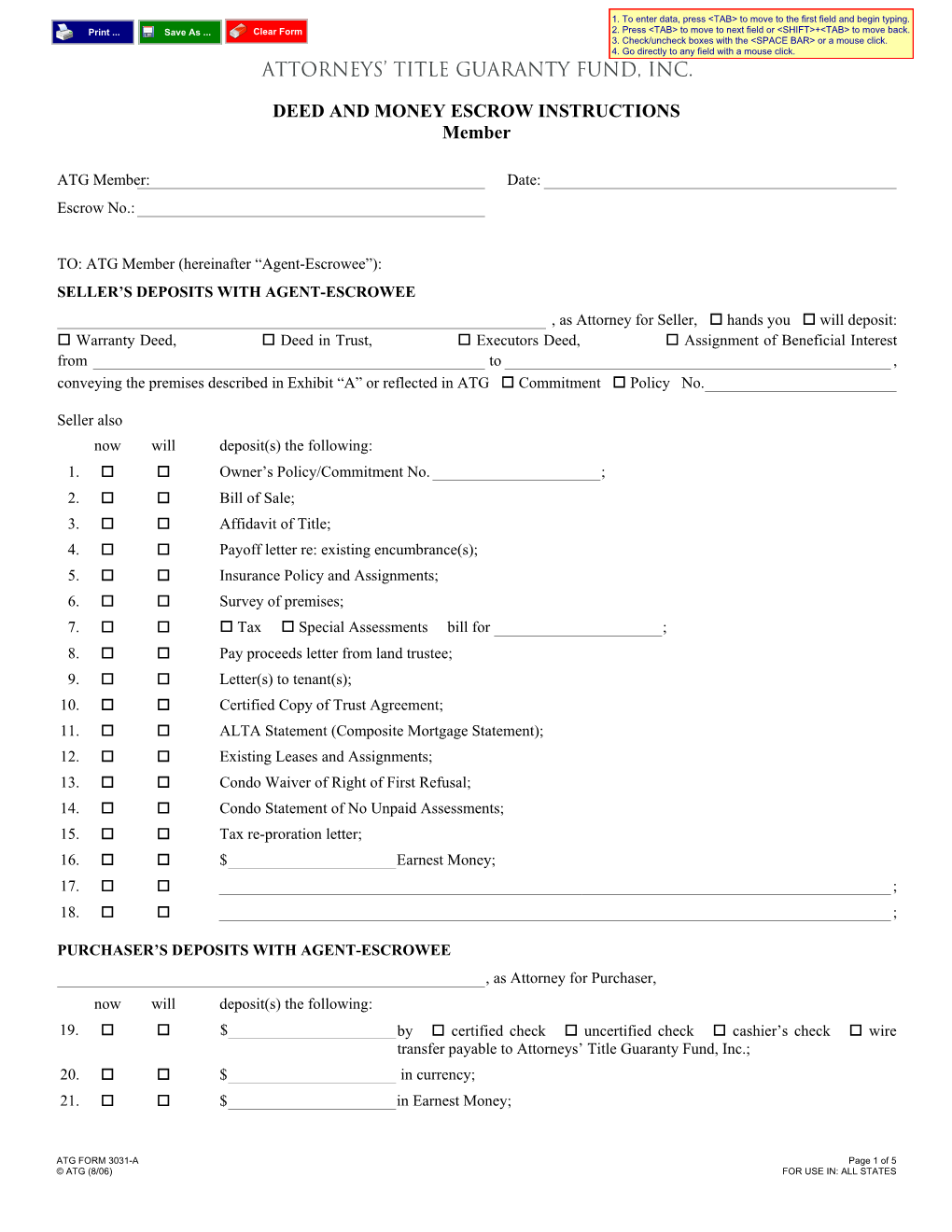

DEED and MONEY ESCROW INSTRUCTIONS Member

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Good Faith Estimate (GFE)

