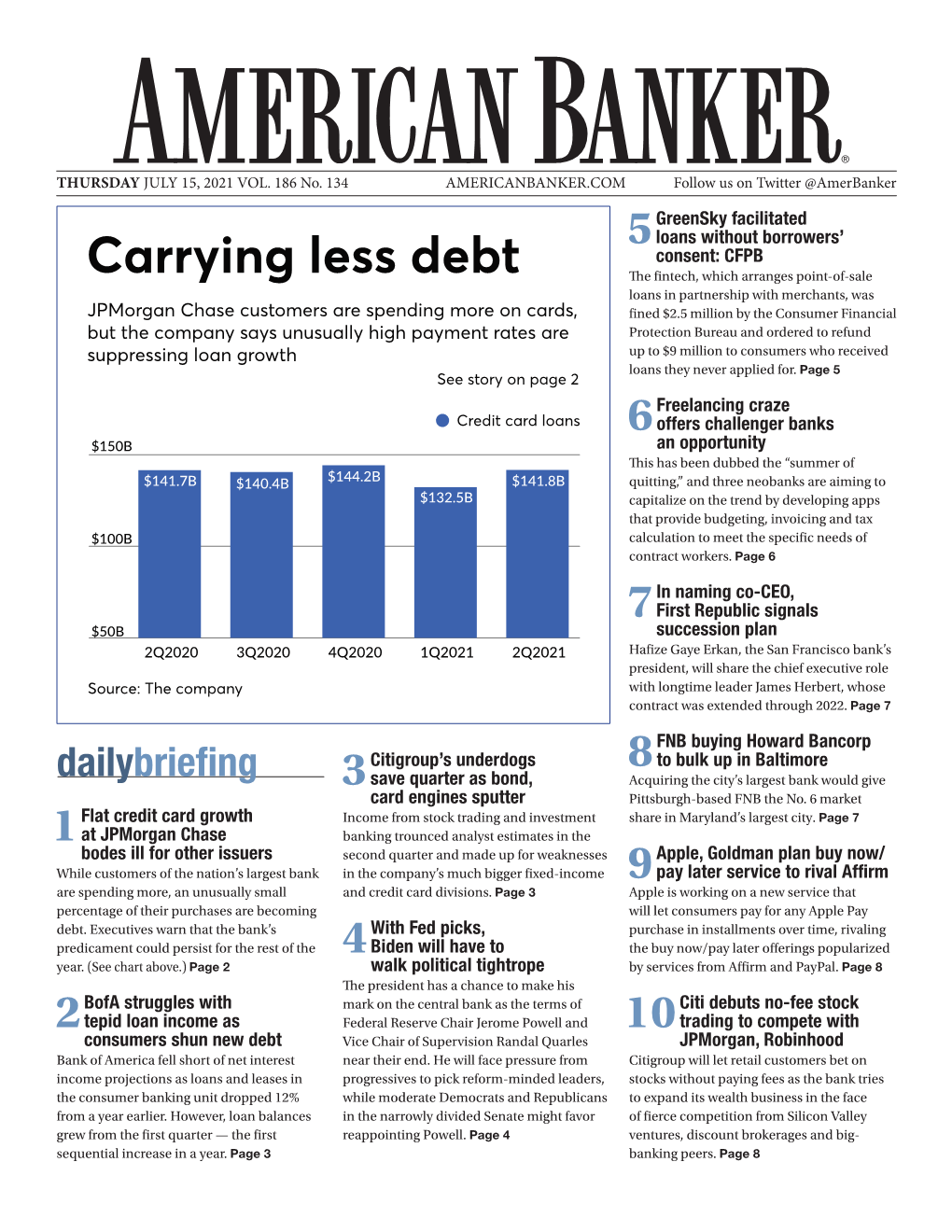

Carrying Less Debt

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Chicago's Largest Privately Held Companies

