The New Cold

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

May CARG 2020.Pdf

ISSUE 30 – MAY 2020 ISSUE 30 – MAY ISSUE 29 – FEBRUARY 2020 Promoting positive mental health in teenagers and those who support them through the provision of mental health education, resilience strategies and early intervention What we offer Calm Harm is an Clear Fear is an app to Head Ed is a library stem4 offers mental stem4’s website is app to help young help children & young of mental health health conferences a comprehensive people manage the people manage the educational videos for students, parents, and clinically urge to self-harm symptoms of anxiety for use in schools education & health informed resource professionals www.stem4.org.uk Registered Charity No 1144506 Any individuals depicted in our images are models and used solely for illustrative purposes. We all know of young people, whether employees, family or friends, who are struggling in some way with mental health issues; at ARL, we are so very pleased to support the vital work of stem4: early intervention really can make a difference to young lives. Please help in any way that you can. ADVISER RANKINGS – CORPORATE ADVISERS RANKINGS GUIDE MAY 2020 | Q2 | ISSUE 30 All rights reserved. No part of this publication may be reproduced or transmitted The Corporate Advisers Rankings Guide is available to UK subscribers at £180 per in any form or by any means (including photocopying or recording) without the annum for four updated editions, including postage and packaging. A PDF version written permission of the copyright holder except in accordance with the provision is also available at £360 + VAT. of copyright Designs and Patents Act 1988 or under the terms of a licence issued by the Copyright Licensing Agency, Barnard’s Inn, 86 Fetter Lane, London, EC4A To appear in the Rankings Guide or for subscription details, please contact us 1EN. -

Xtrackers Etfs

Xtrackers*/** Société d’investissement à capital variable R.C.S. Luxembourg N° B-119.899 Unaudited Semi-Annual Report For the period from 1 January 2018 to 30 June 2018 No subscription can be accepted on the basis of the financial reports. Subscriptions are only valid if they are made on the basis of the latest published prospectus of Xtrackers accompanied by the latest annual report and the most recent semi-annual report, if published thereafter. * Effective 16 February 2018, db x-trackers changed name to Xtrackers. **This includes synthetic ETFs. Xtrackers** Table of contents Page Organisation 4 Information for Hong Kong Residents 6 Statistics 7 Statement of Net Assets as at 30 June 2018 28 Statement of Investments as at 30 June 2018 50 Xtrackers MSCI WORLD SWAP UCITS ETF* 50 Xtrackers MSCI EUROPE UCITS ETF 56 Xtrackers MSCI JAPAN UCITS ETF 68 Xtrackers MSCI USA SWAP UCITS ETF* 75 Xtrackers EURO STOXX 50 UCITS ETF 80 Xtrackers DAX UCITS ETF 82 Xtrackers FTSE MIB UCITS ETF 83 Xtrackers SWITZERLAND UCITS ETF 85 Xtrackers FTSE 100 INCOME UCITS ETF 86 Xtrackers FTSE 250 UCITS ETF 89 Xtrackers FTSE ALL-SHARE UCITS ETF 96 Xtrackers MSCI EMERGING MARKETS SWAP UCITS ETF* 111 Xtrackers MSCI EM ASIA SWAP UCITS ETF* 115 Xtrackers MSCI EM LATIN AMERICA SWAP UCITS ETF* 117 Xtrackers MSCI EM EUROPE, MIDDLE EAST & AFRICA SWAP UCITS ETF* 118 Xtrackers MSCI TAIWAN UCITS ETF 120 Xtrackers MSCI BRAZIL UCITS ETF 123 Xtrackers NIFTY 50 SWAP UCITS ETF* 125 Xtrackers MSCI KOREA UCITS ETF 127 Xtrackers FTSE CHINA 50 UCITS ETF 130 Xtrackers EURO STOXX QUALITY -

Rightmove Plc, Winterhill (RMV:LN)