OMB Approval No. 2502-0265 Good Faith Estimate (GFE) Name of Originator Borrower Originator Property Address Address Originator Phone Number Originator Email Date of GFE Purpose This GFE gives you an estimate of your settlement charges and loan terms if you are approved for this loan. For more information, see HUD’s Special Information Booklet on settlement charges, your Truth-in-Lending Disclosures, and other consumer information at www.hud.gov/respa. If you decide you would like to proceed with this loan, contact us. Shopping for Only you can shop for the best loan for you. Compare this GFE with other loan offers, so you can find your loan the best loan. Use the shopping chart on page 3 to compare all the offers you receive. Important dates 1. The interest rate for this GFE is available through . After this time, the interest rate, some of your loan Origination Charges, and the monthly payment shown below can change until you lock your interest rate. 2. This estimate for all other settlement charges is available through . 3. After you lock your interest rate, you must go to settlement within days (your rate lock period) to receive the locked interest rate. 4. You must lock the interest rate at least days before settlement. Summary of Your initial loan amount is $ your loan Your loan term is years Your initial interest rate is % Your initial monthly amount owed for principal, interest, and any mortgage insurance is $ per month Can your interest rate rise? c No c Yes, it can rise to a maximum of %. -

Chapter 3: Escrow, Taxes, and Insurance

HB-2-3550 CHAPTER 3: ESCROW, TAXES, AND INSURANCE 3.1 INTRODUCTION To protect the Agency’s interest in the security property, the Servicing and Asset Management Office (Servicing Office) must ensure that real estate taxes and any other local assessments are paid and that the property remains adequately insured. To ensure that funds are available for these purposes, the Agency requires most borrowers who receive new loans to deposit funds to an escrow account. Borrowers who are not required to establish an escrow account may do so voluntarily. If an escrow account has been established, payments for insurance, taxes, and other assessments are made by the Agency. If an escrow account has not been established, the borrower is responsible for making timely payments. Section 1 of this chapter describes basic requirements for paying taxes and maintaining insurance coverage; Section 2 provides procedure for establishing and maintaining the escrow account; and Section 3 discusses procedures for addressing insured and uninsured losses to the security property. SECTION 1: TAX AND INSURANCE REQUIREMENTS [7 CFR 3550.60 and 3550.61] 3.2 TAXES AND OTHER LOCAL ASSESSMENTS The Agency contracts with a tax service to secure tax information for all borrowers. The tax service obtains tax bills due for payment, determines the optimal time to pay the taxes in order to take advantage of any discounts, and provides delinquent tax status on the portfolio. A. Tax Service Fee All borrowers are charged a tax service fee. Borrowers who obtain a subsequent loan are not required to pay a second tax service fee. -

TILA Higher-Priced Mortgage Loans (HPML) Escrow Rule

March 2016 TILA Higher-Priced Mortgage Loans (HPML) Escrow Rule Small entity compliance guide Version Log The Bureau updates this guide on a periodic basis to reflect finalized amendments and clarifications to the rule which impact guide content. Below is a version log noting the history of this document and notable rule changes: Date Version Rule Changes March 28, 1.2 Exemption for Small Creditors that Operate in a Rural 2016 or Underserved Area. The September 2015 Final Rule amends the eligibility criteria for small creditors operating in rural or underserved areas for exemption from the requirement to establish an escrow account for higher-priced mortgage loans (HPMLs). The March 2016 Interim Final Rule further amends the definition of rural areas and replaces the requirement that a small creditor operate predominantly in rural and underserved areas to be eligible for the escrow exemption with a requirement that a small creditor operate in a rural or underserved area. The revised rural-or-underserved test extends eligibility to small creditors that originated at least one covered loan secured by a first lien on a property located in a rural or underserved area in the preceding calendar year. It also amends the conditions for exempting small creditors from the requirement to maintain escrows so that an otherwise eligible small creditor will be able to rely on the exemption if it and its affiliates continue to maintain escrows established for first-lien HPMLs if the application for the HPML was received between April 1, 1 2010 and May 1, 2016. (See “What are the exemptions to the TILA HPML Escrow Rule?”on page 13 and “What are the loan volume and size requirements to qualify for the exemption for creditors operating in a rural or underserved area?” on page 14. -

Good Faith Estimate (GFE)

