A Year of Consolidation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2013/14: a Very Good Year

Economic Insights Economics | July 1 2014 2013/14: A very good year Economic & financial perspectives A good year: Total returns on Australian shares (All Ordinaries Accumulation index) rose by 17.6 per cent in 2013/14 after lifting by 20.7 per cent in 2012/13 – the best back-to back returns in seven years. Other returns higher: Returns on dwellings are up 14.7 per cent while returns on government bonds have lifted by 5.4 per cent. A rare event – bonds, property and shares have all lifted over the past year. Financial markets: The Aussie dollar held in a US11 cent range over 2013/14, the smallest range in eight years. The cash rate stands at a 54-year low of 2.50 per cent with only one change in the year – the quarter percent rate cut in August 2013. Impressive economic credentials: The economy is recording ‘above-average’ growth; inflation is contained; interest rates are at 54-year lows; and the current account deficit is the best (lowest) in 34 years. The report is useful to assist investors start planning for 2014/15 What does it all mean? Overall, it has been a positive year, despite a raft of challenges such as geopolitical events (Egypt, Tunisia, Libya, Ukraine and Iraq, to name a few), the Federal Election, the shutdown of the US Government and even weather events like the harsh winter experienced in the Northern Hemisphere. Returns on shares, residential property and bonds have all lifted over the past year while interest rates and the Aussie dollar have ended little-changed on a year ago. -

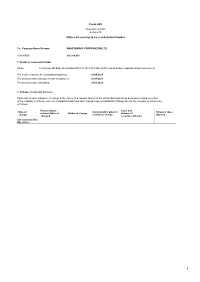

Form 605 Notice of Ceasing to Be a Substantial Holder

Form 605 Corporations Act 2001 Section 671B Notice of ceasing to be a substantial holder To: Company Name/Scheme: ARISTOCRAT LEISURE LIMITED ACN/ARSN: 002 818 368 1. Details of substantial holder Name: Commonwealth Bank of Australia ACN 123 123 124 (CBA) and its related bodies corporate listed in annexure A The holder ceased to be a substantial holder on: 27/04/2018 The previous notice was given to the company on: 12/04/2018 The previous notice was dated: 11/04/2018 2. Changes in relevant interests Particulars of each change in, or change in the nature of, a relevant interest of the substantial holder or an associate in voting securities of the company or scheme, since the substantial holder was last required to give a substantial holding notice to the company or scheme are as follows: Person whose Class and Date of Consideration given in Person's votes relevant interest Nature of change number of change relation to change affected changed securities affected See annexure B to this notice 1 3. Changes in association The persons who have become associates of, ceased to be associates of, or have changed the nature of their association with, the substantial holder in relation to voting interests in the company or scheme are as follows: Name and ACN/ARSN (if applicable) Nature of association 2 4. Addresses The addresses of persons named in this form are as follows: Name Address Avanteos Investments Limited ACN 096 259 Ground Floor Tower 1, 201 Sussex Street, Sydney, NSW, 2000, Australia 979 CBA Markets Limited ACN 003 485 952 Ground Floor Tower 1, 201 Sussex Street, Sydney, NSW, 2000, Australia Colonial First State Asset Management Ground Floor Tower 1, 201 Sussex Street, Sydney, NSW, 2000, Australia (Australia) Limited ACN 114 194 311 First State Investments (Singapore) ACN 38 Beach Road, #06-11 South Beach Tower, SINGAPORE, 189767 196900420D Realindex Investments Pty Limited ACN 133 Ground Floor Tower 1, 201 Sussex Street, Sydney, NSW, 2000, Australia 312 017 3 5. -