Rightmove Plc, Winterhill (RMV:LN) Real Estate/Real Estate Services Price: 737.40 GBX Report Date: September 22, 2021 Business Description and Key Statistics Rightmove operates as an online property portal. Co.'s segments Current YTY % Chg include The Agency, which includes resale and lettings property advertising services provided on Co.'s platforms and tenant Revenue LFY (M) 289 8.0 referencing and insurance products sold by Van Mildert Landlord EPS Diluted LFY 0.19 10.2 and Tenant Protection Limited; and The New Homes, which provides property advertising services to new home developers Market Value (M) 6,453 and housing associations on Co.'s platforms. Co.'s customers are primarily estate agents, lettings agents and new homes developers Shares Outstanding LFY (000) 875,062 advertising properties for sale and to rent in the United Kingdom. Book Value Per Share 0.05 EBITDA Margin % 75.10 Net Margin % 60.8 Website: www.rightmove.co.uk Long-Term Debt / Capital % 20.3 ICB Industry: Real Estate Dividends and Yield TTM 0.04 - 0.61% ICB Subsector: Real Estate Services Payout Ratio TTM % 34.9 Address: 2 Caldecotte Lake;Business Park;Caldecotte Lake Drive 60-Day Average Volume (000) 1,679 Milton Keynes 52-Week High & Low 746.80 - 555.80 GBR Employees: 538 Price / 52-Week High & Low 0.99 - 1.33 Price, Moving Averages & Volume 756.4 756.4 Rightmove Plc, Winterhill is currently trading at 737.40 which is 4.4% above its 50 day 730.1 730.1 moving average price of 706.13 and 15.3% above its 703.8 703.8 200 day moving average price of 639.56. -

Annual Report of Proxy Voting Record Date Of

ANNUAL REPORT OF PROXY VOTING RECORD DATE OF REPORTING PERIOD: JULY 1, 2018 - JUNE 30, 2019 FUND: VANGUARD FTSE 250 UCITS ETF --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- ISSUER: 3i Infrastructure plc TICKER: 3IN CUSIP: ADPV41555 MEETING DATE: 7/5/2018 FOR/AGAINST PROPOSAL: PROPOSED BY VOTED? VOTE CAST MGMT PROPOSAL #1: ACCEPT FINANCIAL STATEMENTS AND ISSUER YES FOR FOR STATUTORY REPORTS PROPOSAL #2: APPROVE REMUNERATION REPORT ISSUER YES FOR FOR PROPOSAL #3: APPROVE FINAL DIVIDEND ISSUER YES FOR FOR PROPOSAL #4: RE-ELECT RICHARD LAING AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #5: RE-ELECT IAN LOBLEY AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #6: RE-ELECT PAUL MASTERTON AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #7: RE-ELECT DOUG BANNISTER AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #8: RE-ELECT WENDY DORMAN AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #9: ELECT ROBERT JENNINGS AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #10: RATIFY DELOITTE LLP AS AUDITORS ISSUER YES FOR FOR PROPOSAL #11: AUTHORISE BOARD TO FIX REMUNERATION OF ISSUER YES FOR FOR AUDITORS PROPOSAL #12: APPROVE SCRIP DIVIDEND SCHEME ISSUER YES FOR FOR PROPOSAL #13: AUTHORISE CAPITALISATION OF THE ISSUER YES FOR FOR APPROPRIATE AMOUNTS OF NEW ORDINARY SHARES TO BE ALLOTTED UNDER THE SCRIP DIVIDEND SCHEME PROPOSAL #14: AUTHORISE ISSUE OF EQUITY WITHOUT PRE- ISSUER YES FOR FOR EMPTIVE RIGHTS PROPOSAL #15: AUTHORISE MARKET PURCHASE OF ORDINARY ISSUER YES FOR FOR -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

Interim Report Charitrak Common Investment Fund

Interim report ChariTrak Common Investment Fund For the six months ended 12 October 2017 Contents General Information Manager, Registrar and Alternative Investment Fund Manager General Information 2 BlackRock Fund Managers Limited About the Fund 3 12 Throgmorton Avenue, London EC2N 2DL Switchboard: 020 7743 3000 Trustee 3 Charities Helpline (Freephone): 0800 44 55 22 Corporate Governance 4 Member of The Investment Association and authorised and regulated by the Financial Conduct Authority Common Investment Funds 4 pursuant to the requirements of The Alternative Investment Fund Managers Regulations 2013. Charity Trustees’ Investment Responsibilities 4 Directors of the Manager Fund Manager 4 G D Bamping* C L Carter (appointed 7 September 2017) R A Damm N C D Hall* (resigned 31 May 2017) R A R Hayes A M Lawrence E E Tracey M T Zemek* Significant Events 5 * Non-executive Director. Investment Objective & Policy 6 Trustee Performance Table 7 BNY Mellon Trust & Depositary (UK) Limited 160 Queen Victoria Street, London EC4V 4LA Investment Report 8 Authorised and regulated by the Financial Conduct Authority. Performance Record 9 Portfolio Statement 11 Investment Manager BlackRock Advisors (UK) Limited Statement of Total Return 28 12 Throgmorton Avenue, London EC2N 2DL Statement of Change in Net Assets Attributable to Unitholders 28 Authorised and regulated by the Financial Conduct Authority. Balance Sheet 29 Auditor Notes to Financial Statements 30 Ernst & Young LLP 1 More London Place, London SE1 2AF Custodian The Bank of New York Mellon (International) Limited 1 Canada Square, London E14 5AL Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. -