OMB Approval No. 2502-0265 Good Faith Estimate (GFE) Name of Originator Borrower Originator Property Address Address Originator Phone Number Originator Email Date of GFE Purpose This GFE gives you an estimate of your settlement charges and loan terms if you are approved for this loan. For more information, see HUD’s Special Information Booklet on settlement charges, your Truth-in-Lending Disclosures, and other consumer information at www.hud.gov/respa. If you decide you would like to proceed with this loan, contact us. Shopping for Only you can shop for the best loan for you. Compare this GFE with other loan offers, so you can find your loan the best loan. Use the shopping chart on page 3 to compare all the offers you receive. Important dates 1. The interest rate for this GFE is available through . After this time, the interest rate, some of your loan Origination Charges, and the monthly payment shown below can change until you lock your interest rate. 2. This estimate for all other settlement charges is available through . 3. After you lock your interest rate, you must go to settlement within days (your rate lock period) to receive the locked interest rate. 4. You must lock the interest rate at least days before settlement. Summary of Your initial loan amount is $ your loan Your loan term is years Your initial interest rate is % Your initial monthly amount owed for principal, interest, and any mortgage insurance is $ per month Can your interest rate rise? c No c Yes, it can rise to a maximum of %. -

Refinancing and Subordination of a Housing

REFINANCING AND SUBORDINATION OF A HOUSING REHABILITATION PROGRAM LOAN (INFORMATION FOR LENDER) Units that have received a loan as part of the City of Hayward Housing Rehabilitation Program (also referred to as the Housing Conservation Program) require City written approval in order to refinance. If the refinance is approved, the City will provide your chosen Lender with an approval letter. The owner will then have to submit a Subordination request. The information provided below is meant to inform the Lender and Escrow Officer about the information the City will require while handling the refinance. It is very important that the Lender and Escrow Officer contact [email protected] for refinance requests as soon as possible in order to ensure timely close of escrow. Please note: Lender must work with a third-party escrow company unaffiliated with the Lender. This is because the City is unable to deposit City documents required for the refinance with the Lender who would be a party to the refinance transaction. SUBMITTING A REFINANCE REQUEST Lenders who have clients who wish to refinance their home should e-mail abel.mora@hayward- ca.gov. LENDER Lenders needs to provide the City with the documents below: 1. 1003 - signed by Borrowers 2. 1008 3. Credit Report 4. Loan Estimate 5. Anticipated closing date 6. Subordination request (in writing to the City of Hayward – Community Services Division) 7. Vesting for trustor, trustee, and beneficiary of new Loan as it will appear on new Deed of Trust and Note ESCROW OFFICER Escrow Officers needs to provide the City with the documents below: 1. -

The Smart Consumer's Guide to Reducing Closing Costs

The Smart Consumer’s Guide to Reducing Closing Costs When buying, selling or refinancing a home The Smart Consumer’s Guide to Reducing Closing Costs TABLE OF CONTENTS An Introduction to Closing Costs ................................................... 4 The Closing Process Begins with a Good Faith Estimate .......................................... 4 What are typical closing costs? ................................................................................ 5 I. Real Estate Broker or Agent Fee ........................................................................... 6 II. Items Payable in Connection with Loan .............................................................. 6 Application fee ............................................................................................................ 6 Loan origination charge ............................................................................................... 6 Discount “points” ......................................................................................................... 7 Wire transfer fee ......................................................................................................... 7 Appraisal fee ............................................................................................................... 7 Lender-required home inspection fee ............................................................................ 7 Termite/pest inspection ............................................................................................... 7 Property -