CONFIDENTIAL Commonwealth Bank of Australia

_R CBA.0502.0001.8021 CONFIDENTIAL Commonwealth Bank of Australia AGENDA FOR THE 311th MEETING OF THE BOARD TO BE HELD IN SYDNEY ON MONDAY, 11DECEMBER2017 AT 4.25PM AND TUESDAY, 12 DECEMBER 2017 AT 8.00AM Monday, 11 December 2017 Administration 4.25pm - 4.35pm 1. Non-Executive Director Private Session 10 mins 4.35pm - 4.45pm 2. Board Matters 10 mins 2.1. Minutes of the 31Qth Meeting of the Board held on 13-14 November 2017 2.2. Matters Arising 2.3. Disclosure of Directors' Interests (if any) 2.4. 2017 and 2018 Board Forward Agenda Business Operations 4.45pm - 5.1 Spm 3. Chief Executive Officer's Report and Board Discussion 30 mins Presented by Ian Narev 5.1Spm - 5.35pm 4. Chief Financial Officer's Report 20 mins Presented by Rob Jesudason with Jean Olivier in attendance 4.1. Investor Relations Presented by Gregg Johnston 4.2. Funding & Liquidity Presented by Paolo Tonucci 4.3. Economic Update (For Noting) ExCo to join the Meeting 5.35pm -6.15pm 5. Management Reports 40 mins 5.1. Enterprise Services 5.2. Retail Banking Services 5.3. Business & Private Banking 5.4. Bankwest 5.5. Institutional Banking & Markets 5.6. International Financial Services 5.7. Wealth Management* and KordaMentha Report* 5.8. ASB Bank* 5.9. Group Marketing & Strategy .. Group Executive to provide 5 minute update, followed by 5 minute Q&A _R CBA.0502.0001 .8021 _0002 CONFIDENTIAL 6.15pm - 6.25pm 6. India Entity Establishment 10 mins Presented by David Whiteing and Scott Wharton 7. Health, Safety and Wellbeing Report (For Noting) 6.30pm - 9.30pm BOARD AND EXCO DINNER Tuesday, 12 December 2017 ExCo to join the Meeting 8.00am -12.45pm 8. -

The Blenheim Report

The Blenheim Report CONFIDENTIAL INTELLIGENCE REPORT COMMONWEALTH BANK OF AUSTRALIA NOVEMBER 2013 Blenheim Partners is an elite international Board, Executive Search and Advisory firm. The Blenheim Partners team have acted at Board, Chief Executive Officer and other C-Level for the ASX 100, FTSE 100, North American and European multi-national companies, Asian listed, and a range of premier financial institutions, mid-cap and early stage developing companies both publicly and privately owned. Our philosophy is to perform at the highest standard and to provide a service which is innovative and unmatched by committing to a strategic long term partnering relationship. We are bonded by a singular purpose of providing a search and consulting model that ensures our clients achieve the optimal outcome. Our goal is to help our clients deliver superior performance by maximising the composition of their Board and Executive team. Blenheim combines the quality, structure and process of a large firm with the flexibility, creativity and relationship focus of a boutique. Our work falls into three areas: Top Level Executive Search, Non-Executive Search and Advisory. We only partner with one to two companies per sector to ensure our clients receive sector expertise and complete market coverage. We do not have Conflicts of Interest or Off Limits restrictions as a result of our partnering model. We support our clients long term planning capability with Strategic Succession Planning. We provide an end to end international search process, including Assessment and a 90 day On Boarding Programme. We provide international reach and superior candidates due to our rigorous research methodology and confidential recommendations from key industry leaders. -

Form 604 Notice of Change of Interests of Substantial Holder

Form 604 Corporations Act 2001 Section 671B Notice of change of interests of substantial holder To: Company Name/Scheme: ORBITAL CORPORATION LIMITED ACN/ARSN 009 344 058 1. Details of substantial holder Name Commonwealth Bank of Australia ACN 123 123 124 (CBA) and its related bodies corporate listed in annexure A There was a change in the interests of the 26/11/2020 substantial holder on The previous notice was given to the company on 11/01/2017 The previous notice was dated 10/01/2017 2. Previous and present voting power The total number of votes attached to all the voting shares in the company or voting interests in the scheme that the substantial holder or an associate had a relevant interest in when last required, and when now required, to give a substantial holding notice to the company or scheme are as follows: Class of securities Previous notice Present notice Person’s votes Voting power (%) Person’s votes Voting power (%) 7,729,118 9.99 8,744,458 11.27 Fully Paid ordinary shares For the Securities (if any) listed below see NOTE 1 at the end of this form Class of securities Previous notice Present notice Person’s votes Voting power (%) Person’s votes Voting power (%) Fully Paid ordinary shares 0 0.00 See note 1 at the end of this form 0 0.00 See note 1 at the end of this form Class of securities Previous notice Present notice Person’s votes Voting power (%) Person’s votes Voting power (%) GRAND TOTAL 7,729,118 9.99 8,744,458 11.27 1 3. -

