relevant interest of the substantial holder or an associate in voting securities of the company or scheme, since the substantial holder was last required to give a substantial holding notice to the company or scheme are as follows: Person whose Class and Date of Consideration given in Person's votes relevant interest Nature of change number of change relation to change affected changed securities affected See annexure B to this notice 1 3. Changes in association The persons who have become associates of, ceased to be associates of, or have changed the nature of their association with, the substantial holder in relation to voting interests in the company or scheme are as follows: Name and ACN/ARSN (if applicable) Nature of association 2 4. Addresses The addresses of persons named in this form are as follows: Name Address Avanteos Investments Limited ACN 096 259 Ground Floor Tower 1, 201 Sussex Street, Sydney, NSW, 2000, Australia 979 CBA Markets Limited ACN 003 485 952 Ground Floor Tower 1, 201 Sussex Street, Sydney, NSW, 2000, Australia Colonial First State Asset Management Ground Floor Tower 1, 201 Sussex Street, Sydney, NSW, 2000, Australia (Australia) Limited ACN 114 194 311 First State Investments (Singapore) ACN 38 Beach Road, #06-11 South Beach Tower, SINGAPORE, 189767 196900420D Realindex Investments Pty Limited ACN 133 Ground Floor Tower 1, 201 Sussex Street, Sydney, NSW, 2000, Australia 312 017 3 5. -

CONFIDENTIAL Commonwealth Bank of Australia

_R CBA.0502.0001.8021 CONFIDENTIAL Commonwealth Bank of Australia AGENDA FOR THE 311th MEETING OF THE BOARD TO BE HELD IN SYDNEY ON MONDAY, 11DECEMBER2017 AT 4.25PM AND TUESDAY, 12 DECEMBER 2017 AT 8.00AM Monday, 11 December 2017 Administration 4.25pm - 4.35pm 1. Non-Executive Director Private Session 10 mins 4.35pm - 4.45pm 2. Board Matters 10 mins 2.1. Minutes of the 31Qth Meeting of the Board held on 13-14 November 2017 2.2. Matters Arising 2.3. Disclosure of Directors' Interests (if any) 2.4. 2017 and 2018 Board Forward Agenda Business Operations 4.45pm - 5.1 Spm 3. Chief Executive Officer's Report and Board Discussion 30 mins Presented by Ian Narev 5.1Spm - 5.35pm 4. Chief Financial Officer's Report 20 mins Presented by Rob Jesudason with Jean Olivier in attendance 4.1. Investor Relations Presented by Gregg Johnston 4.2. Funding & Liquidity Presented by Paolo Tonucci 4.3. Economic Update (For Noting) ExCo to join the Meeting 5.35pm -6.15pm 5. Management Reports 40 mins 5.1. Enterprise Services 5.2. Retail Banking Services 5.3. Business & Private Banking 5.4. Bankwest 5.5. Institutional Banking & Markets 5.6. International Financial Services 5.7. Wealth Management* and KordaMentha Report* 5.8. ASB Bank* 5.9. Group Marketing & Strategy .. Group Executive to provide 5 minute update, followed by 5 minute Q&A _R CBA.0502.0001 .8021 _0002 CONFIDENTIAL 6.15pm - 6.25pm 6. India Entity Establishment 10 mins Presented by David Whiteing and Scott Wharton 7. Health, Safety and Wellbeing Report (For Noting) 6.30pm - 9.30pm BOARD AND EXCO DINNER Tuesday, 12 December 2017 ExCo to join the Meeting 8.00am -12.45pm 8. -

For Personal Use Only Use Personal For

F-4183 FORM 605 Corporations Act 2001 Section 671B Notice of ceasing to be a substantial holder To: Company Name/Scheme: CLEANAWAY WASTE MANAGEMENT LIMITED ACN/ARSN: 101 155 220 1. Details of substantial holder Name: Commonwealth Bank of Australia ACN 123 123 124 (CBA) and its related bodies corporate listed in annexure A The holder ceased to be a substantial holder on: 20/07/2016 The previous notice was given to the company on: 20/07/2016 The previous notice was dated: 19/07/2016 2. Changes in relevant interests Particulars of each change in, or change in the nature of, a relevant interest of the substantial holder or an associate in voting securities of the company or scheme, since the substantial holder was last required to give a substantial holding notice to the company or scheme are as follows: Person whose Nature of Consideration given in Class and number of Person's votes Date of change relevant interest change relation to change securities affected affected changed See annexure B to this notice For personal use only 3. Changes in association The persons who have become associates of, ceased to be associates of, or have changed the nature of their association with, the substantial holder in relation to voting interests in t he company or scheme are as follows: Name and ACN/ARSN (if applicable) Nature of association For personal use only 2 4. Addresses The addresses of persons named in this form are as follows: Name Address Level 2, ASB North Wharf, 12 Jellicoe Street, Auckland, 1010 , ASB Group Investments Limited Company Number -