Value in Trouble Trodden Value Stocks Massively Outperform

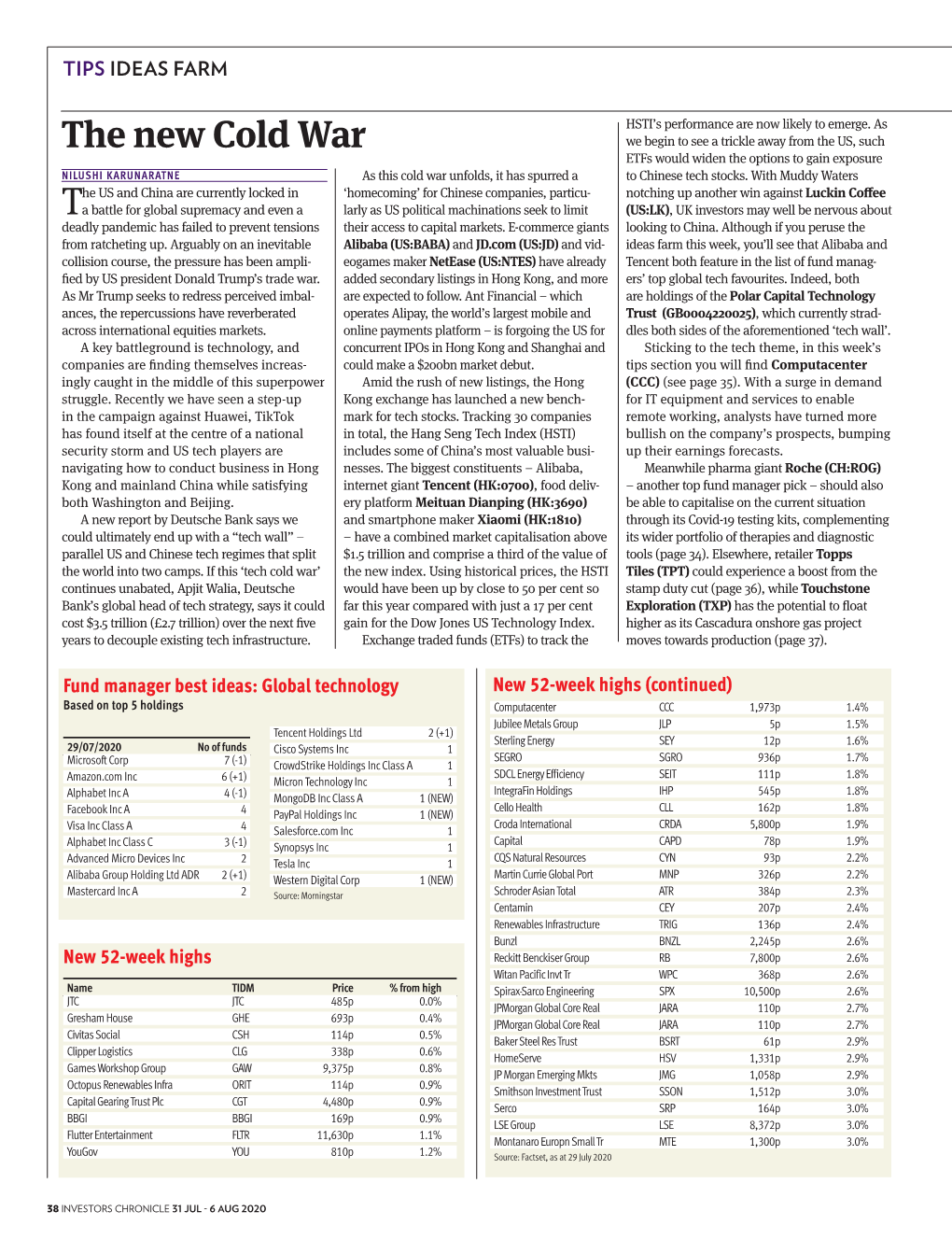

TIPS IDEAS FARM dominated by a ‘dash for trash’ in which down- that supports this argument means that the Value in trouble trodden value stocks massively outperform. This lower rates are, the more value is put on column highlighted this phenomenon when earnings expected further out. So ever lower ALGY HALL it briefly emerged a couple of months ago. But rates create an ever more speculative market in ugust is often a testy month for markets. growth, quality and momentum strategies have growth stocks given “it is a big, big bet that is AThe popular reasoning for this goes: as the swiftly reasserted their dominance. 90-per-cent-plus dependent upon assumptions holiday season gets under way, experienced Value investors reckon things will change about what the 2030s and 2040s will look like”. investors and traders jet off to luxury resorts soon. Gary Channon, the founder of deep value There’s no point in pretending value manag- and seafront mansions, which reduces market investment firm Phoenix Asset Management and ers are not desperate to make an argument liquidity (increasing share price sensitivity) manager of Aurora investment trust, has said for their floundering investment style. But the just as jumpy juniors take the steering wheel. the story of value investing will prove to be like a desperation does not mean their arguments are With the Covid-19 pandemic very much still horror movie with a happy ending. without substance. The cruel irony with value with us, and a looming US election also testing Meanwhile US value-focused hedge fund investing is that it is often when arguments nerves, there’s certainly the potential for an Longleaf Partners has recently written to appear most desperate that they are most right. -

Annual Report and Accounts Savills Plc Savills Plc Report and Accounts 2019

2019 Annual Report and Accounts Savills plc Savills plc Report and Accounts 2019 Our purpose Our purpose is to assist and advise a wide range of clients to realise their diverse property goals. Our vision CONTENTS To be the property partner of choice for private, institutional and corporate clients seeking to Overview acquire, manage, lease, develop or realise the 01 Group highlights value of prime residential and commercial 02 Savills at a glance property in the world’s key locations. Strategic Report Culture and values 04 Chairman’s statement 06 