FORM 603 Corporations Act 2001 Section 671B Notice

F-4780 FORM 603 Corporations Act 2001 Section 671B Notice of initial substantial holder To: Company Name/Scheme: ORBITAL CORPORATION LIMITED ACN/ARSN: 009 344 058 1. Details of substantial holder Name: Commonwealth Bank of Australia ACN 123 123 124 (CBA) and its related bodies corporate listed in annexure A The holder became a substantial holder on: 29/11/2016 2. Details of voting power The total number of votes attached to all the voting shares in the company or voting interests in the scheme that the substantial holder or an associate had a relevant interest in on the date the substantial holder became a substantial holder are as follows. Class of securities Number of securities Person's votes Voting power (%) Fully Paid ordinary shares 4,179,118 4,179,118 5.41 For the Securities (if any) listed below see NOTE 1 at the end of this form Class of securities Number of securities Person's votes Voting power (%) Fully Paid ordinary shares 0 0 0.00 Class of securities Number of securities Person's votes Voting power (%) GRAND TOTAL 4,179,118 4,179,118 5.41 Fully paid ordinary shares 3. Details of relevant interests The nature of the relevant interest the substantial holder or an associate had in the following voting securities on the date the substantial holder became a substantial holder are as follows: Holder of relevant interest Nature of relevant interest Class and number of securities Relevant interest under paragraph 608(1)(b) and/or 608(1)(c) of the Corporations Act 2001 (Cth), being a relevant interest arising from having the power to control the exercise of the right to vote attached to securities and/or to control the exercise of the power to dispose of securities in its capacity as investment manager (as provided for under its investment mandates). -

Form 605 Notice of Ceasing to Be a Substantial Holder

Form 605 Corporations Act 2001 Section 671B Notice of ceasing to be a substantial holder To: Company Name/Scheme: GWA GROUP LIMITED ACN/ARSN: 055 964 380 1. Details of substantial holder Name: Commonwealth Bank of Australia ACN 123 123 124 (CBA) and its related bodies corporate listed in annexure A The holder ceased to be a substantial holder on: 01/03/2021 The previous notice was given to the company on: 18/02/2021 The previous notice was dated: 17/02/2021 2. Changes in relevant interests Particulars of each change in, or change in the nature of, a relevant interest of the substantial holder or an associate in voting securities of the company or scheme, since the substantial holder was last required to give a substantial holding notice to the company or scheme are as follows: Person whose Class and Date of Consideration given in Person's votes relevant interest Nature of change number of change relation to change affected changed securities affected See annexure B to this notice 1 3. Changes in association The persons who have become associates of, ceased to be associates of, or have changed the nature of their association with, the substantial holder in relation to voting interests in the company or scheme are as follows: Name and ACN/ARSN (if applicable) Nature of association 2 4. Addresses The addresses of persons named in this form are as follows: Name Address Avanteos Investments Limited ACN 096 259 979 Ground Floor Tower 1, 201 Sussex Street, Sydney, NSW, 2000, Australia ASB Group Investments Limited 533945 Level 2, ASB North Wharf, 12 Jellicoe Street, Auckland, 1010, New Zealand Commonwealth Bank Officers Level 11 Tower 1, 201 Sussex St, Sydney, NSW, 2000, Australia Superannuation Corporation Pty Limited ACN 074 519 798 The Colonial Mutual Life Assurance Society Ground Floor Tower 1, 201 Sussex Street, Sydney, NSW, 2000, Australia Limited ACN 004 021 809 Colonial First State Investments Limited Ground Floor Tower 1, 201 Sussex Street, Sydney, NSW, 2000, Australia ACN 002 348 352 3 5. -