Closing Disclosure Document with Your Loan Estimate

This form is a statement of final loan terms and closing costs. Compare this Closing Disclosure document with your Loan Estimate. Closing Information Transaction Information Loan Information Date Issued 4/15/2013 Borrower Michael Jones and Mary Stone Loan Term 30 years Closing Date 4/15/2013 123 Anywhere Street Purpose Purchase Disbursement Date 4/15/2013 Anytown, ST 12345 Product Fixed Rate Settlement Agent Epsilon Title Co. Seller Steve Cole and Amy Doe File # 12-3456 321 Somewhere Drive Loan Type x Conventional FHA Property 456 Somewhere Ave Anytown, ST 12345 VA _____________ Anytown, ST 12345 Lender Ficus Bank Loan ID # 123456789 Sale Price $180,000 MIC # 000654321 Loan Terms Can this amount increase after closing? Loan Amount $162,000 NO Interest Rate 3.875% NO Monthly Principal & Interest $761.78 NO See Projected Payments below for your Estimated Total Monthly Payment Does the loan have these features? Prepayment Penalty YES • As high as $3,240 if you pay off the loan during the first 2 years Balloon Payment NO Projected Payments Payment Calculation Years 1-7 Years 8-30 Principal & Interest $761.78 $761.78 Mortgage Insurance + 82.35 + — Estimated Escrow + 206.13 + 206.13 Amount can increase over time Estimated Total Monthly Payment $1,050.26 $967.91 This estimate includes In escrow? Estimated Taxes, Insurance x Property Taxes YES & Assessments $356.13 x Homeowner’s Insurance YES Amount can increase over time a month x Other: Homeowner’s Association Dues NO See page 4 for details See Escrow Account on page 4 for details. You must pay for other property costs separately. -

CFPB Consumer Laws and Regulations RESPA

CFPB Consumer Laws and Regulations RESPA Regulation X Real Estate Settlement Procedures Act The Real Estate Settlement Procedures Act of 1974 (RESPA) (12 U.S.C. 2601 et seq.) (the Act) became effective on June 20, 1975. The Act requires lenders, mortgage brokers, or servicers of home loans to provide borrowers with pertinent and timely disclosures regarding the nature and costs of the real estate settlement process. The Act also prohibits specific practices, such as kickbacks, and places limitations upon the use of escrow accounts. The Department of Housing and Urban Development (HUD) originally promulgated Regulation X which implements RESPA. Congress has amended RESPA significantly since its enactment. The National Affordable Housing Act of 1990 amended RESPA to require detailed disclosures concerning the transfer, sale, or assignment of mortgage servicing. It also requires disclosures for mortgage escrow accounts at closing and annually thereafter, itemizing the charges to be paid by the borrower and what is paid out of the account by the servicer. In October 1992, Congress amended RESPA to cover subordinate lien loans. Congress, when it enacted the Economic Growth and Regulatory Paperwork Reduction Act of 1996,1 further amended RESPA to clarify certain definitions including “controlled business arrangement,” which was changed to “affiliated business arrangement.” The changes also reduced the disclosures under the mortgage servicing provisions of RESPA. In 2008, HUD issued a RESPA Reform Rule (73 Fed. Reg. 68204, November 17, 2008) that included substantive and technical changes to the existing RESPA regulations and different implementation dates for various provisions. Substantive changes included a standard Good Faith Estimate form and a revised HUD-1 Settlement Statement that were required as of January 1, 2010. -

Mortgage Closing Forms

Guide to closing forms Closing Disclosure interactive tool Promissory Note ����������������������������������������������������������������������������������� 1 Mortgage / Security Instrument �������������������������������������������������� 2 Initial Escrow Disclosure ������������������������������������������������������������������ 3 Right to Cancel form �������������������������������������������������������������������������� 4 Consumer Financial Protection Bureau Learn more at consumerfinance.gov/owning-a-home GUIDE TO CLOSING FORMS Promissory Note The Note is the legal document you sign to agree to repay your mortgage. The Note will provide you with details regarding your loan, including the amount you owe, the interest rate of the mortgage loan, the dates when the payments are to be made, the length of time for repayment, and the place where the payments are to be sent. The Note also explains the consequences of failing to make your monthly mortgage payments. Read this document carefully. If something is different from what you agreed upon, contact your lender right away. Breaking down the form 1. Total amount of money you NOTE ___________________________, ________ ___________________________, ______________ are borrowing. [Date] [City] [State] ______________________________________________________________________________________________________ [Property Address] 1. BORROWER’S PROMISE TO PAY This is your interest rate. If In return for a loan that I have received, I promise to pay U.S. $____________________ (this amount is called “Principal”), 2. plus interest, to the order of the Lender. The Lender is ___________________________________1 _________________________ _________________________________________________________________________________. I will make all payments under this Note in the form of cash, check or money order. you have an adjustable rate I understand that the Lender may transfer this Note. The Lender or anyone who takes this Note by transfer and who is entitled to receive payments under this Note is called the “Note Holder.” 2. -

What Is Title Insurance?