A Year of Consolidation

Economic Insights Economics | July 12015 2014/15: A Year of Consolidation Economic & financial perspectives Unfulfilled expectations: Total returns on Australian shares (All Ordinaries Accumulation index) grew by 5.7 per cent over 2014/15 after rising by 17.6 per cent in 2013/14 (20-year average +10.3 per cent). Notably, back in late April, the total return index was at record highs and on track to 14.5 per cent annual gains. Other returns higher: Returns on dwellings grew by 14.1 per cent in 2014/15 with returns on government bonds up by 5.8 per cent. So for the second year, bonds, property and shares have all lifted. The report is useful to assist investors to start planning for 2015/16 What does it all mean? In late April, total returns on Australian shares (shares prices and dividends) were at record highs. And the ASX 200 was on the cusp of breaking through 6,000 points. But a raft of jitters served to drag the sharemarket lower over the final two months of the 2015 financial year. So, 2014/15 can be best described as a year of consolidation for investors. Greece returned to haunt investors. Interest rates were trimmed to all-time lows. A stimulatory Federal Budget was unveiled. China continued to rebalance its economy, as did Australia. The US Federal Reserve still hadn’t decided to lift interest rates. And higher bond yields served to check the upward progress of global sharemarkets. But despite the challenges, returns on shares, residential property and bonds all lifted over the past year while interest rates and the Aussie dollar ended lower than a year ago. -

The Blenheim Report

The Blenheim Report CONFIDENTIAL INTELLIGENCE REPORT COMMONWEALTH BANK OF AUSTRALIA NOVEMBER 2013 Blenheim Partners is an elite international Board, Executive Search and Advisory firm. The Blenheim Partners team have acted at Board, Chief Executive Officer and other C-Level for the ASX 100, FTSE 100, North American and European multi-national companies, Asian listed, and a range of premier financial institutions, mid-cap and early stage developing companies both publicly and privately owned. Our philosophy is to perform at the highest standard and to provide a service which is innovative and unmatched by committing to a strategic long term partnering relationship. We are bonded by a singular purpose of providing a search and consulting model that ensures our clients achieve the optimal outcome. Our goal is to help our clients deliver superior performance by maximising the composition of their Board and Executive team. Blenheim combines the quality, structure and process of a large firm with the flexibility, creativity and relationship focus of a boutique. Our work falls into three areas: Top Level Executive Search, Non-Executive Search and Advisory. We only partner with one to two companies per sector to ensure our clients receive sector expertise and complete market coverage. We do not have Conflicts of Interest or Off Limits restrictions as a result of our partnering model. We support our clients long term planning capability with Strategic Succession Planning. We provide an end to end international search process, including Assessment and a 90 day On Boarding Programme. We provide international reach and superior candidates due to our rigorous research methodology and confidential recommendations from key industry leaders. -