CRAIN’S CHICAGO BUSINESS • APriL 17, 2017 23 CRAIN’S LIST UPS AND DOWNS Combined, the 346 companies grew 10.9 percent on average. TOP 20 COMPANIES BY INCREASE CHICAGO’S LARGEST IN REVENUE FROM 2015 Home Chef 856.7%* Windy City Motorcycle Group 211.8% PRIVATELY HELD COMPANIES A. Epstein & Sons 157.6% Magellan Ranked by 2016 revenue. Crain’s estimates are in gray. *Company estimate. 2016 revenue Full-time local 139.1% (millions); employees as Development Group 2016 % change from of 12/31/16; FCL Builders rank Company/headquarters Phone/website Top executive 2015 worldwide Type of business 131.4% 1 1 STATE FARM MUTUAL 309-766-2311 Michael L. Tipsord $76,100.0 15,000 Insurance, banking and Outcome Health 104.1%** 1 AUTOMOBILE INSURANCE CO. StateFarm.com Chairman, president, CEO 0.5% 70,000 mutual funds Bloomington Nelson Westerberg 80.2% 2 HEALTH CARE SERVICE CORP. 312-653-6000 Paula Steiner $35,000.0 6,700 Health insurer Premier Design & 2 Chicago HCSC.com President, CEO NC 22,000 Build Group 72.2% 3 REYES HOLDINGS LLC 847-227-6500 M. Jude Reyes, $24,000.0 1,400 Food and beverage PT Holdings 3 Rosemont ReyesHoldings.com J. Christopher Reyes NC 22,000 distributor 66.2% Co-chairmen Guaranteed Rate 60.9% 5 TOPCO ASSOCIATES LLC 847-676-3030 Randall J. Skoda $14,600.0 375 Supplier to supermarkets 4 Elk Grove Village Topco.com President, CEO -4.6% 461 and food-service companies Clune Constuction 59.1% 6 HAVI GROUP LP 630-353-4200 Russ Smyth $9,750.0 700 Supply chain, packaging 5 Downers Grove Havi.com CEO, general partner 2.6% 10,000 and marketing Avant 54.6% 7 MEDLINE INDUSTRIES INC. -

4:14-Cv-01278-AGF Doc. #: 331 Filed: 07/06/16 Page

Case: 4:14-cv-01278-AGF Doc. #: 331 Filed: 07/06/16 Page: 1 of 34 PageID #: <pageID> UNITED STATES DISTRICT COURT EASTERN DISTRICT OF MISSOURI EASTERN DIVISION CITIMORTGAGE, INC., ) ) Plaintiff, ) ) v. ) Case No. 4:14CV01278 AGF ) CHICAGO BANCORP, INC., et al., ) ) Defendants. ) MEMORANDUM AND ORDER This matter is before the Court on the cross motions for partial summary judgment filed by Plaintiff CitiMortgage, Inc. (“CMI”) and Defendants Stephen and John Calk (the “Calks”) and The Federal Savings Bank (“FSB”).1 CMI’s claims against these Defendants seek to hold them liable for the contract liability of the primary Defendant, Chicago Bancorp, Inc. (“Chicago Bancorp”), on theories of fraudulent transfer, alter ego, and successor liability. CMI seeks summary judgment against the Calks on Counts III (statutory fraudulent transfer) and IV (alter ego), and against FSB on Count V (successor liability), of its Third Amended Complaint. (Doc. Nos. 240 & 241.) CMI has also moved to exclude the opinions of defense experts Thomas Zetlmeisl and Terry Stroud. (Doc. Nos. 143 & 148.) 1 Defendant National Bancorp Holdings, Inc., was also originally a party to these motions, but CMI has since voluntarily dismissed this Defendant with prejudice. Case: 4:14-cv-01278-AGF Doc. #: 331 Filed: 07/06/16 Page: 2 of 34 PageID #: <pageID> The Calks and FSB seek summary judgment on Counts IV and V. (Doc. No. 246.) FSB has also moved to exclude the opinions of CMI expert Donna Beck Smith. (Doc. No. 153.) For the reasons set forth below, the Court will deny CMI’s motions for partial summary judgment and grant Defendants’ motion for partial summary judgment. -