Commonwealth Bank Australia

Commonwealth Bank Australia Active This profile is actively maintained Send feedback on this profile Created before Nov 2016 Last update: Sep 3 2021 About Commonwealth Bank The Commonwealth Bank of Australia (commonly referred to as the CommBank), was founded in 1911 by the Australian government, listed on the Australian Stock Exchange in 1991, and fully privatised in 1996. The Commonwealth Bank is on of the "big four" Australian banks, and the largest Australian listed company on the Australian Securities Exchange as of August 2015. The bank has brands including BankWest, Colonial First State Investments, ASB Bank (New Zealand), Commonwealth Securities and Commonwealth Insurance. Website http://www.commbank.com.au Headquarters 11 Harbour Street NSW 2000 Sydney Australia CEO/chair Matt Comyn CEO Supervisor Reserve Bank of Australia Annual report Annual integrated report 2020 Ownership listed on Australian Securities Exchange Commonwealth Bank's shareholder structure can be accessed here. Complaints Commonwealth Bank does not operate a complaints channel for individuals and communities that may be adversely affected by its finance. However, it is possible to contact the bank via corporateresponsibility@cba. and com.au and [email protected]. grievances Stakeholders may raise complaints via the OECD National Contact Points (see OECD Watch guidance). Sustainability Voluntary standards Commonwealth Bank has committed itself to the following voluntary standards: Carbon Disclosure Project Dow Jones Sustainability Indices Equator Principles Global Reporting Initiative Principles for Responsible Banking (PRB) Principles for Responsible Investment (PRI) Task Force on Climate-related Financial Disclosures UNEP Finance Initiative United Nations Global Compact Investment policies The Commonwealth Bank's group's asset management business, Colonial First State Group Asset Management and insurance business, CommInsure, are both signatories to the UN Principles for Responsible Investment. -

Company Name/Scheme: VOCUS COMMUNICATIONS LIMITED

F-3175 FORM 604 Corporations Act 2001 Section 671B Notice of change of interests of substantial holder To: Company Name/Scheme: VOCUS COMMUNICATIONS LIMITED ACN/ARSN: 084 115 499 1. Details of substantial holder Name: Commonwealth Bank of Australia ACN 123 123 124 (CBA) and its related bodies corporate listed in annexure A There was a change in the interests of the substantial holder on 09/07/2015 The previous notice was given to the company on 13/03/2015 The previous notice was dated 12/03/2015 2. Previous and present voting power The total number of votes attached to all the voting shares in the company or voting interests in the scheme that the substantial holder or an associate had a relevant interest in when last required, and when now required, to give a substantial holding notice to the company or scheme are as follows: Class of securities Previous notice Present notice Person's votes Voting power (%) Person's votes Voting power (%) Fully Paid Ordinary 5,507,447 5.22 9,854,195 4.28 Shares For the Securities (if any) listed below see NOTE 1 at the end of this form Class of securities Previous notice Present notice Person's votes Voting power (%) Person's votes Voting power (%) Fully Paid Ordinary 0.83 See note 1 at the 0.76 See note 1 at the 883,624 1,770,781 Shares end of this form end of this form Class of securities Previous notice Present notice Person's votes Voting power (%) Person's votes Voting power (%) Grand TOTAL 6,391,071 6.06 11,624,976 5.05 3. -

For Personal Use Only Use Personal for Grand TOTAL 65,980,513 11.96 78,315,268 14.20