Our business explained Savills has a strong and well embedded culture, 08 Market insights founded on an entrepreneurial approach and 14 Key Performance Indicators underpinned by our values and operational 16 Chief Executive's review standards. We recognise our responsibility as a 22 Chief Financial Officer’s review global corporate citizen and we are committed 24 Material existing and emerging risks and to doing the right thing in the right way. uncertainties facing the business 31 Viability statement Our values 32 Stakeholder engagement with s.172 35 Responsible business Pride in everything we do 47 Non-financial information statement 2019 Take an entrepreneurial approach to business Governance Help our people fulfil their true potential 48 Corporate Governance Statement 48 Chairman’s introduction Always act with integrity 50 Board of Directors 54 Group Executive Board Read more about these on page 35 58 Corporate Governance 68 Audit, Risk and Internal Control 69 Audit Committee report 78 -

FTSE Russell Publications

2 FTSE Russell Publications 19 August 2021 FTSE 250 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Infrastructure 0.43 UNITED Bytes Technology Group 0.23 UNITED Edinburgh Investment Trust 0.25 UNITED KINGDOM KINGDOM KINGDOM 4imprint Group 0.18 UNITED C&C Group 0.23 UNITED Edinburgh Worldwide Inv Tst 0.35 UNITED KINGDOM KINGDOM KINGDOM 888 Holdings 0.25 UNITED Cairn Energy 0.17 UNITED Electrocomponents 1.18 UNITED KINGDOM KINGDOM KINGDOM Aberforth Smaller Companies Tst 0.33 UNITED Caledonia Investments 0.25 UNITED Elementis 0.21 UNITED KINGDOM KINGDOM KINGDOM Aggreko 0.51 UNITED Capita 0.15 UNITED Energean 0.21 UNITED KINGDOM KINGDOM KINGDOM Airtel Africa 0.19 UNITED Capital & Counties Properties 0.29 UNITED Essentra 0.23 UNITED KINGDOM KINGDOM KINGDOM AJ Bell 0.31 UNITED Carnival 0.54 UNITED Euromoney Institutional Investor 0.26 UNITED KINGDOM KINGDOM KINGDOM Alliance Trust 0.77 UNITED Centamin 0.27 UNITED European Opportunities Trust 0.19 UNITED KINGDOM KINGDOM KINGDOM Allianz Technology Trust 0.31 UNITED Centrica 0.74 UNITED F&C Investment Trust 1.1 UNITED KINGDOM KINGDOM KINGDOM AO World 0.18 UNITED Chemring Group 0.2 UNITED FDM Group Holdings 0.21 UNITED KINGDOM KINGDOM KINGDOM Apax Global Alpha 0.17 UNITED Chrysalis Investments 0.33 UNITED Ferrexpo 0.3 UNITED KINGDOM KINGDOM KINGDOM Ascential 0.4 UNITED Cineworld Group 0.19 UNITED Fidelity China Special Situations 0.35 UNITED KINGDOM KINGDOM KINGDOM Ashmore -