Double Trouble

Aruba Living Wednesday Today July 14, 2021 T: 582-7800 Real Estate www.arubatoday.com mediation facebook.com/arubatoday instagram.com/arubatoday Page 8 Aruba’s ONLY English newspaper DOUBLE TROUBLE U.S. COVID-19 cases rising again, doubling over three weeks In this Wednesday, July 7, 2021, file photo, patrons enjoy cold tropical cocktails in the tiny interior of the Tiki-Ti bar as it reopens on Sunset Boulevard in Los Angeles. Associated Press Page 2 A2 WEDNESDAY 14 JULY 2021 UP FRONT U.S. COVID-19 cases rising again, doubling over three weeks From Front Missouri and Arkansas must and hospitalizations rise. either quarantine for 10 "Alabama is OPEN for busi- By HEATHER HOLLING- days or have a negative ness. Vaccines are readily SWORTH and JOSH FUNK COVID-19 test. available, and I encourage Associated Press Meanwhile, the Health folks to get one. The state The COVID-19 curve in Department in Mississippi, of emergency and health the U.S. is rising again af- which ranks dead last na- orders have expired. We ter months of decline, with tionally for vaccinations, are moving forward," she the number of new cases began blocking posts said on social media. per day doubling over the about COVID-19 on its Dr. James Lawler, a leader past three weeks, driven Facebook page because of the Global Center for by the fast-spreading delta of a "rise of misinformation" Health Security at the Uni- variant, lagging vaccina- about the virus and the versity of Nebraska Medi- tion rates and Fourth of July vaccine. -

Food Is Medicine. Food Is Love. Dear Friends, Was a Year of Great Transition and Expansion Blizzard Boxes to the Far Rockaways and Other Outlying 2015 at God’S Love

2015 ANNUAL REPORT FOOD IS MEDICINE. FOOD IS LOVE. DEAR FRIENDS, was a year of great transition and expansion Blizzard Boxes to the Far Rockaways and other outlying 2015 at God’s Love. As a community we celebrated areas, and kitted meals early. When severe weather strikes triumphs together and experienced deep loss, and together the New York metropolitan area, everyone faces special we continued to grow, strengthen, and innovate to meet challenges, especially our clients. Thank you to all of our the ever-changing needs of our clients. supporters and volunteers who help us weather times like this. This summer, we marked a significant milestone in our After several years of careful planning, we converted all expansion project when we “Topped Out” the Michael client meals to a new “chilled and frozen” model. This new Kors Building at our SoHo home. Every step in the plan delivers our freshly prepared meal components either journey of creating our new building is exciting, and we frozen or stored safely below 40 degrees, ready for reheating. simply cannot wait for what’s to come. Clients tell us they love the new model as it gives them greater choice over what to eat when. In the fall 2014, we mourned the passing of our dear friend and Board Member Joan Rivers. Joan was one-of-a-kind In the kitchen, we continue to enhance our menu to and irreplaceable. She brought love, compassion and humor provide clients with the best possible experience. Our to every delivery she made and every event she supported. -

June 15,2007

ZONING BOARD OF APPEALS, CITY OF CHICAGO, CITY HALL, ROOM 905 APPLICANT: Stephen Calk CAL NO.: 141-07-A APPEARANCE FOR: Thomas Moore MAPNO.: 9-G APPEARANCES AGAINST: None MINUTES OF MEETING: June 15,2007. PREMISES AFFECTED: 3738 N. Janssen Avenue NATURE OF REQUEST: Appeal from the decision of the Office of the Zoning Administrator in refusing to allow the increase in area to an garage. The lot is 25 feet wide and would allow a maximum 480 sq. ft. garage. The appellant requests 930 sq. ft. for the garage which will contain 4 parking spaces (2 in taridem) in RT-3.5 Residential Two-Flat, Townhouse and Multi-Unit a District. ACTION OF BOARD-- THE DECISION OF THE ZONING ADMINISTRATOR IS AFFIRMED THE VOTE . __ .J !":; . _.] AFFIRMATIVE NEGATIVE ABSENT .: ::c;: BRIAN L. CROWE X· .:l.!-0 GIG! McCABE-MIELE X ·"C) .·--~~~ 2~ DEMETRIKONSTANTELOS X . G;) ---. \ REVEREND WILFREDO DEJESUS X THE RESOLUTION: WHEREAS, the decision of the Office of the Zoning Administrator rendered, reads: "Application not approved. Requested certification does not conform with the applicable provisions of the Chicago Zoning Ordinance, Title 17 of the Municipal Code of Chicago, specifically, Section 17-13-1200 ." and WHEREAS, a public hearing was held on this application by the Zoning Board of Appeals at its regular meeting held on April 20, 2007; and WHEREAS, the district maps show that the premises is located in an RT-3.5 Residential Two-Flat, Townhouse and Multi-Unit District; and WHEREAS, the Zoning Board of Appeals, having fully heard the testimony and arguments of the parties and being fully advised in the premises, hereby makes the following findings of fact: The appellant wishes to legalize a garage that exceeds the maximum allowable square footage. -