What is title insurance? So, you’re buying a house. It’s an exciting time. It can also Who needs it? be a bit confusing. Things feel like they’re happening pretty Purchasers and lenders need title insurance in order fast and, often, some important things can go unexplained to be insured against various possible title defects. – like title insurance. Many people don’t understand exactly The buyer, seller and lender all benefit from the issuance of what title insurance is or what it does, even a lot of people title insurance. that already have it. As a title insurance company, Stewart Title would like to remedy that. So we’ve put together some How is a title policy created? basic information for you on title insurance in this flyer. After the escrow officer or lender opens the title order, Stewart Title begins a title search. A Preliminary Report is What is title? issued to the customer for review and approval. All closing Simply stated, the title to a piece of property is the evidence documents are recorded upon escrow’s instruction. When that the owner is in lawful possession of that property. recording has been confirmed, demands are paid, funds are disbursed, and the actual title policy is created. What is title insurance? Title insurance protects real estate owners and lenders What is escrow? against any property loss or damage they might experience Escrow refers to the process in which the funds of a because of liens, encumbrances or the defects in the title to transaction (such as the sale of a house) are held by a third the property. -

Answers to Your Questions About Title Insurance

A N S W E R S TO Y O U R Q U E S T I O N S A B O U T A M E S S A G E T O HOME BUYERS from THE AriZonar Department of Insurance Buying a home is, for many of us, the most substantial, single investment we’ll ever make and all of us want to make sure we do it right! Most homeowners provide for security and safekeeping of their homes through homeowners insurance – to protect against hazards such as fire, theft and weather damage, yet title insurance offers protection to home ownership as well. “Title” is a collective term used to describe your legal rights to own, possess, use, control or dispose of your home. As you know, one of the first steps in purchasing and acquiring title to your home is to choose a title insurance company to perform a title search on the property to make sure the title is free and clear of any unacceptable defects, claims or encum- brances. A title defect might involve unpaid taxes, liens, an undisclosed claim from an heir of a previous owner, or perhaps, just an easement from the local power company to install a power line on your property. Your title insurance company will search the history of the property in the public records and issue a title policy assuring the condition of the title at the time of your purchase. There are two types of title insurance policies: a lender’s policy (usually required by the lender to cover the amount of the loan) and an owner’s policy (optional homeowner’s protection for full property value). -

GOOD FAITH ESTIMATE of BUYER's ACQUISITION COSTS on Acquisition of Property

GOOD FAITH ESTIMATE OF BUYER'S ACQUISITION COSTS On Acquisition of Property Prepared by: Agent Phone Broker Email NOTE: This form is used by a buyer's agent when preparing a purchase agreement offer or receiving a counteroffer and disclosing the financial requirements the buyer can anticipate, to prepare a worksheet for review with the buyer estimating the total costs of acquisition and amount and source of funds needed to close the transaction. The figures estimated in this cost sheet may vary the time of closing due to periodic changes in lender demands, escrow fees, other charges and prorates, and thus constitute an opinion, not a guarantee of the preparer. If acquiring IRC §1031 replacement property, also use a §1031 Profit and Basis Recap Sheet to compute the income tax consequences of the transaction. [See RPI Form 354] DATE: , 20 , at , California. 1. This is an estimate of acquisition costs and the funds required to close the following transaction: � Purchase Agreement � Exchange Agreement � Counteroffer � Escrow Instructions � Option 1.1 entered into by , 1.2 dated , 20 , at , California, 1.3 regarding real estate referred to as . 2. EXISTING FINANCING ASSUMED: 2.1 First Trust Deed of Record................................................................... $ 2.2 Second Trust Deed of Record.............................................................. $ 2.3 Other Encumbrances/Liens/Bonds.......................................................$ 2.4 TOTAL Encumbrances Assumed [lines 2.1 to 2.4]...................................................................(+)$