FORM 603 Corporations Act 2001 Section 671B Notice

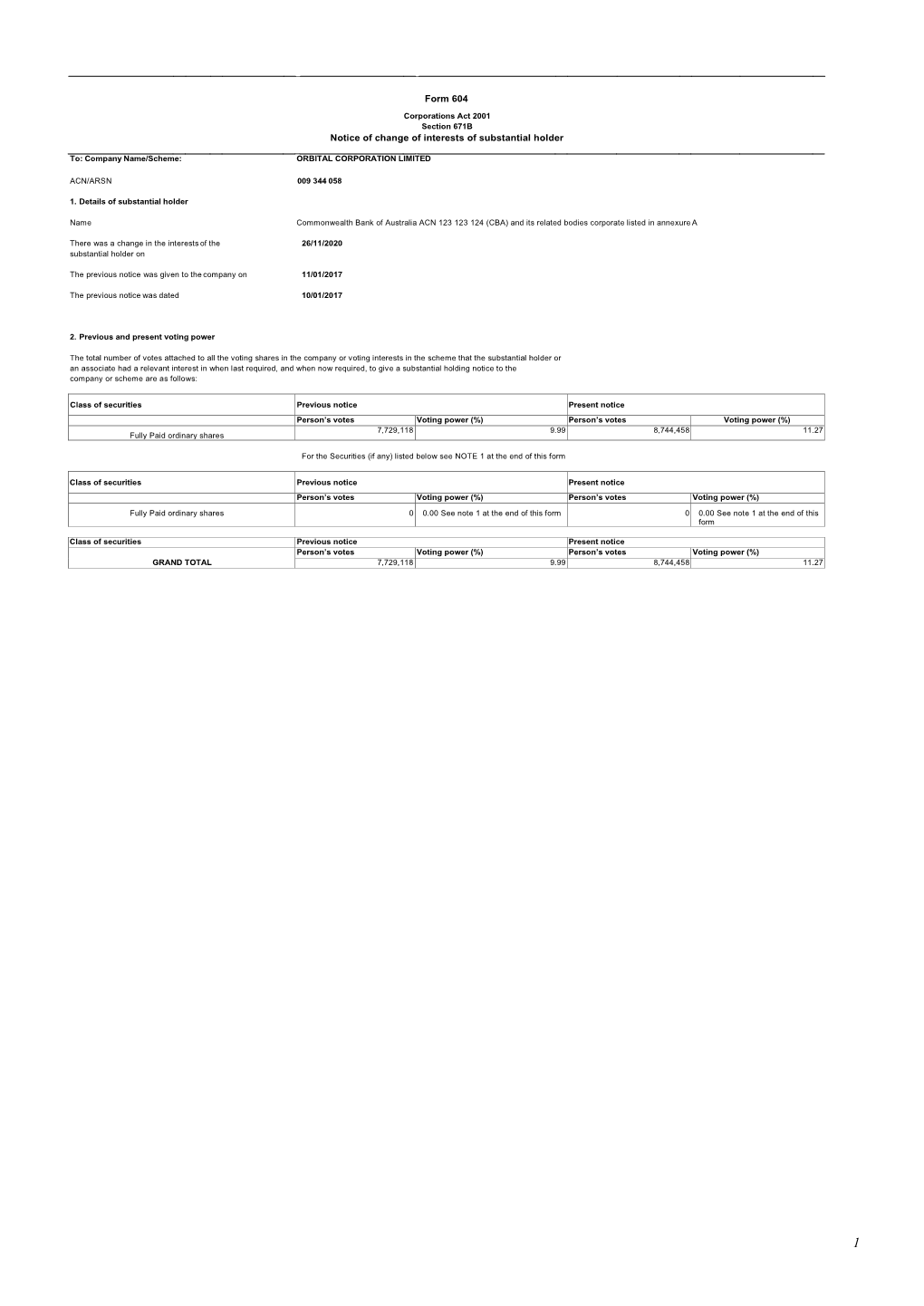

F-4780 FORM 603 Corporations Act 2001 Section 671B Notice of initial substantial holder To: Company Name/Scheme: ORBITAL CORPORATION LIMITED ACN/ARSN: 009 344 058 1. Details of substantial holder Name: Commonwealth Bank of Australia ACN 123 123 124 (CBA) and its related bodies corporate listed in annexure A The holder became a substantial holder on: 29/11/2016 2. Details of voting power The total number of votes attached to all the voting shares in the company or voting interests in the scheme that the substantial holder or an associate had a relevant interest in on the date the substantial holder became a substantial holder are as follows. Class of securities Number of securities Person's votes Voting power (%) Fully Paid ordinary shares 4,179,118 4,179,118 5.41 For the Securities (if any) listed below see NOTE 1 at the end of this form Class of securities Number of securities Person's votes Voting power (%) Fully Paid ordinary shares 0 0 0.00 Class of securities Number of securities Person's votes Voting power (%) GRAND TOTAL 4,179,118 4,179,118 5.41 Fully paid ordinary shares 3. Details of relevant interests The nature of the relevant interest the substantial holder or an associate had in the following voting securities on the date the substantial holder became a substantial holder are as follows: Holder of relevant interest Nature of relevant interest Class and number of securities Relevant interest under paragraph 608(1)(b) and/or 608(1)(c) of the Corporations Act 2001 (Cth), being a relevant interest arising from having the power to control the exercise of the right to vote attached to securities and/or to control the exercise of the power to dispose of securities in its capacity as investment manager (as provided for under its investment mandates). -

ASB Subordinated Notes Investment Statement 17 March 2014

ASB Subordinated Notes Investment Statement 17 March 2014 issuer of ASB Subordinated Notes ASB Bank Limited issuer of CBA Ordinary Shares if ASB Subordinated Notes are Exchanged Commonwealth Bank of Australia ABN 48 123 123 124 Arrangers Commonwealth Bank of Australia Goldman Sachs New Zealand Limited Joint Lead Managers ASB Securities Limited Deutsche Craigs Limited Forsyth Barr Limited Goldman Sachs New Zealand Limited Macquarie Capital (New Zealand) Limited This investment is riskier than a bank deposit. The securities are not call deposits or term deposits with ASB Bank Limited and may not be suitable for many investors. investments in ASB Subordinated Notes are an investment in ASB and may be affected by the ongoing performance, financial position and solvency of ASB. ASB Subordinated Notes may also be affected by the ongoing performance, financial position and solvency of CBA. They are not deposit liabilities or protected accounts of CBA for the purposes of the Australian Banking Act. asb.co.nz i Important Information (The information in this section is required under the Securities Act 1978.) investment decisions are very important. They often have long-term consequences. Read all documents carefully. Ask questions. Seek advice before committing yourself. Choosing an investment When deciding whether to invest, consider carefully the answers to the following questions that can be found on the pages noted below: Page What sort of investment is this? 13 Who is involved in providing it for me? 14 How much do i pay? 15 What are the charges? 15 What returns will i get? 16 What are my risks? 22 Can the investment be altered? 29 How do i cash in my investment? 29 Who do i contact with inquiries about my investment? 30 Is there anyone to whom i can complain if i have problems with the investment? 30 What other information can i obtain about this investment? 31 The Financial Markets Authority regulates conduct in financial markets The Financial Markets Authority regulates conduct in New Zealand’s financial markets.