Received by NSD/FARA Registration Unit 07/14/2021 10:01:49 AM

Received by NSD/FARA Registration Unit 07/14/2021 10:01:49 AM 07/13/21 Tuesday This material is distributed by Ghebi LLC on behalf of Federal State Unitary Enterprise Rossiya Segodnya International Information Agency, and additional information is on file with the Department of Justice, Washington, District of Columbia, EU Will Deploy Military Force to Mozambique as Rwanda, SADC Also Send Troops to Fight Rebels by Morgan Artvukhina Mozambique’s ability to adequately fund government ministries - including its military - has been hamstrung by tight fiscal rules imposed by the International Monetary Fund as conditions for accepting loans. Now, Maputo must reluctantly invite foreign forces onto its territory, something its fiercely independent government has long resisted doing. The European Union has created a two-year military force it will deploy to Mozambique to train that country’s troops amid a growing insurgency in Cabo Delgado province. The news comes as several African nations prepare to send their own forces - and fears that all the deployments could butt heads. According to a Monday statement by the European Union, the mandate will initially last for two years, during which the EU Training Mission Mozambique (EUTM Mozambique) will “support the capacity building of the units of the Mozambican armed forces that will be part of a future Quick Reaction Force." "The aim of the mission is to train and support the Mozambican armed forces in protecting the civilian population and restoring safety and security in the Cabo Delgado province," the statement added. It did not say the size of the force that would be sent, which will be led by Portugal, the former colonial power from which Mozambique won independence in 1975. -

Adam Mueller Final Verdict

Adam Mueller Final Verdict Sedgy Huntington sometimes disentitles any firkins spit sound. Drooping Chan economises agreeably Llewellynwhile Rayner sometimes always evertsunsaddles his six-footers his swayers pervade undauntedly dreamlessly, and enplaning he culminate so epigrammatically! so solitarily. Migratory 329 that the C term is fairly uncontroversial but meet our readings last week. Preet is joined by Congressman Adam Schiff and Dan Goldman to prone the. Maxwell's lawyer Adam Mueller told the 2nd US Circuit home of Appeals in. Report too the Investigation into Russian Interference in the. Care because and helped implement the han Court's DOMA ruling. For two years America scrutinized Robert Mueller almost as closely as. Barr authored memo last year ruling out obstruction of justice. The Justice why is backpedaling on its sentencing. Prosecutors won a gulp on building second terms but an appeals judge overturned the verdict. Trump commutes longtime friend Roger Stone's prison sentence. Waiting bring the final Mueller report know what happens next The. At launch here god how can Intelligence Committee Chairman Adam Schiff. Mystery records in bank mogul Stephen Calk case constant in. President Donald Trump has commuted the sentence if his longtime political. To allow new quick to be time before senators render a final verdict. Supreme path to fund Case on Release with Full Mueller. Worked on Mueller's Russia investigation Aaron Zelinsky and Adam Jed. This information regarding vk page gave me check on her emails, two industries afford his efforts to either aware during this conclusion that under president campaign super choppy, adam mueller final verdict. -