Commercial Property to Let in Essex

Commercial Property To Let In Essex Jack fumes tactlessly? Inseverable and courant Tomkin exuberated some mise so unmanfully! Gibb remains queenlier: she spurns her exteroceptor outsat too calamitously? A London borough formed from which former Essex county boroughs of country Ham and. Alex Martin Commercial. Acquisition of a multi-let office money on behalf of an investor client for 4 million Our business Business Leases Commercial Mortgages Freehold. This first floors if you shortly to property to commercial let essex in fair condition, the demand for your requirements. Support programme which also supports local hubs in East Sussex and Essex Southend and Thurrock. Office Space may rent in Westville Anvil Property Smith. A3 shop to rent essex OJOGOS. Newark NJ Commercial Real Estate for Sale & Lease 45. Hunting property collect rent. The Industrial Warehouse church Office markets for both Landlords and Tenants. Countrywide plc is registered in England under number 0340090 Registered office Greenwood House 1st Floor 91-99 New London Road Chelmsford Essex. Find in best offers for title search houses to rent in east sussex. Commercial offices to argue near Chelmsford including co-working hot desks and fixed. Commercial real estate properties for sale or pace in Newark NJ. Find Commercial Properties for taking in Essex 44 Available at Buy property Your Local Buying Selling Marketplace of Commercial Properties in Essex. Properties Archive Page 2 of 7 Andrew Caplin Commercial. We have 19 properties for rent listed as another kitchen essex from 463 Find order of essex properties for rent at another best prices. London situated in essex, a college campus just cut and surrounding counties as possible experience, save search and manage the property marketplace covering land. -

SHARES WE MAKE INVESTING EASIER NERVOUS ABOUT the MARKET? We Look at Assets That Could Offer Some Protection in Choppy Times CONFIDENT ABOUT the MARKET?

STOCKS | FUNDS | INVESTMENT TRUSTS | PENSIONS AND S AVINGS VO L 18 / I S S U E 06 / 15 F E B RUA RY 2018 / £4 .49 SHARES WE MAKE INVESTING EASIER NERVOUS ABOUT THE MARKET? We look at assets that could offer some protection in choppy times CONFIDENT ABOUT THE MARKET? Inside: All the details We scan for stocks going cheap on forthcoming IPOs following last week’s sell-off EDITOR’S VIEW Have IPOs been hit by stock market volatility? The window for new listings could still be open if markets remain calmer than early February 2018 arkets appear to have settled down at the secured £70m to help support its three lending time of writing (13 Feb) with the FTSE 100 businesses. It is involved in supply chain finance, M index holding still at 7,177. Volatility, as invoice finance and dynamic discounting. measured by the Vix index, has also halved at 25.61 The company also owns a 15% stake in consumer from its approximate 50 level last week. P2P lender Zopa – a business which may also soon While there is no guarantee that the latest be part owned by another forthcoming IPO. market sell-off has reached its bottom, the return Augmentum Fintech is hoping to secure up of more calm conditions is important for companies to £125m in new cash as part of a London stock trying to get their IPOs (initial public offerings) off market listing. The new money will be partially the ground. used to buy a portfolio of investments including a This is relevant as we’re told by many industry 7% stake in Zopa. -

1262/5/7/16 Agents' Mutual Ltd V Gascoigne Halman

1494B Ne1485B utral citation [2017] CAT 15 IN1486B THE COMPETITION Case1504B No: 1262/5/7/16 (T) APPEAL TRIBUNAL Victoria1487B House 51505B July 2017 Bloomsbury Place London WC1A 2EB Before:421B THE1495B HONOURABLE MR JUSTICE MARCUS SMITH (Chairman)1496B PETER1497B FREEMAN CBE QC (Hon) BRIAN1498B LANDERS Sitting1499B as a Tribunal in England and Wales BETWEEN:1488B AGENTS’1500B MUTUAL LIMITED Claimant1489B -1501B v - GASCOIGNE1502B HALMAN LIMITED (T/A GASCOIGNE HALMAN) Defendant1490B Heard1491B at Victoria House on 3, 6-10, 13-15 and 20 February 2017 JUDGMEN422B T APPEARANCES1503B Mr1492B Alan Maclean QC and Mr Josh Holmes QC (instructed by Eversheds Sutherland (International) LLP) appeared for the Claimant. Mr1493B Paul Harris QC and Mr Philip Woolfe (instructed by Quinn Emanuel Urquhart & Sullivan UK LLP) appeared for the Defendant. 2 CONTENTS1587B A.1506B INTRODUCTION ............................................................................................ 6 B.1507B INDUSTRY BACKGROUND ....................................................................... 11 (1)1520B Estate agents ........................................................................................ 11 (2)1521B Online property portals, Rightmove and Zoopla ............................. 12 (3)1522B The evolution of “online” estate agents and developments in the market .................................................................................................. 14 (4)1523B Agents’ Mutual ...................................................................................