F-2174 FORM 604 Corporations Act 2001 Section 671B Notice of change of interests of substantial holder To: Company Name/Scheme: ARISTOCRAT LEISURE LIMITED ACN/ARSN: 002 818 368 1. Details of substantial holder Name: Commonwealth Bank of Australia ACN 123 123 124 (CBA) and its related bodies corporate listed in annexure A There was a change in the interests of the substantial holder on 29/05/2014 The previous notice was given to the company on 24/04/2014 The previous notice was dated 22/04/2014 2. Previous and present voting power The total number of votes attached to all the voting shares in the company or voting interests in the scheme that the substantial holder or an associate had a relevant interest in when last required, and when now required, to give a substantial holding notice to the company or scheme are as follows: Class of securities Previous notice Present notice Person's votes Voting power (%) Person's votes Voting power (%) Fully Paid Ordinary 50,169,521 9.09 61,611,101 11.17 Shares For the Securities (if any) listed below see NOTE 1 at the end of this form Class of securities Previous notice Present notice Person's votes Voting power (%) Person's votes Voting power (%) Fully Paid Ordinary 2.86 See note 1 at the 3.02 See note 1 at the 15,810,992 16,704,167 Shares end of this form end of this form Class of securities Previous notice Present notice Person's votes Voting power (%) Person's votes Voting power (%) For personal use only Grand TOTAL 65,980,513 11.96 78,315,268 14.20 3. -

Form 605 Notice of Ceasing to Be a Substantial Holder

Form 605 Corporations Act 2001 Section 671B Notice of ceasing to be a substantial holder To: Company Name/Scheme: DATA#3 LIMITED ACN/ARSN: 010 545 267 1. Details of substantial holder Name: Commonwealth Bank of Australia ACN 123 123 124 (CBA) and its related bodies corporate listed in annexure A The holder ceased to be a substantial holder on: 24/09/2019 The previous notice was given to the company on: 12/03/2018 The previous notice was dated: 09/03/2018 2. Changes in relevant interests Particulars of each change in, or change in the nature of, a relevant interest of the substantial holder or an associate in voting securities of the company or scheme, since the substantial holder was last required to give a substantial holding notice to the company or scheme are as follows: Person whose Class and Date of Consideration given in Person's votes relevant interest Nature of change number of change relation to change affected changed securities affected See annexure B to this notice 1 3. Changes in association The persons who have become associates of, ceased to be associates of, or have changed the nature of their association with, the substantial holder in relation to voting interests in the company or scheme are as follows: Name and ACN/ARSN (if applicable) Nature of association Colonial First State Asset Management Colonial First State Asset Management (Australia) Limited ceased to be a subsidiary and associate of (Australia) Limited ACN 114 194 311 CBA on 2 August 2019. * Realindex Investments Pty Limited Realindex Investments Pty Limited ceased to be a subsidiary and associate of CBA on 2 August 2019. -

Ceasing to Be a Substantial Holder From

Form 605 Corporations Act 2001 Section 671B Notice of ceasing to be a substantial holder To: Company Name/Scheme: SMARTGROUP CORPORATION LTD ACN/ARSN: 126 266 831 1. Details of substantial holder Name: Commonwealth Bank of Australia ACN 123 123 124 (CBA) and its related bodies corporate listed in annexure A The holder ceased to be a substantial holder on: 01/04/2021 The previous notice was given to the company on: 26/03/2021 The previous notice was dated: 25/03/2021 2. Changes in relevant interests Particulars of each change in, or change in the nature of, a relevant interest of the substantial holder or an associate in voting securities of the company or scheme, since the substantial holder was last required to give a substantial holding notice to the company or scheme are as follows: Person whose Class and Date of Consideration given in Person's votes relevant interest Nature of change number of change relation to change affected changed securities affected See annexure B to this notice 1 3. Changes in association The persons who have become associates of, ceased to be associates of, or have changed the nature of their association with, the substantial holder in relation to voting interests in the company or scheme are as follows: Name and ACN/ARSN (if applicable) Nature of association 2 4. Addresses The addresses of persons named in this form are as follows: Name Address Avanteos Investments Limited Ground Floor Tower 1, 201 Sussex Street, Sydney, NSW, 2000, Australia ACN 096 259 979 Commonwealth Bank of Australia Ground Floor Tower 1, 201 Sussex Street, Sydney, NSW, 2000, Australia ACN 123 123 124 The Colonial Mutual Life Assurance Society Ground Floor Tower 1, 201 Sussex Street, Sydney, NSW, 2000, Australia Limited ACN 004 021 809 Colonial First State Investments Limited Ground Floor Tower 1, 201 Sussex Street, Sydney, NSW, 2000, Australia ACN 002 348 352 3 5.