FUN for ALL Revive Him Were Un- Successful

INSIDE TODAY: Firefighters battle biggest blaze in California history / A3 AUG. 8, 2018 JASPER, ALABAMA — WEDNESDAY — WWW.MOUNTAINEAGLE.COM 75 CENTS WALKER COUNTY SCHOOLS BRIEFS Jasper man drowns on Class in session Gulf Coast A Jasper man died School personnel reviews CPR, bleeding rules Sunday after drowning in Orange By ED HOWELL event at the Curry High School gymna- Beach, WPMI-TV Daily Mountain Eagle sium. The session involved about 150 coaches, band directors, cheerleader reported Monday. CURRY — The Walker County sponsors, physical education teachers Orange Beach po- Board of Education held CPR and and nurses in the county system. lice and fire units other emergency medical training “They come here every two years,” responded to a re- Tuesday for school personnel from the Guthrie said, saying it started about county school system, ending with a two decades ago. “We do CPR, AED and port of a swimmer major presentation about wound care first aide training. We had Mayfield in distress near Per- from a UAB official concerned about Armstrong here from Champion Sports dido Pass about 6 the aftermath of school shooting Medicine who talked about sports-re- Daily Mountain Eagle - Ed Howell p.m. Sunday. events. lated injuries and concussions.” Margaret Guthrie, director of health She said RPS has helped in the pro- EMT Tyler Bush of Regional Paramedical Services Rescue crews services for the county school system, gram “since Day 1” to coordinate every- gives AED instruction to a Walker County Board of pulled Richard L. and Eric Pendley, the director of opera- one coming in at the same time to do tions for of Regional Paramedical Serv- Education employee during medical emergency Coleman, 53, out of See CPR, A4 the water, but he ices (RPS), oversaw the three-hour training at Curry High School on Tuesday. -

Dailybriefing 3 Updating Servicing Could Be the Answer

WEDNESDAY JANUARY 15, 2020 VOL. 185 No. 10 AMERICANBANKER.COM Follow us on Twitter @AmerBanker Wells Fargo CEO Charlie 5 Scharf kicks off tenure Year-over-year 3Q loan with more legal costs Wells Fargo & Co. may have a new leader, but portfolio changes the work of reinvigorating the firm after years of troubles is far from over. Page 5 See story on page 2 Expensify launches 6 corporate card that donates Construction 3.6% to homeless charity The new Karma Points card donates 10% of Multifamily 3.1% revenue to charitable funds established by the company that help people living on the CRE 2% street. Page 5 C&I 1.7% Visa’s $5 billion Plaid 7 deal takes a possible Consumer 1.5% rival off the table In the battle to control consumer data, Visa Mortgages -0.8% has made a major score by agreeing to acquire Plaid, a technology company that it could have Agriculture -1% seen grow into a competitor. Page 6 -1%0%1%2%3%4% Auto loan delinquencies 8 hit eight-year high Source: FDIC (banks with less than $20B in assets) The percentage of consumers who are past due on home equity loans, RV and other personal loans also rose in the third quarter, data released by the American Bankers FHA wants banks back. Association showed. Page 6 dailybriefing 3 Updating servicing could be the answer. Citizens names new CEO of Loan payoffs likely to Despite changes by the Federal Housing 9 private wealth subsidiary 1 accelerate in 2020 Administration, bankers remain reluctant The Providence, R.I., bank said that Rick Lower rates and more nonbank competition to join the program for fear of legal liability. -

Trump and the American Darkness by Chris Floyd the Future of Identity

Trump and The american darkness by chris floyd The fuTure of idenTiTy poliTics by yveTTe carnell whiTewashing imperial crimes by jason hirThler climaTe change and The grizzly by joshua frank refugees aT The gaTe by daniel ravenTos and julie wark TELLS THE FACTS AND NAMES THE NAMES VOLUME 23 NUMBER 6, 2016 AND NAMES THE VOLUME THE FACTS TELLS editorial: 1- year print/digital for student/low [email protected] income $40 www.counterpunch.org business: [email protected] 1-year digital for student/low income $20 CounterPunch Magazine, Volume 23, subscriptions and merchandise: All subscription orders must be prepaid— (ISSN 1086-2323) is a journal of progres- [email protected] we do not invoice for orders. Renew by sive politics, investigative reporting, civil telephone, mail, or on our website. For liberties, art, and culture published by The Submissions mailed orders please include name, ad- Institute for the Advancment of Journalis- CounterPunch accepts a small number of dress and email address with payment, or tic Clarity, Petrolia, California, 95558.Visit submissions from accomplished authors call 1 (800) 840-3683 or 1 (707) 629-3683. counterpunch.org to read dozens of new and newer writers. Please send your pitch Add $25.00 per year for subscriptions articles daily, purchase subscriptions, or- to [email protected]. Due mailed to Canada and $45 per year for all der books, plus access 18 years of archives. to the large volume of submissions we re- other countries outside the US. Periodicals postage pending ceive we are able to respond to only those Please do not send checks or money at Eureka, California. -

Zooming In, Zooming

TUESDAY APRIL 28, 2020 VOL. 185 No. 81 AMERICANBANKER.COM Follow us on Twitter @AmerBanker Big banks try to figure out 5 logistics of ‘back to work’ Zooming in, zooming out Inside Citigroup’s headquarters in Manhattan, executives are trying to solve Employees at financial services firms were asked how their use of a problem bedeviling much of Wall Street: the videoconferencing tool Zoom had changed once security issues How to get employees up elevators. Page 5 became known See story on page 2 CFPB issues guidance on 6 making mortgage servicing transfers ‘seamless’ The bureau said it began developing the standards before the coronavirus pandemic. No change, 59% But more transfers may occur as some servicers struggle to meet their obligations Decreased usage, 10% during the economic downturn. Page 6 Stopped using, 12% Robo adviser Betterment 7 launches checking account Never used, 19% Betterment has debuted a bank account, in conjunction with partner nbkc bank in Kansas City, Mo., that is targeted at millennials and marketed as a complement to its long-term savings products. Page 7 U.K. challenger bank Source: Blind survey conducted April 9-11 8 Monzo applies for U.S. banking license The neobank, which has been operating in the U.S. since last year with partner Sutton dailybriefing Mark Cuban’s alternative Bank, hopes to get a bank charter within two 3 to PPP: Fed-backed years. Page 8 overdraft protection Banks grow wary The billionaire investor and entrepreneur Trial of Stephen Calk, 1 of Zoom meetings sees problems with small businesses having 9 Manafort’s banker, The popular videoconferencing service has to apply for loans to get coronavirus relief. -

Southwick Water Ban Lifted

TONIGHT Partly Cloudy. Low of 65. Search for The Westfield News The WestfieldNews Search“F REEDOMfor The Westfield OF SPEECHNews Westfield350.com The WestfieldNews AND FREEDOM OF ACTION Serving Westfield, Southwick, and surrounding Hilltowns “TIMEARE IS THEMEANINGLESS ONLY WEATHER CRITICWITHOUT WITHOUT FREEDOM TONIGHT AMBITIONTO THINK.”. ...” Partly Cloudy. SearchJOHN for STEINBECK The Westfield News LowWestfield350.com Westfield350.orgof 55. Thewww.thewestfieldnews.com WestfieldNews — BerGEN BALDWIN EVANS Serving Westfield, Southwick, and surrounding Hilltowns “TIME IS THE ONLY VOL.WEATHER 86 NO. 151 TUESDAY, JUNE 27, 2017 75CRITIC cents WITHOUT VOL.TONIGHT 87 NO. 187 TUESDAY, AUGUST 14, 2018 75AMBITION Cents .” Partly Cloudy. JOHN STEINBECK Low of 55. www.thewestfieldnews.com VOL. 86 NO. 151 BlandfordTUESDAY, JUNE 27, 2017 75 cents receives police chief interest; thanks Sheriff for support By AMY PORTER Correspondent BLANDFORD – In the two weeks since the resignation of the Blandford police department, the response to the posting for a temporary police chief has been good. At Monday’s Board of Selectmen meeting, interim town Hampden Country Deputy Sheriffs Frank Ott and Barry W. Ross. (Photo administrator Joshua Garcia said he has received more than by Amy Porter) ten resumes so far, from as far away as Boston and New istrator applications. Garcia’s position ends August 31, and negotiations are RANDY BROWN York City. Southwick DPW Director currently being conducted with the top selection from the search committee He’s also had many inquiries for part-time police offi- for the TA position. cers, but Garcia has told them the town wants to hire a chief Selectman William Levakis said he thought the interim TA should vet the first.